MARKET OVERVIEW

The Global UHMWP Fiber in Military Industry market is therefore a niche market focused on the production and application of UHMWP fibers for military purposes; it highlights the unique strength, lightweight, and durabilities of UHMWP fibers as being very critical for the advancement of military technologies and applications. UHMWP fibers, therefore, are engineered products that deliver high-performance solutions well tailored to meet the needs of defense organizations worldwide.

For military applications, UHMWP fibers are incorporated into products where the importance of protection and tactical benefits takes precedence. The integration of UHMWP fibers enhances the effectiveness and safety of the use of body armor, ballistic-resistant vests, and vehicle protection systems. High tensile strength, combined with resistance to wear and tear, makes the use of these fibers highly important in ropes, nets, and parachutes. The emphasis of the market lies in designing products that are resistant to extreme environmental conditions and rigorous usage with a minimal weight that supports mobility and ease of deployment.

The Global UHMWP Fiber in Military Industry will continue to evolve with the advancement of defense technology and rising demand for high-tech protective gear. Manufacturers will focus on improving fiber toughness and performance when subjected to high-stress conditions. As militaries around the world resort to better materials to handle emerging threats, UHMWP fibers will likely form an indispensable part of the design of the next-generation systems.

Strategic collaboration between the manufacturers of fibers and the defense agencies will be instrumental in driving market growth. Solution tailormade to cater to specific demands for operations of military forces across the globe are going to drive innovation in this industry. Such collaboration is expected to foster development in advanced composite materials wherein UHMWP fibers could be combined with other advanced materials to achieve unexampled standards of performance.

In addition, the Global UHMWP Fiber in Military Industry market will focus on sustainability along with performance. As growing environmental concerns become more important, UHMWP fiber manufacturers could seek eco-friendly production to produce UHMWP fibers. Sustainable practices will not only be a response to environmental responsibility but, at the same time, fit into the broader, more general goals of modern defence organizations that increasingly value technologies as green.

The geopolitical landscape will affect this market, with demand patterns to shift as countries invest in defense upgrades to maintain their competitiveness. Research and development will form the center of the industry and continue to drive breakthroughs into how UHMWP fibers are used in military operations. The resultant efforts will be toward developing more thermally resistant, higher durability, and less expensively produced materials to place these fibers within the scope of a wider range of defense budgets.

The sector will continually evolve to meet the multifaceted needs of modern military operations, ensuring the safety and efficiency of personnel and equipment in challenging environments. Such trajectory highlights the critical role markets can play in shaping the military capacity to fight effectively within tomorrow, as material science pushes toward leaps and strategic collaborations across defense sectors.

Global UHMWP Fiber in Military Industry market is estimated to reach $756.2 Million by 2031; growing at a CAGR of 12.8% from 2024 to 2031.

GROWTH FACTORS

The Global UHMWP Fiber in Military Industry market will stand out as a bastion of innovation in defense technology in the coming years. Increasing demand across the world is causing growth in the market for high-level personal protection equipment used for military applications. This can be attributed to the fact that increasing demands in military situations necessitate the use of better protective equipment that will allow personnel to work with maximum safety and efficiency. Global governments have been striving for better defense capabilities, as evidenced by the consistent growth in their defense budgets. These investments aim at equipping military forces with the advanced protective gear required to meet today's requirements for durability, lightweight, and functionality.

Despite this promising growth, there are still some issues that arise. One major challenge remains in the fact that UHMWP fibers are costly to produce. These fibers find wide-scale usage in producing personal protection gear because of excellent strength-weight ratios and a high ability to resist impacts. However, this expensive production cost may cause end products not to be economical, as they remain inelastic or less than a reasonable limit in more sensitive markets and regions. Not much of awareness or lesser adoption also hinders growth in those parts of the world. Market, in areas where advanced protective equipment is not well known or understood or prioritized, is not going to fully achieve its potential.

However, the future is quite promising for this market. Hybrid composites are one of the avenues through which development can be made. UHMWP fibers can be combined with other materials to create products that are more performance-enhanced while also addressing some of the cost-related issues. Such innovations can make protective equipment stronger and lighter while being more accessible to a wider audience.

