MARKET OVERVIEW

The global healthcare cold chain logistics market, which is a part of the healthcare supply chain and pharmaceutical shipping business, will serve as a critical system to ensure controlled-temperature storage and shipment of temperature-sensitive health care products. The market will provide for the distribution of vaccines, biopharmaceuticals, clinical trial materials, diagnostics, and other sensitive health care commodities that necessitate demanding temperature control throughout the logistical process. The transport of such commodities will entail the use of advanced refrigeration methods, monitoring systems, and specific transport facilities, which will set the scope of activities for this market.

In comparison to general freight or conventional logistics, this market will require that there be compliance with international quality standards, and the handling processes need to be extremely accurate to avoid any fluctuation in temperature levels. Even minor changes in temperature conditions may result in loss of effectiveness or contamination, and precision will therefore be a non-negotiable criterion in each phase of the global healthcare cold chain logistics market. Manufacturers, logistics companies, packaging solution vendors, and government bodies will form the interconnected web that facilitates hassle-free movement of products across global borders.

The scope of the market will extend beyond storage and transportation phases alone. It will even enter integrated service models that include data logging, supply chain transparency, real-time monitoring, and route optimization. The market will employ digital technologies for enhanced operational effectiveness and mitigation of risks associated with temperature excursion. Such functionalities will not only add to the integrity of the products being shipped but will also comply with the compliance requirements enforced by regulatory agencies such as the FDA, WHO, and domestic pharmaceutical regulators.

Global, this market will serve a wide segment of end users ranging from hospitals, diagnostic clinics, research institutions, to biotech/Pharma companies. All will require special logistic needs based on the sensitivity and shelf life of the medical product being transported. Cold storage warehouses, temperature-controlled vehicles, and insulation packaging materials will be the backbone network infrastructure for the system. Multimodal transport across air, roads, and sea freight will need to be coordinated to deliver stable environmental conditions across the entire supply chain.

As pharma research gets more specialized, and biologics are at the forefront, the demand for dependable cold chain logistics will become more sophisticated. The market will not only seek new refrigeration units but make use of predictive analysis, machine learning algorithms, and AI-based diagnostics to foretell risks and ensure consistency. Whether or not they can integrate physical logistics with data intelligence will be a hallmark of top providers in the global healthcare cold chain logistics market.

Regulatory environments in various parts of the world will influence how this market operates. North America and Europe will still have high standards of quality, and emerging markets in Asia, Latin America, and Africa will adjust their infrastructure to address domestic demand for high-quality health care services. This trend will make the global healthcare cold chain logistics market a cornerstone of public health infrastructure and pharmaceutical supply chains so that the key medical products are transported globally in a safe, efficient, and traceable manner.

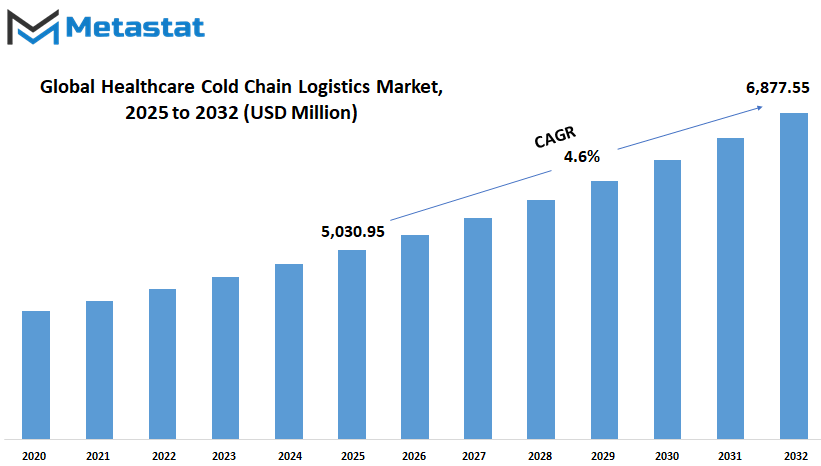

Global healthcare cold chain logistics market is estimated to reach $6,877.55 million by 2032; growing at a CAGR of 4.6% from 2025 to 2032.

