MARKET OVERVIEW

The global supply chain finance market are important when it comes to availing liquidity and optimizing the flow of cash for companies engaged in international trade. Indeed, with the increasing complexity of supply chains, firms will look for various financial solutions that help make cross-border transactions less risky as well as improve operational effectiveness. The short-term credit solution is therefore focused on this type of market that can help suppliers and buyers effectively manage working capital to ensure a smooth business operation.

This market will address the financial challenges businesses face when navigating global supply chains through an interconnected network of suppliers, manufacturers, and distributors. It encompasses a range of financing solutions designed to improve liquidity for companies at various stages of production and distribution. Businesses will be able to access working capital more efficiently without disrupting their cash flow by leveraging financial instruments such as invoice financing, factoring, and reverse factoring.

As trade networks expand, there will be increasing collaboration between financial institutions, technology providers, and corporations to hone financing models. Digital platforms will become increasingly key in the entire process, cutting down on complexities and enhancing the transparency between parties involved. The automation of the financing solutions and data analytics with blockchain technology will ensure less paperwork and minimize the risks of fraud and delayed payments.

As a result, businesses will be able to navigate financial complexities with greater precision, leading to a more efficient allocation of capital. Cross-border trade introduces currency fluctuations, regulatory compliance, and geopolitical uncertainties. The global supply chain finance market will adapt by integrating advanced risk assessment models, ensuring that companies can secure funding with greater confidence.

Financial institutions will develop tailored solutions to accommodate the diverse needs of businesses operating across different regulatory environments, allowing for more resilient financial strategies. This trend will further give shape to the future market: sustainable and ethical business practices. More firms will look for financing that adheres to environmental, social, and governance principles. Lenders and investors will focus on those businesses and what they do about responsible sourcing, lower carbon footprints, and fair labor practices.

As sustainability-linked financing continues to grow in popularity, organizations will include ESG considerations in supply chain strategies that eventually influence capital allocation and financial decision-making. The contribution of emerging economies toward the international trade will also influence market development. With increasing integration of businesses in the developing region, demand for financing solutions is expected to increase. Financial institutions and technology providers will look for innovative models that help small and medium-sized enterprises compete at scale.

With decentralized lending, alternative methods of assessing credit, and mobile-based financing, new opportunities will open up for businesses looking for growth. Regulatory frameworks will continue to develop, influencing the form of financial transactions in a supply chain. Policymakers and industry participants will work together to increase transparency, standardize practices, and address compliance and security concerns. Financial institutions must navigate these changes strategically to allow businesses to obtain funding while adjusting to shifting regulatory landscapes.

As technology advances and trade networks expand, the global supply chain finance market shall continue to be an element of international commerce. This market will continue to influence the efficiency and stability of supply chains around the globe by promoting liquidity, reducing financial friction, and keeping pace with shifting economic environments. Companies that adopt digital transformation and sustainable financing in their operations will strongly position themselves for long-term success within a competitive global marketplace.

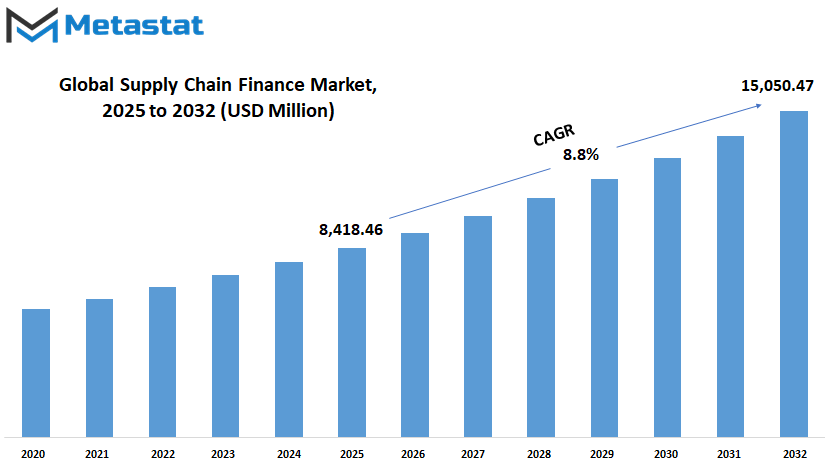

global supply chain finance market is estimated to reach $15,050.47 Million by 2032; growing at a CAGR of 8.8% from 2025 to 2032.