As the demand for advanced personal protective equipment increases, it is expected that the industry would evolve and change to overcome the current shortcomings. The measures to reduce production costs, increase awareness, and bring innovative solutions will be highly influential in determining the path of growth for the market. With the advancement in materials and technologies, significant developments are expected to come with the passing years. The products will be widely spread, and military operations across the globe will become more safe and effective.

MARKET SEGMENTATION

By Type

The category is segmented into several specific types. This includes ropes and cables, ballistic protective materials, tents and fabrics, fishing nets and lines, among other related items. Ropes and cables are most extensively used in industries as these have strength and flexibility qualities. They are found most important in construction and shipping, and even during fun activities such as climbing or sailing. Ballistic protective materials are also the crucial elements in defense and safety sectors. These materials are made to work under high-velocity impact conditions and will protect individuals whether they are military people or civilians who are threatened in such dangerous situations.

Tents and fabrics would also form an important portfolio as it would be largely applied for outdoor activities like adventure sports, disaster reliefs, and military forces. Such materials are quite appreciated due to their reliability and ability to withstand several weather conditions, providing good shelter. Fishing nets and lines are essential for the fishing industry. These products are used to catch fish and other marine life, with designs tailored to different types of fishing, whether commercial or recreational. The quality of these nets and lines is vital for ensuring successful and efficient fishing operations.

Apart from the above categories, there are other products that don't fit into the neat groups but still play a significant role in industries such as agriculture, textiles, and security. These include ropes used for different purposes, fabrics used for diverse applications, and other specialized materials that serve a variety of needs. Each segment serves a unique function, offering solutions to specific problems or needs across different sectors. The wide variety of products ensures that they can be tailored to meet specific requirements in diverse environments, from the toughest military operations to everyday activities.

With industries growing, and new challenges arising every day, these materials' demand will likely increase in the future. Their adaptability and use in different applications make them indispensable to many different fields.

By Application

It is also divided into key categories based on applications of the market. Such divisions are personal protection, vehicle protection, naval defense, ropes and cables for military, and other defense applications. These serve different purposes, contributing to the defense effort toward effectiveness and security.

Among these most important sectors is personal protection, which focuses on safeguarding the individual in defense-related operations. This involves designing personal protection equipment like body armor, helmets, and other apparatuses meant to protect soldiers and personnel from the possibility of harm in a combat or hostile environment. Personal protection is crucial for the well-being of individuals engaged in high-risk operations.

The application in the vehicle protection sector is equally significant because protection of military vehicles, like tanks, armored personnel carriers, and trucks, is an area that is absolutely necessary. Here, advanced materials and technologies are used to increase the resistance of these vehicles to attack. Vehicle protection systems involve armored plating, blast-resistant components, and other defense mechanisms which may minimize the damage due to explosives, gunfire, etc.

Naval defense involves protecting naval assets, which include ships, submarines, and other maritime vessels. In this category, technologies have been developed to protect vessels against missile attacks, underwater threats, and other dangers that may arise during naval operations. Naval defense applications significantly play a role in the security of naval fleets and the control of territorial waters.

Military ropes and cables represent an important component of the defense system in most armed operations. Specialized materials, among others, are applied in securing equipment, supporting the operations, and safety measures on high-risk activities. Military ropes and cables are manufactured to withstand extreme situations, including heavy loads, harsh weather, and environments of high stress.

Lastly, there are defense applications that do not specifically fall into the above-mentioned categories. These may be in the form of surveillance technologies or products used in communication and logistics that can make up the overall effectiveness of defense operations.

All these applications play an important role in the defense industry. As security challenges continue to evolve, so will these areas, and it is through this process that defense forces will remain abreast of emerging threats.

By Distribution Channel

The market can be further divided based on the distribution channels. These include direct sales to military agencies, contracts with defense contractors, and third-party distributors. Direct sales to military agencies are a major part of the market. In this distribution model, companies are involved in direct transactions with government bodies or military organizations to provide products or services specifically tailored to the needs of defense. These sales are usually long-term relationships that demand a lot of trust and reliability.

