MARKET OVERVIEW

The global LNG market will continue to redefine the energy industry's limits as it evolves beyond traditional expectations. As international locations slowly transition closer to cleanser options, this marketplace will now not be a brief answer between fossil fuels and renewables it will chart its very own direction. The global LNG market is no longer confined through transport, garage, or change by myself; instead, it's going to amplify across industries, impacting geopolitical shifts, remaking regional economies, and growing unexpected era leaps.

Liquefied herbal gas, traditionally, has been linked to filling energy gaps, coping with seasonal demand, or supplementing risky energy grids. The market will now not be constrained to these utilitarian functions. With the growth of floating LNG facilities and decentralized power answers, LNG will play a pivotal role in redefining off-grid strength deliver, mainly in developing countries that hold to pursue scalable but smooth alternatives. As infrastructure evolves into the modern-day era, the LNG enterprise will become part of sophisticated strength portfolios wherein it assists business boom and urbanization rather than simply complementing call for.

Digitalization will imply a completely different technique to LNG operation compared to the beyond. Sophisticated analytics, blockchain networks for monitoring and contracts, and actual-time facts change among manufacturers and importers will be the norm and no longer the exception. These technology will get rid of inefficiencies and sell a more vibrant trading marketplace. Additionally, AI will provide demand forecasting that is minimized waste and enhanced delivery accuracy. These systemic shifts will enable the market to work closer to how a tech-enabled service industry operates, rather than a high fuel content supplier.

The global LNG market will also change in its relationship with policy. Rather than having to react to regulations, players within the industry will proactively contribute to the environmental standards they operate under. Carbon-neutral LNG cargoes and green hydrogen usage in liquefaction operations will be pointers of this direction. Where it was once viewed as part of the problem, the LNG industry will more and more be viewed as part of the solution to the transition covering current infrastructures towards aggressive carbon cuts. This shift in attitude will influence how its future is invested in by stakeholders governmental and commercial.

One very neglected path will be utilization of LNG in non-power-related markets, including transportation and industry. Heavy trucking fleets, maritime shipping, and even mining will utilize LNG not as a replacement, but rather as a fundamental element of their fuel blend. The transportability and scalability of LNG will provide benefits that electricity and liquid fuels cannot in out-of-the-way or logistically difficult locations.

As new frontier opportunities emerge and innovations make small LNG projects increasingly feasible, the global LNG market will increase not just in volume but also in nature. It will be a meeting place for energy access, sustainability aspirations, and digital transformation. Behind its traditional perception is a market that will shape more than energy numbers it will shape global economic, environmental, and technological trends in the decades ahead.

