MARKET OVERVIEW

The Global Financial Lines Insurance market and industry protect businesses and financial institutions with various risks attached to regulatory changes, legal liabilities, and operational vulnerabilities. This market will cater to entities exposed to possible financial uncertainties through specialized insurance solutions to mitigate probable loss arising from professional liabilities, management risks, and transactional exposures.

The market is set to cover industries that have dealings in banking, asset management, corporate enterprises, and all professional service providers. As organizations traverse complex legal and financial terrains, the demand for coverage solutions addressing risks such as directors and officers (D&O) liability, errors and omissions (E&O), fiduciary liability, and cyber perils will gain emphasis. The policy structures will respond to changing regulations to ensure that jurisdictional-specific requirements and industry best practices are complied with.

With increasing digitalization and financial interconnectivity, exposure to cyber-related liabilities and fraudulent activities will form the very basis for concurring demand for comprehensive coverage options. Insurance providers will craft bespoke policy wordings tailored to the new risks that arise due to data breaches, cyber extortion, and regulatory fine aggregation. The underwriting processes incorporating advanced analytics and artificial Intelligence shall make quite an advancement whereby risk assessment models will be fine-tuned to ensure that policyholders will get tailor-made coverage that meets their operational requirements.

Regional dynamics in the market will take different ambience depending on economic conditions, legal frameworks, and company governance standards. In developed economies, stringent regulatory oversight will demand robust insurance solutions that adequately address the needs of publicly listed companies and financial institutions managing substantial amounts of client assets.

At the same time, in emerging markets, there will be gradual adoption as businesses start recognizing the need for financial protection in reducing potential litigation threats and compliance liabilities. Nevertheless, the demand for products addressing cross-border risks and regulatory divergences will be pronounced as multinational corporations continue to expand into new jurisdictions.

While competitive strategies in the industry will emphasize developing innovative insurance products with a modern risk environment, insurance companies will develop and negotiate terms with flexible coverage options for organizations of all sizes and operational complexities they will encounter. Besides, collaboration between insurers and risk management firms will foster the way for all policyholders to prepare for expected exposures and develop a strategy to minimize the interruption of their financial affairs.

Financial lines insurance products will see evolving distribution channels where digital platforms will enter more into policy issuance and risk evaluation. Direct-to-client models and online brokerage services will ease the direct access to customized coverage and lessen reliance on traditional intermediaries. Higher levels of transparency in policy pricing and terms will lead to more market efficiency, allowing businesses to make informed decisions concerning their financial protection strategies.

Regulatory development continues to play a role in any setting by further defining policy structures and criteria with which risk is assessed. Insurers will be required to constantly align their products with developing reports on financial statutes, corporate governance, and trade legislation. Alliances with law and consulting firms would be a part of the delivery of holistic solutions tailored to meet said re-emerging market needs.

The Global Financial Lines Insurance sector will be an essential part of corporate risk management, always responding to the heavy burden of financial uncertainties and legal exposures. The need remains for specialized insurance solutions to inculcate sustainability and operational resilience in a changing world economy as companies expand and finances get more complicated.

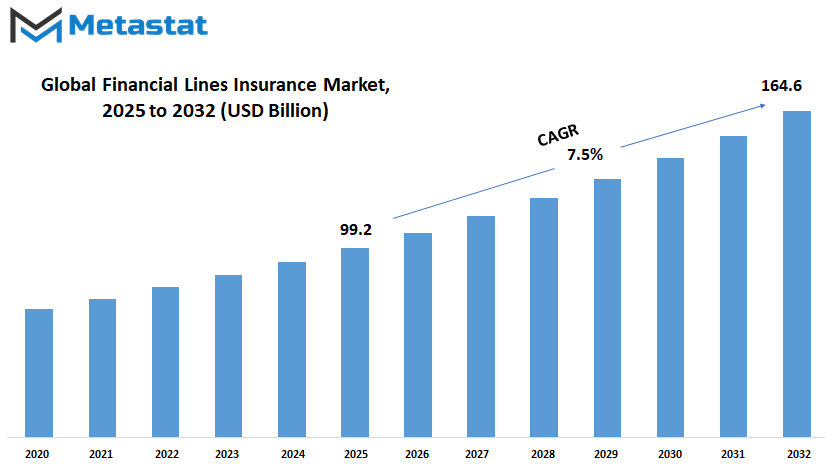

Global Financial Lines Insurance market is estimated to reach $164.6 Billion by 2032; growing at a CAGR of 7.5% from 2025 to 2032.

