MARKET OVERVIEW

The global liability insurance market, a section of the overall financial services industry, shall continue to be a niche market dealing with third-party risk management and transfer across industries. It shall be an institutionalized arrangement for companies, professionals, and institutions looking to be insured against legal liability for accidents caused by their operations, products, or services. As regulatory climates tighten and the nature of corporate exposures evolves, the Global Liability Insurance industry will respond with innovative approaches to address the needs of diverse industries, including manufacturing, health care, construction, energy, and technology.

The marketplace will no longer be defined by static products but by dynamic coverage forms anticipating legal, financial, and reputational loss that may be incurred through charges of negligence, injury, or damage. This form of coverage will differ from traditional indemnity schemes, as it will help clients by paying for defense legal costs, settlements, and awards given, which would be a huge difference to the financial condition of a company. With business operations operating across the world today, such policies will grow in importance, particularly as cross-border exposures to liabilities and litigation risks become more complex and rising.

The structure of products in the global liability insurance market will be determined to fit sectoral and geographic nuances. Underwriting approaches and premium rates will be guided by varying standards of law and claim environments across regions. Insurers will invest their expertise in understanding jurisdictional difference in designing policy wordings that will take into consideration localized risks. This heterogeneity of coverage architecture will differentiate the market and force insurers to remain competitive without compromising on the adequacy of coverage.

In scope, the market will be diversified across general liability, professional liability, product liability, and environmental liability, each handling different zones of exposure. For instance, professional liability will concentrate on service providers such as accountants, architects, and consultants who are vulnerable to claims of malpractice or non-performance. On the other hand, general liability policies will cover physical damage or property damage in the majority of public or commercial settings. All these branches will have to contend with multiple regulatory codes and contractual standards, hence the requirement for precise policy design and risk assessment principles.

Data analysis and technology will play a greater role in shaping the future shape of the Global Liability Insurance industry. Predictive models will be used by underwriters and claims adjusters to analyze potential losses and price premiums accordingly. As new threats emerge, most significantly through cyber claims that blur the distinction between traditional liability categories, insurers will expand their definition of what constitutes covered events. This will require innovativeness in the development of exclusions and endorsements to maintain legal lucidity.

The global liability insurance market will not be the preserve of veterans. It will witness new entrants with specialized products, resulting in a more active market where reinsurance, captive programs, and alternative risk transfer methods will be strategically utilized. The market's future will depend on its ability to absorb future liabilities without sacrificing policy clarity, correct pricing, and timely settlement of claims. As business enterprises continue to answer legal risk in an interconnected world, the impact of this insurance market will be felt

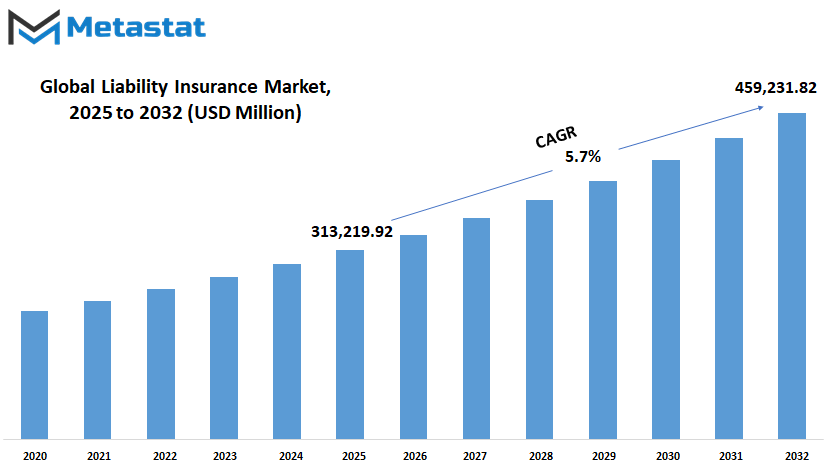

Global liability insurance market is estimated to reach $ 459,231.82 million by 2032; growing at a CAGR of 5.7% from 2025 to 2032.