GROWTH FACTORS

The global healthcare cold chain logistics market is likely to witness continuous growth in the future as a result of a number of key factors. One of the key reasons for this growth is the increasing demand for temperature-sensitive vaccines and biologics. These should be maintained between a precise temperature limit from the moment of production until the time they are administered. Any change, even temporary, might render them useless or even harmful. With more such products coming onto the market and becoming de rigueur in healthcare, the demand for stable cold chain logistics will keep expanding.

Governments and health bodies globally have put in place stringent requirements to make medicines, particularly those that need cold storage, properly stored and transported. These regulations are in place to preserve public health and ensure the efficacy of sensitive medicines. Due to this, cold chain logistics firms are required to make investments in quality systems and processes. They must ensure their storage facilities, their transport, and their monitoring systems are all dependable and comply with these regulatory requirements.

Establishing and sustaining these systems, however, is not inexpensive. Establishing cold storage facilities, the acquisition of specialized cars, and the installation of monitoring systems are costly. Also, on a daily basis, there is the cost of power consumption, equipment maintenance, and employee training, which contributes to the expense. For other companies, particularly new entrants into the market, these costs can be a major concern. There is also a risk of product loss in case there is a system breakdown. When a refrigerator malfunctions or a temperature sensor fails to provide proper readings, precious medicines can go to waste. This not only results in a financial loss but also disrupts supply and retards treatment for patients.

In the future, the industry might be aided by recent technological innovations. Real-time monitoring equipment for temperature, aided by IoT-based systems, provides greater control over the whole supply chain process. These can enable companies to track conditions along the way through a product's journey and react instantaneously if something fails. With time, these technologies will be more prevalent and at affordable prices, assisting in mitigating risks and enhancing efficiency.

With the advancement of medical science, the requirement for reliable cold chain logistics will continue to grow. Firms that can provide secure, affordable, and technology-driven solutions will be instrumental in determining the future of the global healthcare cold chain logistics market.

MARKET SEGMENTATION

By Product

The global healthcare cold chain logistics market ensures temperature-sensitive medical goods reach their ultimate destination in the right condition. This logistics sector enables secure handling, storage, and transportation of products including biopharmaceuticals, vaccines, and clinical trial products. All such products require storage within a specific range of temperature in order to maintain their effectiveness, and even a slight variation will alter their quality. With the increasing requirement for healthcare globally and growing demand for personalized medicine, the function of cold chain logistics will only rise. Biopharmaceuticals, the prevailing segment of this industry, rely upon strict temperature control. They are complex drugs that originate from living cells and typically must be stored and shipped in highly regulated conditions. In 2025, this segment is anticipated to become USD 2,506.42 million. With the increasing incidence of chronic diseases and focus on targeted therapy, the delivery of these drugs to remote and urban regions will necessitate more effective cold chain networks.

Yet another prominent product segment in the market is vaccines. Since vaccines are heat susceptible, they will need to stay cold all the time. Failure of transportation and storage can lead to a loss of efficacy, thereby undermining public health. Vaccines in the global healthcare cold chain logistics market are expected to be valued at USD 1,284.40 million by 2025. Vaccination campaigns in the world, especially among young populations and with respect to diseases, will fuel demand for efficient cold chain solutions.

Clinical trials that examine new drugs prior to their release to the public also depend heavily upon cold chain logistics. Clinical trials are usually deployed over different countries and need strict timetables. Sample and drug stability during the process is crucial in order to achieve exact results. This sector is likely to grow to USD 738.80 million in 2025 due to a rise in research and development activities in the pharma industry.

The Others category, which includes home care products and radiopharmaceuticals, is also rising in prominence. The items of this category often need special handling, and the increase in home treatment will further boost their demand. The segment will expand to USD 501.33 million by 2025.

Technology in the future will transform the global healthcare cold chain logistics market. Advanced sensors, enhanced packaging, and traceability solutions will help reduce losses as well as improve efficiency. With increasingly advanced medicine, efficient and high-quality cold chain networks will be ever more important.

By Mode of Transportation

The global healthcare cold chain logistics market is projected to experience consistent growth as a result of the increasing demand for temperature-sensitive medical products. With continued developments in health care, several products—vaccines, biologics, and some pharmaceuticals—are required to be shipped at controlled temperature levels in order to remain effective. These demands encourage businesses to spend more on improved transportation and storage equipment. Without a trusty cold chain, the chance for spoilage grows, which can result in money loss as well as injury to patients. Therefore, companies and governments globally are becoming more interested in developing reliable systems capable of handling this type of delicate logistics.

