MARKET OVERVIEW

The global wealth management market is within the larger financial services sector and will continue to influence the strategic focus of asset preservation, investment advisory, and high-net-worth client services for international markets. It is a complex web of private banks, financial advisors, family offices, and online platforms that customize solutions for individuals and institutions in pursuit of long-term financial organization. Its reach goes beyond investment suggestions, embracing specialized structuring of portfolios, estate planning strategies, tax optimization solutions, and risk mitigation tools designed to benefit high-net-worth clients. As the financial ecosystem continues to evolve in reaction to regulation, digital infrastructure, and investor sentiment, the global wealth management market will evolve by reconfiguring service delivery models and portfolio construction techniques.

The reach of the global wealth management market is institutional investors, ultra-high-net-worth individuals, and mass affluent segments, all of whom require differing levels of personalization and transparency. In future worlds, wealth managers will use complex data analytics to build financial roadmaps that correlate client behavior, asset diversity, and international exposure. A defining feature of this market will be navigating cross-border dynamics. With regulatory systems becoming more stringent across borders, wealth managers will have to balance compliance and provide clients with smooth access to global investment opportunities. The global wealth management market will assume a pivotal position in defining the movement of capital within regions and sectors, considering legal frameworks, currency exchange, and geopolitical developments. In scope, this market crosses several services, including portfolio management, alternative asset strategy, philanthropic planning, and retirement consulting.

These products will be increasingly brought together on platforms that combine traditional advisory and algorithm-based approaches, enabling clients to have both control and visibility over their holdings. Technology will serve as an amplifier, not a substitute, for the nuanced relationships clients have with trusted advisors. As these technologies advance, they will enable advisors to present more sophisticated risk-adjusted models and individualized asset allocation recommendations. The organization of the global wealth management market will also transform with shifting wealth demographics. Intergenerational wealth transfers and growing interest from younger investors will reshape service expectations. This transition will create demand for ethical investment choices, increased ESG thinking, and stronger digital engagement capabilities.

To respond, service providers must adapt their outreach techniques, language, and investment products to serve the tastes of newer market players without interrupting older client relationships. In addition, the market will also extend its digital custodian services and non-traditional classes of investments, namely private equity and structured credit. The diversification would not only be reflective of opportunity but also prudence, as volatility on traditional markets continues to dictate investor action. The global macroeconomic environment will dictate how wealth is safeguarded, utilized, and revalued within this market's schema. The global wealth management market will not be a static sector in financial services. Its evolution will be continuous, influenced by regulatory reforms, client expectations, and both product and service innovation. Therefore, it will have a dynamic profile in the financial industry landscape and will remain critical in facilitating wealth-based decisions for a broad range of global participants.

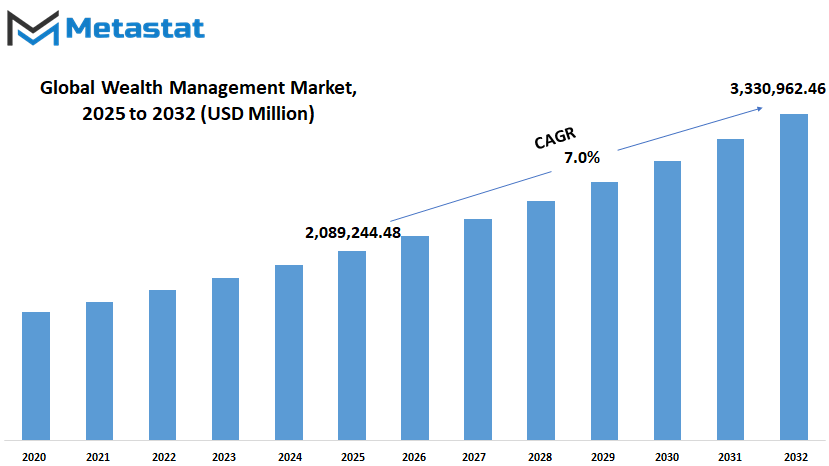

Global wealth management market is estimated to reach $3,330,962.46 Million by 2032; growing at a CAGR of 7.0% from 2025 to 2032.

