MARKET OVERVIEW

The Global Asset Integrity Management market to industries is to ascertain the long-term performance and safety of critical infrastructure. The market concerns advanced methodologies, technologies, and services to ensure that the physical assets maintain operational efficiency that meets regulatory and safety standards. Industries such as oil and gas, power generation, chemicals, and manufacturing utilize asset integrity management for risk minimization against equipment failure, structural degradation, and unforeseen disruptions. The evolution of this market will be thus defined by making way for reliable management strategies as industries continue to expand, while assets continue to age.

Continuous monitoring, inspection, and maintenance for assuring the reliability and safety of assets is what forms the basis of the Global Asset Integrity Management market. Those offshore platforms, refineries, and power plants that are subjected to extreme operating conditions require proactive management to prevent failures, which could mean considerable financial and environmental implications should they occur. Providers in this field use advanced inspection technologies, corrosion-tracking tools, and risk-based assessment frameworks to ensure extended asset life while optimizing performance. Also, deploying digital technologies in asset integrity strategies will continuously enhance predictive maintenance practices and decision-making.

Heavy-duty industries, with heavy machinery and huge infrastructural concerns, require comprehensive strategies to maintain operational viability. The Global Asset Integrity Management market addresses this need by offering solutions for the assessment of structural health and functioning of the assets with time. Corrosion, material fatigue, and mechanical stress abound on different occasions, which calls for intervention. The advanced NDT methods, real-time monitoring systems, and data-driven analytics would dictate the future asset integrity approaches of companies. The adoption of more automated and AI-controlled processes in risk assessment and failure forecasts will revolutionize the traditional ways of doing things, permitting finer evaluations and expedited interventions.

Compliance with regulatory standards greatly impacts the Global Asset Integrity Management market. Industries that operate under stringent safety and environmental rules are bound to design their asset integrity programs according to legal requirements. Strict regulations to prevent accidents, equipment failures, and environmental damage are enforced by governments and industry bodies alike. According to upcoming safety regulations, firms will be compelled to integrate asset management frameworks that extend the life of their infrastructure while simultaneously proving compliance with new regulatory conditions. The actual implementation of standard operating procedures and best practices shall thus remain at the core of industry activities.

Keeping in mind the cooperation of technology providers, service firms, and industrial operators, the Global Asset Integrity Management market would come to mushrooming growth. Real-time sensors, cloud-based platforms, and remote monitoring capabilities integrated would leverage how organizations perceive the health of the assets and engage-potential risks even before escalation. Industries are now eyeing more parameters like reliability and cost-optimization at which time the next generation of asset management strategies would rely on data analytics and artificial intelligence-driven insights. Not only would operational efficiencies be gained, but a marked reduction in downtime and maintenance costs brought about by unplanned failures.

The Global Asset Integrity Management market has and will continue to evolve as organizations focus on asset strategies that increase longevity, improve safety, and performance. The emergence of new solutions like predictive analytics and automation technologies, as well as digital monitoring capabilities, will reshape the overall picture by which organizations manage their infrastructure and equipment. With everyone claiming to be reducing risks and ensuring that they are regulatory compliant with asset integrity management, it will find a very relevant place in the long-term sustainability and operational efficiency of industries globally.

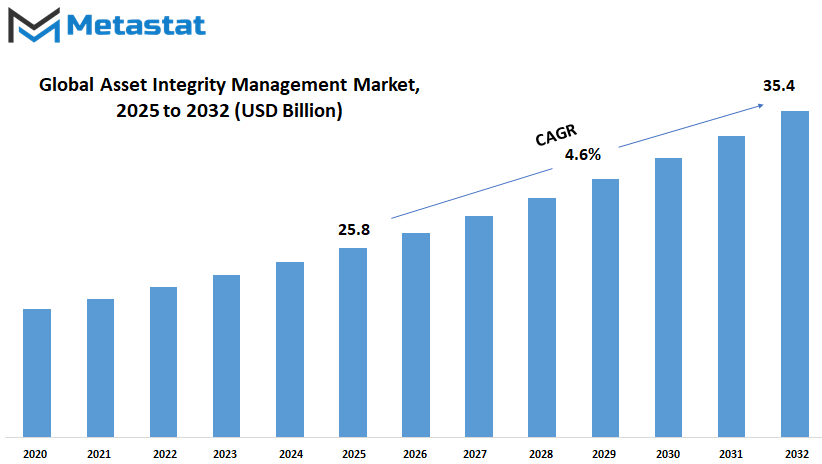

Global Asset Integrity Management market is estimated to reach $35.4 Billion by 2032; growing at a CAGR of 4.6% from 2025 to 2032.

