MARKET OVERVIEW

The global baby shampoo market and its industry will be characterized by the way infant care remains consistent with safety, gentleness, and trust. Contrary to general hair care products, this market will become a niche segment closely related to parents' trust in brands. The sector will not only provide a product that cleans but will also have the onus of safeguarding sensitive skin and hair. Due to that burden, the marketplace will differentiate as a category formed by equally emotional and practical choices.

In investigating the nature of this market, it will be critical to recognize that it will spread far beyond bottles on store shelves. It will be an entire ecosystem that ties together manufacturers, healthcare voices, retailers, and caregivers. Each phase will identify how intensively cultural expectations, regulatory structures, and consumer trust will influence demand. Compared to many of the personal care categories, parents will seek more reassurance than trendiness, which will make the foundation of the market distinct in nature.

The global baby shampoo market will not be limited to the conventional retailing area. It will extend itself online where new parents will look for safe choices, compare the ingredients, and even go by peer reviews before deciding. This virtual space will be inseparable from its design in the future, particularly as online shopping sites will provide a space where parents geographically will become familiar and even influence one another's buying decisions. This interdependence will redefine the way the market will function internationally, whereby one product conceptualized in a country can become a household name elsewhere soon.

Defining the parameters of this industry will also include considering how dermatological and medical input will drive product development. The products will not be driven by cosmetics only but will be subjected to strict testing to meet both scientific requirements and the worries of parents. This harmony between science and care will make the industry always bear a bit more burden than regular personal care markets.

The other aspect that will define the global baby shampoo market will be the variation in consumer needs based on cultures. Mild herbal mixtures will be preferred in one set of regions and hypoallergenic product types in another. This cultural divide will not weaken the market but will give it a broader reach, making it more flexible and accommodating. In the process, the industry will become a composite identity of not just safety but cultural sensitivity.

The global baby shampoo market ultimately will be more than a business category. It will become an expression of how societies value early childhood care, how much importance they give to well-being, and how trust will inform their decisions. The business will go on to define itself less in terms of rapid evolution and more in terms of reassurance that what it is providing is safe and nurturing. Over the coming years, this market will remain a distinctive nexus of parental responsibility, cultural values, and scientific reliability.

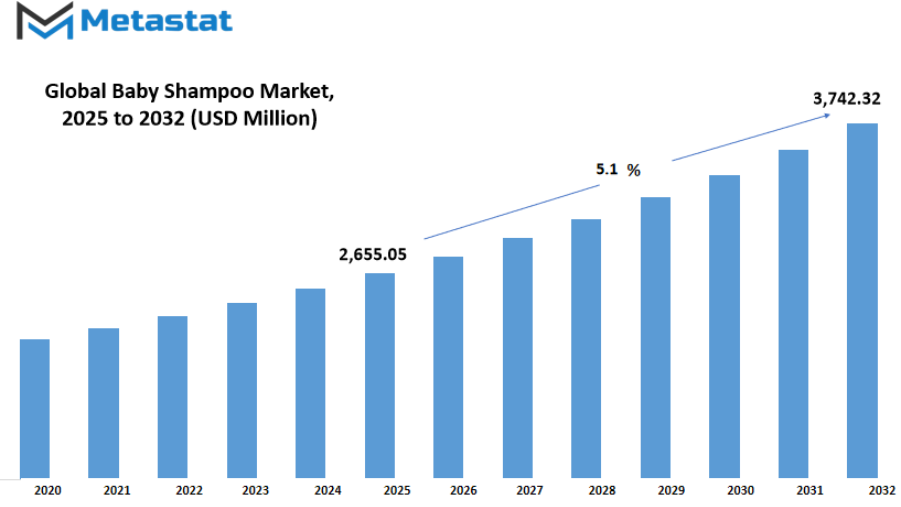

Global baby shampoo market is estimated to reach $3,742.32 Million by 2032; growing at a CAGR of 5.1% from 2025 to 2032.

GROWTH FACTORS

The global baby shampoo market is expected to see steady growth as parents place more importance on infant hygiene. In many developing countries, higher birth rates are contributing to a greater need for safe and effective baby care products. Families are paying closer attention to the products they use for their children, and shampoo plays an important role in this. Parents want gentle solutions that will not harm sensitive skin, and this has encouraged brands to develop safer and more natural options. Rising awareness about hygiene has also created new demand for daily-use baby care products, and shampoo is at the center of this trend.

