MARKET OVERVIEW

The global mutual fund transfer agency market is part of the overall financial services sector, serving a defined function in how investor transactions are processed and recorded. The market encompasses third-party entities that are charged with maintaining shareholders' records for mutual funds, ensuring that transactions like subscriptions, redemptions, and transfers are correctly processed. With the investment environment increasingly becoming more technology-based and diversified, the function and purpose of transfer agencies will evolve subtly yet significantly.

Transfer agencies manage the back-end of mutual fund business. While asset allocation and performance are the concerns of fund managers, transfer agencies provide the transactional spine, holding investor information and facilitating the smooth movement of funds between parties. When it comes to mutual funds, these agencies will be responsible more and more for data validation, compliance checks, and operational transparency as central hubs. The global mutual fund transfer agency market will tend toward new operational paradigms that minimize manual intervention, courtesy of software-enabled automation and digital identity protocols. This shift toward greater efficiency will not only address operational needs, but also align with tighter compliance requirements being framed by multiple financial jurisdictions.

In coming years, the global mutual fund transfer agency market will begin to function in a more networked arrangement. Cross-border investing will become less abstricted, and the back-office functions of transfer agencies will mirror that by embracing standardized processing systems that adapt to international investor bases. These systems will have to manage multilingual communications, regulatory harmonization, and data formatting that facilitates high-speed reconciliation. Instead of being separate national entities, transfer agencies will have to coordinate more closely with international custodians, fund administrators, and regulatory databases.

Another implicit change in the global mutual fund transfer agency market will result from the increasing need to manage not only financial precision, but also investor participation. Historically, these agencies have operated largely behind the scenes. In the future, there will be greater demands for them to assist investor portals, mobile access, and secure document management. That will redefine the role of expectations from one that was previously a strictly administrative position. Those upgrades will not be superficial but will stem from the needs of an increasingly more cognizant and digitally literate investor class.

While the majority of public focus remains locked on fund performance or market activity, the support system for investor engagement will remain increasingly significant. The global mutual fund transfer agency marketplace will probably spread its influence without ever becoming more apparent. These agencies will develop into nimble and secure handlers of confidential financial information, keeping pace with both technological innovation and regulation demanding quicker and more transparent processes.

As mutual fund action gets more dynamic and decentralized, transfer agencies will be behind-the-scenes facilitators of that energy. The stability and flexibility they introduce to fund operations will have an impact on how effectively mutual funds operate geographically. Although they might not be front-page material, their presence behind the scenes will continue to be essential to the financial system's integrity.

