MARKET OVERVIEW

The global intermediate bulk containers (IBC) market represents one of the largest segments within the industrial packaging sector and is aimed at bulk shipping and storage of liquids and semi-solids. IBCs, being cubic in shape and capable of handling heavy loads, shall remain a strategic option for industries seeking cost-efficient, dependable, and scalable packaging options. Designed to be recycled with the ability to contain hazardous and non-hazardous products, IBCs will continue to be industry standard in most end-use markets in the coming years.

As companies look for simplicity of logistics and the environment-friendliness in packaging, the global intermediate bulk containers (IBC) market will play a crucial role in facilitating possible bulk transport without the logistical burden of drums or rigid tanks. Chemical companies, food processors, and pharmaceutical firms will depend on IBCs for attaining compliance, safety, and efficiency standards. The market will no longer be limited to the traditional uses, as innovation in design and development in the materials science will propel the penetration into newer markets, particularly those with complex regulatory environments or global distribution problems.

It takes an understanding of this market to see beyond the primary purpose of IBCs. These are not mere storage containers; they are sophisticated systems that can communicate with automated filling lines, trackable logistics platforms, and environmental management systems. In the near future, IBCs will become more integrated with IoT-capable features for real-time data interchange on container status, fill level, and location tracking. This will make manufacturers and logistics suppliers rethink conventional container approaches in favor of smart, responsive containers.

