MARKET OVERVIEW

The global property and casualty insurance market in the financial sector will be an integral platform for managing risks related to physical assets and liabilities in the days ahead. The industry will be a cornerstone in deciding how businesses and individuals guard themselves against loss due to accidents, natural disasters, and other unexpected events. Rather than addressing life or health, the Global Property and Casualty Insurance business will concentrate its activities on assets such as buildings, autos, and equipment, and liability for damage to third parties.

The market will cover a wide spectrum of insurance products aimed at addressing different client profiles, ranging from multinational corporations to homeowners. The products offered under these conditions will extend far beyond simple coverage, with new policy forms designed to reflect emerging patterns of exposure. The underwriting process will be more tailored, using massive pools of data to deliver more accurate assessments and improved pricing accuracy. These developments will determine the operating strategy of the market and its ability to provide strong financial protection.

The structure of the global property and casualty insurance market will vary strikingly by region, as regulatory regimes both influence product development and the manner of distribution. Insurers within more disciplined jurisdictions will have to modify their products to fit very specific legislative requirements, while others will encourage more innovation in the delivery of products. The competitive arena will not be limited to conventional insurance carriers. It will extend to new players such as tech firms introducing new risk transfer models and digital policy platforms. These new forces will redefine customer engagement and expectation.

Policyholders in the global property and casualty insurance market will demand greater transparency and personalization in the future. Insurers will oblige by integrating digital tools to enhance the claim process, facilitate ease of communication, and offer real-time updates. Automation, artificial intelligence, and analytics will transform the identification and mitigation of risks. These technologies will propel not only operational efficiency but also service quality improvement along the insurance lifecycle. The trend towards increased connected infrastructure e.g., smart homes and vehicles equipped with telematics will influence the data that insurers collect and the policy terms they construct.

As businesses expand their footprints and face more advanced risk environments, the Global Property and Casualty Insurance industry will be forced to have broader risk distribution strategies. Reinsurance structures, captives, and syndicated models will be all used to level the exposure. These instruments will serve as financial backstops for the primary insurers to help them write a broader and more diversified book of business. Furthermore, the market will continue to push deeper into underinsured markets, offering new prospects for providers looking to take a risk in niche categories and underwriting populations.

Ultimately, the Global Property and Casualty Insurance industry will not remain stationary. Its perimeters will continue to expand due to changing customer requirements, technological advancements, and global pressure for stronger infrastructure. It will continue to serve its purpose as a necessary activity of modern economies, delivering economic protection that allows industries and residences to move forward with confidence against uncertainty.

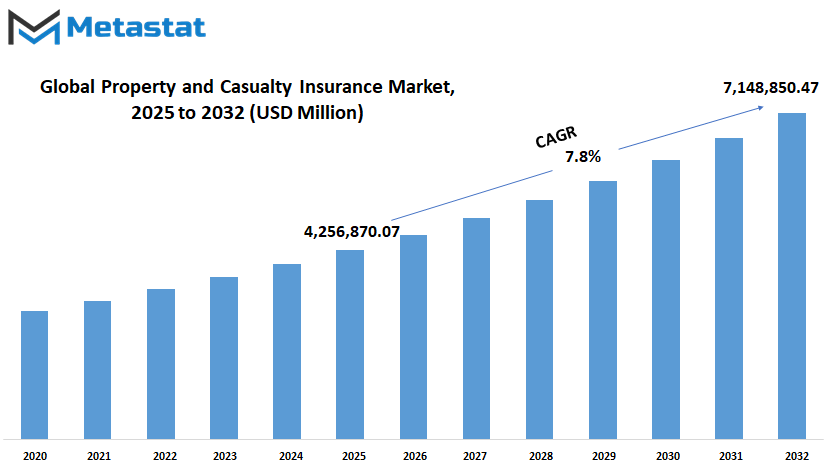

Global property and casualty insurance market is estimated to reach $7,148,850.47 Million by 2032; growing at a CAGR of 7.8% from 2025 to 2032.

