MARKET OVERVIEW

The global digital banking market will keep reshaping the experience of financial services, not just for consumers but also for businesses relying on quicker and safer systems. The market won't stay within the conventional concept of online checking of accounts or mobile apps. It will grow into a wider ecosystem where money interaction will be defined by technology, user confidence, and the drive for efficiency. As institutions on different continents converge towards seamless operations, the industry will lay a foundation that makes banking a natural aspect of everyday digital life and not an isolated activity. What will set the global digital banking market in the future apart is its capacity to evolve from an ancillary service to becoming the foremost determinant of the way economies control circulation of funds.

Banks won't just be money custodians but will evolve into centers of technology where security, identity, and customized engagement are handled as prime elements. The sector will be understood from a perspective that blurs both finance and innovation, with customers' expectations driving the pace of change. One of the hallmarks of this market will be how it redefines trust between financial institutions and consumers. Transactions previously requiring face-to-face guarantees will be replaced by digital processes that are equally secure but much more convenient.

This shift will not eradicate personal relationships but will create room for more meaningful interactions enhanced by data and timely insights. The global digital banking market will thus emerge as a decision-making partner in daily life, much beyond the traditional roles banks have hitherto played. The future of the sector will also be characterized by diversity in access. Areas that had hitherto restricted infrastructure will become part of the digital fold, enabling access to financial systems that were previously out of reach. The growth will not merely be an adoption of devices but will demonstrate how banking can be reconfigured to suit local requirements while remaining consistent with international standards.

Every entry into the market will have its own story, demonstrating that digital banking is not an homogeneous product but a malleable system which adjusts to its users. Secondly, the global digital banking market will bring to the forefront convenience versus responsibility. Not just speed of service, but also protection of the integrity of the data. The equivalence of these two will be the cornerstone of its authenticity, so that while speed takes center stage, safety is not compromised. The trend of the industry will hence be one of constant innovation, where trust and technology co-evolve. In the future, the Global Digital Banking industry will be more than a substitute for traditional branches. It will be an industry that establishes financial trust in a digital-first world, transforming how money is managed, shared, and secured. The process will not only be about making transactions modern but making banking an invisible but integral part of everyday human life.

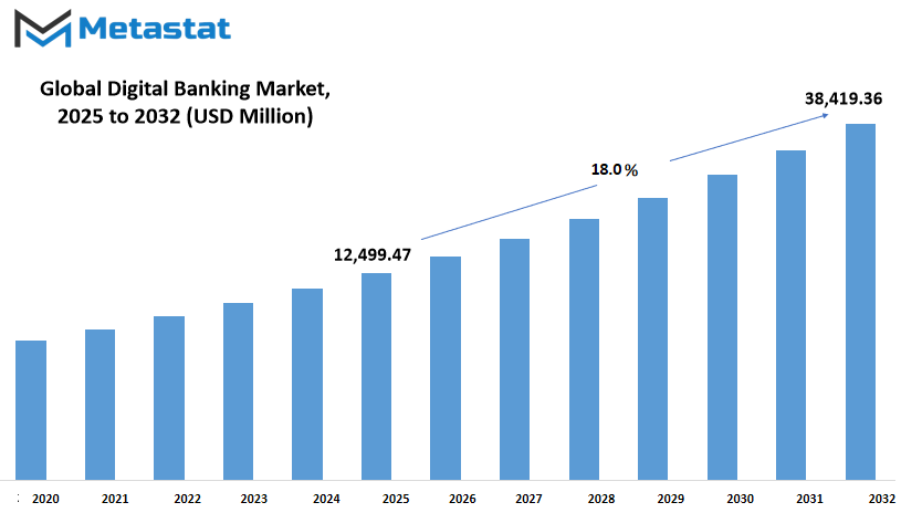

Global digital banking market is estimated to reach $38,419.36 Million by 2032; growing at a CAGR of 18.0% from 2025 to 2032.

GROWTH FACTORS

The global digital banking market is moving toward a future where financial services will become faster, more personalized, and widely accessible. Rapid adoption of smartphones and wider internet penetration will continue to change how people handle banking activities. The preference for convenient and real-time services will push banks and financial institutions to expand digital offerings. Mobile applications and online platforms will increasingly become the primary channels for daily transactions, creating a shift from traditional banking methods toward digital-first solutions. This transformation will bring efficiency, speed, and accessibility, making financial services easier for both individuals and businesses.

