MARKET OVERVIEW

The global parametric flood insurance market is at the crossroads of high-end data analysis and financial mitigation, rewiring the insurance sector in terms of preparing for and reacting to climate-induced flood events. The new industry is not only a technical transformation but also a fundamental rethinking of how risk will be measured and paid out in the near term. Old-fashioned indemnity-based schemes, typically slowed by ground damage surveys and paperwork, will be replaced progressively with systems that value speed, transparency, and certainty. As this market gathers momentum, it will introduce fresher methodologies centered on quantifiable triggers such as intensity of rain, river-level rise, or satellite-sensing flood detection. These parameters will form the foundation for making payouts, cutting the usual time lag between disaster and recovery.

In the future, the global parametric flood insurance market will expand to cover larger, more diversified geographies, particularly regions that were not previously served by traditional insurance because they were too risky or lacked adequate infrastructure. Such underserved territories will discover new resilience opportunities since parametric solutions make risk-sharing on a more balanced basis. It will not just benefit individual policyholders but also local governments, NGOs, and businesses who have to contend with large-scale disruption from floods. By translating statistical probabilities into actionable data, the market will facilitate a more proactive response to financial exposure from extreme weather.

Technology will continue to play a key role in this transformation. Machine learning, real-time monitoring, and blockchain verification will increase the validity and speed of the parametric model. These technologies will enable the detection of flood causes with near-perfect accuracy, enabling insurance claims to be settled in virtually real time. This will cause the market to greatly decrease administrative expenses and human mistakes while ensuring financial assistance is paid out at the point when it is most required. Insurers will start making partnerships with weather tech companies and satellite data companies, indicative of a future where cooperation exists across industry lines.

However, the transition will not be technology-based alone. Legal practices and fiscal policies will also increasingly accommodate this model, providing it with a more solid foundation within national and global insurance practices. Training modules and public-awareness campaigns will also arise to inform potential users about the advantages of parametric protection over conventional policies. Stakeholders across industries will have to get together and establish mutual trust and transparency regarding trigger mechanisms and payment processes.

As the global parametric flood insurance market continues to grow, it will take with it the promise to revolutionize disaster preparedness and financial recovery. Although the model is not yet mature, its direction indicates a future where resilience is based on certainty, data informs decision-making, and speed is a key ally in moments of crisis. This transformation, while also updating insurance business, will plant a culture of adaptive thinking in the context of increasing climate uncertainty.

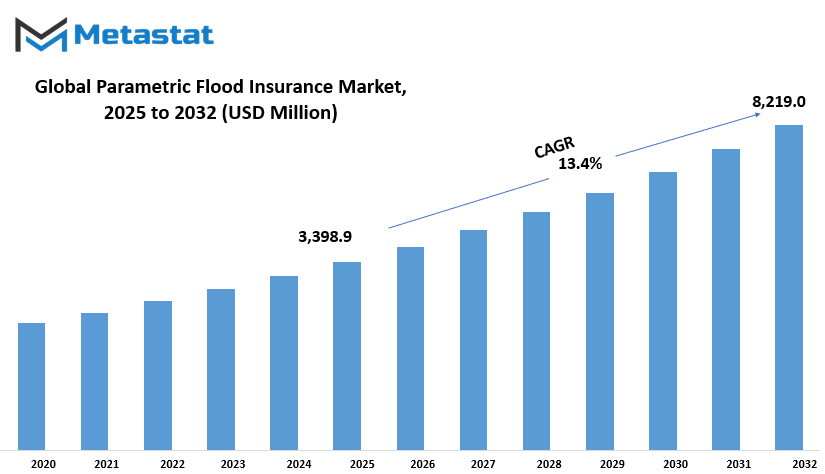

Global parametric flood insurance market is estimated to reach $8,219.0 Million by 2032; growing at a CAGR of 13.4% from 2025 to 2032.

GROWTH FACTORS

The global parametric flood insurance market is gaining prominence with the effects of climate change growing stronger every day across the globe. With unstable weather patterns resulting in rapid and intense floods, insurance schemes need to adapt to respond more rapidly and effectively than conventional ones. Individuals and companies in flood-risk areas now specifically look for solutions that guarantee quicker payout of claims without the hassles of lengthy assessment processes. This is driving insurers to data-intensive models, in which set triggers like rainfall or river level readings can be used to automatically release payouts. More areas with high vulnerabilities will start appreciating the importance of this system as more take it up.