The other essential distribution channel is the contract with defense contractors. It is a method whereby the companies enter into agreements with large defense contractors who go ahead to supply the military or other government organizations. These are usually detailed contracts that expect the companies to comply with strict standards and regulations. The use of defense contractors enables smaller companies to get access to larger, more established networks and benefit from the contractor's expertise in handling government dealings.

Third-party distributors also play a crucial role. The third-party distributors act as intermediaries, purchasing the products from the manufacturers and reselling them to military agencies or defense contractors. In this manner, third-party distributors expand the reach of a product by connecting the manufacturers with a broader network of potential buyers. This is usually utilized when firms intend to enter markets or areas in which they cannot reach directly; it helps a company cut through the regulatory tangle of local laws and preferences.

Each of these distribution channels has its pros and cons. The advantage of direct sales is control and close relationships with customers, while the disadvantages include a significant amount of resources and know-how in dealing with governmental contracts. Working through defense contractors may make things easier, but it may also involve competition and the need to meet high standards. Third-party distributors are effective in increasing market reach but may sometimes limit the manufacturer's control over pricing and customer interactions. In all cases, businesses need to consider the best way to distribute their products based on their goals, resources, and target market.

By End-User

The global UHMWP Fiber market in the military industry is divided into several segments based on the end-user categories. The categories of the end-user include Army, Navy, Air Force, and Paramilitary Forces. Each of these sectors has specific needs that UHMWP Fiber can address, making it a vital material for a wide range of military applications.

Army would include UHMWP Fiber application as part of the protective apparatus body armor, helmets, or ballistic vests. Its mechanical strength and durability are just what is needed in items designed to protect soldiers operating with combat. It is available in lightweight, high-performing ballistic protection, that allows soldiers to do missions while staying safe. In addition to personal armor, UHMWP Fiber also finds its application in the development of vehicle armor, a critical protection for military vehicles.

The Navy also makes wide-ranging applications of UHMWP Fiber. For instance, this fiber is applied in protective sailor suits built to protect the sailors in extreme conditions. High tensile strength, coupled with high resistance to abrasion, makes it an ideal application for naval operations in terms of cables, ropes, and nets. The ruggedness of the material, which withstands the harsh conditions of marine environments, assures protection to both Navy personnel and equipment.

With regards to the Air Force, one of the key materials utilized in aircraft protection development using UHMWP Fiber; the fiber is used as a material to produce the tough, lightweight components that stand up to flight stresses to protect against damage from threats in the form of bullets. UHMWP Fibers are also applied within the production of parachutes and other airborne equipment such as ensuring safety for personnel through high-risk situations.

Paramilitary Forces also uses UHMWP Fiber for applications that are similar to the applications used by the Army, Navy, and Air Force. The strength and versatility of the material make it ideal for protective clothing, vehicles, and other equipment that law enforcement and security forces use in challenging situations.

The global UHMWP Fiber market in the military industry is diverse, with applications across the Army, Navy, Air Force, and Paramilitary Forces. The material's unmatched strength, durability, and versatility make it an essential part of military operations, providing critical protection for personnel and equipment.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$400.4 million |

