MARKET OVERVIEW

The global off-price retail market will be a unique segment of the retail space, providing consumers with entry to premium branded merchandise at lower prices through innovative sourcing and selling practices. This sector will not just replicate conventional retail formats but will have a business model based on buying excess inventory, closeouts, and out-of-season items, delivering a shopping experience that combines affordability with brand attraction. In the next few years, the market will transition from its present status as a secondary channel for leftover products to a strategic channel that global brands will increasingly rely on to target cost-conscious yet brand-aware consumers.

What will distinguish this market is its ability to adapt to shifting consumer expectations. Instead of just being a bargain hunter's destination, it will more and more be a highly curated platform for quality and style minus the high-end price. This transition will come about through a strategy of selecting carefully inventory that is reflective of changing fashion trends, lifestyle needs, and even sustainable consumption patterns. Retailers in this space will further develop their supply chain models to operate with speed, flexibility, and responsiveness to the trend while not diluting the value proposition to the consumer.

The future scope will operate far from the boardroom. As purchaser buy conduct increasingly tilts closer to on line convenience, the global off-price retail market will welcome omnichannel strategies that mix the joys of treasure-hunt purchasing with the benefit of online shopping. Improved virtual systems will allow actual-time inventory, custom designed promotions, and digital product displays, allowing customers to create the thrill of in-shop discovery without leaving their residing rooms. The integration of physical and virtual stories will create a much broader and greater dependable client pool.

Sustainability will also contribute more toward establishing this market's identity. As awareness of environmental issues increases, off-price retailing will take on the role of working to minimize waste by lengthening the life of products that are unsold through primary retail channels. This sustainable perspective will attract not just price-sensitive consumers but also the consumers who want to make the right buying decisions without having to compromise quality. With time, this theme will reinforce the attitude of off-price retail as an economic and moral decision.

Globalization will further increase the reach of the market. With more streamlined cross-border e-commerce, consumers in areas where there is limited access to some international brands will find themselves increasingly seeking out off-price channels to obtain them. This will provide the industry with opportunities to diversify its product portfolio and offer wide cultural variations at the same time as it continues to enjoy its price competition advantage.

Finally, the global off-price retail market will no longer be constrained to cut price purchasing limitations. It turns into a vibrant, customer-orientated industry in which logo desirability intersects with affordability, fueled by using era, sustainability, and international reach. Its future might be characterised by the ability to combine price, variety, and an opportunity shopping enjoy that, thru its relevance and boom, exceeds traditional expectations.

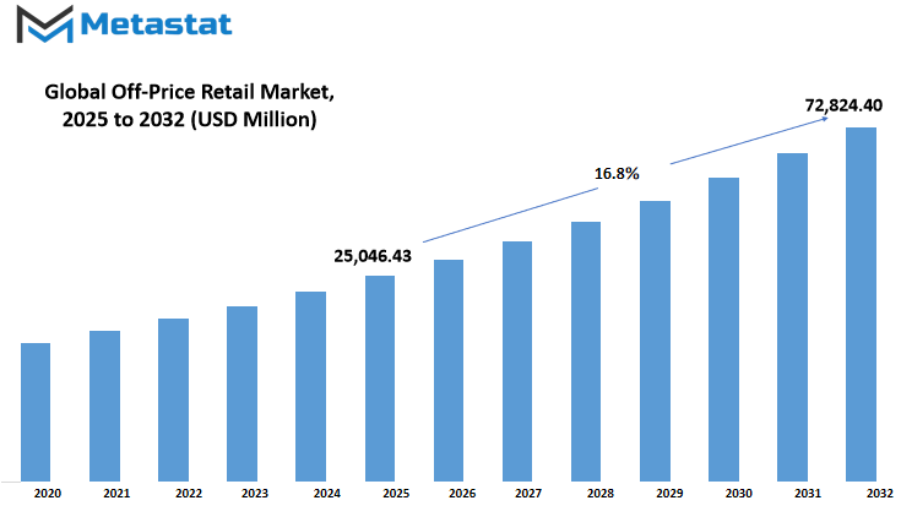

Global off-price retail market is estimated to reach $72,824.40 Million by 2032; growing at a CAGR of 16.8% from 2025 to 2032.