GROWTH FACTORS

The global property and casualty insurance market will likely experience radical transformation in the future based on a mix of challenges and opportunities. One of the major drivers of the growing interest in this sector is the greater frequency of natural catastrophes and extreme weather conditions. These events amplify the risks for individuals and corporations, and therefore insurance protection becomes a requirement rather than a choice. As more floods, storms, wildfires, and other extreme events take place, individuals and businesses will look to secure firm coverage to protect their properties, generating demand for this market.

In addition to concerns over climate, real estate and automobile industries' growth adds fuel to the need for property and liability insurance. As more and more houses are built and automobiles purchased, coverage of potential damages or loss is naturally on the rise. Increased new building of infrastructure and expanding urbanized areas even more advance the need for large insurance protection. People are investing more in real items, and they will purchase protection to safeguard these investments.

While there are such positive trends, there are also deterrents which would slow the growth of the market. One of the challenges which linger is expensive claim expenses, especially in years where there are large numbers of catastrophes. When the insurers are overpaying to a great extent, it erodes the profit margins and can lead to financial stresses. This issue combined with underwriting losses provide a real challenge to sustaining long-term growth. Another concern is the intricacy of the regulations that change from one geographical region to another. Insurance companies need to adhere to local rules and remain compliant, which requires time, money, and brainpower. This one-sided regulatory framework makes it more difficult for insurers to launch operations across borders.

Technological innovation is, however, beginning to alter the landscape. Artificial intelligence and big data analytics are helping insurance companies to learn more about risk. These tools allow them to offer more specific policies, improve pricing, and identify fraud more effectively. In the years to come, these advances are likely to be at the forefront of unlocking new avenues for growth. With further technological advances, insurers will be in a position to refine their strategies and offer smarter solutions to buyers.

In the future, the global property and casualty insurance market will grow not just due to increasing risks, but due to better ways to manage them. The road will be rough, but opportunities for development and innovation will drive the market forward.

MARKET SEGMENTATION

By Type

The global property and casualty insurance market is going through a time of unprecedented transformation, fueled by the emergence of new technology along with evolving customer expectations. While the origins of property and casualty insurance are rooted in shielding customers from loss as it pertains to physical assets and legal liabilities, the trend that this business is on is one of much broader scope and vision. It's no longer a question of just insuring losses once they occur. More emphasis is now being placed on predicting risks with the use of big data tools and artificial intelligence to prepare better for reactions and reduce losses in the future. The market will not only get larger but also more functional, adopting tools that can read patterns and behaviors to better serve customers.

Depending on type, the global property and casualty insurance market also bifurcates into Property Insurance and Casualty Insurance. The two types play the vital role of supporting people and companies in financial insecurity. Property insurance focuses on the protection of physical buildings such as office buildings or homes, while casualty insurance ensures protection from legal liability and accidents or injury-related hazards. Until now, this market has a value of USD 2,079,490.39, and as estimated, in 2025 it will be 2,177,379.68 million. This rise in value is how important these services are now, especially in a time when random weather events, cybersecurity issues, and legal issues are increasing.

In the coming years, the global property and casualty insurance market will likely see more focus on flexible insurance policies, which are customized to the specific needs of the consumers. Rather than adhering to inflexible schemes, companies may adopt individualized plans based on real-time data. For example, customers may be given protection that differs depending on what they are doing or where they are, something that could not have been achieved by traditional models. The ability to collect and examine information will dictate how decisions get made and how quickly claims settle.

Ultimately, the destiny of this market will be molded by a mix of technology, consumer insight, and need to respond to threats rapidly. As it continues, trust and honest communication between providers and customers will be as important as innovation. This blend of sophisticated tools and hand-holding will decide the extent to which robust and reliable the market is.

By Policy Duration

The global property and casualty insurance market is moving gradually, inexorably towards a future shaped by changing risk patterns, technology, and consumer attitudes. As people and businesses are facing more and more new types of threats, ranging from hurricanes to cyber-attacks, the need for reliable coverage keeps on growing. This transformation is keeping carriers looking forward and offering more solutions to protect what matters most to their customers.