GROWTH FACTORS

The Global Financial Lines Insurance market will make a significant change as companies customize their products and services to changes in the economy and emerging risks. The complexity of financial exposures faced by companies will increase the demand for specific insurance. Meanwhile, businesses have become aware of potential threats; for instance, cyberattacks followed by regulatory hurdles and claims resulting from litigation, which in a way adds to the demand for more tailored structures in financing protection. With industry expansion and the growing complexity of financial transactions, insurers will come up with policies that will basically address some of the risks involved with a company and allow it to stay covered in unexpected scenarios.

Technology will help adapt the marketplace and, at the same time, tailor policies for insurers by means of data analysis and AI techniques. Digital platforms will facilitate risk assessment, provide faster and more accurate coverage for insurers, and enable a company with advanced analytics to predict financial threats and do something about it before worse things happen. Insurers will also include automated claims processing, with a resultant reduction in paperwork while improving efficiency. As a result, such products will become available to enterprises with all budgets, encouraging more organizations to invest in such lines in the future.

This market will indeed grow with stiffening of regulations. Governments and financial institutions impose compliance measures demanding businesses to have adequate financial protection. This will translate to increased demand for policies covering directors' and officers' liability, professional indemnity, and cyber risks. Also, as legal frameworks change, insurance companies will have to be a step ahead by offering coverage similar to these fast-shifting regulations' provisions so that companies may keep themselves loyal to the law, for the preservation of their financial stability.

Thus, while all these factors would work towards growth, some of the possible challenges for market development could delay the growth of such an industry. Economic uncertainties coupled with the changing interest rates may ascertain how business houses may spend in financial lines insurance. Some companies might decide not to allocate their resources according to coverage because of budget constraints, often found during financially unstable periods. In addition, the complexity of policy terms and conditions may discourage small businesses from exploring their insurance options.

Yet, technology advancement and increased awareness regarding financial risks will lead to new opportunities for the market. The availability of artificial intelligence, blockchain technology, and automated underwriting will make financial lines insurance efficient, which, in turn, brings about higher transparency and accessibility. Insurers who bring up innovations and customer-centric solutions will be in a stronger position than their competition because they will attract businesses with the best solutions for reliable financial protection.

MARKET SEGMENTATION

By Product Type

The Global Financial Lines Insurance market will keep expanding as, on the other hand, businesses face a perilous risk in this world that is increasingly digital and interconnected. From cyberattacks through fraud to legal liabilities, companies today are more alert to the financial threats that may come upon them,·thereby ensuring financial lines insurance remains a cogent option in the ambit of the risk management functions.

In the past, businesses primarily sought insurance that protected executives, professionals, and the organization from financial losses directly resulting from lawsuits, regulatory actions, or cyber incidents. As the various firms' operations become increasingly digital, there will be an increasing need for customized solutions, consequently spurring further developments and higher customization of policies.

Specialty lines are in demand, and it is these specialty lines that are booming. Directors and Officers (D&O) Insurance will unabatedly hold forth its guardianship as the corporate leadership will be entertained through various forms of legal and regulatory confrontations. While governance issues continue to be a focus, companies will seek policy options that will best protect their executives. In the case of Professional Indemnity Insurance, increasing demand, particularly from industries where professional advice and services are of utmost importance, will, therefore, prevail. As cybercrime cases become rampant, therefore, automation of Cyber Liability Insurance will become utmost priority in that it comes in to prevent losses in data breaches and cybercrime activities.

