MARKET OVERVIEW

The global magnesium alloys market is a key segment of the entire materials industry. With its unique properties, this market is bound to influence many other sectors wherein magnesium alloys turn out to be a pivotal constituent for many applications. Moving forward with innovation in industries and reaching out toward lighter yet more efficient materials, thereby growing the demand for magnesium alloys. These alloys are lightweight, high in strength-to-weight ratio, and demonstrate very good resistance to corrosion, making them very suitable for use in automotive, aerospace, and electronic industries. Magnesium alloys will be the answer to most of the problems in these industries, especially in cutting down the overall weight of products without jeopardizing their integrity.

For instance, the aerospace industry will continue to make extensive use of such alloys in the future to achieve fuel efficiency through a reduction in aircraft weight. Similarly, the automotive industry will also lay more emphasis on the use of magnesium alloys in vehicle manufacturing to meet strict emission standards by reducing vehicle weight and thereby improving fuel efficiency. The Global Magnesium Alloys market is foreseen to take a lead role in a world with ever-tightening environmental concerns and regulations. Apart from the automotive industry, magnesium alloys will also come in handy for the production of lighter and resilient electronic devices.

The trends of having smaller, more portable, yet powerful devices are further expected to outline the importance of this market. As consumers continue to demand sleeker and more efficient products, more and more manufacturers will turn toward magnesium alloys to meet these needs. Unique properties of the alloys will allow the production of thinner and lighter electronic components, further allowing for more compact and efficient devices. This may probably account for the growing demand for magnesium alloys in this sector of applications. Moreover, the Global Magnesium Alloys market will be driven continuously by innovations in manufacturing technologies. Newer processes will enable the production of a number of complex and bespoke magnesium alloy components. Innovation in these aspects will make it very easy to integrate magnesium alloys into a host of products, hence broadening their scope of application. Therefore, producers from various and very different industries will be more eager to use such materials during their production, which will enhance this market.Magnesium alloys will find applications in the medical industry, particularly in developing bioresorbable implants.

These are designed to gradually dissolve in the body and thus reduce the burden of carrying out more surgeries to remove such implants. As medical technology becomes increasingly sophisticated, the need for new materials, including magnesium alloys, is also on the rise, thereby supporting the growth of the Global Magnesium Alloys market. Such versatility will make the alloys one of the preferred materials for a vast range of applications in medicine, from orthopedic implants to cardiovascular devices. To put it in a nutshell, the Global Magnesium Alloys market will always remain a backbone for the materials industry, only enhancing its applications across various sectors.

Aided by breakthroughs in manufacturing and technology, the unique properties of magnesium alloys secure their growing importance in the future. Demand for magnesium alloys has already been rising in seeking more efficient and sustainable solutions; this will be a growth market over the coming years.

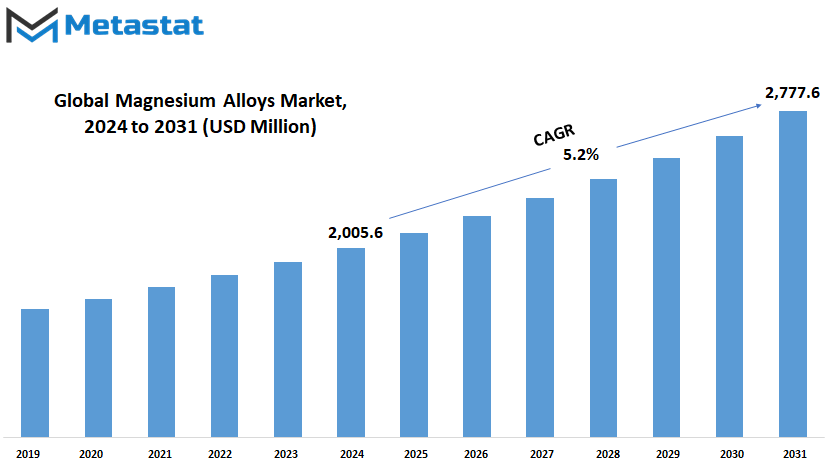

Global Magnesium Alloys market is estimated to reach $2,777.6 Million by 2031; growing at a CAGR of 5.2% from 2024 to 2031.