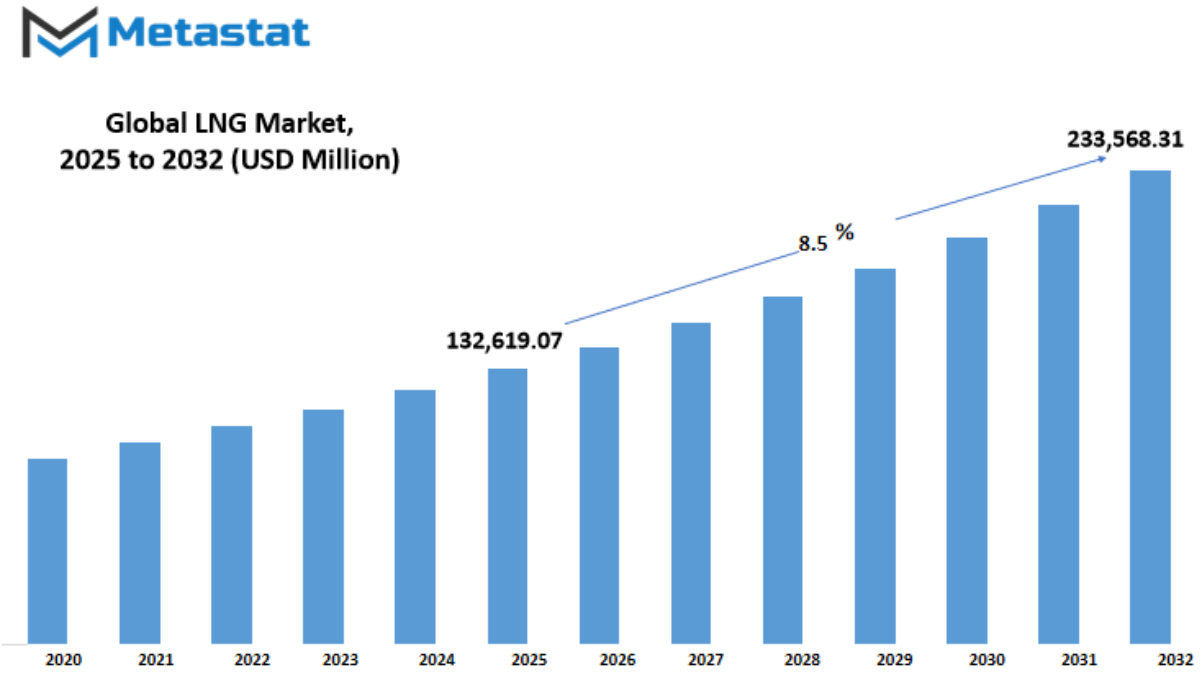

Global LNG market is estimated to reach $233,568.31 Million by 2032; growing at a CAGR of 8.5% from 2025 to 2032.

GROWTH FACTORS

The global LNG market is gaining momentum steadily as the globe moves steadily closer to purifier sources of strength. With extended situation over carbon emissions and environmental sustainability, LNG has been regarded as a possible opportunity to conventional fossil fuels. Most international locations are now searching at LNG not handiest as an intervening time gasoline but also as a protracted-term substitute to fulfill increasing power needs. This increasing demand is fueled more often than not by using industrialization, urbanization, and the necessity for steady energy, specially in areas wherein renewable strength can not provide base-load on my own. As nations try to move far from coal and oil dependence, LNG is especially mentioned for being comparatively cleanser and extra efficient in electricity era as well as transportation.

Benefiting the global LNG market to increase even further is increasing LNG infrastructure in rising markets. These areas are making an investment in import terminals, storage facilities, and distribution networks so that LNG can be made to be had and priced at less costly tiers. Public-non-public financing and government-subsidized initiatives have created a subculture conducive to those investments, particularly in international locations in Asia and portions of Africa. The capacity to send LNG over huge distances by sea also presents trading opportunities to exporters located in the Middle East, the United States, and Australia. As infrastructure becomes stronger and more interconnected, LNG is emerging from being a niche fuel to becoming an easily accessible player in the global energy mix.

The global LNG market has some tough challenges ahead, however. One of the largest demanding situations is the fee associated with liquefaction, transport, and regasification of herbal gasoline. These techniques are capital-in depth, and the rate inevitably is exceeded directly to very last customers inside the shape of increased expenses, rendering LNG much less aggressive than coal or maybe pipeline gasoline in a few markets. In addition, volatility of the market and instability of global expenses may additionally mirror on both supply agreements and future funding. This rate issue restricts the usage of LNG in fee-sensitive or much less evolved markets where strength affordability is of key subject.

Besides the cost troubles, regulatory and environmental issues are increasingly more crucial. Most LNG tasks should go through lengthy approvals due to the environmental, land use, and protection components. Increasingly stringent emission rules and neighborhood competition in certain areas further put off or stall assignment expansions. These demanding situations can thrust back creation schedules and demotivate investors from making an investment in high-potential initiatives. With growing attention directed at fossil gasoline initiatives in fashionable, LNG developers ought to enhance compliance and reduce their environmental effect to steady public and regulatory acceptance.

Despite those challenges, there are encouraging symptoms for future improvement. Advances in technology, particularly in small-scale LNG structures, are making get entry to available in hitherto inaccessible areas. All these answers allow LNG to be utilized in off-grid societies, small industries, and even powering automobiles and ships. Through the minimization of requirements for massive infrastructure and bendy delivery alternatives, small-scale LNG is opening up opportunities in faraway and developing regions.

MARKET SEGMENTATION

By Infrastructure

The global LNG market stays at the growth, fueled through growing strength intake and the conversion to cleaner fuels. Liquefied Natural Gas (LNG) has emerged as a key contributor to enjoyable the arena's energy requirements, especially as international locations abandon using coal and oil. The reality that it is able to be transported over huge distances without the need for pipelines enhances its software wherein natural gas deposits are not reachable. Due to this, funding in LNG infrastructure has visible notable growth, presenting a solid foundation for growth inside the quarter.

