Global Linear Motion System Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global linear motion system market and its industry were prompted by a very simple requirement: to move objects accurately along a straight line. By the beginning of the twentieth century, most workers in factories were replaced by manual operators and essential mechanical tracks. The expansion of industrial production motivated the builders of various machines to come up with the ways that would allow the movements to be guided with minimum friction and maximum repeatability. The very first and most significant move was the introduction of rolling elements and precision rails that permitted machinery in automotive and metal processing industries to glide without any resistance. What initially was a mechanical assistance develop into the base of unobtrusive manufacturing.

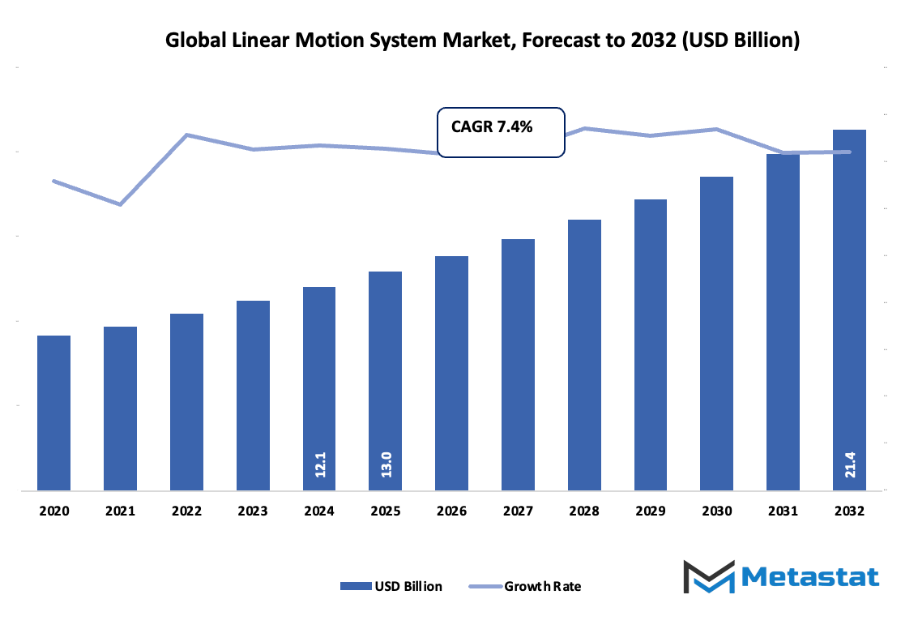

- The global linear motion system market is estimated to be approximately USD 13 billion for the year 2025 and is forecasted to grow at a CAGR of around 7.4% until 2032, having the capacity to also cross the mark of USD 21.4 billion.

- The Single-Axis Linear Motion System holds nearly 63.2% of the market share, which leads the research all the way through and the innovation of new applications.

- The main factors that are causing growth are: Increasing Automation in Manufacturing, and the ever-increasing demand for Precision Engineering.

- The future that holds opportunities for Industry 4.0 Technologies Expansion is one such opportunity, to name just a few.

- Key insight: the global linear motion system market is going to experience a massive increase in value over the next ten years, and this is going to be a great opportunity for the companies to grow significantly.

The space witnessed a revolution in the late twentieth century due to electronics. Motors, sensors, and control software all together made the linear motion much more reliable. Computers made their way into the factory floors, and the manufacturers started to ask for systems that could keep the exact speed and position without any human adjustment. The CNC machining came in, and it was a turning point. All of a sudden, the linear motion was not just a helper but rather the backbone of the entire automation process. The linear motion systems were gradually adopted by the pharmaceutical, semiconductor, and medical equipment industries due to the levels of accuracy that manual setups could not deliver.

At this point, it was the consumer behaviour that determined the next stage. The customers began to expect among many things, speedy deliveries, products that are tailored to their preferences, and digital services that are flawless. The production process had to change from mass or bulk production to that of being flexible. As a result, linear motion systems were required to operate at rapid changeovers and to frequently update designs. The customers' concerns regarding sustainability also influenced the choice of motion systems that brought about lesser energy usage and waste. Government also played a role by setting safety and efficiency standards which in turn pushed the manufacturers to come up with designs that would have less mechanical failure and less risk for the workers.