GROWTH FACTORS

The global liability insurance market will experience spectacular growth due to several key factors. As companies continue to grow and face new risks, guarding against lawsuits and financial loss becomes increasingly significant. Growing awareness about risk management and the intricacy of business operations are key drivers for the market. Companies want to cover themselves against potential liability arising from accidents, negligence, or other unexpected events, pushing the demand for liability insurance higher.

At the same time, technology advancement and digitalization are leading drivers for what the future of the global liability insurance market will look like. With more information and sophisticated risk assessment methods at hand, insurers can provide more customized and efficient protection. This will allow businesses to be able to view their exposure better and choose insurance coverages that are most appropriate for them. Emerging industries and changing regulations will also create demand for liability insurance as businesses work in an environment where legal requirements are shifting.

However, certain problems can cause setbacks to the growth of the market. One of them is the increase in premium costs, which discourage small businesses from purchasing liability insurance. Another problem might be a lack of awareness in certain regions for the importance of such an insurance, limiting market growth. Regulation-related barriers and country-specific variations might also make it harder for international insurers to operate effectively, affecting overall market growth.

Despite all these problems, the Global Liability Insurance industry will have profitable opportunities in the future. With companies embracing innovation and looking for ways to insulate their operations, there will be new insurance products that will address these needs. Growth would also come from emerging markets as more companies see the importance of liability insurance. Environmental concerns and social problems will lead to new forms of liability coverage, contributing to an increase in the size of the market.

In general, the global liability insurance market stands at a crossroads where expansion will continue to expand as the need for protection grows and technology advances. While challenges are present, opportunities thereby making it a desirable area for insurers and firms alike. The industry will adjust to forthcoming developments and provide solutions that allow businesses to cope with risks in a more complicated and interconnected world.

MARKET SEGMENTATION

By Type

The global liability insurance market is on the cusp of experiencing drastic transformation in the next few years due to increasing demand for safeguarding against financial and legal perils. The industry has several large segments, each of which deals in a distinct area of liability cover. Of these, the biggest is General Liability Insurance that serves the universal need for general protection against claims of bodily injuries, property damage, and other general hazards to which business and individuals are subject. Its worth is estimated to be a big number, reflecting just how essential such coverage is to a broad array of industries.

Apart from general liability, Professional Liability Insurance is also a top priority in the market. This insurance provides a shield for professionals for negligence, mistake, or omission of their professional services. As professional services grow and become more diversified, the demand for this insurance will grow along with it, enabling professionals to secure their business and profession. The market value of this industry will also be top-notch, determining its increasing significance.

Another prominent segment in the Global Liability Insurance industry is Director and Officer Insurance. It covers corporate officers for claims that can be made against them for actions taken on their part as officers. With growing scrutiny and lawsuits, this kind of insurance gains greater significance. Its estimated market value also reflects the growth in consciousness and demand for it.

The last segment, Other, is a group of specialty liability insurance products which cover against other uncommon special needs which are not covered in the other segments. Although smaller in value compared to the other segments, this market segment is on the rise due to the creation of new risks and corporations seeking tailored insurance solutions.

The global liability insurance market will continue to change with the evolving business landscape in the next few years. Advances in technology, regulatory requirements, and changes in economic conditions will shape how companies and professionals hedge risk. The combined value of the market will progress significantly by the indicated year to illustrate the increasing recognition of liability insurance as a core element of risk management programs. Every segment will help in growth, offering specialized coverage products to fulfill diversified client needs across the world. The perspective identifies that liability insurance will continue to be among the most important areas of focus for companies looking for certainty and security in an uncertain future.

By Enterprise Size

The global liability insurance market will be set to grow steadily as companies around the world recognize how important it is to insure themselves against legal exposure. Liability insurance gives companies a chance to guard their financial well-being against claims of injury, damage, or negligence. As the business climate changes, more and more companies will look for full coverage that fits their unique needs.

When segmented based on enterprise size, the market can be split primarily into two categories: Small and Medium Enterprises (SMEs) and Large Enterprises. Both categories have their own set of challenges and risks, which will determine the nature of liability insurance that they purchase. SMEs typically have limited resources and might not possess specialized legal staff to deal with complicated claims. Because of this, their insurance needs will be focused on low-cost policies that are still effective protection. They will require insurance that will indemnify basic liabilities without subjecting them to a large financial burden. Big businesses, on the other hand, manage complicated risks because they are big and have massive operations. They usually have various departments, branches, and partners, which increase the likelihood of incurring liability claims. Large companies will require more detailed policies, often tailor-made, which address a wide range of scenarios, e.g., product liability, professional errors, and damage to the environment.