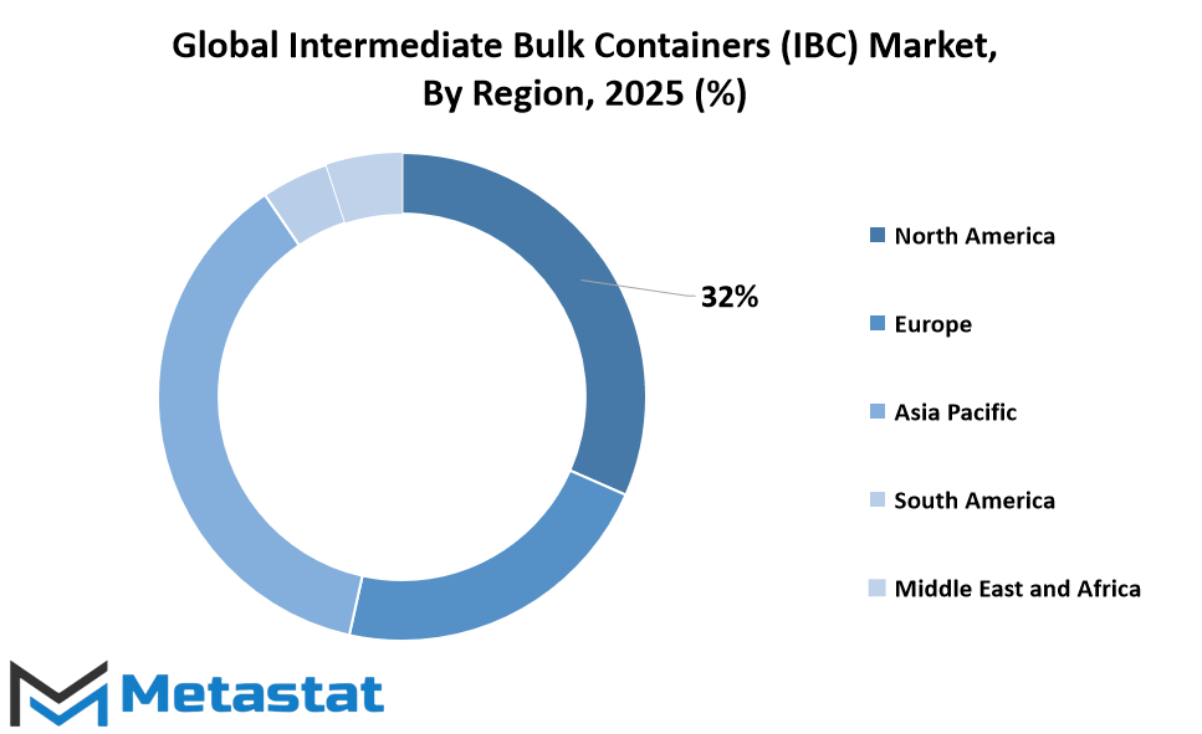

The global intermediate bulk containers (IBC) market will also witness regional differences based on supply chain infrastructure, green laws, and industrial demand. Although North America and Europe will continue to have demand owing to their well-established manufacturing bases and waste reduction policies, Asia-Pacific will increasingly be a force owing to industrial growth and export-led manufacturing. This will create a competitive market influenced by innovation, reliability, and adaptability towards regional compliance standards.

Relative to other markets for packaging that may be subject to seasonal variations or rapid changes in consumer patterns, this market will be impacted by industrial trends in the long term. Demand will lag behind industrial production, international trade, and regulation controlling treatment of liquid or semi-liquid products. As sustainability becomes a more dominant driver of purchasing decisions, IBC structure and recyclability will be more strongly controlled, pushing material transitions away from older plastics to newer composites or possibly even bioplastics.

Though frequently out of view for final consumers, IBCs will anonymously enable a gigantic scope of industries in the background to make product transport inexpensive and safe. They will be part of the pillar of modern manufacturing and global supply chain, as manufacturers, suppliers, and final consumers continuously reoptimize their position in industrial processes.

Over the coming years, the global intermediate bulk containers (IBC) market will not only be reacting to industrial demands but also defining the mode of transportation and handling of goods across the globe. With the expansion of industries, the market will expand alongside them as well, always focused on efficiency, safety, and an environment-friendly means in bulk handling solutions.

