Sep 26, 2025

The just-released report on the B2B Payments Market by Metastat Insight provides a detailed analysis of an industry that has continued to receive increased focus from financial institutions, technology innovators, and international businesses. This paper is not limited to statistics and projections; it captures the trends and developments defining business-to-business transactions between countries and sectors.

The global B2B Payments Market is expected to realize tremendous growth, with estimates showing it will exceed USD 214.8 trillion in 2032, up from about USD 98.4 trillion as of 2025, growing at a compound annual growth rate (CAGR) of 11.8%. To look through the in-depth findings and have the entire analysis, visit: https://www.metastatinsight.com/report/b2b-payments-market

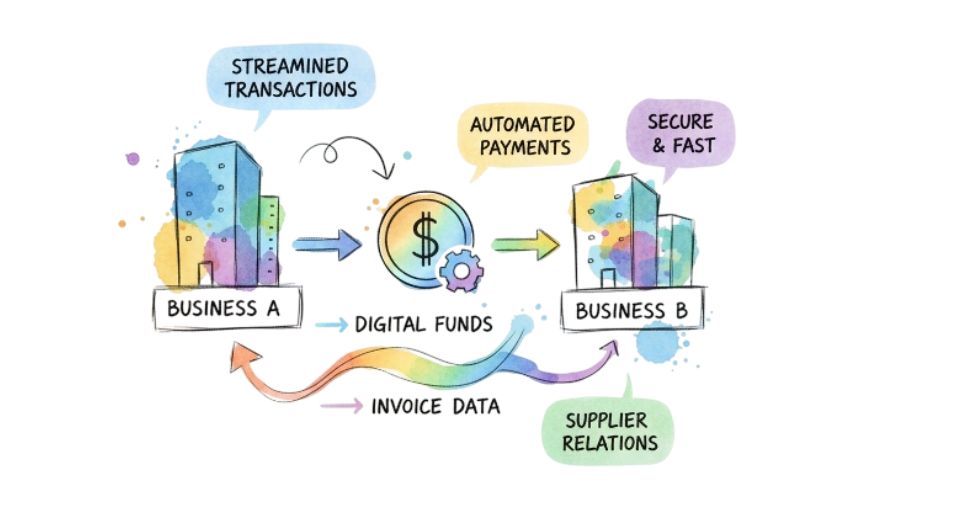

At the core of this market is the evolution of old financial processes into more digital and effective systems. While consumer payments have a tendency to middle on convenience at the character level, B2B transactions deal with higher quantities, multi-level verification approaches, and regulatory strategies that vary across geographies. All these dynamics call for modern answers that reconcile pace with safety, with a view to making sure that global change flows aren't interrupted. The push towards automation, integration with employer resource making plans systems, and seamless reconciliation has redefined how businesses control their operating capital and support dealer relationships.

The momentum of digital adoption within businesses is not limited to transactional efficiency. It also extends to areas such as fraud prevention, compliance management, and the expansion of cross-border networks. Financial technology companies are constantly optimizing platforms to accept a range of payment models, allowing enterprises of every size to better navigate once-harsh settlement terrain. These innovations are creating inclusivity by allowing small and medium-sized enterprises to engage more purposefully in international trade, lessening the gap previously occupied by only large corporations with established banking relationships.

Geographically, usage of innovative B2B payment systems is influenced by diverse regional priorities. Advanced economies are looking to enlarge automation and contain next-technology era into modern-day frameworks. Emerging economies, on the other hand, are adopting digital payments rather than cash transactions, beginning doorways to expedited modernization in trade and alternate. The worldwide panorama depicts an environment where not simply the dimensions of transactions but also requirements of accessibility, transparency, and inter-operability impact advancement.

Competition in this arena is characterized by the way of both traditional finance homes and dynamic fintech upstarts vying to make their reach bigger. Mergers, acquisitions, and tech deployments are all part of a larger trend to stake out new ground and enlarge international attain. These alliances are developing ecosystems that provide extra incorporated solutions, going beyond discrete services to structures that integrate more than one side of enterprise economic control.

In bringing technological advancement, local development, and competitive innovation together, the Metastat Insight B2B Payments Market report transmits more than just statistical projections. It is a response to an industry marked by constant improvement, in which companies across the globe are reinventing the way they trade value. As this shift takes place, it emerges that the market is defined not by set practices but by its endless ability to change and grow, forging the future of international business.

Drop us an email at:

Call us on:

+1 5186502376

+91 73850 57479