Infrastructure is one of the principal segments of this market and additionally paperwork the core of its boom. It is further divided into Liquefied Natural Gas (LNG), with a worth of $58,850.23 million, as well as liquefaction plants, regasification terminals, and shipping. All segments are part of the supply chain to enable LNG to flow smoothly and efficiently from source to end-consumer. Liquefied natural gas plants freeze natural gas to a liquid, which is then shipped by specialized LNG vessels. On arrival at its destination, regasification terminals turn it back into gas for domestic use, industries, and power generation.

Another important link in this chain is shipping of LNG. Specialized ships are constructed to ship LNG safely at very low temperatures across sea routes. The need for such shipping arrangements has increased with more nations importing LNG to secure more diversified sources of energy and enhance energy security. Without this network of ships around the world, the flexibility and extent of the global LNG market would be dramatically reduced.

Increased apprehension regarding carbon emissions and the clamor for energy transition have also fueled demand for LNG. It has a lower carbon emission compared to oil and coal, so it is more desirable in the short and medium term. Those nations with minimal domestic energy resources are reaching out to LNG as a reliable and cleaner alternative. This has created new supply routes, long-term contracts, and increased terminal capacities in major regions.

Overall, the global LNG market is influenced via its developing infrastructure and global need for purifier fuels. As heavy investments are being channeled into liquefaction facilities, regas terminals, and shipping fleets, the complete device is becoming an increasing number of resilient and green. As the world continues to strike a stability among surroundings and strength wishes, LNG is most possibly to come to be an vital factor of the sector energy blend.

By Application

The global LNG market is entering attention as the sector's call for for cleaner, more green power sources mounts. When liquefied, natural fuel is less complicated to move and shop, offering an appealing opportunity for nations with sparse pipeline infrastructure. This convenience has opened alternate routes and enabled international locations to diversify strength supplies, better addressing multiplied electricity wishes in a international looking to slash its carbon footprint.

Cooking, heating, and small-scale power generation for residents are far more practicable with LNG. Now that populations are urbanizing and consumption of energy is on the rise, residential areas, especially in developing countries, are going towards greater use of LNG as a backup fuel instead of coal or biomass as regular fuels. The household finds it more affordable and environment-friendly due to lesser emission and higher supply. Governments are also urging the public by offering some subsidies and policies in support of clean energy.

For enterprise, LNG is an alternative source of strength for corporations, retail chains, eating places, and institutions. It provides a regular deliver of energy for day by day operations, in particular in regions in which electric powered grids are unstable or under stress. With companies looking for efficient and price-powerful resources of power, LNG is a balance among efficiency and a green method, positioning it as a viable choice for small and massive companies alike.

In the commercial enterprise area, LNG is the strength source for manufacturing centers, mining installations, and chemical flora. Industries need massive quantities of strength, and LNG gives the dimensions and consistency they require with out the environmental effect of other fossil fuels. It can produce high tiers of heat whilst liberating less air pollution, making it an appealing preference as industries shift toward sustainable operations.

In well-known, the global LNG market is developing regularly as makes use of across residential, industrial, and industrial applications maintain escalating. Its flexibility, cleaner image, and widening availability are defining the destiny of global strength intake. With greater countries investing in LNG centers and era, the market is expected to extend even extra, with sensible and sustainable electricity answers to provide.

By Scale

The global LNG market has skilled robust changes in current years due to increasing energy demand, moving in the direction of cleanser fuels, and increasing change lanes. As international locations preserve to search for cleanser assets of energy, LNG has emerged as a extra preferred option given its lower carbon emissions in comparison to grease and coal. This transformation has not best elevated the quantity of LNG uploading international locations but additionally promoted the construction of export centers in new locations. Consequently, LNG infrastructure is now not the keep of a few giants but is extending over a broader spectrum of economies.

Based on size, the marketplace is likewise segmented similarly into massive-scale, mid-scale, and small-scale initiatives, each with unique strengths and programs. Large-scale LNG centers, with a capability above five million tonnes in line with annum (mtpa), are generally designed for fundamental exporters. These vegetation benefit from economies of scale, making them greater price-green ultimately. They cater to high-quantity contracts and guide worldwide trade through presenting a regular and dependable supply. Nations with big fuel reserves and great monetary support opt for this model to ensure lengthy-term earnings from international exports.

