Global Renters Insurance Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global renters insurance market has gone on in relative silence over the years to become a typical element of the insurance market. It begins its history in the mid-20th century when urban migration began to reshape the pattern of housing in North America and large areas of Europe. As homeownership became less of an option to younger generations and city living more prevalent, landlords and property managers started to urge renters to insure personal property and liability through specialized coverage. From a growing add-on option linked with lease arrangements, the product evolved into a recognized product class with its own underwriting basis and consumer expectations.

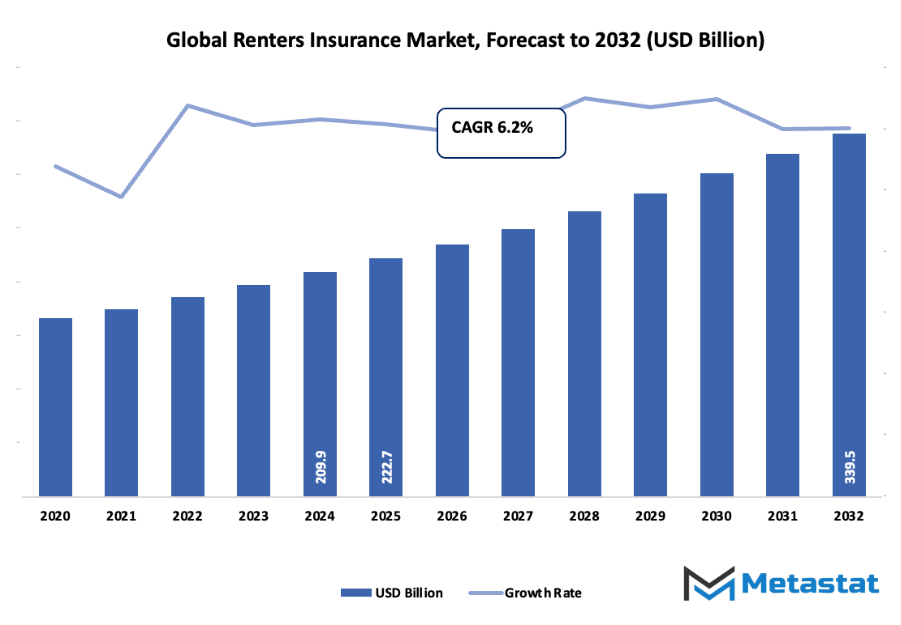

- Global renters insurance market valued at approximately USD 222.7 Billion in the year 2025 and is growing at a CAGR of approximately 6.2% from 2025 to 2032, with the potential to exceed USD 339.5 Billion.

- Liability Coverage accounting for nearly 40.4% market share, encouraging innovation and various applications through intense research.

- Key trends driving growth: Growing urbanization and increased number of rental residences around the world, Increased awareness of personal property coverage and liability coverage

- Opportunities are: Integration of digital platforms and embedded insurance models to engage younger, technologically sophisticated renters

- Key insight: The market will rise exponentially in value over the next decade, with huge growth opportunities.

During the 1980s and 1990s, the market grew in conjunction with changing lifestyles. Dual-income families, increasing student numbers, and short-term rentals on the rise generated a consistent demand for low-cost, flexible cover. Insurers began creating plans using simple-to-interpret language and computerized claim systems, leaving behind intricate policy books that had deterred prospective customers in the past. Another landmark was achieved with the introduction of web-based policy management during the early 2000s, where shoppers could compare quotes and purchase coverages directly without the use of middlemen. Technology has restructured renters insurance even more in the past several years. Policy tailoring is today almost instantaneous via data analysis and smartphone applications.

Startups entered the arena with the promise of transparency and speed, compelling traditional carriers to adapt their architectures. AI and automation will make risk assessment more precise, reducing the duration of processing claims and improving customer experience. These technologies will also help insurers to understand shifting lifestyles such as co-living arrangements, work-from-home environments, and temporary residence agreements which continue to redefine policy structures. Regulatory emphasis has also shifted, with several countries emphasizing consumer awareness and fair claim behavior. Governments and housing cooperatives must adopt regulations to ensure that tenants have knowledge of coverage limits and requirements. This evolution towards informed decision-making will determine the market's credibility and foster more widespread use in developing economies where sensitivity is low. Today, however, the global renters insurance industry is a reflection of social change and digital adaptation. It will continue to undergo transformation to meet the growing demand for convenience, personalization, and trust among renters and evolve what was once a niche offering into a central element of modern security of living.

