MARKET OVERVIEW

The global liquid packaging market is an intrinsic segment of the packaging industry and is likely to witness prominent developments and changes. It refers to the liquids packaged in a number of industries, including water, juices, dairy products, alcoholic beverages, and household cleaners. With the demand from the consumer side rising for convenience and safety in liquid products, the attention of the industry will shift more towards innovative and sustainable solutions for packaging.

The market in the future would be marked by innovations in technology. Companies are most likely to make huge investments in research and development in order to come up with packaging that takes care of the safety of products and their shelf life as well as meets the environmental standards. The trend of using biodegradable and recyclable materials is bound to go upward due to regulatory requirements and consumer preference for 'green' products. Smart packaging will also grow, featuring QR codes and sensors that track product quality to improve the consumer experience and to ensure integrity in products.

Sustainability will become one of the most important themes that will resonate in the global liquid packaging market. With the sudden surge in environmental awareness, the dependency on products that cause less harm to the environment will increase. Responding to this shift in consumer behavior, packaging manufacturers will quickly incorporate sustainable practices into business operations, drive plastic reduction, optimize packaging structure to reduce waste, and increase the use of renewable resources. This shift to sustainability will be driven by strict regulations regarding the reduction of carbon footprints and the creation of circular economies.

Another important trend in the global liquid packaging market is going to be innovation in design and functionality. Lightweight, yet strong and convenient, packaging solutions will evolve. These innovations bring a greater level of convenience for the consumer who wants more time for himself, especially in urban areas where lifestyles are fast-moving. More user-friendly packages with ease of pouring, resealing, and storing will increase, therefore bringing more convenience and satisfaction to users.

Digitalization will also impact the market since integration of digital technologies in packaging processes will help smoothen operations and bring in much-needed efficiency. On this note, automation and data analytics will enable manufacturers to optimize production, reduce costs, and ensure uniform quality. In addition, digital platforms will enhance the communication between manufacturers and consumers through real-time feedback and customization of packaging solutions.

Now, when it comes to regional dynamics, growth in the market across the globe will differ. The emerging economies, especially in Asia and Africa, will witness fast urbanization and rise in disposable incomes, thereby raising demand for packaged liquid products. In mature markets of Europe and North America, innovation and sustainability will be prime drivers.

There will be a growing need for collaborations or partnerships between key players, with companies at the forefront of the market. Companies will enter into strategic alliances to help tap into each other's strengths, share resources, and boost their presence across target markets. Such collaboration will facilitate knowledge and technology-sharing processes towards developing better packaging solutions.

Consumer behavior, too, shall bend the contour of the global liquid packaging market. With increasing health awareness and rising knowledge about the products consumed, consumers will seek transparency and quality in packaging. Brands that can effectively communicate the benefits of their packaging solutions and demonstrate their commitment to sustainability will gain a competitive advantage.

At the very broadest level, the market will become very dynamic due to new technologies, sustainability, innovation, and digitalization. With time, the sector shall continue to meet the shifting needs and tastes of consumers, ensuring that liquid products are packaged in a way that is safe, convenient, and as environmentally friendly as possible. This continuing evolution will help not only the consumer but also the greater aims of sustainability and efficiency in packaging.

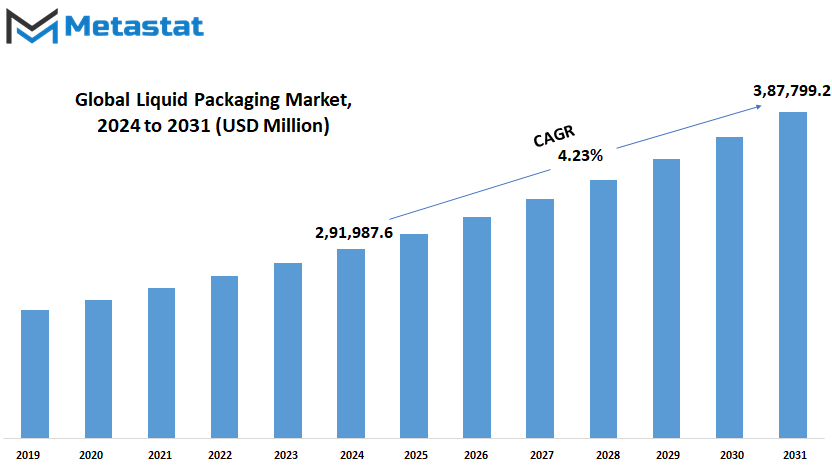

Global liquid packaging market is estimated to reach $3,87,799.2 Million by 2031; growing at a CAGR of 4.23% from 2024 to 2031.