But there are challenges facing the global parametric flood insurance market too. One major impediment is the limited pool of historical flood data, something that would hinder insurers from creating reliable risk models. Without solid records of the past, insurers would find it increasingly difficult to price these insurance products and anticipate future risks accurately. In addition to that, the regulatory structures in most emerging markets remain incomplete or ambiguous, fueling apprehension among insurers who want to roll out more parametric products. These uncertainties can hinder market growth and deter innovation.

In spite of these drawbacks, there are robust indications of opportunity in the future. Progress in technology, particularly in fields such as satellite tracking and IoT sensors, is making it feasible to initiate payouts in real time according to real events, not estimates. This not only minimizes loss-compensation time but also instills confidence in the system. In addition, there is an increasing urge to expand parametric insurance into areas that have traditionally been underserved by conventional insurers. Through entering such underserved markets, providers can make a significant difference while accessing new streams of revenue.

The global parametric flood insurance market is headed toward a future where technology and risk protection are entwined. While challenges exist, the path is clearsmarter, quicker, and more accessible flood coverage will be an essential element of the insurance industry in the coming years.

MARKET SEGMENTATION

By Type

The global parametric flood insurance market has been of increasing interest since floods have been affecting people globally. Rather than waiting for the old method of loss assessment, parametric insurance is a quicker, more transparent alternative. It functions by applying pre-agreed triggers, like rainfall intensity or river levels, to trigger payouts. It eliminates the lag normally associated with claim payouts, thus becoming more dependable during emergency situations where time counts. With increasing frequency and severity of natural disasters, numerous governments and private entities are inclined towards parametric models in order to cover infrastructure, agriculture, and public welfare.

The global parametric flood insurance market for this is further divided into four categories based on the type of insurance. River Flood Insurance dominates with a value of approximately $2,364.1 million. This category is major, particularly along seasonal flooding caused by overflowing rivers. Flash Flood Insurance is another important sector, providing insurance where water comes up suddenly and evaporates fast, sometimes before there is time to prepare. Coastal Flood Insurance applies in areas that are susceptible to storm surges and sea level rise, increasingly a concern with climate change. Urban Flood Insurance provides insurance for flooding risk in towns and cities, where inadequate drainage and fast development can enhance exposure. Each form is for specialized geographic and environmental purposes, mirroring how location and exposure create demand for this type of coverage.

More areas in the future will find parametric flood insurance due to its efficiency and swiftness. It's especially useful for areas that in the past lacked easy access to financial protection after disasters. Developing countries might view this model also as a means of lessening the economic burden resulting from widespread floods. Technology will increasingly play a larger role in enhancing the way triggers are quantified, leveraging satellite information and weather monitoring systems. This will make it more accurate, making insurers and customers more confident in the system.

In total, the global parametric flood insurance market will keep growing, driven by climate risk, insurance practice innovation, and the demand for prompt relief following severe weather. As tools become better and awareness rises, this market is expected to expand to sectors and areas that were not previously being served.

By Application

The global parametric flood insurance market is taking shape as a concentrated reaction to the increasing demand for quicker and more effective flood-related payout. As volatile weather conditions continue to impact millions worldwide, the need for new insurance paradigms is poised to expand. Parametric flood insurance distinguishes itself by providing a simple solution compensation is automatically paid out when predetermined conditions are reached, like the amount of rain or river level, without necessitating time-consuming damage assessments.

By application, the market is segmented into four broad fields: protection of municipal infrastructure, coverage of residential property, commercial property coverage, and coverage of agricultural land. Each of these classes is a specific task in dealing with overall flood effects. Protecting the infrastructure of the municipality would be a concern for governments and urban planners, especially in flood areas. Roads, bridges and drainage facilities are part of everyday functions, and maintaining a financial buffer can accelerate recovery processes and reduce pressure on public finance.

Residential property insurance will become more popular among homeowners who want quicker settlements of claims and fewer forms to fill out. Conventional insurance sometimes includes delay and conflict regarding damage assessment, but parametric models provide more straightforward direction. With growing frequency of natural disasters, home owners in risk-prone areas will increasingly prefer this straightforward approach. Similarly, commercial property coverage will be used rapidly by business owners who cannot wait for weeks or months to process traditional claims. Quick payments allow them to repair damage, restart operation and avoid further financial losses.

