MARKET OVERVIEW

The global M-phenylene diamine market functions in the specialty chemicals market, influenced by complex industrial requirements and extremely specialized end-use needs. The industry focuses on m-phenylene diamine (MPD) production, distribution, and use, a chemical most highly prized for its characteristics as an intermediate used in high-performance polymers, especially aramid fibers. These fibers, which have thermal stability and strength-to-weight ratio, need MPD during synthesis, and hence it is an essential feedstock in producing materials for aerospace, defense, and automotive industries. The global M-phenylene diamine market's identity is not one of volume but of precision in its demand.

In contrast to bulk chemicals that perform a wide range of functions, MPD is used for targeted applications, particularly where structural integrity and thermal resistance are not compromised. The importance of the compound is that it can affect the molecular structure of polymers, thereby directly affecting the performance of the finished product. Consequently, those industries that value these results will persist in depending on secure supplies of MPD and build a value chain that is narrow in scope but deep in technical dependency. Major players in this market will continue to fine-tune manufacturing processes in order to hit purity levels that are within high-quality standards. Purity variations can change downstream product properties, hence the importance of controlling synthesis processes. This is why manufacturers of MPD will frequently spend money to optimize available technologies as opposed to increasing volumes indiscriminately. Precision and uniformity will remain key objectives of suppliers in the future.

The global M-phenylene diamine market will also be confronted by regional availability of precursor chemicals. Because MPD synthesis relies on benzene derivatives and other controlled intermediates, regional policy systems and environmental compliance regulations will take a key role in determining where and how MPD can be made. Those countries with robust chemical manufacturing capacities will remain centers, although diversification of supply chains may become a strategic imperative.

Trade patterns surrounding MPD will be partially shielded from volatility, thanks to the niche status of the chemical. As opposed to commodities bought and sold in high frequencies across various borders, MPD will be mostly transferred under committed agreements between producers and advanced materials developers. Such a pattern of limited yet pivotal transactions renders the market less responsive to short-term fluctuations and more dependent on long-term consistency.

In the future, the path of the global M-phenylene diamine market will be determined by changes in the advanced materials sector. Since technological advancement in industries like aerospace and protective gear is ongoing, the need for polymers constructed with MPD will remain.

But this demand will not lead to reckless growth but will rather propel the market toward constrained growth and process innovation. The emphasis will be on ensuring chemical integrity and developing supplier relationships that provide uninterrupted, specification-grade supply.

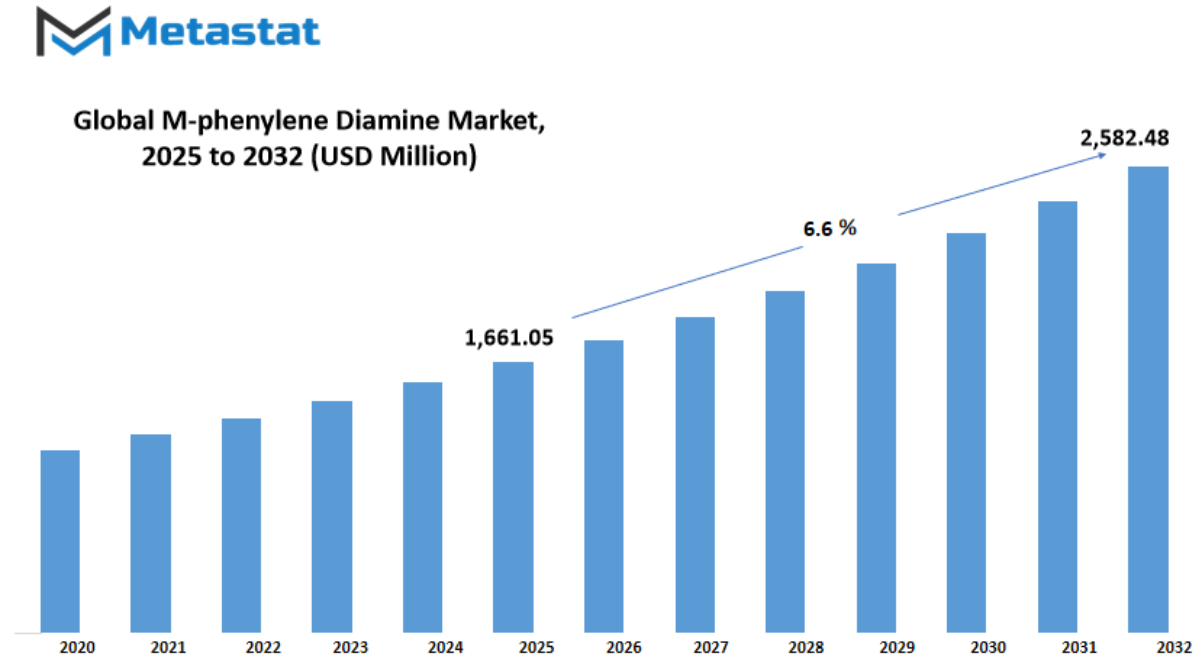

Global M-phenylene diamine market is estimated to reach $2,582.48 Million by 2032; growing at a CAGR of 6.6% from 2025 to 2032.

