MARKET OVERVIEW

The global office equipment market is a central business supplies category that serves day-to-day operational requirements in many corporate, institutional, and administrative environments. The market will encompass a broad range of products facilitating day-to-day functions, simplifying internal operations, and sustaining productivity levels in traditional and telecommuting environments. From giant corporations to small companies, demand for reliable office equipment will keep steady, driven by changing organizational structures and the ongoing integration of digital practices.

The market will consist of equipment that enables the effective conduct of managerial and administrative tasks. These include equipment such as printers, scanners, multifunctional machines, shredders, telecommunication networks, and ergonomic furniture, all selected to serve various operation requirements. The global office equipment market will transcend geographical and industry boundaries, molding itself to suit particular workplace conditions, cultural practices, and levels of technology access. Organizations will be making equipment decisions based on compatibility with network infrastructures, secure management of data, and long-term efficiency, thereby reiterating the value of robust infrastructure.

Office processes in different industries will increasingly depend on physical hardware, although digital transformation is at the top of the agenda. The global office equipment market will evolve in harmony with hybrid work models and decentralized office configurations. Remote teams within organizations will be interested in scalable, low-footprint, energy-efficient devices that can be easily integrated into home-based infrastructure without compromising on performance. With employees working across multiple geographies and time zones, office equipment will be created to enable smooth connectivity, reduce downtime for maintenance, and offer consistent output.

The impact of policy reforms, labor laws, and environmental policies will also influence product design and material consumption in the Global Office Equipment sector. Firms will react to this by investing in technologies that enhance sustainability goals, waste reduction standards, and circular economy practices. Purchasing practices will be increasingly data-driven, with purchasing units seeking equipment that reflects durability, maintainability, and compliance with evolving operational standards.

Innovation will be the driving force behind the identity of this market. Automation will be introduced into routine office machinery so that devices can perform advanced functions with a minimal amount of human intervention. Artificial intelligence will also supplement diagnostic monitoring and anticipatory maintenance to reduce downtime and provide business continuity. Digitally embedded products that integrate voice commands, biometric verification, and cloud synchronization, combining convenience and security, will also be part of the global office equipment market in the future.

As businesses decide operational costs and strategic investments, office equipment choices will reflect higher-level goals towards efficiency, employee comfort, and information security. The corporate sector will remain a principal end-user base, but the industry will also focus on schools, co-working spaces, government offices, and healthcare administration buildings. Demand will be engineered to mirror functional roles, space limitations, and the technical ability of employees using the equipment.

Generally, the Global Office Equipment industry will be a reflection of the structural demands of the workplaces of today, proximately tracking technology, regulatory, and working culture shifts. Its fate won't be measured in the number of units sold but in the extent to which the equipment meets the performance, sustainability, and flexibility demands of the organizations that use it.

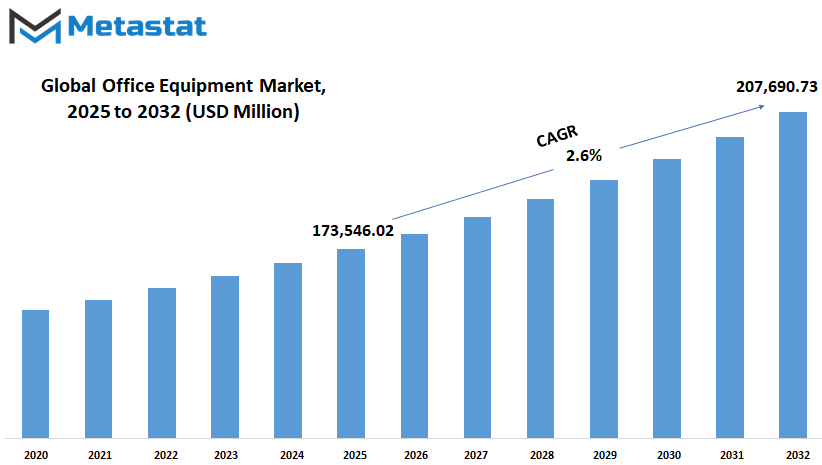

Global office equipment market is estimated to reach $207,690.73 Million by 2032; growing at a CAGR of 2.6% from 2025 to 2032.

GROWTH FACTORS

The global office equipment market is expected to steer through significant changes in the coming years, based on the way people work and the way technology aids these changes further. Increasingly, companies are now focusing efforts on making offices more efficient. This is fueling the need for equipment and devices that will be capable of automating routine tasks and liberating time from tedious tasks. Thus, companies are looking for equipment and systems that not only do the job faster but also offer more accuracy and convenience.

At the same time, the way people work is changing. The majority of employees nowadays spend their time in the home and the office. This change has encouraged more demand for home office installations. People want equipment in their homes to be as good as the equipment they use in their office. Because of this, the demand for small, high-tech equipment for use at home is on the rise. Examples include printers, scanners, and internet-enabled smart devices that can be accessed and managed remotely. Trends like these are probably going to shape the future of the global office equipment market in important ways.

