MARKET OVERVIEW

The global equity management software market is set to forge a new era in the financial technology sector as firms in industries look for more advanced ways of managing equity structures and ownership records. This market will soon exhibit a profound shift, extending far beyond its conventional role of monitoring stock options or streamlining cap table management. Instead of being used merely for administrative functions, it will become an integral part of corporate strategy, dictating decision-making, investor relations, and compliance effectiveness. With growing pressures from stakeholders and regulators, firms will look toward these software platforms not only as an aid, but as a necessity.

Over the next few years, the global equity management software market will come to shape the manner in which businesses engage with shareholders and handle internal governance. Companies will no longer view equity management as a back-office activity. Rather, they will embed such solutions department-wise so that finance teams, legal advisors, human resource departments, and executives alike can take advantage of them. As startups stretch across borders and major corporations keep buying smaller ones, the complexity of equity structures will require software that is not only precise but also nimble and scalable. This will cause the creation of systems that can manage multi-currency transactions, jurisdiction-sensitive regulations, and dynamic changes within organizations with higher accuracy.

Artificial intelligence and insight-driven data will probably become standard features, turning these platforms into tools for forecasting, scenario planning, and risk analysis. The global equity management software market will experience an increasing interest in automation that will enable companies to cut down on manual calculations, error elimination, and more transparency in stakeholder communication. These technologies will enable real-time updates and notifications, keeping company leaders apprised of equity movements, vesting schedules, and potential compliance issues. As companies shift towards more transparent financial operations, the ability to disclose clear, real-time equity data to investors and employees will become crucial to preserve trust and alignment.

In addition, security and data privacy will become increasingly important in the global equity management software market. With more digital activity and global data protection regulations, software vendors will have to include stronger encryption, secure authentication, and region-based compliance features. Reliable platforms will not just safeguard sensitive equity data but also enable firms to provide proof of accountability during audits and regulatory examinations. Financial data being a strategic asset, the purpose of equity management software will go well beyond spreadsheets and dashboards.

Ultimately, this marketplace will dictate how businesses will be funded, grown, and valued in the future. Startups will use these platforms from inception, integrating them into their business DNA, while established companies will replace antiquated systems with bundled solutions. The global equity management software market will not only evolve to meet new requirements it will define the next generation of financial stewardship and corporate disclosure, opening up opportunities beyond its current scope.