GROWTH FACTORS

The global supply chain finance market is likely to grow substantially in the next few years. The key drivers for this demand and adoption are shaped by some key factors, such as increasing demand from businesses to optimize working capital. With constant pressure to optimize cash flow management, companies are now using supply chain finance (SCF) solutions to realize the hidden value in their working capital. It is more than ever important today, given that businesses seek a more efficient and effective means of using their financial resources, avoiding traditional lending and not overloading their balance sheets.

Another major factor driving the growth in the global supply chain finance market is the rapid adoption of digital platforms. Businesses are rapidly migrating into digital transformation, with a growing trend toward this in the finance sector as well. The digital platforms provide a convenient experience for SCF transactions, and it becomes easier for businesses to connect with suppliers and financial institutions.

For SCF transactions, these platforms provide better transparency, reduced paperwork, and faster processing of transactions. In a world that is becoming more dependent on technology, digitalization has revolutionized the SCF landscape, making it more accessible to a wider range of businesses, from large corporations to small and medium-sized enterprises (SMEs).

However, the growth of the global supply chain finance market is not without challenges. One of the key obstacles that businesses may face is the complexity involved in integrating SCF solutions with their existing systems. The transition to new platforms is lengthy and expensive, especially for well-established businesses and legacy systems. The integration process needs careful planning and execution in order to be able to share information between the suppliers, buyers, and the financial institutions of the business effectively.

The third threat is dependence on the financial institutions. Liquidity management can be so heavily dependent on the financial institutions that SCF transactions may potentially create vulnerabilities to businesses. Dependence on these financial institutions may limit the flexibility of the business regarding cash flow and, in situations like financial institution’s liquidity issues or risk management constraints, the dependency may even present some challenges. Despite these impediments, there are also exciting opportunities awaiting the global supply chain finance market.

Growing SCF solutions for small and medium-sized enterprises (SMEs) is an area of significant growth. Simplicity and cost efficacy through technology-enabled platforms can allow SMEs to access SCF and to optimize working capital and supplier relationships and overall financial performance. As these interfaces become more intuitive and accessible, it will throw open new vistas for SMEs to participate in supply chain finance, which, in turn, will propel further market growth through the years ahead.

The global supply chain finance market is therefore likely to experience a significant expansion due to increased demand for working capital optimization, digital platforms, and the growing adoption of SCF by SMEs. The integration complexity and dependency on financial institutions are the major challenges but would be addressed in the future with the improvement of technology and increased adoption of supply chain finance solutions.

MARKET SEGMENTATION

By Provider Type

The global supply chain finance market is an expanding sector which significantly contributes to maintaining the business operation smooth and ensuring that its working capital is optimized and its financial flexibility enhanced. The market keeps on growing, with the new entrants as well as several types of providers contributing to its growth. Types of providers include banks, non-banking financial institutions, fintech companies, and trading finance houses. Each of the vendors brings their unique strength and innovation with them, defining the future shape of supply chain finance.

Banks have traditionally been the backbone of the supply chain finance industry. With their established networks and access to substantial financial resources, banks provide a wide range of financing options. They help businesses manage liquidity and improve cash flow by offering solutions such as trade credit, invoice financing, and letters of credit. Despite their strong presence, banks will likely face increasing competition from more flexible and innovative players in the coming years.

Non-banking financial institutions are gradually becoming the leading vendors in the supply chain finance market. Private equity firms, insurance companies, pension funds, and other companies form a list whose majority is increasingly getting involved with funding and supporting businesses. Their flexibility and alternatives for funding make them an important element in the global supply chain finance market. These organizations will further expand their role, especially in regions with limited accessibility to conventional banking services.

Fintech companies are interestingly important in the global supply chain finance market. Their technology-based solutions revolutionize the way businesses deal with finance. Using artificial intelligence, blockchain, and other sophisticated technologies, fintech companies can offer faster, more efficient and more transparent financing options. These companies are also making it easier for small and medium-sized enterprises (SMEs) to access financing, which has been a challenge in the past. As technology continues to advance, the influence of fintech companies in supply chain finance will only grow, offering new opportunities and challenges for businesses and financial providers alike.

Another key player is supply chain finance providers who are heavily involved in international trade transaction facilitation, also referred to as trading finance houses. They quite often offer financing solutions across the supply chains between the buyer and supplier through global markets, and through this process help reduce various risks while making payments in the shortest time possible for goods and services. More and more international trade will become complex and interwoven, and business houses will look to increasingly efficient solutions to address cross-border transactions as trading finance houses progress.