Mid-scale LNG, between 1 and 5 mtpa, is finding its area of interest in those regions in which infrastructure development is in progress or where slight marketplace call for exists. These projects balance investment and flexibility and are well placed for use in emerging markets and also for utilization in nations desirous of lowering reliance on conventional fuels but that are not yet capable of supporting full-scale operations. The flexibility of mid-scale units similarly allows quicker improvement and interfacing with to be had local electricity era or industry.

Small-scale LNG, much less than 1 mtpa in capability, has turn out to be more and more popular in geographically far flung regions or smaller nations where considerable terminals are not economically possible. These devices are more bendy and may deliver isolated industries, islands, or communities that have confined get entry to to electricity infrastructure. They are instrumental in growing the footprint of LNG and making it possible for even low-demand areas to access cleaner energy sources. Their significance has increased with greater emphasis on decentralized energy solutions and energy security in underserved regions.

The segmentation of the global LNG market by size mirrors how energy policies are evolving to serve distinct geographic, economic, and environmental requirements. From powering cities or providing fuel to off-grid points, every form of LNG facility contributes to redefining the way the world burns natural gas. With innovation and investment ongoing, the range of sizes will serve global needs more efficiently and sustainably.

By Location

The global LNG market has been gradually expanding over recent years as a result of mounting demand for cleaner fuels and versatile fuel supplies. Cooled to liquid form, herbal gas turns into extra handy to move and save, making it the first alternative for numerous international locations seeking to address mounting electricity demands with reduced carbon emissions. As governments and industries look for viable strength substitutes, LNG has come into focus because of its efficiency and reduced environmental footprint in assessment to traditional fossil fuels along with coal and oil.

When thinking about the marketplace based totally on geography, LNG infrastructure is frequently divided into offshore and onshore centers. Onshore LNG terminals constitute the conventional arrangements, that are commonly observed close to pipelines and depots. These terminals procedure high volumes of gas and are typically related directly to national networks or commercial customers. Nations with sizeable coastlines and advanced power industries preserve to make investments closely in onshore terminals, as they offer lengthy-time period dependability and the capacity to expand operations over time. The process, though, of constructing and keeping those styles of centers can be sluggish and luxurious, specifically for places with restricted space or tight environmental controls.

Offshore alternatives are more flexible and can be deployed more quickly. There are Floating LNG (FLNG) units and Floating Storage Regasification Units (FSRUs) among these. FLNG units produce, liquefy, and store gas on the open sea directly, frequently near gas fields. This arrangement does away with the necessity of extensive pipelines for gas transportation to shore-based facilities, so it is a feasible choice for places that are far away. FSRUs, on the other hand, are utilized to receive LNG, hold it for temporary storage, and then regasify it for sale. FSRUs are usually moored off the coast and installed to shore-primarily based gas networks, presenting a quicker and more flexible alternative to conventional terminals.

The alternative of onshore vs. Offshore infrastructure is usually based on various factors including to be had area, funding, regulatory environment, and the fee at which strength deliver is required. Although onshore terminals stay well-known as a result of their magnitude and massive applicability, offshore configurations have become increasingly more popular, particularly in rising markets or locations where land-based totally schemes incur delays. Both strategies remain underneath improvement to address new international electricity needs and environmental requirements, demonstrating how the LNG enterprise is adapting to enable a cleanser and extra accessible electricity destiny.

In general, the global LNG market is defined no longer simplest by means of increasing demand however additionally by the bodily function of the infrastructure. As strategies in electricity evolve and era improves, both onshore and offshore technologies might be vital in maintaining a stable and green deliver chain for LNG globally.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$132,619.07 million |