GROWTH FACTORS

The global liquid packaging market is likely to exhibit high growth, driven by some of the major factors reflecting changing consumer preferences and industry trends. On the back of growing hectic lifestyles, customers are increasingly reaching out to on-the-go and ready-to-consume products, thereby increasing the demand for efficient liquid packaging solutions. This is one of the significant factors driving the growth of the market. Furthermore, green packaging is getting more and more trending with the people becoming environmentally conscious. This factor has attracted manufacturers to invest in innovative steps toward ecofriendly packaging, which would additionally boost the market growth.

However, the growth path is not entirely smooth. The main constraint to market growth could be the high cost related to advanced liquid packaging technologies. Though these technologies have better functionality and sustainability, they call for high investment, which deters some companies. Besides, strict environment regulations on plastic packaging are increasingly another barrier. Across the world, governments and regulatory bodies are tightening the noose around plastic use with a view to checking pollution, forcing manufacturers to find substitutes and alternative materials and solutions.

The market is also wide open to very fine opportunities in innovations for developing eco-friendly and biodegradable liquid packaging solutions. As environmental concerns gradually come to the foreground, there is a growing demand for packaging that meets stringent environmental standards without affecting functionality or aesthetics. Companies pioneering such solutions are likely to find significant growth prospects in the coming years. These same innovations meet regulatory needs while aligning with changing consumer attitudes toward sustainability.

This market will attain different dimensions of transformation in times to come, with adjustments in these dynamic factors. There is a balancing that would occur in respect to cost concerns on the one hand and the demand for more evolved, sustainable packaging formats on the other. The development of low-cost biodegradable materials and technologies will play a major role in overcoming existing barriers and capturing growth opportunities. Those firms investing in research and development to come up with new solutions will be at the forefront of this market transformation.

The outlook for the global liquid packaging market, therefore, remains pretty bright, driven by two major drivers: consumer demand for convenience and sustainability. High costs and regulatory challenges will no doubt come in the way but are also a spur to innovation to move towards more eco-friendly solutions. The market is therefore on course to further develop; it thus holds huge growth potential for those companies that can master these complexities in a bid to address the changing needs of consumers and regulators alike. This journey toward more sustainable packaging solutions is not going to be a trend, but a course maker for years in the future characterizing the future of the market worldwide.

MARKET SEGMENTATION

By Type

The future of the global liquid packaging market will be full of spectacular developments, pegged on innovations in both flexible and rigid packaging solutions. Industries are changing, and thus, the demand for effective, clean, and convenient packaging solutions will continue to rise, altering the dynamics of the market in ways never experienced before.

Flexible packaging, with its versatility and cost-effectiveness, is likely to dominate the market. Since this type of packaging is lightweight and adaptable, growing uses in the future will be witnessed across different industries. It will pack products that range from beverages to household liquids and offer practical solutions by way of minimizing transportation costs and extending shelf life. The trend of flexible packaging will also fall in line with global movement toward sustainability, since most flexible materials used in packaging are recyclable or biodegradable.

This focus on eco-friendly options can only continue to drive innovation in materials and designs that make flexible packaging integral to the global liquid packaging market. Rigid packaging continues to be paramount in more sectors where durability and protection matter. Rigid packaging available in the forms of bottles, cans, and cartons goes on to offer robust solutions for the safe transportation and storage of liquids. Not even the rigid ones will miss being smart in their own way; tamper-evident seals and QR codes will add to the traces in today's world. These changes will be for the betterment of user experience, providing further assurance to consumers about product safety and authenticity. Strength and technological integration will establish the role of rigid packaging in the market.