GROWTH FACTORS

It is most likely that the Global Magnesium Alloys market will experience huge boosters in growth due to a number of factors, particularly the increased demand from the automotive and aerospace industrial sectors. The undisputed thirst for fuel efficiency, durability, and better performance of the passenger carries these industries closer to great consumption of magnesium alloys, which present great strength-to-weight ratios. In fact, this trend will further pressure the adoption of magnesium alloys as manufacturers strive to produce more fuel-efficient and harder-wearing vehicles and aircraft.

Also regarding the electronics and portable devices sectors, there is an increased demand for materials that could offer the combination of strength with lightness. The new applications of these metals in such areas have shown magnesium alloys since the metals have been able to provide the needed durability without the addition of too much weight. As consumers prefer a more portable and light device, the market for magnesium alloys within electronics will further grow.

Despite these growth factors, certain challenges still confront the Global Magnesium Alloys market. The high cost of magnesium alloys relative to other materials presents the primary barrier to their widespread adoption. This cost factor may, in fact, severely curtail the use of magnesium alloys in several industries where the budget is a major issue. Another disadvantage of magnesium alloys is that these tend to corrode, and their application gets limited in the environments where durability is a serious concern. Apart from this, problems with welding and joining magnesium alloys also limit the use of these to apply in many manufacturing processes wherein these properties are very crucial.

However, some promising opportunities are being created for the Global Magnesium Alloys market through the development of advanced manufacturing techniques. It is expected that with time, as these techniques further develop and mature, the cost of manufacturing magnesium alloys will drop, enabling them to find applications in a wider arena. Also, these make corrosion-resistant coatings available, which will improve the resistance of magnesium alloys and hence make them useful in more aggressive environments. These are some of the ways in which the current limitations will be eliminated, and more extensive applications for magnesium alloys established other than in the automotive and aerospace industries.

Going forward, these technological advancements will reinforce the Global Magnesium Alloys market as adoption is increased across different sectors. Magnesium alloys will be an important part of providing industries that continue to increase their demand for strong yet lightweight materials. The future of the Global Magnesium Alloys market is certainly positive due to increasingly newer innovations that are taking place, and some of the current trends that will see an increase in magnitude in the coming years.

MARKET SEGMENTATION

By Type

The Global Magnesium Alloys market shall continue to grow in the future with industries now acknowledging the need for lightweight yet durable materials. Since the market is carved into two major categories—Cast Alloys and Wrought Alloys—it is expected that these alloys will see colossal growth since they can enhance efficiency and performance in several industries.

Cast Alloys are known for their high strength-to-weight ratio, which is foreseen to be very popular in the automotive and aerospace sectors. As demand for greener vehicles and aircraft continues to rise, so manufacturers will increasingly turn to magnesium alloys to trim the weight of components while ensuring no loss of safety or performance. Growth of electric vehicles shall further reinforce this market segment as lighter materials like Cast Alloys shall be critical in extending the range of these vehicles. In addition, the drive toward sustainability will foster the use of Mg alloys, since they can be more environmentally benign compared to the conventional materials.

Wrought Alloys will continue to progress as these can be applied to a wide variety of uses in many different manufacturing operations. Being easily fabricated and having good mechanical properties, expect more applications of these alloys in electronics, medical devices, and sporting equipment. Another factor that will increase demand for Wrought Alloys is the growing trend in miniaturization of electronics, as these alloys allow for smaller, lighter, yet more efficient components. In the health sector, magnesium alloys, due to their biocompatibility, will be one of the implants and devices of choice, hence contributing to its growth.