Market Segments

The global renters insurance market is mainly classified based on Coverage Type, Customer Type, Distribution Channel, Customer Generation.

By Coverage Type is further segmented into:

- Liability Coverage: The globe Renters Insurance market under the liability cover addresses financial protection against property damage to a third party or accidents in rented premises. This insurance covers sudden costs from accidents efficiently. Growing awareness about the responsibilities of tenants and increasing rental trends support demand in this category.

- Personal Property Coverage: This segment of the global renters insurance market includes loss or damage of personal belongings due to robbery, fire, or climate conditions. Renters receive reimbursement for repair or replacement of valuable items. Increasing urban housing rates and increased property damage risks propel the steady expansion of this coverage type.

- Others: There are other forms of coverage under the market that include additional living expenses, identity theft protection, and pet damage coverage. These specialized options enhance the overall protection for renters beyond standard plans. Providing such benefits finds appeal among a broader pool of customers and leads to product diversification for insurance companies.

By Customer Type the market is divided into:

- Individual Renters: In the global renters insurance market, individual renters represent a major segment driven by single-person households and professionals living in urban apartments. The demand arises from the need to safeguard personal assets and meet landlord insurance requirements. Increased employment mobility and affordable premium plans continue to strengthen this category.

- Family Renters: Family renters contribute significantly to the market as families seek comprehensive protection for household assets. This group often opts for broader coverage to ensure security for all members and possessions. Steady growth in family rental housing and awareness of financial safety boost the expansion of this segment.

- Student Renters: Student renters form a growing segment in the market, mainly due to rising enrollments in international education and off-campus housing. Affordable policies and simplified digital processes make insurance accessible for students. Educational institutions also play a role by promoting awareness of coverage benefits among young renters.

- Others: The other category within the global renters insurance market includes corporate tenants, shared housing occupants, and temporary renters. Demand arises from short-term lease agreements and specific housing needs. Insurance companies design flexible plans that adapt to varied rental durations, enhancing customer satisfaction and coverage reach.

By Distribution Channel the market is further divided into:

- Digital / Online: The digital or online channel dominates the global renters insurance market as customers prefer quick, transparent, and convenient policy access. Online platforms simplify comparison, purchase, and renewal processes. The increasing use of smartphones and digital payment systems enhances customer engagement and supports the growing popularity of this distribution method.

- Contact Center: In the market, contact centers play a vital role in offering personalized customer assistance. Renters receive guidance regarding claim procedures, policy upgrades, and premium management. The direct communication approach strengthens trust and ensures customer satisfaction, particularly among those seeking clarity before purchasing insurance plans.

- Embedded Insurance: Embedded insurance within the market allows coverage to be included directly with rental agreements or digital platforms. This integrated method increases accessibility and convenience for renters. Property management companies and digital rental apps frequently partner with insurers to offer seamless protection at the point of lease or service.

- Agent / Broker: Agents and brokers maintain a strong presence in the global renters insurance market through personalized consultation and policy recommendations. Their expertise helps customers identify suitable coverage based on property value and risk factors. Despite digital transformation, this traditional distribution channel remains essential for complex or high-value rental cases.

By Customer Generation the global renters insurance market is divided as:

- Gen Z: Gen Z participants in the global renters insurance market show growing interest in affordable, flexible, and digital-first insurance options. This group values mobile-based access, quick claims, and transparency in policy terms. Insurers focus on user-friendly platforms and social media engagement to attract this tech-savvy generation of new renters.

- Millennials: Millennials drive a substantial portion of the market due to their increasing preference for rental living and awareness of asset protection. Many prioritize ease of purchase, budget-friendly plans, and sustainability-focused providers. Insurers tailor digital marketing and reward-based programs to meet the lifestyle expectations of this group.

- Gen X: The Gen X segment in the market emphasizes stability, reliability, and comprehensive protection. This group typically seeks higher coverage limits and personalized service. Their consistent income levels and long-term rental preferences contribute to steady premium growth, making Gen X an essential target for insurers.

