Global OLED Display Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

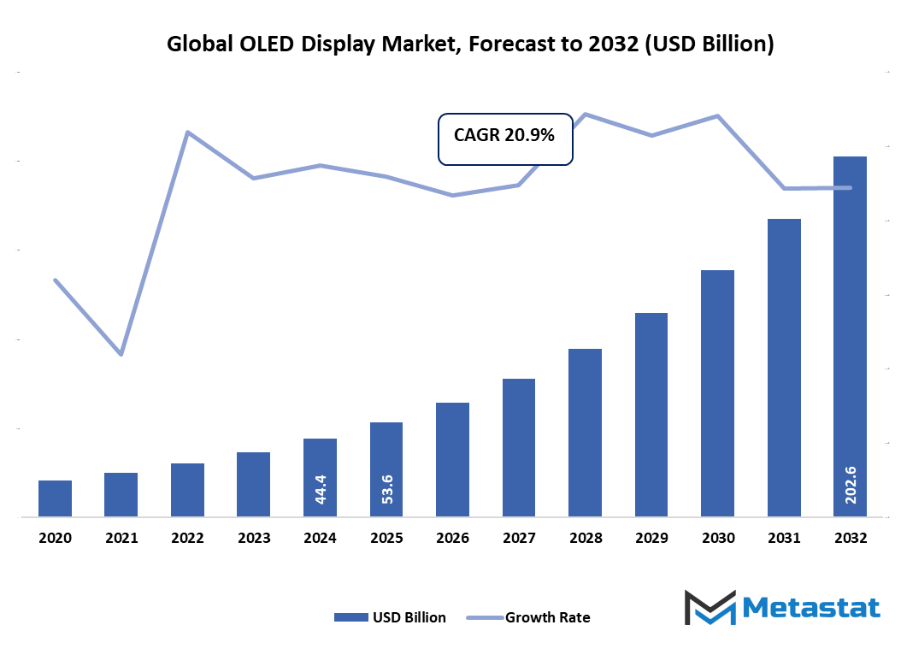

- The global OLED display market valued at approximately USD 53.6 billion in 2025, growing at a CAGR of around 20.9% through 2032, with potential to exceed USD 202.6 billion.

- AMOLED account for a market share of 72.2% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing demand for high-resolution and energy-efficient displays in consumer electronics, Rising adoption of flexible and foldable screen technology

- Opportunities include: Increasing applications in automotive displays and wearable devices present growth opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The central theme of the total global OLED display market has been the expansion of OLED usage in various fields such as TVs, smartphones, wearables, and other electronic devices, but it still remains a market overall for display technologies. OLED displays compared to traditional LCD will be able to offer the following advantages: deeper blacks, higher contrast ratios, wider viewing angles, and even less power consumption. As demand for "eye-candy" consumer experiences grows, the display market will extend its presence into such sectors as automotive, transparent display, and foldable devices, thus giving the go-ahead to an era of flexible, multi-functional, and ultra-light display solutions.

The market will experience ongoing technological advances that mainly concentrate on the aspects of hardening, color accuracy, and power efficiency. Companies will achieve this by investing in progressive manufacturing methods, science of materials, and the use of creative panel designs for the reason of reducing the costs and enlarging the scalability. Since the OLED usage is going down this path from costly electronic devices to mass-produced gadgets, the collaboration between panel manufacturers, component suppliers, and device makers will not only get more numerous but also create a network which will allow faster commercializing of the next generation display solution. The company's emphasis on innovation will indeed invigorate the market's competitive dynamics, thus enriching the differentiation aspect with higher visual quality and functional flexibility.

Moreover, the global OLED display market is next in line to bring about significant changes in the automotive infotainment, smart home devices and wearable technologies products as a result of the new applications. As producers seek new application areas and enhance production efficiency, OLED displays will redefine the concept of stylishness, energy efficiency, and user experience. The market will transform the future for visual technologies with the changes, putting first the integrations, customisations, and perfect running on the different electronic platforms.

Market Segmentation Analysis

The global OLED display market is mainly classified based on Technology, Display Size, Application, End User.

