MARKET OVERVIEW

The global adhesive market and definitely the industry are broadening confines everywhere, and they will not be confined to the established applications only. From the press, this is an area that practically calls for construction, automotive, packaging, and healthcare. Its footprints can be found in many surprising areas that are quite different from the most common refocusing of industries. Much more than material development and sustainability initiatives, and even the fact that they now involve newer technologies, adhesives are already redefining innovations across various sectors other than being just bonding agents.

New technologies are beginning to find new usages for adhesives that haven't been conventionally classified. For example, the aerospace world anticipates an entire replacement of conventional fasteners with adhesive formulations, leading designs to lighter aircraft, which can more effectively move against gravity. Similarly, miniaturization and flexible displays and wearable technology--is being made possible in a developing electronics sector where adhesives play the role of enablers. The potential of 3D printing is also expanded by research leading into adhesive-based printing methods destined for future production processes.

Demand for sustainability will lead adhesive advancements not only into biodegradable areas of activity. Innovations in recyclability will probably see adhesives designed for separation from substrates without compromising the integrity of materials. It could be expected to impact the various industries, particularly on composite-dependent ones like automotive and furniture, since disassembly and recovery of materials have become crucial considerations. Furthermore, self-healing adhesives would make a major shift make things less messy, extend the service life of products, reduce wastage, and minimize long-run costs associated with maintenance and repair.

Medical applications are also going beyond borders. Adhesives will not only be used for wound care or surgical appliances. They will also be employed in the design of drug delivery systems for making medicines more effective with respect to transdermal patches as an alternative to injections. In regenerative medicine, bioadhesives are being tried for tissue engineering and organ transplantation under which cells can be grown and integrated using synthetic or naturally derived adhesives. Another area of growth is the emergence of smart adhesives that can monitor health metrics in real time, indicating potential progress toward personalized healthcare solutions.

Construction and infrastructure applications have therefore started to embrace adhesives in ways beyond what they were conventionally known for. Self-repairing roads would be made by testing asphalt with an adhesive in its constituent parts for long life and a well reduced maintenance requirement. Accelerated from further developments in modular construction through adhesive use would be the production of houses that are greener and yet stronger and flexible for extreme conditions. Meanwhile, advances in thermal and acoustic insulation adhesives would also be instrumental in improving energy efficiency in buildings, with contributions to evolving global sustainability goals.

The transportation future, as much as it is envisioned, continues to expand the applicability of adhesives. As electric vehicles will occupy most spaces, adhesives will find application in battery assembly and thermal management for safety and efficiency. Next-generation adhesives are being synthesized to withstand the most major underwater conditions for marine engineering applications, allowing deeper areas to be explored, as well as offshore energy projects. Space should be another frontier where adhesives are likely to assume a greater role in research focused on extreme temperature fluctuations and radiation exposure as they affect the performance of materials.

The global adhesive market now goes beyond the limits of its known scope, evolving as an industrial force driving change in myriad professions and walks of life. Medicine will be joined in the future by next-generation transport and building construction in making advances, all thanks to the adhesives whose scope will only widen further to redefine what it can mean for the industry in terms of efficiency, durability, and functionality around the world.

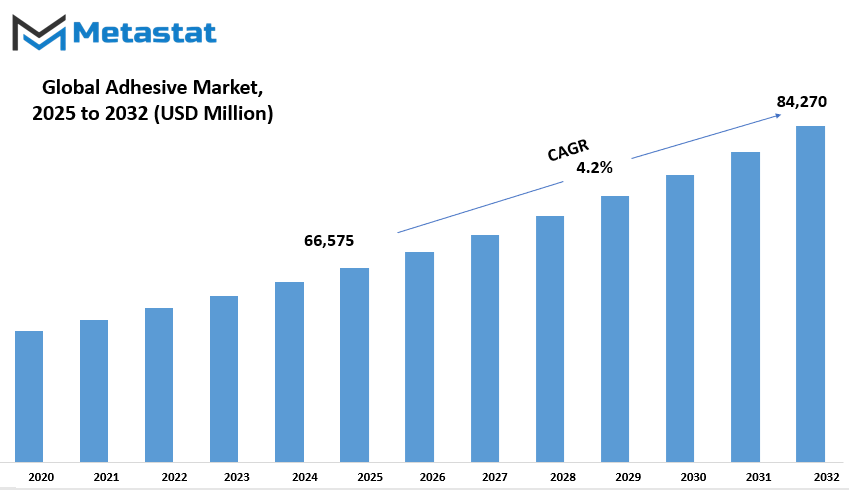

Global adhesive market is estimated to reach $84,270 Million by 2032; growing at a CAGR of 4.2% from 2025 to 2032.