GROWTH FACTORS

The global off-price retail market has been receiving notable attention over the past few years as more shoppers have been adopting value-based purchasing and the attraction of branded items at discounted prices. This is an indication of changing buying behavior in which customers wish to obtain quality at less than full retail prices. Retailers operating in this segment have established their credibility on providing familiar brands at reduced prices, generating feelings of satisfaction and exclusivity among purchasers. The intersection of value and brand name has helped off-price retail to establish a broad base of shoppers, including cost-sensitive families and fashion-forward individuals seeking top-quality products at a fraction of the price.

The onrush of e-commerce and mobile commerce platforms has further sped up this growth, with discounted goods being more reachable than ever. Consumers can browse and store from multiple off-rate stores on-line, with functionalities inclusive of flash sales, advice-based offers, and app-only reductions. This ease has widened the scope of off-rate retail to beyond brick-and-mortar stores, permitting it to serve clients in areas in which such centers had been previously absent. The combination of on line get admission to with the joys of cut price hunting has strengthened consumer loyalty and promoted recurrent purchasing.

Despite that, the marketplace is not void of risks. Perhaps the biggest impediment is the spotty availability of merchandise, which can also save you consumers from locating favored items, sizes, or styles. This uncertainty, as a whole lot a part of the treasure-hunt syndrome as it's miles at times, serves to annoy clients who like consistency. Off-price retailers additionally regularly anticipate overstock from manufacturers or leftover stock from complete-price retailers. This reliance creates the potential for the deliver of products to differ consistent with the overall performance of other retail markets, which could have an effect on income in the course of durations of low surplus.

Opportunities for growth remain sturdy notwithstanding those challenges, in particular in rising economies in which call for low-priced home items and fashion is growing. With higher disposable incomes and a strengthening interest in branded products, off-charge retail can advantage a larger market share in those markets. With strategic sourcing complemented via a stronger online presence, outlets are able to meet this growing consumer base with out sacrificing the cost-pushed enchantment that characterizes the enterprise. In the following couple of years, those able to manipulate inventory problems with increasing call for for discounted branded objects may be in an amazing role to prosper.

MARKET SEGMENTATION

By Product Type

The global off-price retail market has been growing consistently with customers continuing to are trying to find first-class merchandise at discounted costs. This commercial enterprise version allows outlets to offer branded merchandise at deep reductions, earning the patronage of price-sensitive customers while ensuring product satisfactory isn't compromised. Off-rate retail is appealing because products are constantly being turned around, which creates a feeling of urgency and thrill for the purchasers to keep. This method does not handiest advantage customers however also enables brands to cast off extra stock seamlessly without denting their reputation. As extra clients grow to be value-conscious of their purchasing behavior, the off-price segment will continue to be a key player inside the retail market.

Across this market, clothing is the biggest product category, with its value achieving $11,421.17 million. Apparel remains the leader due to the quick pace of fashion, resulting in a consistent stream of discounted brand apparel. Consumers are able to locate high-quality apparel for prices significantly lower than when purchased at traditional retail, making apparel the leading draw for people into off-price stores. Seasonal fluctuations, changing fashion trends, and overruns provide the source of these products, which brings a constant stream of new options for consumers to select from.

Accessories and footwear are right behind, contributing to the array of variety and attraction of the shopping enjoy. Shoes from reputed brands and latest accessories which include rings, bags, and belts upload price to buyers seeking bargains within the luxurious section. The creation of recent lines ensures that those categories live fresh and popular. Home fixtures and electronics additionally have an increasing marketplace percentage, from furnishings and kitchen gadgets to devices and appliances. These merchandise enchantment to purchasers seeking nice household and technological gadgets at less than full charges, growing a much wider base for the market.

These other merchandise, ranging from seasonal items to beauty products, toys, and the like, provide depth to the products, so off-rate shops enchantment to a numerous array of needs. By providing some thing one-of-a-kind for each client base and section, stores are able to gain distinctive patron segments in addition to repeat commercial enterprise. As greater clients search for value and variety in their purchasing reports, the global off-price retail market will maintain growing due to the fact it is able to keep up with trends at the same time as maintaining an emphasis on affordability and first-class.

By Distribution Channel

The global off-price retail market has evolved into a force to be reckoned within the retail sector, and it draws consumers in by virtue of its potential to provide branded products and high-quality items at more affordable prices. Not only is this enticing for price-sensitive consumers but also for people who like to feel the excitement that comes with discovering great bargains. Through the sale of surplus merchandise, end-of-season merchandise, or marginally overproduced goods, off-price retailers provide an ongoing supply of merchandise that brings people back in. The market excels on the premise of value for money, yet does so at affordable prices and in doing so has redefined how individuals shop.