GROWTH FACTORS

The global M-phenylene diamine market is expected to witness steady progress over the coming years, driven by several important factors. One of the major reasons for this growth is the rising demand for high-performance materials in industries such as automotive and construction. M-phenylene diamine is often used to produce aramid fibers, which are known for their strength and resistance to heat. As the need for durable and lightweight materials increases, especially in sectors looking to improve safety and efficiency, this demand is likely to grow. Alongside this, the expanding electronics industry also plays a role in pushing the market forward, as M-phenylene diamine is used in the production of insulating and heat-resistant components.

Another factor helping the market move ahead is the increased focus on fuel efficiency and emission control. Governments and manufacturers across the globe are adopting newer technologies that require stronger and more reliable materials, many of which depend on M-phenylene diamine. The chemical's use in protective coatings, adhesives, and other applications continues to gain attention. As industries lean toward better performance and sustainability, this material's value becomes more apparent.

However, some challenges may hold back the full potential of the global M-phenylene diamine market. One of the major concerns is the strict environmental regulations surrounding the production and use of chemicals. These rules can make it harder for producers to operate freely, possibly slowing down supply or increasing costs. Additionally, the volatility of raw material prices may also create uncertainty. If key ingredients needed to make M-phenylene diamine become too expensive or hard to get, this could affect how smoothly the market grows.

Despite these obstacles, there are still plenty of chances for improvement and expansion. The development of bio-based and environmentally friendly alternatives could offer new paths for the market. As research continues and technology advances, more sustainable production methods may become widely available. This would not only help in reducing the environmental impact but also attract investors and manufacturers who are conscious of future regulations and consumer preferences.

In the coming years, the global M-phenylene diamine market could benefit from innovations in material science and shifts in industrial strategies. If companies continue to invest in research and focus on cleaner methods of production, the market is likely to reach new heights. With the right support and direction, this sector holds strong promise for both short-term development and long-term success.

MARKET SEGMENTATION

By Form

The global M-phenylene diamine market is expected to witness steady changes in the coming years. As industries push toward innovation and better performance materials, the demand for specialty chemicals like M-phenylene Diamine will continue to grow. This chemical is often used in producing aramid fibers, dyes, and polymer additives, and its role is becoming more important in sectors that focus on strength, heat resistance, and durability. Looking ahead, with new technologies and advanced materials being developed, the need for this compound will likely expand across multiple sectors.

By form, the global M-phenylene diamine market is divided into solid and liquid. Both forms are essential, but each one serves different applications depending on the end-use industry. The solid form is commonly used in manufacturing processes that require high thermal stability and is favored where storage and transport are easier in a solid state. The liquid form, on the other hand, is more suited for applications where faster mixing and direct chemical reactions are needed. As industries lean into more specialized production methods, the demand for each form will continue to evolve. Manufacturers may look into developing even more efficient versions or blends to suit future requirements.

Environmental standards and safety regulations will also play a role in shaping the market. As countries tighten their rules around chemical use, companies involved in the production and application of M-phenylene Diamine will likely invest in cleaner production techniques. This may include reducing emissions during manufacturing and improving handling procedures. These efforts will not only help companies meet regulatory requirements but may also create opportunities for cleaner, more sustainable product offerings.

Global trends such as increasing urban development, rising automotive production, and growth in protective clothing will support this market’s expansion. With infrastructure and transportation systems needing stronger materials, and safety gear becoming more important in industrial workspaces, this compound’s applications will likely grow. Research into advanced fiber technology and coatings could also open new doors for M-phenylene Diamine in areas that have yet to fully adopt it.

Looking into the future, innovation will be a key driver. As new use cases arise and performance needs increase, the global M-phenylene diamine market will need to stay adaptable. Companies that invest in flexible solutions and ongoing research will likely lead the way. Although the market’s direction will depend on both economic and technological factors, its role in supporting next-generation materials will keep it relevant.

By Application

The global M-phenylene diamine market is expected to see steady growth over the coming years due to its rising use across several important industries. M-phenylene diamine, a chemical used as a building block in various products, has become increasingly valuable in manufacturing and industrial applications. As industries push for advanced materials and better product performance, the demand for this compound is likely to grow.