GROWTH FACTORS

While industries are increasingly focused on the safety and efficiency of their infrastructure systems to counter challenges with failures, the Global Asset Integrity Management market is predicted to surge in growth. As infrastructure and industrial systems are increasingly being focused on reliability, companies are switching to advanced technologies to prevent failures and prolong the life span of assets. Oil and gas, power generation, manufacturing, and other industries are now focusing on asset integrity to minimize safety risks and revenues lost due to downtime. The new demand for better monitoring tools and predictive maintenance will drive the future of this industry, wherein issues will be highlighted and attended to before they become too serious.

One of the major magnifying factors for the market is safety regulations. Governments and other regulatory bodies are placing more emphasis on the direct enforcement of stringent guidelines in asset integrity management, which in turn exert pressure on companies to employ adequate asset management strategies. The pressure to minimize operational costs and optimize productivity is, however, another factor motivating companies to adopt advanced inspection techniques. The amalgamation of digital tools, such as AI and IoT, will enhance monitoring capabilities, providing data in real time on the condition of assets. This change toward smart solutions will thereby improve operational efficiency and enable industries to comply with ever-evolving environmental and safety standards.

However, despite the attractive growth potential, certain challenges could pose some restraints on the flourishing market. High capital investments required to implement modern asset integrity solutions could deter market entry by some companies. Aging infrastructure might face challenges that hamper adoption of the aforementioned solutions, particularly in terms of compatibility. Nevertheless, advancements in automation and remote monitoring would gradually mitigate those issues, allowing asset integrity management solutions to reach a wider scope.

That said, as certain advancements emerge, several opportunities will also arise for corporations willing to seek new avenues toward asset reliability enhancement. Drone inspection, machine-learning-enabled predictive maintenance, and digital twin real-time simulation will define the next generation of industrial asset management programs. This will enable the early identification of impending failures, thereby reducing associated risks and ensuring smoother operations. Companies that invest in research and development for cost-effective, yet simple solutions are bound to hold an edge in competition.

The more rapid industrialization is set to trigger the further need for efficient asset management. Therefore, companies concentrated on technological advancement and compliance will gain larger shares of future benefits. Asset Integrity Management will evolve to encompass advanced monitoring systems, data-driven decision-making, and proactive maintenance.

MARKET SEGMENTATION

By Service Type

The reveal focuses on safety, efficiency, and compliance within various industries, wherein asset integrity management shall obviously see an upward demand growth. Companies are undertaking an awareness, whereby they need to invest in measures which will ensure their long-lived asset reliability. There has been a technological change, which pushes companies towards industries using predictive maintenance and real-time monitoring to nip failure before it occurs. The Global Asset Integrity Management market should, therefore, be really ready for this shift towards strengthening performance and saving costs.

Service-type functions like Non-Destructive Testing, Risk-Based Inspection, Corrosion Management, Pipeline Integrity Management, and Structural Integrity Management will be an important exercise for industries keeping their infrastructures in good health. Non-Destructive Testing will be useful to pinpoint hidden defects without inflicting damage, allowing informed decision-making for maintenance and repair. Risk-Based Inspection will put emphasis on inspection priorities decided by risk, directing company resources into worthwhile inspections. Corrosion Management will have high relevance, as aging infrastructure calls out for protection. Pipeline Integrity Management will ensure that material transport is safe and that environmental hazards do not arise. Structural Integrity Management is expected to assist industries in performing safety and stability checks on critical structures.

Future asset integrity management will be driven by digital transformation. With AI and machine learning, data analysis will enable companies to forecast failures accurately. Drones and robots will be employed in inspections of dangerous or complex locations to ensure safety and efficiency. With real-time monitoring systems and continuous updates on asset conditions, sudden failures shall be in abyssal pitch. Companies can then have cloud access allowing them to follow up on their performance and make timely decisions.