|

Market Size by 2032 |

$233,568.31 Million |

|

Growth Rate from 2025 to 2032 |

8.5% |

|

Base Year |

2024 |

|

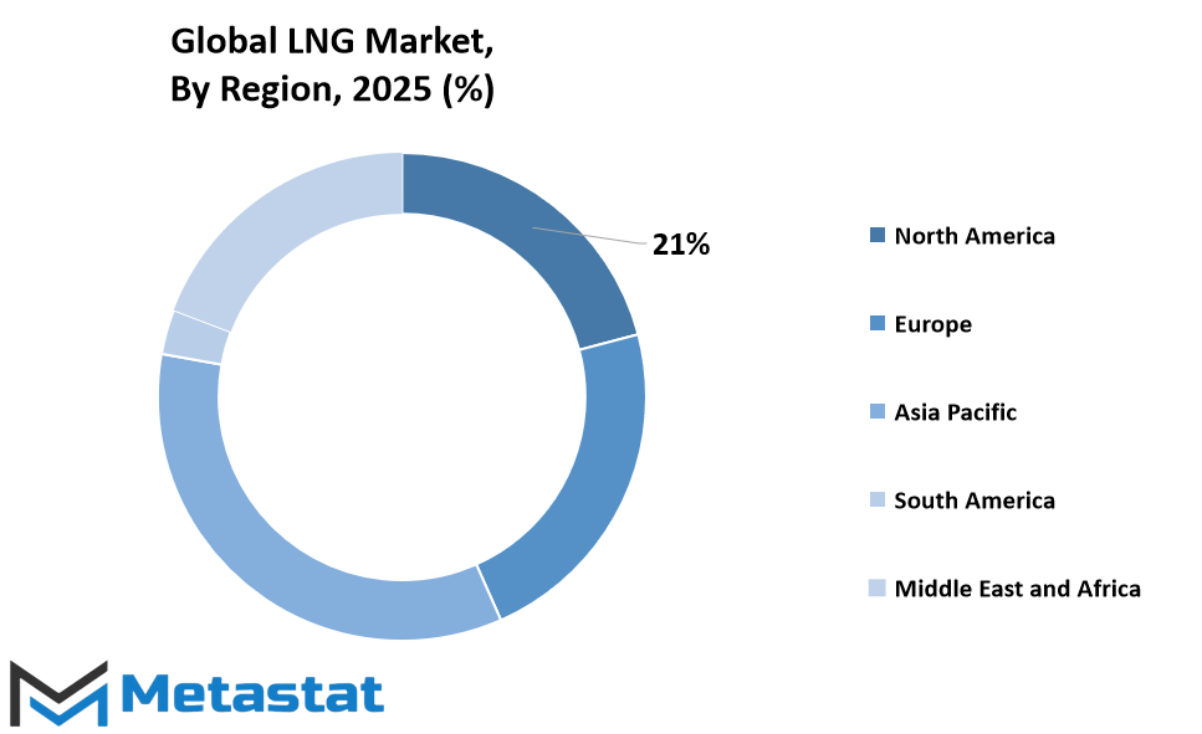

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global LNG market remains on an upward trajectory, determined by geographic supply and demand trends. Various regions have established their LNG infrastructures in response to internal energy policy, economic agendas, and availability of natural gas fields. This has formed a web of importers and exporters that drive world pricing, routes of trade, and investment in energy projects. As nations transition towards cleaner energy sources, LNG has emerged as a strategic choice between meeting energy requirements and environmental issues.

North America's LNG market is ruled by the US, with Canada and Mexico ranking 2d and 0.33. The United States has end up one of the leading LNG exporters in current years, courtesy of the shale gas boom and heavy funding in liquefaction plant life. Canada has been attempting to increase its LNG potential, although regulatory troubles have impeded its progress. Mexico, however, has been concentrating greater on importing LNG to reinforce its emerging strength needs, especially in the commercial and power sectors.

Europe's LNG scenario is influenced by its priorities for energy security. The UK, Germany, France, and Italy have all established well-functioning LNG terminals, and the remainder of Europe is upgrading infrastructure in order to cut back on pipeline gas dependence. Global events of recent times have compelled European nations to go for diversification of sources more intensely. This has led to growing imports from LNG and new terminal construction that is being expedited. These nations view LNG as an important component of their shift towards cleaner fuels, but not necessarily giving up on their dependence on fossil energy.