One of the major areas where M-phenylene diamine is used is in the production of aramid fibers. These fibers are known for their strength and heat resistance. As future technologies demand lighter yet stronger materials, especially in defense, aerospace, and protective clothing, the need for aramid fibers will increase. That will naturally drive up the need for M-phenylene diamine. Manufacturers are likely to continue focusing on efficiency and innovation, and the role of this compound will remain central in the production process.

The dye and pigment industry are another key area. M-phenylene diamine is used to make colorants that are stable and long-lasting. As fashion, textiles, and packaging trends shift, the market for better quality dyes will expand. With more focus on bright, lasting colors that don’t fade easily, companies may rely more on this compound to meet the demand.

Polymer additives also rely on M-phenylene diamine to improve flexibility, durability, and chemical resistance. As consumer goods and industrial products are expected to become more durable and sustainable, the use of such additives will likely increase. The future will see greater investment in products that last longer and perform better under different conditions. That means this chemical will continue to play a crucial role in enhancing material properties.

Rubber chemicals made from M-phenylene diamine are used to make products like tires and industrial belts more resistant to heat and wear. As transportation needs shift and industries aim to produce longer-lasting rubber goods, this area of application will also grow. Furthermore, with ongoing research into electric vehicles and smarter mobility solutions, the materials supporting these technologies must also evolve.

Corrosion inhibitors are important in protecting metals from rusting, especially in pipelines, storage tanks, and machinery. As industries work to reduce maintenance costs and improve safety, using chemicals like M-phenylene diamine to prevent damage will become even more important. In short, the global M-phenylene diamine market is positioned for steady expansion as its applications continue to support industries shaping the future.

By Grade

The global M-phenylene diamine market is expected to see significant changes in the years ahead. As industries grow and technologies improve, the demand for M-phenylene Diamine will likely rise. This chemical is widely used in producing polymers, fibers, and coatings. What makes it important is its ability to improve the strength, durability, and resistance of materials. Because of this, more manufacturers are starting to consider it a necessary component in their processes. When we look at how the market is divided, especially by grade, it becomes clear that both Technical Grade and Industrial Grade will play major roles in shaping its future.

Technical Grade M-phenylene Diamine is often used in highly controlled environments. It has applications in areas where precision and quality matter the most. This includes electronics, aerospace, and high-performance materials. As these sectors continue to push for better performance and safety, the need for high-purity chemicals like this will only grow. Companies will invest more in research and better production methods to meet the demand. Since technology is always moving forward, there’s a strong chance that new uses for Technical Grade materials will be discovered.

On the other hand, Industrial Grade M-phenylene Diamine is commonly used in larger-scale production. It finds its place in manufacturing rubber products, dyes, and certain plastic materials. Even though it doesn’t always require the same level of purity as Technical Grade, its role in producing everyday industrial goods makes it just as important. As more countries focus on building local industries and cutting down on imports, the demand for Industrial Grade chemicals will increase. This could lead to more regional players entering the market and creating competition.

Looking ahead, environmental policies and sustainability goals will shape how both grades are produced and used. Companies will be expected to create cleaner, safer ways to manufacture these chemicals. There will likely be stricter rules on emissions and waste, which could raise production costs but also encourage innovation. These changes might result in new types of M-phenylene Diamine or improved versions of the existing ones.

In the coming years, the global M-phenylene diamine market will not only expand but also shift based on new needs and standards. Businesses that can adapt to these changes while maintaining quality will be the ones to lead the way. With both Technical and Industrial Grade segments growing in importance, the market is set to follow a path that rewards progress, responsibility, and long-term thinking.

By End Use Industry

The global M-phenylene diamine market is set to grow steadily as several industries increasingly depend on this compound for its chemical properties and performance benefits. One of the key sectors driving this market is the textile industry. With the demand for stronger and more durable synthetic fibers, manufacturers are turning to materials that can withstand wear and harsh environments. M-phenylene diamine helps in producing fibers that are not only tough but also resistant to heat and chemicals, making them suitable for protective clothing and other technical textiles.

In the automotive industry, the future shows even more potential. As electric vehicles gain popularity, there's a growing need for lightweight, durable materials that support efficiency and performance. Components made using M-phenylene diamine-based materials meet those needs by offering both strength and thermal stability. This makes it useful for car interiors, engine components, and other parts that need to perform under pressure. Over time, these qualities will become even more valuable as manufacturers look for ways to reduce weight without compromising safety or function.

