Global Retail POS Terminals Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global retail pos terminals market has evolved from being a simple cash handling concept to a highly sophisticated digital platform that is still redefining the processing of transactions in retail outlets. The sector initially found its shape in the middle of the 20th century when mechanical cash registers began replacing manual accounting. These systems gave retailers an option for recording sales accurately and preventing human errors. But it was during the late 1980s that the real revolution began, as electronic point-of-sale technology started to incorporate bar code scanners, enabling faster checkouts and in real time inventory management. The seeds of what would eventually become the data-driven marketplace were planted here.

- Global retail pos terminals market size of approximately USD 42.6 Billion in the year 2025 with almost 7.6% CAGR through the forecast period of 2032 and is capable of surpassing USD 71.1 Billion.

- Fixed POS Terminals command a market share of almost 59.3%, powering innovation and growing applications with tough research.

- Major trends driving growth: Growing adoption of digital and contactless payment solutions, Growing demand for integrated POS with analytics and inventory features

- Opportunities are: Cloud and mobile POS growth for small and medium enterprises

- Major observation: The market would grow exponentially in terms of value during the ten-year period, which emphasizes growth opportunities.

Growth in internet connectivity by the early 2000s transformed the trajectory of the global retail pos terminals market. Merchants began to link terminals to central databases so prices, promotions, and inventory could be easily synchronized among outlets. Touchscreen user interfaces added to these systems made the systems less complicated to operate, pushing widespread adoption even to small and medium-sized businesses. At this point, giant software and hardware companies entered the market, establishing protocols and improving system reliability.

The growth of mobile technology and cloud computing over the next ten years redesigned the boundaries of retail enterprises. Terminal-based and portable terminals gave enterprises the ability to be flexible in addressing customers anywhere within the store. Meanwhile, digital wallets and contactless payments began increasing consumer acceptance, and enterprises were compelled to adopt improved security procedures and levels of encryption. Regulatory conditions of payment security and data security also began to affect product development, compelling manufacturers to develop responsibly.

Today, the global retail pos terminals market is a mix of hardware precision and software intelligence. Artificial intelligence, analytics, and integration into the cloud will continue to be the prime movers, giving retailers predictive insights and operational efficiency. The focus will gradually shift to one-to-one customer interactions, sustainability, and omnichannel compatibility. From its mechanical beginnings through its modern day digital savvy, the development of this market shows how technology and consumer behavior will keep reshaping global retail experiences for decades to come.

Market Segments

The global retail pos terminals market is mainly classified based on Type Of Terminal, Deployment Mode, Application.

By Type Of Terminal is further segmented into:

- Fixed POS Terminals: Fixed POS Terminals will continue to be the established ones in gigantic retail floors with voluminous transactions. They will keep being essential in department stores, supermarkets, and large chains for their ruggedness, stability, and ability to support advanced payment systems. Subsequent generations will come with better user interfaces, higher processors, and enhanced security to reduce downtime and data breaches. Integration of AI-driven analytics and biometric authentication will provide fixed systems with enhanced efficiency and security.

- Mobile POS Terminals: Mobile POS Terminals will become more and more fashionable for being convenient and inexpensive, which will make them an ideal choice for small and medium businesses. The ease of receiving payments anywhere within the store or even beyond physical stores will improve customer experience and reduce checkout time.

By Deployment Mode the market is divided into:

- Cloud-Based POS Systems: Cloud-Based POS Systems will experience high demand as retail merchants seek low-cost, elastic, and remotely manageable solutions. They will facilitate easy data management and allow for multi-store operations to automatically synchronize. Frequent software updates, improved data analysis, and secure storage will deliver improved business performance. With increased internet stability and data security, cloud-based deployment shall be the preferred choice for the majority of today's retailers who seek flexibility and lower maintenance costs.

- On-Premise POS Systems: On-Premise POS Systems will remain valuable to businesses that desire full control of data and operations regardless of internet connectivity. These deployments will be attractive to merchants with rigorous data controls or those that operate within environments with weak connectivity. The systems will become more sophisticated to include stronger encryption, localized data analytics, and customized features to support specific operational demands.

By Application the market is further divided into:

- Department Stores: Department Stores will rely on advanced POS solutions in an effort to handle high stock levels, multiple categories of merchandise, and intricate pricing systems. Modern terminals will support loyalty schemes, real-time stock levels, and automated billing. With the arrival of data analytics, department stores will enhance customer interaction and sales forecasting, making business operations smoother.

- Supermarkets/Hypermarkets: Supermarkets/Hypermarkets will focus on quick checkout, real-time price updates, and inventory system integration. The global retail pos terminals market will meet the demand with terminals that can handle high-volume transactions efficiently. Smart checkout counters and contactless payments will reduce waiting time, and cloud integration will enable centralized monitoring of store performance and inventory management.