Another key factor shaping the future of the global baby shampoo market is the growing interest in chemical-free and natural formulations. Many parents now read labels more carefully, looking for ingredients they can trust. Shampoos that highlight features such as being free of parabens, sulfates, or artificial fragrances are gaining popularity. Products that are dermatologist-tested and certified as organic are also finding more space on store shelves. This shift reflects a broader lifestyle change, where people want healthier and more sustainable choices not only for themselves but also for their children.

However, the market is not without challenges. One of the biggest issues comes from the strong competition posed by smaller local and organic brands. These companies often connect more directly with parents through trust and transparency, which can make it harder for premium international brands to maintain their dominance. In addition, regulatory rules around baby care products are becoming stricter. Ingredients that were once widely used are now under more careful review, and this makes product development more costly and time-consuming. Companies must balance safety, compliance, and consumer expectations to stay competitive.

Even with these challenges, opportunities remain promising. Innovation will be key to shaping the global baby shampoo market in the coming years. Formulations that use eco-friendly packaging, plant-based ingredients, and clinically tested safety standards are expected to attract more buyers. Parents of the future will likely prioritize both effectiveness and sustainability, pushing companies to introduce products that meet these values. The brands that can successfully blend trust, safety, and environmental responsibility will have the strongest chance to grow. Looking ahead, the market will not only expand in size but also in diversity, as companies create solutions that reflect changing lifestyles and parental expectations worldwide.

MARKET SEGMENTATION

By Material Type

The global baby shampoo market has been witnessing steady growth as parents across the world become more conscious of the products they use for their children. Shampoo designed for babies is not only about cleaning but also about ensuring safety and comfort. With rising awareness about harmful chemicals and the need for gentle ingredients, the demand for specialized products has been increasing. Many families today look for items that promise mildness while also protecting the sensitive skin and scalp of infants. This has made companies more focused on producing shampoos that meet both health and convenience standards.

By material type, the global baby shampoo market is further segmented into medicated and non-medicated categories. Medicated baby shampoos are generally recommended when a child has specific skin conditions such as cradle cap, dandruff, or irritation that requires more than regular cleaning. These shampoos are usually developed with ingredients that provide relief without being too harsh. Parents often turn to them when advised by pediatricians or when over-the-counter options are trusted for their mild therapeutic effects. On the other hand, non-medicated baby shampoos are the most widely used since they are designed for everyday use. They focus on being gentle, tear-free, and safe for the eyes and scalp. This category is preferred by parents who simply want a daily wash that keeps their baby’s hair soft, clean, and easy to manage.

Looking ahead, the future of the global baby shampoo market will continue to evolve around innovation and parental expectations. With technology advancing in the field of personal care, brands are expected to focus more on natural and organic ingredients that are safer and more sustainable. The preference for eco-friendly packaging will also rise as more families pay attention to reducing waste and supporting environmentally responsible companies. In addition, digital platforms will influence consumer decisions as parents rely on reviews, recommendations, and online communities to select trusted products.

Another important direction for the future will be the customization of baby shampoos. As data-driven research grows, companies might develop products tailored to specific hair types, climates, or even genetic factors. This personalized approach will likely make parents feel more secure about the products they choose. At the same time, medicated shampoos will see improvements as healthcare and skincare research advances, allowing safer and more effective solutions for babies with special needs.

Overall, the global baby shampoo market will not just grow in size but also in diversity. With changing lifestyles and increasing awareness, the demand for safer, effective, and innovative products will shape the industry, making it an essential part of modern childcare.

By Capacity

The global baby shampoo market is expected to continue its steady growth in the coming years, driven by the increasing awareness among parents about safe and gentle products for children. The demand for baby shampoos has grown not only because of rising populations in several regions but also due to changing lifestyles, higher disposable incomes, and a greater focus on health and hygiene. Parents today are more conscious of the ingredients used in these products, and companies are focusing on mild formulations that avoid harmful chemicals. This shift toward safer choices has encouraged both established brands and new players to create shampoos that address these concerns, making the market highly competitive.

Looking at the market by capacity, it is divided into four categories: less than 100 ml, 100 ml to 250 ml, 250 ml to 500 ml, and more than 500 ml. Each category reflects the buying habits of parents and caregivers, influenced by both convenience and affordability. The smaller packs, less than 100 ml, are often chosen for travel purposes or by first-time buyers who want to test a product before committing to larger sizes. The 100 ml to 250 ml segment appeals to households looking for a balance between affordability and regular use, while the 250 ml to 500 ml category has become common for families who prefer stocking up on essentials. Larger bottles, above 500 ml, are gaining popularity in households with multiple children or among parents who prioritize cost-effectiveness over smaller, portable options.