For agriculture, the safety of land and crops is important to maintain food security and rural livelihood. Flood may destroy the efforts of many seasons, and traditional insurance may not be enough to maintain farmers. Parametric insurance will equip them to make timely money and re -invest in future crops, stabilize rural economies and slow down from agricultural communities.

With advancing technology and enhanced data gathering, parametric models will both become more precise and more accessible. Insurers, governments, and providers of technology will all work together to enhance modeling systems and make them more available, especially in under-served markets. The global parametric flood insurance market isn't just expandingits redefining how flood risk is managed, making coverage more responsive, more reliable, and tied to measurable events. This transformation will redefine how individuals and institutions prepare for the financial impact of natural disasters.

By End User

The global parametric flood insurance market continues to evolve as societies, governments, and industries seek quicker and more transparent means of rebuilding after disasters. Conventional methods of insurance are too slow to evaluate damage and disburse money, leaving individuals and companies exposed in the interim. It is here that parametric insurance comes into play, paying faster based on agreed-upon thresholds such as levels of rainfall or river level, instead of the wait for a prolonged claims process. With climate patterns becoming less predictable, the need for such solutions would be expected to increase, particularly in flood-prone areas.

If one considers the global parametric flood insurance market in the context of its users, it becomes apparent that various groups of users are embracing parametric flood insurance for different purposes. Local governments, for instance, tend to bear the responsibility of recovering roads, infrastructure, and public areas following a flood. Quick access to capital can allow them to respond promptly and minimize disruption to communities. For individuals who own homes, the psychological and economic burden resulting from floods tends to become overwhelming. Parametric policies provide a safety net that provides prompt help, so they can start fixing or find shelter without hesitation. Store owners have threats as wellwhen a shop or factory is flooded, business can grind to a halt, supply chains are interrupted, and losses can accumulate quickly. Insurance that reimburses them swiftly can be the difference between making it and closing up shop for good.

Farmers have another kind of problem. Floods not just damage crops but also the property and coming harvests. Prompt financial relief can make them recover their means of livelihood earlier, buy new seeds, fix broken equipment, or guard livestock. In all these instances, parametric flood insurance's attraction is its guarantee of speed and certaintyultimates that conventional policies cannot provide. This segment-based adoption presents a better image of how varied and necessary this type of insurance will be.

As technology around data continues to evolve, the setting and confirmation of parameters will become increasingly efficient. This will not only improve precision but also increase trust among policyholders. Satellite imagery, IoT sensors, and AI modeling will probably become more prevalent instruments in defining when payouts are initiated. The global parametric flood insurance market will increasingly be headed towards user-specific uses, with each groupgovernment agency, household, firm, or farmergetting the type of assistance they require when disaster happens.

What is special about this market is not only the product itself but how it's structured around actual needs. The ease of the payout system, combined with improvements in weather forecasting and data tracking, will redefine how customers use insurance. These changes will not only revolutionize policy design; they will alter how individuals project into the future. With more people and institutions valuing preparedness, this market will not only grow in size but value.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3,398.9 million |