GROWTH FACTORS

The global wealth management market is moving toward a future governed by change, innovation, and emerging expectations. Among the most compelling forces driving it is continuous economic advancement in most regions. As companies grow and individuals have more assets, the demand for services that assist in wealth management and preservation will keep growing. On another note, technology is revolutionizing the way the services are being delivered. The introduction of newer, more sophisticated tools enables companies to provide personalized counsel quicker, monitor investments better, and deliver a better experience to customers. All these make financial advice more accessible to individuals regardless of their location. But with expansion comes challenges.

The greatest threat to the global wealth management market is maintaining pace with evolving regulation. Financial regulations are also revised periodically in order to safeguard investors, ensure transparency, and keep illegal practices at bay. Although these rules play a significant function, they also cost companies time and money to comply with. A second barrier is economic uncertainty. Unforeseen alterations to the world economy, whether by political developments, natural catastrophes, or economic recessions, can influence patterns of investment. These changes may make customers more risk-averse, and hence there could be slower decision-making and a potential decrease in demand for certain services. In spite of these apprehensions, there are strong indications that the future is full of promise. One of the most promising spaces is sustainable investing.

With more people and businesses understanding environmental and social concerns, the demand for socially responsible investments keeps increasing. This change enables wealth management companies to present products that not only yield financial returns but also align with the values of their clients. This type of investing is not a fad—it is becoming an integral part of personal financial planning for many. In the future, the Global Wealth Management industry will be defined by the extent to which it accommodates change. The firms that succeed will be those that embrace new technologies, stay ahead of economic shifts, and listen to what clients truly want. If these services remain flexible and responsive, they will continue to play a key role in guiding individuals and families toward their financial goals, even in a world that is constantly shifting. The future of the global wealth management market is to balance innovation with stability and to establish trust through wise and forward-thinking service.

MARKET SEGMENTATION

By Business Model

The global wealth management market is gradually redefining itself as the globe increasingly drifts into a digital era. The manner in which individuals manage, build, and preserve their financial assets is being transformed by shifts in technology, client aspirations, and economic trends. In the future, this market is poised to become increasingly dynamic and responsive to personal and global financial trends. This transformation is not merely about utilizing new technology; it is about redefining the way financial advice is given and accepted. A key aspect of this market is the manner in which companies decide to advise their clients.

This is expressed through three primary ways: Human Advisory, Robo Advisory, and Hybrid Advisory. Each performs a distinct function and has distinct value based on the client's requirement. Human Advice, true to its name, entails in-person discussions or individual contact with a financial advisor. It provides reassurance, particularly when trust and comprehension are critical. Clients can opt for it when their finances are complicated or when they require reassurance in the face of uncertain situations. Conversely, Robo Advisory employs computer programs and algorithms to give advice from data. It lessens the role of human interaction but increases availability and generally speed.

The choice is more suited for individuals who are familiar with technology and like to do things independently with minimal interaction. Although it may lack the same emotional intelligence, it is likely to expand due to its ease of use and affordability. Others believe the future won't tip entirely in one way. That is where Hybrid Advisory fits in. This model combines both human advice and technology. Clients have the option to take advantage of personalized advice when needed, yet apply tools that simplify everyday management. This balance is seen to have an increasingly important role as more individuals demand a balance between technology and human interaction. As the global wealth management market evolves, flexibility will probably be more necessary than ever.

There will be increasing demand for varied styles of advice as new generations enter the world of finances with alternative expectations. Financial organizations will have to look ahead, plan accordingly, and modify their services to remain linked to their clients. What the future holds is not just a wiser method of managing wealth but also one that works according to the lives and aspirations of people it seeks to benefit.

By Services

The global wealth management market is gradually evolving into something much larger and more attuned to individual financial requirements. It is not so much about managing investments anymore. It is evolving into a framework that takes into account everybody's objectives, living habits, and tolerance for risk. With services such as Portfolio Management, Asset Management, and other customized financial solutions, the paradigm is slowly shifting towards generating long-term value rather than seeking short-term gains. Individuals are starting to seek advice and tactics that align with their evolving lives, rather than fads in the global wealth management market. With technology expanding and becoming increasingly prevalent in everyday financial choices, this market will also evolve, merging human advice with computerized tools. Portfolio Management is a major force behind this evolution.