GROWTH FACTORS

The global adhesive market is currently witnessing a boost in demand from various industries, making it one of the fundamental contributors to this composite industry. Lightweight and high-performance adhesives are especially in demand for automotive and aerospace applications, and thus the market is speeding up. The acceptance of replacing metal fasteners by adhesives to reduce fuel consumption and to decrease weight was made since these materials are exceptionally durable-modern vehicle and aircraft production.

With the thriving packaging and construction industries, there is a rapid growth in demand for adhesives. In construction, adhesives are used majorly for insulation, paneling, and flooring purposes, thereby creating a long-lasting and strong bond. Adhesives are also utilized in the packaging industry to seal labels, cartons, and flexible products. The unprecedented development of e-commerce has increased an excellent demand for safe and secure packaging materials, which has further boosted the demand for adhesives.

However, there are challenges during the operation of a market that would hinder the growth rate. First and foremost is fluctuating raw material prices which are highly influential upon production costs. Some still are petrochemically derived adhesives pegged against crude oil prices; therefore, manufacturing costs for such materials may unpredictably vary, thereby creating problems for the manufacturers in terms of price stability and profit margins.

The environmental regulations have, in turn, collaterally arisen as a major hindrance, particularly with respect to solvent-borne adhesives. Government agencies the world over have been enacting regulations aimed at limiting the VOC emissions, which places great demands for the industry to develop greener alternatives. Therein lies the promotion of environmental responsibility which entails sustainability, but overtime; it may require more research and additional investments, probably slowing down proposed product launches in the short-term.

Nevertheless, there are plenty of opportunities for the global adhesive market, particularly with the vast innovations made in bio-based and sustainable adhesives. The industries are now rapidly pursuing greener alternatives to adhesives based on renewable resources. Besides complying with environmental regulations, the products also respond to the end-users desire for sustainability.

Another potential increase for the market will arise from the increasing popularity of smart adhesives in electronics and healthcare. Adhesives hold all components of virtually every electronic unit such as circuit boards, batteries, and flexible displays. In contrast, smart adhesives find an equal footing in health with medical devices, wound care, and wearable technology. The demand for high-performance adhesives will grow with creative technologies, creating a variety of new opportunities for the industry. With expanding innovations and applications daily, the global adhesive market is on a sustainable growth trajectory over the next years.

MARKET SEGMENTATION

By Type

The adhesive market across the world is growing further with rising demand from various sectors. Uses cover packaging, building, automotive, pharmaceuticals, electronics, among others. Demand for effective bonding solutions has led to innovation in adhesive technology, offering adhesives that are more effective but eco-friendly. The demand for better performance and sustainability also guides the manufacturers in innovations that support durability, flexibility, and usability.

The largest driving force in the growth of the global adhesive market is the increased focus on eco-friendly and sustainable products. Adhesives based on water, for instance, have begun gaining traction as a result of lower environmental footprint. One segment alone translates to 26,483.4 million dollars, which is a pretty strong indicator of demand. Solvent adhesives continue to bear heavy use even with laws related to volatile organic compounds. Being good and fast binders, hot melts are rapidly gaining attention for fast-turnaround industries. Shackled adhesives produce extremely strong and long-lasting bonds and are structurally best utilized. The pressure-sensitive adhesives (PSA) would remain the staple for labels, tapes, and medical uses but contribute more to the market value.

The automotive segment, for example, has entered the high-performance adhesive needs - safety and performance of the vehicle more so in weight reduction - which also is driven into high gear by the advent of electric vehicles. Further, the shift toward electric vehicles has driven demand for specialized bonding solutions that further improve battery performance and overall durability. Similar adhesive solutions provide strong bonds, which, in turn, add durability against the elements, thereby making them fit for modernized civil engineering projects. Last but not least, is food packaging, e-commerce, and flexible packaging, which remains critical drivers of adhesive demand.