|

Market Size by 2032 |

$8,219.0 Million |

|

Growth Rate from 2025 to 2032 |

13.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

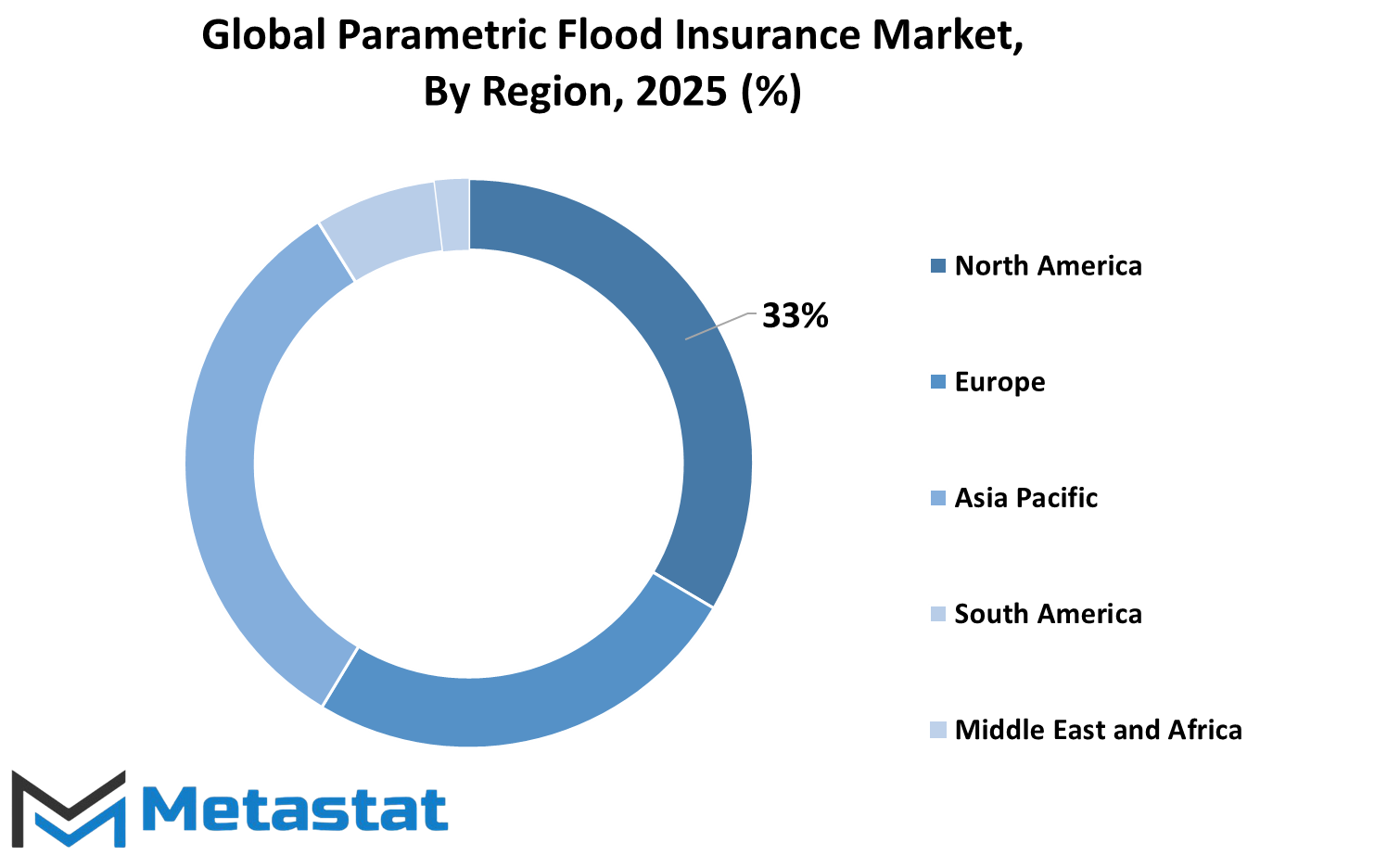

The global parametric flood insurance market, as observed through the lens of geography, has a well-organized spread across prominent global regions. These regions are North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each region has prominent countries that uniquely feature in the composition and direction of the market.

North America is significant in influencing the parametric flood insurance market. In this region, the United States, Canada, and Mexico are the main players. The U.S., especially, will remain a major contributor owing to its well-established insurance industry and emerging demand for alternative flood protection options. Canada and Mexico are likely to trail with mounting interest, particularly in regions that are subject to dramatic weather conditions.

Europe's presence is comprised of the UK, Germany, France, and Italy, and other nations classified as part of the Rest of Europe. The UK and Germany will drive the region's participation, as both countries are progressing proactively in addressing flood-based risks using innovative insurance models. France and Italy will also contribute, particularly as governments and private sectors start seeking more responsive solutions to address natural disaster-related losses.

In the Asia-Pacific region, India, China, Japan, and South Korea constitute the core market, with the rest of the countries categorized as Rest of Asia-Pacific. As climatic trends keep on altering, nations such as India and China are expected to see an increasing need for fast and flexible insurance settlements, a parameter paramount to parametric models. Japan and South Korea, known for their forward-thinking approach to disaster preparedness, are also expected to adopt these insurance solutions more widely over time.

