Global B2B Payments Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global B2B payments market is a sector that will go on reshaping the way firms trade value across borders, sectors, and digital platforms. Beyond the horizon of conventional transactions, this marketplace will slowly redefine efficiency, transparency, and trust in business-to-business financial exchanges. What will set it apart from the existing structures of commerce is not just speed of movement but also the capacity to incorporate finance into extended operational processes. Payment systems will no longer be discrete functions; they will be integrated into supply chains, procurement processes, and extended business planning.

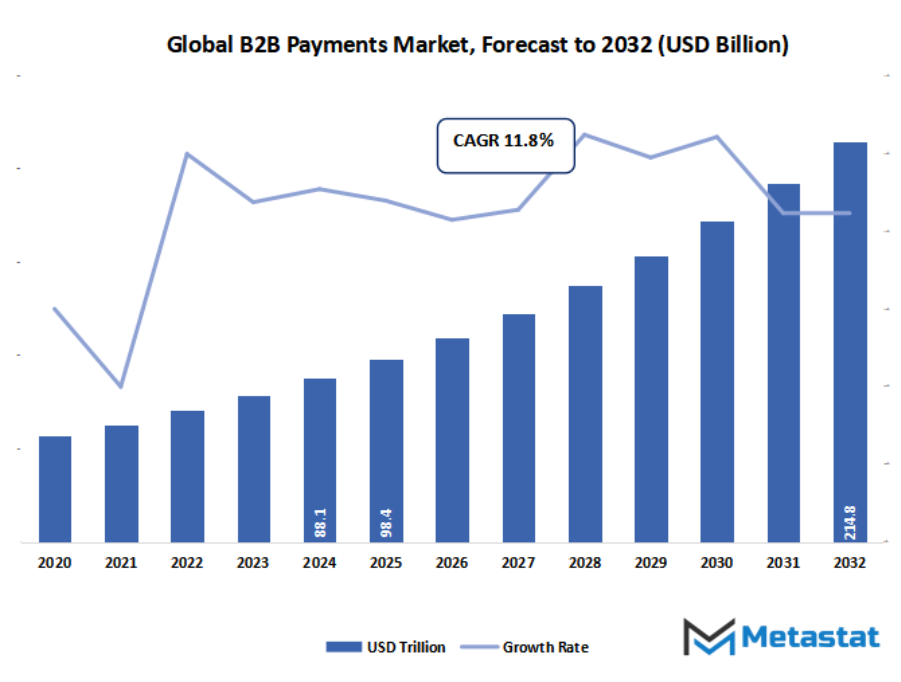

- Global B2B payments market valued at approximately USD 98.4 Trillion in 2025, growing at a CAGR of around 11.8% through 2032, with potential to exceed USD 214.8 Trillion.

- Domestic Payments account for nearly 75.7% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rapid digitization of finance and demand for automated accounts payable/receivable., Globalization of supply chains requiring cross-border payment solutions.

- Opportunities include Embedded finance and integration with procurement/ERP platforms.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Will the developing adoption of digital charge systems redefine how organizations deal with pass-border transactions, or will conventional techniques preserve to dominate positive markets? Could emerging technology like blockchain and AI disrupt the present charge infrastructure, growing new winners and losers inside the industry? As regulatory frameworks evolve throughout areas, how will organizations balance innovation with compliance in shaping the destiny of B2B payments?

Over the next few years, the global B2B payments market will go way beyond mere transactions and would be viewed as an enabler that facilitates cross-industry collaboration. Businesses will look for solutions that reduce holdups, diminish errors, and facilitate deeper financial relationships. Consequently, payment platforms will evolve into mature networks that can handle more layers of compliance, security, and global standards without sacrificing their agility. This change will enable companies to concentrate more on strategic decision-making than on administrative hurdles related to payments.

Market Segmentation Analysis

The global B2B payments market is mainly classified based on Payment Type, Payment Method, Enterprise Type, End Users.

By Payment Type is further segmented into:

- Domestic Payments - Domestic payments within the global B2B payments market will remain robust as a result of aggressive uptake of digital settlement tools. Governments' encouragement of cashless economies will accelerate domestic transactions, making them faster, more transparent, and trustworthy. Future systems will focus on efficiency to ensure that businesses pay invoices sooner at reduced transaction costs.

- Cross Border Payments - Cross border payments in the global B2B payments market will go through change with technology-driven innovation. Blockchain and AI-powered compliance will streamline and shorten delays, and eliminate errors, making global trade more facile. The future will see lower cost of conversion, clear trackability, and quicker settlement cycles, allowing businesses to expand easily across multiple nations.

By Payment Method the market is divided into:

- Bank Transfer - Bank transfers within the global B2B payments market will continue to be a popular option, but digital advancements will transform their usage. Real-time settlement systems will displace old slow systems. Increased security, fraud detection, and compatibility with digital platforms will encourage more companies towards automated and flawless bank transactions.