The adherence market does not sleep; reinventing itself with companies putting more research into new developments of their high-performance products. Bio-based adhesives hold a more dominant position with increasing interest as industries look for petroleum alternatives. Nanotechnology and smart adhesives are also some other advances that will affect the future of the industry, providing even more properties, such as self-healing and temperature adapting.

The global adhesive market growth is fueled by new requirements for more effective and sustainable bonding solutions across different industries. The industry will open new avenues for both manufacturers and consumers in a booming and technologically advanced market and a shift to environmental considerations.

By Product

The global adhesives market is sustained by many different industries-the Construction, Automotive, Packaging, and Healthcare. The adhesive has a very important function in ensuring that rigid and durable materials-holding in conditions where conventional fastening methods, like nails and screws, are not used. This effect would provide high-performance adhesives to the manufacturers according to their particular industrial requirement of withstanding extremes of temperature, chemicals, and flexibility.

Adhesives are differentiated and studied by product types into acrylics-based, epoxy-based, PVA-based, PU-based, and styrenic block-based.. Adhesives typically formulated for their adhesion and resistance to aggressive environment, moisture, and UV are acrylics. Therefore, the same is very much in demand by the automotive and construction industries. Epoxies now have the greatest adhesion strength and, being proven to handle heat and chemicals, are used in industries where really tough constructions are required, such as aerospace and electronics.

Polyvinylacetate (PVA)-type adhesive is commonly applied to woodworking and paper. It is quite simple to apply and therefore fairly economical. It also forms a very strong joint with porous materials. Polyurethane (PU)-based adhesives are outstanding for their flexibility and impact resistance and find use in applications similar to that of construction, footwear, and automobile applications, where moving or stressing takes place. Styrenic block-based adhesives have very high elongation and adhesive properties towards a wide variety of surfaces and are thus typically ideal for applications in packaging, textiles, and medicals.

Such growth-driving factors are part of the overall global adhesive market. These advanced adhesives are replacing traditional welding and mechanical fastening techniques as this lightweight requirement gets popularized in the automotive and aerospace industries to get the most out of them. The environmental trend has also pushed the manufacture of solvent-free and biodegradable options into the hands of manufacturers. The other sector in growth identification is packaging, as nearly all consumer goods are sealed and labeled by adhesives in the market.

However, coupled with increasing demand, the market faces challenges such as rising raw material prices and strict chemicals regulations. Research and development combined will always lead to new innovations that will probe these questions while increasing the performance of adhesives.

The future of the global adhesive market looks bright as industries have truly increased their efforts to make bonding effective and sustainable. The glue continues to be the linchpin in any sector, motivating progress and ensuring longevity in products through continued advancement and wider application scope.

By Application

Over the recent years the advancement of the global adhesive market seems impressive owing to increasing demand witnessed in several industries. The adhesives bind two or more materials to produce a strong and durable bond that is essential in varied applications. The market keeps on growing as industries keep searching for better and dependable solutions.

In packaging, adhesives have major applications. The e-commerce revolution has moved to safe transporting goods, and packaging adhesives are strong seals against protection product in transit. Companies make both things be intact by using these adhesives to prevent products from damages and contaminations. On top of it all, sustainable production is the in-thing at a time when most manufacturers are developing environmentally friendly adhesives without compromising the performance of glue.

Another key application area is considered building and construction, where bonding in place has occurred in wood, concrete, glass, and metal. Such bonding improves structural stability and energy efficiency. The bonding reduces leakage of air and creates a better insulation environment within the building. Green building practices are on great acceptance and consequently demand higher amounts of adhesives that would support sustainable construction practices without hazardous chemicals.

Adhesives also draw a hefty dependence for bonding vehicles, airplanes, ships, and so on. The bond done by adhesives is strong as well as light and therefore, they eliminate heavy mechanical fasteners. Thus, such light-weight vehicles contribute towards fuel efficiency and safety as well. Adhesives manufacture aircraft for the durability of features under very harsh conditions. Production in electric vehicles has been amplified even more, as these adhesives are also utilized in battery assembly along with the structure of the entire vehicle.

