Oct 31, 2025

With today's changing world of housing, with more people renting than owning, comes an ever-growing awareness of protecting personal belongings and liability exposures. It is here that the global renter's insurance market, presented by Metastat Insight, steps in to offer coverage solutions for the renter translating uncertainty over possessions, accidents, and theft into manageable outcomes. The increasing rate of urbanization, households on the go, and leading digital behaviors brings the need for coverage designed just for the renter into sharper focus.

Current Market Scenario

Traditional insurance solutions for homeowners in many regions do not meet the needs of renters: the contents of an apartment, liability from guests, damage to rented space or temporary relocation costs. Meanwhile, the rental housing sector is growing, lease lengths are shorter, and younger generations have less attachment to property ownership and more to flexibility. The result is a mix of dynamics that creates a protection gap. The renters insurance market targets this gap by offering policies based on the rented-asset environment rather than owner-occupied homes. In doing so, it also acts as a key enabler to allow renters to get coverage that reflects their living situation, not one predicated on ownership.

How it works and why it's valuable

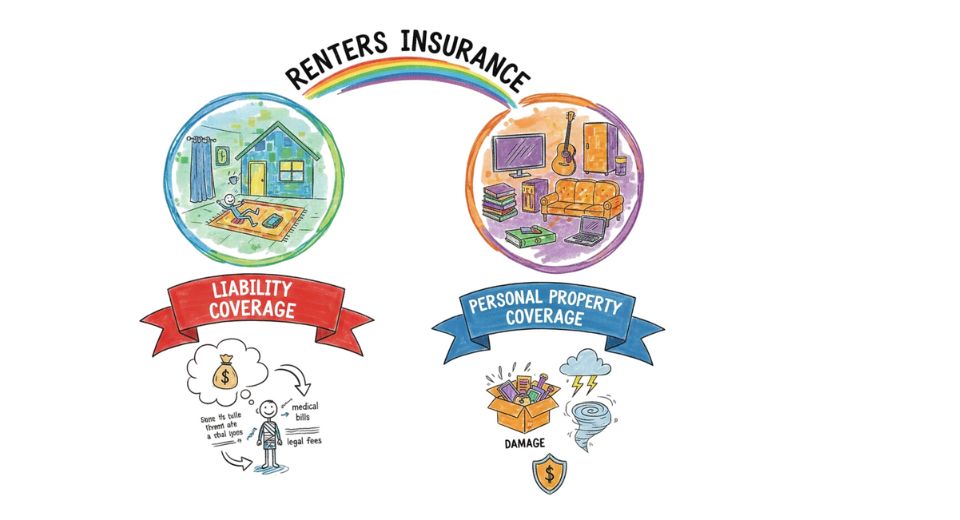

In essence, renters' insurance includes a renter's personal property, liability for injuries or damage caused to others, and often covers loss of use or temporary relocation when a rented space becomes uninhabitable. Added value comes from providing a tailored layer of coverage rather than forcing renters into homeowners' products or omitting protection altogether. Unique advantages include flexible policy options such as actual cash value versus replacement cost, distribution through digital platforms for ease of purchase and claims, and often lower premium tiers given the narrower exposure compared to full home ownership coverage. For renters, that means peace of mind: it means knowing that in the event something affects their personal belongings or liability arising from a guest injury, there is a backup plan. For insurers, this opens a relatively underpenetrated segment with scalable potential.

Growth story/technological evolution

It was at first a small segment, with few contracts targeted at the more mature renting markets. Over the last five to ten years, it has developed further as rental tenancy has grown and the liability exposures among renters have become more apparent. The embracing of digital interfaces-mobile apps, automated underwriting, instant quotes-speeds up the pace, especially among technology-adept renters. Innovations such as AI-driven policy issuance and claims automation have now been thrown into the mix, further enhancing efficiency and improving the customer experience. More recently, partnerships between property managers, rental platforms, and insurance providers have made it easier to offer renters insurance as part of the lease workflow-a good signal that the product has reached maturity within the larger ecosystem.

Regional or global trends

Adoption is strongest in North America, where rental housing penetration is high, regulatory or lease-requirement frameworks often encourage or mandate coverage, and digital insurance offerings are mature. In other regions, including parts of Western Europe and certain Asia-Pacific markets, the growth of rental housing and the expansion of digital insurance distribution mean that adoption is catching up. High growth potential will be seen in emerging regions, such as parts of Asia, Latin America, and the Middle East, combining rising urbanization with increasing rental penetration and under-insurance. These markets bring relative low current density of renters' coverage and thus attractive upside.

Challenges and opportunities

There remain obstacles: in many regions, awareness amongst renters remains low-many either believe that coverage is included or ignore the risks. Distribution channels may be underdeveloped, with frictions in both purchase and at claims time. Regulatory differences from country to country make rolling out standardized offerings complex. Competition from alternative financial protection products exists. On the opportunities side, digital-first policy models lower costs and broaden reach. Partnerships with property platforms and landlords open large distribution channels. New product features, such as the integration of smart-home devices or cyber-oriented add-ons for renters, extend the value proposition. Growth in rental housing globally and increasingly mobile populations further increase the addressable base.

Why it matters now

As global demographics increasingly show that fewer people are staying in homes for decades and urban rental markets keep growing, along with increasing risks to property and belongings caused by nature and accidents, the global renters insurance market provided by Metastat Insight does not come a day too early. Moreover, such transitions also move along the path of affordability pressures through housing markets, the march towards flexible living arrangements, digital-first consumer behavior, and tailored risk-protection solutions. In other words, this is where insurance finally starts catching up to the real world of renters and offers one more significant dimension of risk management in today's rental-centric living environment, thereby tangibly contributing to resilience among a large and growing cohort of tenants worldwide.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479