The Global Asset Integrity Management market will become quite competitive as companies that venture to provide advanced solutions will raise the competition. Innovation and the application of digital tools will be an added advantage for companies in providing services involving efficiency and cost-effectiveness. Automation and smart technologies will be adopted as a convention to enable the industries to minimize downtime and, whereas expand the longevity of their assets. As regulatory standards tighten, companies will need to stay compliant with minimum operational input.

As industries become more reliant on technology, asset integrity management will develop to meet these emerging challenges. Advanced monitoring, predictive analytics, and automated inspection techniques will characterize the future of this sector.

By Component

The Global Asset Integrity Management market is projected to see steady growth, as more industries strive to uphold their operation safety, reliability, and efficiency. Companies are now realizing that systems need to be designed to prevent failures, reduce downtime, and ensure that assets perform optimally throughout their expected lifespan. As technologies improve, the trend for advanced integrated solutions that combine predictive maintenance, real-time monitoring, and automation to enhance asset performance will be adopted by businesses.

It divides into services, software, and hardware; all of which are significant in sustaining operations. The services help a lot since the industry places reliance on expert assessments, inspections, and risk evaluations to ensure safety compliance. Asset maintenance and testing on a regular basis remain paramount to extending asset life and help prevent unexpected failures. Demand for specialized asset integrity services will grow as companies seek to improve cost and efficiency.

Software solutions will become very advanced and empower asset management in terms of following asset health, predicting failures, and optimizing maintenance scheduling. Artificial intelligence and machine learning will assess big data dimensions, presenting insights for companies to consider in decision-making. Predictive analytics are vital in detecting a potential issue before it becomes a big problem, which will aid industries in alleviating the need for costly repairs and unplanned shutdowns. As the digital transformation continues, more companies are expected to invest in cloud solutions allowing remote asset data access, thus enabling the manager to monitor operations no matter the location.

Meanwhile, the hardware paradigm will shift as industries will take onboard sensors and smart devices to enhance their monitoring capacity. Advanced sensors would give real-time data regarding conditions of assets, temperature, pressure, and other parameters, including possible alerts on any adverse changes due to risks. This would make inspection accuracy better, with minimum manual involvement, and overall improve asset management.

As oil and gas and other industrial sectors continue to develop, the call for integrity in asset management will become synonymous with reliability in the industries. Companies will look for solutions that are not only able to prolong the life of their equipment but also ensure compliance with environmental and safety requirements. In line with sustainability, developments in the market may involve energy-efficient hardware, AI-based software, and service modalities that ensure the present and future operational success of our assets. This would give some level of competitive advantage in the arena of asset integrity management for companies that are willing to integrate newer means of practicing asset integrity management, to reduce risks and enhance operational efficiency.

By Deployment Mode

In the future, the Global Asset Integrity Management market will have further growth in the avenue of industries focusing more on the industrial efficiency of their equipment and safety with regard to longer operational periods. It is now seen by organizations in different territories that it is necessary to have failure-prevention strategies that minimize downtime but also maximize the lifespan of mission-critical assets. The future is not far away because technology alters how industries maintain assets and assess risks in a way that reliability and performance become the top priority.

Companies are looking for solutions that marry technology and real time monitoring. The use of AI, predictive analytics, and automation will occupy a prime position in the first place reduces issue escalation and most importantly, it will save firms from horrendous blows by making informed and educated judgments in decision making. Particularly in oil and gas production, power generation, manufacturing, and chemical processing, even minor malfunctions can disrupt significantly the associated processes.

In fact, the market now diversified on the basis of deployment in terms of onshore applications and offshore applications. While the onshore operations deal with infrastructural maintenance like pipelines, refineries, manufacturing plants, land operating companies will be spending more on automated inspection tools, robotic systems, and advanced sensors where these equipment is installed. This will help in the early detection of corrosion, structural weaknesses, and other potential risks before they escalate.