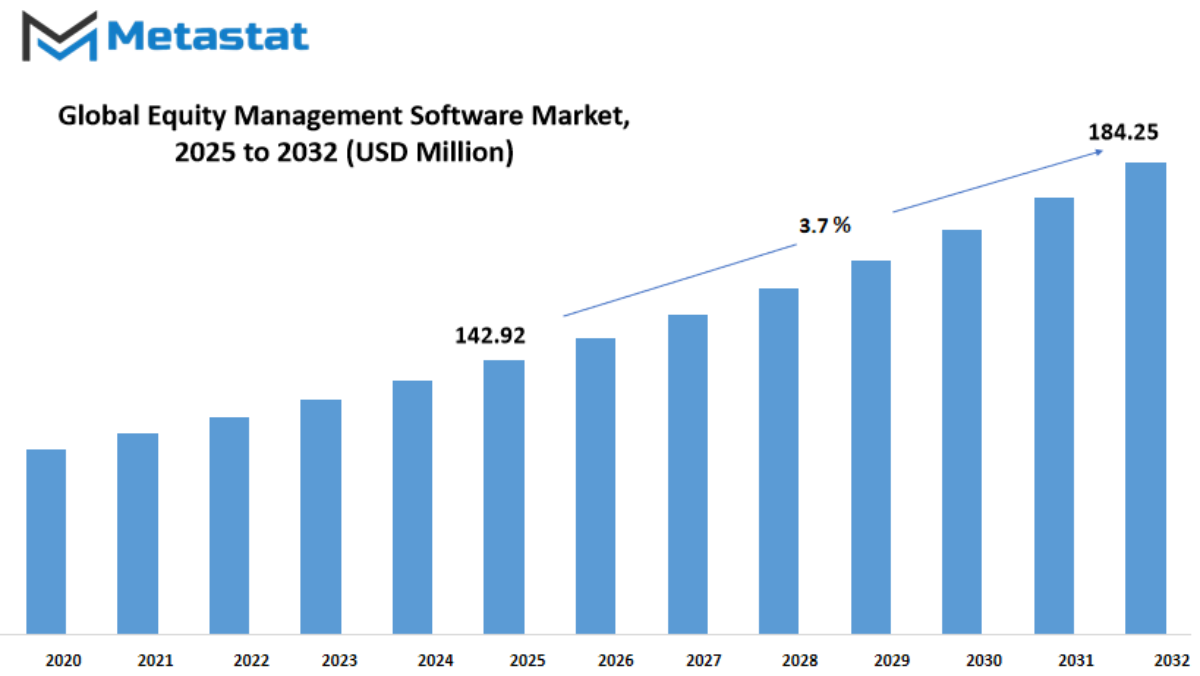

Global equity management software market is estimated to reach $184.25 Million by 2032; growing at a CAGR of 3.7% from 2025 to 2032.

GROWTH FACTORS

The global equity management software market is registering strong boom, encouraged by way of the increasing use of employee inventory possession plans (ESOPs) and equity-primarily based compensation throughout industries. Increasingly, companies are starting to offer equity as a method of attracting and preserving key talent, specially in startups and hastily growing businesses where coins reimbursement might be scarce. This transition has introduced with it a sizeable need for software that may make the technique of administration of employee equity plans simpler and extra streamlined, correct and minimizing guide mistakes. With the growth of groups, the complexity of their fairness arrangements, as a result the need for classy software program equipment, additionally grows. They aren't just suitable, however vital.

Another driver of the global equity management software market is increasing demand for transparency and regulatory compliance. Firms are actually required to conform with tighter requirements for financial reporting, employee disclosures, and verbal exchange with shareholders. Equity management software program assists in automating and streamlining this manner so that firms continue to be compliant with home and worldwide regulations. It additionally provides real-time reporting abilties, which allow it to be extra convenient for companies to get a clean and unique view in their fairness distribution. This form of transparency creates accept as true with among stakeholders and locations management in a more commanding role regarding decision-making about equity.

These advantages notwithstanding, there are still some challenges preventing the full potential of the global equity management software market from being actualized. Data security and privacy is one of the key concerns. Because equity management platforms deal with sensitive financial data and personal information, any compromise could be very damaging. Firms should thus be highly careful when selecting software providers that focus on strong encryption, secure access controls, and frequent system updates. Another obstacle is how complicated integrating these platforms with current HR and finance systems is. Most businesses, particularly companies with old software, struggle to make a seamless transition without interfering with their continuous operations.

Despite this, these obstacles also present new opportunities for innovation. The future for this market is in combining artificial intelligence and machine learning. With analytics powered by AI, equity management software will be predictive in nature, providing corporations with the capacity to model scenarios and make more informed strategic choices. For instance, they would be able to model the effects on employee retention of offering stock grants or predict the financial effects of various vesting schedules. All these features would not just enhance operational efficiency but also give a competitive advantage in handling workforce and investor expectations.

In the future years, the global equity management software market will probably experience continued investment and progress, particularly as businesses go global and need more flexible solutions. With mounting pressure to maintain talent, remain compliant, and operate more effectively, equity management software will become a core piece of business infrastructure instead of an adjunct element. As technology progresses, the market will revolutionize how organizations manage one of their most prized assets ownership.

MARKET SEGMENTATION

By Type

The global equity management software market is making steady inroads as more companies and investors are focusing on digital means to manage ownership information, administer shareholder information, and keep themselves compliant with rising regulatory requirements. These software packages have evolved from being add-on support packages to fundamental elements of corporate and financial management. As companies expand, so does the requirement for a centralized and trustworthy system to accurately monitor equity, providing transparency and efficiency among departments.

The global equity management software market is segmented into three principal categories under pricing models: Basic, Standard, and Senior. The Basic plan costing less than $50 per month has been valued at $60.88 million. This is usually targeted by small businesses and start-ups that require core features without excess complexity. These customers prioritize affordability and ease of use, relying frequently on such a tool to track cap tables, issue stocks, and hold easy-to-understand reports. Though limited in features, the Basic plan is crucial in bringing equity management products to early-stage companies.

The Standard segment, priced between $50 and $100 monthly, suits mid-sized businesses seeking a more comprehensive set of features. These include advanced reporting, HR and accounting system integration, and enhanced user controls. Firms that utilize this tier tend to have an increasing investor community and require more advanced compliance monitoring and communications capabilities. The mix of price and capacity places this tier as appropriate for growing businesses, particularly those getting ready for funding or acquisition.

