MARKET OVERVIEW

The global room door market, which is itself a part of the larger architectural and interior design sector, will be revolutionized in a way that refuses to stick to traditional predictions and goes far beyond mere utility. No longer bound by their usual function as access controls or spatial separators, room doors will become expressive pieces blending art, engineering, and human-centered design. This marketplace, previously spurred by necessity and homogeneity, will now play host to an era that will be characterized by individuality and material experimentation, coupled with responsiveness to technology.

As the demand of consumers evolves, the global room door market will adopt much more than traditional wood, steel, or PVC. Modern materials with haptic beauty and sustainable attributes will spearhead a quiet but strong revolution in door appreciation. Over the next few years, materials will not only endure but will proactively interact with light, air, and energy. Doors will become interactive surfaces that can adjust opacity, texture, and even acoustic performance according to interior parameters or user choice. This smart accommodation will make doors more than passive components and turn them into responsive contributors to the built environment.

Cultural influence will also drive this industry's evolution. While global identities converge and neighborhood craftsmanship is recognized, door aesthetics will incorporate multiple narratives. What previously was mass-produced will yield to tradition and innovation's hybridization. Designers and producers will be inspired by native shapes while conforming to minimalist or futuristic global tastes. Within this new paradigm, every door will have a unique narrative designed not simply to seal a room but to convey a visual and sensory dialogue.

Digital technology will act as the facilitating link between creativity and personalization within the Global Room Door industry. The use of AR and VR in choosing products will revolutionize the way consumers conceptualize interior space. Custom-designed solutions, generated from 3D scans and spatial analysis, will supplant one-size-fits-all fittings. This highly customized process will redistribute decision-making authority into the hands of homeowners and architects who want more than functionality they will require balance, efficiency, and intention. As production processes continue to become more fluid, the distinction between a manufacturer's work and that of a creative collaborator will become greatly diminished.

In addition, the crossroads of security and beauty will broaden. While strong locking systems and sophisticated biometric integrations will keep on improving security, these features will no longer detract from aesthetics. Security upgrades, in fact, will be subtly integrated into slender profiles and hidden hardware, leading to a new breed of smart but stylish door systems. Market direction will no longer rely on technology trends but on how elegantly these innovations can be infused without upsetting design ethos.

In the future, the global room door market will not be about units sold but about experiences created. Every door that goes up will be a conscious decision influenced by identity, context, and comfort. In urban apartments and rural escapes alike, doors will cease to be inanimate objects they will tell the story of a space's personality and react to the needs of the people who occupy it. This redefinition will put the industry on a completely new track, one where creative intent and usefulness are given equal footing.

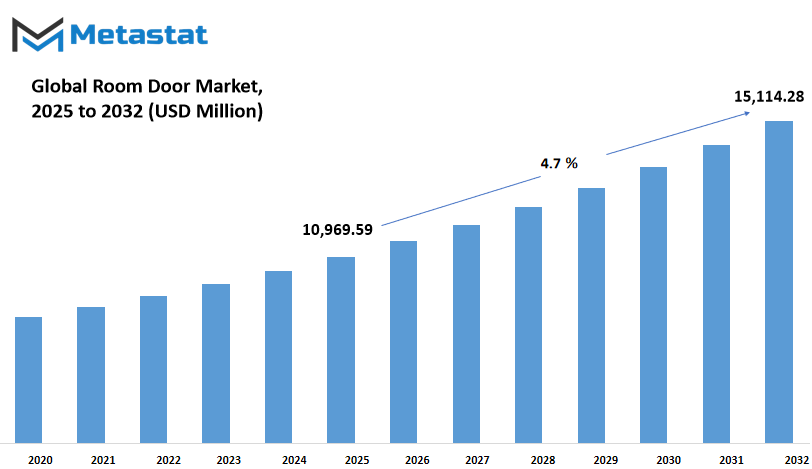

Global room door market is estimated to reach $15,114.28 Million by 2032; growing at a CAGR of 4.7% from 2025 to 2032.

GROWTH FACTORS

The global room door market, as developed through the lens of the perspective offered by Metastat Insight, is changing with increasing consumer demands and industry pressures. With ongoing construction activity for homes and business structures on the increase, the demand for quality interior doors grows increasingly important. Homeowners and business developers alike are concerned with design, functionality, and comfort more so than ever. That has driven a growing call for room doors that not only divide space, but also add beauty to the way spaces appear and feel. Today's consumers are not only picking any door they want doors that are quieting and fit their interiors, frequently leading the market towards more premium and fashionable options.