Transportation is a significant factor in maintaining the cold chain smoothly. The Global Healthcare Cold Chain Logistics industry relies on a number of modes of transport, with each mode having some advantages. Air freight is preferred when there needs to be speed. Certain medical supplies cannot wait, and air freight provides the quickest means of transport. It is ideal for rapid delivery over a long distance, which can be critical during an emergency or when there are time-sensitive shipments. But it is more costly and requires proper handling and packaging.

Sea freight is handy when there is ample time for delivery and cost is an issue. It supports shipping large quantities of goods at a time, but it is slower. Due to this reason, sea transport is often used for scheduled bulk deliveries where speed of delivery is not the priority. Road transport is the most prevalent mode applied to shorter distances. It assists in linking various segments of the supply chain, e.g., transporting products from the seaport or airport to a hospital or pharmacy. Trucks with in-built refrigeration are commonly applied for this use. In contrast, rail transport provides a compromise between cost and speed. Trains are able to transport huge shipments overland more effectively than trucks and can even provide more consistent delivery timetables at times.

In the future, the global healthcare cold chain logistics market will expand not just in size but in sophistication. Emerging technologies are being field-tested to enhance the way merchandise is tracked in transit. GPS monitoring, intelligent sensors, and automated notifications are on the rise. These resources assist businesses to respond more quickly should something go wrong, reducing waste and ensuring patients are protected. With demand for advanced medical treatments still increasing, the infrastructure that enables them to be delivered will also have to advance, making this market more crucial than ever.

By End-User

The global healthcare cold chain logistics market is attracting increasing interest with increasing demand for temperature-sensitive healthcare products. With more treatments and vaccines depending on being maintained at certain temperatures, the demand for dependable logistics systems is more critical than ever before. In the future, this industry will most certainly be an increasingly larger part of healthcare delivery globally. As medical technology becomes increasingly about personalized care, biologics, and new treatments, the need to keep these products safe in transit will continue to grow.

The market, by end-user, is influenced by a number of decisive groups. Pharmaceutical firms depend greatly on cold chain systems to transport drugs securely from manufacturing sites to multiple destinations. Most of these medicines become ineffective if they are subjected to even mild variations in temperature, hence the reliable logistics becomes a must. Biotechnology firms, which tend to create highly sensitive products such as gene therapies or cell-based therapies, also rely on these logistics networks to provide product integrity from research to the point of delivery. The segment is likely to expand even more as science advances with more targeted medicines that need stringent temperature control.

Hospitals and healthcare providers also play an important role. With more distributed healthcare and homecare on the rise, hospitals will require regular and dependable cold chain service. This change translates to increased transport of medicines more directly to the patients, particularly those who are chronically ill or recovering at home. Clinical Research Organizations, which manage trials for new drugs, also have similar requirements. The data collected in these trials should be precise, and that is why the samples and products utilized in the process of study should be handled and transported safely. Any compromise in the cold chain is likely to impact trial outcomes and postpone launching new treatments.

Drug stores and retail pharmacies put an additional piece on the market. Since they are broadening their function to provide immunizations and specialized medicines, these companies will require more advanced cold storage systems. Consumers are demanding more from their community pharmacies, not only in supply but also in quality and safety. This will cause the market to create more accessible and effective cold chain technologies.

In the years ahead, the global healthcare cold chain logistics market will be increasingly devoted to innovation in areas of automation, intelligent packaging, and sophisticated tracking systems. Such advancements will prevent mistakes, minimize waste, and safeguard patient health. As healthcare transforms in years to come, this market will serve as a pillar ensuring safe delivery of life-saving treatments.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5,030.95 million |

|

Market Size by 2032 |

$6,877.55 Million |

|

Growth Rate from 2025 to 2032 |

4.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global healthcare cold chain logistics market is increasingly important as the population of the world expands and temperature-sensitive medical materials become increasingly in demand. This isn't all about vaccines or biologicals anymore. It encompasses a great variety of drug products, laboratory samples, and even some medical devices that need to be stored at precise temperatures from the point of manufacture until they are consumed. As health systems become increasingly interconnected and the delivery of care is increasingly extended out of hospital settings, demand for cold chain logistics is likely to grow in the coming years.