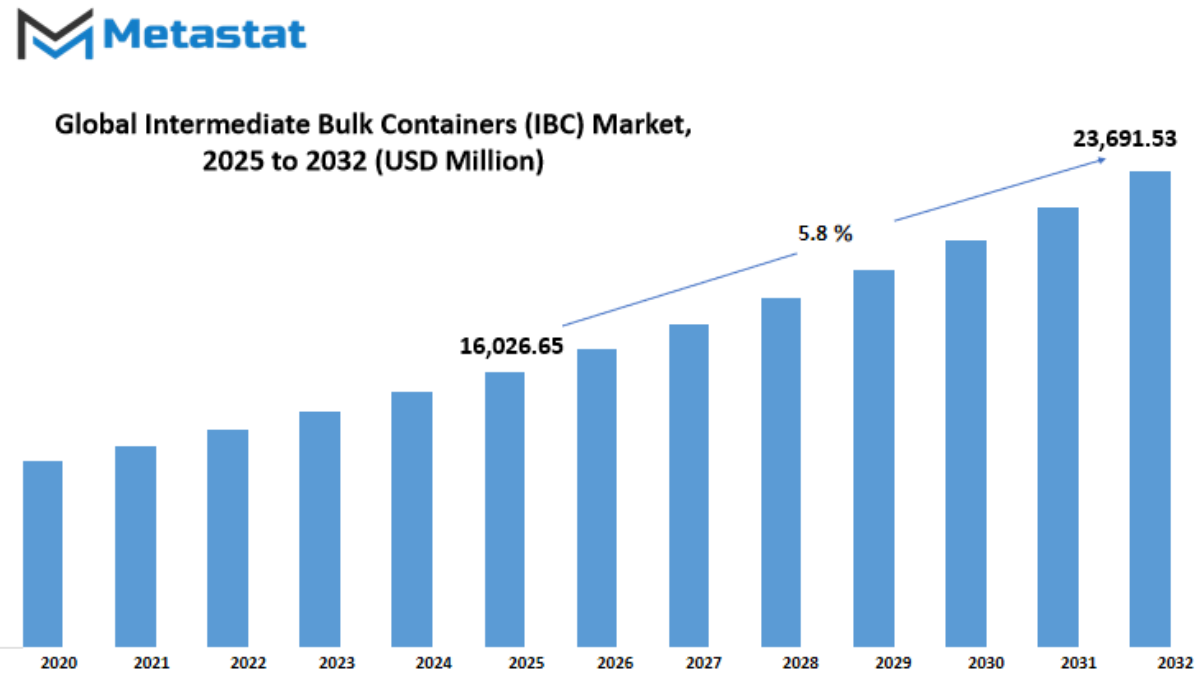

Global intermediate bulk containers (IBC) market is estimated to reach $23,691.53 Million by 2032; growing at a CAGR of 5.8% from 2025 to 2032.

GROWTH FACTORS

The global intermediate bulk containers (IBC) market is expected to grow steadily over the coming years as industries continue to look for smarter, more efficient ways to store and transport materials. These containers are widely used in sectors like chemicals, food and beverage, pharmaceuticals, and agriculture, where safe and cost-effective handling of goods is important. As businesses push for improved supply chain processes and sustainability, IBCs offer a reusable and durable option that fits well into these goals. With rising demand for products that support long-term use and reduce waste, the market will likely see more adoption in both developed and developing regions.

One of the key driving factors behind this growth is the increasing shift towards industrial automation and bulk handling processes. Companies are moving towards packaging solutions that save time and labor while also reducing costs. IBCs allow for larger volumes to be handled with fewer trips, making them more efficient than traditional packaging. Another important factor is the growing awareness of hygiene and safety standards. In industries like food and pharmaceuticals, these containers meet strict regulations, which makes them a preferred choice. Also, the strong build and design of IBCs help reduce the risk of spillage and product damage, which saves money and resources in the long run.

However, certain factors might hamper market growth. The initial cost of these containers can be higher compared to regular packaging, which may hold back small and mid-sized companies from investing. Some businesses may also lack the right infrastructure to handle or clean these containers properly, which could limit their use. In addition, concerns about the environmental impact of plastic-based containers may affect buying decisions, especially in countries with strict environmental policies.

Even with these challenges, the future offers promising opportunities. The rise of eco-friendly materials and smart packaging technology could open new doors for the global intermediate bulk containers (IBC) market. Containers made from biodegradable or recyclable materials could attract more buyers who are focused on green practices. At the same time, digital tracking features may soon be integrated to improve inventory control and reduce product loss. With innovations like these, the market is likely to expand further, driven by the need for smarter storage and transport solutions that align with changing industry needs and environmental goals.

MARKET SEGMENTATION

By Material

The global intermediate bulk containers (IBC) market is expected to grow steadily in the coming years, shaped by a growing demand for safe, reusable, and efficient packaging solutions across different sectors. These containers, often used for storing and transporting bulk liquids and granulated substances, are gaining attention because they offer a balance between durability and cost-effectiveness. Looking ahead, industries such as chemicals, pharmaceuticals, and food and beverage will continue to adopt these containers due to their reliability and ability to reduce waste during transportation.

When it comes to materials, the global intermediate bulk containers (IBC) market is segmented into plastic, metal, and paper & paperboard. Each of these materials serves specific needs depending on the product being stored or transported. Plastic IBCs are currently the most common due to their lightweight structure, resistance to corrosion, and relatively low cost. They are especially popular in food, beverage, and chemical industries where hygiene and safety are a top priority. Metal IBCs, on the other hand, are used when extra strength is needed. They are particularly useful for hazardous materials or flammable liquids. Although they are heavier and more expensive, their long-lasting nature makes them a preferred choice in certain industrial applications.

Paper & paperboard IBCs are expected to gain more attention in the future as sustainability becomes a bigger concern. These types of containers offer an eco-friendly alternative that can be recycled and decomposed more easily than other materials. While they are not suitable for all kinds of goods, ongoing improvements in packaging design may allow them to be used more widely. This shift toward environmentally friendly materials will likely influence how manufacturers design and market IBCs moving forward.