|

Market Size by 2031 |

$756.2 Million |

|

Growth Rate from 2024 to 2031 |

12.8% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

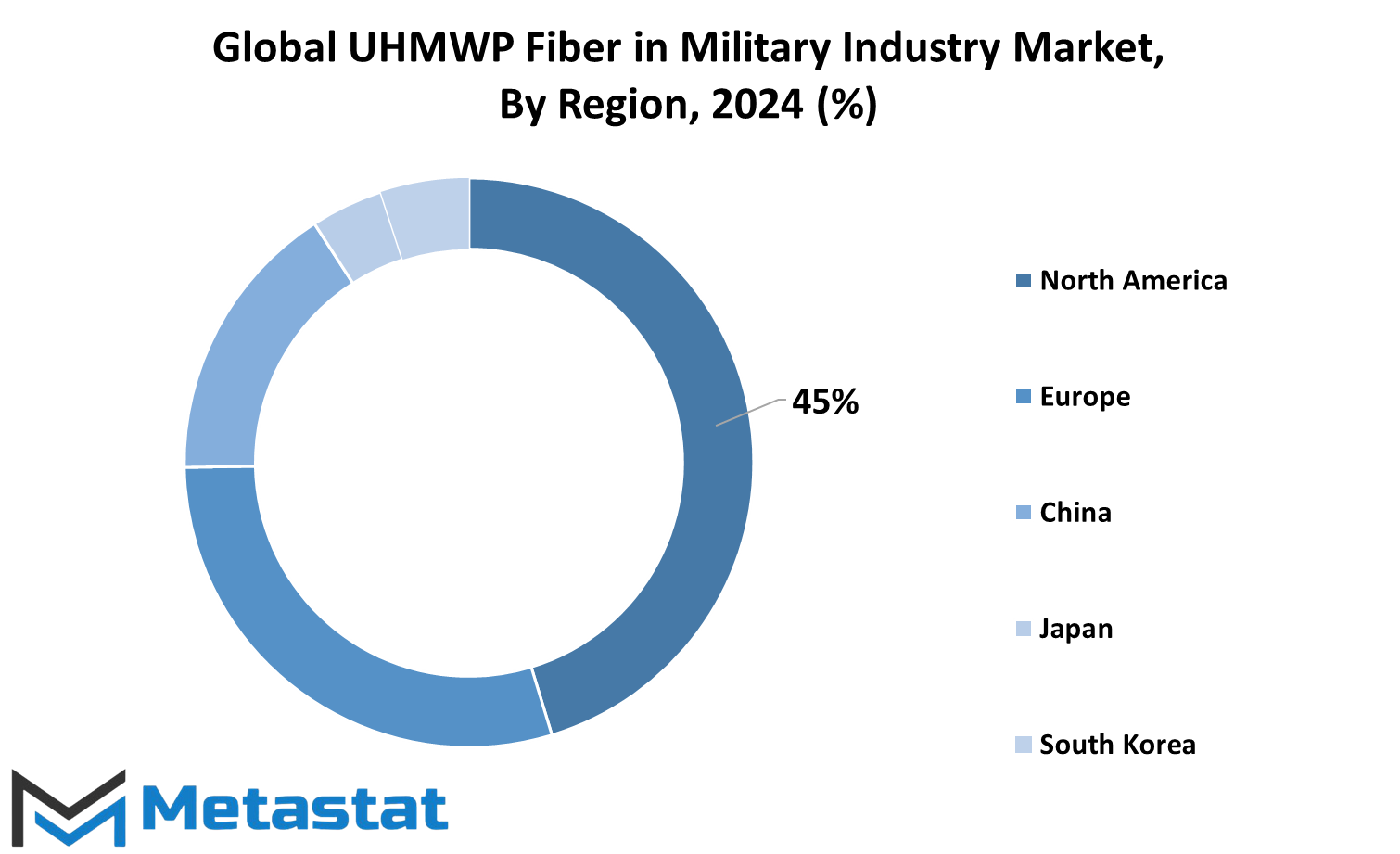

Geography wise, the global UHMWP fiber market for military can be classified into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. Under North America, the market can be categorized into U.S., Canada, and Mexico. The Europe region can be segregated into various major countries which include UK, Germany, France, Italy, and the remaining countries of Europe. Inclusion of the Asia-Pacific Region: This region comprises nations including but not limited to India, China, Japan, South Korea, and others in the Asia-Pacific. South America is divided as Brazil, Argentina, and the rest of South America. Middle East & Africa is further divided into regions such as GCC countries, Egypt, South Africa, and the rest of them.