Crime Insurance will help in financial fraud and theft protection of companies, whereas Fiduciary Liability Insurance will also protect companies in case of negligence in the administration of employee benefit and retirement plans. Bankers Blanket Bond Insurance will also be important for banks and other financial institutions that require protection from fraudulent acts. Other lines of financials insurance shall keep evolving with respect to emerging risks and changes that shall be placed on a global market. As more and more companies understand the financial threats awaiting them, insurance companies will then create policies with coverage strong enough to cater for industry risks.

Looking into the future, it will be technology that will be the main determinant of activities within the Global Financial Lines Insurance. From AI to data analytics, insurers would measure risks with more precision, which guarantees the right price with the right assessment, efficient handling of their claims, and fulfillment of insurability. Underwriting functions will be made easy with automation, allowing seamless access to tailor-made protection for businesses. Insurers will focus on the forward-looking modeling, thereby nipping threats from the bud, thus complementing their reactive measures with first-on-the-ground solutions. Hence, insurance companies would have to provide flexible policies that will address ever-changing business needs, as soon-new regulations and financial challenges will spring up.

Now, competition amongst insurers will only grow fiercer as companies will demand innovative solutions for protecting against financial risks. Insurance providers that maintain a laser focus on initiatives supporting their digital transformation with a suite of customer-centric solutions will find themselves with first-mover advantage.

By Distribution Channel

The Global Financial Lines Insurance Market is poised to grow as businesses contend with increasing risks in an unpredictable economic environment. Companies now are more aware of the financial threats like cyberattack, regulatory changes, and legal disputes. Increased awareness leads to increasing specialization of insurance due to that evolving need of businesses. As industries are opening up and digital transformation is accelerating, organizations set to adopt financial protection will place such assets and reputations under risk. This demand will enforce competition towards insurers, making them advance the new offers for policies toward the evolving market needs.

Technology will play a most interesting role in reshoping the future of financial lines insurance. More assessment of risk is expected using artificial intelligence and data analytics by insurers to offer customized options for coverage. Faster claims processing and more flexible consideration of an industry will also benefit businesses. The refocusing will be on how the insurance will be bought or managed, further inflected by the dependence on digital platform usage. Customers will search for access, transparency, and convenience, bringing a lot of change in the sale of policies.

The market is segmented by distribution channel into direct sales, brokers, and online channels. Each channel will continue to serve the various preferences of customers, but online channels will open up the fastest. Digital solutions will increasingly serve companies seeking a timely and effortless way to obtain coverage. Instant policy comparison, automated risk assessments, and smooth claims processings will become online channel hallmarks.

All these make insurance available to companies, regardless of size. But brokers still have a future because they are still needed by organizations that require personalized advice or need complex coverage solutions. Also, the great guidance their expertise offers businesses through the insurance selection process is invaluable in ensuring the right policy is selected according to specific needs. While it is true that there are still many instances of direct selling, insurers strive to build direct contact with their clients and offer tailored solutions without the intervention of third parties.

The Global Financial Lines Insurance market will continue its expansion, which will challenge insurers to keep up with modern technologies and perfect customer experience. This will be achieved through automation, AI-powered analytics, and digital platforms that will be the new conductors of business-in-hand financial protection. Customers will make an effort to learn about insurers who are not only strong in coverage but also user-friendly in their commercial dealings to simplify the insurance process. Those insuring a balance of reliability and innovation will have a significant advantage in meeting emerging requirements.

By End-User Industry

The Global Financial Lines Insurance market will follow the upward trend as companies would need the facility of higher availing financial risks and legal challenges. All types of industries are coming to a point of considering it absolutely essential to secure themselves against liabilities that can have a risk impact on their stability. As the barrage of threats from cyber crime, regulatory changes, and even economic uncertainties increases, so shall the demand for financial lines insurance. More businesses are becoming aware of potential risks involving data breaches, professional liability, and management errors, prompting them to move toward more comprehensive coverage.