The offshore operations bring even more rigor due to the adverse environmental conditions. All equipment functioning in deep-sea drilling, offshore wind farms, and marine structures are subjected to very high pressure, intense tidal flows, and corrosive seawater. For this reason, industries operating offshore environments tend to adopt very sophisticated asset integrity solutions like remote monitoring systems or AI-based predictive maintenance for their installations. Such technologies enable companies to monitor their assets in real time while minimizing manual inspections in hazardous locations.

The Global Asset Integrity Management market would soon be competing on various fronts as businesses come aboard and create new methods to ensure safety and efficiency improvements. The services provided will usually be innovative for these companies to stay ahead of the competition, with solutions that are adaptable to the changing faces of various industries, including sustainability as a growing concern for most industry players.

Again, asset management itself would be way more accurate and proactive as industries continued digitizing solutions toward automation and predictive maintenance. The transition toward predictive maintenance and automation is a significant change in how organizations manage reliability of equipment to ensure seamless operations and protection against costly disruptions.

By End-Users

As industries continue to expand and grow, it will become increasingly critical to keep all equipment, structures, and systems in proper safe and efficient working condition. Global Asset Integrity Management will thereby ensure the future continued long-time reliability of critical assets in industries and sectors worldwide. The companies will adopt new and improved maintenance strategies, minimize downtimes, and prevent unexpected failures resulting in monetary losses or safety hazards. With technological advancements, asset management and monitoring will forever be changed to solutions that are smart and proactive.

Asset Integrity Management will be the glue that keeps industries functioning from oil and gas, power generation, marine, mining, aerospace, to manufacturing. Deterioration of pipelines, drilling equipment, and storage tanks will remain a priority in its oil and gas sub-sector. There will be investments in predictive maintenance tools that employ sensors and data analysis in detecting issues before they happen to cause serious damage. The life of turbines, transmission lines, and power plants will be increased with operation efficiency and failure-free operation during power generation. The marine sector will benefit tremendously from this revolution as ships and offshore structures will undergo incessant assessments to prevent structural weaknesses and corrosion.

Mining activities will now incline towards a better state of managing equipment and underground infrastructure as asset integrity management will entail reduced risks for companies dealing with heavy machinery and unstable ground conditions. Most of the components used in aircraft maintenance will include automated inspections with AI-powered monitoring, which will offer better accuracy in wear detection. The smart solutions will cut across manufacturing, where real-time data will be used to optimize production lines and minimize machine failures. The same practices will be applied in other industries for better safety and efficiency.

With modern businesses continually coming up with more impressive methods to manage their assets, there will be a great demand for such advanced solutions in the future. Further along the line, artificial intelligence, automation, and digital monitoring will change how businesses manage an asset's integrity. Continuous monitoring by innovative smart sensors and the use of cloud-based systems as well as remote inspection will draw assets closer to automated conditions without disrupting daily routines. Hence, such advances will greatly reduce costs as well as improve safety by discovering issues before they arise.

Predictive and automated systems will then replace their asset integrity management. Industries will rely on intelligent solutions to maintain operational efficiency, prevent failures, and improve safety for themselves over different sectors in the long run. The future is ensuring long lifetime operation for critical infrastructure and equipment by making companies stand for operational lapses in reliability.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$25.8 billion |

|

Market Size by 2032 |

$35.4 Billion |

|

Growth Rate from 2025 to 2032 |

4.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The prospects for asset integrity management will grow due to an increasing focus on equipment reliability and safety across different industries. Since investments are growing in infrastructure, energy, and manufacturing, companies will gravitate toward solutions that will allow their assets to stay alive for prolonged periods. Global Asset Integrity Management will have a central role in helping industries prevent failures, reduce maintenance expenditures and comply with safety programs. The practice of asset integrity monitoring will further enhance productivity while reducing risks as companies embrace digital and automated technologies.