The aerospace and defense sectors also rely heavily on advanced materials. Aircraft and defense equipment must endure extreme conditions. M-phenylene diamine is key in producing components that can handle high temperatures and mechanical stress. In the future, as countries invest more in defense and space exploration, demand for high-performance materials will increase, further supporting this market’s growth.

Chemical manufacturing continues to use M-phenylene diamine in the production of various polymers and coatings. As innovation moves forward, the need for stable intermediates will rise, especially for products that demand precision and consistency. This trend is likely to continue as industries focus on producing better, longer-lasting materials with lower environmental impact.

Electronics is another area where M-phenylene diamine will find more usage. As devices become smaller yet more powerful, the materials used must handle heat and resist breakdown over time. This compound fits well into that need, especially in semiconductors and insulation materials.

Other sectors, including construction and marine equipment, also show promise for future adoption. As the focus shifts to durability, strength, and efficiency across industries, the value of M-phenylene diamine becomes clearer. Looking ahead, its role in making products stronger, safer, and more reliable will continue to grow, reinforcing its place across many industrial applications. This outlook suggests long-term opportunities and consistent demand in the global M-phenylene diamine market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,661.05 million |

|

Market Size by 2032 |

$2,582.48 Million |

|

Growth Rate from 2025 to 2032 |

6.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

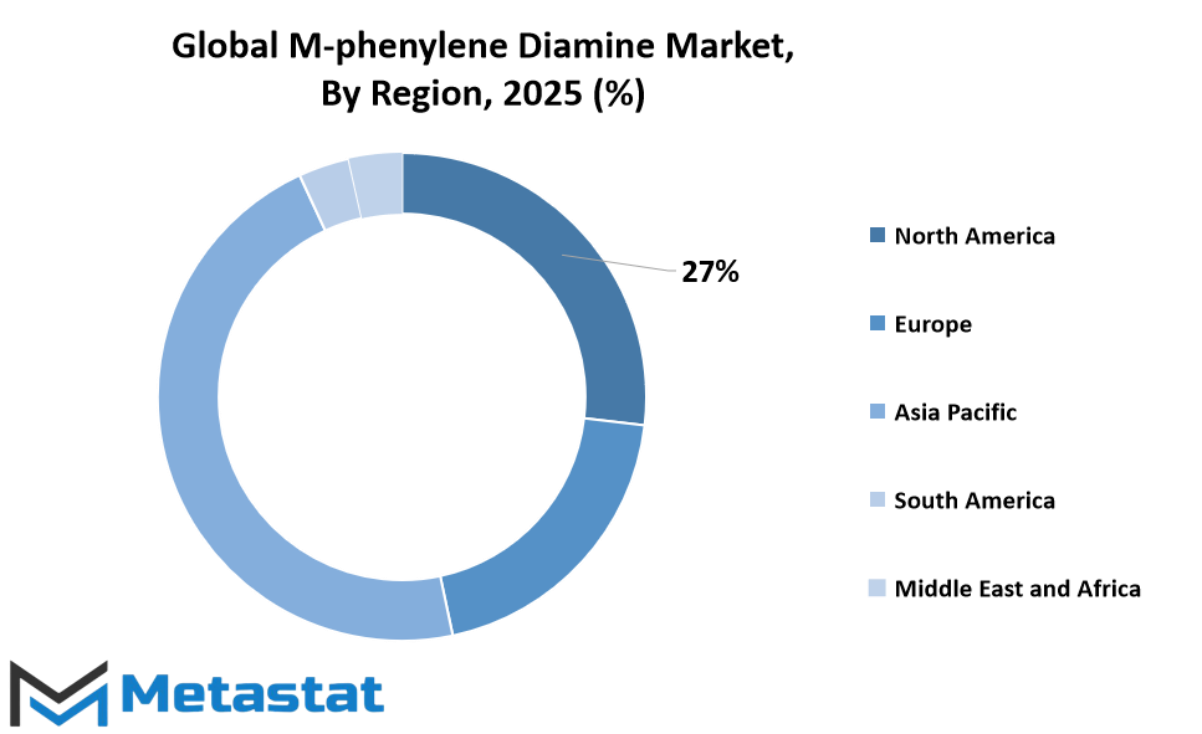

The global M-phenylene diamine market is expected to see notable changes across different regions as industries shift and technology progresses. This market, tied closely to the demand for polymers, fibers, and coatings, plays a significant role in many industrial applications. It is geographically divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Within North America, the U.S., Canada, and Mexico are key players. The region has a solid industrial base and growing interest in advanced materials, which will likely keep driving steady demand. In the U.S. especially, innovations in aerospace and defense are contributing to the wider use of M-phenylene Diamine in specialized manufacturing.

