MARKET OVERVIEW

The Global Ferro Aluminum Market evidently holds great importance in the metallurgical industry by dictating the various processes involved in manufacturing across sectors that rely heavily on the use of high-performance alloys. The application of these alloys will always be up for use in driving innovations in manufacturing and engineering as industries keep demanding materials with improved strength, resistance, and conductivity. Applications in steelmaking, aerospace, automobile construction, and the energy sector still keep this alloy alive in the minds of industry developers. And indeed there is much more behind-the-scenes disquisition on its value today; there is an entire other story on unused potentials, manifold possible transformations, or unconventional applications that could radically alter its destiny in the years to come.

The most exciting applications of Global Ferro Aluminum market will, no doubt, be in sustainable metallurgy for the future. As industries throughout the world begin to embrace more stringent measures for reducing their carbon footprint, the evaluation of materials that can be put in place for clean production will be pushed further. With lightweight properties and outstanding corrosion resistance, ferro aluminum would be at the heart of innovations for next-generation alloys for energy-efficient applications. Researchers will probably also look into the recycling possibilities of these materials to reduce reliance on primary extraction and build the circular economy of metals.

Trends in the aerospace and defense sectors will likely set new frontiers for the use of ferro aluminum. Space exploration is rapidly becoming such a priority for many countries and private organizations that, at a pace, the demand for tough, lightweight material will increase. Ferro aluminum gains priority in construction and advanced satellite technology for spacecraft for providing structural integrity without adding too much weight. Add 'space communication electronic shielding against extremes' to its properties of conducting electric current, and you have the potential for incorporating it into some future applications.

Expected automotive innovations would significantly change the definition of the roles the Global Ferro Aluminum market has in the future with electric vehicles (EVs) stealing the limelight. OEMs are working hard to innovate on battery technologies; consequently, the demand for materials that promote energy transfer and thermal management, definitely without falling short in vehicle efficiencies, would further push the capability of ferro aluminum, being conductive and heat resistant, as a core material for the battery casing and motor components, as well as in lightweight continuous chassis designs.

The very speed of revolutionizing additive manufacturing and that of 3D printing will also keep introducing changes in the processing and application of ferro aluminum. At the moment, it is alloyed by traditional means in the near future, however, may also be available as 'tailor-made' metal powders for 3D-printed aerospace as well as medical implants.

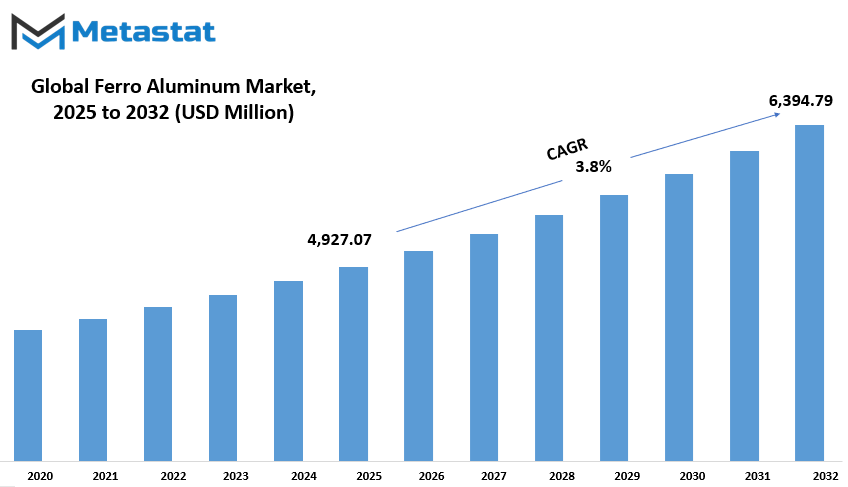

Global Ferro Aluminum market is estimated to reach $6,394.79 Million by 2032; growing at a CAGR of 3.8% from 2025 to 2032.

GROWTH FACTORS

The Global Ferro Aluminum market has been keeping up with the times to cope with its increasing application in various industries. Growing demand from the automotive sector drives this market. The automotive industry has been preparing to manufacture lighter vehicles, which in turn help to minimize fuel consumption and emissions, driving the use of ferro aluminum in the manufacturing of components. It is of critical importance in the modern manufacturing of motor vehicles, as it provides strength and lightness. Also, pretty importantly, the new construction boom, especially in developing economies, is shaping the market. With urbanization progress and infrastructural development projects requiring ever-increasing durability and corrosion resistance, the market will certainly see some significant opportunity for ferro aluminum.