- Baby Boomers: Baby Boomers within the global renters insurance market value trust and simplicity in their insurance choices. Many rent for convenience after downsizing, making coverage for belongings and liability crucial. This generation appreciates direct communication, dependable service, and clear policy details, supporting steady participation in the rental insurance landscape.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$222.7 Billion |

|

Market Size by 2032 |

$339.5 Billion |

|

Growth Rate from 2025 to 2032 |

6.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

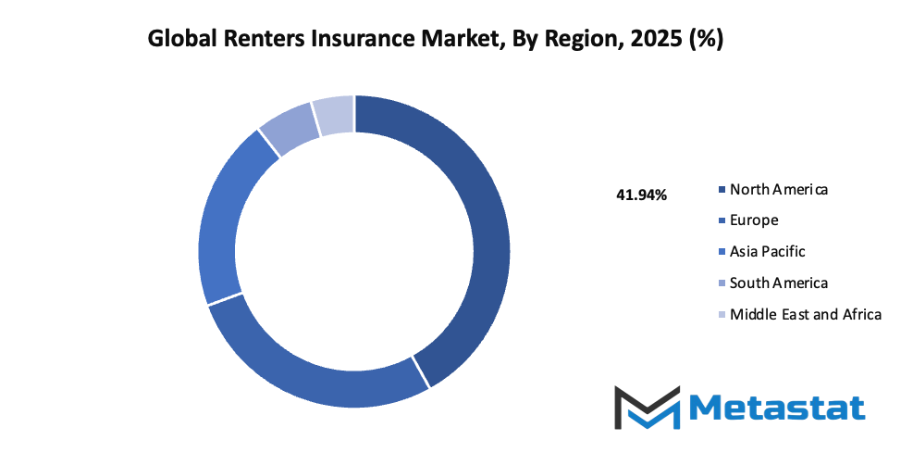

By Region:

- Based on geography, the global renters insurance market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing urbanization and rising number of rental households worldwide: The global renters insurance market will see consistent growth as more people move to cities in search of jobs and better living standards. Urbanization increases the number of individuals and families choosing rental properties instead of home ownership. With this shift, the demand for renters insurance continues to expand, as tenants look for affordable ways to protect their belongings and personal liability. This trend is expected to strengthen further in the coming years due to changing lifestyles and increasing mobility across countries.

- Increasing awareness of personal property protection and liability coverage: The market is benefiting from a higher level of understanding about the importance of securing personal property. Education campaigns, digital access to information, and the influence of insurers are encouraging tenants to recognize the need for protection against theft, fire, and accidental damages. As more people learn how renters insurance can reduce financial risks and offer peace of mind, policy purchases are expected to rise steadily. The increased promotion by insurance providers is also driving this awareness forward.

Challenges and Opportunities

- Low penetration due to lack of awareness in developing regions: The global renters insurance market faces slow adoption in many developing areas due to limited awareness about its benefits. Many tenants in these regions are not familiar with how insurance can safeguard their assets or assume that such protection is unnecessary. Weak marketing presence and insufficient financial literacy also contribute to this low market reach. Expanding educational initiatives and collaborations with local agencies will be important to overcome this barrier and promote growth in untapped markets.

- Price sensitivity and misconceptions about coverage necessity among tenants: The market encounters challenges linked to cost concerns and misunderstandings about its importance. Many renters believe insurance premiums are expensive or that landlords’ insurance already covers their personal items, which is not the case. This perception discourages potential buyers and limits market growth. Simplifying policy options, providing transparent pricing, and highlighting the true benefits can help address these issues and build stronger trust among tenants.

Opportunities

- Integration of digital platforms and embedded insurance models to reach younger, tech-savvy renters: The global renters insurance market is gaining new opportunities through technology-driven solutions. The integration of insurance offerings into digital platforms such as rental apps and property management systems makes it easier for tenants to access and purchase policies. Younger generations, who are more comfortable with digital tools, are likely to adopt these convenient and transparent options. Embedded insurance models also allow instant sign-ups, improving market visibility and encouraging wider adoption among tech-oriented renters.

Competitive Landscape & Strategic Insights

The global renters insurance market is poised for a significant transformation in the coming years, as major players reshape their offerings and new technologies enter the field. Companies like State Farm, USAA (United Services Automobile Association), Lemonade Inc., Amica, Farmers Insurance Group, Nationwide Mutual Insurance Company, GEICO (Berkshire Hathaway Inc.), Travelers Companies Inc., The Hartford Financial Services Group, Chubb Limited, Liberty Mutual Insurance, Progressive Corporation, Allstate Corporation, Erie Insurance Group, Assurant Inc., AXA S.A., Allianz SE, Zurich Insurance Group and Aviva plc each bring distinct strengths to that shift.

