MARKET OVERVIEW

The Thailand cutting fluid market will soon be placed outside of the confines of its traditional role in manufacturing. What has traditionally been viewed as an ancillary component in machining and metalworking will increasingly become a building block for sustainable industrial practices. As Thailand consolidates its role in Southeast Asia's manufacturing profile, the debate around cutting fluids will not only revolve around lubrication and cooling but also branch into concerns about environmental footprint, workplace safety, and information technology.

Going forward, the Thailand cutting fluid market will shape the way manufacturers coordinate their strategies with larger technological and environmental shifts. Instead of putting emphasis on machining efficiency, firms will start to regard fluids as an integral part of a system. Intelligent monitoring devices, for example, will track usage habits and fluid lifespan, giving rise to predictive maintenance models. Such a shift will decrease downtime and enable manufacturers to accurately project expenses. Fluid itself will no longer be treated as a stand-alone consumable but as a managed resource of Thailand's industrial processes.

Beyond direct use in cutting and grinding, the Thailand cutting fluid market will also extend into regulatory and trade factors. With increasing demands from global buyers for conformity to environmental standards, Thailand's manufacturers will look for solutions that conform to export demands without compromising competitiveness. Fluids with less chemical hazard, better recyclability, and lower cost for disposal will come into prominence. These adjustments will enable the industry to satisfy both domestic policy requirements and international partners' expectations.

The social theme will also arise. Safety for workers will promote the production of fluids that reduce unsafe mist and odors, ensuring cleaner shop conditions. This will not only be healthier but also increase the general attractiveness of technical careers in Thailand. In the long term, a healthy population will improve productivity and minimize concealed costs due to occupational hazards.

Another path on which the Thailand cutting fluid market will grow is digital collaboration among industries. Machine tool manufacturers, chemical innovators, and data solution vendors will collaborate to create systems wherein fluids engage with machines in real time. By connecting sensors to cloud platforms, cutting fluid usage will correlate with performance data, providing decision-makers with more insightful information. This integrated approach will revolutionize how Thailand's factories attain efficiency in cost as well as sustainability.

Outside national boundaries, the Thailand cutting fluid market will also shape regional dynamics. As neighboring nations are also improving in manufacturing, Thailand will become a center of innovation by embracing cutting-edge fluid technologies sooner. This will further enhance its position in regional supply chains so that the nation would not just be a player but becomes a trendsetter in terms of machining practice benchmarks in Southeast Asia.

Eventually, the Thailand cutting fluid market will expand far beyond its present boundaries. It will be transformed from a technical requirement to an innovation, sustainability, and partnership driver that influences how Thailand's manufacturing industry functions in the decades to come.

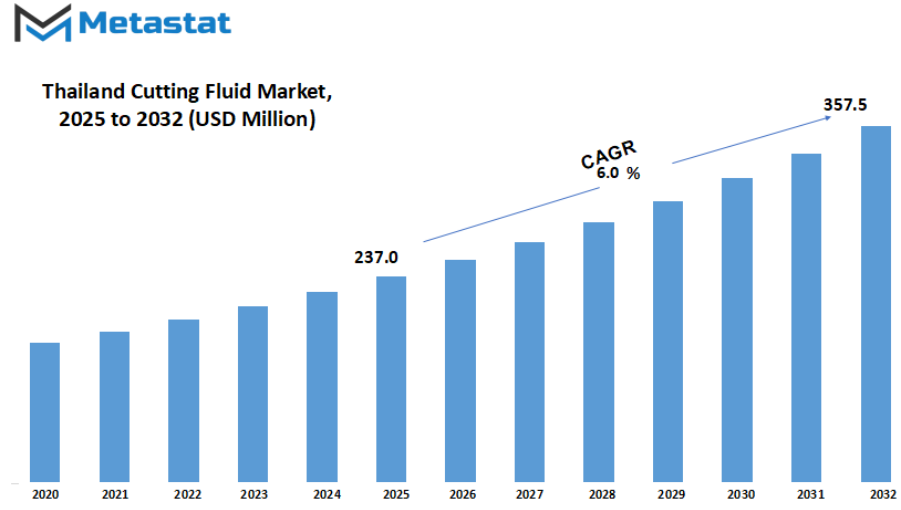

Thailand cutting fluid market is estimated to reach $357.5 Million by 2032; growing at a CAGR of 6.0% from 2025 to 2032.