Footwear and leather goods producers use adhesives for improving the durability and appearance of their products. Strong bonding is required while assembling various components of a shoe to endure the daily availing marks of wear and tear. Heavily relied on by the leathery world-of-associations soles to applying linings to attaching decorative embellishments for improving the quality of the products overall.

Adhesives are used in product assembly, from electronics to appliances and various consumer goods. They fit joints for slick smooth designs minus screws and bolts. The consumers or DIYers are some of the areas where adhesives are useful, for providing quite easy-to-use between household repairs and crafts.

As the industries grow and ever develop, the future for advanced adhesives would only grow. Prospects are being made by companies for the stronger ones made flexible as well as more environment-friendly adhesives to meet the swiftly changing market trend. Given their reliability in creating bonding across the different sectors, adhesives remain one of the things held essential in both manufacturing and daily lives.

By Sales Channel

Increase demand from various industry sectors such as construction, automotive and manufacturing, packaging and healthcare is what driving the growth of the global adhesive market. Bonding materials together to give strength and durability, adhesives do not require any mechanical fasteners. As the industry continues to evolve, innovations in formulations of products for performance adhesives have been used to ensure optimum adhesion, flexibility, as well as resistance from environmental factors.

Eco-friendly and sustainable adhesive solutions have become the main factor driving this market. Companies are developing adhesives which have lower volatile organic compounds (VOCs) to comply with stringent environmental regulations. Water-based adhesives, bio-based formulations, and recyclable adhesive kinds are all becoming popular as the industry attempts to lessen carbon footprints. This trend is generally observed in the packaging sector where sustainable adhesives are being demanded for food-grade and recyclable package solutions.

Technologies which develop the performance of adhesives also affect this industry. Bonding strength, temperature-willingness, and durability make adhesives increasingly reliable over use for critical applications. The improvement of weight reduction and better overall fuel economy results from the more efficient use of modern adhesives in lightweight materials for the automotive and aerospace sectors. Bonding solutions improve structural integrity and provide superior insulating and sealing properties for buildings.

The global adhesive market segments sales channels diversifiedly into online and offline segments. The offline segment still holds sway, and it is transacted by direct sales through retailers, wholesalers, and industrial suppliers. Many of these businesses are traditional and direct when purchasing their adhesives. However, online sales are on the move as they prove to be quite convenient to most people, selling at competitive prices, and having a nice choice of adhesives for much better matchups. E-commerce platforms and direct websites of manufacturers make it easier for businesses and consumers to compare options, read reviews, and find specialized adhesives suited to their needs.

There are certain factors such as price fluctuations which bring in the raw materials to affect production costs, thus impacting the overall pricing strategy in the market. Manufacturers must also invest heavily in research and development just to be on guard from the stringent regulations imposed by states in the parameter of chemical composition and environmental issues, which bring about a heavier cost. Still, the tide flows at the other end. The need for innovation, replacement by eco-friendly technologies, and the demand for performance adhesives, which have much to be spoken about, continues to grow with a manufacturing focus on product portfolio expansion.

However, as industries progress further into reliance on advanced adhesive technologies, the market will see steady growth. The combination of sustainability initiatives, improvements in technology, and continually changing consumer preferences ensures that the global adhesive market remains relevant for multiple applications globally.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$66,575 million |