It can be finally said that the global supply chain finance market would grow and diversify, but every type of provider would make an essential contribution based on specific business needs. As the market grows more competitive and technology-based, businesses will find more alternatives at their disposal for a dynamic, efficient financial environment. Traditional financial institutions will still be complemented by new and innovative fintech companies as this future continues to reshape the face of global supply chain finance.

By Offering Type

The global supply chain finance market is an increasingly emerging industry sector that has considerably enabled businesses to manage financial operations. With the world becoming more interconnected, companies face a challenge of ensuring smooth and timely transactions across borders. This need for financial flexibility in managing the flow of goods and services has given way to the emergence of various financial solutions tailored to different aspects of the supply chain. Through providing various types of solutions, the market offers a range of options that cater to diversified needs-some for small startups, some for large enterprises.

Receivables financing is one such facility. For example, businesses can gain access to the funds by selling their receivables to a third-party financial institution. This will help improve cash flow for the company without depending on when their customers make payments. It will become one of the popular financing types of facilities to be used in the near future as businesses keep seeking out ways to optimize working capital. With continuous development in digital tools, the companies will easily access this type of funding. It is more efficient since the time required to obtain the funds will reduce and overall financial management efficiency improves.

Payables financing allows a company to give long payment periods with suppliers without causing harm to its relationship. In this model, a third-party financial service provider pays for the suppliers instead of the business, thus ensuring that the firm can delay the payment while building trust with suppliers. As businesses continue to desire flexible payment modes, payables financing will find its way, and businesses can better manage their cash flow by reducing the tension of immediate payment. With the growth of digital payment systems, this type of financing will continue to evolve and become more accessible to businesses of all sizes.

Inventory financing allows businesses to secure loans based on the value of their inventory. This solution allows companies to turn their physical stock into liquid capital, providing them with the necessary funds to expand or manage operational costs. With more and more automation of inventory management and its transparency, it is more than likely that the financing of inventories would also become integral to supply chain operations. Better access to funds for businesses means cost and stock levels will be more efficiently managed at peak times.

Another innovation within the global supply chain finance market is reverse factoring solutions. This service consists of a financial provider making payment to a supplier on behalf of a company; the provider receives repayment over an extended period of time. As businesses look to enhance their flexibility in financial flexibility and relationship strength with suppliers, reverse factoring will also find increased usage among industries having lengthy payment cycles.

Going forward, business enterprises will see an increase in Global Supply Chain Finance as a way to achieve their financial optimizations and better control of their supply chain. Further development in the application of technologies in these finance solutions will create streamlined financial applications to help all businesses around the world access needed capital to maintain growth in such a competitive world.

By Application

The global supply chain finance market has been growing rapidly and transforming. As businesses face increasing complexity in managing supply chains across borders and industries, they are increasingly turning to innovative financing solutions. This growth is primarily driven by the demand for effective solutions to improve liquidity and streamline the financial processes between buyers and suppliers. Going forward, the global supply chain finance market is likely to continue to change, as this process turns very sophisticated and further integrates with the advancements in technology, including blockchain and artificial intelligence.

These features will dramatically transform how businesses manage their financing in supply chains. The global supply chain finance market can be segmented into several major applications, each addressing particular financial needs of a supply chain. One of the major applications Is the domestic supply chain finance. This segment will see continued growth as businesses focus on improving relationships with local suppliers.

Domestic supply chain finance allows companies to offer financing solutions to their suppliers, ensuring smoother cash flow and stronger partnerships. This type of financing will be particularly beneficial for small and medium-sized enterprises that may not have easy access to traditional credit facilities. This will play a crucial role in ensuring the stability of supply chains within a single country or region.

International supply chain finance will also see significant development during these years. With globalization, businesses are increasingly working with suppliers and customers located in different countries with their own financial regulations and risks. Companies will require international supply chain finance to overcome the risks associated with cross-border transactions. Such international supply chain finance solutions will bridge financial gaps created by currency fluctuations, trade barriers, and regulatory differences. With international trade growing, businesses will need international supply chain finance as a means of managing working capital and minimizing risk.

Invoice financing is another component of this market. Invoice financing already is a great tool for those businesses seeking a way to liquidate cash sitting in unpaid invoices. It essentially allows businesses direct access to these funds by selling their outstanding invoices to a third party at some discount. But in the foreseeable future, such financing will still be very sought after because there are many organizations that will increasingly look for better ways to gain cash flow rather than increase further debt. Additionally, easy access to such solutions, mainly through digital means, will see their usage increased across the various industries.