GROWTH FACTORS

The Thailand cutting fluid market is attracting more attention as businesses more and more move towards new machining technologies in order to boost productivity and accuracy. Manufacturers in Thailand are upscaling their operations with current, high-tech equipment that needs effective lubrication and cooling mechanisms. Cutting fluids is an imperative factor of the commercial manner as they make certain higher device lifestyles, minimize friction, and make certain first-class manufacturing lines, thereby gambling a critical function in streamlining procedures. This increasing use of sophisticated machining technologies will continue propelling the call for excessive-overall performance slicing fluids, mainly in industries wherein accuracy is important.

Automotive and aerospace sectors are also significant players in the increasing demand for cutting fluids in Thailand. With automotive production being one of Thailand's pillars of economy, the demand for effective machining solutions has increased. Likewise, aerospace manufacturing, which is very dependent on precision and longevity, also contributes to market expansion. Both industries are expected to enhance their manufacturing capabilities in the near future, providing consistent business opportunities for cutting fluid manufacturers to provide these industries with dedicated and high-performance products.

The Thailand cutting fluid market does have some common challenges that should not be ignored. Environmental issues over disposal of expended fluids and toxicity with certain chemical-based products have resulted in regulatory and operational concerns. Proper waste recycling and treatment need to be invested in by manufacturers to reduce environmental impact, which can raise prices and delay take-up. In addition to this, the premium synthetic fluid's high price is another deterrent since not all companies are in a position to make the switch from traditional fluids to more complex ones. Such limitations will make it harder to achieve faster uptake among small and medium-scale industries that are still very sensitive to costs of operations.

Despite all this, new opportunities are emerging with particular emphasis on sustainability. The innovation of eco-friendly and bio-based cutting fluids presents a promising route for producers who want to strike a balance between functionality and ecological responsibility. Not only are these alternatives less toxic, but they also enhance the safety of the workers, opening up a positive transformation of industry mindset. Furthermore, Thailand's growing involvement in precision engineering and its desire to increase excessive-value exports will maintain call for for innovative cutting fluids. As the country keeps to bolster its manufacturing surroundings, carriers of amazing and environmentally friendly cutting fluids may be well-located to capitalize on these budding possibilities.

MARKET SEGMENTATION

By Type

The Thailand cutting fluid market is becoming popular as companies continue to seek ways to enhance machining performance and increase tool life. Cutting fluids are important in operations together with drilling, milling, turning, and grinding because of the reality that they do away with heat, lower friction, and provide a smoother surface on metals. In Thailand, the marketplace is experiencing regular increase because the car, production, and manufacturing industries preserve to amplify, generating multiplied demand for precision machining and long-lasting equipment. Companies realize that selecting an appropriate reduce of slicing fluid will no longer simplest improve productiveness however also lessen preservation expenses and decorate performance.

Of the various types of fluids employed, water-soluble cutting fluids have the biggest market share at $117.0 million. These fluids are most commonly used due to the fact that they are inexpensive, simple to use, and adapt well to a wide variety of operations. Straight cutting oils, though smaller in market share, are crucial in heavy-duty machining where heavy lubrication is needed. Semi-synthetic cutting fluids are slowly becoming more popular as they find a middle ground between the advantages of oil and water-based solutions, providing both cooling and lubrication while being comparatively easier to maintain. Synthetic cutting lubricants, however, are used in specific applications that require optimum cooling and cleanliness and are beneficial to industries that have high performance and hygiene requirements.