In the future, these capacity divisions will shape marketing strategies and product innovation. For example, eco-friendly packaging in smaller packs may attract parents who travel frequently, while refillable bottles in larger categories may help brands gain loyalty from environmentally conscious buyers. Digital retail platforms will also play a strong role, giving parents the ability to compare products instantly and choose sizes that best fit their household needs.

The future of the global baby shampoo market will also see an increase in premium products, especially in the mid to larger capacity ranges. This trend will be driven by parents willing to pay more for shampoos that promise natural ingredients, added vitamins, or unique fragrances designed to enhance the bathing experience. At the same time, smaller packs will remain important in regions where affordability is the main factor. Together, these divisions by capacity will continue to guide how brands produce, package, and market their products to meet the changing expectations of families around the world.

By Application

The global baby shampoo market is steadily gaining importance as more parents across the world focus on safe and gentle products for their children. Shampoo designed specifically for babies has become a trusted category, as it is expected to protect delicate skin and hair while being free from harsh chemicals. This demand will continue to rise as awareness of child health increases and as families look for brands that combine safety, convenience, and affordability. With more research being directed at developing better formulas, the market is likely to see significant changes in the years ahead.

One of the most important ways the global baby shampoo market is structured is through its application channels, which are divided into online retail and offline retail. Offline retail will continue to hold strong, as many parents still prefer to visit stores directly to check products before buying. Physical shops provide the chance to compare different brands, check product authenticity, and feel reassured by the availability of customer service. Pharmacies, supermarkets, and specialty baby stores will remain an essential part of the purchasing process. However, the influence of online retail is expected to grow at a faster pace, supported by the convenience it brings to families who may not have easy access to stores or prefer shopping from home.

Online retail in the global baby shampoo market will likely become even more influential in the future. Digital platforms allow parents to read reviews, study ingredient lists, and access discounts that may not be available in physical stores. Subscription-based services for baby care products are expected to gain momentum, ensuring parents never run out of essentials while also saving time. With the expansion of e-commerce in both developed and developing countries, the reach of baby shampoo brands will cross traditional geographic limitations, giving small and new players an opportunity to compete with well-known names.

Looking ahead, the global baby shampoo market will be shaped by innovation, awareness, and accessibility. Parents will be more careful about the type of products they select, and this will encourage companies to invest in natural ingredients and eco-friendly packaging. The balance between online and offline channels will keep shifting, but both will play an important role in ensuring products are available to families worldwide. As technology continues to change shopping behavior, and as parents become even more focused on the well-being of their children, the market will continue to expand and adapt to meet new expectations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2,655.05 million |

|

Market Size by 2032 |

$3,742.32 Million |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global baby shampoo market is expected to move toward steady growth as consumer preferences and lifestyles continue to shift. Parents everywhere are becoming more aware of the importance of safe and gentle products for children, and this awareness will influence future demand. Many families are looking for shampoos that use natural ingredients and avoid harsh chemicals, which will likely push companies to create new formulas that meet these expectations. With growing conversations about sustainability, eco-friendly packaging and responsible sourcing will also play a major role in shaping how products are made and sold.