By End-use

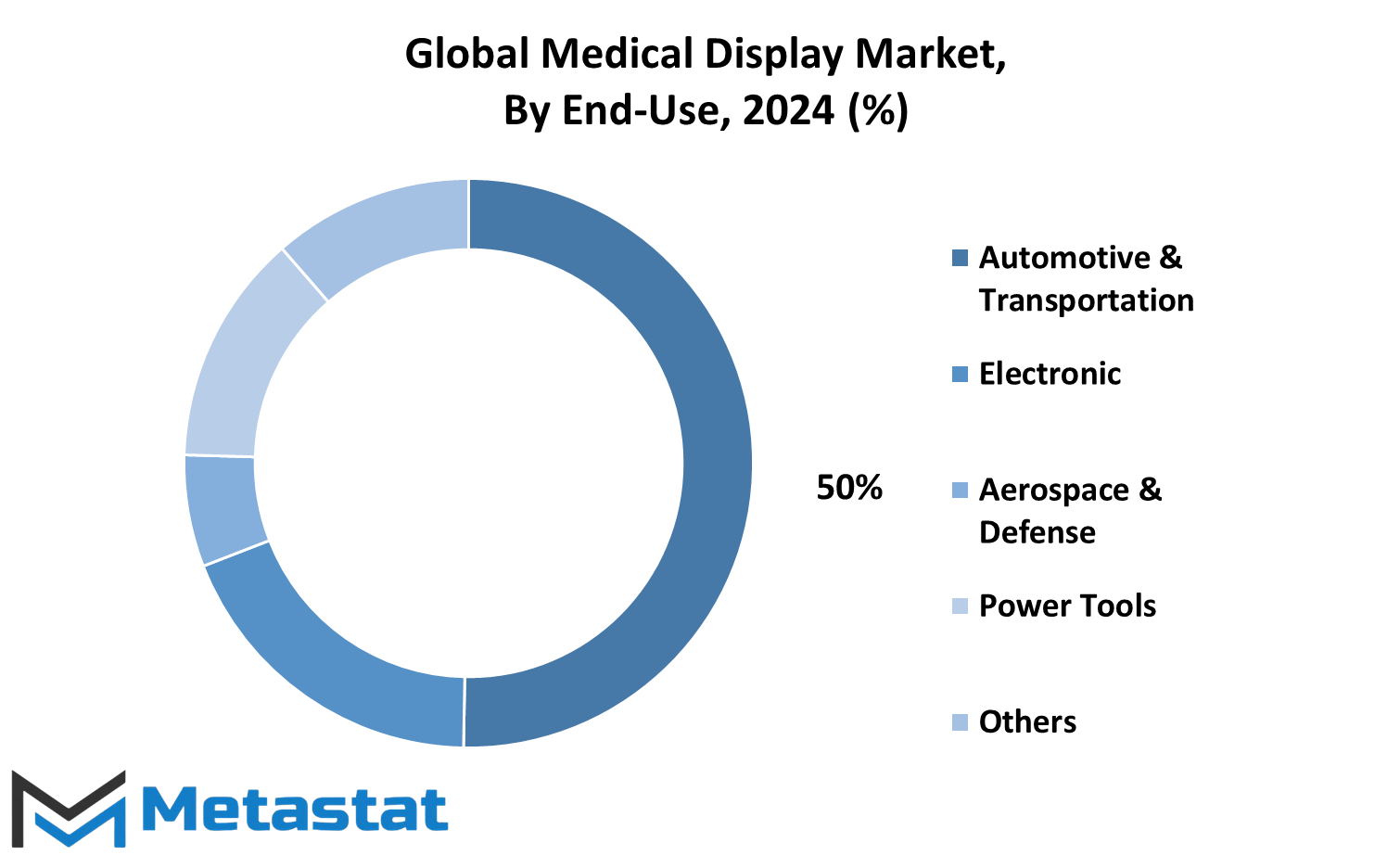

In the next couple of years, the Global Magnesium Alloys market is projected to show huge growth driven by its wide range of application areas across various industries. Magnesium alloys are lightweight, high-strength alloys that find applications in several industries, including automotive and transportation, electronics, aerospace and defense, power tools, and others.

This is in relation to the demand for magnesium alloys in the automotive and transportation industries, which will be continuously demanded by the alloys' capacity to achieve a lighter weight of vehicles that ensures improved fuel efficiency and overall performance. In the achievement of more lightweight and fuel-efficient vehicles, the role of magnesium alloys assumes prime importance as the world's automotive manufacturers try to move toward greener pastures. Demand for these alloys is bound to surge with more electric and hybrid vehicles entering the market, where every gram saved can add up to enhanced range and efficiency.