- Warehouses: Convenience stores will leverage POS systems for precise stock management, real-time updates, and order management. Intelligent POS terminals will also assist in the automation of dispatch and restocking operations, reducing errors and lag. Coordination with logistics systems will make supply chain coordination more effective. Automating and prioritizing tracking speed and accuracy will improve productivity and reduce operational expenses.

- Convenience Stores: Convenience Stores will be augmented by low-cost and compact POS systems for quick transactions. Mobile POS terminals will support flexible billing, while data analysis will help store owners understand purchasing patterns. Cloud connectivity will allow better inventory control and sales reports. Easy setup, low cost, and ease of use will be priorities for small-sized retailers.

- Discount Stores: Discount Stores will have POS systems to support quick-speed transactions and easy price changes. Automation will aid in the quick management of routine promotions and discounts. Utilization of high-level POS solutions will support accurate inventory and sales tracking along with giving customers a smoother checkout experience. Improved integration with loyalty programs will further keep customers coming back.

- Specialty Stores: Specialty Stores will require POS systems capable of handling specialty products and differentiated customer relations. Sophisticated inventory management and customer preference monitoring will be facilitated through POS technologies in the future. Personalized marketing and reward programs will be facilitated through integration with CRM software. These features will allow specialty stores to develop a core base of loyal customers while maintaining operational effectiveness.

- Others: Other retail categories, including small pop-up shops and kiosks, will integrate streamlined POS systems that are well-suited for smaller transactions. Cloud and mobile-enabled systems will take the lead due to their mobility and ease of implementation. These implementations will be such that even small firms will be able to tap real-time sales data, secure payments, and improved customer interactions with lower-cost digital solutions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$42.6 Billion |

|

Market Size by 2032 |

$71.1 Billion |

|

Growth Rate from 2025 to 2032 |

7.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

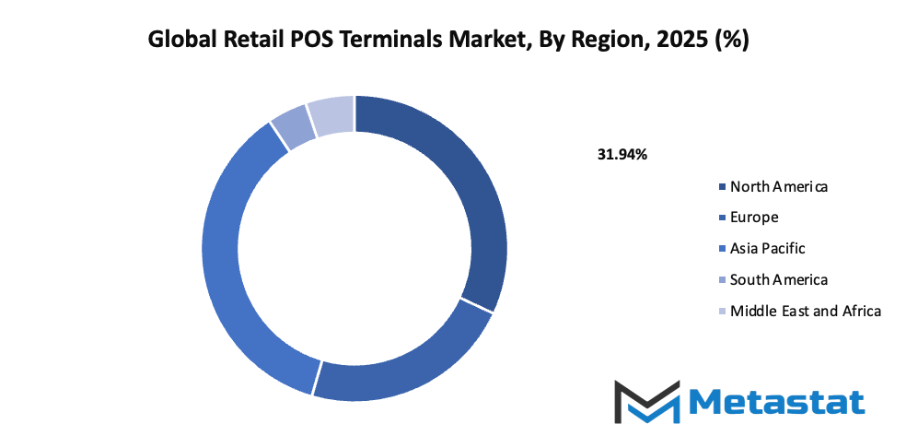

By Region:

- Based on geography, the global retail pos terminals market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing adoption of digital and contactless payment solutions: The shift toward digital and contactless payment methods will play a major role in boosting the global retail pos terminals market. Retailers are investing in systems that accept cards, mobile wallets, and QR codes to meet consumer expectations for faster, touch-free experiences. The trend gained significant momentum after the pandemic, with both customers and merchants seeking safer, cleaner ways to complete transactions. As financial institutions expand support for contactless technology, POS terminal manufacturers will develop more compatible and cost-efficient devices, ensuring long-term adoption and growth in both physical and online retail environments.

- Increasing demand for integrated POS systems with inventory and analytics capabilities: Retailers will increasingly seek integrated POS systems that not only process payments but also manage inventory, sales, and customer data. The global retail pos terminals market will benefit from this growing need for data-driven operations. Businesses want to track stock levels in real-time, identify consumer behavior patterns, and streamline order management through a single platform. These capabilities improve efficiency and support strategic decisions. As artificial intelligence and cloud technologies advance, integrated systems will become more intelligent and accessible, helping even small retailers enhance productivity and competitiveness in a data-centered retail future.

Challenges and Opportunities

- High initial cost of advanced POS systems: The setup and maintenance of modern POS systems will remain a key barrier to the growth of the global retail pos terminals market. Small and medium enterprises often struggle to afford the latest hardware, software updates, and technical support required to maintain reliable systems. This cost challenge limits access to advanced analytics and integrated tools that could otherwise improve performance. However, as competition increases among suppliers, more flexible financing models and affordable subscription-based services are expected to emerge, reducing the financial burden and encouraging wider adoption in the coming years.