The dynamic discounting solutions are yet another market opportunity. Such solutions enable a company to give its suppliers an early payment discount for faster payment from the firm. These solutions are expected to increase as firms will look at developing their supply chain relationships and cash flow management together. With advancements in digital platforms and automation, dynamic discounting will become more accessible to a wider range of companies, including smaller businesses that otherwise may not have been able to take advantage of such offerings.

In conclusion, the global supply chain finance market will experience significant growth and innovation in the coming years. In this context, a greater need for efficient financing solutions will elevate the adoption of domestic and international supply chain finance, invoice financing, and dynamic discounting. As businesses navigate a more complex global landscape, these solutions will provide the necessary tools to optimize cash flow, reduce risks, and foster stronger relationships within the supply chain.

By End-User

The global supply chain finance market is an increasingly vital component of contemporary business operations. It aims at how to make improvements to the financial flow in the supply chain through a wide range of financing options. This helps bridge the gap between the buyer and supplier, providing flexible payment terms and alleviating cash flow pressures to both parties. With growth in the market, different end-users are contributing towards it, and thus changing its future course.

Corporates, being one of the key end-users, are among the largest drivers of the global supply chain finance market. Large corporations rely heavily on robust supply chain finance solutions to maintain liquidity and ensure smooth operations. With complex supply chains spanning across various regions, these businesses need to optimize their cash flow, manage risks, and ensure timely payments to suppliers. It also provides them with the flexibility of extending payment terms to their suppliers while offering early payment options to their creditors, hence optimizing the overall financial efficiency of the corporations so that they stay abreast with their competitors in the global marketplace.

Small and medium-sized enterprises also make essential market contributions. While SMEs often face hindrances in achieving access to some traditional financial services, supply chain finance offers such opportunities for it to improve. Supply chain finance programs allow SMES to increase their access through better payment conditions and working capitals. This boosts the growth capacity of the respective businesses and bolsters relationships in the supply with larger corporate buyers. As the global supply chain finance market continues growing, the possible number of SMEs receiving financial solutions is projected to be higher as they can compete with the big corporations and be able to increase their market share.

Financial institutions play a dominant role in this market as it requires supply chain finance solutions that provide all necessary financial and expert support for the transaction between buyers and suppliers. Their engagement is crucial in offering liquidity and making sure financing operations go on seamlessly. The financial institutions are gradually taking a great deal of interest in the development of their supply chain finance, mainly catering to corporations and SMEs. And the way forward, financial institutions are bound to be in command as they are also looking for improvements in technological competencies and thereby refining financing.

Government agencies also add to the development of the global supply chain finance market. Since their policies promote economic growth and assist small and large businesses alike, governments have come to realize the significance of effective supply chain finance solutions. Governments can offer incentives or establish regulatory frameworks that would encourage the implementation of supply chain finance among businesses, hence making the financial landscape stable in most industries.

In the coming years, all these end-users will participate in the global supply chain finance market, driving innovations and improvements that will streamline operations, reduce risks, and provide greater financial flexibility for businesses worldwide. This transformation will continue to reshape the financial landscape, creating new opportunities and enhancing economic activity across industries.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8,418.46 million |