At the top, the Senior tier is designed for companies that will spend more than $100 per month on higher-level capabilities. These tend to be larger companies or those with intricate equity structures, multiple stakeholders, or international operations. Software at this level can provide more advanced security, deep customization, legal assist tools, and detailed analytics. This segment's demand is based on the need for accuracy, accountability, and strategic decision-making. Businesses that get to this level tend to view equity software as a core business operation rather than an add-on support.

With the evolution of digital finance, the global equity management software market will experience growing adoption across every segment. From startups in the early stage to full-fledged businesses, the demand for robust equity tracking as well as communication with stakeholders will not diminish. The various pricing models enable growth with one's business needs, making this market equally affordable and scalable for a great variety of users.

By Enterprise Size

The global equity management software market is gaining attention as businesses seek higher methods to address possession systems, song shares, and live compliant with converting regulations. Equity management changed into as soon as a assignment managed manually or with scattered tools, but corporations today are shifting towards centralized, dependable platforms. These gear are especially beneficial for streamlining approaches together with cap desk control, worker inventory options, and fundraising pastime. With virtual solutions, companies can now avoid high priced mistakes, enhance transparency, and ensure that all stakeholders continue to be informed and aligned.

When looking at the global equity management software market by using business enterprise length, huge corporations had been short to adopt fairness management software due to the complexity of their monetary systems and a better number of shareholders. Managing heaps of equity holders or complex possession histories needs strong systems that could take care of quantity without mistakes. For those agencies, it’s not just about retaining track it’s also approximately assembly legal necessities and presenting a clear image to traders and inner teams. Large corporations often combine those systems with other monetary tools, making fairness control a part of a much wider digital environment.

On the opposite hand, small and medium-sized corporations are starting to apprehend the long-time period blessings of making an investment in equity management structures. While their desires may additionally seem greater straightforward on the begin, boom speedy brings challenges. As startups enhance investment or provide worker equity, they face the same dangers and reporting demands as larger companies. By using equity control software early on, these groups can keep away from confusion later.

Cost is mostly a challenge for smaller businesses, however many software providers now offer scalable solutions. These gear develop with the organisation, in order that they don’t need to switch structures for the duration of key growth degrees. For small and medium-sized corporations, this adaptability is important. It lets in them to begin easy and amplify functions best when important. User-friendly dashboards and automatic reporting also are massive benefits, helping groups with restrained monetary backgrounds control equity with no need a committed department.

Overall, the market for fairness management software is being fashioned with the aid of the desires of both massive organizations and smaller ones with huge aims. As the enterprise landscape will become extra targeted on transparency, duty, and efficient digital equipment, groups of all sizes will retain to explore solutions that assist them manage possession in smarter, more organized ways. Whether a employer is just getting began or already nicely-mounted, having the proper system in region will guide smoother operations and more potent relationships with shareholders.

By Application

The global equity management software market is gradually shaping the manner groups manipulate ownership and funding structures. With the increasing complexity of fairness distribution, organizations are turning to digital tools that assist them preserve transparency, accuracy, and compliance. These software solutions are no longer restrained to huge organisations; rather, they're being followed by using businesses of all sizes looking for better manipulate and perception into their fairness. As markets end up more competitive, correct tracking of possession stakes, worker stock options, and investor relations is becoming less of a luxury and greater of a necessity.

Private organizations are one of the major customers of fairness management structures. These companies depend on such software to manage cap tables, investor communications, and employee equity plans. Unlike public organizations, private companies regularly lack access to big in-residence prison or finance groups, so having a dependable virtual device enables them stay on top of critical obligations. It also makes it less difficult when they are trying to find extra funding or put together for potential acquisitions or mergers. With steady statistics coping with and simplified reporting, this software program reduces both manual workload and room for errors.

Start USA have additionally began to recognize the cost of based fairness management early on. As they develop and produce in more than one buyers across one-of-a-kind levels of funding, having a right gadget in vicinity will become critical. These companies often experience rapid changes, including hiring new personnel with inventory-based repayment and managing complicated investment rounds. Software solutions tailor-made for start-united states of America assist founders and their groups maintain the entirety in order from the start, reducing confusion and boosting investor self belief.