The market has never been without some challenges, notwithstanding the optimistic growth prospects. Some of the major issues concerned with it include price fluctuations of raw materials. The price of aluminum and other elements responsible for the production of ferro aluminum keeps fluctuating due to supply chain disruption, political dilemmas, or their economic condition. Such uncertainties in prices result in an ambiguous situation for manufacturers and thus compromise the overall market stability. In addition, there are no favors for industrial players with regard to stringent emissions and waste disposal regulations, as they are major obstructions for them. Governments around the world are introducing stricter policies addressing industrial pollution, possibly increasing the cost of compliance and restricting the operations of manufacturers.

Yet the market still has vast opportunities, especially for the aerospace and defense industries. As the technology progresses in aviation and defense, the demand for materials that are very strong yet light will increase. Ferro aluminum is being increasingly adopted by aircraft manufacturers, military vehicle manufacturers, and defense applicers on account of its superior mechanical properties and resistance to harsh conditions. With improvements in material performance continuously driven by advances in technology, the use of ferro aluminum in such high-performance applications is ever-increasing.

Market participants will continue to shift their focus towards optimizing production processes and seeking alternate sourcing options to cover price fluctuations in raw materials in the future. Some companies may invest further research and development efforts to improve quality and sustainability in their ferro aluminum products as per evolving environmental standards. With more industrial applications and development of new products in this area, the Global Ferro Aluminum market will keep up with steady growth.

MARKET SEGMENTATION

By Type

As industries are becoming aware of Ferro Aluminum's wide applications, the market is getting noticed. While the Ferro Aluminum types include Pure Ferro Aluminum Alloy and Ferro Aluminum Alloy Mixture, each caters to specific industrial requirements. Their industrial demand is soaring due to strength enhancement, weight reduction, and stainless qualities, which conveniently fit into the manufacturing processes. Due to technological advancement, many industries have been discovering different applications for these alloys, thereby enhancing its role in construction, automotive, and aerospace.

Pure Ferro Aluminum Alloy is valued at $3,126.97 million and is used widely when very high purity and specific properties of the material are required. This is essential in the refining of steel, enhancing its durability and suitability for many applications; the mixture version allows maximum flexibility for any producer with its customized compositions to satisfy his production needs. Registration may be for any or both forms affecting greatly the efficiency and performance of industrial processes in favor of cost saving while keeping quality standards.

Industries dependent on Ferro Aluminum alloys continue to look at innovative ways to enhance efficiency and sustainability. From steelmakers relying on these alloys to enhance production processes, to automotive manufacturers relying on these alloys for lightweight yet strong components, all the way to the aerospace sector taking advantage of Ferro Aluminum for its unique strength-to-weight ratio to bestow structural integrity without any overstated weight, expanding the applications for Ferro Aluminum alloys looks promising with respect to research and development.

The Global Ferro Aluminum market is signaling a shift towards advanced material solutions that promote industrial growth. Companies have begun to refine their methods of production to ensure that these alloys conform to some of the most stringent quality specifications. Steady expansion of the industry is an outcome of an increase in demand from the core industries that appreciate the advantages of these materials in enhancing performance, cost reduction, and adherence to evolving standards. As industries evolve, Ferro Aluminum applications in various fields will increasingly shape the future of advanced manufacturing and engineering solutions.

By Application

In steel manufacture and foundries, aluminum alloying, welding electrodes, and other metallurgical processes, Ferro Aluminum has its place in the main sections of industrial applications. The material is appreciated for enhancing strength, durability, and resistance among metals, giving it a wide-equipped acceptance across industries. As industries are evermore concentrating on efficiency and performance, Ferro Aluminum will keep being brought forth with steady demand.

Steel production is, we can say, the important sector where Ferro Aluminum is deoxidizer and alloying agent. This good quality chemical is added to steel to remove impurities from it and thus improve resistance to oxidation. This gives rise to high-strength steel, which is used in construction work, automobile manufacture, and infra-development. The foundry sector is also benefited because it helps refine metal compositions and create cast products having great structural integrity.