The industry that is in the midst of the global linear motion system market still keeps a balance between cost efficiency and precision. Engineers are constantly improving the properties of materials, trying out lubrication-free designs and installing real-time monitoring. Machine builders are linking these systems with smart data platforms, which result in predictive maintenance and reduced downtime. In the coming times, these systems will not just be one of the components; instead, they will be intelligent units that interact with bigger production networks. They will take part in factories that automatically increase or decrease the output based on the demand which in turn would make the manufacturing cleaner, faster, and much more flexible. From its mechanical beginnings to its data-driven present, the journey of linear motion reflects how technology consistently pushes industries toward accuracy and smart automation.

Market Segments

The global linear motion system market is mainly classified based on Type, End-User Industry.

By Type is further segmented into:

- Single-Axis Linear Motion System: The single-axis linear motion system is a one-dimensional movement system that delivers consistent and precise positioning for the most basic production requirements. Cutting, sorting, and labeling are some of the activities that the single-axis linear motion system is primarily used for in factories. The growth of demand for the system can be attributed to the fact that it enables companies to achieve faster output with less manual handling. The global linear motion system market is witnessing the dominance of single-axis units primarily due to their economical installation and easy maintenance.

- Multi-Axis Linear Motion System: The multi-axis linear motion system is a three-dimensional movement system that offers great flexibility and efficiency during the complex production stages. The system supports high-speed automation which results in faster product turnovers and better accuracy. Many modern factories go for multi-axis systems in detail where the single-axis movement will not provide enough control or allowance.

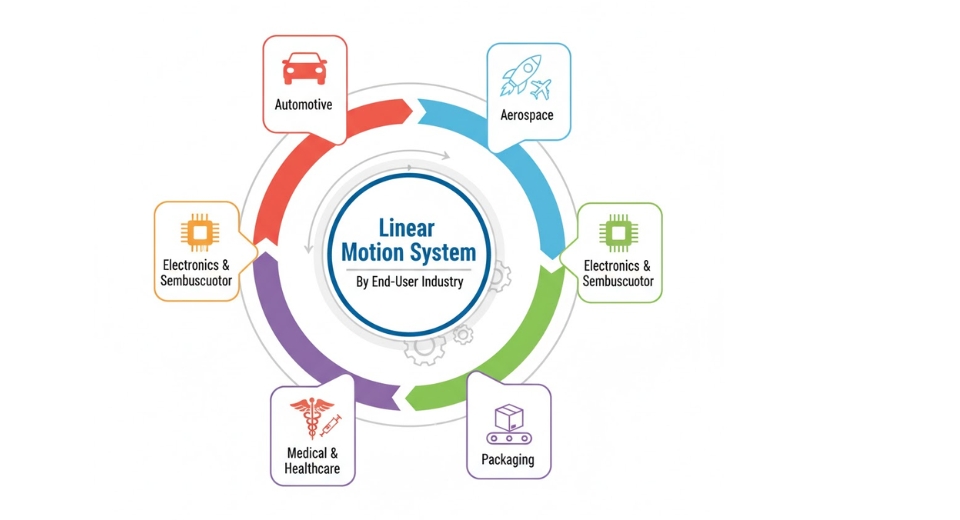

By End-User Industry the market is divided into:

- Automotive: In the automotive industry, linear motion systems are extensively used in the manufacturing of the car body as well as in welding, painting, and inspection processes. The reduction of manual work and the achievement of consistent quality across all units are the main advantages of these systems. The implementation of the automated and motion-controlled processes in the production line has become a common scenario in cutting-edge automotive factories to lower the time required for manufacturing, reduce the amount of waste and enable easy transition of the products between the different manufacturing stages.