By distribution channel, the global off-price retail market is segmented into B2B and B2C, both serving different customers and functioning in their own manner. The B2B division includes promoting goods in bulk to enterprise clients like small stores, e-commerce websites, or neighborhood shops. These customers commonly buy products to resell them in smaller portions at decrease prices, permitting them to price competitively in their respective markets. This channel has a imperative position in moving heavy volumes of products economically at the same time as making surplus inventory reach the right customers.

The B2C channel, however, ties up with final consumers immediately the usage of physical stores, outlet centers, or websites. The emphasis here is on imparting an interesting patron revel in where customers feel they may be availing of extremely good products at a reduction. The layout, presentation, and merchandising in this channel are intended to get the good buy looking enjoy interesting and rewarding. With the increasing popularity of e-commerce, severa off-rate stores have prolonged their presence via imparting income on-line, permitting clients to shop at any time and at any place while nonetheless cashing in on the low expenses.

Both channels play their element within the average achievement of the marketplace, however they've unique techniques to accommodate the desires in their respective audiences. While B2B makes a speciality of efficiency and amount, B2C focuses on experience and emotional connection. They merge as a balanced framework that enables the off-charge retail market to gain constant growth and resilience in the wake of transferring customer tendencies. The ability to appeal to organizations in addition to the person customer ensures that the marketplace will remain a force to cope with within global retail, supplying a combination of rate, nice, and get right of entry to unavailable somewhere else.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$25,046.43 million |

|

Market Size by 2032 |

$72,824.40 Million |

|

Growth Rate from 2025 to 2032 |

16.8% |

|

Base Year |

2024 |

|

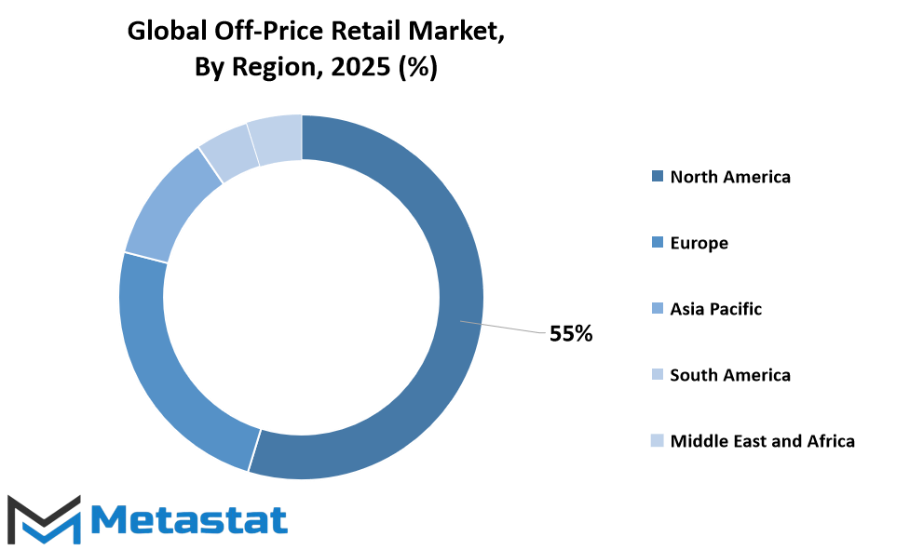

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global off-price retail market is geographically dispersed across multiple regions, each with its personal client tastes, retail framework, and monetary outlook that impact the market's improvement. North America has a sturdy base, with the U.S., Canada, and Mexico being its number one participants. The U.S. Marketplace has created a strong platform for off-price retail with well-hooked up chains and patron call for excellent goods at a discounted charge. Canada reflects parallels, and Mexico presents expanding prospects by virtue of its growing middle class and shifting purchasing habits. These nations collectively form a strong foundation for retailers to sell customers that are looking for value without sacrificing quality.

In Europe, the UK, Germany, France, and Italy have established a consistent off-price retail demand through physical stores as well as digital channels. The UK stays one of the maximum developed markets in this phase, with Germany and France enjoying a aggregate of local and multinational players. Fashion-conscious consumers in Italy additionally make certain excessive call for in this market. The ultimate European economies, with their diversified economic situations and converting retail channels, offer extra resources of growth as increasingly consumers demand discounted branded objects.