State Farm, already a leading entity in the renters insurance market, offers broad reach and strong distribution via local agents. In the future that role will evolve further as digital tools and data analytics become more central. USAA brings a specialized focus on military customers and has very high customer-satisfaction ratings in the renters insurance market, which gives it an edge in a segment that expects convenience and trust. Lemonade Inc. represents a more radical change: its reliance on artificial intelligence, streamlined online sales and claims processing helps it serve renters looking for simplicity and speed. Its presence signals how the renters insurance market may shift toward digital-first experiences.

Amica and Farmers Insurance Group will likely lean into personal service and niche offerings in the renters insurance market. They may target renters who prefer human interaction and tailored advice. Nationwide Mutual and GEICO (under Berkshire Hathaway) strengthen the bundling play: renters insurance being sold alongside auto or other lines, which becomes a bigger part of keeping costs down and convenience up in the renters insurance market.

Travelers Companies Inc., The Hartford Financial Services Group and Chubb Limited each bring strong financial strength and reputation; in the coming years their role in the renters insurance market may tilt toward higher-end policies, specialty coverage and international growth rather than simply low-cost mass market. Liberty Mutual, Progressive Corporation and Allstate Corporation remain major players in volume and brand recognition; they will compete on pricing, ease of purchase and integration with other coverages in the renters insurance market.

Erie Insurance Group and Assurant Inc. provide regional or niche players’ perspective. They remind the renters insurance market that smaller, more focused insurers can still make inroads by offering dedicated service, or specialized risk management. Beyond the US, global firms such as AXA S.A., Allianz SE, Zurich Insurance Group and Aviva plc highlight how the renters insurance market may increasingly think globally: foreign players entering US markets, or US players expanding abroad, and cross-border data, regulation and consumer expectation will affect what renters expect.

Looking ahead, the global renters insurance market will likely be shaped by several trends. First, digital platforms and data-driven underwriting will reduce costs and enable personalized pricing. Startups like Lemonade set the pace. Second, bundling of renters insurance with other lines (auto, life, home) becomes more common and more expected, so insurers such as State Farm, Nationwide, GEICO and Allstate will intensify that dynamic. Third, the rise of urban renting and the changing patterns in dwelling types mean insurers must adapt coverage, loss modelling and claims handling to newer risks (shared living, appliances, mobility). Fourth, global insurers will bring different regulatory experience and technology into the US renters insurance market, meaning cross-pollination of ideas and products. Finally, strong brand reputation, financial stability, claims speed and customer service will continue to distinguish the major firms in the renters insurance market.

Market size is forecast to rise from USD 222.7 Billion in 2025 to over USD 339.5 Billion by 2032. Renters Insurance will maintain dominance but face growing competition from emerging formats.

In sum, when someone looks at choosing a provider for renters coverage, it will matter which insurer they pick whether it is USAA with its specialized focus, Lemonade with its tech-centric design, or one of the broad incumbents like State Farm or Allstate that offer campaign size, local agent networks and bundling options. As the renters insurance market evolves, the winners will be those who combine affordability, speed, transparency and trust and each of the firms listed brings a piece of that future.

Report Coverage

This research report categorizes the global renters insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global renters insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global renters insurance market.

Renters Insurance Market Key Segments:

By Coverage Type

- Liability Coverage

- Personal Property Coverage

- Others

By Customer Type

- Individual Renters

- Family Renters

- Student Renters

- Others

By Distribution Channel

- Digital / Online

- Contact Center

- Embedded Insurance

- Agent / Broker

By Customer Generation

- Gen Z

- Millennials

- Gen X

- Baby Boomers

Key Global Renters Insurance Industry Players

- State Farm

- USAA (United Services Automobile Association)

- Lemonade Inc.

- Amica

- Farmers Insurance Group

- Nationwide Mutual Insurance Company

- GEICO (Berkshire Hathaway Inc.)

- Travelers Companies Inc.

- The Hartford Financial Services Group

- Chubb Limited

- Liberty Mutual Insurance

- Progressive Corporation

- Allstate Corporation

- Erie Insurance Group

- Assurant Inc.

- AXA S.A.

- Allianz SE

- Zurich Insurance Group

- Aviva plc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252