- Cards - Cards in the global B2B payments market will evolve with virtual solutions and tokenization. Physical card usage will slowly decline as digital-first company card applications grow. Improved expense tracking, immediate issuance, and extra international popularity will allow groups to handle procurement, travel, and provider payments greater efficaciously.

- Online Payments - Online payments will prevail over the global B2B payments market as businesses embrace sophisticated platforms with integrated financial services. Instant verification, AI-driven fraud monitoring, and integrated accounting capabilities will simplify the process. The future will witness online systems delivering speed, cost-effectiveness, and security, becoming the core of global supply chain payments.

By Enterprise Type the market is further divided into:

- Small & Medium Enterprises - Small and medium-sized corporations within the global B2B payments market can be served by means of streamlined, affordable answers tailored to their size. Cloud-primarily based structures and mobile-first answers will provide convenient get entry to funding and instant bills. These tendencies will enable small corporations to compete greater competitively in foreign and home markets.

- Large Enterprises - Major groups in the global B2B payments market will adopt stop-to-end automation, embedding payments into sophisticated ERP structures. Data-pushed forecasting, centralized treasury control, and AI-facilitated reconciliation will reign ultimate. Enterprises will give attention to reducing risks and optimizing performance throughout borders, presenting extra transparency and manipulate over transactions of huge scale.

By End Users the global B2B payments market is divided as:

- Government - Governments within the global B2B payments market will go digital-first to streamline efficiency in vendor and procurement payments. Secure platforms will minimize leakage and corruption while facilitating speedier settlements. Digital compliance systems will provide transparency, enhancing trust among public financial management and making cross-departmental collaborations better.

- Manufacturing - Production will be a major force in determining the global B2B payments market by transforming to automated supply chain payments. Digital ledger integration and IoT-based systems will minimize payment delays. Quick invoice clearances will increase supplier relationships, while real-time transaction tracking will make industrial operations on an industrial scale smoother.

- BFSI - BFSI segment within the global B2B payments market will fuel uptake of sophisticated solutions, providing customers digital platforms for domestic and cross-border transactions. Payment innovations will comprise AI-based credit evaluation and embedded financial products. Future systems will focus more on security and compliance while enhancing overall efficiency for institutional customers.

- Metal & Mining -Metal and mining firms in the global B2B payments market will embrace blockchain-based solutions to enhance commodity transactions' transparency. Digital payment landscapes will tackle high-risk, high-value transactions through traceable, secure systems. Automation and accelerated settlements will minimize financial bottlenecks to facilitate hassle-free trade between suppliers and buyers globally.

- IT & Telecom - IT and telecom sectors in the global B2B payments market will implement cloud-native financial platforms for automatic payments. With increasing emphasis on outsourcing global services, real-time payment systems will help reduce settlement cycles. Improved fraud prevention capabilities and data analytics will enhance operational effectiveness and customer confidence.

- Retail & E-commerce - Retail and online shopping will spur the global B2B payments market using instant payment tools. Payment gateway integration with ease, flexible credit, and mobile wallets will be the trend. As global trade increases, companies will depend on fast, scalable solutions that can process high transaction volumes with integrity and speed.

- Others - The other markets in the global B2B payments market will further adopt sophisticated technologies to build transaction security. Sectors from logistics to healthcare will reap the rewards of quick, open systems that minimize manual handling. Solutions in the future will revolve around automation, scalability, and conformance, propelling efficiency in various business environments.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$98.4 Trillion |