Due to their excellent properties for thermal and electromagnetic shielding, magnesium alloys will see further implementation in the electronics industries. The miniaturization trend in electronics, associated with a low weight requirement for components, will drive demand for magnesium alloys. In the future, innovation in electronic devices, including smartphones and tablets, may come with the adoption of such materials to improve their performances and durability.

The aerospace and defense industries are another significant application area for magnesium alloys. Their lightweight nature, combined with the possession of high strength, is of vital importance to the reduction of total weight in aircraft and spacecraft, which might result in a reduction of fuel cost and enhancement of operational efficiency. In view of increasing space exploration and defense technology, the demand for magnesium alloys will continue to rise and be at the forefront of the development of more efficient, improved aerospace systems.

Magnesium alloys will help power tools with their resistance to impact and reduced weight. With the trend of power tools being more user-comfortable and tool-efficient, magnesium alloys will feature in the design and manufacturing of lighter yet resilient tools.

Other applications of magnesium alloys include use within consumer goods and a number of industrial products. The versatility of these materials will no doubt spawn a host of innovative uses in the development of new products in a whole range of industries.

Looking ahead, the Global Magnesium Alloys market will continue to see new alloy formulation developments and processing technique innovations that enhance the already good properties of magnesium alloys, making them increasingly attractive for a broad range of applications. This makes magnesium alloys an increasingly popular choice to fulfill the demand of industries seeking weight reduction and performance improvement, thus boosting growth in the market.

REGIONAL ANALYSIS

The Magnesium Alloys market globally is changing, and significant developments are foreseen in the coming years. Regionally, some specific characteristics and trends stand out. On the North American continent, including the U.S., Canada, and Mexico, better demand from the sectors of the automotive and aerospace industries drives the market. This has been anticipated to enhance demand for lightweight, high-strength materials, which would benefit the consumption of magnesium alloys in these industries. As the automotive sector continues to focus on fuel efficiency and enhancing the performance of their vehicles, magnesium alloys are bound to play a key role in the achievement of these goals.

The European region comprises countries such as the UK, Germany, France, Italy, and other European countries. The region is also likely to be one of the prominent growth centers for the magnesium alloys market. The European region has a strong culture in technological innovation and sustainable practices. Reports indicate that European automotive and aerospace industries are pumping huge sums into research and development that will help integrate magnesium alloys into their products. This need is triggered by the high demand for lighter materials that guarantee better fuel efficiency and emission reductions. Besides, rising demand for magnesium alloys from the building and construction and electronics industries is expected to boost the growth of the European market.

The Asia-pacific region, including India, China, Japan, South Korea, and others, occupies a substantial share of the global market. This region is projected to display considerable growth during the forecast period owing to rapid industrialization and economic growth. China and India are emerging as the most prominent players of the magnesium alloys market. The automotive and electronics industries of these countries are rapidly growing, paving the way for increased demand for lightweight yet strong materials. The increasing impetus toward infrastructure development and technological advancement will further continue to raise the application of magnesium alloys across various industries.

Growth in the magnesium alloys market is also expected in South America, including Brazil and Argentina, among others. Most of the demand that comes from South America, from industries such as the automotive and aerospace, is driven by improving performance through weight reduction of vehicles. Increasing investment in construction works, combined with transportation infrastructure development, is also fueling the consumption of magnesium alloys in the region.

In the Middle East & Africa, the magnesium alloy market will show growth with increasing industrial activities and infrastructure development. The focus of the region on economic diversification and investments in several sectors will increase its demand for magnesium alloys. The aerospace and automotive industries will drive the magnesium alloy market of this region, further supported by improving technology and industrialization.