This move toward stylish, soundproof, and feature-loaded doors is opening up a broader market for manufacturers to serve. There are more individuals who desire their residential or working space to be tranquil and intimate, and that is why sound insulation as a desirable attribute has gained popularity. To this end, there is a trend away from bland, functional doors towards those with improved acoustics, firmer construction, and a classier look. All this continues to set the bar higher for what is acceptable in today's home or office.

All that said, not all of the market is silky. Perhaps the most dire issue is raw material cost and availability. Prices frequently swing wildly based on circumstances outside manufacturers' control, impacting how much it costs to produce and ultimately sell these doors. Steeper costs can discourage some purchasers particularly price-sensitive ones to spend money on higher-end products. This is especially challenging in low-income housing developments, where door technologies tend to be several generations old or simply omitted because of cost constraints.

Despite these obstacles, there is still room for the market to expand. Innovation is creating new opportunities. Smart doors, combining security and automation, are gradually being taken seriously. These products potentially bring new value to home buyers who desire more intelligent homes. Smart features such as fingerprint readers, remote control, and motion detectors already begin to make their mark on the aspects that customers seek when they go shopping. With growing awareness and improving affordability of technology, these smart features are poised to gain acceptance on a larger scale.

In conclusion, the global room door market, as exemplified by insights provided by Metastat Insight, is shifting to the future of doors that function not just as needed but more. Growing interest in design, sound management, and intelligent technology is defining the next wave of room doors. Although cost concerns and slower rates of tech adoption in some regions may temporarily dampen the pace, the direction is evident: smarter, more attractive, and more efficient doors will characterize the rooms where we work and reside.

MARKET SEGMENTATION

By Material

The global room door market is still growing as residential and commercial building projects increase globally. Individuals are more conscious than ever of the significance of design and durability in interior environments, and this is fueling greater demand for different door material. As homes and working environments become increasingly customized, the selection of room doors takes on a combination of style, functionality, and cost.

Metal room doors occupy a major position in the market, providing strength and durability. Of this category, the application of wood is found to cover a major share, valued at $5,676.79 million. This would possibly come as a marvel first of all, however it represents how the producers stability metal frames with wooden panels so that it will offer toughness with warm temperature. Wood continues to be the choice for lots due to its conventional appearance and sort of finishes. In addition to wooden, plastics, composites, and so forth additionally discover their locations, providing light and waterproof alternatives to suit unique purposes which includes toilet or application room packages.

Consumer developments are moving in the direction of doorways that now not best lock up a room however additionally deliver it character. Interior designers and house owners are seeking products that fit present day, minimalist, or conventional tastes with out compromising on quality. As a result, manufacturers are concentrating on innovative substances and finishes to fit various tastes. Customization isn't a luxury anymore; it is turning into a widespread choice for which customers demand it.

The future of the global room door market depends on the success of manufacturers at keeping up with sustainability requirements. Green materials and processes are on the rise, and consumers are beginning to consider the environmental impact of a product. This is encouraging companies to redesign and manufacture from scratch, keeping in mind that the doors they provide must not only be fashionable and functional but sustainable options for the earth as well.

Shown by a recent report by Metastat Insight, this summary of the global room door market demonstrates the functional and emotional benefit room doors introduce into residences and working spaces. With changing lifestyles and growing design needs, room doors will only become more vital more than mere entrances, but aspects that influence the way people live their spaces.

By Application

The global room door market, as highlighted inside the presentation by using Metastat Insight, is shaped by the practical and aesthetic needs of modern-day structure and interior design. Doors are now not just a manner of privateness or safety they have developed into factors that have an effect on the overall look and sense of a area. As homes get smarter and more space-conscious, the characteristic and design of doorways also are converting to satisfy new demands. The desire of door type can significantly affect how a room features, and that is precisely where the segmentation by using swinging method performs a chief function.

By swinging type, the marketplace is divided into Sliding, Folding, Revolving, Door Leaves, and Others. Each kind gives awesome blessings depending at the layout, purpose, and frequency of use in both residential and industrial environments. Sliding doorways are popular in tight areas wherein traditional swing doorways might not healthy, providing a clean and efficient alternative. Folding doorways, alternatively, deliver versatility best for areas that require occasional partitioning or for individuals who select a wide opening with flexibility. Revolving doors, although often associated with high-traffic commercial zones, are starting to be noticed for their electricity-saving advantages and continuous drift, assisting lessen air change and retaining indoor temperatures. Door Leaves, the more traditional and nevertheless broadly used class, offer simplicity and durability, in particular in home settings. The “Others” phase catches improvements that don't fall neatly into those categories evidence of ways design and function preserve to push obstacles in subtle but beneficial methods.