The persisted growth of Thailand's manufacturing sector is riding agencies to upgrade their machining strategies, and that is where subsequent-era slicing fluids come into play. Manufacturers are increasingly realizing the importance of enhancing performance without sacrificing environmental standards. Water-based and semi-synthetic cutting fluids are possibly to remain in more demand considering the fact that they decorate overall performance but also facilitate less difficult control regarding disposal and place of business safety. The exchange will effect suppliers to be more inclined toward providing environmentally pleasant and revolutionary cutting fluids as consistent with Thailand's industrial necessities.

The future will see the Thailand cutting fluid market grow further with industries opting for modernization and using wiser technologies. The request will not only be one of volume but also one of product quality, sustainability, and suitability with sophisticated machining platforms. Businesses that can find a balance between performance and safety as well as environmentally friendly considerations will be leaders in this arena. With Thailand solidifying its role in the manufacturing base of Southeast Asia, cutting fluids will continue to be a critical component of smooth functions and consistent delivery across a variety of industries.

By Source

The Thailand cutting fluid market is turning into increasingly sizable as groups are looking for effective answers to beautify machining overall performance and tool toughness. Cutting fluids are critical in cooling and lubricating gear all through drilling, milling, and grinding operations, permitting companies to supply elevated accuracy and better finishes. In Thailand, that's increased transferring to automotive, aerospace, and heavy machinery industries, the call for reducing fluids will remain wholesome. Industries rely appreciably on accurate manufacturing, and the importance of cutting fluids will preserve on growing in productiveness and value-saving.

Based on supply, the marketplace is segmented into bio-based and synthetic-primarily based cutting fluids. Bio-based fluids are gaining reputation as they're formulated from renewable substances and cause less damage to the surroundings and human hard work. Businesses are more and more seeking to them as a sustainable option, especially with increasing global and local laws around workplace safety and environmental control. More than this, artificial-based totally fluids are liked for his or her predictability in satisfactory, stepped forward service life, and capacity to deal with excessive-strain applications efficaciously. This makes them a preferred choice for industries that value performance and durability.

The equilibrium between bio-based and synthetic-based fluids in Thailand will probably be governed by industry needs. Sustainability and environmentally pleasant solutions have become famous, yet fee savings and technical performance retain to dominate the priorities for most producers, in which synthetic-based solutions have a tendency to be desired. Nevertheless, the non-stop transition in the direction of greener operations may also prompt companies toward using bio-primarily based answers, especially in companies that need to decorate their environmental popularity and meet international requirements on sustainability.

Leading global producers are also influencing the Thailand cutting fluid market by launching sophisticated formulations that minimize waste, provide longer tool life, and improve safety. With technology leading the changeover, both bio-based and synthetic-based fluids will have their niche in the market and cater to different demands in industries. The industrial development of Thailand will continue to create opportunities for both and hence this market will be a sector of consistent development and innovation.

By Application

The Thailand cutting fluid market is progressing smoothly as Thai industries hold to boom their adoption of advanced machining strategies. Cutting fluids provide widespread functions in prolonging device life, improving accuracy, and facilitating easy operations in production factories. As Thailand's commercial sector maintains to gain momentum, mainly inside the car, aerospace, and heavy equipment sectors, the call for efficient cooling and lubrication systems will persist. Cutting fluids do not seem as merely supplemental to machine but as a vital thing that enables industries to gain expanded output and stepped forward product excellent.

Based on utility, the marketplace is segregated into milling, drilling, turning, and grinding, all of which emphasize the significance of fluids specifically machining operations. Milling, as an example, calls for consistent cooling and lubrication to manage excessive-pace cutting and keep away from put on the cutting gear. Drilling tends to generate excessive friction and heat, and slicing fluids are needed to make certain accuracy and save you device breakage. Turning presents unbroken tool and workpiece contact, and consequently appropriate lubrication is necessary for device protection and surface finish. Grinding, where the abrasive action is continuous, also produces quite a lot of heat, and cutting fluids are employed not only to cool but also to sweep away small particles that can injure the tool and the workpiece.

