MARKET OVERVIEW

The global recovery footwear market will be at the intersection of performance innovation and consumer health, an industry that will go far beyond the manufacturing of shoes. As sports, wellness, and lifestyle increasingly overlap, recovery footwear will no longer be viewed as a niche offering for athletes but as part of daily comfort and long-term physical wellbeing. The market will shift towards producing designs that not only cater to post-activity relief but also assist in preventive care, increasing balance, and increasing walking efficiency for the masses.

Going forward, the global recovery footwear market will be in sync with changing consumer lifestyles wherein wellness will no longer be an afterthought but a continuous practice. Humans will increasingly preference to have footwear that promotes their feet via every segment of interest, from early morning workout routines to prolonged durations of office paintings. Tomorrow's shoes will include materials and designs that adapt to personal biomechanics, turning in cushioning and alignment blessings that alter in real time. Such merchandise will create a subculture in which recuperation is constructed into every day wear as opposed to being saved for times following severe hobby.

As the marketplace keeps to progress, sustainability may be a driving force in the back of layout and manufacture. Recyclable merchandise, low-impact manufacturing procedures, and modular layout becomes an increasing number of preferred, because of this the global recovery footwear market merchandise will fulfill overall performance necessities as well as ecological responsibility. This exchange will attract athletes in addition to socially accountable clients who will demand that their shoe purchase helps larger ecological principles.

Technological advancements in cloth technology will enable upcoming recuperation footwear to be lighter, extra strong, and more responsive with out sacrificing durability. Breakthroughs in cushioning technologies might be capable of offer focused electricity go back, permitting smoother gait cycles and less pressure on muscles and joints. Integration with smart era may also be a component, with sensors being capable of screen such recovery factors as foot stress distribution, gait pattern, and stage of fatigue, allowing wearers to make informed compensations to their rest and activity cycles.

The cultural view of recovery shoes will change, too. No longer just utilitarian designs for after-sport wear, the products of the future will marry fashion appeal with performance and become applicable for work, travel, and play. Designers will adopt adaptable styling, keeping the recovery advantages subtle but still strong, appealing to fashion and performance-driven consumers alike.

Retailing in the global recovery footwear market will also change. Customized fitting services, both online and offline, will guarantee that purchasers get products specifically designed for their foot type, activity level, and recovery demands. The convergence of augmented reality fitting systems and bespoke-order websites will render purchasing choices more precise and engaging.

In the coming years, the global recovery footwear market will not only provide footwear—it will redefine how individuals perceive foot health, comfort, and recovery as a way of life. Through innovation in technology, environmentally friendly innovation, and design adaptability, the sector will reimagine the role of footwear, constructing a world where every step has a positive role to play in ensuring long-term well-being.

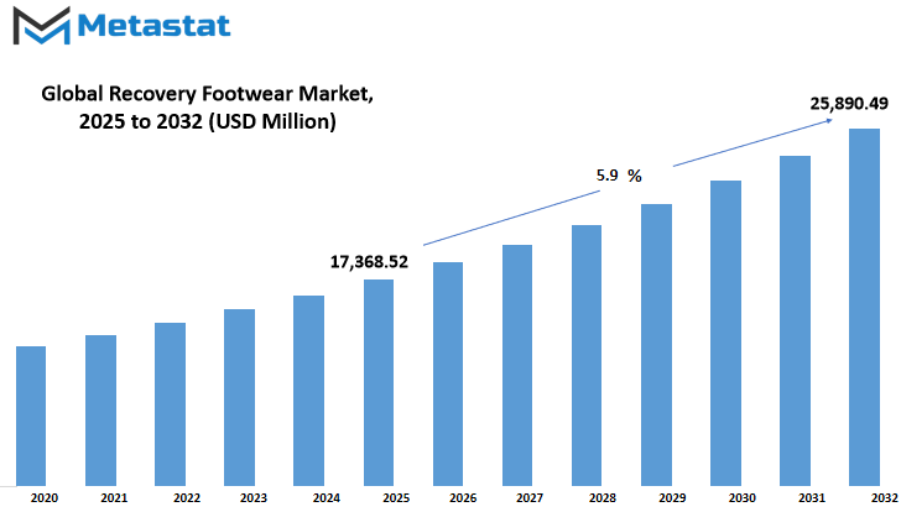

Global recovery footwear market is estimated to reach $25,890.49 Million by 2032; growing at a CAGR of 5.9% from 2025 to 2032.

