MARKET OVERVIEW

The global electronics adhesive market takes a central place, particularly in the electronics industry. It covers a wide spectrum of adhesive products to meet special manufacturing requirements for various electronic devices across the world.

In this backdrop, the Global Construction Equipment market emerges as an active counterpart, characterized by tremendous growth and innovative acquisition. This market deals with the manufacturing and supply of heavy plants and equipment related to the running of construction-related activities worldwide. It means production lines related to machinery like excavators, bulldozers, cranes, concrete mixers, among others, in relation to infrastructure development, residential construction, and commercial projects.

The future of the global construction equipment market has been continuous in technology development. Inventions such as Telematics and IoT integration promise to change equipment management in a very big way with an increase in operational efficiency by bringing about better predictive maintenance capabilities. Manufacturers are becoming interested in sustainability. A shift to electric and hybrid construction machinery from traditional ones is expected to decrease environmental impact drastically.

The geographies are likely to be the biggest driver of construction equipment demand, given the trends in urbanization and new investment in infrastructure. The fast industrialization in regions like Asia-Pacific and Latin America opens various opportunities for market growth. Not only that, many initiatives taken by the government to improve public infrastructure are likely to further fuel global electronics adhesive market growth.

As far as market segmentation is concerned, the global electronics adhesive market comprises various product categories that best serve different construction needs. Heavy construction machinery rules the roost in usage because large-scale projects need stronger equipment capabilities. Compact construction equipment has recently achieved fame in urban areas where space efficiency is key.

The future landscape of this market has also underlined the growth in adoption of automation and robotics in construction equipment. Autonomous vehicles and drones are likely to revolutionize conventional construction methods with better safety, accuracy, and productivity at construction sites. Furthermore, new developments related to materials science can produce lighter yet strong equipment, thereby enhancing their mobility and operational flexibility.

The global electronics adhesive market is on the verge of entering a transformational growth process at the core of which will be technology innovations, geographic expansion, and changing industry dynamics. With growing global demand for efficient and sustainable construction solutions, it will see fundamental change and adaptation to meet the burgeoning needs. It is this dynamic evolution that underlines the critical role construction equipment will play in building a future for infrastructure development worldwide.

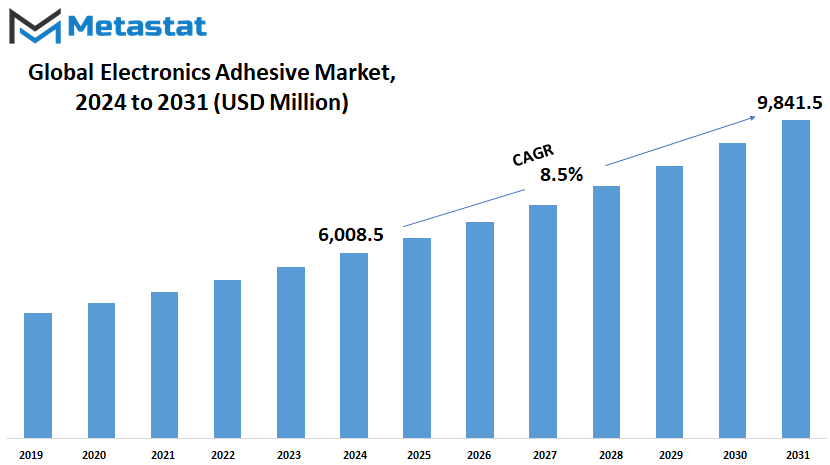

Global electronics adhesive market is estimated to reach $9,841.5 Million by 2031; growing at a CAGR of 8.5% from 2024 to 2031.

GROWTH FACTORS

The global electronics adhesive market will grow for reasons determined by some defining factors. One such factor is the increased demand from within the electronics market for devices of smaller and lighter weight. This trend calls for advanced adhesives capable of preserving enough durability and performance despite the reduced size and weight.

It is further complemented by continuous advances made in electronic manufacturing technologies, which illustrate the cutting edge at which potentials in adhesives lie. These technology trends are driving the demand for more conductive, better thermal management, and enhanced reliability adhesives. All these factors combine to drive the acceptance of electronics adhesives in a variety of applications.