Aluminum alloy production is another widespread application where Ferro Aluminum enhances the mechanical properties of aluminum-based materials. The mechanical performance of this alloy contributes to enhancing hardness, wear resistance, and thermal stability, making it appropriate for aerospace sector, automotive, and industrial machinery components. The Ferro Aluminum enhanced welding electrodes provide stabilization of arc performance and improvements in weld quality to ensure that metal structures will have strong and durable joints.

Apart from the above major applications, Ferro Aluminum can find its place in other metallurgical processes that require precision control on both composition and performance of the respective materials. Because of its property of improving metal characteristics, it will always be a core for industries trying to increase reliability and longevity in any product. Potentially there will be other frontiers in metallurgy awaiting to be tapped, even as technology improves and manufacturers wish to search for ways to optimize Ferro Aluminum application.

Internationally, the Global Ferro Aluminum market is likely to witness a lot of interests from manufacturers, as industries now expect not just meet concourse standards but also offer high-quality materials. Companies are looking at the best methods to refine production, thereby increasing efficiency and sustainability. With the growth of various industries, Ferro Aluminum will play an important role in assuring high-performance applications for metals, guaranteeing constant demand and growth in metallurgical solutions.

By End-Use Industry

As industries across the board are beginning to realize the advantages offered by Ferro Aluminum, the Global Ferro Aluminum market is being spotlighted. With these properties, this specialty alloy Applications in various industries. The significance of Ferro Aluminum is becoming more pronounced as industries increasingly seek materials that not only enhance performance but also reduce costs with technological advancements. Companies wish to optimize production methods, focusing on this growing business in various fields.

Ferro Aluminum is one of the key industries in major consumption. The automobile manufacturers willing to include this alloy in various vehicle components would further reduce weight, hence improving fuel economy and durability. Due to stricter emission regulations being suddenly imposed on the manufacturers, Ferro Aluminum is one of those materials that is bound to be the best pick in heavy automotive components. On the other hand, construction uses the strength and environment-level properties of this alloy to advantage. Architects and engineers use Ferro Aluminum to provide structural frameworks, roofing, and all applications where durability and lightweight properties are essential.

The demand for Ferro Aluminum is a significant catalyst coming from the aerospace and defense industries. Aircraft manufacturers are looking for materials that impart strength without imposing any major weight. Ferro Aluminum fits this bill and is hence a vital metal for aircraft structures, engine parts, and military equipment. In defense applications, Ferro Aluminum is further extended to armored vehicles and body armor, where the strength-to-weight ratio is a credit advantage.

In the electrical and electronics industries, Ferro Aluminum is used in a variety of components for its conductivity and resistance to corrosion. It is used for wiring, connectors, and structural parts of electronic devices which ensures reliability and longevity. There is constant demand for durable and lightweight materials by the expanding electronics industry. Another arena where Ferro Aluminum is gradually gaining acceptance is in packaging. Due to its durability and resistance to outer elements while being lightweight, it is being used in producing foils and containers.

Ferro Aluminum shows the merit in more specialized applications beyond this sector. As industries search for new ways to optimize efficiency and sustainable weight, application of this alloy will witness an upsurge. Manufacturers are also investing in research and development to improve the properties of Ferro Aluminum that will be even more relevant for contemporary industrial needs. The Global Ferro Aluminum market reflects this continuous shift towards innovative material solutions in support of advancement across various fields.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,927.07 million |

|

Market Size by 2032 |

$6,394.79 Million |

|

Growth Rate from 2025 to 2032 |

3.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global Ferro Aluminum market develops due to increasing demands for industries. This material is important in many manufacturing processes due to its well-positioned strength and lightweight properties, especially in steel and aluminum production. The technologies that drive efficient metal alloying are also expected to keep the market steadily eying progress in the air for years to come.