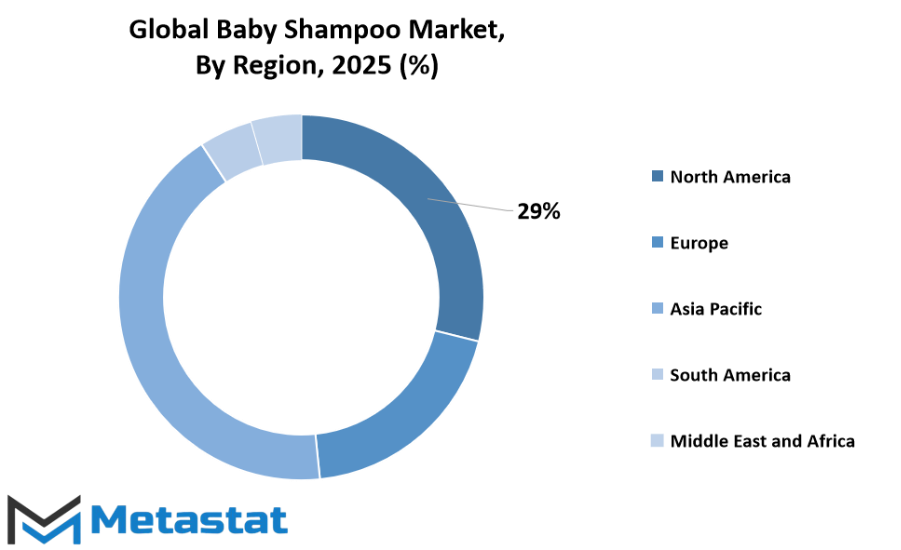

When looking at the global baby shampoo market from a geographical view, it is clear that each region carries its own influence. North America, led by the U.S., Canada, and Mexico, will continue to be a strong consumer base due to high spending on childcare products and a focus on premium quality. In Europe, including the UK, Germany, France, Italy, and the Rest of Europe, there will be growing opportunities for brands that highlight organic and dermatologist-tested solutions, as European parents are often particular about product safety standards.

Asia-Pacific, which includes India, China, Japan, South Korea, and the Rest of Asia-Pacific, is expected to be one of the fastest-growing regions. The rise of middle-class families and increased awareness of child hygiene will play a large role here. As urbanization grows and parents look for convenience, the demand for trusted and well-known brands will rise. South America, with countries such as Brazil and Argentina, will gradually expand its share as economic conditions improve and access to international and local brands increases. Meanwhile, the Middle East & Africa, which includes GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, will see future growth supported by young populations and the growing retail sector.

Looking forward, the global baby shampoo market will not only be shaped by parents’ desire for safe products but also by digital platforms. Online shopping, reviews, and targeted marketing will guide buying decisions more than ever before. Companies that invest in innovation and maintain transparency about ingredients will likely gain trust and loyalty. As technology improves, production methods will become more efficient, making it easier to meet the rising demand across different regions.

The future shows that while parents will always focus on quality and safety, they will also expect companies to adapt to new standards of sustainability and convenience. This will create a market that continues to grow while responding to the changing expectations of families worldwide.

COMPETITIVE PLAYERS

The global baby shampoo market will continue to expand as more parents around the world place greater importance on safe, gentle, and effective products for their children. With growing awareness about health and wellness, parents are now more cautious in their choices, leaning towards products that promise safety, natural ingredients, and tested quality. This shift in preference is shaping how companies design their offerings and how they compete with one another.

Some of the most competitive players in this space include Beiersdorf, Johnson & Johnson, L’Oréal, Unilever, Burt’s Bees, California Baby, Chicco, Earth Mama Baby Angel, Himalaya Wellness, Mothercare, and Pigeon. Each of these brands has its own strategy, which will play an important role in how the market grows in the future. Johnson & Johnson, for example, has long been a trusted name in baby care, and the company will likely keep innovating while maintaining its strong global presence. Unilever and L’Oréal bring with them the advantage of wide distribution networks and strong brand recognition, which will help them compete as parents demand both safety and convenience.

Smaller but equally influential companies such as Burt’s Bees and California Baby will continue to draw attention through their emphasis on natural and organic products. Parents are becoming more inclined to look for chemical-free solutions, and these brands are already positioned to meet that demand. Himalaya Wellness and Earth Mama Baby Angel will also benefit from this growing interest in herbal and plant-based care, giving them an edge in markets where traditional remedies hold value. Meanwhile, Chicco, Mothercare, and Pigeon will continue strengthening their portfolios by combining baby care expertise with trusted reputations.

The competition among these players will not only shape current offerings but will also guide the future direction of the global baby shampoo market. Innovation will be central, as companies will need to develop formulas that are mild yet effective, appealing not only to parents’ expectations but also to evolving safety standards. Eco-friendly packaging and sustainable sourcing will also be strong selling points in the years ahead, as customers look for brands that align with their values.

Overall, the global baby shampoo market will move forward with a mix of established giants and agile smaller brands pushing each other to innovate. The growing demand for safe, natural, and trustworthy products will ensure that these companies keep competing to deliver shampoos that parents can confidently use for their children.

Baby Shampoo Market Key Segments:

By Material Type

- Medicated

- Non-Medicated

By Capacity

- Less than 100 ml

- 100 ml to 250 ml

- 250 ml to 500 ml

- More than 500 ml

By Application

- Online Retail

- Offline Retail

Key Global Baby Shampoo Industry Players

- Beiersdorf

- Johnson & Johnson

- L’Oréal

- Unilever

- Burt’s Bees

- California Baby

- Chicco

- Earth Mama Baby Angel

- Himalaya Wellness

- Mothercare

- Pigeon

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252