However, the global electronics adhesive market also has its share of challenges that will likely serve as dampeners to its growth. Regulatory constraints and mounting environmental concerns related to the use of some adhesive formulations are making a sizeable impact. These factors work hand in hand in making adhesives manufacturers innovate toward sustainable and green formulations to keep pace with global regulatory requirements and consumer demands.

The global electronics adhesive market is competitive competitively in nature, which also creates pressure on prices. Theoretically, this hypercompetition environment results in performing a part of its own competitive actions and sustaining profitability in such a market is quite difficult for the manufacturer. These play a critical job to balance between cost-effectiveness and the performance and quality of the product.

As the analysts predict, in the global electronics adhesive market, the situation promises some good things for the future. A potential growing area is the development of adhesive formulations that are developed through eco-friendly and sustainable means. All these innovations respond to both regulatory demands and consumer preferences in environmentally conscious products; they are about sustenance. It is through this angle of sustainability that companies can carve out a new avenue in terms of growth and differentiation in the global electronics adhesive market.

True, a couple of bottlenecks do exist with vigorous regulatory complexities and market competition viewing the growth prospects as not very bleak for the global electronics adhesive market. There's a continuous demand for miniaturization and advanced manufacturing technologies that surely keep the need for high-performance adhesives knocking on its door. If this sector is able to embrace innovation and sustainability, it can avail itself of the incoming opportunities supporting its growth in the future.