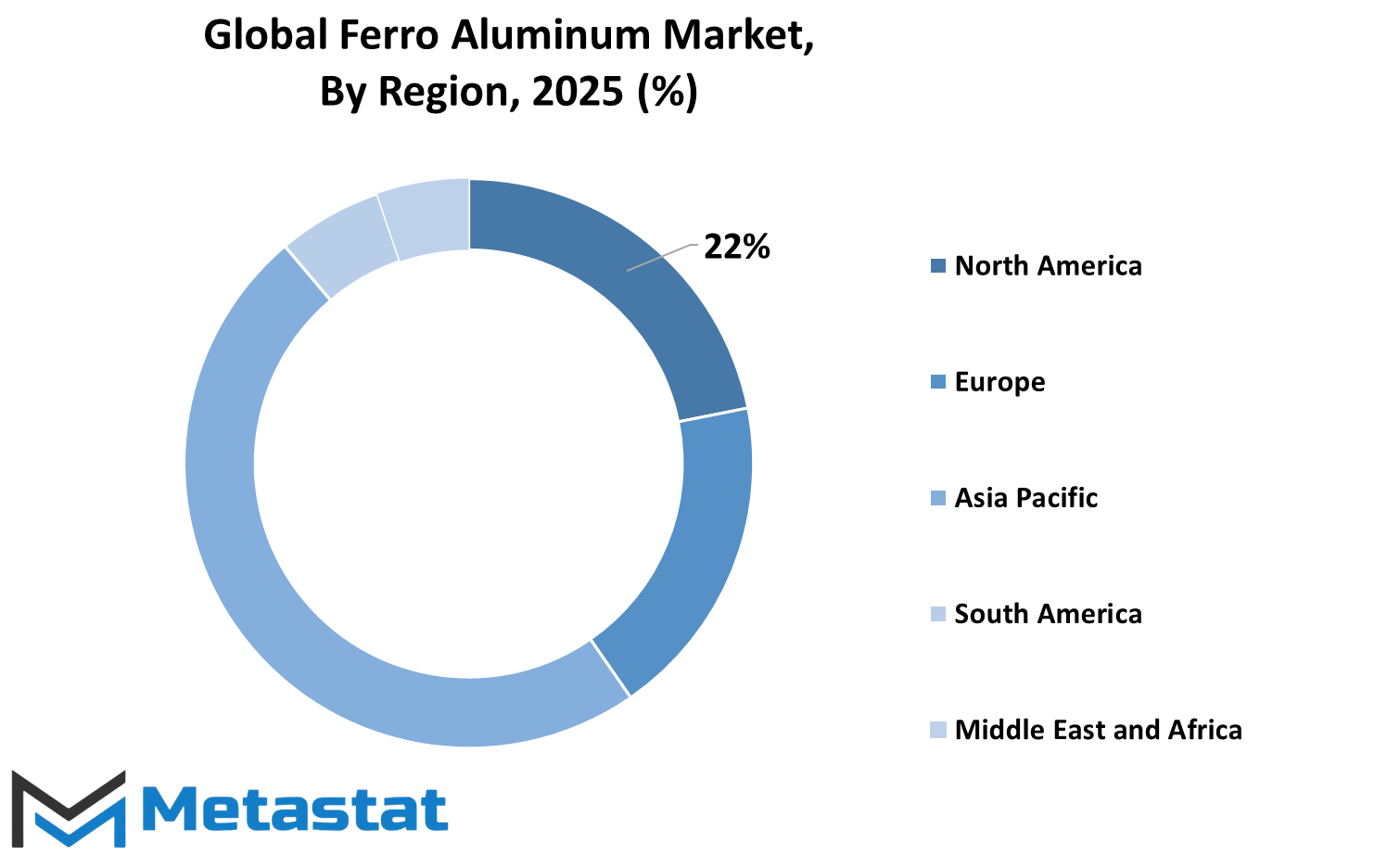

Understanding the overall market landscape has now been divided geographically into several key segments: North America, comprising the U.S., Canada, and Mexico; industrial advancements drive demand in the North American continent complemented by the strong manufacturing sector; this region also forms the overvalue picture of the country. In Europe, UK, Germany, France, and Italy form the primary pillars of Ferro Aluminum reliance concerning their respective industries in construction, automotive, and aerospace. The rest of Europe generally has some market growth potential, as developing economies continue improving their industrial infrastructures.

Asia-Pacific, however, remains one of the most dynamic regions for the Ferro Aluminum market. India, China, Japan, and South Korea, the key players, require advanced metal alloys for rapid industrialization and infrastructure development. The rest of Asia-Pacific is also taking its part under the budding economies. Among South American countries, Brazil and Argentina are strong contenders as promising markets, spurred on by other developing industries such as transportation and manufacturing. The rest of South America is selling into the market potential developed by the different growing industrial sectors.