In the long term, the Global Liability Insurance sector will be more bespoke and dynamic. Insurers will use advanced technology to have a better appreciation of the risk that each company presents and issue policies that are more accurately tailored to those risks. For SMEs, this could mean expanded access to insurance products, formerly available only to larger firms. The shift towards digital platforms will make the procurement process simpler, allowing smaller companies to obtain cover for themselves without the requirement of elaborate paperwork or long wait times.

Large firms will benefit from more advanced data analysis and risk management functions. The insurers can anticipate the probable claims for liability in advance, and this will avoid the business from investing in faulty issues. It will make the companies save cash and minimize their exposure to the legal liabilities. Overall, the Global Liability Insurance industry will continue to evolve to meet different sizes of businesses so that every business can obtain the appropriate coverage for its operations.

By Application

The global liability insurance market will see tremendous revamps in the coming years, brought about by the new way of thinking for and managing risks by businesses and individuals. The sector includes policies of insurance that insulate against claims for injury, damage, or negligence. As awareness of liabilities among businesses and individuals grows, demand for such insurance policies will continue to rise, shaping the future of this sector.

From an application perspective, the market is typically divided into commercial and personal. Commercial liability insurance is structured for businesses of all sizes and types and protects against risks that arise from regular business. This includes defense against suits by customers, employees, or third parties who may be injured or lose something related to a business operation. As regulations and issues of law become more complex and stringent, companies will most likely be in search of expanded coverage to shield their assets and reputation. This would mean that insurers need to adapt their products, crafting more versatile and tailor-made policies to meet the specific needs of various industries.

At the individual level, liability insurance will become even more prominent since individuals are being subjected to more risks in their day-to-day lives. Personal liability insurance protects individuals against claims arising out of accidents or harm that they unintentionally cause to others. As lives get more interlinked and active, the type of scenarios encompassed under personal liability insurance is bound to rise. For instance, new technologies and trends may be creating risks yet to be identified but will call for insurance solutions in the future. This will create even more innovative products with broader coverages to individuals beyond traditional scenarios.

Technological developments in the future will also support the Global Liability Insurance sector. Artificial intelligence and data analytics will help insurers to estimate risks more accurately and develop more exact and cost-effective policies. At the same time, the customers will require faster, more transparent service and digital tools that make it easier to manage their insurance. The business will likely observe increased synergy between the clients and the insurers to create customized solutions adapted to changing needs, both business and personal.

Overall, the future for the global liability insurance market is promising with growing understanding of liability risks and protection requirements. Companies and individuals will continue to rely on these insurance products to provide peace of mind amid uncertainty. Innovation and customer focus will be at the heart of tackling new challenges and opportunities for liability insurance as the market evolves.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$313,219.92 million |