MARKET SEGMENTATION

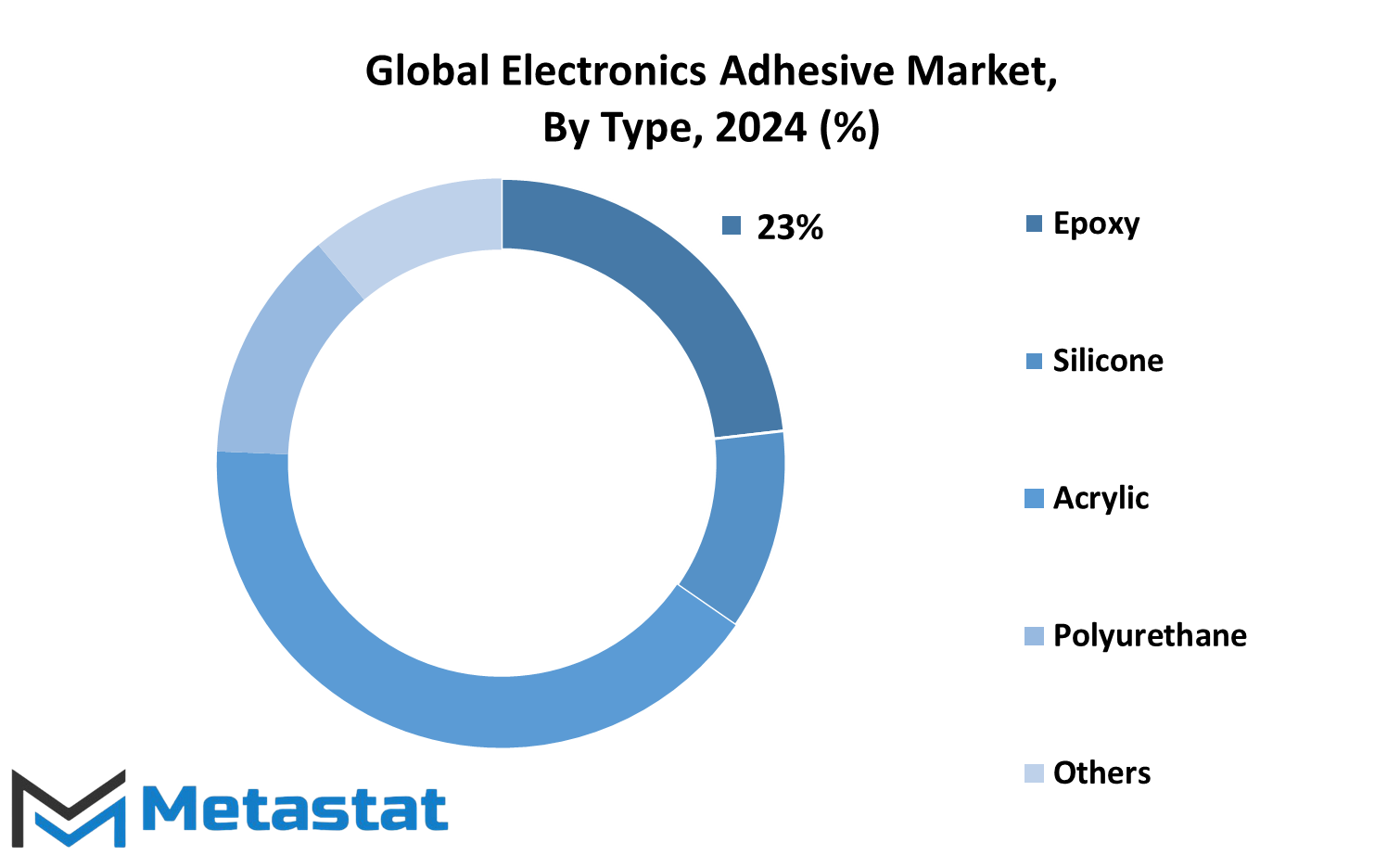

By Type

Without adhesives having played a role in high performance and durability for electronic devices, modern electronics would not have been conceivable. The various adhesives, ranging from epoxies to silicones and acrylics to polyurethanes, help bind critical parts together, increasing the reliability and durability of an electronic product.

Epoxy adhesives are known for their high bonding strength and find wide application in electronics assembly, which provides a very strong bond that can withstand a wide temperature variation. Silicone adhesives add flexibility and resistance to both heat and moisture, making these ideal for such a variety of seal and bond applications in electronic devices under very aggressive environments.

Acrylic adhesives, due to their advantages in fast cure and very good adhesion to a wide range of substrates, play an important role in increasing the efficiency of electronic manufacturing processes. In turn, polyurethane adhesives have a balance of flexibility and strength and are commonly used in such applications as impact resistance and vibration dampening.

From consumer electronics to automotive, industrial equipment, and many more, the wide array of adhesives on offer caters to very specific needs. Special properties in each kind of adhesive answer critical requirements on thermal management, moisture protection, and mechanical stability.

By Form

In the developing modern world, a product such as Electronics Adhesive is taking its place as an essential one. This niche adhesive is advantageous in the manufacture and assembly of electronic devices. It ensures that the various constituent parts hold strongly to add on to the durability and efficiency of the total product.

The global electronics adhesive market is estimated to grow by huge magnitudes. The market is segmented based on types such as Paste, Liquid, and Solid, serving varied functions in electronic applications, from the attachment of electrical components to the improvement of conductivity.

Paste Form Electronics Adhesive is generally applied with precision; thus, intricate parts of electronic devices are effectively bonded in place. It efficiently holds the part in a stable and reliable way without affecting the sensitive circuit.

On the other hand, Liquid Electronics Adhesive allows flexibility during assembly processes. With this characteristic of being fluid, it can be presented in tight spaces so that the coverage of such material on the other diverse materials involved in electronics manufacturing industries is effective and it adheres strongly.

Solid Electronics Adhesive is sought after for its stability and process-friendly nature. Available in pre-formed shapes or sheets, it is pretty easy to apply with minimal to no losses at production lines. This format is hence especially appreciated for offering an acceptable level of consistency and reliability in adhering parts to each other over extended periods of time.

In these existing forms, technology is emerging and straightening the future of Electronics Adhesives. Emerging electronic applications will continue to drive manufacturers to improve these products to meet the evolving requirements of electronics. In advancing material science, the performance of adhesives will continuously improve, seeking strong bonds, high thermal conductivity, and compatibility with new electronic materials.