|

Market Size by 2032 |

$21,716.01 Million |

|

Growth Rate from 2024 to 2031 |

8.8% |

|

Base Year |

2024 |

|

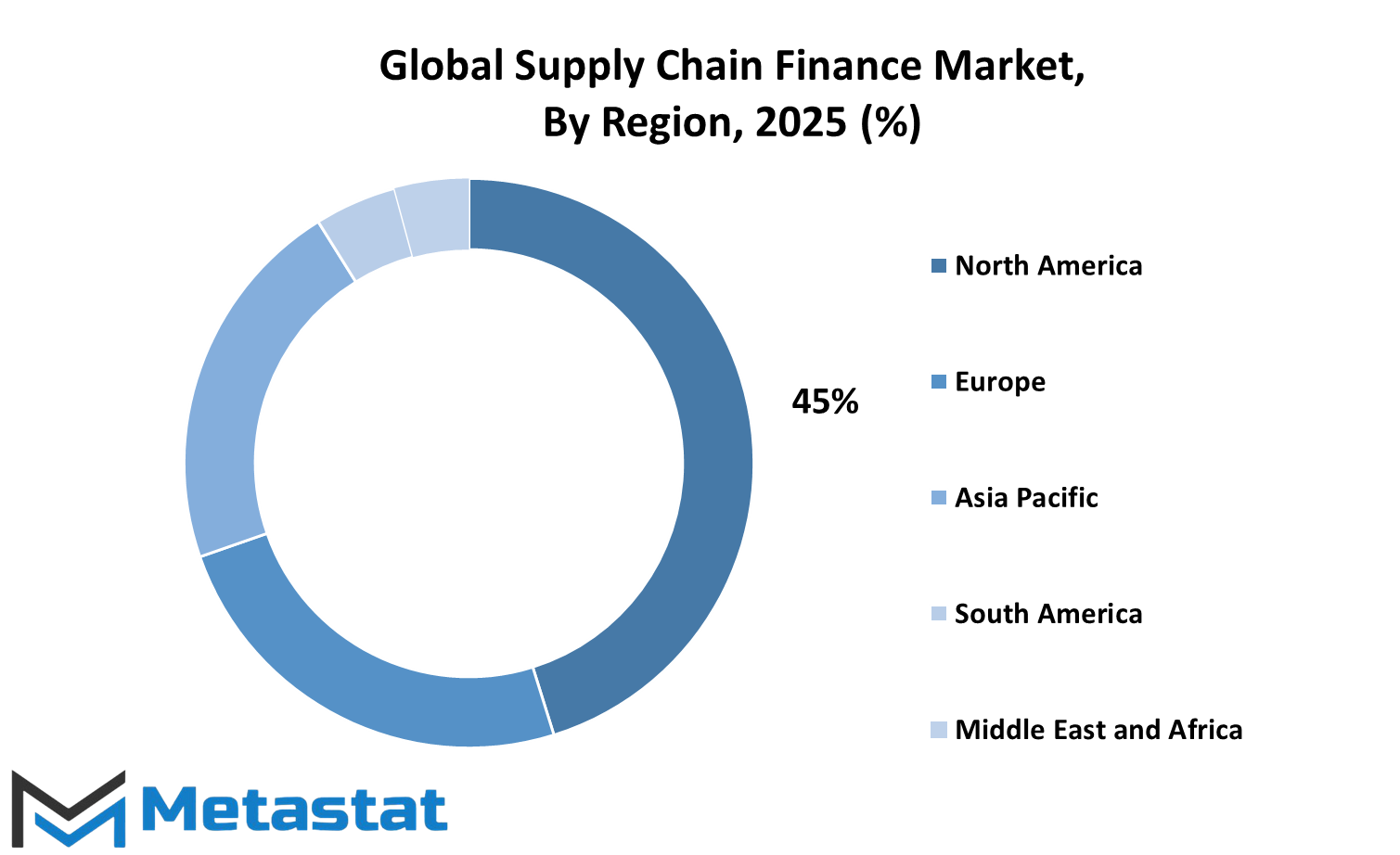

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Global Supply Chain Finance is an area that is gaining priority in the operations of businesses around the world. In today's world, supply chain finance acts as a critical element to facilitate enhanced liquidity and leverage reduced financial risk. In the case of the regional trend in the global supply chain finance market, there are unique trends and opportunities in different geographies. Each region adopts differing approaches, according to its needs and the way it enjoys growth through supply chain finance.

The market is seen to expand, especially in the North American domain, including its U.S. and Canada or Mexico sub-segments, attributed to well developed infrastructure and advances in technology deployment. Investments and growth are observed in the context of digital solutions for supply chain management, within the United States, being dominant in the whole world. Canada and Mexico, though smaller, are also gaining from increased trade agreements and a close proximity to the U.S., thus providing an ideal scenario for more efficient supply chain finance strategies.

Europe, with markets in the UK, Germany, France, and Italy, will continue to grow steadily as companies increasingly turn to more advanced financial solutions. The region is strong in the financial sector, and as companies look for ways to optimize working capital, the importance of supply chain finance will increase. The UK and Germany will lead the charge, given their strong industrial and manufacturing bases, while France and Italy will contribute significantly, particularly in automotive and luxury goods, which require precise supply chain financing mechanisms.

In the coming years, Asia-Pacific will be a global leader in supply chain finance market. With economies like China, India, Japan, and South Korea, it has diverse economies with fast growing economies that hold a large volume of opportunities in supply chain finance solutions. China, being one of the largest manufacturing hubs in the world, will remain a central force in this market, with increasing demand for financing solutions that help streamline cross-border trade. India’s growing e-commerce sector, along with Japan and South Korea’s advanced technology adoption, will also contribute to the expansion of the market.