|

Market Size by 2032 |

$84,270 Million |

|

Growth Rate from 2025 to 2032 |

4.2% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

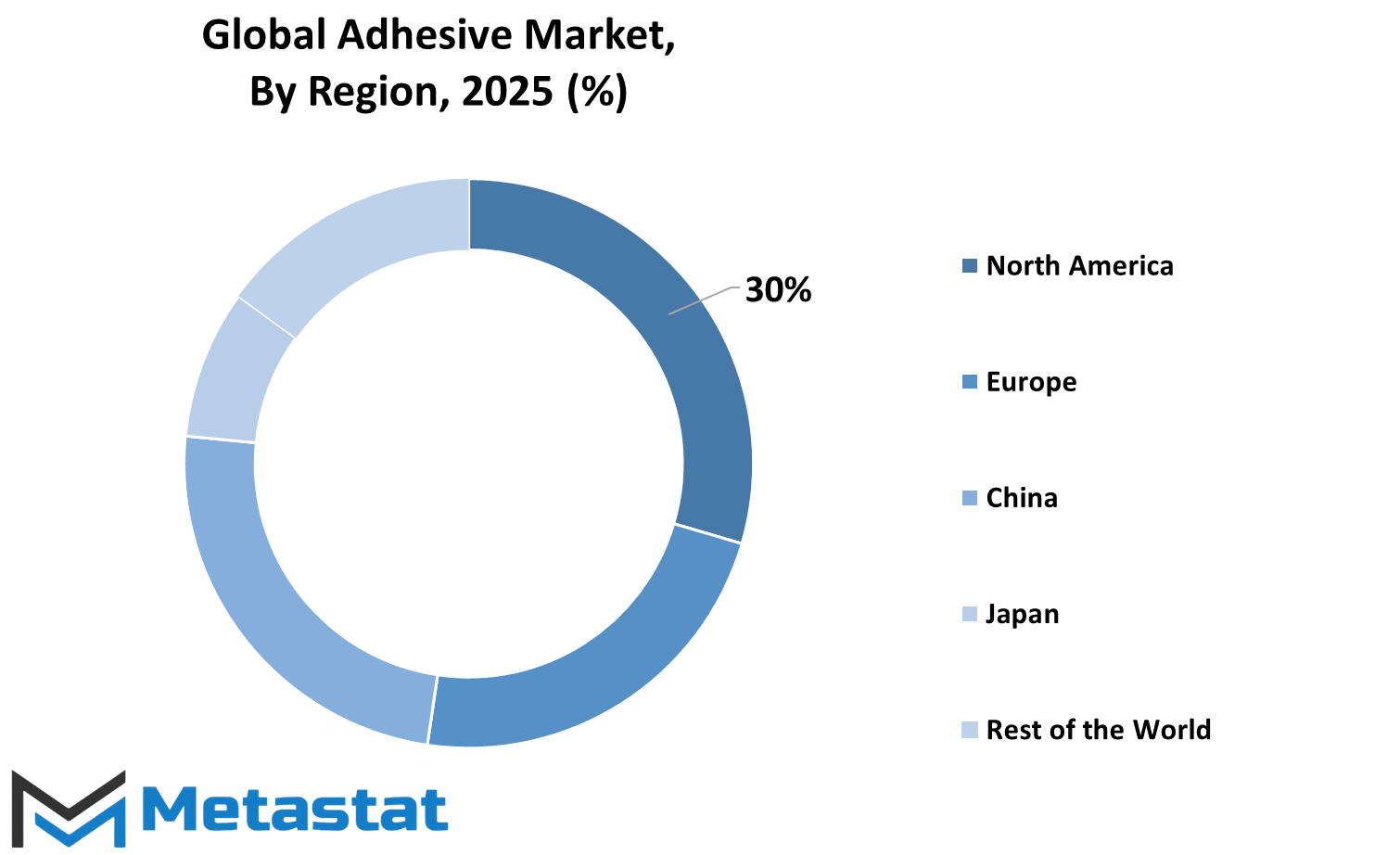

REGIONAL ANALYSIS

Adhesives can broadly be classified as products depending on the developmental processes in the economic performance, industrial growth, and technological innovations based on their use. Industrial applications such as construction, automotive, packaging, and healthcare demand adhesives. This simply means demand from the aforementioned industries will trigger an impressive market growth in the near future.

The global adhesive market can easily be categorized into five geographical market segments: North America, Europe, Asia-Pacific, South America, and Middle East and Africa. Continental members of North America include the USA, Canada, and Mexico. The region supplies adhesives for automotive and construction. It is indeed the US that is most responsible for technological advancement and product innovation that create new markets. Trade agreements of the kind NAFTA are great enhancers of trade in Canada and Mexico as well.

This region encompasses the UK, Germany, France, Italy, and the rest of Europe. It is indeed worth mentioning that Germany is a major player on this continent as it boasts an efficient manufacturing backbone, particularly in automotive parts and packaging materials. The other major players in the continent are of course the UK and France who are mainly in need of adhesives for their construction and consumer goods industrial sectors. There lies also an extremely high demand in Italy which most European countries share due to the highly specialized performance of adhesives used.