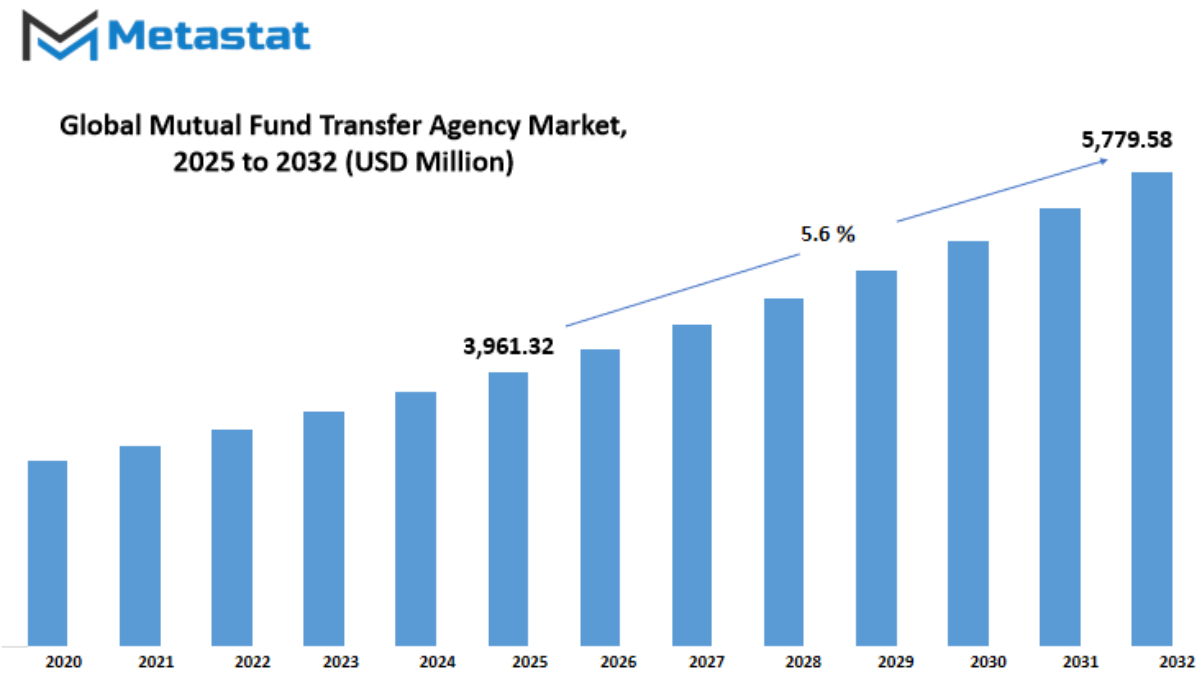

Global mutual fund transfer agency market is estimated to reach $5,779.58 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The global mutual fund transfer agency market is expected to grow steadily in the coming years, shaped by technological progress and the rising demand for efficient investment management services. As the financial world continues to expand and shift, more investors and institutions will look for ways to simplify how they handle mutual funds. This will increase the need for services that help manage investor records, process transactions, and provide regular reporting. The growing number of individual and institutional investors will likely push transfer agencies to adopt digital platforms that offer faster, more accurate, and secure services. This demand for smoother processes and better investor experiences will act as a strong force behind the market’s growth.

One of the main reasons this market will continue to rise is the increasing focus on automation and digital tools. Companies that manage mutual funds are looking for solutions that can lower manual work, reduce errors, and make handling large volumes of data more manageable. As more countries open up their financial sectors, the cross-border movement of funds will rise too, pushing the global mutual fund transfer agency market forward. Financial firms are also under pressure to follow strict rules, and transfer agencies play an important role in helping them stay compliant. This factor, along with a broader interest in saving time and lowering costs, will keep driving the market.

However, some challenges might slow down this progress. Data privacy concerns and the high cost of setting up advanced systems could make some firms hesitate. Smaller firms, in particular, might find it tough to match the pace of bigger players due to limited budgets. Also, a lack of awareness in certain regions might affect how quickly these services are adopted. These issues may create roadblocks in some parts of the market, but they are not expected to stop the overall momentum.

In the future, greater use of cloud-based systems and artificial intelligence will create new chances for growth. These tools will help agencies offer even better service by predicting customer needs, increasing security, and streamlining operations. The rise of mobile and online platforms will make it easier for investors to manage their assets on the go, further supporting the market. As more people turn to digital solutions, the global mutual fund transfer agency market will have the opportunity to grow in ways that were not possible before, opening new paths for innovation and development.

MARKET SEGMENTATION

By Service Type

The global mutual fund transfer agency market is gradually becoming more important as investment activity grows around the world. As financial markets expand and more people look for long-term ways to grow their money, the services that support and manage mutual fund transactions are expected to play a much larger role in the near future. One area showing steady development is the service type within this market, which includes Mutual Fund Accounting, Shareholder Recordkeeping, Dividend Processing, Compliance Reporting, and others. Each of these services will shape how investors interact with mutual funds going forward.

Mutual Fund Accounting is one of the core parts of transfer agency services. In the future, this process will be made faster and more accurate by technology, especially with the help of automation and cloud-based systems. This will help avoid errors and reduce the time it takes to process transactions. As investors demand more transparency, fund managers will rely on these tools to deliver precise and timely financial information. Shareholder Recordkeeping is also expected to grow in importance. It involves keeping accurate details of who owns what within a mutual fund. With more people investing in global funds, handling large volumes of data safely and quickly will be a key focus for transfer agencies.