Technological advancements will continue to push for banking institutions to seek insurance policies that protect them against cybercrime fraud and the different operational risks. Patient data and a maze of regulatory requirements will require healthcare industries to acquire special health insurance designed to manage legal as well as financial exposures. Companies in the technology sector such as performing high volumes of digital transactions and dealing with intellectual property will seek coverage against leakage of information as well as software failure. Law firms and the likes of consulting companies will have a need for insurance policies that will protect them against liability claims in the course of advisory services.

Insurance plans addressing fraud, customer data protections, as well as supply chain failure, will be the focus of retail and e-commerce companies, thrumming up to an even more digital world. With countries having a hodgepodge of different environmental regulations and certain legal infrastructure risks, the energy and utilities industries will need insurance that will put them in good stead, in the case of unforeseen financial loss as a result of operational failure or, for that matter, lawsuits.

Manufacturing and engineering companies run extensive production and other industrial processes, and insurance must cater for the deaf risk concerning product defects, equipment breakdowns, and accidents at work. Transportation or logistics focus on getting things from one point to another efficiently; hence laws will be more on policies that ensure financial cover in cases of delays, damages to cargo, and liability claims.

It really seems that going by how different industries are changing with time and how financial threats have become more and more complex, Global Financial Lines Insurance would increasingly move toward customized insurance solutions. Insurance providers will likely identify and develop their insurance policies according to specific industry requirements while integrating data-driven risk assessment methodologies for better coverage options. Artificial intelligence would help analyze financial threats and uproot possible future losses, which indeed could help design more accurate and adaptive policies for the insurance providers in future.

As businesses are now adopting newer technologies and internationalizing their business, financial protection requirements will keep increasing. Companies will look for insurers that provide flexible personalized solutions to cater to their own peculiar risks. With increased focus on digital securities, legal compliance, and operational stability, financial lines will become a component of managing business risk, inducing provisions that are long.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$99.2 Billion |

|

Market Size by 2032 |

$164.6 Billion |

|

Growth Rate from 2025 to 2032 |

7.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

With awareness growing among organizations and individuals alike of the need for protection of financial risk, the Global Financial Lines Insurance Market will continue to grow. It is a key sector that protects organizations against liabilities that arise out of professional errors, management decisions, and finance losses. Given that industries are becoming more interconnected, and regulations are tightening, the demand for bespoke insurance solutions will rise. Companies will begin looking for policies that not only provide traditional coverage for existing risks but also adapt to emerging risks such as cyber threats and regulatory changes.