Looking at the market from a policy duration point of view, there are three most notable categories short-term, yearly, and long-term policies. They are all used for different purposes, and as a whole, they offer flexibility to insurers and users of their service. Short-term policies, for example, will increasingly become common where there is a demand for quick, short-term insurance. Short-term policies are best for a single event, traveling overseas, or holiday requirements. They give people the ability to be safeguarded without being tied into a lifetime commitment, and as people live more mobile lives, this kind of option will probably grow in popularity.

Yearly policies are the standard choice for many. They provide individuals and companies a sense of comfort and familiarity, with the capacity to manage finances budget-wise with set renewal dates. Insurers prefer such policies as they generate stable revenues and better relationships with their customers. Companies will continue to develop the format of such annual contracts in the future, such as online submission of claims and faster processing to satisfy customer needs.

Long-term policies, although not as common, will become more popular in the future. As people shop for long-term protection for things like equipment or property, the ability to have a multi-year policy will seem like a good idea. Policies like these will probably include such benefits as fixed rates or added services, giving value and security to customers.

In the future, the global property and casualty insurance market will see even more disruption driven by data and automation. Insurers will use data collected from Internet of Things devices and past behavior to develop more tailored policies that are better suited for each person or business. That means customers could get more accurate pricing and faster service. Ultimately, the future of this marketplace will be more than simply about protection will be more about building more intelligent, more adaptive systems that make people feel more secure in their everyday lives.

By End User

The global property and casualty insurance market is to be subjected to profound change driven by expanding needs of individuals, organizations, and institutions. The planet is afflicted more and more by natural catastrophes, scientific discovery, and changes in lifestyles, and thus this type of insurance is more critical than ever before. Individuals require protection against unexpected loss, and organizations want to protect their assets and operations. Governments, too, desire products that will manage risk and secure public infrastructure. It is not so much about insuring the usual damages; it is about preparing for the future.

In the future, the market will most likely be driven by three segments: individual policyholders, corporate policyholders, and governments. All three segments play a crucial role in demand determination. Individuals are also more aware of personal risks, whether these involve homes, autos, or other assets. As knowledge grows, so does the need for more customized insurance policies that fit different lifestyles and budgets. Insurers will also need to become more flexible in the way they sell and service coverage and pay claims, especially as clients want quicker and more convenient service.

For businesses, property and casualty insurance necessity is directly connected with what they are doing and how extensive their activities are. Businesses are becoming global, and risks are seeping across more geographies. Policyholders for businesses will look for entry into traditional coverage as well as products that will help losses avert before those losses occur. New technology will play a major part here, delivering improved ways of information-exchange between insurance companies and customers, risk analysis, and reaction to incidents. Corporate policyholders will also expect counsel and guidance from outside the insurance contract.

Government entities, nevertheless, will have other priorities. Their top priority will be the protection of strategic infrastructure and public safety. With the expansion of public projects and their growing complexity, their insurance needs will increase. Governments will look for partners who can help them manage their short-term and long-term exposures. Climate risks will especially hit this segment of the market hard.

Over time, the global property and casualty insurance market will have to respond to mounting pressures for fairness, speed, and openness. Those insurers who really listen to what their customers want are all end users will be better positioned to grow and adapt in this new environment.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,256,870.07 million |

