Nov 25, 2025

The newly presented outlook on the global debt financing market by Metastat Insight opens an in-depth view into the financial space that has steadily gained the attention of institutions, investors, and organisations in search of sustainable means to finance long-term growth. Rather than simply arranging numbers and projections, the report reflects how lending mechanisms, investor confidence, and economic conditions come together to shape decisions that influence both corporate expansion and national development. global debt financing market valued at approximately USD 16.7 Billion in 2025, growing at a CAGR of around 4.1% through 2032, with potential to exceed USD 22.2 Billion.

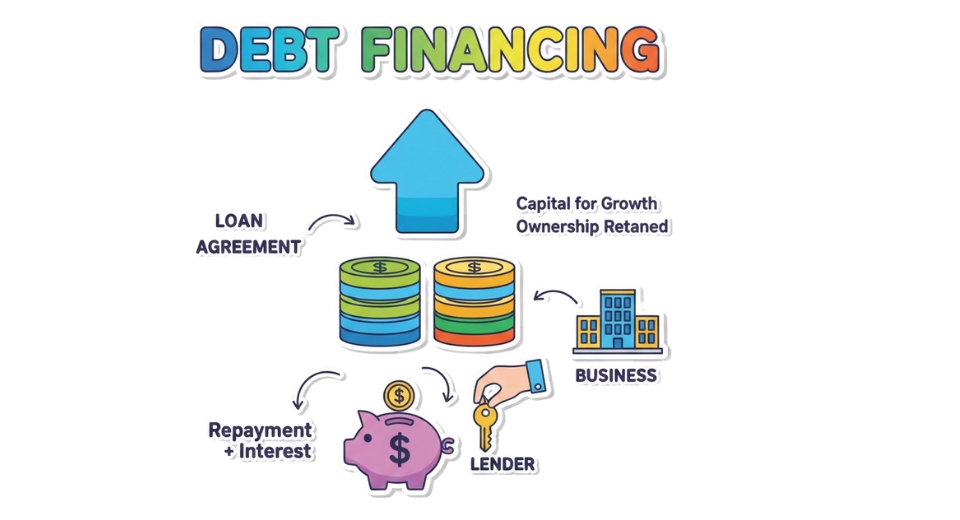

Debt financing continues to lie at the heart of international capital flow, providing corporations and public entities with a means of accessing finance without diluting ownership. Its significance is related to the fact that it facilitates infrastructure projects, corporate expansion, and government budgetary functions. Bonds, loans, and related instruments provide channels for counterparties to access capital while retaining control over operational decisions, which enables them to react to economic cycles in a more sustainable manner. Over time, monetary intermediaries have perfected their artwork of lending by introducing modern systems and underwriting strategies as a feature of marketplace imperatives and regulatory requirements. Such exceptional-tunings have facilitated smoother deal execution and more articulate threat profiles, thereby bolstering accept as true with among opposite numbers.

Innovation has additionally performed its component in shaping how debt devices are issued, traded, and monitored. Digital systems, advanced analytics, and automated danger-evaluation equipment have made it simpler for lenders and borrowers to align phrases that shape their objectives. These developments have improved transparency and supported stronger engagement inside worldwide financial networks. The result is a growing practicality by which organisations in both established and emerging economies can pursue funding through structured debt arrangements that suit their operational timelines.

Approaches to debt financing vary across areas, depending at the regulatory surroundings, economic maturity, and monetary priorities. North America remains very lively, underpinned through deep capital markets and a long history of dependent lending. Europe participates continuously, reflecting financial rules aimed at selling solid investment conditions. Meanwhile, Asia Pacific is set to retain its increased direction as each company and government make bigger use of financing channels to fund infrastructural and commercial tasks. Other regions, which include Latin America and a few regions of the Middle East and Africa, are witnessing growing hobby as enhancements in monetary literacy and institutional potential foster more active involvement.

The aggressive surroundings encompasses global banks, asset managers, score businesses, and financial provider providers who refine products, enhance compliance structures, and introduce advanced digital approaches. Their strategies mirror the shared goal of expanding attain, enhancing provider accuracy, and adapting to converting financial behaviors. The panorama is formed now not only by means of traditional lenders but additionally by way of emerging individuals who use generation to create opportunity routes of lending and streamlined models of transactions.

Their aggregated effort goes toward shaping a market where access and efficiency keep getting better. Linked to regulatory direction, technological progress, lending practices, and market participation, this new study of the global debt financing market, prepared by Metastat Insight, presents a broad narrative of a sector that has continued to adjust to financial aspirations across regions. The final perspective thereby firmly establishes that this updated global debt financing landscape presented by Metastat Insight provides a comprehensive understanding of a market shaped by relentless adaptation and increasing international involvement.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479