Europe, which includes the UK, Germany, France, Italy, and the rest of the region, has shown consistent activity in adopting sustainable practices and regulating industrial chemicals more strictly. These efforts could encourage the development of more efficient and environmentally friendly production methods involving M-phenylene Diamine. Germany and France may lead this shift, as they continue to invest in new technologies to support a balance between industrial performance and environmental care.

Asia-Pacific, made up of India, China, Japan, South Korea, and other neighboring nations, is projected to be the most dynamic region for the global M-phenylene diamine market. Rapid industrialization, a rise in automotive and electronics production, and increasing infrastructure needs are all contributing to higher demand. China and India, with their growing economies and expanding middle class, are expected to play a central role. These countries are also building more local manufacturing capacity, which will likely reduce dependence on imports over time.

In South America, particularly Brazil and Argentina, gradual growth is anticipated as local industries begin to adopt more advanced materials. Although this region may expand at a slower pace, it still holds potential, especially with rising investments in infrastructure and agriculture.

The Middle East & Africa, which includes GCC Countries, Egypt, South Africa, and others, is also expected to contribute. As these countries develop their industrial sectors and seek to diversify their economies beyond oil, the use of M-phenylene Diamine in construction and protective equipment may grow.

Looking ahead, global trends suggest that demand for materials offering strength, heat resistance, and chemical stability will increase. As industries adapt and technologies evolve, the global M-phenylene diamine market will likely respond with smarter production strategies, expanded capacities, and greater focus on local sourcing to meet future challenges.

COMPETITIVE PLAYERS

The global M-phenylene diamine market is expected to witness significant changes in the coming years, driven by technological progress, growing industrial needs, and evolving environmental standards. M-phenylene diamine, a chemical compound used mainly in polymer production, dye intermediates, and high-performance materials, is seeing rising demand due to its essential role in producing heat-resistant and strong polymers. As the world leans more towards advanced materials that can perform under extreme conditions, the importance of this compound is only expected to grow. Industries such as automotive, aerospace, and electronics are investing in research and development to find better uses for M-phenylene diamine, pushing the market forward.

The competition among key players in the global M-phenylene diamine market is likely to increase, especially as innovation becomes central to staying ahead. DuPont, a long-standing name in the chemical industry, continues to use its extensive research background to find new applications for this compound. Companies like Mitsui Chemicals and BorsodChem are expected to focus more on environmentally friendly solutions and cleaner manufacturing processes, making them key players in shaping the future of this market. Longsheng and Panoli Intermediates India Pvt. Ltd. are expected to continue strengthening their supply chains and production capabilities to meet global demand. Similarly, firms such as Amino-Chem Co., Ltd and Haihang Industry Co., Ltd. are increasing their production to match both local and global needs.

Smaller but highly focused companies like Otto Chemie Pvt. Ltd, Jay Organics Pvt. Ltd., and AB Enterprises are likely to target niche segments, providing customized solutions that larger competitors may not offer. Their flexibility in adapting to customer needs will give them a competitive edge. Thermo Fisher Scientific and Spectrum Chemical Manufacturing Corp. are expected to keep offering high-purity materials, meeting the needs of laboratories and industries that demand precision. Tokyo Chemical Industry Co., Ltd. (TCI) will continue to serve the research and education sectors with high-quality products that support innovation. Online platforms like Rxchemicals.com are also changing the way this market operates by offering quicker access to products, making distribution more efficient.

The future of the global M-phenylene diamine market will be shaped by sustainability, smarter supply chains, and ongoing innovation. As industries continue to seek materials that can withstand stress and high temperatures while being safer and cleaner to produce, the companies involved in this market will need to adapt fast. This constant shift will drive both competition and progress.

M-phenylene Diamine Market Key Segments:

By Form

- Solid

- Liquid

By Application

- Aramid Fibers

- Dyes and Pigments

- Polymer Additives

- Rubber Chemicals

- Corrosion Inhibitors

- Other

By Grade

- Technical Grade

- Industrial Grade

By End Use Industry

- Textile

- Automotive

- Aerospace and Defense

- Chemical Manufacturing

- Electronics

- Other

Key Global M-phenylene Diamine Industry Players

- DuPont

- Longsheng

- Panoli Intermediates India Pvt. Ltd

- Amino-Chem Co., Ltd

- Mitsui Chemicals

- Otto Chemie Pvt. Ltd

- Jay Organics Pvt. Ltd.

- Thermo Fisher Scientific

- Rxchemicals.com

- BorsodChem

- Haihang Industry Co., Ltd.

- Spectrum Chemical Manufacturing Corp.

- Tokyo Chemical Industry Co., Ltd. (TCI)

- AB Enterprises

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252