Listed groups use equity control gear to satisfy regulatory necessities and improve performance in managing shareholder information. Since these agencies need to offer obvious records and distinctive reporting to public stakeholders, having a centralized platform reduces the danger of inconsistencies. Automating methods like issuing shares, dividend calculations, and compliance assessments makes operations smoother and more dependable. With an increasing awareness on responsibility, indexed companies benefit from structures that provide clean documentation and actual-time updates.

Beyond those primary classes, a growing wide variety of businesses in different sectors also are exploring fairness management software program. This consists of funding companies, accelerators, or even non-traditional ventures like cooperatives or community-based totally groups. As the call for for transparency and green file-maintaining grows, greater sectors will adopt these tools. Whether for handling worker ownership or managing investor relations, fairness software is becoming a core part of how cutting-edge companies stay prepared and prepared for increase.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$142.92 million |

|

Market Size by 2032 |

$184.25 Million |

|

Growth Rate from 2025 to 2032 |

3.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

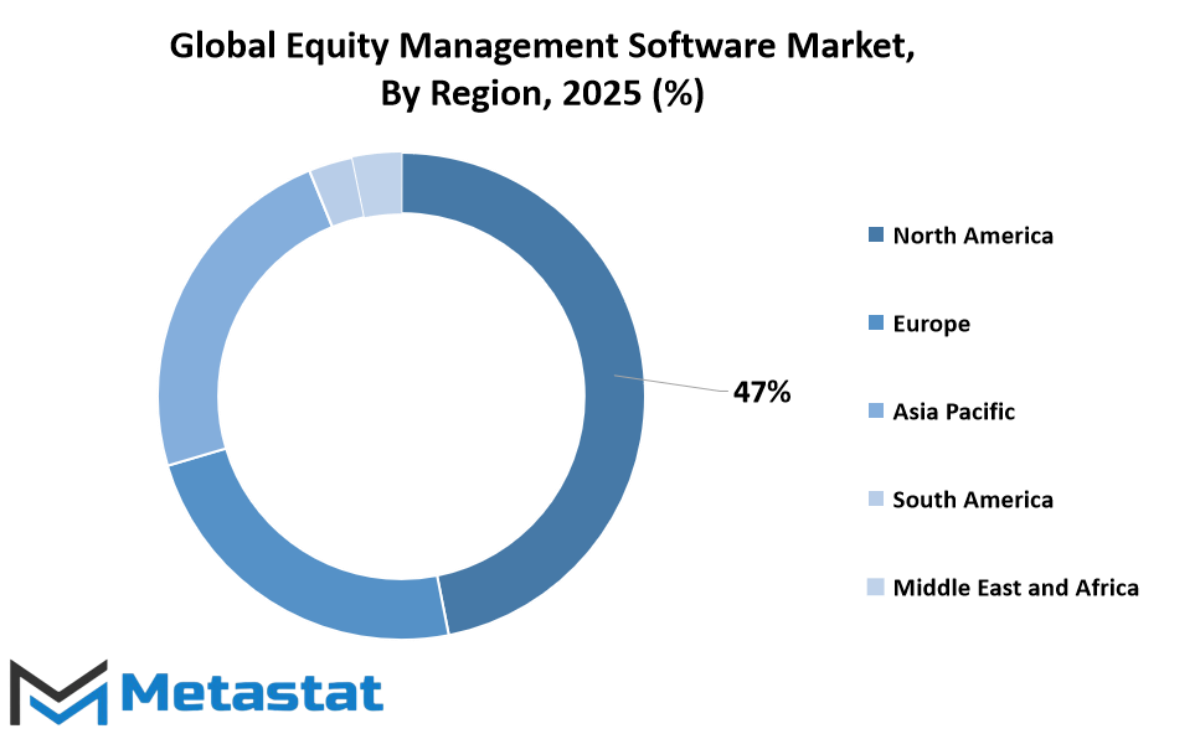

The global equity management software market suggests clear local styles in phrases of adoption and improvement. North America maintains to lead the manner, pushed via high digital attention and the presence of numerous equity-based businesses. Within this region, the USA plays a enormous position due to its mature monetary infrastructure and developing demand from startups and huge corporations looking for to automate and simplify fairness techniques. Canada and Mexico also are gaining momentum, supported through a rise in assignment-backed businesses and authorities efforts to assist digital transformation in finance.