The needs for cutting fluids in Thailand will remain driven by the expanding manufacturing industry of the country and its heightened interest in precision engineering. With industries transferring in the direction of state-of-the-art machining technologies, needs for fluids with more capability to address better speeds, tighter tolerances, and difficult materials may be more. This will spur producers and providers to launch merchandise which can be optimized for overall performance however also ensure protection and sustainability, responding to both industrial necessities and environmental needs.

As a whole, the Thailand cutting fluid market will grow due to increased industrial demand and the need for improved efficiency. Uses like milling, drilling, turning, and grinding will continue to be at the forefront of growth, defining the progression of products that are efficient and dependable. As Thailand's manufacturing industry continues to modernize, only the significance of cutting fluids will increase, enabling industries to continue their productivity, quality, and competitiveness.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$237.0 million |

|

Market Size by 2032 |

$357.5 Million |

|

Growth Rate from 2025 to 2032 |

6.0% |

|

Base Year |

2024 |

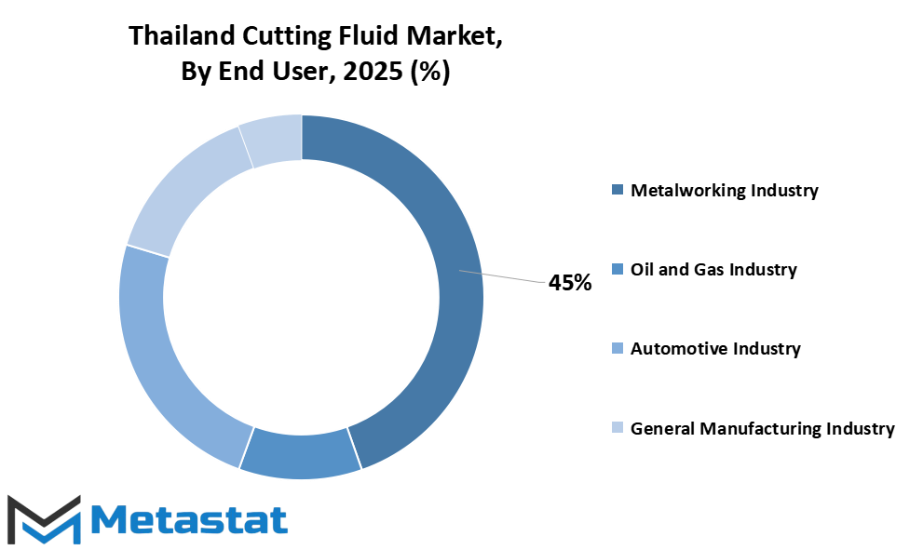

By End-Users

The Thailand cutting fluid market is directly related to industry growth that is based on machining and precision work. Cutting fluids find application in minimizing friction, cooling metal surfaces, and prolonging the lifetime of tools. The greater Thailand movements closer to becoming a manufacturing and business base, the better the demand for these fluids. Various quit-users create this call for, each gambling a unique role depending on their wishes and length of operations.

Cutting fluids' largest cease-user is the metalworking enterprise, as they're vital in operations consisting of drilling, grinding, and milling. In Thailand, that is a developing region that is meant to assist the growth of production, infrastructure, and equipment production, which means efficient machining answers will remain in demand. Not handiest do cutting fluids decorate the exceptional of finished items, however additionally they maintain machines walking easily, permitting industries to preserve a constant level of production with minimum downtime.

The oil and gas sector is another sector where cutting fluids are particularly significant with use in equipment repair and production. The severe conditions and accuracy level needed in this industry render dependable fluids crucial in prolonging the lifespan of machinery. In addition to this, Thailand's automotive sector is a significant contributor to the market. Since the nation remains a manufacturing center for vehicles and vehicle components, cutting fluids are instrumental in providing precision and efficiency throughout the manufacturing process. The demand will probably be consistent with both domestic and foreign markets propelling automotive growth in Thailand.