|

Market Size by 2032 |

$459,231.82 Million |

|

Growth Rate from 2025 to 2032 |

5.7% |

|

Base Year |

2024 |

|

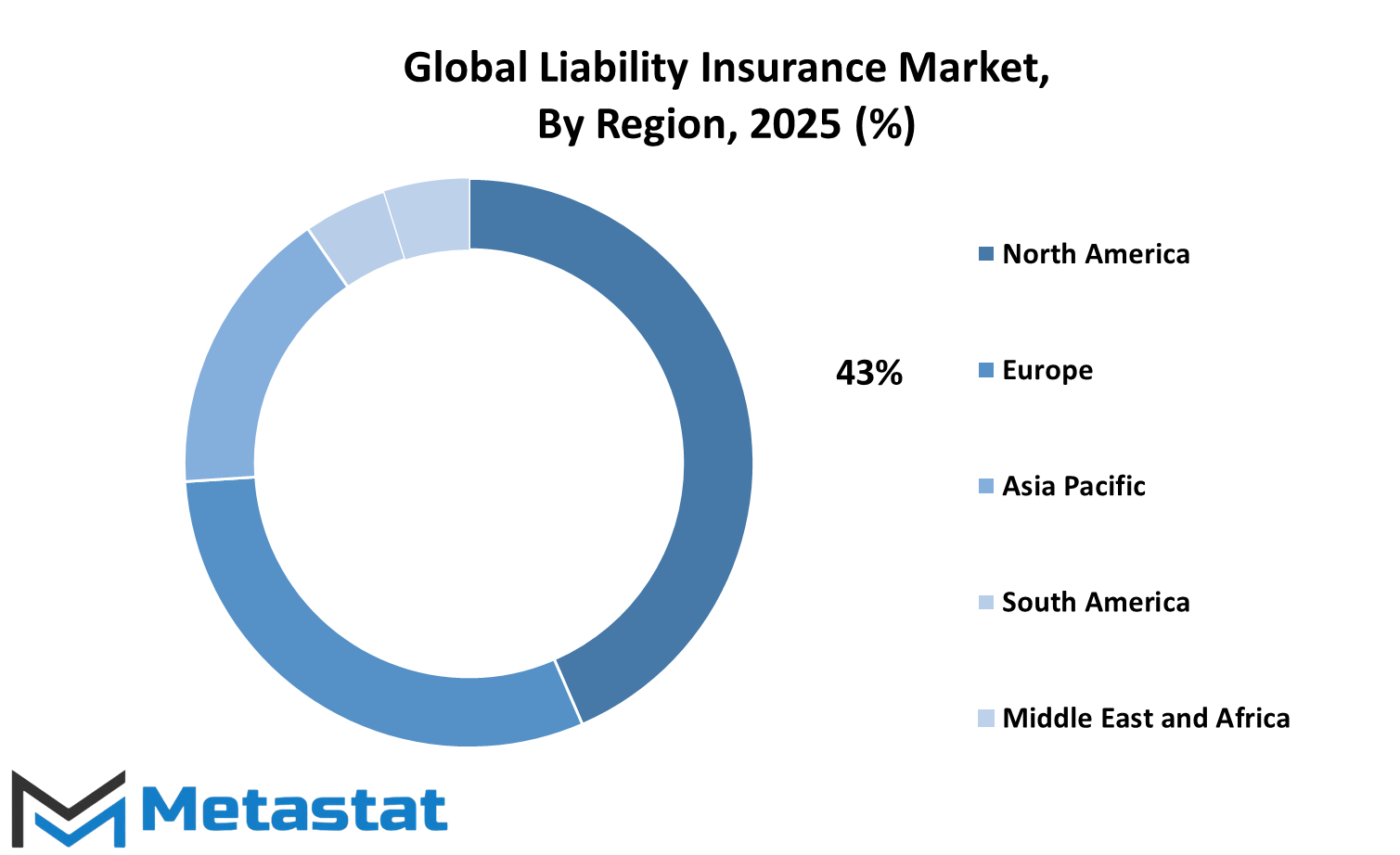

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global liability insurance market is poised to record tremendous growth and development as other parts of the world improve and adjust to evolving economic and regulatory landscapes. Regional economic landscapes, legal environments, and increasing risk sensitivity will dictate the future of the market. Each region will be contributing its own unique role in propelling the overall market growth because some of them will be setting the pace with their well-established insurance infrastructure while others will be opening up slowly with the maturity of their economies.

North America shall be a strong contender in the global liability insurance market, aided by a strong legal system and high need for liability insurance across most industries. The United States, specifically, shall be a leading driver owing to its massive economy as well as the growing need to protect businesses from lawsuits and claims. Canada and Mexico will also contribute to growth, with Mexico poised when more of its sectors become aware of insurance benefits. With changing rules and companies placing higher value on risk management, North America's market will continue to expand steadily.

Europe will also be a dominant force in the global liability insurance market, with the UK, Germany, France, and Italy at the forefront. The technical regulatory character of the continent ensures that liability insurance will be vital for businesses to avoid legal problems. With European countries continuing to tweak laws pertaining to company liability and consumer protection, the need for liability insurance will increase. Outside of that, the constant emphasis on sustainability and a company's governance will make companies place more funds in cover for protecting themselves against incoming danger.