|

Market Size by 2032 |

$214.8 Trillion |

|

Growth Rate from 2025 to 2032 |

11.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

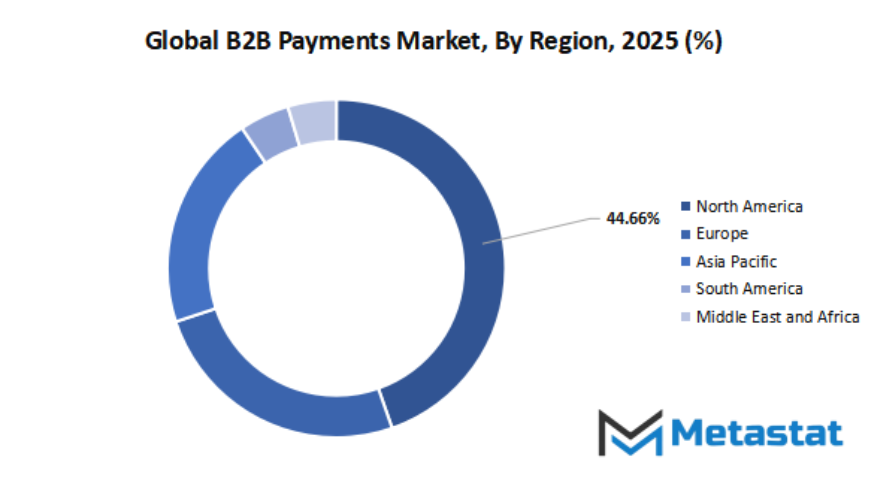

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global B2B payments market is now a significant component of the way companies conduct financial transactions between themselves. In contrast to consumer payments, which tend to be simple, B2B transactions are higher-value, cross-border transactions with more sophisticated settlement mechanisms. This has driven demand for secure, efficient, and trustworthy payment solutions. As businesses seek ways to decrease delays, contain costs, and secure payments, the market will further increase in significance. Digitalization and the move away from the conventional use of paper-based approaches are also driving businesses to embrace more intelligent and effective systems.

The market is influenced by a combination of global titans and robust regional companies, each with their own way of approaching digital payments. World financial giants such as Mastercard Inc., Visa Inc., American Express, and JPMorgan & Chase have led the way for safe and far-reaching solutions. They are joined by companies such as FIS, Stripe, Inc., Squareup Pte. Ltd., and Flywire that are bringing new, tech-based systems that prioritize velocity and ease of use. This mix of long-established institutions and rapid-growth companies maintains competition fierce, which helps businesses of every size.

New entrants inclusive of Paystand, Inc., Payoneer Inc., and Edenred Payment Solutions are also changing the attitude of businesses about payments. Their emphasis on flexibility, price savings, and seamless integration with rising economic technologies is allowing even smaller companies to interact in international trade with reduced obstacles. These tendencies will spark off more companies to go into virtual-first answers and abandon sluggish and elderly methods of doing business like tests and guide processing. The transition owes not best to a shift in generation but also to an evolution inside the way organizations perceive consider, speed, and transparency in financial transactions.

As the marketplace maintains to evolve, the feature of such firms may be to reconcile innovation with protection and regulatory necessities. With international exchange at the upward thrust and companies looking for faster cross-border payments, the want for secure B2B charge systems will hold to become extra reported. Players along with Mastercard, Stripe, Visa, and Payoneer will preserve to persuade how groups conduct transactions, yet regional players may even play a substantial position, especially in enjoyable nearby needs. The destiny of the global B2B payments market will rely upon how correctly those pioneers and entrants can collaborate to attain systems which might be efficient, inclusive, and receptive to the speedy pace of world business.

Market Risks & Opportunities

Restraints & Challenges:

Persistence of manual, paper-based processes and legacy systems. - The global B2B payments market will still be hindered by obstacles as manual documentation and legacy systems impede speed. Most organizations will remain reliant on legacy structures that restrict speed and agility. It will take time, considerable investment, and training to migrate to digital-first operations, causing resistance to change in various industries.

High complexity and cost of cross-border transactions and compliance. - The global B2B payments market will be affected by continued issues in cross-border operations where compliance regulations and foreign exchange increase expense. Companies will grapple with delayed settlements, excessive transaction fees, and region-specific regulations. These barriers will hinder faster adoption of effective global payment systems.

Opportunities:

Embedded finance and integration with procurement/ERP platforms. - The global B2B payments market will be enhanced by integrated financial tools that will make transactions easier right within procurement and ERP systems. With integration, friction is removed, monitoring is stronger, and coins float management is made seamless. These improvements will enable corporations to store time, lessen costs, and enhance standard operational effectiveness.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 98.4 Trillion in 2025 to over USD 214.8 Trillion by 2032. B2B Payments will maintain dominance but face growing competition from emerging formats.

Why the future of this sector is exciting is that it will have an influence on building trust between trading partners. Payment innovations will not only pay bills but also give insights into trade patterns, enabling companies to make judgments about opportunities with greater confidence. With time, the global B2B payments market will be an anchor for world trade, not only providing companies with a means of exchange but a competitive edge. Its evolution will challenge companies to reimagine the exchange of value so that payments are no longer the end of a transaction but the start of better alliances.

Report Coverage

This research report categorizes the B2B Payments market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the B2B Payments market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the B2B Payments market.

B2B Payments Market Key Segments:

By Payment Type

- Domestic Payments

- Cross Border Payments

By Payment Method

- Bank Transfer

- Cards

- Online Payments

By Enterprise Type

- Small & Medium Enterprises

- Large Enterprises

By End Users

- Government

- Manufacturing

- BFSI

- Metal & Mining

- IT & Telecom

- Retail & E-commerce

- Others

Key Global B2B Payments Industry Players

- Mastercard Inc.

- FIS

- Stripe, Inc.

- Paystand, Inc.

- Flywire

- Squareup Pte. Ltd.

- Edenred Payment Solutions

- Payoneer Inc.

- American Express

- Visa Inc.

- JPMorgan & Chase

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252