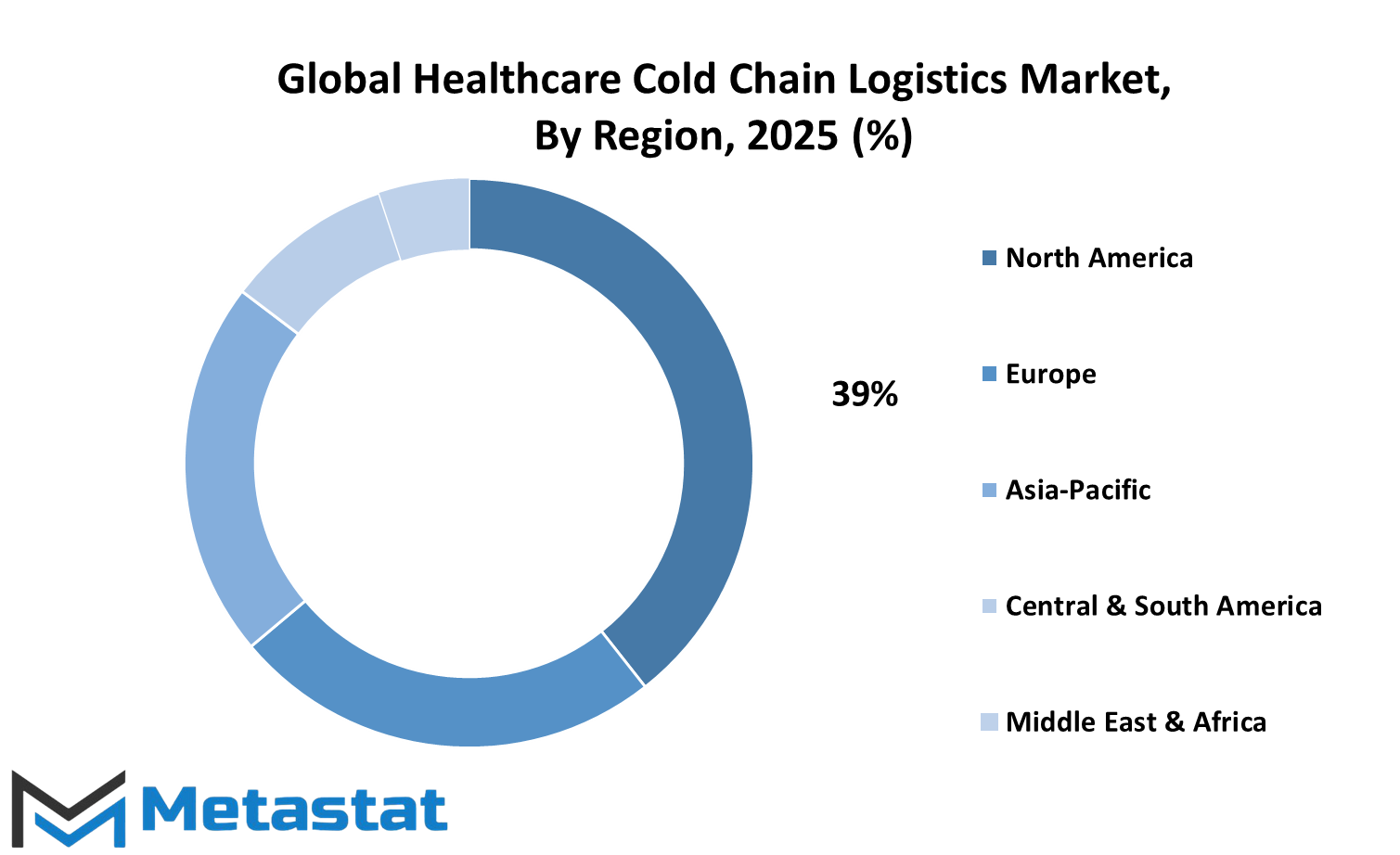

Various regions around the globe will shape the way this market evolves. North America, with the U.S., Canada, and Mexico, boasts an established infrastructure and robust healthcare systems. This area will most probably lead in innovation and investment in cold chain technologies. With increased research in biotechnology and continuous manufacture of sensitive drugs, emphasis on safe and effective transport will still be high. The U.S., in turn, will most probably drive ahead through its steady expenditure on healthcare and pharma innovations.