By Material

The global liquid packaging market is bound to make mammoth progress in the coming years. Segmentation on the basis of materials such as plastic, paper, glass, and metal, the liquid packaging would evolve into what the changing world demands. Materials used in liquid packaging would find favor, with sustainable options already finding favor among consumers.

Plastic has been the major material used for liquid packaging due to the fact it is versatile and cost-effective. The future, however, lies in the hands of greener alternatives. Businesses are working on the production of biodegradable and recyclable plastics that will bring down environmental degradation. Bioplastics, produced from renewable raw materials, will also be instrumental in this change. These materials will be just as resistant and pliable as traditional plastics but much more sustainable.

Paper-based liquid packaging is on a roll. This material provides a renewable, recyclable option, hence appealing to the 'green' consumer. In the near future, improvements in paper packaging technology will raise the barrier performance and open up more opportunities for many types of liquids. Coatings ensuring moisture resistance and structure while maintaining recyclability will come to prominence, placing paper as a strong competitor in the market.

Glass, owing to its inert properties and premium appeal, will continue to be a material of choice for certain beverages and high-end products. Innovations for reducing the weight of glass containers in order to reduce transportation costs and carbon emissions are foreseen in the market. Improving recycling technologies will also ensure a more viable future for glass. Improving recovery and re-use methods that currently characterize glass will definitely ensure its long-term relevance in the market.

Metal packaging is excellent at providing protection, and it is highly recyclable, particularly aluminum. In the future, lightweighting innovations and increasing the use of recycled materials will make its use more sustainable and reduce the impact on the environment from metal containers. The functionality and appeal of metal packaging will also be driven by innovation in new designs and coatings, further keeping this option very competitive.

The global liquid packaging market will mostly vary as consumption patterns of the modern consumer and environmental concerns are slowly changing it. The materials will change as new technologies and a focus on sustainability shape their development. As companies further innovate, we can foresee the rise of packing solutions that, other than being functional and cost-effective, become environment-friendly. This future-oriented approach is, therefore, going to set the course for liquid packaging to meet up with the new needs of the next generation of consumers.

Finally, it can be summarized that the market is transitioning towards sustainable materials. In this context, plastic, paper, glass, and metal products are impossible to ignore. Improvements in technology are fueling the development of such aspects. Innovation and commitment to reducing environmental impact will define the market in the future by creating a more sustainable and efficient way of packaging.

By Technique

Considerable dynamics could be seen in the global liquid packaging market in the coming years owing to innovations in packaging techniques and changing consumer preferences. This critical market to industries like beverages and pharmaceuticals is fragmented into different techniques, all of which will imminently have to play a part in constant, ever-growing demand in the market for product safety, convenience, and sustainability.

Aseptic Packaging will remain dominant in the market because of the ability for product preservation without refrigeration. This process refers to the filling of a sterile container in which a sterile liquid has already been enclosed and sealed in a sterile atmosphere, so the product can remain unspoiled for a long time. Role of aseptic packaging in the market is going to be growing when shelf life and the need for nutritional value is increasingly important to the customer.

Intelligent Packaging is yet another technology that is going to alter the status of the market. The technology incorporates sensors and indicators into packaging substances, which detect and respond to varied conditions such as temperature, humidity, and freshness. As smart packaging solutions continue to surge in the industry, consumers are going to benefit from improved safety and quality of products, while supplementing manufacturers to make sense of the supply chain efficiency and how products perform.

The other area where the market is poised to grow significantly is in Modified Atmospheric Packaging. MAP extends the shelf life and maintains the quality of liquid products by changing the composition of gases surrounding the product. It is, therefore, of paramount importance to perishable goods and beverages where maintenance in optimal conditions is important to prevent spoilage and maintain the taste.

By removing air from the package, vacuum packaging prevents oxidation and thereby spoilage of the contents. Because of this factor, it will continue to be one of the prime movers in the market. This method will go on lengthening the life span of liquid products, making them safer by reducing the possibility of contamination and degradation. With the growing demand of consumers for fresh and safe products, vacuum packaging will gain popularity for the preservation of liquid goods.