Dividend Processing is another area that will likely see improvement. Investors expect payments to be made on time, and automation will help with scheduling and tracking these payouts more smoothly. As funds become more global, ensuring that dividends reach investors across different regions without delay will be a top priority. Compliance Reporting is expected to face more pressure due to changing regulations. Governments and financial bodies are setting stricter rules to protect investors. Transfer agencies will need to stay ahead by updating systems regularly and training staff to meet these standards.

Other services that support the global mutual fund transfer agency market, like client support and digital solutions, will also grow. These extras may not be the main features, but they help ensure the overall system works well. In the future, user-friendly platforms, secure online access, and mobile tools will help investors feel more in control of their assets. As the market grows, each service type will play a part in building trust and efficiency, showing that the transfer agency market is moving towards a future where speed, accuracy, and service quality are more important than ever.

By Fund Type

The global mutual fund transfer agency market is expected to grow steadily as financial systems become more interconnected and investors continue to explore broader opportunities. With new technologies shaping the way transactions are managed and monitored, the future of fund transfers is likely to look much different than today. People will expect faster, safer, and more transparent services, and transfer agencies will have to meet these growing demands without delays. The market plays a key role in how investment activities are carried out, and as this role becomes more advanced, it will support better decision-making for both institutions and individual investors.

Looking ahead, one major factor driving change in this space is how fund types are evolving and attracting different kinds of investors. Equity Funds are expected to see strong movement, especially with more young investors entering the market. These funds allow for ownership in companies and often have higher returns, making them appealing for those willing to take risks. On the other hand, Debt Funds may appeal more to investors looking for stability, especially during uncertain economic times. They offer returns with less risk, and that’s something many people will continue to value.

Hybrid Funds, which balance growth and safety, are likely to grow as well. They mix investments in stocks and bonds, giving investors a way to manage risk while still aiming for solid returns. As more people want both income and capital growth, Hybrid Funds may become a popular choice. Money Market Funds will also hold a place in this system, especially for short-term investments. These funds are useful for people who want to keep their money safe but still have it available when needed. The category of Others may include newer, more creative fund types that will likely emerge as technology changes and financial strategies become more flexible.

The global mutual fund transfer agency market will also need to adjust to newer rules and standards. Governments and international bodies are working on ways to make the financial system more fair and open, and this will influence how transfer agencies operate. Agencies will likely need to adopt better tools for data management and reporting. Automation and artificial intelligence may be used to improve how transactions are handled, but human oversight will still be important to keep things running smoothly.

In the future, transfer agencies will play an even more central role in helping people manage their money wisely. Their work will not only support investment activities but also build trust in the system as a whole.

By End-User

The global mutual fund transfer agency market is expected to grow steadily as more financial services move toward digital platforms and efficiency becomes a top priority. The market plays a key role in helping manage investor transactions, maintain records, and support communication between investors and fund managers. As financial markets continue to expand worldwide, this market is likely to become even more important in the future. It supports the smooth operation of mutual funds by acting as a bridge between investors and the funds they invest in. With growing investments and wider participation, the need for a reliable transfer agency becomes more obvious.

Looking at the global mutual fund transfer agency market by end-user, mutual fund companies will continue to be the major users. These companies rely on transfer agencies to ensure transactions are recorded properly, reports are generated on time, and investors receive accurate account information. As the number of mutual funds grows, the demand for fast and secure handling of data will increase too. Mutual fund companies will look for technology-driven solutions that reduce manual work and limit errors.

Wealth management firms are also expected to contribute more to the market in the future. These firms provide personalized investment strategies, and the global mutual fund transfer agency market supports them by simplifying fund transactions and offering clean records. As more individuals seek financial advice and long-term planning, these firms will require dependable transfer agencies that can manage complex portfolios.

Banks and financial institutions are another important group. They offer a wide range of financial products and need organized systems for managing mutual fund investments. As traditional banking blends with online financial services, these institutions will look for better support from transfer agencies to meet client expectations and manage large volumes of transactions with ease. They will need solutions that are not just fast, but also secure and user-friendly.