Brazil and Argentina are relatively integrated into the global supply chain in South America; therefore, integration will lead to an increased demand for supply chain finance solutions in this region. While the region has economic instability issues, there is a lot of unused market potential. When businesses move their operations in South America towards efficiency, improving cash flow management and minimizing financial risks will require supply chain finance.

The Middle East and Africa will also experience growth in the global supply chain finance market but at a slightly slower pace compared to the other regions. In the Middle East, regions that are part of the GCC, such as Saudi Arabia and the UAE, will continue to develop their infrastructure and expand trade relations, which will lead to increased adoption of supply chain finance solutions. In Africa, regional market growth will definitely be led by the likes of South Africa; however, political and economic challenges may more broadly restrict regional expansion.

The future of the global supply chain finance market will differ when relating to its regional variations. North America, Europe, and Asia-Pacific will be growing aggressively, whereas South America and the Middle East & Africa are going to grow steadily as these regions increase their integration in the global supply chains. The advancement of technology and interconnected industries will continue, and that will grow the global supply chain finance market to provide innovative financial solutions for businesses to improve their efficiencies in supply chains.

COMPETITIVE PLAYERS

The global supply chain finance market will continue to grow as more and more businesses understand the need for optimizing their financial operations. Supply chain finance is designed to help companies manage cash flow by providing solutions that enable suppliers to receive early payments while buyers are granted extended payment terms. This model benefits all parties involved in the supply chain, fostering smoother transactions and stronger partnerships. There are several key players driving the growth of the market, which continue to evolve their services to address the needs of a rapidly changing global economy.

The leading financial institutions include Citi Group, HSBC Holdings Plc, JPMorgan Chase & Co., and Bank of America Corporation. These banks have used their vast experience and technological capabilities to provide customized solutions to businesses. Such institutions, integrating blockchain technology, artificial intelligence, and cloud-based platforms into their processes, make supply chain finance accessible, efficient, and secure. The objective of the process is to be smooth for all participants: small suppliers as well as huge multinational companies involved in a supply chain transaction process.

Except for the old, traditional financial houses, new emerging technology firms will be significantly part of this emerging global supply chain finance market of the future. BNP Paribas and Mitsubishi UFJ Financial Group Inc. along with the Royal Bank of Scotland Plc, joined hands with Fintech like Demica and PrimeRevenue or Finastra to create solutions. The collaborative nature of such projects is therefore necessary to fulfill the increasing needs for digitized, transparent, and flexible supply chain finance solutions to meet modern businesses' demands.

As more global markets integrate into one large, interconnected market, these fintech solutions will only continue to simplify financial transactions even further and enable companies to more easily cross borders to make business deals. Additionally, companies like Tradeshift, Vayana Network, Axis Bank, Emirates NBD Bank, and SAP (Taulia) are contributing to the growth of supply chain finance through their technology-driven platforms.

These platforms provide businesses with the tools to automate and optimize their supply chain operations, making it easier to track and manage payments. Through these innovations, businesses will be able to reduce operational inefficiencies, which can have a significant impact on their overall profitability.

The global supply chain finance market will continue to evolve with new entrants into the industry and existing companies expanding their offerings. The next wave of innovation in this space will be driven by the combined efforts of traditional financial institutions, fintech companies, and tech giants. It is in the area of increasing efficiency in operations, increasing transparency, and managing cash flow that businesses will see supply chain finance as an essential element in an increasingly competitive marketplace.

Supply Chain Finance Market Key Segments:

By Provider Type

- Banks

- Non-Bank Financial Institutions

- Fintech Companies

- Trading Finance Houses

By Offering Type

- Receivables Financing

- Payables Financing

- Inventory Financing

- Reverse Factoring Solutions

By Application

- Domestic Supply Chain Finance

- International Supply Chain Finance

- Invoice Financing

- Dynamic Discounting Solutions

By End-User

- Corporates

- Small and Medium Enterprises (SMEs)

- Financial Institutions

- Government Entities

Key Global Supply Chain Finance Industry Players

- Citi Group

- HSBC Holdings Plc

- JPMorgan Chase & Co.

- Bank of America Corporation

- BNP Paribas

- Mitsubishi UFJ Financial Group Inc.

- Royal Bank of Scotland Plc

- Standard Chartered Plc

- Asian Development Bank

- Demica

- PrimeRevenue

- Finastra

- Tradeshift

- Vayana Network

- Axis Bank

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252