The global liquid packaging market is expected to evolve and transform as various modes of packaging evolve. Aseptic Packaging, Intelligent Packaging, Modified Atmospheric Packaging, and Vacuum Packaging will all have a role in the future demands made by consumers and manufacturers. These methods will be tasked with the job of keeping liquid products safe, fresh, and convenient as the market continues to grow.

By End-use

This means that the global liquid packaging market is growing at fast-paced speed while catering to a vast range of end-use industries like personal care, food and beverages, pharmaceuticals, chemicals, and so on. This, therefore, becomes a quintessential part of the whole procedure for the safe and efficient packaging of liquid products, and its importance would further increase with the changing consumer needs and advancements in technology.

There is a great demand for liquid packaging solutions in the personal care industry due to the various types of shampoos, conditioners, lotions, and hygiene products available in the market. As consumers become more demanding for convenience and sustainability, manufacturers will need to make new innovative answers in terms of packaging design. Further evolution could include more environmentally friendly materials and designs which improve the user experience while having less impact on the environment.

Furthermore, it is evident that another principal sector of the global liquid packaging market the food and beverage industry has been changing. Development of packaging solutions for juices, soft drinks, and alcoholic beverages is conducted with the purpose of increasing shelf life without losing the quality of products. In view of trends moving toward a healthier diet, organics, and other related changes in the market, packaging will have to be changed to these new demands, probably improving barrier properties to meet customers’ requirements for freshness and safety.

Another major area of focus through which the development of liquid packaging will be executed is pharmaceuticals. Since the medications need to preserve their efficacy, packaging is essentially required, and it needs to pass stringent regulatory standards. With improved technology in packaging, future trends might be towards smart packaging that ensures real-time monitoring of medication conditions to have greater safety and compliance for patients.

The other industry that liquid packaging will have to absorb risks from is the chemical industry. The packaging solutions will need to offer good protection, be leak-proof, and non-contaminating. Further, this trend could be instigated by creating new materials for packaging that resist very high and low temperatures in order to transport and store chemicals in safety.

Consolidation and growth lie ahead for the liquid packaging global market. As industries continue to request ever-more specialized and sustainable solutions, so will the pace of packaging technology development. Through innovation and adaptability, the market will keep pace with the changing consumer preference and regulatory requirement landscape to ensure the efficient and effective packaging of liquid products.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$2,91,987.6 million |