Demand for LNG is especially high in the Asia-Pacific region. India, China, Japan, and South Korea are among the world's largest LNG importers. With urbanizing populations and growing industries, they need a clean and dependable source of power. Japan and South Korea have traditionally depended on LNG since domestic energy production is low, and China and India are employing LNG to reduce coal consumption. The remaining Asia-Pacific is also experiencing a change in the pattern of consumption of energy, as various countries are looking towards LNG as a low-cost option to satisfy increasing electricity needs.

South America and the Middle East & Africa are performing complementary but significant roles in the LNG market. Argentina and Brazil are the key consumers in South America, using LNG to augment hydro and other sources of energy during dry months or periods of supply deficiency. In the Middle East & Africa, nations like the GCC countries, Egypt, and South Africa are engaging in both importing and exporting LNG. Their position is determined by local gas resources and infrastructure capacity. With advancing technology and investment, these areas are likely to play a larger role in dictating the international LNG scene.

COMPETITIVE PLAYERS

The global LNG market has seen incredible expansion over the past few decades, principally fueled by the increasing demand for clean energy sources and divergence from coal and oil. Asian, European, and some American nations have looked towards LNG as a more adaptive and cleaner alternative. With increasing importance of energy security through geopolitical tensions and climate pledges, LNG has grown even more influential in defining the energy world. Governments are today gearing up for imports and infrastructure of LNG not just to address industrial and residential requirements but also to complement their plans of transition toward lower emissions through energy systems.

This increasing demand has promoted a broad chain of suppliers, infrastructure developers, and traders to invest in LNG operations. Leading exporters such as QatarEnergy LNG (Qatargas), Shell plc, and Cheniere Energy Inc. have emerged as regular and predictable providers to energy-thirsty countries. Their activities encompass exploration, liquefaction, shipping, and regasification, which assist in the maintenance of stable supply chains in a market that is highly susceptible to political and environmental disruptions. The companies are still adding capacity, entering into long-term contracts, and advocating for innovation in processing and transport technology.

Aside from the incumbents, other major players such as TotalEnergies SE, Petronas, Novatek, and Chevron Corporation are also driving the direction of the market. Each of them provides a mix of international presence, technical capability, and financial support that serves to sustain the LNG supply chain from producer to buyer. At the same time, players such as Exxon Mobil Corporation, Woodside Energy Group, Equinor ASA, and Sempra Infrastructure are engaged in exploration, production, and infrastructure development, further underlining LNG's role in addressing both present and future energy needs.

At the infrastructural level, companies like Venture Global LNG, ENI SpA, KOGAS, and Mitsui OSK Lines are assisting in the development of more robust logistics and supply chains. Golar LNG and BW LNG shipping and storage solutions play pivotal roles in safe and efficient transportation of gas over oceans. In the engineering and construction sector, organizations such as Technip Energies, Bechtel Corporation, Fluor Corporation, and KBR Inc. go on designing and constructing next-generation plants that look to be more efficient, cost-effective, and environmentally friendly.

With the international energy industry traversing a combination of supply issues and climate obligations, the global LNG market stands poised to take a crucial place in the future energy mix. With the advent of new technologies, cross-border partnerships, and infrastructure development, these major players are doing their part to make sure LNG is still a viable source of energy in decades to come. Production is no longer the issue; now the spotlight turns to cleaning up LNG, making it more available, and more sustainable in a world that is ever-more energy aware.

LNG Market Key Segments:

By Infrastructure

- Liquefied Natural Gas (LNG) Liquefaction Plants

- Liquefied Natural Gas (LNG) Regasification Facilities

- Liquefied Natural Gas (LNG) Shipping

By Application

- Residential

- Commercial

- Industrial

By Scale

- Large-Scale (Above 5 mtpa)

- Mid-Scale (1 to 5 mtpa)

- Small-Scale (Below 1 mtpa)

By Location

- Onshore

- Offshore (FLNG and FSRU)

Key Global LNG Industry Players

- QatarEnergy LNG (Qatargas)

- Shell plc

- Cheniere Energy Inc

- TotalEnergies SE

- Petronas

- Novatek

- Chevron Corporation

- Exxon Mobil Corporation

- Woodside Energy Group

- Equinor ASA

- Sempra Infrastructure

- Venture Global LNG

- ENI SpA

- KOGAS

- Mitsui OSK Lines

- Golar LNG

- BW LNG

- Technip Energies

- Bechtel Corporation

- Fluor Corporation

- KBR Inc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252