Asia-Pacific is the most promising area for the off-price retail market, with massive and varied populations in India, China, Japan, and South Korea. India and China, with increasing incomes and growing urbanization, are drawing domestic and worldwide off-price stores. Japan and South Korea, with their fashion-ahead cultures and technology-pushed clients, offer possibilities for manufacturers to have interaction with clients searching out extremely good merchandise at lower fees. The rest of Asia-Pacific additionally has untapped capacity, with emerging economies more and more adopting off-price retail as customer focus mounts.

In South America, Brazil and Argentina force the off-price retail market, sponsored via their large urbanization base and a surge in call for for cost-priced branded products. Although economic trends in the region may have an effect on consumption patterns, the strength of off-price retailing holds strong, especially with young consumers. The remainder of South America is gradually building pace as more global brands strengthen their footprint and local players shift to meet evolving needs.

The Middle East & Africa region that encompasses the GCC states, Egypt, South Africa, and others is slowly moving towards off-price retailing. The GCC nations, being well-equipped with a good retail infrastructure and high-end consumers, are converging luxury retail with increasing demand for value-driven shopping. Egypt and South Africa, however, are experiencing growth as more people are opting for discounted apparel, electronics, and home goods. The final area has ability for similarly growth as the infrastructure and retail chains enlarge. Combined, those areas show how the Off-Price Retail enterprise will hold to are trying to find opportunities for growth globally, responding to every area's precise choices and financial conditions.

COMPETITIVE PLAYERS

The global off-price retail market has gained exquisite traction in current years, driven by changing purchaser habits and a growing demand for cheap but excellent products. This business model permits customers to buy branded or dressmaker items at drastically lower costs than conventional retail, frequently via selling overstock, past-season collections, or excess stock. Consumers are getting greater aware of balancing fashion, fine, and price, making off-fee retail an attractive desire. With monetary uncertainties influencing spending patterns, shoppers are increasingly more prioritizing value for cash, which has created sturdy opportunities for this segment to make bigger both in physical shops and through on-line platforms.

Companies on this area have subtle their techniques to attract a extensive range of customers, from finances-conscious customers to logo-savvy customers who experience the fun of finding premium products at decreased costs. The main players operating in the industry include TJX Companies, Ross Stores, Burlington Stores, Macy’s Backstage, Bluefly, J.Crew Factory, 6pm.Com, BFL Group, Bim A.S., Discount My Fashion (DMF), Saks Off 5th, Tuesday Morning, NOZ, and Familia. Each of these companies has built its personal technique to sourcing products, managing inventory, and handing over a purchasing experience that feels each low cost and interesting. Their competitive advantage frequently lies in their ability to refresh inventory often, making sure that customers find new offers every time they visit.

The expansion of e-commerce has similarly bolstered the off-charge retail marketplace, enabling manufacturers to attain a broader audience with out the constraints of physical locations. Platforms which includes 6pm.Com and Bluefly, as an example, have capitalized on the ease of online buying whilst supplying reductions that appeal to good buy hunters. At the equal time, brick-and-mortar shops continue to be a robust a part of the arena, particularly for customers who decide upon the enjoy of browsing through objects in man or woman. The combination of on line and offline presence permits these companies to evolve to distinct customer possibilities even as preserving steady income growth.

As opposition intensifies, innovation and flexibility may be critical for maintaining achievement inside the off-price retail market. Retailers are an increasing number of leveraging information analytics to apprehend buying trends, optimize product assortments, and improve supply chain efficiency. Many also are focusing on enhancing the purchaser revel in through save layouts, virtual engagement, and personalised promotions. With customers continuing to are searching for value with out compromising on best, the enterprise is set to stay a great pressure in international retail, with most important gamers continuously refining their strategies to live in advance in an environment in which affordability meets aspiration.

Off-Price Retail Market Key Segments:

By Product Type

- Apparel

- Footwear

- Accessories

- Home Goods

- Electronics

- Others

By Distribution Channel

- B2B

- B2C

Key Global Off-Price Retail Industry Players

- TJX Companies

- Ross Stores

- Burlington Stores

- Macy’s Backstage

- Bluefly

- J.Crew Factory

- 6pm.com

- BFL Group

- Bim A.S.

- Discount My Fashion (DMF)

- Saks Off 5th

- Tuesday Morning

- NOZ

- Familia

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252