Other users, which include government bodies and insurance companies, will also play a growing role. They might not be the main users today, but as regulations tighten and financial products grow in number, even these sectors will depend on reliable transfer agency services.

In the coming years, the global mutual fund transfer agency market will not only support traditional players but also adapt to new financial technologies. Automation, artificial intelligence, and secure digital systems will drive the market forward, making it easier for all users to manage funds effectively and build trust with their clients.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3,961.32 million |

|

Market Size by 2032 |

$5,779.58 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

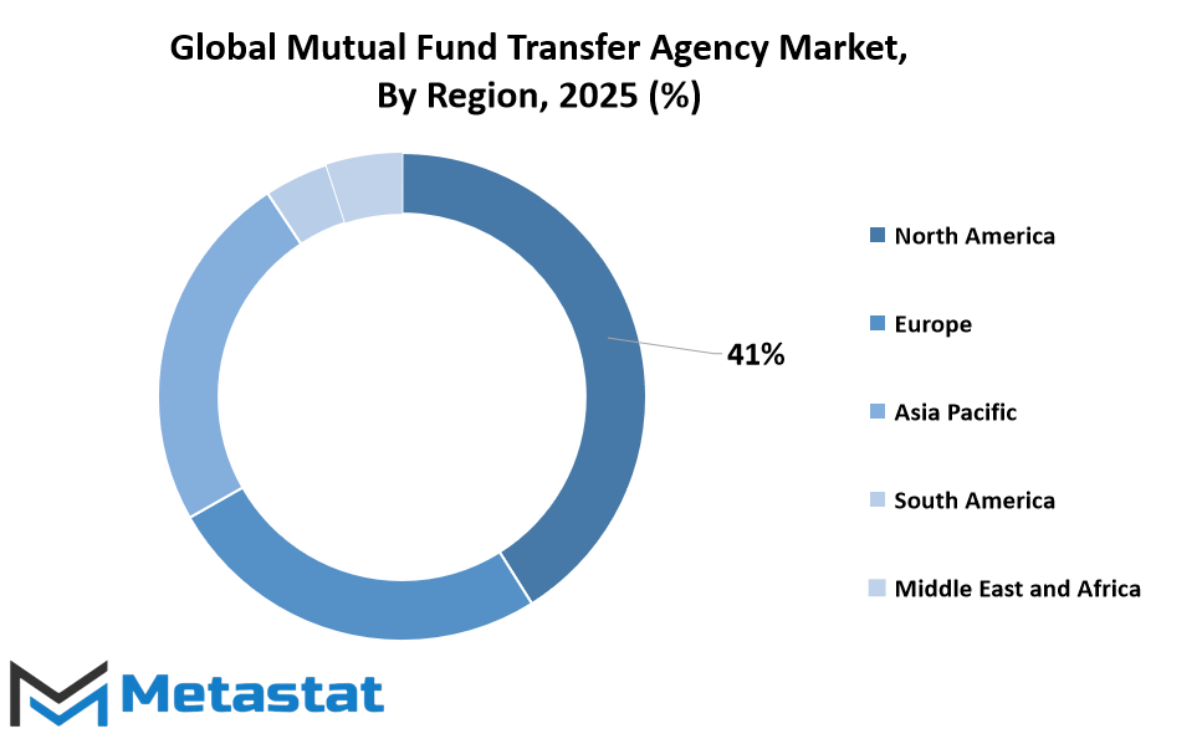

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global mutual fund transfer agency market is growing steadily, shaped by technological progress and increasing demand for efficient financial services across regions. When we look at this market from a geographical standpoint, it is clear that different parts of the world are contributing in unique ways, and these contributions are expected to become even more significant in the future. North America, with strong financial infrastructure and established investment systems, plays a leading role. Countries like the U.S., Canada, and Mexico are focusing on streamlining fund transfer processes and improving transparency. With a tech-forward approach and emphasis on customer experience, this region will continue to lead, setting benchmarks for digital transformation in fund services.

In Europe, the UK, Germany, France, and Italy are key players. They are placing efforts on aligning regulations and making cross-border transactions smoother. This push for standardization, combined with a stable economic environment, will likely support the further development of services connected to fund transfers. Europe's market is likely to see growth through modernization of legacy systems, especially as younger investors seek digital options that offer convenience and control.