GROWTH FACTORS

The global recovery footwear market is witnessing consistent focus as individuals more and more appreciate the significance of appropriate footwear in keeping the feet healthy and supporting recovery post-activity. As lifestyles turn increasingly active and fitness sessions a common norm in daily life, more realize that recovery is equally essential as performance. Customers are actually searching out footwear that aren't only for style or mere comfort but also for specific benefit together with assuaging muscle weariness, aiding blood glide, and providing guide following a sports or workout session. This trend is in particular apparent in people who engage in excessive-impact activities due to the fact they see the lengthy-term advantages of cushioning their ft and joints the usage of recuperation footwear.

Fitness enthusiasts and athletes are fueling much of this segment's trend. For some, recovery shoes are now a staple of their training arsenal alongside energy supplements or foam rollers. The draw is that the products marry comfort with science-driven designs that contribute to more rapid recovery and decreased stress. With increasing sports participation and active lifestyles being embraced by individuals, the demand for footwear compatible with these habits is necessarily on the rise. From running, gym workouts, to other types of physical exercises, the requirement for efficient recovery solutions has transformed specialty footwear into a popular choice.

Yet some challenges restrain the global recovery footwear market from capitalizing fully. Among the primary impediments is the premium cost of quality recovery footwear, hindering adoption in price-conscious markets. Although the advantages are valued by the end users, numerous consumers in emerging markets are unable to justify the cost. Furthermore, awareness of the function and benefits of recovery footwear remains limited in a number of emerging markets. Lacking education and promotion, potential customers might ignore these products or confuse them with conventional footwear, neglecting their exclusive advantages.

Barring these limitations, there is a significant potential for expansion. Developing in untapped markets like Asia-Pacific and Latin America holds the potential to reach massive populations with rising disposable incomes and developing interest in health and wellness. These markets also feature growing sports and fitness culture, which makes them excellent markets for recovery shoes. Simultaneously, advances in sustainable substances are growing new possibilities. Creating green and recyclable merchandise no longer only attracts those consumers who're eco-aware but also differentiates businesses in a crowded marketplace. By product innovation and targeted marketplace enlargement, agencies have an excellent threat of establishing brand loyalty and increasing their base of clients.

MARKET SEGMENTATION

By Product Type

The global recovery footwear market has been growing progressively as people increasingly apprehend the price of foot care and comfort after interest. Recovery footwear allows to support, minimize strain at the toes, and decorate standard healing following sports like going for walks, schooling, or extended status. The shoes include cushioning, ergonomic styles, and supportive soles to alleviate pain and avoid harm. The growth in the market is pushed by using the extended adoption of lively life, rise in participation in sports activities, and extended awareness about foot-associated troubles due to ill-becoming shoes. With greater consciousness on comfort and nicely-being, restoration shoes have shifted from being a spot product for sports individuals to an normal choice for extra people.

Within the product category, flip-flops remain one in every of the largest segments, worth $4,977.39 million, driven by using their ease of use, lightweight structure, and breathable design. They are mainly popular in warmer climates and amongst people seeking out informal, cushty footwear for every day put on. Closed-toe footwear also hold a strong function, offering extra safety and support for those who need stability during recuperation. Slides and sandals remain contemporary for the combination of fashion and comfort, and they remain a famous versatile choice for both inside and out-of-home use. Boots cope with a lower however regular call for, especially for people who require extra ankle help or humans residing in chillier climates. The "Others" segment encompasses new designs that characteristic modern materials and uncommon capabilities centered at specific recuperation necessities.

Consumer demand is underpinned through growing innovation in substances and design. Consumers increasingly view recovery shoes as not strictly medical or sporting products but rather as something to fit into their normal wardrobe. This has led firms to develop broader color palettes, designs, and contemporary silhouettes while holding onto the inherent benefits of recovery-oriented construction.

Rising awareness of preventive care for foot health is also likely to keep this market moving in a positive direction. As individuals become aware of the long-term advantages of proper support, demand for various forms of recovery shoes will continue to grow even further. With robust sales in flips-flops, closed-toe footwear, slides and sandals, boots, and new designs, the market will continue to be a strong segment of the global footwear market, providing comfort and recovery options for diverse needs and lifestyles.