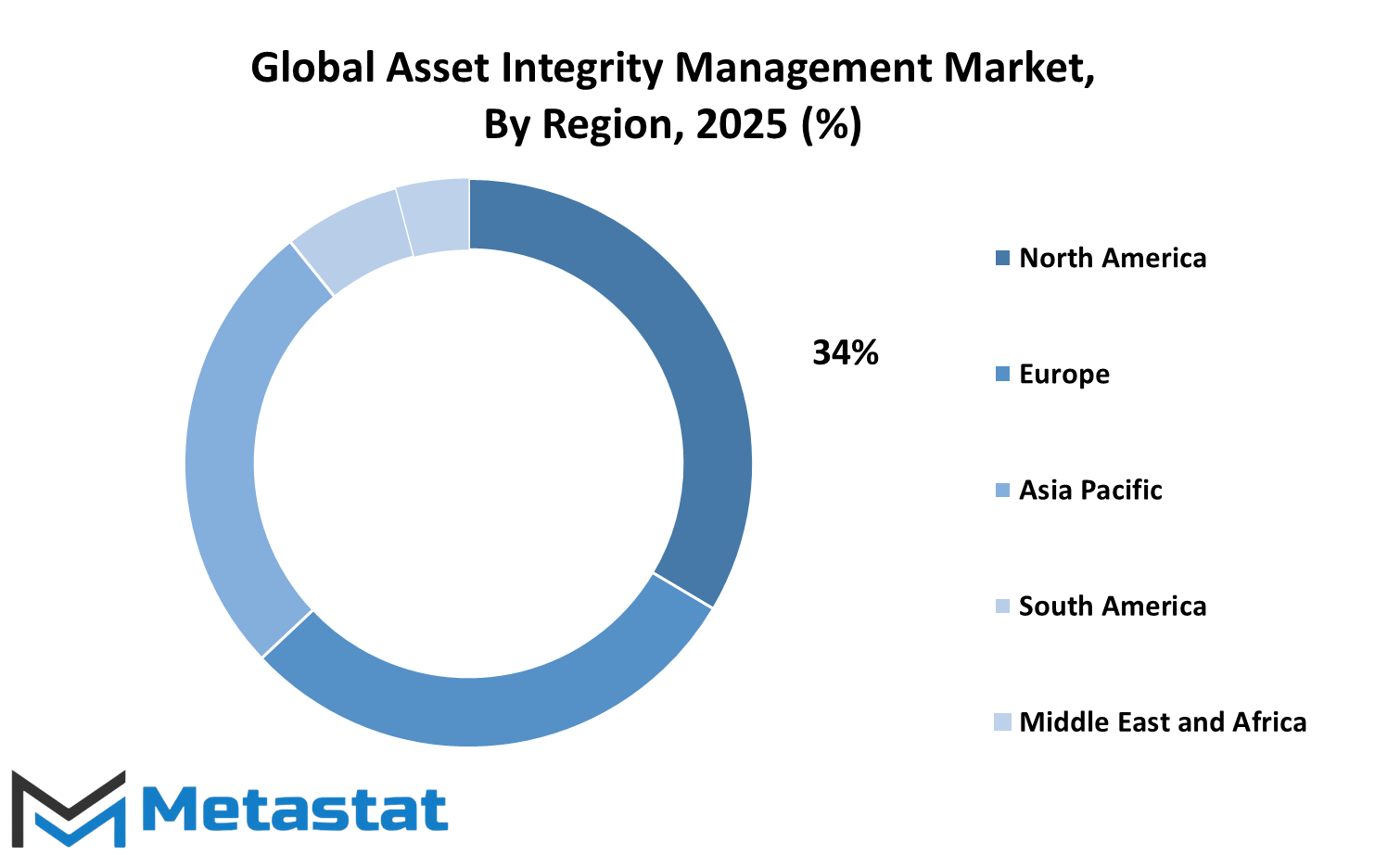

The adoption trend for asset integrity solutions will vary by region. In North America, demand will be steady owing to a strong industrial base and an emphasis on safety regulations. The U.S. will continue to lead in technology advances, integrating artificial intelligence and real-time monitoring systems. Canada and Mexico will also contribute to the market because industries are expanding and modernizing their operations. Asset management in Europe will focus on sustainability, with the U.K., Germany, France, and Italy investing in eco-friendly technologies. The transition to renewable energy will also drive effective maintenance of assets.

Asia-Pacific will be one of the major regions to shape the future of the market. The rapid industrialization in India and China will escalate the need for solutions improving operational efficiency and safety. Japan and South Korea will lead smart-tech adoption such that automation and predictive analytics are utilized in the maximization of asset performance. As industries in the region grow, the need for asset integrity management will increase, thus motivating companies to adopt advanced maintenance methods.