By Technology is further segmented into:

- AMOLED

Active Matrix OLED (AMOLED) technology is a major flagship-use that travels with the cell phones, the panel tablets, and also the ultramodern TVs. These devices can work in the background, hence providing consumers with their daily dose of entertainment and relaxation, thanks to the high refresh rates, rich colors, and energy efficiency offered to them by this technology. The global OLED display market will be on continuing with the trend of the market that is growing due to the adoption of foldable and flexible displays, increased pixel density, and enhanced longevity, especially in high-end consumer electronics. - PMOLED

Passive Matrix OLED (PMOLED) is the default choice for the small psectrum of the glass displays i.e. smart wearables, digital meters, and small consumer electronics. The technology feature a simpler design and lower production cost. The future development of PMOLED is mainly concerned with brightness efficiency and size extension to be able to penetrate further into the energy-saving and flexible niches of the display market. - Others

Hybrid and transparent OLED are two of the several new developments that aim to occupy the most advanced applications in the automotive HUD, smart mirrors, and digital signage industries. The global OLED display market will welcome these sorts of advancements that offer visually appealing, customizable, and interactive display options for consumer and commercial markets to industries.

By Display Size the market is divided into:

- Below 6 Inches

Less than 6 inches displays are mostly used in the smartphones, wearables, and small IoT devices. The small size of these along with OLED's high color accuracy and resolution makes these displays the perfect choice for portable electronics. The trend of upgrading smartphones and using wearables will be the main driver for the small OLED display market. - 6 to 20 Inches

The devices that have a 6 to 20-inch size range are tablets, laptops, and small monitors. The segment is expected to grow as users will need high-definition displays with vibrant colors and energy-saving features for home computing and entertainment. - 21 to 50 Inches

The displays with sizes ranging from 21 to 50 inches are mostly used in TVs and digital signage. The transition to OLED is happening as the result of better contrast ratios, thinner frames, and more appealing viewing experiences, which are getting more attractive to the buyers who are looking for high-quality visual presentation. - More than 50 Inches

OLEDs greater than 50 inches are employed in TVs, digital signs, and immersive commercial displays. With declining production costs and increasing demand for home entertainment and commercial advertising, this segment will experience rapid growth in the global OLED display market.

By Application the market is further divided into:

- Smartphones and Tablets

OLED screens are de rigueur on high-end smartphones and tablets with high contrast, energy efficiency, and bendable form factors. Consumer desire for slim, bright screens will keep the trend going. - PC Monitors and Laptops

OLED monitors and laptops provide clearer images, faster refresh rates, and improved color accuracy for gaming, design, and business use. Increasing demand for high-end computing machines drives growth in this category. - Television Sets

OLED TVs deliver superior viewing with deep blacks and broad color gamuts. Growing consumer demand for home entertainment and high-end large-screen televisions is fueling growth in this space. - Digital Signage/ Large Format Displays

Public and commercial environments are embracing OLED for interactive sign, advertising, and information signage. The global OLED display market is fueled by increasing demand for impactful, long-life, and visually striking solutions. - Smart Wearables

OLED is suitable for smartwatches, fitness bands, and wearables because of flexibility, low power consumption, and bright display quality. Expanding wearable adoption sustains market growth. - Automotive Display

Automotive use cases include dashboards, infotainment, and HUDs. OLED adoption is on the rise because of flexibility, curved displays, and high visibility in different light conditions. - Others

Other uses are AR/VR products, medical devices, and new consumer electronics. Long-term growth is anticipated to be supported by emerging applications.

By End User the global OLED display market is divided as:

- Residential

Residential use emphasizes consumer electronics, home entertainment, and smart devices. Increasing disposable income and the need for high-quality visuals are prompting homes to adopt OLED. - Industrial