The cognizance of the global room door market isn’t just on range but additionally on how these door patterns help lifestyle shifts. As more houses double up as workspaces and commercial buildings intention to electrify with layout, the call for for elegant, efficient, and realistic doorways will keep growing. Material alternatives are transferring, too lightweight but robust materials are being used more often, improving sturdiness without compromising on aesthetics. Customization is turning into more commonplace, with clients wanting doors that replicate their character or mixture seamlessly with their interiors.

Looking in advance, the global room door market will probably see improved demand for space-saving and clever solutions. Smart doors, although nonetheless a growing segment, hint at a future in which get entry to can be touchless, and protection functions are built in. The have an effect on of global design trends and urban residing pressures will maintain to form alternatives, making room doors an thrilling intersection of software, protection, and fashion.

In closing, the global room door market explored through the lens of Metastat Insight indicates how some thing as normal as a door is becoming more than just a fixture. Through sliding, folding, revolving, door leaves, and other designs, the market will keep adapting to converting existence and creation trends quietly remodeling the areas we stay and paintings in, one door at a time.

By End User

The global room door market, as shown by Metastat Insight, indicates an increased demand for both style and functionality in built-up environments. As individuals continue to invest in commercial and residential properties, the market for room doors is bound to increase gradually. The door is no longer merely a functional separator it's now a vital part of interior design, energy efficiency, privacy, and security. From contemporary homes to large commercial buildings, doors today play visual and performance roles.

At home, the global room door market ranges from a single apartment unit to a standalone house, where doors serve to control privacy and establish spaces. The rightly selected door not only finishes a room but can be beneficial for insulation as well as controlling noise. Wooden, glass, and engineered wood doors are some of the common ones, combining strength and design. Individuals are seeking products that fit the style of their interiors, and producers are catching up with an array of customizable products.

Outside of households, the market is also segmented into segments such as commercial structures, healthcare facilities, retail outlets, offices, schools, hospitality venues, and so forth. Each of these requires different needs. In healthcare, for instance, doors must be up to hygiene standards and be easily operable. In offices and retail, design and brand typically dictate what doors are used. Hospitality environments are concerned with both guest comfort and security. In all of these markets, the trend is moving toward products that balance practicality, visual impact, and long-term performance.

What also contributes to this expansion is the trend in the construction sector toward smart and sustainable building practices. As new structures are built and existing ones are redeveloped, there is greater emphasis on doors that look good and perform well. Fire doors, soundproof doors, and smart door locks are becoming increasingly popular. Such features are no longer niceties but increasingly normal expectations in various types of buildings.

In the future, innovation will increasingly define this market. Materials will improve, design will become more considered, and technology will have an even greater influence. But what will stay the same is the very fundamental function of a room door to join and separate spaces in a manner that is beneficial to the individuals occupying them.

In short, the global room door market that Metastat Insight shares is a mirror of shifting needs, more intelligent designs, and the increasing role of detail in construction and interiors. For homes or companies, this market will keep transforming to satisfy practical requirements as well as become better parts of people's day-to-day realities.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,969.59 million |

|

Market Size by 2032 |

$15,114.28 Million |

|

Growth Rate from 2025 to 2032 |

4.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global room door market presents a distinct image of the various regions and how each affects the aggregate demand and supply of these necessary fixtures. The global room door market is segmented by geography into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. All of these regions portray an individual combination of consumer activity, construction activity, and interior design trends.

North America, comprising the U.S., Canada, and Mexico, remains the riding pressure in the marketplace with its consistent call for for residential and commercial doorways due to renovations, new domestic construction initiatives, and an growing preference for design-orientated interiors. Europe has markets just like the UK, Germany, France, Italy, and more. The marketplace favors power-efficient and fashionable door solutions, frequently inspired by means of both conventional architectural tastes and contemporary dwelling styles.

Within the Asia-Pacific region, inclusive of India, China, Japan, South Korea, and the Rest of Asia-Pacific, demand is increasing immensely. This is normally pushed by means of persistent urbanization and growing disposable income, leading to rising construction interest inside cities and rural regions. Country-precise local possibilities differ, but there may be a well-known trend in the direction of innovative, low-cost, and long-lasting door answers.