The overall global Magnesium Alloys market is poised to be large across many diverse geographies, impelled by advances in technology and the rapidly growing demand for lightweight, high-strength materials. Regional analysis indicates that each area will bring its unique contribution to the growth of the market, influenced by the respective peculiarities of the industrial and economic factors.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$2,005.6 million |

|

Market Size by 2031 |

$2,777.6 Million |

|

Growth Rate from 2024 to 2031 |

5.2% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

COMPETITIVE PLAYERS

On a global level, the magnesium alloys market is possibly increasing due to technological advancements and improvements in demand from various end-use industries. Such companies are likely to dominate the market with regard to the influence they are set to have in the magnesium market and will include major players, as previously discussed, like Magnesium Elektron, Ka Shui International Holdings Ltd., Magontec, and US Magnesium LLC. Each of these respective companies maintains a strategic stance toward the trends and innovations that occupy the market landscape.

The main player in the magnesium alloy with a reputation of reliable products, Magnesium Elektron, has over the past times improved its technologies to meet the dynamic needs of fast-growing industries, including the automotive and aerospace, and continues doing so. It is likely to take leading positions by product performance increase and entering new markets worldwide. Ka Shui International Holdings Ltd. follows the same pattern: using available core proved in strength and manufacturing capabilities to meet higher demand in different industries and thus reinforce a position on the market.

Other key companies include Magontec and US Magnesium LLC. Magontec's strong faith in the capabilities of new and innovative technology, together with quality, simply means it will be one of the key stakeholders in terms of technological development in magnesium alloys. With its significant capacity and strategic partnerships, US Magnesium LLC is well-placed to capitalize on the increasing demand for magnesium alloys in various applications.

Other critical players operating in the market include Nanjing Yunhai Special Metals Co. Ltd. and Meridian Lightweight Technologies. Through this investment, Nanjing Yunhai will focus on the production of performance-driven magnesium alloys, responding to the one need of this industry for more efficient and tougher material. Recognized for advanced manufacturing techniques, Meridian Lightweight Technologies constantly leads innovation in the output of lightweight magnesium components.

Other dominating companies contributing to the supply are Globe Specialty Metals and Fugu Jinwantong Magnesium Industry Co., Ltd. Globe Specialty Metals is the company recognized in the manufacturing of high-quality alloys. It has been specialists in the research and development processes to provide the best products in the industry and remain competitive in the market. Fugu Jinwantong has large-scale production with a big essence of quality control, hence major in forming a big place in the international supply chain.

Some other companies that will set the pace for the others in the market are Heneken s.r.o., Advanced Magnesium Alloys Corporation (AMACOR), and Dead Sea Magnesium Ltd. Heneken will bring to the fore some special products and advanced technologies that answer specific industry needs, and an innovative approach in alloy production at AMACOR will set future market trends. Unique production methods and efforts oriented towards sustainability designates the third player in this category away from the non-ferrous metal markets and onward to new unexplored territory: Dead Sea Magnesium Ltd.

It includes major players such as MAGONTEC GROUP, m-tec powder, Nippon Kinzoku, Rima Group, Shanghai Regal Magnesium Limited Company, and Smiths Advanced Metals, among others. Each of these brings in its strengths to the market, either through market offerings most recently developed technology, significant research capabilities, or efficient manufacturing processes.

These key players shall come up at the vanguard as the Magnesium Alloys market shapes and evolves worldwide with innovative solutions that best cater to general industrial needs. Their dedicated efforts toward enhancing product performance shall let them establish their position on the global front stage in this market.

Magnesium Alloys Market Key Segments:

By Type

- Cast Alloys

- Wrought Alloys

By End-use

- Automotive & Transportation

- Electronics

- Aerospace & Defense

- Power Tools

- Others

Key Global Magnesium Alloys Industry Players

- Magnesium Elektron

- Ka Shui International Holdings Ltd.

- Magontec

- US Magnesium LLC

- Nanjing Yunhai Special Metals Co. Ltd.

- Meridian Lightweight Technologies

- Globe Specialty Metals

- Fugu Jinwantong Magnesium Industry Co.

- Heneken s.r.o.

- Advanced Magnesium Alloys Corporation (AMACOR)

- Dead Sea Magnesium Ltd

- MAGONTEC GROUP

- m-tec powder

- Nippon Kinzoku

- Rima Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383