General manufacturing also plays a substantial role, with industries manufacturing equipment, tools, and consumer goods relying on cutting fluids for efficient production. Small establishments and other industries that are categorized as "others" additionally contribute to the total demand. From precision engineering to big-scale manufacturing, utility of reducing fluids assists in enhancing efficiency and product exceptional, which helps make certain the competitiveness of Thailand's production industry.

Overall, Thailand cutting fluid market mirrors the requirements of diverse quit-users, starting from huge-scale vehicle factories to decrease-scale manufacturing facilities. Every quarter relies upon on these fluids for continuity of production, fee discount, and fine output. As Thailand progresses in developing its business base, call for for cutting fluids in these give up-consumer segments will remain a key factor in its growth narrative.

COMPETITIVE PLAYERS

The Thailand cutting fluid market is becoming a significant sector fostering the development of the nation's manufacturing and industrial operations. Cutting fluids are extensively applied in metalworking operations to cool and lubricate the tools, enhance efficiency, and prolong machine life. As Thailand serves as a center of auto, electronics, and heavy machinery manufacturing, the demand for high-performance cutting fluids will never cease to grow. The market is also experiencing heightened awareness of how liquid quality affects productivity and operating expenses, and hence it has become an area of concern for manufacturers that seek to remain competitive.

One striking feature of this market is that it has both established global players and regional players, all vying to address the expanding needs of industries. Some of the companies that operate in this space include Yushiro Chemical Industry Co., Ltd., MORESCO Corporation, and Top Sun Co. Ltd. offer potent technical expertise and product offerings specific to metalworking use. Master Fluid Solutions, Castrol Limited, and Fuchs Lubricants are also widely recognized across the world and are further solidifying their presence in Thailand by providing the latest formulations that improve performance while guaranteeing greater machine uptime. These companies are not only supplying products but are also closely interacting with industries to provide technical assistance and solutions for particular machining problems.

Another force behind business in this market is increasing emphasis on sustainable and green fluids. As industries are increasingly pushed to cut waste and limit deleterious emissions, Idemitsu Kosan Co., Ltd., ExxonMobil Corporation, and Chevron Corporation are increasingly emphasizing lower-toxicity and higher-biodegradable fluids. TotalEnergies Corporation and other players are also investing in research and development to develop formulations that balance efficiency with sustainability. Such a shift is changing the way cutting fluids are viewed, from a mere industrial requirement to a more strategic input that enables cleaner production processes.

The rivalry among these major players will likely introduce more innovation and better-quality products to Thailand's market in the years ahead. With industries growing, the need for custom cutting fluids designed for intricate machining operations will further increase. Such companies that can provide stable, effective, and environmentally friendly solutions will establish greater market presence. Thailand, being a manufacturing base in Southeast Asia, will continue to be an appealing market for international leaders as well as domestic suppliers who are interested in building long-term business relationships with industries that have heavy dependence on machining and metalworking operations.

Thailand Cutting Fluid Market Key Segments:

By Type

- Water-soluble Cutting Fluids

- Straight Cutting Oils

- Semi-synthetic Cutting Fluids

- Synthetic Cutting Fluids

By Source

- Bio-Based

- Synthetic Based

By Application

- Milling

- Drilling

- Turning

- Grinding

By End-Users

- Metalworking Industry

- Oil and Gas Industry

- Automotive Industry

- General Manufacturing Industry

- Others

Key Thailand Cutting Fluid Industry Players

- Yushiro Chemical Industry Co., Ltd.

- MORESCO Corporation

- Top Sun Co. Ltd.

- Master Fluid Solutions

- Castrol Limited

- Fuchs Lubricants

- Idemitsu Kosan Co.,Ltd.

- ExxonMobil Corporation

- Chevron Corporation

- TotalEnergies Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252