|

Market Size by 2032 |

$7,148,850.47 Million |

|

Growth Rate from 2025 to 2032 |

7.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

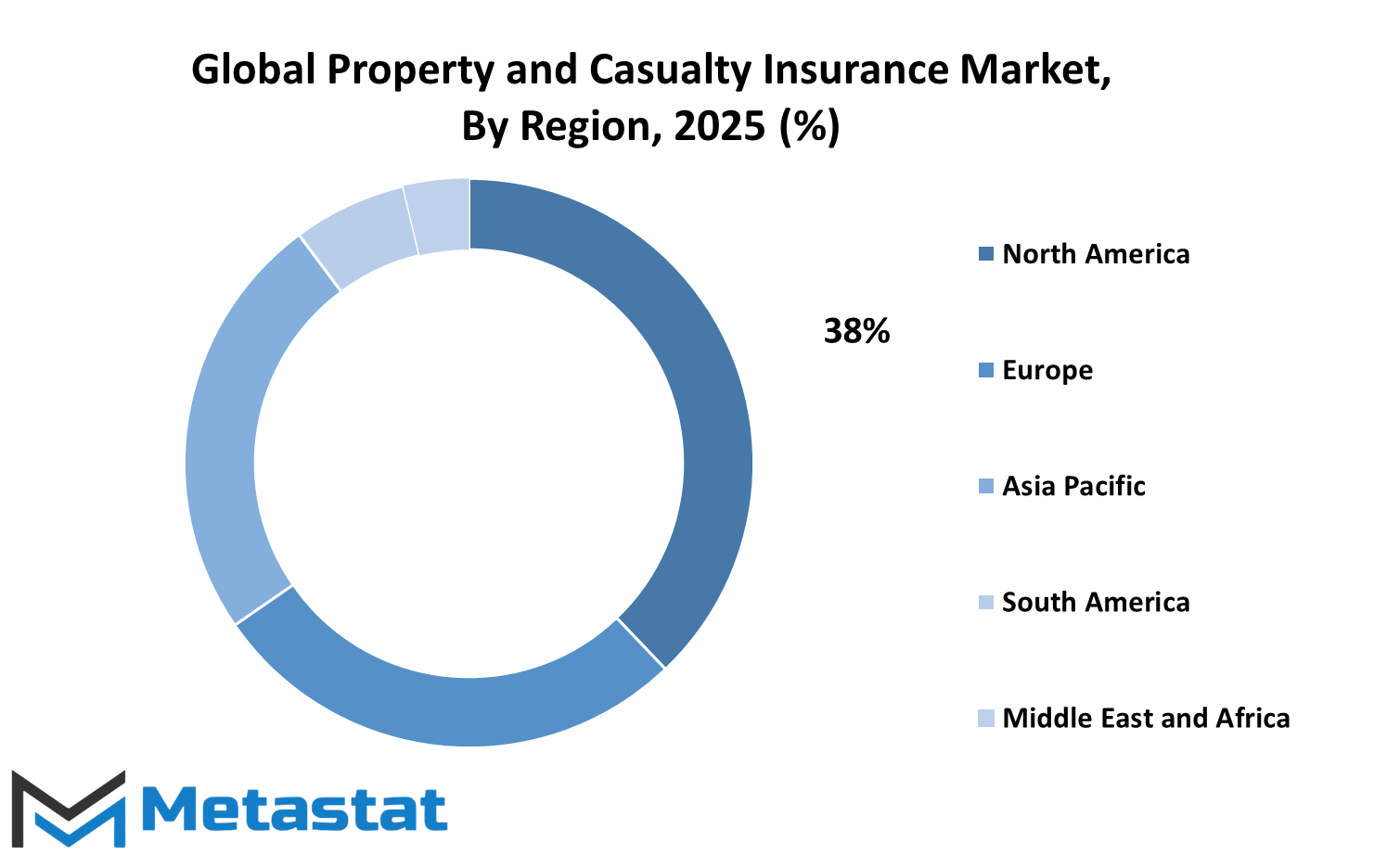

The global property and casualty insurance market is affected by regional differences, and every region plays differently in its development. As the industry grows, economic fluctuations, technological improvements, and regulatory policies will continue to affect the way this market operates worldwide. North America, which includes the U.S., Canada, and Mexico, has historically been one of the major drivers of the market. The U.S. in particular will be well-placed due to a strong insurance infrastructure and strong demand for coverages on both personal and commercial lines. Canada and Mexico are also set to exhibit steady growth, as digital adoption and consumer education boost the insurance industry in these countries.