Thus Middle East & Africa is another promising region concerning the market's growth potential. The GCC countries, notably such as Saudi Arabia, the UAE, and others, enjoy a good presence in the metal and construction industries and so contribute to demand for Ferro Aluminium. Similarly, Egypt and South Africa form important markets, with increasing industrial bases and investments into infrastructure projects. The rest of the Middle East & Africa region is still developing and modernizing, thus presenting some potential of its own.

In total, the whole global Ferro Aluminum market has ever been transformed by the taking place in industrialization, technological progress, and economic growth among regions. As industries strive for stronger and more efficient materials, Ferro Aluminium becomes a standard solution for such applications. Each region has a distinct tale within the tale of industrialization in that region and hence should provide unique perspectives on how such developments will shape the market. It is therefore expected that the industry will be set on a steady growth path and, from these regions, present opportunities for manufacturers, suppliers, and investors.

COMPETITIVE PLAYERS

As industries turn more to Ferro Aluminum's unique properties for their applications, it has become increasingly alluring to the market. This special alloy, consisting of iron and aluminum, is commonly consumed in metallurgical, manufacturing, and industrial applications. The ability of Ferro Aluminum to impart strength, durability, and resistance to advanced systems makes it a useful material in various sectors including steelmaking, automotive, aeronautical, and construction sectors. The Ferro Aluminum demand remains steady as companies look to improve their efficiency and reduce costs and invest in various advanced production techniques to ensure quality output.

The growing demand for industries worldwide is mainly supported by the key suppliers of high-grade Ferro Aluminum. Belmont Metals, Advanced Metallurgical Group NV, Tremond Metals Corp., and Bear Metallurgical Company are among the forefronts in catering to such demands around industries. With strong leadership in metal refining and alloy production, they provide materials that adhere rigidly to manufacturers' quality requirements. Hickman Williams & Company, NORTECH FERRO ALLOYS PVT. LTD., Norsk Hydro ASA, and Vedanta Resources Limited also contribute significantly to the development of the market by providing a wide range of alloy compositions for varied industrial applications. Well-developed through innovation and research, these companies work hard to develop products that support the needs of their customers with enhanced manufacturing efficiency and material performance.

Multinational giants such as Glencore Plc, JK Ferroalloys, RusAL, and Alcoa Corporation extend the industrial outreach globally. Owing to their enormous distribution and supply networks, Ferro Aluminum reached industries at far-off places across regions. BN Industries, Avon Metals Ltd, and A.M.P.E.R.E. alloys provide yet another stiff competition to the variance of Ferro Aluminum via several tailored options designed to suit niche requirements. With developments in metal processing continuing apace, these industry leaders are also focusing on enhancing production processes and improving their product quality.

Need for strong- and lightweight materials in diverse industries has triggered heavy investment into Ferro Aluminum R&D. As new ways of exploring optimum performance are sought by firms, further enhancements in production methods and alloy composition will likely be witnessed in the market. Ferro Aluminum, through advancements in technology, will forever keep increasing its place in the industrial application, hence making it an important constituent of modern manufacturing. With the presence of market-driven companies willing to enhance production efficiency, it remains evident that the market will sustain itself amid competition and supply high-quality solutions to the industries across the globe.

Ferro Aluminum Market Key Segments:

By Type

- Pure Ferro Aluminium Alloy

- Ferro Aluminium Alloy Mixture

By Application

- Steel Production

- Foundry

- Aluminum Alloy Production

- Welding Electrodes

- Other Metallurgical Processes

By End-Use Industry

- Automotive

- Construction

- Aerospace & Defense

- Electrical & Electronics

- Packaging

- Others

Key Global Ferro Aluminum Industry Players

- Belmont Metals

- Advanced Metallurgical Group NV,

- Tremond Metals Corp.

- Bear Metallurgical Company

- Hickman Williams & Company

- NORTECH FERRO ALLOYS PVT. LTD.

- Norsk Hydro ASA

- Vedanta Resources Limited

- Glencore plc

- JK Ferroalloys

- RusAL

- Alcoa Corporation

- BN Industries

- Avon Metals Ltd

- A.M.P.E.R.E. alloys

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252