Despite this growth, challenges remain. Cybersecurity risks and data privacy concerns will continue to pose significant threats to the global digital banking market. Protecting sensitive financial information will require constant investment in secure systems and technologies. At the same time, banks face high costs when upgrading infrastructure to support advanced digital platforms. Integration of new technologies into older banking systems often proves complex, which might slow down adoption in certain regions or among smaller institutions. These barriers highlight that growth in the digital banking space will require careful planning and substantial resources.

At the same time, new opportunities will emerge. The introduction of AI-driven personalized financial services will transform customer interactions with banking systems. Personalized tools that recommend savings plans, investment options, or spending insights will redefine the relationship between customers and banks. Machine learning and data analytics will allow institutions to anticipate user needs, offering services that feel more tailored than ever before. This personalization will not only strengthen customer satisfaction but also open new revenue streams for the industry.

The future of the global market will also be shaped by rising expectations for seamless digital experiences. Real-time payments, instant fund transfers, and automated financial management will likely become standard. Customers will demand platforms that are simple to use yet secure, pushing banks to innovate continuously. Those able to combine convenience with safety will remain competitive, while others risk falling behind.

Overall, the global digital banking market will expand as technological advancements intersect with customer demand for speed and personalization. Although concerns around cybersecurity and integration will remain, ongoing progress in AI and digital tools will create significant opportunities. The market will not only transform how financial services operate but also redefine the way people engage with money in the years ahead.

MARKET SEGMENTATION

By Deployment Type

The global digital banking market is moving toward a future shaped by advanced technology, customer demand for convenience, and the rapid spread of internet connectivity. As financial services continue to shift from traditional models to digital platforms, banks and financial institutions are finding new ways to operate, improve efficiency, and meet rising expectations. The market is not only about replacing physical branches with apps or websites but about building a complete ecosystem that supports transactions, security, and personalized experiences for users around the world. Growth in this sector will be driven by automation, artificial intelligence, and data analytics, which are being integrated to deliver smarter solutions and faster services.

One important aspect of this change involves deployment type. The global digital banking market by deployment type is further segmented into On-Premises and On Cloud. Both options hold unique advantages, and their adoption will shape the future of digital banking. On-Premises deployment offers greater control and direct oversight of data. It allows institutions to maintain systems internally, providing strong security for sensitive information. This type of deployment will continue to appeal to organizations that prioritize regulatory compliance and need close monitoring of operations. However, it can also mean higher costs for maintenance and limited flexibility, which may affect how quickly services can adapt to change.

On the other hand, On Cloud deployment is steadily gaining momentum. It allows banks to scale quickly, reduce infrastructure expenses, and improve accessibility for both businesses and customers. Cloud-based platforms support innovation by offering faster updates and seamless integration with emerging technologies. The flexibility of the cloud makes it possible to launch new products, expand services, and reach customers across different regions without heavy investment in hardware. Security concerns that once held back adoption are now being addressed with stronger encryption and compliance measures, which will further increase trust in cloud solutions.

The balance between On-Premises and On Cloud will continue to define how the global market evolves. Institutions may choose hybrid approaches, blending the strengths of both models to meet their specific needs. This combination could allow for greater control over sensitive data while also benefiting from the scalability and cost efficiency of the cloud. As technology progresses, cloud-based deployment will likely become the dominant choice, but On-Premises will remain relevant in areas requiring higher control and compliance.

Looking forward, the global digital banking market will continue to expand as digital transformation reshapes finance worldwide. The future will be marked by more personalized services, improved security, and greater accessibility, with deployment choices playing a central role in how institutions deliver value to customers.

By Services

The global digital banking market is moving toward a future shaped by both advanced technology and customer-focused services. The expansion of this market will not only redefine how financial institutions operate but also influence how people manage money on a daily basis. By services, the market is divided into cash deposits and withdrawals, fund transfers, auto-debit and auto-credit services, loans, information security, risk management, financial planning, stock advisory, and other related solutions. Each of these services will continue to grow as digital platforms become more efficient, secure, and accessible.