The Asia-Pacific category comprises India, China, Japan, South Korea, and the rest of Asia-Pacific. The Chinese market is unique in the sense that it is largely driven by concentrated largescale industrial activities and massive demand for adhesives concerning construction and electronics. Following very closely behind China in demand is India, which is predominantly driven by rapid urbanization and infrastructure works. The other two active producers of high-quality adhesives are Japan and Korea, with technology being the vital aspect of concern. The continuation of industrialization will moderate the growth in this region.

The South America region contains Brazil, Argentina, and others. Brazil is the leading market, driven by the construction, automotive, and packaging sectors. Argentina has shown a positive increase in demand, while investment in the infrastructure and industrial sectors has gained demand in other regions of South America.

This part of the world possesses the following groupings: GCC Countries, Egypt, South Africa, and the Rest of Middle East and Africa. Demand in the GCC Countries is fairly steady owing to several construction projects and efforts toward economic diversification. Egypt leans more toward industrial applications, while South Africa is the leader in manufacturing and infrastructure development. Other countries in the region are also forging ahead in applying adhesives in different industries, thereby striving for broader market growth.

To conclude, there will be a lot of growth in the global adhesive market; many developments throughout the world, as discussed, will have an effect on the demand pattern. The industrial developments in other parts of the world will, in turn, affect this industry.

COMPETITIVE PLAYERS

The anticipated growth of the global adhesive market will remain stable due to its applications in various industries such as construction, automotive, packaging, and healthcare. Its main purpose is to bond materials together, imparting strength and durability without using any mechanical fasteners. Demand for new advanced formulations of adhesives is naturally increasing as manufacturers are looking for lightweight high-performance solutions. Companies invest in research to formulate adhesives that bond excellently and resist extreme conditions and which are also sustainable.

The eco-adhesive drive is another major factor, providing traction in the global adhesive market. With the environment gaining priority, manufacturers have started focusing on water-based and bio-based adhesives that minimize harmful emissions and enhance safety. With regulations promoting sustainable products, companies today are being compelled to design adhesives below the threshold limits for VOCs. This has created a win-win opportunity where environmental benefits coincide with fast-growing consumer demand from industrial users for safe alternatives.

Another one benefiting the global adhesive market is the automotive industry. The demand for lightweight materials in vehicle manufacturing has led to the widespread use of structural adhesives for bonding in place of traditional welding and mechanical joints. These adhesives help increase fuel efficiency by minimizing the weight of the vehicles while maintaining their structural integrity. Likewise, in construction, adhesives are used in flooring, insulation, roofing, and paneling. The ability of adhesives to bond difficult materials makes it a boon for any major infrastructure project.

The pandemic stimulated an increasing interest and opportunity for the medical sector to pursue adhesive technology, especially in developing products for wound care, wearable medical devices, and surgical applications.

While demand continues to rise, hurdles come in the form of fluctuating raw materials and interrupted supply chains. Availability and pricing of crucial ingredients affect production costs, which in turn have overall ramifications for market dynamics. Companies are combating this issue by looking for alternative raw materials and improving efficiency in their manufacturing processes.

Key players in the global adhesive market include 3M, H.B. Fuller, Henkel AG & Co. KGaA, The Dow Chemical Company, Sika AG, Arkema, Huntsman Corporation, Avery Dennison, Wacker Chemie AG, BASF SE, Franklin International, and LORD Corporation, Illinois Tool Works. These companies are continuously innovating with a focus on new formulations while expanding their global reach to cater to soaring demands from different industries.

Adhesive Market Key Segments:

By Type

- Water-based

- Solvent-based

- Hot Melt

- Reactive

- Pressure Sensitive Adhesives (PSA )

By Product

- Acrylics-based

- Epoxy-based

- Polyvinyl Acetate (PVA)-based

- Polyurethane (PU)-based

- Styrenic Blook-based

By Application

- Packaging

- Building/Construction

- Transportation

- Footwear & Leather Goods

- Product Assembly

- Consumer/DIY Applications

By Sales Channel

- Online

- Offline

Key Global Adhesive Industry Players

- 3M

- H.B. Fuller

- Henkel AG & Co. KGaA

- The Dow Chemical Company

- Sika AG

- Arkema

- Huntsman Corporation

- Avery Dennison

- Wacker Chemie AG

- BASF SE

- Franklin International

- LORD Corporation

- Illinois Tool Works

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252