South America will add its share towards growing the market, as both Brazil and Argentina ramp up their energy and manufacturing sectors. Investments in oil and gas, mining, and infrastructure are going to increase the demand for reliable asset management solutions. In the meanwhile, growing energy production and infrastructure development in the Middle East and Africa are going to give way to opportunities for asset integrity services. Technologies for enhanced equipment performance and minimizing downtime would be adopted in the countries of the Gulf Cooperation Council along with Egypt and South Africa.

With global industries on the crossroad of digital transformation, asset integrity management will continue to receive its own doses of advancements. Equipped with smart sensors and real-time data analysis processes, artificial intelligence will soon be deployed to reshape how companies maintain their assets. The capability to adopt these advancements will vary for each region, yet the goal will remain unchanged: to ensure that critical infrastructure and machinery operate safely and efficiently for decades to come.

COMPETITIVE PLAYERS

The Global Asset Integrity Management market will keep growing further in the near future as more and more industries shift their focus toward maintaining safety and reliability in their infrastructure. Across various sectors, including oil and gas, power generation, and manufacturing, companies are focusing increasingly on improving the prevention of equipment failures, operational risk reduction, and compliance with regulatory standards. With a view to aging infrastructure and increased environmental concerns, businesses will bet on advanced solutions that can extend the lifespan of their assets while minimizing downtime and repair costs.

Technology will play a significant role in the coming years in converting asset integrity management into the completely new identity of the future. New applications of artificial intelligence and machine learning on real-time live data will alert companies to possible future problems before they initiate serious failures. Predictive maintenance will be most important for the company, ensuring proper timing for repairs and replacements rather than waiting for them to break down before acting on problems. As digital tools will rapidly improve, companies will become better and better at decision-making, achieving increased efficiency, and reduced operational risks.

The competitive landscape of the Global Asset Integrity Management market, at the same time, will be shared by these major companies, who are constantly developing their new offerings within this space. Imperatively, it is expected that companies like SGS Société Générale de Surveillance SA, Bureau Veritas Group, and Intertek Group Plc would strengthen their market positions further through new technology development and expansion of service capabilities. Innovators like TechnipFMC plc, Aker Solutions, and Applus+ are also entering new product development by trying to address industry-specific issues. Services will focus on variable tailored solutions addressing specific problems faced by businesses across the various sectors.

Other major players such as DNV AS, John Wood Group PLC, and Oceaneering International, Inc. are also funding their digital transformation towards better asset monitoring and risk assessment. TÜV Rheinland AG, Baker Hughes Company, and Penspen Limited are carrying out their own share of advanced inspection and automation to later increase efficiencies as industries look for higher reliability and cost-effective solutions. The competition between these companies will further propel asset integrity management advances in search of higher reliability and efficiency in solutions being offered.

The industry will be shifting toward smart technologies, robots, and remote inspection methods to progress in the future. Eco-friendly materials will be used and asset performance will be optimized to minimize the environmental impact of the business operations and materials used. The coming years will see stricter regulations and a rising need to work more efficiently. Therefore, organizations will look for total solutions at a later stage leading to long-term benefits. The market for asset integrity management services will thus increase as industries drive innovations and competition in the field by work towards safer operations that are more reliable.

Asset Integrity Management Market Key Segments:

By Service Type

- Non-Destructive Testing (NDT)

- Risk-Based Inspection (RBI)

- Corrosion Management

- Pipeline Integrity Management

- Structural Integrity Management

By Component

- Services

- Software

- Hardware

By Deployment Mode

- Onshore

- Offshore

By End-Users

- Oil & Gas

- Power Generation

- Marine

- Mining

- Aerospace

- Manufacturing

- Others

Key Global Asset Integrity Management Industry Players

- SGS Société Générale de Surveillance SA

- Bureau Veritas Group

- Intertek Group Plc

- TechnipFMC plc

- Aker Solutions

- Applus+

- DNV AS

- John Wood Group PLC

- Oceaneering International, Inc.

- TÜV Rheinland AG

- Baker Hughes Company

- Penspen Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383