- Data security and privacy concerns: Data protection will continue to be a critical issue for the global retail pos terminals market. With increasing transactions processed digitally, there is a higher risk of cyberattacks and unauthorized data access. Retailers must ensure compliance with security standards to safeguard customer information. Breaches can lead to financial losses and harm business reputation. As technology evolves, improved encryption and multi-layered security protocols will be developed to enhance system reliability. Building trust through strong cybersecurity measures will be essential for long-term success and customer confidence in digital payment platforms.

Opportunities

- Expansion of cloud-based and mobile POS solutions for small and medium enterprises: Future opportunities for the global retail pos terminals market will emerge from the widespread adoption of cloud and mobile-based systems among small and medium enterprises. These solutions offer flexibility, lower installation costs, and easy scalability. Retailers can access real-time data from anywhere, improving operational efficiency and decision-making. As internet connectivity and digital literacy improve, cloud-based POS models will dominate the market landscape. This shift will empower smaller businesses to compete with larger ones, while manufacturers gain new revenue streams by offering subscription-based, customizable, and integrated POS solutions tailored to various retail sectors.

Competitive Landscape & Strategic Insights

The global retail pos terminals market continues to expand as technology advances and digital payment systems become more integrated into daily transactions. This growth is shaped by the collaboration and competition among both international industry leaders and emerging regional players. The market reflects a combination of innovation, adaptability, and the constant pursuit of efficiency. As retail businesses modernize their operations to meet consumer expectations for speed, convenience, and security, the demand for advanced POS systems continues to increase.

The industry is a mix of both established corporations and new entrants, each contributing to the rapid transformation of payment technologies. Major competitors include Verifone Systems, Inc., Ingenico, Invenco Group Ltd., NCR Corporation, Diebold Nixdorf, Inc., Fujian Newland Payment Technology, Shenzhen Xinguodu Technology Co., Ltd. (NEXGO), ADVANTECH-AURES, Shenzhen Truepos Commercial Equipment Co., Ltd., Toshiba Corporation, Samsung Electronics Co. Ltd, Global Payments Inc., Elo Touch, Panasonic Corporation, NEC Corporation, Square, Inc., and PAX Technology Limited. These companies play a central role in shaping the market’s future through innovation, product diversification, and strategic partnerships that strengthen their positions across global and regional markets.

Looking ahead, technological advancement will remain the driving force behind the development of POS terminals. The future will see greater integration of artificial intelligence, cloud-based systems, and data analytics to create smarter and more responsive retail environments. Businesses will rely on real-time insights to better understand consumer behaviour and improve transaction experiences. Contactless payments and mobile wallet compatibility will continue to dominate as consumers increasingly prefer faster, safer, and more convenient payment options.

In the coming years, the focus will likely shift toward sustainability, cybersecurity, and scalability. Companies will invest more in eco-friendly production methods and energy-efficient devices. Enhanced data protection features will become essential as global regulations tighten and consumers demand higher levels of privacy. Modular POS systems will also gain popularity, allowing retailers to upgrade hardware and software easily as technology evolves.

Emerging regional competitors will continue to challenge established players by offering cost-effective solutions tailored to local markets. Their agility and understanding of regional needs will allow them to compete effectively and gain a stronger foothold. Meanwhile, international leaders will continue to focus on research, global partnerships, and digital transformation initiatives that keep them ahead in innovation.

Market size is forecast to rise from USD 42.6 Billion in 2025 to over USD 71.1 Billion by 2032. Retail POS Terminals will maintain dominance but face growing competition from emerging formats.

Ultimately, the global retail pos terminals market will continue to grow as retail operations evolve toward a more connected, data-driven future. The collaboration and competition among these companies will lead to more accessible, efficient, and secure payment technologies that redefine the shopping experience worldwide.

Report Coverage

This research report categorizes the global retail pos terminals market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global retail pos terminals market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global retail pos terminals market.

Retail POS Terminals Market Key Segments:

By Type Of Terminal

- Fixed POS Terminals

- Mobile POS Terminals

By Deployment Mode

- Cloud-Based POS Systems

- On-Premise POS Systems

By Application

- Department Stores

- Supermarkets/Hypermarkets

- Warehouses

- Convenience Stores

- Discount Stores

- Specialty Stores

- Others

Key Global Retail POS Terminals Industry Players

- Verifone Systems, Inc.

- Ingenico

- Invenco Group Ltd.

- NCR Corporation

- Diebold Nixdorf, Inc.

- Fujian Newland Payment Technology

- Shenzhen Xinguodu Technology Co., Ltd. (NEXGO)

- ADVANTECH-AURES

- Shenzhen Truepos Commercial Equipment Co., Ltd.

- Toshiba Corporation

- Samsung Electronic Co. Ltd

- Global Payments Inc.

- Elo Touch

- Panasonic Corporation

- NEC Corporation

- Square, Inc.

- PAX Technology Limited

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383