Cash deposits and withdrawals in digital banking will remain essential because convenience is a driving factor for consumers. Automation in these services will speed up transactions, reduce waiting time, and cut down operational costs for banks. Fund transfers will benefit further from instant processing and cross-border capabilities, allowing smoother global trade and personal remittances. Auto-debit and auto-credit services will become more intelligent by integrating artificial intelligence to predict payment patterns, offering greater accuracy and reliability.

Loans within the global market will also advance as credit evaluations rely more on digital data points rather than traditional paperwork. This approach will increase financial inclusion by making borrowing possible for groups that were previously underserved. Information security will stand at the center of this growth. As digital banking expands, cyber threats will also increase, making advanced encryption, biometric verification, and real-time monitoring a necessity rather than an option.

Risk management in digital banking will continue to evolve with predictive tools that identify irregular activity before it becomes harmful. Financial planning services offered online will grow more personalized, using data analytics to create tailored advice for saving, investing, and retirement planning. Stock advisory services will expand as more investors look for convenient digital platforms that provide instant insights into market trends and portfolio performance. Other services such as bill payments, tax assistance, and insurance management will also gain more demand as users seek to access everything in one place.

The future of the global digital banking market will be defined by adaptability and integration. The market will move beyond offering just basic banking services and transform into a comprehensive digital financial ecosystem. As technology develops further, the line between traditional banks and digital platforms will fade, creating an environment where efficiency, security, and innovation will shape everyday financial activities. This ongoing expansion will ensure that digital banking becomes not just an option but a primary mode of financial management worldwide.

By Technology

The global digital banking market is moving toward a future shaped by rapid technological adoption, changing customer preferences, and strong financial innovation. As financial institutions continue to invest in advanced solutions, the focus is shifting from traditional operations to digital-first strategies that will redefine customer engagement and service delivery. The demand for secure, fast, and personalized financial services is growing, and this will influence how banks and fintech companies design future offerings.

By technology, the global digital banking market is divided into Internet Banking, Digital Payments, and Mobile Banking, each contributing to the transformation of financial systems. Internet Banking will continue to evolve with improved platforms that allow seamless access to services anytime and anywhere. Security measures such as biometric logins and AI-driven fraud detection will strengthen customer trust. Digital Payments will remain central to daily financial activity, with contactless transactions, digital wallets, and blockchain-based systems gaining wider acceptance. These innovations will reduce reliance on physical currency and simplify cross-border transactions, creating a more connected financial environment. Mobile Banking will expand further as smartphones become the primary device for financial management. Enhanced mobile apps with AI chatbots, instant transfers, and investment tools will turn mobile banking into a complete financial hub for individuals and businesses alike.

The global market will benefit greatly from the growing use of artificial intelligence, machine learning, and big data analytics. These technologies will allow banks to predict customer needs, recommend personalized services, and detect risks in real-time. Cloud computing will also play a vital role in scaling operations and ensuring data security. The integration of advanced technology will not only improve efficiency but also create opportunities for banks to provide tailored experiences that meet the expectations of a digital-savvy population.

Future growth of the global market will be supported by regulatory frameworks that encourage innovation while ensuring consumer protection. Governments and financial authorities will continue to shape policies that promote secure digital ecosystems. Collaboration between banks and technology providers will accelerate product development, bringing more accessible and affordable financial services to a wider audience.

In the coming years, the global market will be marked by increasing competition, stronger partnerships, and continuous innovation. As digital channels become the main touchpoint for financial activities, the boundaries of traditional banking will expand, offering customers more choices and greater convenience. With technology advancing at a steady pace, the future of the global digital banking market will be defined by smarter solutions, improved accessibility, and stronger customer trust.

By Industries

The global digital banking market is growing at a fast pace and will continue to change the way industries function in the future. This market will bring major shifts in how financial services are delivered, making operations smoother and more connected across different sectors. As technology becomes a stronger part of everyday business, the global market will expand its reach and offer new opportunities for innovation. The use of advanced platforms will not only improve speed and security but will also create a more user-friendly experience for both companies and consumers.