Europe follows carefully, with international locations like the UK, Germany, France, and Italy witnessing constant boom. These international locations are specializing in improving compliance and transparency in financial management, which has caused an boom inside the use of equity management platforms. As agencies expand their operations across borders, they’re searching out software that could deal with complex ownership systems and regulatory needs. The demand inside the relaxation of Europe is developing progressively as companies in smaller economies start to adopt virtual equipment to live competitive in an an increasing number of global market.

Asia-Pacific is another speedy-growing region, particularly in nations inclusive of India, China, Japan, and South Korea. Rapid economic improvement, growing startup ecosystems, and improved overseas investments are riding the need for scalable equity answers. Companies on this area are becoming more privy to the significance of handling employee inventory plans and cap tables with precision. The relaxation of Asia-Pacific is likewise displaying signs and symptoms of progress as virtual finance gear step by step gain reputation beyond important towns and economic hubs.

In South America, Brazil and Argentina are the number one markets pushing forward with fairness management adoption. These countries are dealing with evolving company systems and a developing wide variety of small to mid-sized corporations interested by attracting investors. The want to control equity in a transparent and organized manner is main greater corporations on this location to undertake reason-built software. Other elements of South America are still catching up however are predicted to comply with in shape as economic literacy and access to generation enhance.

The Middle East & Africa is still at a developing degree in this market, although boom is seen. GCC international locations just like the UAE and Saudi Arabia are making an investment in digital finance gear as they purpose to diversify their economies beyond oil. Egypt and South Africa are also showing promise, with corporations starting to adopt modern-day software program solutions to manipulate ownership information and improve investor family members. The relaxation of the place is progressing more slowly however has the potential to develop as awareness will increase and virtual infrastructure expands.

COMPETITIVE PLAYERS

The global equity management software market is seeing steady development as more organizations shift closer to digitized and transparent economic operations. With startups developing unexpectedly and installed corporations looking to streamline their fairness methods, this software is becoming a critical device for handling cap tables, fairness plans, and compliance with regional rules. As organizations amplify throughout borders, having a centralized system that handles complex percentage systems and automates time-consuming calculations may be greater of a need than a choice. This market’s development will also be supported by way of the call for for accuracy, real-time updates, and steady platforms which could manipulate touchy ownership facts.

Among the companies main this space are Carta, Gust Equity Management, and Eqvista, all recognised for their smooth-to-use systems and robust client aid. These players provide solutions tailored to each early-stage startups and large organisations, assisting them manage investor relations, fairness splits, and criminal documentation in a single region. Ledgy and Astrella, too, are gaining traction for his or her efforts to simplify fairness monitoring for global groups. By imparting transparency and stepped forward selection-making gear, they’re assisting businesses construct consider with buyers and employees alike.

Software options via firms inclusive of insightsoftware (Certent) and Preqin Solutions are attracting firms with more complicated reporting wishes. These structures assist regulatory filings and integrate with economic systems, making them appealing to agencies that want extra than just cap desk monitoring. Meanwhile, Global Shares and OptionTrax offer strong administrative tools that allow organizations to manipulate large fairness swimming pools without manual effort.

On the funding control aspect, Altvia Solutions LLC and Imagineer Technology Group are assisting firms live aggressive by way of integrating fairness software into broader portfolio management structures. This now not simplest simplifies operations however additionally gives stakeholders a unified view of ownership systems and overall performance metrics. Pulley (Prolific Labs Incorporated) and Vestd also are really worth citing for their cognizance on equity schooling and worker engagement, bringing a extra inclusive approach to ownership.

As more groups move far from spreadsheets and scattered records, the global equity management software market will maintain growing in relevance. The industry’s key gamers are constructing tools that aren't simply purposeful but additionally designed with the consumer in thoughts specializing in clarity, ease, and adaptability. In a world where fairness subjects more than ever, software program that facilitates agencies control it better will now not most effective help boom however also form how businesses value and distribute possession.

Equity Management Software Market Key Segments:

By Type

- Basic ($Under 50/Month)

- Standard ($50-100/Month)

- Senior ($Above 100/Month)

By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises

By Application

- Private Corporation

- Start-ups

- Listed Company

- Others

Key Global Equity Management Software Industry Players

- Euronext

- Gust Equity Management

- Preqin Solutions

- Carta

- Eqvista

- insightsoftware (Certent)

- Ledgy

- Altvia Solutions LLC

- Imagineer Technology Group

- Global Shares

- Prolific Labs Incorporated (Pulley)

- Astrella

- OptionTrax

- Vestd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252