Rather than being a basic review of what stocks or bonds to own, it is becoming a plan that incorporates life stages, anticipated earnings, and objectives. This will facilitate easier planning for future events with greater confidence. The combination of automation and human observation may provide better control without sacrificing flexibility. Asset Management is also evolving. What previously concentrated primarily on conventional assets is now expanding to encompass options specifically created for long-term planning. This may involve novel approaches to considering property, business equity, or green investments. Asset Management services in the future will more than likely become more interactive, where investors can monitor their positions in real time, better comprehend risks, and modify goals without burdensome processes. Other Global Wealth Management products will remain on the upswing in terms of priority. These include retirement planning, estate planning, and individualized tax consulting.

All of these will increasingly draw upon technology that can project trends into the future while maintaining human contact. Individuals will want to feel that their financial plans are personalized with regard to their values and personal aspirations, not mere data points. This connection between financial knowledge and life planning will help build trust in the advisors and systems that support them. As financial instruments become increasingly accessible and convenient to use, more individuals with diverse backgrounds will seek means of accumulating and safeguarding their wealth. This will assist the global wealth management market in its growth into new areas, with services that increase in parallel with the individuals they are created to assist.

By End-user

The global wealth management market is gradually taking form as something much wider and more attuned to individual financial requirements. It is no longer simply about managing investments. It is developing into a framework that takes into account every individual's objectives, way of life, and risk tolerance. Through offerings such as Portfolio Management, Asset Management, and other tailored financial solutions, the emphasis is progressively being laid on generating long-term value rather than seeking instant gains. Individuals are starting to seek advice and strategies that are appropriate for their evolving lives, rather than what's popular in the global wealth management market. With technology expanding and increasingly becoming a larger factor in day-to-day financial choices, this market will also transform, merging human advice with automated resources. Portfolio Management is a key driver of this transformation.

Rather than being an easy primer on what stocks or bonds to invest in, it is becoming more of a strategy based on life stages, anticipated earnings, and objectives. This will enable people to anticipate and plan for future things with greater certainty. The combination of automation and human perception may provide better control without sacrificing flexibility. Asset Management is changing too. What used to concentrate on conventional assets is expanding today to encompass strategies that are geared towards long-term planning. This could involve new approaches to property, business equity, or green investments. Asset Management services in the future will likely be more interactive, where customers can monitor their investments in real time, comprehend risk better, and modify goals without cumbersome processes. Other Global Wealth Management services will be increasing in relevance. These are estate planning, retirement planning, and customized tax guidance.

These services will all be dependent more on the technology that is capable of forecasting trends but still offer an individual experience. Individuals will seek to feel as though their financial strategy is doing more than just mirroring numbers. It needs to mirror their values and their dreams as an individual. This link between financial literacy and life planning will establish trust with the advisors and systems that underlie them. As investment tools become increasingly accessible and user-friendly, more individuals from various walks of life will seek means to create and maintain their riches. This will see the global wealth management market grow in new avenues, with services that increase in tandem with the individuals they are intended to cater to.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,089,244.48 million |