By Application

In the future, this adhesive will see much growth in various applications in the global electronics adhesive market. This adhesive kind is majorly applied to enhance performance and durability in electronic devices. The adhesive applies in various ways: thermal management, conformal coatings, encapsulation, surface mounting, wire tacking, soldering, underfills, sealing, and constructional.

It simply means that thermal management makes use of electronics adhesive to enhance the dissipation of heat within any electronic component, so it does not get too hot and remains efficient in its operation, promoting a longer life for such devices. The other area is conformal coatings, used to protect the electronic circuitry from the environment, especially against moisture and dust. The coating is vital in enhancing the reliability and longevity needed for any electronics under extreme conditions.

This serves to protect the electronic components against physical damage and environmental contamination. The adhesives used in encapsulation enhance the structural integrity of devices in view of impact and vibration. On the other hand, components are attached securely to the circuit boards using adhesive in surface mounting to achieve stable connections for improved electrical performance.

This is important in wire tacking and soldering applications, especially in placing adhesives that hold wires or bond electronic components together to provide mechanical stability and electrical conductivity to the assembled device. Underfills have a critical role in semiconductor packaging for filling the gap between the chip and substrate and, hence, in reducing the mechanical stresses during thermal cycling.

The sealing applications use electronics adhesives, which seal out moisture and other contaminants. This is very important in protecting sensitive components of the electronic circuitry. Constructional uses for adhesives include the bonding of electronic assemblies into larger structures, whereby mechanical support can improve durability.

By End Use

It is in these fast-changing electronics that adhesives play a huge role: they ensure that every component is strongly integrated and thus can work harmoniously. These special substances are designed for bonding different materials used in the manufacture of these electronics like metals, plastics, and composites, thereby improving any electronic device's reliability and performance.

The global electronics adhesive market is segmented by end-use applications which cater to wide application industries right from the Automotive and Consumer Electronics to Industrial applications, Medical devices, Semiconductor Packaging, and other specialized industries. Therefore, each of these segments uses electronics adhesives for different purposes, which calls for the performance of certain specific characteristics.

An example is in automotive electronics, where adhesives secure all the different components of vehicle systems to withstand range vibrations and thermal changes. In Consumer Electronics, adhesives make compact design and strong assembly of the device possible, thus making the smartphone or tablet look sleek yet ruggedly capable.

In the industrial sector, adhesives in electronics are used to bond equipment and machinery that are to be exposed to rigorous operational conditions. Medical adhesives, on their part, are biocompatible, sterile, and adhere to strict safety and regulatory requirements.

Semiconductor packaging is based upon adhesives for microelectronic assembly, where precise bonding is critical to the performance and life of integrated circuits. Other specialized industries include aerospace and telecommunications, which also use such adhesives in electronics but apply them in special ways, solving the associated specific problems with extreme conditions and high performance requirements.

With further technological innovation and demand from these wide-ranging sectors, the future certainly looks bright for the global electronics adhesive market. Forecasts for new developments in adhesives are expected to be centered on advanced thermal management, moisture resistance, and sustainability concerns in line with broader miniaturization and energy efficiency trends in electronic devices.

Thus, the role of electronics adhesives will continue to be indispensable for the industries and technologies evolving, helping to sustain the development into more compact, reliable, and sophisticated electronic products. All of this has placed greater significance on adhesive solutions in shaping the future of electronic manufacturing and applications across global markets.

REGIONAL ANALYSIS

Based on geographical regions, the global electronics adhesives market can be segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America consists of the United States, Canada, and Mexico. Europe includes the United Kingdom, Germany, France, Italy, and the rest of Europe. Asia-Pacific includes India, China, Japan, South Korea, and the rest of Asia-Pacific. Here, South America includes Brazil, Argentina, and the rest of South America, while the Middle East & Africa include GCC Countries, Egypt, South Africa, and the rest of the Middle East & Africa. Overall, the electronics adhesives market is projected to see massive growth across all these regions.