|

Market Size by 2031 |

$3,87,799.2 Million |

|

Growth Rate from 2024 to 2031 |

4.23% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

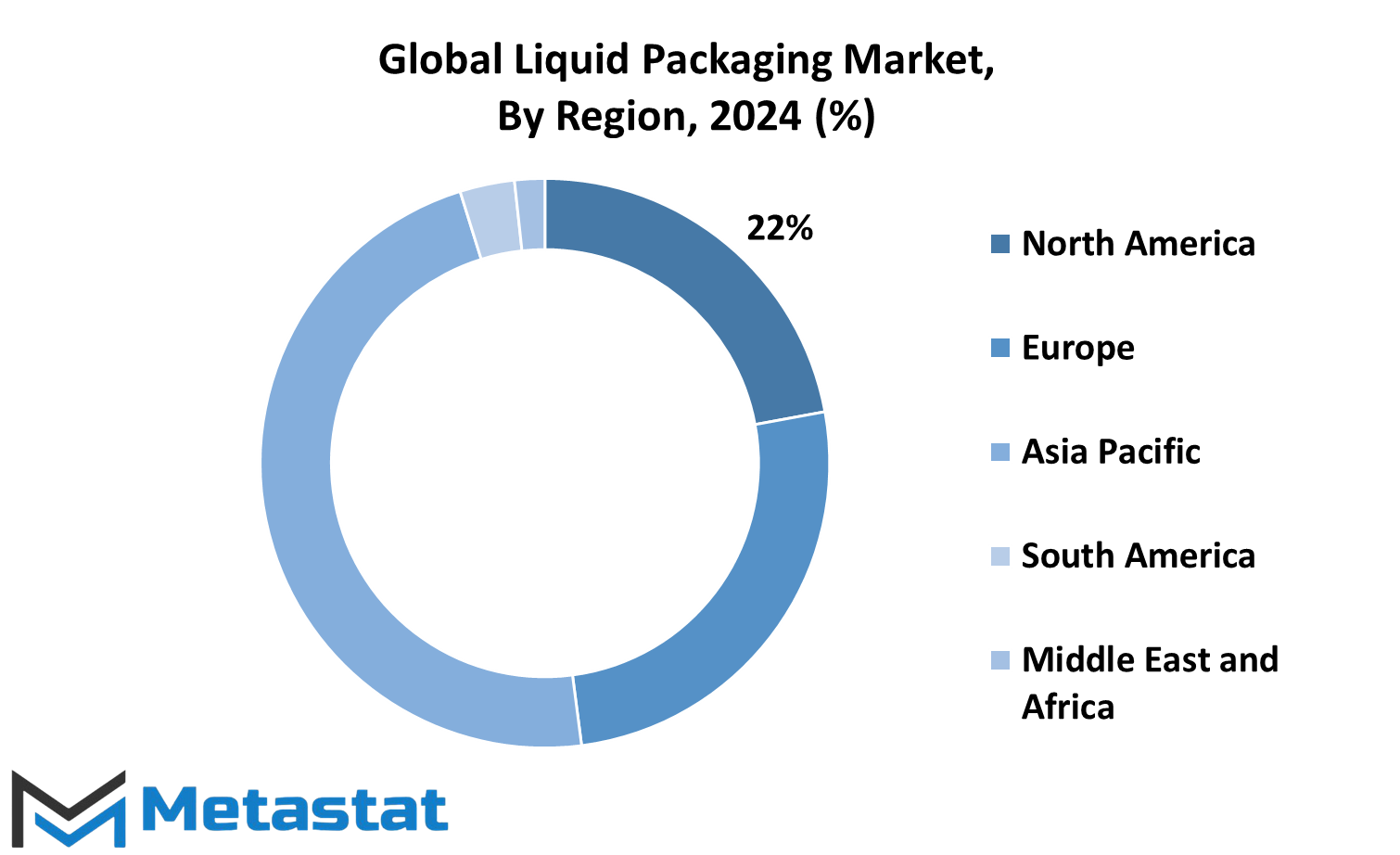

The liquid packaging market is really huge, with regional diversities reflective of the dynamic demands and trends in the world. Only a few of the geographical regions that the market can be segmented into include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each region has its different characteristics, emerging trends that are sustainably bound to shape the future trajectory of the market.

North America is dominated by the USA, Canada, and Mexico. The USA will lead and is expected to continue leading the market due to its highly developed technological infrastructure and high demand for innovative packaging solutions. Canada and Mexico will also show a considerable contribution driven by the growing consumer preference for green or sustainable packaging and improvements in technology related to production methods.

The European region displays a diversified landscape with major markets in the UK, Germany, France, Italy, and the Rest of Europe. The demand for eco-friendly and recyclable packaging solutions is expected to be witnessed in the region due to increasing awareness about environmental issues and related pressures from regulatory bodies. As far as advanced technologies are concerned, Germany and France will be at the forefront, while innovation and green practices will support the growth in the case of the UK and Italy.

The Asia-Pacific region comprises India, China, Japan, South Korea, and the Rest of Asia-Pacific, and is projected to grow at a rapid pace. Growth in these nations will be largely facilitated by China and India, due to large populations and rising industrialization. With China and India rapidly becoming economically viable countries, the demand for liquid packaging solutions will definitely increase in a number of industries such as food and beverages, pharmaceuticals, and personal care. Japan and South Korea will further fuel this market growth through their technology advancement and thrust for high-quality packagings.

South America, comprising Brazil, Argentina, and the Rest of South America, will log stable growth but at a somewhat slower rate compared to other geographies. Brazil, being the largest market in this region, will spearhead this growth, driven by its large consumer base and rising industrial output.