Applications industrial include manufacturing, control systems, automotive interfaces, and commercial signage. OLED technology supports durability, flexible designs, and high visibility, enabling wider industrial use cases.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$53.6 Billion |

|

Market Size by 2032 |

$202.6 Billion |

|

Growth Rate from 2025 to 2032 |

20.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

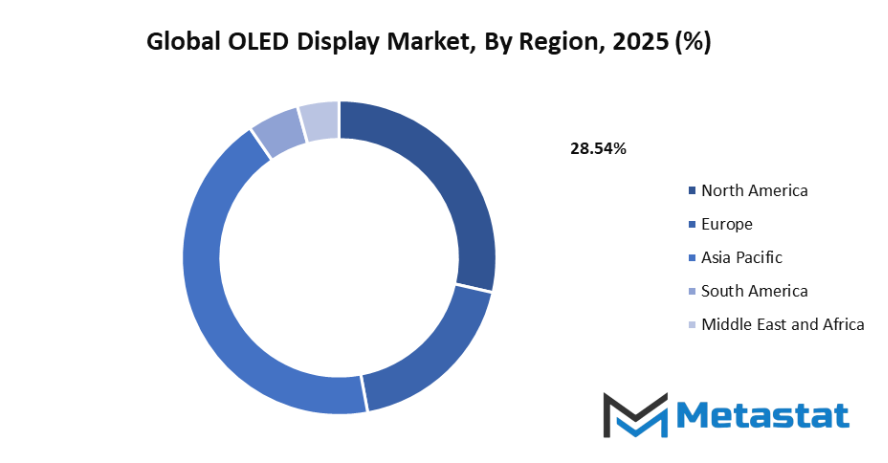

By Region:

The global OLED display market's North American segment will be made up of the U.S., Canada, and Mexico. This area will see a growing use of the OLED technology in consumer electronics, automotive displays, and smart home devices. Manufacturers will concentrate on the innovation of extremely detailed panels, energy-saving solutions, and the integration of luxury devices to satisfy the changing needs of technology-savvy consumers. This will empower the region to be the one that takes the lead in the use of new display technologies and be the early innovation hub in the world.

Europe encompasses not only the UK but also Germany, France, Italy, and the Rest of Europe. The main focus in this area will be on energy efficiency, environmental compliance, as well as the integration of OLED technology in luxury electronics and automotive infotainment. Enterprises will allocate a lot of money and effort to research collaborations and advanced manufacturing methods to meet not only the high-quality standards of the products but also the preferences of the environmentally conscious consumers. This will lead to a steady market growth in both mature and emerging European economies.

The Asia-Pacific region comprises India, China, Japan, South Korea, and the Rest of Asia-Pacific; on the other hand, South America consists of Brazil, Argentina, and the Rest of the region. The Middle East & Africa includes the GCC countries, Egypt, South Africa, and other nations. These areas will experience different levels of OLED uptake mostly due to rising consumer demand, urbanization, and technological infrastructure improvements. Manufacturers will customize their products and prices to match local market dynamics. This will spread the march into new markets across the globe in the various economic and cultural landscapes.

Market Dynamics

Growth Drivers:

Growing demand for high-resolution and energy-efficient displays in consumer electronics

The demand for displays with extremely high resolutions and low power consumptions is greatly increasing in consumer electronics. The main reason for the use of OLED displays is the rising consumer demand for visually attractive and refined solutions. These displays offer more accurate colors, higher contrast ratios, and consume less power than old LCDs. The global OLED display market will have a lot to gain from the continuous updates of smartphones, tablets, and TVs, which will meet the need of end-users for cleaner and brighter pictures and power-saving, mostly in markets with a large number of high-end consumer electronic device users.

Rising adoption of flexible and foldable screen technology

The application of flexible and foldable OLED displays for smartphones, wearables, and innovative consumer devices has expanded significantly. These form factors are enabling smaller, portable devices with the same display quality or size. The global OLED display market will be enlarged by the manufacturers’ embracing of the foldable technology for the new lines, which will not only offer a unique user experience but also tag along the trend of premium display’s curiosity by the tech-savvy consumers across the world.

Restraints & Challenges:

High production costs compared to traditional LCD displays

The making of an OLED display is still more expensive than an LCD one due to materials that are more costly and the complicated process of fabrication. These expenses can limit uptake especially in low-price sensitive markets or in the lower-end consumer electronics segment. The global OLED display market is facing difficulties in achieving a balance between cost-effectiveness and quality which requires the manufacturers to bring in new ways of producing OLED to make it more affordable and competitive with the maintenance of performance standards of the highest quality.