|

Market Size by 2032 |

$3,330,962.46 Million |

|

Growth Rate from 2025 to 2032 |

7.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

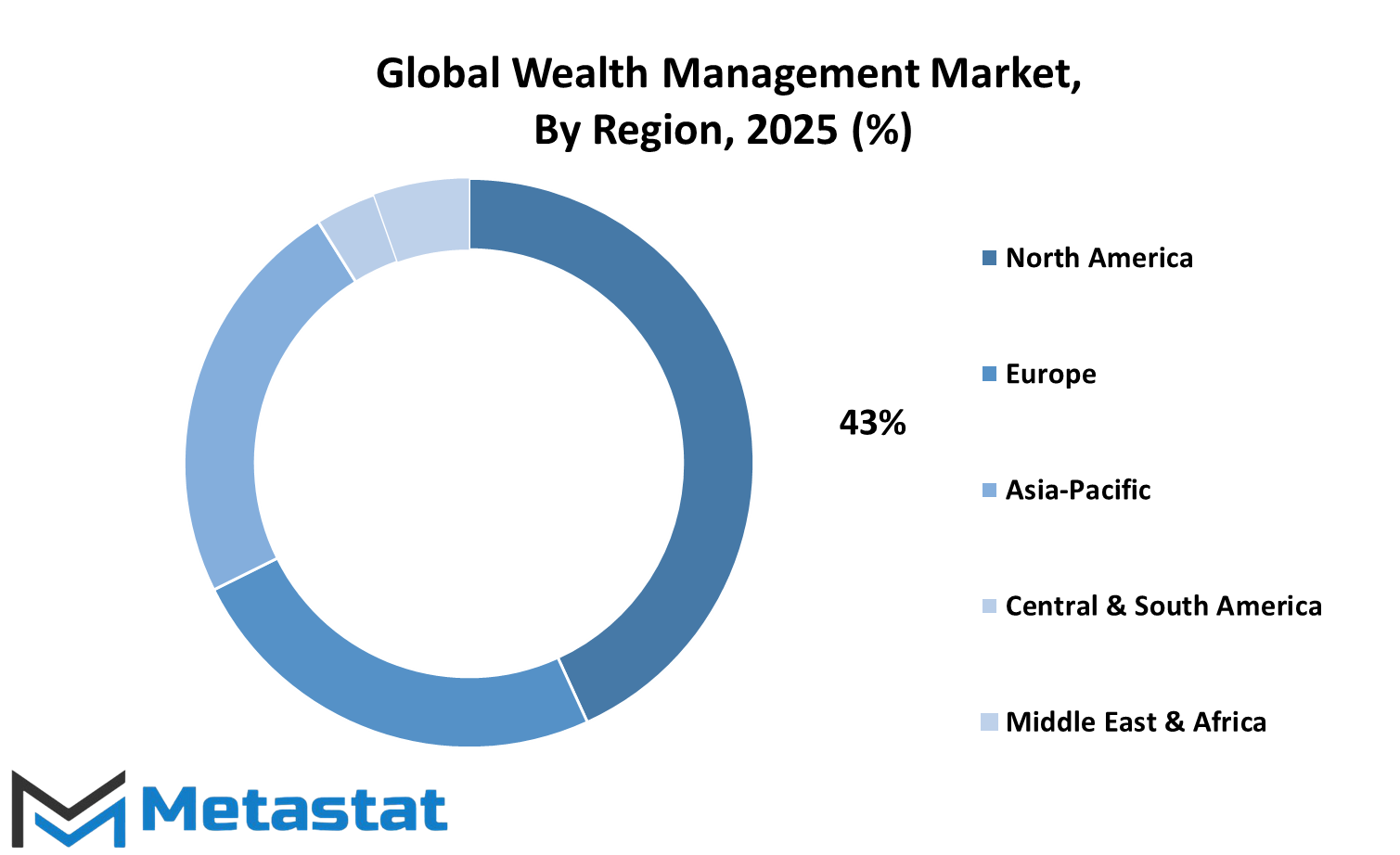

With the world progressing, the global wealth management market is emerging as a core focus area, driven by changing financial requirements, state-of-the-art technology, and growing awareness of preserving wealth. The market is driven by numerous social, political, and economic influencers that determine individuals' asset handling and financial decision-making processes. Forward, the performance and form of this market will be influenced by how well regions respond to emerging trends in investment and customer demand. Examining the global wealth management market by geography, it is obvious that every region has its own impact and direction.

North America, consisting of the U.S., Canada, and Mexico, is a significant factor. The U.S., however, leads the way, and other countries tend to follow it. With more high-net-worth individuals and greater utilization of financial technologies, this region will also continue to dominate. Canada and Mexico, while smaller, are also experiencing growth with greater access to digital tools for investing and increased financial literacy. Europe, comprised of the UK, Germany, France, Italy, and the remainder of the continent, has a strong interest in sustainable investing and individual financial planning. The UK, with its established financial centers, remains at the center of things.