South America, such as Brazil, Argentina, and the rest of the region, is witnessing a slow increase in demand. With increasing consumer expectations and growth in infrastructure projects, there's increased interest in stable, beautiful room door designs. The Middle East & Africa, comprising GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, also has potential for market growth. Continuous growth in commercial and residential sectors, particularly in the Gulf region, prompts greater use of high-end and bespoke door solutions.

Together, these areas constitute the vista of the international Room Door market. The extent of this market, examined and reported on by Metastat Insight, not only reveals geographical variation but also indicates developing trends that companies and suppliers will track in the years to come. As each region continues to develop, replace, or update, the significance of room doors tactically and aestheticallly viewed as well as both will continue to be a key consideration across borders.

COMPETITIVE PLAYERS

The global room door market, as seen through the eyes of Metastat Insight, remains on the march with consumers gravitating toward style as well as functionality in interior spaces. With increased sensitivity to architectural style and maximizing available space, individuals and companies alike are reassessing their door choices not only for their practicality but for the ambiance and appearance they evoke. Human beings desire more from their homes, and doors are no longer mere dividers of spaces; they've become a reflection of individual preference and deliberate design.

Room door makers are meeting the demand with a combination of innovation and craftsmanship. AG Millworks, Andersen Corporation, Artisan Hardware, and JB Kind Doors are all pushing traditional materials to their limits while introducing new directions toward form and finish. Others specialize in custom craftsmanship, including Allegheny Wood Works Inc. and Appalachian Wood Products Inc., while still others, like Masonite International Corporation and Jeld-Wen Holding, Inc., mass-produce to serve commercial and residential markets in larger areas. The options vary from modern sliding panels to heavy wood-paneled stalwarts, each helping shape a room's character.

What's striking is how diversified the choices have become. Minimalist finishes that coexist with open-concept rooms are becoming popular, while heavily stained or textured surfaces appeal to owners who value warmth and classicism. Manufacturers such as Rustica and TruStile Doors LLC are making it simpler for consumers to select a door that has a natural feel as an integral component of the space, and not an afterthought. Clearview Bi-folding Doors Ltd and LaCantina Doors are renowned for their expansive view solutions and natural light flow, which are becoming increasingly important for more customers.

From wood-centred experts like Hume Doors & Timber and Cedar Company to tech-forward companies like Origin Frames Ltd. and Nana Wall Systems Inc., tradition and technology are both embraced by the industry. There's room for all of it from the rustic character of Lynden Door Inc. to the precision and finish of Simpson Door Company and Marvin. Meanwhile, volume producers like Pella Corporation and Steves & Sons Inc. provide broad availability and price flexibility for big projects or cost-conscious construction.

Notably, it's not merely a matter of looks or construction. Decision-making too centers on how simple it is to install a door, how well a door will insulate sound or heat, and how a door assists with security and privacy. Here, companies such as Sun Mountain Inc., TWR Trade Frames Limited, and USA Wood Door have gained trust through emphasis on performance as well as style. Today's consumers are more knowledgeable and pragmatic; they desire products that are good-looking, function well, and will last.

The inclusion of Bayer Built Woodworks Inc., Concept SGA, and Woodgrain Millwork Inc. brands in this competitive amalgam is an indicator of the richness of product diversity and growing significance of user-centric design. No longer limited to traditional openings, room doors now are being designed to fit houses of all shapes, sizes, and orientations. From bi-folds to barn-style sliders and French door traditions, the diversity continues to grow to meet the diversity of international demand.

As observed by Metastat Insight presentation of the global room door market, this space will continue to attract attention as long as interior trends evolve and new materials become available. With a balance of heritage, innovation, and practical function, these players are shaping not just doorways, but how people feel in their everyday spaces.

Room Door Market Key Segments:

By Material

- Metal

- Wood

- Plastic

- Composite

- Others

By Application

- Swinging

- Sliding

- Folding

- Revolving

- Door Leaves

- Others

By End User

- Residential

- Commercial

- Healthcare

- Retail and Offices

- Education

- Hospitality

- Others

Key Global Room Door Industry Players

- AG Millworks

- Allegheny Wood Works Inc.

- Andersen Corporation

- Appalachian Wood Products Inc.

- Artisan Hardware

- Bayer Built Woodworks Inc.

- Cedar Company

- Clearview Bi-folding Doors Limited

- Concept SGA

- Hume Doors & Timber.

- JB Kind Doors

- Jeld-Wen Holding, Inc.

- Karona Inc.

- Kloeber UK Ltd.

- LaCantina Doors

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383