Limited lifespan and burn-in issues affect long-term performance

The problem of burn-in in combination with the shorter lifespan of OLED compared to LCD are the main issues affecting OLED performance. The image that does not move on the display can cause an uneven wear of the pixels, and, therefore, the quality of the display will, gradually, become worse. This drawback decreases the trust of the consumers and the use of OLED in the long term. The manufacturers are making efforts to bring forward the technological processes that will assist them in prolonging the lifespan, achieving uniformity, and lessening the risk of burn-in which will be an imperative factor for the global OLED display market taking root and expanding further.

Opportunities:

Increasing applications in automotive displays and wearable devices present growth opportunities

The use of OLED in car dashboards, infotainment systems and smart wearables is gaining momentum rapidly. The great brightness, flexibility, and light design that come with OLED make it a perfect match for today's vehicles and tiny wearable gadgets. The demand for automotive electronics and the wearable devices trend will be a major booster to the global OLED display market leading to a positive impact on the market opening up new avenues of the manufacturers to produce the OLED solutions compatible with the new industrial and consumer applications.

Competitive Landscape & Strategic Insights

As the main contributors to the global OLED display market, a combination of established international leaders and emerging regional competitors will be presented. Besides, AUO Corporation, BOE Display, eMagin Corporation, and IPG Automotive, just to mention a few, will always be on the edge of breaking through new resolutions, brightness, and energy efficiency technologies. The scope of their endeavors will be quite varied, and they will be working on consumer electronics, automotive displays, and wearable devices, the most trending applications.

L G Electronics, Samsung Electronics, Sony Corporation, and Universal Display Corporation, on the other hand, will work out ways to become more dominant players in the market. They will achieve this through making partnerships with other companies and creating new products. They will be so dedicated to research and development for flexible, foldable, and high-performance OLED panels that not only meet consumer expectations but also industrial requirements that they will invest a lot of money in it.

The fact is, they will not merely be zealous about lowering the prices of their products but will also run after niche applications as well. Visionox, Innolux, Konica Minolta, AU Optronics, Panasonic Corporation, JOLED, and Toshiba are a few of the regional companies that will be the initiators of new competitive dynamics by introducing innovations that are designed for the local market and aligning their products with the indents of the customers. To put it simply, the fight between these companies will be shaped by the plethora of factors such as ongoing technological breakthroughs, strategic partnerships, and product uniqueness, all of which will be deciding factors for market leadership and will have an impact on the future growth trajectory of the global OLED display market.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 53.6 billion in 2025 to over USD 202.6 billion by 2032. OLED Display will maintain dominance but face growing competition from emerging formats.

To sum it up, the global OLED display market is going to keep changing the parameters of the visual technology field with the features that go beyond the usual ones that include high image quality, low power consumption, and adaptable designs. Moreover, the developments in the industry would bring OLED just not into the usual automotive, wearable, and foldable gadgets but also make it the trendsetter for the future of consumer electronics and beyond. Moreover, the market will benefit from the interplay of strategies, the progress of manufacturing, and the wide adoption across sectors that will lead not only to differentiation of products but also to growth of the market. Eventually, the market will redefine the global urban and rural living with the most immersive, sustainable, and versatile display solutions.

Report Coverage

This research report categorizes the global OLED display market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global OLED display market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global OLED display market.

OLED Display Market Key Segments:

By Technology

- AMOLED

- PMOLED

- Others

By Display Size

- Below 6 Inches

- 6 to 20 Inches

- 21 to 50 Inches

- More than 50 Inches

By Application

- Smartphones and Tablets

- PC Monitors and Laptops

- Television Sets

- Digital Signage/ Large Format Displays

- Smart Wearables

- Automotive Display

- Others

By End User

- Residential

- Residential

- Industrial

Key Global OLED Display Industry Players

- AUO Corporation

- BOE Display

- eMagin Corporation

- IPG Automotive

- LG Electronics

- Rit Display

- Samsung Electronics

- Sony Corporation

- Universal Display Corporation

- Visionox

- Innolux

- Konica Minolta

- AU Optronics

- Panasonic Corporation

- JOLED

- Toshiba

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383