By Material Type

The global recovery footwear market is an increasing number of gaining traction as more people find out about the need of publish-exertion comfort and help. Recovery footwear intention to cause the feet to relax, alleviate anxiety, and speed up recuperation after exercises. Through the provision of cushioning, arch assist, and surprise absorption, these items attraction to athletes, health lovers, and folks who paintings on their ft for extended periods. With developments in health and well-being continuing to form patron choices, demand for top-first-rate recovery footwear is at the upward thrust globally. Companies are moving their attention to substances that no longer only offer comfort but also hold pace with sustainability and sturdiness expectancies.

Based on fabric type, the global recovery footwear market is segmented into EVA foam, rubber, and others. EVA foam is maximum popular due to its lightness and extremely good shock-absorbing capabilities. It makes footwear smooth but supportive, and it is for that reason a extraordinary option for relieving foot tiredness. The comfort and flexibility of EVA foam also make it a extraordinary choice for individuals improving from foot accidents or individuals who require introduced cushioning throughout normal sports. EVA foam is extensively used by many manufacturers as a foundational material in slides, sandals, and restoration casual footwear because it offers a good stability of charge and luxury.

Another common substance located in restoration footwear is rubber, which is likewise relatively long lasting and grip-powerful. Footwear made from rubber can sustain every day put on and tear even as still being structurally sound and appropriate for each indoor and outdoor purposes. Its herbal resistance and slip-resistance abilities are particularly suited for people looking for steady traction with out compromising comfort.

"References" includes factors like polyurethane, memory foam combos, and green options from recycled or botanical assets. These products have a tendency to deal with area of interest segments within the market, that specialize in consumers that fee environmentally friendly products or revolutionary consolation capabilities. Many of these alternatives are crafted to balance foam's softness with rubber's strength, offering users with a balanced recovery experience. This phase is likewise an area for experimentation, with businesses experimenting with new material blends to decorate performance, sustainability, and universal comfort.

Material choice, in fashionable, has an effect on the global recovery footwear market no much less great than design and fashion. EVA foam presents exceptional lightweight consolation, rubber gives you sturdiness and traction, and different substances clear up for character desires including sustainability and progressed guide. With clients nevertheless valuing fitness and healing, the choice of substances could be instrumental in driving buying selections, assisting manufacturers to innovate while catering to varying tastes. This emphasis on feature and cloth fine will probable hold to propel the market within the future.

By End User

The global recovery footwear market is attracting interest as people learn more about the need to care for their feet after physical activity. Recovery footwear is designed to reduce fatigue, promote natural alignment, and enhance comfort after exercise, long-standing hours, etc. With the alteration of lifestyle patterns and increasing emphasis on individual well-being, the demand for such goods is gradually rising in various customer segments. Brands are developing choices that are not only practical but also fashionable, so that the users need not sacrifice looks in favor of comfort.

By cease person, the global recovery footwear market further bifurcates into men, girls, and unisex. Men's merchandise generally emphasize durability, huge fits, and heavier cushioning to house bulkier builds and more effect activities. Women's recovery footwear will regularly have light weight designs, softer textures, and a design that fits a variety of tastes, from everyday wear to lively healing. The unisex market draws customers who need merchandise that are adaptable and can be used for each males and females, blending capability with widely wide-spread styling. This version permits corporations to address specific necessities as well as attain out to a much broader populace.

Men's section is facilitated by an increasing reputation of sports activities restoration, fitness center workout routines, and out of doors sports. More participation in strolling, trekking, and excessive-impact sports activities has fueled the call for for footwear that could relieve post-workout tension. The ladies's phase is facilitated by using the expanding uptake of fitness regimens, yoga, and wellbeing-orientated existence. Women also are increasingly inquisitive about footwear that may be effortlessly transformed from restoration use to every day wear, and capability and style are equally applicable.

The unisex section is developing unexpectedly as purchasers are seeking for smooth and powerful answers without having to don't forget gender-constrained designs. These are specially sought-after for domestic use, travel, and regular excursions, offering comfort and luxury for more than one customers. As consciousness of the benefits of restoration footwear increases, brands may be compelled to hold enhancing designs and materials to reply to evolving desires of guys, ladies, and unisex customers. This balanced strategy maintains the market interesting for numerous categories of customers across the globe.