North America, driven by technological changes and the presence of key players in the global electronics adhesive market, will continue leading the momentum in terms of both innovation and demand. With Europe's increasing emphasis on green processes and a growing consumption of electronic items, the global electronics adhesive market will grow at a stable rate. In Asia-Pacific, rapid industrialization coupled with increasing investments in electronics manufacturing shall fuel strong market growth. Though South America and the Middle East & Africa regions are relatively smaller markets, the growing consumer electronics sector and infrastructure development is expected to boost the demand for electronics adhesives.

The global electronics adhesives market represents a competitive landscape, with a few large players who are emphasizing product innovation and strategic expansion. Key trends observed in this market are the trend towards eco-friendly and sustainable adhesive solutions; regulatory pressures and consumer preference for green products are increasing demand for green adhesives. Improvements in electronic components and materials will further raise the bar on the demand for specialized adhesives having better performance and reliability in a myriad of applications. The global electronics adhesive market is prepared to grow dynamically across different geographical regions. The future scenario for this busy market segment would be founded on a number of factors, including technological developments, market growth strategies adopted by key players involved in the supply chain of this space, and growing demand from consumers for advanced electronic devices.

COMPETITIVE PLAYERS

In the world of today's technology, electronics adhesives help to ensure fluent and long-lasting performance of electronic devices. These adhesives are designed for stringent applications in electronic components and are very helpful in facilitating the entire process of assembly and packaging of various types of electronic products

The global electronics adhesives market is very dynamic, supported by continuous innovation and technology advancement. The major operating companies in this segment, such as Sika AG, Henkel AG & Co. KGaA, 3M Company, and others, are developing the best adhesive solutions for electronic applications. These adhesives not only bond the component parts but also provide reliability and functionality to the electronic device.

With the growing electronics industry, there are huge needs for developing adhesives with advanced technologies that will explosively grow in demand. Currently, manufacturers are working on adhesives with desirable features that have high thermal conductivity, high electrical insulation properties, and resistance to various environmental aspects. Such characteristics are basic in facilitating an electronic device's life and stability, especially within consumer electronics, automotive electronics, and telecommunications sectors.

The increasing trend towards complexity and miniaturization in electronic components encourages the adoption of electronics adhesives. Miniaturization trends require adhesives that can bond small, delicate components reliably without compromising on performance. Another key factor is the trend toward environmental friendliness: adhesives free from VOCs and other harmful substances mirror broader industry trends toward sustainability and regulatory compliance.

With the invention of new applications and improvement in existing technologies, the global electronics adhesives market will continue to grow. Next-generation emerging markets in Asia-Pacific, such as China and India, are going to witness high growth on the back of rapid industrialization and growing consumer demand for electronic goods. This rise presents opportunities for established and new entrants to innovate and capture share in this competitive landscape.

Adhesives in electronics have their roles in both device functionality and reliability. Constant development of advanced adhesive solutions underlines the commitment of the industry to emerging technological challenges and consumer expectations. With increasing demand and better technology, the global electronics adhesives market is bound to act as one of the main drivers of innovation and progress in the electronics industry.

Electronics Adhesive Market Key Segments:

By Type

- Epoxy

- Silicone

- Acrylic

- Polyurethane

- Others

By Form

- Paste

- Liquid

- Solid

By Application

- Thermal Management

- Conformal Coatings

- Encapsulation

- Surface Mounting

- Wire Tacking

- Soldering

- Underfills

- Sealing

- Constructional

By End Use

- Automotive

- Consumer Electronics

- Industrial

- Medical

- Semiconductor Packaging

- Others

Key Global Electronics Adhesive Industry Players

- Sika AG

- Henkel AG & Co. KGaA

- H.B. Fuller Company

- 3M Company

- tesa SE

- Parker Hannifin Corporation

- Panacol-Elosol GmbH

- Meridian Adhesives Group

- The Dow Chemical Company

- Avery Dennison Corporation

- DELO Industrie Klebstoffe GmbH & Co. KGaA

- Xiamen Weldbond New Material Co., Ltd.

- Huntsman Corporation

- Permabond Engineering Adhesives Ltd

- Master Bond Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383