Meanwhile, Asia-Pacific is emerging quickly, with India, China, Japan, and South Korea bringing energy and innovation to the scene. As more people in these countries invest in mutual funds, the need for transfer agencies to manage transactions and records accurately becomes more important. Digital platforms, mobile access, and increasing financial literacy are some of the factors driving this growth. The region’s youthful population and rapid adoption of technology will make Asia-Pacific a strong force in shaping the future of this market.

South America, with countries like Brazil and Argentina, is also showing potential. As economic conditions stabilize and access to investment tools improves, the demand for reliable fund transfer services will grow. Similarly, the Middle East and Africa are expected to play a larger role, especially with the GCC Countries, Egypt, and South Africa pushing for improved financial services and infrastructure.

Looking ahead, the global mutual fund transfer agency market will rely heavily on digital tools, data security, and global coordination. As technology evolves, the market will shift towards faster, safer, and more transparent operations. Each region will bring its strengths, and together, they will shape a future where fund transfers become simpler, smarter, and more user-friendly across the world.

COMPETITIVE PLAYERS

The global mutual fund transfer agency market is expected to go through steady changes as financial systems become more advanced and investor needs keep evolving. This market plays a key role in the smooth processing and administration of mutual fund transactions across different financial platforms. As technology moves forward, transfer agencies will not just handle data but also become important tools for improving investor experience, increasing efficiency, and lowering risks. Companies in this space are focused on using digital tools that allow faster, more secure services while meeting global regulatory standards.

Looking at the future, automation and artificial intelligence will support a new phase for transfer agencies. These systems will help in streamlining operations, reducing paperwork, and speeding up fund settlements. The firms leading these efforts include SS&C Technologies Holdings, Inc., Broadridge Financial Solutions, Inc., and HSBC Holdings plc. Each of them brings a strong background in financial services, and they continue to invest in systems that can handle more volume with fewer errors. With more investors entering global markets, there is a growing need for accurate and quick transaction handling, something these companies are preparing for by upgrading their systems.

In addition, companies such as Apex Group Ltd., SEI Investments Company, and U.S. Bancorp Fund Services are putting resources into creating platforms that connect better with clients and offer more transparency. By focusing on user-friendly interfaces and mobile access, they aim to meet the expectations of a younger, tech-savvy generation. These platforms will not only manage transactions but also offer real-time tracking and reporting tools. This shift is likely to become the new standard across the industry.

Security will also remain a top concern. Firms like Northern Trust Corporation, BNY Mellon, and Depository Trust & Clearing Corporation are working on improving cybersecurity to protect sensitive data. As digital threats grow, these agencies will need to build stronger systems that guard both client information and transaction records. Meanwhile, Computer Age Management Services Limited (CAMS) and KFin Technologies Ltd. are expanding in growing markets, positioning themselves as key players for future growth in the global mutual fund transfer agency market.

As these changes continue, the market will be shaped by firms that are able to mix strong operations with the flexibility to adapt. Over time, the focus will be on building systems that are faster, safer, and more accessible for investors worldwide.

Mutual Fund Transfer Agency Market Key Segments:

By Service Type

- Mutual Fund Accounting

- Shareholder Recordkeeping

- Dividend Processing

- Compliance Reporting

- Others

By Fund Type

- Equity Funds

- Debt Funds

- Hybrid Funds

- Money Market Funds

- Others

By End-User

- Mutual Fund Companies

- Wealth Management Firms

- Banks and Financial Institutions

- Others

Key Global Mutual Fund Transfer Agency Industry Players

- SS&C Technologies Holdings, Inc.

- Broadridge Financial Solutions, Inc.

- HSBC Holdings plc

- Apex Group Ltd.

- SEI Investments Company

- U.S. Bancorp Fund Services

- Northern Trust Corporation

- BNY Mellon

- Computer Age Management Services Limited (CAMS)

- KFin Technologies Ltd.

- Depository Trust & Clearing Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252