By Distribution Channel

The global recovery footwear market is gradually increasing with the realization among larger numbers of people about the need for recovery-friendly, comfortable footwear after engaging in any physical activity or due to some form of injury. Based on distribution channels, this market can be broadly categorized as online-based or offline-based. Both channels provide different facilities for consumers. Recovery footwear are no longer a area of expertise object for athletes alone—it's far being adopted with the aid of individuals across every age who wish to decorate comfort, alleviate pressure, and inspire progressed foot health on a everyday basis. This has widened the scope of the marketplace so that it can now reach out to a larger phase.

The digital phase is proving to be a powerful pusher of sales, mainly because it presents an added comfort. Shoppers are able to browse thru numerous brands, test expenses, examine opinions with the aid of different customers, and purchase without having to exit of the house. This is mainly attractive to people with mobility troubles or tight schedules. Online sites additionally offer an opportunity for smaller and younger brands to rival the massive names on the grounds that online stores have the potential to reach consumers in various locations without paying hire for bodily stores. Besides, e-commerce frequently includes focused advertising to assist purchasers in finding products that meet their person necessities.

The offline segment, however, stays a first-rate contributor to the global recovery footwear market. Consumers regularly like to attempt on footwear earlier than they buy them to get the right match and luxury. Physical shops additionally offer the benefit of in-man or woman help from salespeople, who can direct clients to the satisfactory preference for his or her desires. This face-to-face revel in can be especially crucial for those shopping restoration footwear for medical or healing use, due to the fact right fitting is important to make sure fulfillment.

Both channels are responsible for the market's growth, but they operate differently. The web platforms accommodate speed, convenience, and diversity, and offline shops prioritize human interaction and instant product trial. Both complement each other in providing recovery shoes to a broad and varied population of customers. With further realization of foot health, both channels will continue to be vital in fulfilling the varied needs and wants of purchasers, striking a balance and availability of the global recovery footwear market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$17,368.52 million |

|

Market Size by 2032 |

$25,890.49 Million |

|

Growth Rate from 2025 to 2032 |

5.9% |

|

Base Year |

2024 |

|

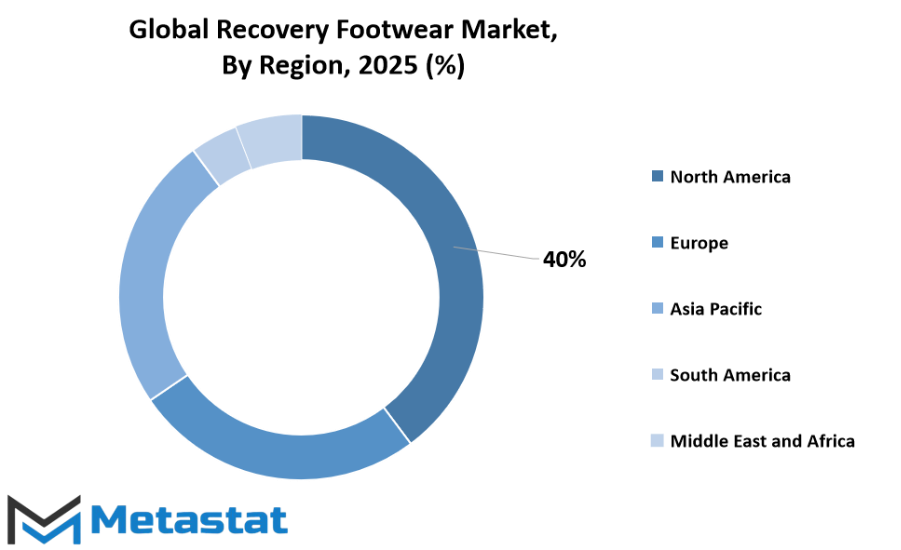

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global recovery footwear market is influenced by varied geographical segments, each playing with its own preferences, consumer patterns, and growth trends. North America is significant in this market, and the United States, Canada, and Mexico are its central markets. Here, an increasing awareness of foot health and recovery after exercise or activity has motivated more individuals to seek out recovery footwear for comfort and support. The U.S. takes the lead with a high need for innovative designs, followed by Canada and Mexico, which are showing consistent growth as consumers increasingly appreciate the advantages of recovery-specific footwear.