Germany and France contribute their own strengths with innovation and organized financial services. Italy and others within the region are exhibiting signs of catching up by embracing more inclusive financial models, allowing a broader segment of the population to participate in wealth planning. Asia-Pacific, comprising India, China, Japan, South Korea, and the neighboring countries, is expanding rapidly. These countries are witnessing a growing middle class, more savings, and a surging demand for wealth management. India and China are growing rapidly, aided by digital platforms that enable wealth services to reach more individuals. Japan and South Korea, with their developed financial markets, are still emphasizing security and long-term planning. South America, represented by nations such as Brazil and Argentina, is attempting to build confidence in its financial systems. The region's markets are promising because they enhance access to financial guidance and instruments. Middle East & Africa, including GCC Countries, Egypt, South Africa, and others, is emerging due to a combination of old-fashioned wealth and new-age investment interests. In the years to come, as technology further becomes the focal point and individuals crave more control over their money, Global Wealth Management will increasingly expand in size and relevance, trending according to local requirements and international developments.

COMPETITIVE PLAYERS

The global wealth management market is navigating a phase of steady evolution, influenced by changes in client expectations, technological developments, and evolving investment trends. While core services continue to be traditional, there is increasingly a bias toward more bespoke financial solutions. These shifts are not merely responses to immediate requirements but indicators of how the sector will mold itself forward. With ongoing technological advancement, companies are changing their strategies, marrying human expertise with computer support systems. This change is designed to deliver clients with advice that is precise and simple to follow. Dominant names in this sector, such as UBS Group AG, Fidelity Wealth Management, Morgan Stanley, and J.P.

Morgan Chase & Co., remain strong because of their established histories and international connections. Nevertheless, competition has increased. These companies are not only holding their ground; they are spending money on better tools, building up advisory staff, and crafting plans based on specific objectives. Companies like Goldman Sachs Group, Inc. and Citi Group are putting more emphasis on inclusive money planning, making clients from different backgrounds and financial positions feel comfortable. More specialized but less giant players such as Lombard Odier Group and Julius Baer Group Ltd. are establishing their presence through a focus on trust and client-centric thinking.

What is particularly evident is that the global wealth management market will experience deeper changes in the manner in which advice is rendered. Wealth managers in the near future will increasingly depend on sophisticated data tools able to analyze patterns and recommend investment trajectories with more accuracy. Yet despite such advancement, the human touch will remain vital. Clients will continue to desire a person to describe intricate financial concepts in a manner that appears authentic and natural. Companies like HSBC Holdings plc, Deutsche Bank AG, Bank of America Corporation, and Vanguard Group will continue to expand their presence by establishing more robust digital foundations. Meanwhile, Barclays Wealth & Investment Management and Northern Trust Corporation are making their services more appealing to younger generations who begin accumulating wealth early.

As client demand continues to evolve, competition will be intense. The market will require not only smarter solutions but also deeper listening and flexibility from wealth advisors. The winners in this area will be those who reconcile technology with human touch, remaining flexible while never losing the focus on trust and long-term relationships.

Wealth Management Market Key Segments:

By Business Model

- Human Advisory

- Robo Advisory

- Hybrid Advisory

By Services

- Portfolio Management

- Asset Management

- Other

By End-user

- Retail

- High Net Worth Individuals (HNIs)

Key Global Wealth Management Industry Players

- UBS Group AG

- Fidelity Wealth Management

- Morgan Stanley

- J.P. Morgan Chase & Co.

- Wells Fargo & Company

- Goldman Sachs Group, Inc.

- Citi Group

- Credit Suisse Group AG

- BNP Paribas Wealth Management

- Julius Baer Group Ltd.

- HSBC Holdings plc

- Deutsche Bank AG

- Bank of America Corporation

- Vanguard Group

- Barclays Wealth & Investment Management

- Société Générale Private Banking

- Northern Trust Corporation

- Charles Schwab Corporation

- Pictet Group

- Raymond James Financial, Inc.

- Ameriprise Financial, Inc.

- Lombard Odier Group

- First Republic Bank

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252