- Aerospace: The aerospace industry expects high levels of accuracy because the parts have to be exactly according to the specified dimensions. Linear motion systems are used to aid the drilling, inspecting and assembling of wings, engine parts, and cabins. Precision cutting eliminates the possibility of production delays and the risk of errors. Rapid transfer of the products between the stations allows for a bigger production schedule to be handled without compromising on reliability or safety during the complex manufacturing processes.

- Electronics & Semiconductor: In the Electronic and semiconductor manufacturing, every movement has to be very small and very accurate. Linear motion systems are used for wafer processing, circuit placement, and inspection. The application of smoother motion not only prevents product damage but also maintains the quality. Thus, speed and precision lead to rapid output, which is crucial for satisfying the rapid growth of demand in the consumer electronics and computing hardware markets.

- Medical & Healthcare: The production of medical and healthcare devices seeks very clean, stable, and precise movements. Imaging machines, diagnostic tools, and laboratory instruments are just some examples of linear motion systems in the medical field. The accuracy feature of the systems saves time and avoids manufacturing errors, which helps to uphold safety standards. Steady motion during the delicate assembly stages is facilitated by linear motion systems because they allow for very smooth and controlled movement.

- Packaging: Packaging facilities depend on linear motion systems for filling, sealing, and sorting. Fast movement supports high output, helping factories meet shipping deadlines. Motion systems reduce product damage during handling, supporting safe and consistent packaging. Reduced manual steps also help maintain hygiene, which is required for food and pharmaceutical packaging sectors.

- Other: Beyond major industries, linear motion systems support furniture production, printing, research labs, and warehouse automation. These systems replace manual effort and support steady movement during repetitive handling. Each sector gains longer machine life, higher accuracy, and improved safety by reducing direct contact between workers and heavy or sharp production components.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$13 Billion |

|

Market Size by 2032 |

$21.4 Billion |

|

Growth Rate from 2025 to 2032 |

7.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

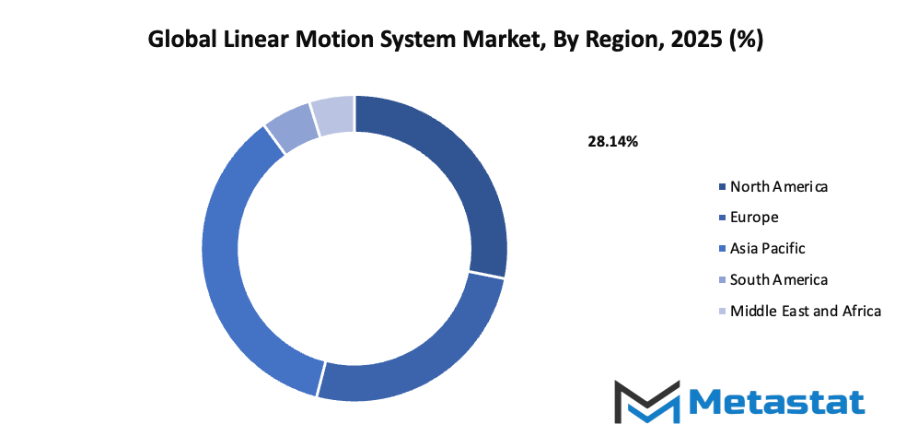

By Region:

- Based on geography, the global linear motion system market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Automation in Manufacturing:

Automation in manufacturing encourages the use of linear motion technology for smooth movement, quick positioning, and steady production speed. Automated facilities benefit from reduced manual labor, fewer errors, and consistent output. More facilities now adopt advanced equipment, increasing demand for motion components that support faster workflow and stronger production reliability. - Growing Demand for Precision Engineering:

Precision engineering requires accurate movement and steady control. Linear motion technology provides dependable accuracy for medical devices, electronics, and laboratory equipment. Higher quality standards encourage adoption of motion components that reduce variation. A focus on smaller production errors supports fresh interest in advanced and well-controlled movement solutions across multiple industries.