The market in Europe too will continue to be led by countries such as the UK, Germany, France, and Italy. The insurance markets of these nations are relatively advanced, and continued economic stability in much of the region will help to grow the market. Furthermore, there will be more focus on sustainable and bespoke insurance solutions as consumer needs shift and environmental concerns continue to grow. Europe's strength and sound regulatory framework will lead to most likely innovation and innovative policy products, which will retain its position in the international Property and Casualty Insurance market.

Asia-Pacific, with key players India, China, Japan, and South Korea, has strong future potential. The region will continue to grow due to an emerging middle class, urbanization, and usage of digital platforms. China and India, with their enormous population and developing financial markets, will be particularly dominant. Japan and South Korea, being an advanced region technologically, will be at the forefront of offering more personalized and technology-intensive insurance services. The ability of this region to respond to changes and adopt new technologies will position it at the center stage of the future market.

South America, particularly Brazil and Argentina, will witness stable growth as economic reforms and digital solutions pick up pace. The market here may face resistance, but enhanced awareness and initiatives by the government to increase insurance access will drive the momentum. In the Middle East & Africa, especially in nations like the GCC countries, Egypt, and South Africa, investment and infrastructure growth will be the growth drivers. With greater demand for protection from more industries, this region will play an even stronger role in the global property and casualty insurance market.

COMPETITIVE PLAYERS

The global property and casualty insurance market is bound to transform in many ways as risk trends, technology, and industries continue to evolve. This business offering protection against liability and property damage coverage is bound to experience consistent growth. This will be driven by rising climate risk, digitalization, and shifting customer demands. With the advances in technology advancing fast, insurance companies will be required not only to keep pace with new tools but also to predict how the tools will impact customer behavior and the concept of risk itself. The future is likely to hold more significant applications of data by insurers, allowing them to more accurately assess risk and deliver more customized products. Artificial intelligence, predictive analytics, and digital platforms will continue to revolutionize how insurers operate business, making them more responsive and efficient.

Competition will also be a driving force that will define the future of the Global Property and Casualty Insurance industry. The industry, with various strong players, each with its own style of innovation, customer service, and risk management. Companies like Topdanmark Insurance A/S, Tryg Forsikring A/S, Codan Forsikring A/S, and Alm. Brand Forsikring A/S will continue to consolidate their strengths as they adjust to new difficulties. They will invest more capital in digital instruments, not only to improve processes but to interact with clients more. With continued digital adoption, client expectations will rise as well. Insurers that cannot keep up with these requirements will lose their market advantage.

Other major players in the sector such as LF Skåne, Folksam, If Non-life Insurance AB, Dina Insurance AB, OP Financial Group, and Fennia Group will also drive this trend in the market. They will be forced to respond to emerging threats like cyber attacks, changing weather patterns, and the growing need for coverage in under-insured regions. The fight will not be merely on price but on who can anticipate, prevent, and respond to risk the best. While conventional policies will remain relevant, the insurers that trade in forward-looking solutions and customer-centric innovation are more than likely to be the leaders.

Looking ahead, the global property and casualty insurance market won't just grow but transform. Ability to balance innovation with trust, with the customer at its core, will decide who stays in the lead. This relentless change will continue to make the industry competitive and focused on what matters most to its customers.

Property and Casualty Insurance Market Key Segments:

By Type

- Property Insurance

- Casualty Insurance

By Policy Duration

- Short-Term Policies

- Annual Policies

- Long-Term Policies

By End User

- Individual Policyholders

- Corporate Policyholders

- Government Entities

Key Global Property and Casualty Insurance Industry Players

- Tryg Forsikring A/S

- Topdanmark Insurance A/S

- Codan Forsikring A/S

- Alm. Brand Forsikring A/S

- LF Skåne

- Folksam

- If Non-life Insurance AB

- Dina Insurance AB

- OP Financial Group

- Fennia Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383