The Middle East & Africa will also show gradual growth, categorized by GCC Countries, Egypt, South Africa, and the Rest of the region. Huge investments by GCC countries in infrastructure, coupled with rising demand for packaged goods, will drive its contribution to this growth. Egypt and South Africa will play important roles on the back of their expanding economies and changing consumer preferences.

With regional dynamics, the overall global liquid packaging market will be molded in a particular way by each area. The market will keep on changing its trends as per global developments with respect to technological evolution and changing consumer demand.

COMPETITIVE PLAYERS

The global liquid packaging market is projected to grow significantly in the coming times. This surge of demand could be assigned to the growth in demand for sustainable and innovative packaging. Against such a backdrop of dynamism, multiple competitive players are involved in designing the future of this industry. Some of the most crucial companies operational in this sector include Elopak AS, SIG Global Pte. Ltd, and Evergreen Packaging LLC. Their role in meeting the fluctuating consumption needs concerning eco-friendly and effective packaging is very significant.

Elopak AS has remained pioneering in paper-based packaging and will thus not, at any time, be without some market influence, particularly on the part of sustainability. Others worth noting are SIG Global Pte. Ltd and Evergreen Packaging LLC. These are major firms whose innovative solutions have recyclable and biodegradable materials at the forefront, keying in with the surging demand. In that sense, these companies raise the bar of what can be achieved in liquid packaging, ensuring their products are in line with global environmental goals.

In this respect, Tetra Laval International SA will continue to play a very critical role by providing the widest range of aseptic packaging solutions, excluding high-quality liquid products that cannot be stored for so long. Other companies to be involved include Greatview Aseptic Packaging Co. Ltd, which is already working on advanced aseptic packaging technologies, and Mondi PLC, which provides comprehensive paper-based solutions.

Further innovation in the market is powered by Nippon Paper Industries Co. Ltd and IPI SRL. The expertise of Nippon Paper in paper-based packaging and that of IPI in high-performance materials are likely to contribute to the industry's advancement. On the other side, Refresco Group NV and BillerudKorsnas AB are likely to make huge contributions. Refresco, with its wide reach in beverage packaging, and BillerudKorsnas, with an emphasis on sustainable paper products, will do so similarly.

Comar LLC, International Paper Company, Klabin Paper, and Liqui-Box Corporation will also play their roles in shaping the market. Each of these companies brings different capabilities ranging from flexible packaging solutions to large-scale production and distribution networks. Their input in that direction would prove very vital in serving these diverse needs of both consumers and businesses.

Add to this the presence of Smurfit Kappa Group and The DOW Chemical Company in the global liquid packaging market. The role of Smurfit Kappa in providing sustainable paper packaging and DOW Chemical with its inventions in plastic packaging will further continue to push the market. Finally, beverage packaging from Sidel will ensure that the industry keeps pace with the rising demand for effective and quality-oriented packaging solutions.

These are going to be the key players needed in the further development of new technologies and solutions for the market while continuing its evolution in line with the future market needs and environmental standards. Their continuous innovations will define significantly the roadmap of the industry and help guarantee its sustainability.

Liquid Packaging Market Key Segments:

By Type

- Flexible

- Rigid

By Material

- Plastic

- Paper

- Glass

- Metal

By Technique

- Aseptic Packaging

- Intelligent Packaging

- Modified Atmospheric Packaging

- Vacuum Packaging

By End-user

- Personal Care

- Food & Beverage

- Pharmaceuticals

- Chemical

Key Global Liquid Packaging Industry Players

- Elopak AS

- SIG Global Pte. Ltd

- Evergreen Packaging LLC

- Tetra Laval International SA

- Greatview Aseptic Packaging Co. Ltd

- Mondi PLC

- Nippon Paper Industries Co. Ltd

- IPI SRL

- Refresco Group NV

- BillerudKorsnas AB

- Comar LLC

- International Paper Company

- Klabin Paper

- Liqui-Box Corporation

- Smurfit Kappa Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383