Challenges and Opportunities

- High Initial Investment Costs:

Advanced linear motion equipment often requires higher upfront spending. Procurement, setup, and supporting software increase expenses. Smaller manufacturers sometimes delay upgrades because older equipment still functions. Long-term advantages, including less waste and fewer breakdowns, often balance early spending, motivating many facilities to consider gradual modernization. - Technical Challenges in Integration:

Integration of linear motion equipment requires careful planning and strong knowledge of mechanical layouts. Mismatched components can slow production or reduce accuracy. Skilled technicians are needed to ensure correct alignment, correct speed, and safe operation. Successful integration supports stronger productivity and dependable movement throughout the entire production environment.

Opportunities

- Expansion of Industry 4.0 Technologies:

Industry 4.0 adoption encourages digital monitoring and smarter motion control. Sensors and connected software provide real-time performance updates, supporting more accurate planning and quicker problem detection. Facilities achieve better speed, reduced downtime, and stronger energy efficiency. Digital progress continues to open new applications for modern linear motion equipment.

Competitive Landscape & Strategic Insights

The global linear motion system market shows strong competition and continuous progress. Major companies from several regions work toward better technology and steady improvement. Well-known groups such as Bosch Rexroth, Schneeberger Group, NSK Ltd., SKF Group, HIWIN Corporation, Schaeffler AG, NTN Corporation, LinTech, Schneider Electric Motion, Rockwell Automation, Ewellix AB, Thomson Industries, Inc., Igus Inc., TBI Motion Technology Co., Ltd., Rollon S.p.A., PBC Linear, Bishop-Wisecarver Corporation, Kuroda Precision Industries Ltd., and MISUMI Group Inc. play leading roles. Each company focuses on strong engineering standards, dependable performance, and product longevity.

Global demand continues to rise as factories and automated facilities search for faster and more accurate movement of machine parts. Faster production, reduced downtime, and higher product quality encourage further investment. Growing use of automation in manufacturing, medical equipment, packaging, and material handling increases interest in advanced linear motion systems. Consistent research supports quiet movement, improved load capacity, and lower energy use. Clear goals guide development: stronger durability, lower maintenance, and smoother operation.

Established corporations offer broad product lines and long industrial experience. These organizations hold strong distribution channels and dependable service networks, which help secure customer trust. Regional competitors enter the market by offering specialized designs and affordable solutions. Competition pushes every organization to strengthen product quality and customer support, creating wider choices for buyers.

Ongoing progress in robotics and precision machinery encourages greater adoption of linear motion equipment. Digital control features allow quicker setup and better accuracy, helping factories run more efficiently. Every improvement supports consistent motion, reduced waste, and smoother production flow.

Market size is forecast to rise from USD 13 billion in 2025 to over USD 21.4 billion by 2032. Linear Motion System will maintain dominance but face growing competition from emerging formats.

Future growth will depend on continued innovation, investment in research, and strong partnerships between manufacturers and equipment users. Clear attention to customer needs, flexible product designs, and reliable performance will support stable progress. Increasing automation in manufacturing and industrial upgrades across global markets ensures steady demand. By offering dependable solutions and continuous improvement, each competitor contributes to the advancement of high-precision motion technology.

Report Coverage

This research report categorizes the global linear motion system market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global linear motion system market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global linear motion system market.

Linear Motion System Market Key Segments:

By Type

- Single-Axis Linear Motion System

- Multi-Axis Linear Motion System

By End-User Industry

- Automotive

- Aerospace

- Electronics & Semiconductor

- Medical & Healthcare

- Packaging

- Other

Key Global Linear Motion System Industry Players

- Bosch Rexroth

- Schneeberger Group

- NSK Ltd.

- SKF Group

- HIWIN Corporation

- Schaeffler AG

- NTN Corporation

- LinTech

- Schneider Electric Motion

- Rockwell Automation

- Ewellix AB

- Thomson Industries, Inc.

- Igus Inc.

- TBI Motion Technology Co., Ltd.

- Rollon S.p.A.

- PBC Linear

- Bishop-Wisecarver Corporation

- Kuroda Precision Industries Ltd.

- MISUMI Group Inc.

- Bishop-Wisecarver

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252