All these regions add up to a considerable segment in terms of the global market where varied countries are contributing in distinctive ways. Over the next few years, growth is projected to rise dramatically in the North American UHMWP (Ultra-High-Molecular-Weight Polyethylene) Fiber market in the military. Market size will be about 189.0 million US dollars by the end of 2026, rising from 89.3 million US dollars. This growth is at a compound annual growth rate of 13.3% from 2020 to 2026. UHMWP fiber, characterized by high strength, durability, and abrasion resistance, is increasingly being used in military applications such as body armor, ballistic protection, and other advanced defense technologies.

The military sector still holds an upward demand for more advanced and reliable protective materials. Consequently, the UHMWP fiber market will steadily continue its expansion. Europe, with a robust defense industry, also contributes significantly. In Asia-Pacific, an expanding defense need in the countries of China, India, and Japan further pushes the market's boundaries. South America and Middle East & Africa also symbolize emerging markets where military technologies are advancing, which increases demand for high-performance materials like UHMWP fiber.

The regional breakdown identifies the key trends and market drivers in each area, such as technological advancements, defense spending, and the need for stronger, lighter materials in military applications. Understanding regional dynamics will be crucial to the growth of the UHMWP fiber market in the military industry, where demands and capabilities continue to evolve in each region.

COMPETITIVE PLAYERS

Several large firms influence the UHMWP fiber market in the military industry. Some of the major firms are DSM, Toyobo, Honeywell, Hunan Zhongtai Special Equipment Co., Ltd., Ningbo Dacheng, Beijing Tongyizhong Specialty Fiber, Xiangsheng Group, BAE Systems, MKU Limited, Mitsubishi Chemical Advanced Materials, Teijin Limited, and Avient Corporation. These firms play a key role in the development and expansion of the industry with individual expertise and advanced technologies.

DSM has made important contributions towards innovation in material science, helping produce UHMWP fibers that guarantee high-performance solutions in the field of military defense. In this category comes Toyobo, one of Japan's main players, providing advanced fibres widely employed in any kind of equipment used during military applications-in particular in body armor and in protective wear. Honeywell is not an exception at all either; they represent technological inputs into the equipment with specific materials to improve durability and strength when applied in use.

Hunan Zhongtai Special Equipment Co., Ltd. and Ningbo Dacheng, China-based companies, have improved their market positions in the UHMWP fiber market by offering products that meet the demanding needs of military defense. Beijing Tongyizhong Specialty Fiber and Xiangsheng Group are also engaged in the production of UHMWP fibers for military use, offering specialized materials that are critical in various defense applications.

BAE Systems, MKU Limited, and Mitsubishi Chemical Advanced Materials contribute to the military industry on a global scale by designing and manufacturing high-quality fibers used for armor, protective clothing, and other military systems. In terms of continuing innovation through high-performance material, the company Teijin Limited remains a top player that provides fibers to help enhance protection and performance capabilities of the military personnel and equipment.

Avient Corporation is a leading material solutions company in this market. Advanced UHMWP fibers are being developed by Avient to meet the ever-growing demand for protective materials in the military industry. This diverse group of companies will keep the UHMWP fiber market in the military sector growing and bring new, more effective solutions to the needs of defense forces worldwide.

UHMWP Fiber in Military Industry Market Key Segments:

By Type

- Ropes and Cables

- Ballistic Protective Materials

- Tents and Fabrics

- Fishing Nets and Lines

- Others

By Application

- Personal Protection

- Vehicle Protection

- Naval Defense

- Ropes and Cables for Military Use

- Other Defense Applications

By Distribution Channel

- Direct Sales to Military Agencies

- Contracts with Defense Contractors

- Third-Party Distributors

By End-User

- Army

- Navy

- Air Force

- Paramilitary Forces

Key Global UHMWP Fiber in Military Industry Industry Players

- DSM

- Toyobo

- Honeywell

- Hunan Zhongtai Special Equipment Co., Ltd.

- Ningbo Dacheng

- Beijing Tongyizhong Specialty Fiber

- Xiangsheng Group

- BAE Systems

- MKU Limited

- Mitsubishi Chemical Advanced Materials

- Teijin Limited

- Avient Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252