In Europe, including the UK, Germany, France, Italy, and others, stringent regulations for drug safety and storage will compel logistics providers to enhance their services. The regulators' compulsion will result in upgraded storage facilities, improved controls, and more reliable delivery processes. Europe's aging population and preventive care emphasis will further fuel demand for high-quality storage and delivery systems.

Asia-Pacific, which comprises nations like India, China, Japan, and South Korea, is experiencing rapid growth in the healthcare industry. Economic progress and increased healthcare awareness result in greater numbers of people accessing sophisticated treatments. Still, it has challenges such as temperature fluctuation while in transit and scarcity of storage facilities. In the coming times, as investments enhance networks of logistics, these roadblocks will be minimized so that Asia-Pacific will become an important player.

Middle East & Africa and South America are slowly catching up. Brazil, Argentina, Egypt, and South Africa are enhancing their cold chain facilities. With more global pharma players entering these regions, the demand for improved transportation and storage facilities will grow. Governments of these countries will spend more on infrastructure to facilitate this expansion.

Overall, as increasing numbers of individuals across the globe have access to contemporary treatments, the global healthcare cold chain logistics market will proceed to expand and evolve to accommodate shifting requirements.

COMPETITIVE PLAYERS

The global healthcare cold chain logistics market will keep expanding since the world needs more temperature-sensitive medical products. The market is becoming increasingly significant every year as the healthcare systems and pharmaceutical firms make use of secure and effective transport mechanisms for vaccines, biologics, and other life-saving treatments. In the near future, companies will be planning their logistics operations based on a preeminence on keeping the correct temperature from the time of origin to the end-user. Not only will this safeguard products but it will also save lives by keeping medicines potent along the way.

The future of this business will probably include more spending on intelligent technologies that track temperature, humidity, and location in real-time. These technologies will decrease risks of spoilage and provide more authority to receivers and shippers. Businesses will have to adapt rapidly to more stringent regulatory requirements and the increasing requirement for visibility. Increasingly, nations are tightening regulations regarding how delicate healthcare products are treated and stored, particularly on long trips. All of this will encourage businesses to create improved packaging, storage facilities, and transportation options.

In this expanding industry, most large logistics companies are struggling to get ahead. Competitive operators like FedEx Corporation and United Parcel Service of America, Inc. are already enhancing their cold chain facilities with new technology and infrastructure. DB Schenker and Kuehne + Nagel International AG are also developing stronger networks to distribute to more locations while maintaining safety as their number one concern. Entities such as AmerisourceBergen Corporation and Cardinal Health, Inc. are concentrating on providing secure and quick solutions for pharma distribution. Others, such as World Courier and QuickSTAT, have the reputation of being time-sensitive experts in shipping. Marken, DHL Group, and B Medical Systems are refining their systems to accommodate the increased demand, and Dokasch is developing more sophisticated containers that provide consistent temperatures in long journeys.

As healthcare technology introduces new forms of treatments needing cold storage, the global healthcare cold chain logistics market will have to adapt accordingly. The rivalry between participants will trigger innovation and enhance the transportation of healthcare products across the globe. We will see greater collaboration between suppliers, logistics companies, and healthcare entities in the future, enabling easier transportation of critical medical supplies in a safe and timely manner.

Healthcare Cold Chain Logistics Market Key Segments:

By Product

- Biopharmaceuticals

- Vaccines

- Clinical Trials

- Others (Radiopharam, Home Care Products, etc.)

By Mode of Transportation

- Air Freight

- Sea Freight

- Road Transportation

- Rail Transportation

By End-User

- Pharmaceutical Companies

- Biotech Companies

- Hospitals and Healthcare Providers

- Clinical Research Organizations (CROs)

- Retail Pharmacies and Drug Stores

Key Global Healthcare Cold Chain Logistics Industry Players

- FedEx Corporation

- United Parcel Service of America, Inc.

- DB Schenker

- AmerisourceBergen Corporation

- Cardinal Health, Inc

- Kuehne + Nagel International AG

- World Courier

- QuickSTAT

- Marken

- DHL Group

- Dokasch

- B Medical Systems

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383