As global trade continues to grow, the need for reliable bulk packaging will rise with it. Manufacturers are already exploring new ways to improve container designs, making them easier to handle, stack, and clean. There will likely be a push toward smart packaging features as well, including tracking and temperature control technologies to make shipping safer and more efficient. The future of the global intermediate bulk containers (IBC) market will be shaped not just by what materials are used, but also by how well those materials can meet new demands in logistics and storage. With this steady shift, it is clear that innovation and adaptability will play a key role in the market’s future growth.

By Packaging Type

The global intermediate bulk containers (IBC) market will continue to grow steadily as industries look for safer and more cost-effective ways to store and transport materials. IBCs are large containers that can carry liquids, powders, or semi-solids in bulk, and they are commonly used across sectors such as chemicals, food and beverages, pharmaceuticals, and manufacturing. As businesses move toward efficiency and sustainability, the use of these containers is becoming more common due to their reusability and reduced environmental impact.

By packaging type, the global intermediate bulk containers (IBC) market is divided into rigid and flexible containers. Rigid IBCs are made from durable materials like plastic or metal and are designed to last through multiple uses. These containers offer strong protection and are ideal for storing hazardous or heavy materials. Their sturdy structure makes them reliable in demanding conditions. Flexible IBCs, on the other hand, are made from woven materials and can be folded when not in use. They are lighter, easier to transport, and take up less space. While not as strong as rigid ones, flexible IBCs are useful when the contents are not dangerous or when space-saving is a priority.

In the future, both types will play a vital role in how companies handle their packaging needs. Rigid containers will likely see improvements in their design, focusing on lighter materials without losing strength. This will help reduce shipping costs and carbon emissions. Flexible containers might become even more versatile, using smart fabrics or coatings that react to temperature or protect against contamination. These changes will not only improve product safety but also support companies trying to meet stricter environmental rules.

Automation and tracking technologies will also impact how IBCs are used. Sensors can be built into containers to track temperature, location, or usage, helping companies prevent loss or damage. This kind of data can improve planning and reduce waste. As industries aim to cut costs and meet rising safety and sustainability standards, smarter and better-designed IBCs will likely become a standard part of global trade and manufacturing.

In short, the global intermediate bulk containers (IBC) market will continue to evolve with a growing focus on smarter packaging, better materials, and more efficient systems. Both rigid and flexible containers will have their place, depending on what industries need and how much flexibility or strength is required for their operations.

By End-use Industry

The global intermediate bulk containers (IBC) market is expected to grow steadily in the coming years, supported by rising demand across various industries. These containers are used for storing and transporting bulk materials efficiently, making them a practical solution for businesses looking to cut down on packaging waste while improving storage space and handling. They come in different materials, such as plastic, metal, and composite, which allows companies to choose the type that best suits their needs. As industries continue to expand, the need for better packaging and shipping methods will keep increasing, and IBCs are positioned to meet that demand.

In the future, companies will likely rely more on IBCs because of their reusable nature and ability to store both liquids and solids safely. As environmental concerns continue to influence manufacturing and supply chain decisions, IBCs offer a way to reduce single-use packaging. This is especially important in sectors like food and beverage, where hygiene and safety are top priorities, and in the pharmaceutical industry, where strict handling requirements apply. With growing awareness of sustainable practices, businesses will continue shifting towards container solutions that align with eco-friendly standards.

The industrial chemical sector already uses these containers on a large scale, and this trend will likely keep growing. Chemicals need to be transported safely, and the design of IBCs allows for secure handling while preventing leaks. In agriculture, the containers help farmers and suppliers store fertilizers, pesticides, and other liquids, which adds convenience and cuts down on product loss. The building and construction industry also depends on these containers to move and store materials such as adhesives or coatings, helping to maintain consistency in quality during transportation.