In media and entertainment, the global market will support faster transactions and new models of digital content distribution. Secure payment systems will encourage more direct engagement between audiences and providers. With advanced digital banking tools, subscription services and online platforms will have easier ways to manage global payments, making growth more achievable in diverse regions. This will help the industry strengthen its global presence.

In manufacturing, the global market will play a role in making supply chains stronger. Fast digital transactions will reduce delays, while secure systems will allow safer movement of funds between global partners. As more manufacturing firms adopt automated processes, digital banking will help in managing cross-border trade and in streamlining vendor relationships. This will result in faster delivery cycles and better collaboration across regions.

For retail, the global market will support the increasing demand for online shopping. With secure digital payments and real-time processing, retailers will be able to provide a seamless shopping experience. The use of advanced financial tools will make loyalty programs and personalized offers more effective, while also ensuring safety for both businesses and buyers. Global expansion for retail brands will be more achievable with the backing of stronger digital banking systems.

The banking sector itself will see the largest transformation within the global market. Traditional models will shift to fully digital frameworks, allowing for round-the-clock services and improved customer engagement. With the growth of mobile platforms and AI-based tools, banks will be able to deliver faster and more accurate financial solutions. This will strengthen trust and efficiency across the sector.

In healthcare, the global market will provide better payment systems for medical services, insurance claims, and cross-border treatments. Secure platforms will allow for quicker billing and easier coordination between patients, providers, and insurers. This will improve global access to healthcare solutions and ensure smooth financial processes in a sector where time and accuracy are crucial.

Overall, the global digital banking market will become a driving force that shapes industries in the future. By improving security, speed, and accessibility, it will connect industries in new ways and create a stronger global economy.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$12,499.47 million |

|

Market Size by 2032 |

$38,419.36 Million |

|

Growth Rate from 2025 to 2032 |

18.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global digital banking market is becoming a central driver of how financial services will be shaped in the coming years. With technology advancing at a rapid pace, the market is expected to provide opportunities that will redefine how individuals and businesses access financial systems. This transformation is not only about speed and convenience but also about security, transparency, and innovation. Growing adoption of digital payment platforms, mobile banking applications, and artificial intelligence will create a stronger and more accessible banking experience for customers worldwide.

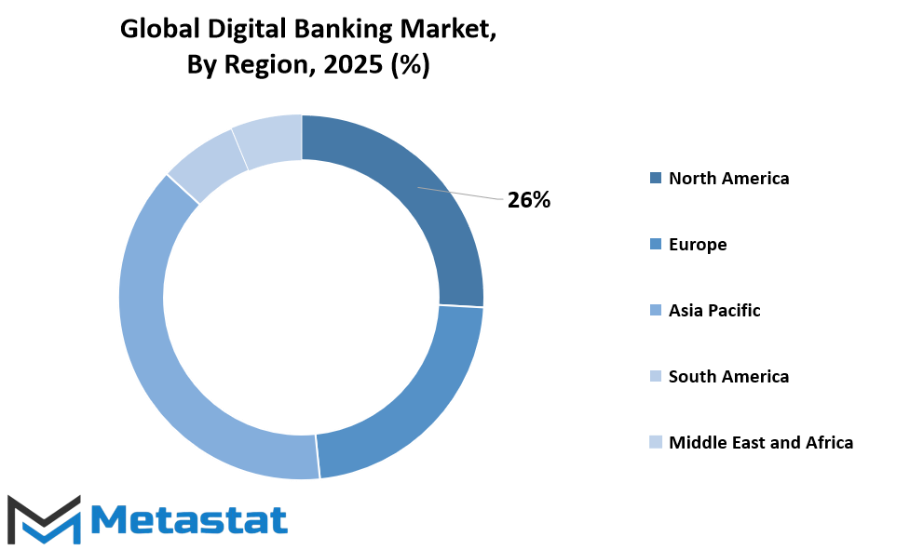

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided into the U.S., Canada, and Mexico, with the U.S. leading due to strong technological infrastructure and a high rate of digital adoption. Canada and Mexico are showing steady growth, supported by increasing smartphone penetration and expanding internet connectivity. Europe consists of the UK, Germany, France, Italy, and the Rest of Europe. Countries like Germany and the UK are witnessing faster integration of digital platforms, while other regions in Europe are gradually adopting modern banking services at a steady pace.