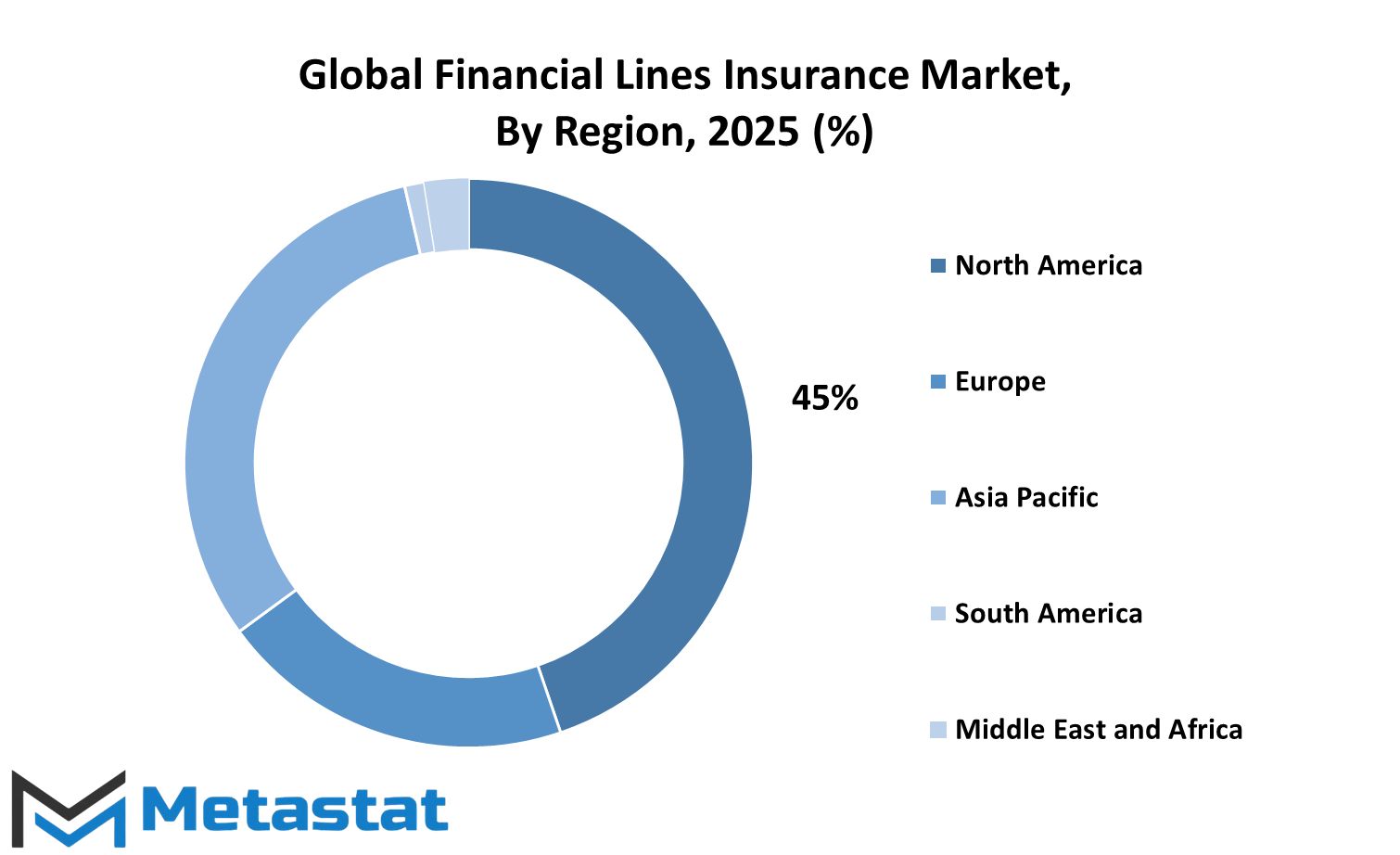

Regional markets will evolve differently due to respective economic conditions, regulatory frameworks, and industry developments. North America will hold its ground, with financial lines insurance being the biggest in adoption in the U.S., Canada, and Mexico. Businesses in this region will particularly be interested in technology, finance, and healthcare for their policies to mitigate complex financial exposures. With increasing digital threats, insurers must offer coverage for data breaches and disputes.

Europe will be another important region as countries such as the UK, Germany, France, and Italy drive market growth. This region will require specialized insurance products to adapt to changes in regulations and corporate governance standards. Financial institutions, law firms, and large corporations will demand coverage to mitigate merger and acquisition and operational liability losses. As the European market moves towards stricter compliance, insurance will need to be flexible and comprehensive.

Asia-Pacific will, on the other side, see one of the most rapid growths in financial lines insurance as developing countries such as India, China, Japan, and South Korea lift their business sectors. Demand for coverage will come from economic development, an increase in foreign investments, and greater awareness regarding financial risks. This region will demand insurance policies covering management liabilities, professional errors, and digital threats. Insurers will therefore need to carve their offerings accordingly to suit such diverse market segments and ensure companies of all sizes have financial protection.