In Europe, nations like the UK, Germany, France, and Italy are leading market interest through the integration of lifestyle trends and developments in shoe technology. Comfort-oriented fashion is picking up here as well, and so recovery footwear becomes a form and function product. Germany's sports-oriented culture and the UK's growing wellness consciousness lead to stable market uptake. France and Italy, with their reputations for combining style and comfort, are opening doors for brands that combine recovery advantage with style. The remainder of Europe also holds opportunities, especially as individuals increasingly embrace active lifestyles.

Asia-Pacific is a rapidly growing region, with India, China, Japan, and South Korea being among the key contributors. The growing middle class in the region, combined with rising usage of sports and fitness items, is driving demand for recovery shoes. In Japan and South Korea, emphasis on technology and innovation in footwear has led to a range of products catering to professional athletes as well as casual consumers. India and China, being densely populated with growing health awareness, are emerging as robust growth hubs. The remaining Asia-Pacific is also coming along as fitness awareness picks up beyond urban centers.

South America, followed by Brazil and Argentina, is slowly developing its recovery footwear market. Brazil's vibrant sports culture and Argentina's expanding fitness demographic are driving demand. While the market itself is smaller than in other areas, growing consumer interest in wellness products indicates potential for growth. The remainder of South America will likely follow this trend upward, particularly with brands investing in awareness initiatives and product distribution.

Middle East & Africa region, comprising GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa, depicts a distinct blend of opportunities. GCC Countries are experiencing a growth in fitness and recreational activities, stimulating demand for premium recovery footwear. South Africa's sporting culture and Egypt's increasing urban consumer base are gaining momentum for market growth. While the balance of the region remains in the early stages of adoption, creeping economic growth and growing exposure to international wellness trends are likely to generate opportunities in the years to come.

COMPETITIVE PLAYERS

The global recovery footwear market is expanding with more individuals seeing the importance of footwear that promotes foot wellness and general comfort following physical exertion. The shoes are designed to relieve pressure on the feet, promote circulation, and cushioning that supports recovery. They are not intended only for athletes; those who work for extended periods on their feet or walk for a long time also benefit from them. With more attention being given to post-workout recovery and long-term foot health, recovery footwear is increasingly in demand in various global regions. Other driver factors that are further fueling this growth include growing participation in sports, fitness consciousness, and a concentration on injury prevention.

A push factor in the global recovery footwear market is the performance by key brands that keep developing in design and materials. Brands such as OOFOS, HOKA ONE ONE, adidas, Nike, Under Armour, and ASICS created products that integrate style with performance, and thus are popular not only for recovery but for everyday use. They incorporate cutting-edge cushioning technology, breathable materials, and ergonomic design to improve comfort and performance. Others like Kuru Footwear, Okabashi, Crocs, Telic, Kane Footwear, Spenco, and Birkenstock meet various customer demands, providing everything from light slip-ons to orthopedic-style sandals.

Market competition has spurred ongoing improvement in quality and variety. Established brands such as Skechers, Reebok, and OluKai bring their own set of loyal followers, while upstarts like Xiamen Jerryfootprint Imp&Exp Co., Ltd. are offering affordable, effective alternatives. This combination of long-established international brands with smaller innovators keeps the balance between high-performance products at the high end and affordable options. Both offline and online retail channels have increased the availability of these products, supporting an increased reach among consumers.

Apart from the increased consumer base, the popularity of recovery footwear has also spilled over into lifestyle movements. Individuals today wear them not just after workouts but also for daily activities due to their comfort and fashionable designs. The market is projected to keep increasing as more people prioritize health-oriented footwear options. With intense competition, emerging technologies, and growing awareness, the global recovery footwear market is poised for consistent growth in the coming years.

Recovery Footwear Market Key Segments:

By Product Type

- Flip-flops

- Closed-toe Shoes

- Slides and Sandals

- Boots

- Others

By Material Type

- EVA Foam

- Rubber

- Others

By End User

- Men

- Women

- Unisex

By Distribution Channel

- Online

- Offline

Key Global Recovery Footwear Industry Players

- OOFOS

- HOKA ONE ONE

- adidas

- Nike

- Under Armour

- ASICS

- Kuru Footwear

- Okabashi

- Crocs

- Telic

- Kane Footwear

- Spenco

- Birkenstock

- Skechers

- Reebok

- OluKai

- Xiamen Jerryfootprint Imp&Exp Co., Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252