Paints and coatings are another growing area, as manufacturers look for packaging that helps maintain the quality of their products and supports longer shelf life. As more companies look to expand their production lines and reach international markets, the demand for reliable, durable, and reusable packaging will grow. Others, including smaller industries, are also beginning to explore the benefits of these containers. Their affordability and practicality make them appealing for businesses of all sizes.

Looking ahead, the global intermediate bulk containers (IBC) market will likely see even more innovation, including smarter container designs that allow for better tracking and inventory management. As digital tools blend more with logistics and supply chain systems, these containers may become smarter and more connected, helping companies manage their goods with greater precision.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$16,026.65 million |

|

Market Size by 2032 |

$23,691.53 Million |

|

Growth Rate from 2025 to 2032 |

5.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

Based on geography, the global intermediate bulk containers (IBC) market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

COMPETITIVE PLAYERS

Key players operating in the Intermediate Bulk Containers (IBC) industry include Greif Inc., Mauser the global intermediate bulk containers (IBC) market is steadily becoming a significant part of the packaging and logistics industry, playing a key role in how materials are stored and transported across the world. This market is shaped by growing demand for efficiency, safety, and sustainability, which pushes companies to improve their products and services continuously. In a time where industries are focusing more on reducing waste and streamlining operations, Intermediate Bulk Containers offer a practical solution. These containers are widely used for handling liquids, powders, and other materials, especially in sectors like chemicals, food and beverage, pharmaceuticals, and agriculture.

Looking ahead, the global intermediate bulk containers (IBC) market will likely see a strong push toward innovation. Manufacturers are expected to invest in stronger, lighter, and more recyclable materials. As businesses aim to cut down on their environmental impact, the future of IBCs will depend heavily on how well companies can offer solutions that align with both economic and environmental goals. Digital tracking and smart container technologies may become standard in the coming years, offering better control and traceability during transport. This will be particularly useful in industries where product integrity and safety are crucial.

The competitive space in the global intermediate bulk containers (IBC) market is active and growing, with major players constantly looking to strengthen their positions. Companies such as Greif Inc., Mauser Packaging Solutions, and SCHÜTZ GmbH & Co. KGaA are leading the way by expanding their global reach and offering tailored solutions. These businesses are focusing on product development, strategic partnerships, and sustainable practices to stay ahead. Others like Snyder Industries, Hoover Ferguson Group, and Time Technoplast Ltd. are also making their mark through innovation and customer-focused approaches. Their success will depend on how well they adapt to changing regulations and customer needs.

Newer companies and mid-sized manufacturers, including Arena Products Inc., TranPak Inc., and Rishi FIBC Solutions PVT. LTD., are also gaining traction. Their ability to offer flexible and responsive services allows them to compete with larger players. Looking forward, mergers, acquisitions, and collaborations will likely shape the future landscape, giving rise to new growth opportunities. With rising global trade and increasing industrial activity, the global intermediate bulk containers (IBC) market is set to continue growing. The players who can anticipate future challenges and respond with smart, reliable solutions will be the ones leading the way.

Intermediate Bulk Containers (IBC) Market Key Segments:

By Material

- Plastic

- Metal

- Paper & Paperboard

By Packaging Type

- Rigid

- Flexible

By End-use Industry

- Industrial Chemical

- Food & Beverage

- Building & Construction

- Pharmaceutical

- Agriculture

- Paint & Coating

- Others

Key Global Intermediate Bulk Containers (IBC) Industry Players

- Greif Inc.

- Mauser Packaging Solutions

- SCHÜTZ GmbH & Co. KGaA

- Snyder Industries

- Hoover Ferguson Group

- Time Technoplast Ltd.

- Thielmann

- Arena Products Inc.

- TranPak Inc.

- Werit Kunststoffwerke W. Schneider GmbH & Co. KG

- C.L. Smith Company

- Schoeller Allibert

- ILC Dover

- Finncont Oy

- DS Smith PLC

- Rishi FIBC Solutions PVT. LTD.

- SIA Flexitanks Limited

- Pyramid IBC Containers

- Palmetto Industries International Inc.

- Global-Pak LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252