The South America region is comprised primarily of Brazil, Argentina, and the Rest of South America. Brazil's growing urbanization and repeated experience with flooding will propel its interaction with this market. Argentina will also be seeking out parametric solutions, especially as the word spreads regarding the shortcomings of conventional indemnity-based insurance in quickly unfolding disasters.

Lastly, the Middle East & Africa category contains GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. As regions of the GCC remain plagued by variable weather and infrastructure issues, the demand for fast-trigger insurance solutions is set to increase. Similarly, South Africa and Egypt also stand to gain, especially where urbanization overlaps with climate-sensitive areas.

Every region presents unique challenges and opportunities, driven by climate factors, regulatory environments, and penetrations of insurance. As climate resilience and awareness become increasingly powerful drivers, these regions will increasingly determine how parametric flood insurance becomes established and develops on the global arena.

COMPETITIVE PLAYERS

The global parametric flood insurance market is increasingly becoming a targeted area of focus as global climate patterns change and floods become more frequent and intense. Conventional insurance schemes typically lag behind in coming to the aid of such calamities, with delayed payouts and difficulties in verifying losses. Parametric insurance is where this gap gets filled. Instead of depending on the time-consuming process of determining individual damages, parametric policies pay out based on pre-established parameterssuch as rain amounts or flood heightsrecorded by reliable data sources. This format enables policyholders to be compensated sooner, resulting in the speediness and timeliness of recovery endeavors.

Within at-risk markets prone to surprise flooding, the answer promises the potential to revolutionize the way both businesses and individuals deal with risk. It provides not only economic aid but also reassurance, in that assistance will be forthcoming without the usual bureaucracy. Governments, big companies, and even small towns are starting to recognize the merit of such models. For them, it's all about speed. Following a flood, individuals want assistance to repair homes, reopen shops, and rebuild roads. The sooner assistance arrives, the sooner things get back to normal. This advantage in itself is making parametric insurance an option of real-world use, rather than mere technical novelty.

Technology dominates the future of this business. Satellites, sensors, and weather stations provide real-time data, enabling contracts that are specific as well as reliable to be designed. It also creates the possibility of new levels of personalization, so coverage can be written to match regional flood risk and seasonal changes. As digital infrastructure continues to advance and access to high-quality climate data becomes increasingly prevalent, the industry will increasingly extend geographically and across customer segments.

Here, at the nexus of this change, are firms dedicated to reshaping risk coverage. Major players in the global parametric flood insurance market are Munich Re Group, Swiss Re Group, FloodFlash Limited, Neptune Flood, AXA XL, Allianz Group, Aon plc, Guy Carpenter & Company, LLC, Floodbase, and Liberty Mutual Reinsurance. These companies are not merely selling policiesthey are making investments in technology collaborations, local market customization, and education initiatives to boost take-up. Their strategies often combine traditional insurance knowledge with modern data modeling, aiming to close the protection gap that affects millions globally.

While the model itself has tremendous potential, it is not without issues. Establishing customer trust, making technical terms accessible, and providing equitable pricing for actual risk continue to be the challenges. But as successful case studies multiply and visibility increases, it's probable that parametric flood insurance will become increasingly accepted. It doesn't intend to displace all that currently exists but enhance itby overlaying the efficiency, speed, and reliability when it's most critical.

In the future, the global parametric flood insurance market will continue to develop as a reaction to environmental change and customer need. With technology improving and flood risks increasing, more areas will start to look into this model not as an option, but as a first line of flood recovery. Through ongoing development and partnership between insurers, tech vendors, and public institutions, this market has genuine potential to transform the way that we prepare for and recover from natural disasters.

Parametric Flood Insurance Market Key Segments:

By Type

- River Flood Insurance

- Flash Flood Insurance

- Coastal Flood Insurance

- Urban Flood Insurance

By Application

- Municipal Infrastructure Protection

- Residential Property Coverage

- Commercial Property Coverage

- Agricultural Land Coverage

By End User

- Municipal Governments

- Homeowners

- Business Owners

- Farmers

Key Global Parametric Flood Insurance Industry Players

- Munich Re Group

- Swiss Re Group

- FloodFlash Limited

- Neptune Flood

- AXA XL

- Allianz Group

- Aon plc

- Guy Carpenter & Company, LLC

- Floodbase

- Liberty Mutual Reinsurance

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252