In the Asia-Pacific region, segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific, digital banking is expected to expand significantly due to a large unbanked population, growing fintech startups, and government support for digital initiatives. China and India are projected to emerge as leaders with massive populations embracing mobile wallets and digital transactions. Japan and South Korea, known for advanced technology, will continue to set new standards in digital innovation.

The South America region, including Brazil, Argentina, and the Rest of South America, is showing potential with increasing investment in financial technology and a younger population that prefers mobile-first banking experiences. Brazil, in particular, is expected to stand out as a leading market due to rising demand for secure digital payment methods.

In the Middle East & Africa, categorized into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, growth is being encouraged by government-led strategies to promote financial inclusion. GCC Countries are moving rapidly toward cashless economies, while South Africa and Egypt are beginning to adopt mobile banking solutions to bridge the gap between traditional and modern systems.

The future of the global digital banking market will likely revolve around creating more inclusive, efficient, and innovative financial ecosystems. Each region will contribute differently, but together the progress will redefine how banking operates on a global scale.

COMPETITIVE PLAYERS

The global digital banking market is expected to grow rapidly as technology continues to shape the future of financial services. With increasing customer demand for convenient, fast, and secure banking solutions, institutions are investing heavily in advanced digital platforms. Traditional banking models are shifting toward mobile-first solutions, and this change is likely to redefine how financial activities will be carried out in the coming years. Digital transformation will not only help banks reduce costs but also enhance customer experience by offering personalized services and real-time support.

Growth in the global market will also be influenced by innovations in artificial intelligence, blockchain, and cloud computing. These technologies will make transactions safer, faster, and more transparent. At the same time, they will enable financial institutions to predict customer needs, automate routine tasks, and deliver tailored solutions. The integration of these tools will create a more connected and seamless financial ecosystem, where both individuals and businesses will benefit from efficiency and security.

Key players in the industry are already setting strong foundations for the future. Companies such as Appway AG, The Bank of New York Mellon Corporation, CREALOGIX AG, ebankIT, and ETRONIKA are advancing digital solutions that are reshaping financial services. Firms including SBS Software, Finastra, Halcom, Infosys Limited, and Intellect Design Arena Ltd are introducing platforms that will improve scalability and meet the needs of global clients. Temenos Headquarters SA, NETinfo Plc, NF Innova, Oracle Corporation, and SAP SE are focusing on technology-driven banking solutions that will address compliance, security, and operational challenges. Other significant contributors like Sopra Steria, Tata Consultancy Services Limited, Galileo Financial Technologies, and Worldline are ensuring that digital banking remains accessible, reliable, and adaptable to future demands.

The global market will also benefit from increasing internet penetration and smartphone usage across both developed and emerging economies. With younger generations expecting fast, mobile-friendly services, digital banking is set to become the standard rather than an alternative. This shift will push banks to improve digital offerings, strengthen cybersecurity, and maintain regulatory compliance while staying competitive.

Looking ahead, the global digital banking market will continue to expand as financial institutions and technology providers work together to meet evolving customer expectations. The combination of advanced tools, strong competition, and customer-focused innovation will ensure that digital banking remains a central part of global finance, paving the way for a smarter, more inclusive financial future.

Digital Banking Market Key Segments:

By Deployment Type

- On-Premises

- On Cloud

By Services

- Cash Deposits and Withdrawals

- Fund Transfers

- Auto-Debit/Auto-Credit Services

- Loans

- Information Security

- Risk Management

- Financial Planning

- Stock Advisory

- Others

By Technology

- Internet Banking

- Digital Payments

- Mobile Banking

By Industries

- Media & Entertainment

- Manufacturing

- Retail

- Banking

- Healthcare

Key Global Digital Banking Industry Players

- Appway AG

- The Bank of New York Mellon Corporation

- CREALOGIX AG

- ebankIT

- ETRONIKA

- SBS Software

- Finastra

- Halcom

- Infosys Limited

- Intellect Design Arena Ltd

- Temenos Headquarters SA

- NETinfo Plc

- NF Innova

- Oracle Corporation

- SAP SE

- Sopra Steria

- Tata Consultancy Services Limited

- Galileo financial Tecnologies

- Worldline

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383