In the South American region, Brazil and Argentina will be the largely responsible countries for market expansion in demand. Locally, businesses operating under varied economic conditions and constant regulatory pressures would see financial lines insurance as protection for their interests. Steady growth will occur also in the Middle East and Africa, particularly in the GCC countries, Egypt and South Africa. With everything from infrastructure projects to international trade and business expansion on the rise, companies will be needing insurance cover that specifically addresses their industry risks.

As the Global Financial Lines Insurance market expands, insurers will have to keep innovating with new types of policies that will account, both for present and future financial risks. In different regions, companies will look towards tailored coverage to safeguard their assets while ensuring that they remain stable during an uncertain economic environment.

COMPETITIVE PLAYERS

The Global Financial Lines Insurance market is expected to continue its growth as businesses face a plethora of ever-increasing risks. Cyberperil, regulatory risks, and economic uncertainties are ever-growing concerns while companies seek stronger protection against financial losses. Insurers are evolving to offer more specialized coverages to ensure that businesses are protected against unforeseen legal, operational, or reputational hurdles. Furthermore, as industries in the present day are interlinked, insurers would also create new-age products addressing modern financial risks like cyber liability, professional indemnity, and management liability.

Growing realization about the importance of financial lines insurance among companies across several sectors has led to stiffer competition among the providers. Thus, businesses need the insurance to take care of threats that do not fall under classical regimes and pertain to digital transactions, data breaches, and compliance. This demand is pushing insurers to devise solutions that provide coverage not only for financial losses but also for risk management services geared toward preventing claims from occurring in the first place.

In view of ever-increasing competition to keep in the van of the Global Financial Lines Insurance market, major players-in the market are likely to concentrate heavily on enhancement of their services. Some well-acknowledged names such as AIG (American International Group, Inc.), Chubb Limited, and Zurich Insurance Group are already well established, excelling in providing comprehensive coverage. Other well-known names such as Allianz Group, AXA XL, and Lloyd's of London are also likely to enhance their offerings with the help of technology and tools with improved risk assessment and claims handling. With businesses requiring swifter and seamless approach, available digital tools powered by AI and predictive analysis will be crucial and will advance the financial insurance paradigm.

Other players, such as Berkshire Hathaway Specialty Insurance, Beazley Group, and Swiss Re, are expected to find ways to make their coverage more tailored to liquidity and new risks. Marsh LLC, CNA Financial Corporation, and The Hartford are focusing on policies that address complex claims to ensure thorough legal and financial support comes into play when exceedances arise. In the meantime, Travelers Companies, Inc., Liberty Specialty Markets, and Munich Re are considering tech-based innovation that will optimize underwriting and policy management for greater precision.

With industry continuities to change, keep shifting in demand are insurance providers. Innovation will form the very fabric of the Global Financial Lines Insurance space to deliver insurance cover in a more responsive and customizable manner. Companies looking for protection will seek insurance companies that give not just economic relief but also strategic insight. The insurers who can anticipate the risks and respond with proactive solutions will create the differentiating factor that binds them with the corporates braving the uncertain economic terrain.

Financial Lines Insurance Market Key Segments:

By Product Type

- Directors & Officers (D&O) Insurance

- Professional Indemnity Insurance

- Cyber Liability Insurance

- Crime Insurance

- Fiduciary Liability Insurance

- Bankers Blanket Bond Insurance

- Others

By Distribution Channel

- Direct Sales

- Brokers

- Online Channels

By End-User Industry

- Financial Institutions

- Healthcare

- Technology

- Legal & Professional Services

- Retail and E-commerce

- Energy & Utilities

- Manufacturing and Engineering

- Transportation & Logistics

- Others

Key Global Financial Lines Insurance Industry Players

- AIG (American International Group, Inc.)

- Chubb Limited

- Zurich Insurance Group

- Allianz Group

- AXA XL

- Lloyd’s of London

- Berkshire Hathaway Specialty Insurance

- Beazley Group

- Swiss Re

- Marsh LLC

- CNA Financial Corporation

- The Hartford

- Travelers Companies, Inc.

- Liberty Specialty Markets

- Munich Re

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383