Asia-Pacific will witness brisk growth in the global liability insurance market over the next few years. China, India, Japan, and South Korea will witness higher use of liability insurance because of growing business opportunities and judicial perception of risks. As economies develop, businesses will more and more cover themselves from financial loss through litigation and claims. Moreover, regulatory progress and the introduction of foreign insurance companies will be driving market growth. Heterogeneity of the economy in the region will result in differences in penetration of insurance, with some nations developing faster than others.

In South America, Brazil and Argentina will be driving the increasing significance of liability insurance as corporations want to be covered against business threats. The continent, though still in an emerging stage with its insurance industry, will also witness more players adopting liability coverage as a result of increasing law mandates and cross-country trade activities. The same applies to the Middle East and Africa, where there will be consistent growth in the global liability insurance market. The GCC nations, Egypt, and South Africa will be driving this growth as business and infrastructure expand. These economies are preparing to become more resilient in their insurance environment in an attempt to lure foreign investment and protect their domestic businesses.

Overall, the destiny of the global liability insurance market will be determined by each region's distinct economic, legal, and social environment. While some regions will still be leaders because of their mature markets, other regions will expand faster as they establish new industries and enhance their regulatory system. The nature of this diverse regional setting will give rise to an interesting and dynamic global market in coming years.

COMPETITIVE PLAYERS

The global liability insurance market is on the verge of radical transformation as competitive dynamics set up for the future. The sector plays an important role in protecting businesses and individuals against economic loss due to legal claims, and while risks become increasingly sophisticated, so does the need for comprehensive cover. Firms that specialize in this sector are constantly evolving in response to emerging challenges, such as shifting regulatory, technology, and customer dynamics. These are the drivers that will determine how the industry evolves in the long term.

Aviva, AXA, RSA Insurance Group, Zurich Insurance Group, and Allianz are some of the major players with established presence and long histories. They have the infrastructure and expertise to offer full insurance solutions that will cater to different types of customers. Their ability to innovate and incorporate new technology will be instrumental in being at the front of the pack. Direct Line and Hiscox, who are specialists in customer service and bespoke products, will also set future trends. NFU Mutual and Tokio Marine HCC are other players who offer specialist know-how, often for idiosyncratic risks facing individual industries or geographical locations.

Specialist operators such as Chubb, Liberty Specialty Market, and Markel International have emerged by focusing on niches in the liability insurance space. Their deep understanding of specific risks and markets will allow them to develop new products addressing new needs. Endsleigh Insurance and The Hartford supply products addressing specific market segments, including small businesses and professionals, which will become increasingly important as the economy becomes more diversified. Multinational behemoths like American International Group Inc and CNA Financial Corporation continue to expand their global reach, guiding clients into facing liability threats with global footprints.

Going forward, the competitive players in the global liability insurance market will invest even further in technologies such as data analytics, artificial intelligence, and automation. Such assets will increase risk evaluation and facilitate settlement of claims, thereby making insurance more customer-oriented and effective. The market will also see increased co-operation among insurers and other sectors, for example, legal and cybersecurity firms, to create cross-section solutions that provide better protection to policyholders against modern threats.

In aggregate, the future of the global liability insurance market will hinge on the capacity of these dominant players to adapt to new conditions and innovate. Their efforts to wed know-how with new technology will not only spell their success but also that of the entire industry. Since risks continue to change, the companies that act fast and judiciously will be the ones that lead the way to providing the protection that businesses and individuals will need in the future.

Liability Insurance Market Key Segments:

By Type

- General Liability Insurance

- Professional Liability Insurance

- Insurance for Directors and Officers

- Other

By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

By Application

- Commercial

- Personal

Key Global Liability Insurance Industry Players

- Aviva

- AXA

- RSA Insurance Group

- Zurich Insurance Group

- Allianz

- Direct Line

- Hiscox

- NFU Mutual

- Tokio Marine HCC

- Chubb

- Liberty Specialty Markets

- Markel International

- Endsleigh Insurance

- The Hartford

- American International Group Inc

- CNA Financial Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383