However, some issues may hold it back. One issue is that many offices are slowly transitioning into digital operations. With more companies now employing digital formats and cloud storage, there will be less need for devices like outdated printers and copiers. This change will temper demand for some of the less complex office machines. The other issue is the cost of modern office equipment. High-end machines tend to require regular servicing, and repairs or replacements are not likely to be affordable. This can mean that small businesses or home users cannot afford top-of-the-line hardware.

Apart from these drawbacks, things look rosy for the future. More and more office equipment is now equipped with smart features like cloud connectivity and remote tracking. The equipment is able to help firms track usage of equipment, reduce wastage, and streamline workflow. With more access to the internet and the ability to share information in real time, these smart devices can become a major part of office operations. The trend will probably introduce new opportunities and will encourage further investment in newer and improved office equipment.

As more offices evolve and technology plays an ever-increasing role in everyday work, the global office equipment market will likely continue to be dynamic and responsive to these developments, adapting to meet current and future needs.

MARKET SEGMENTATION

By Type

The global office equipment market will continue to shape how business is conducted and communicated as technology evolves. Offices always have been dependent on a multitude of devices in order to stay productive and connected. What makes this market stand out is the manner in which it continues to adapt to shifting work patterns, shifting business needs, and the ongoing rise of digital solutions. While traditional machines like printers, fax machines, and copiers still have their place, their purpose is changing. They are no longer standalone machines but are now part of networks and smart systems that are faster, more energy-efficient, and connected to cloud services.

Computers and telephones will be transformed in the future and take on new shapes, becoming smarter, lighter, and networked. The global office equipment market based on type—includes products facilitating daily business operations. These tools are being revolutionized by automation and artificial intelligence. For instance, printers valued at USD 31,732.89 million in 2025 will not only print but can also offer voice control and predictive warning of maintenance issues. Copiers and scanners valued at USD 17,328.57 million and USD 9,909.48 million, respectively, will ease operations by hooking directly into software applications controlling digital content.

Replaced by these in their original use, though, fax machines with an estimated worth of USD 8,651.27 million must remain in existence in some professions based on dependable document transmission such as law and the medical profession. Computers, the hub of contemporary offices, will have strong growth with an estimated worth of USD 60,663.01 million. They will likely incorporate better processors, data security as a part of their inbuilt system, and cloud collaboration tools. Telephones, which are now not just call machines, will be the hubs of video conferences and app-based activities with an estimated worth of USD 26,083.97 million.

Shredders and scanners will also gain importance as privacy laws around data become stricter. Their estimated worth USD 8,946.30 million and USD 9,909.48 million—shows how much enterprises continue to rely on safe paper destruction and accurate digital copying of documents. Equipment of other forms, valued at USD 10,230.54 million, will likely include newer units that enable hybrid workspaces, such as wireless charging stations or compact multifunctional devices.

With office environments still changing, the global office equipment market will not just ensure day-to-day business but also be instrumental in helping businesses stay prepared for what's ahead.

By Material

The global office equipment market will keep growing steadily as offices change to accommodate new needs and environments. As people's ways of work change—whether from home, hybrid spaces, or traditional offices there will be an ongoing need for equipment and furniture that enables productivity, comfort, and effectiveness. The materials that go into creating office equipment play a considerable role in both the appearance and ambiance of such places. In the future, the types of material used will be decided not only in terms of style and comfort but also in terms of environmental awareness and long-term durability.

Wood, however, remains a popular one because of its business-like and warm look. It has even been applied to executive desks, bookcases, and conference tables. In the future, more efforts may be directed toward acquiring wood from forests that are sustainably managed or using engineered wood products that generate less waste but maintain quality. Whatever the trends may be, though, wood will probably be a reliable and desirable option.

Metals will continue to play a major role in support and construction for the majority of office products. Frequently use products like chair frames, filing cabinets, and desk legs use steel or aluminum because they are sturdy without being thick. In the future, producers will most likely look for lighter alloys that reduce weight without lessening strength. There is also the growing ability to use recycled metal, which is less resource-intensive but still maintains safety and performance standards.

Plastic, while often seen as a bargain item, has made great strides in quality. It is used to create everything from chair backs and armrests to storage bins. New plastics are even being engineered to provide greater support and flexibility. In the future, biodegradable or recyclable plastics may be used increasingly, as organizations try to reduce waste and pollution. This change will not be done primarily for environmental concerns but also because consumers are starting to demand responsible options from brands that they support.

Other materials like glass, textiles, or composite blends are also gaining attention. These allow designers to create more individual and fashion-driven objects that still fulfill their function superbly. Developments in the area of materials science could provide even more possibilities blending beauty, strength, and environmental sustainability.

The global office equipment market will not stand still. As businesses become increasingly conscious of the welfare of employees and the planet, the materials used will change to put those considerations first. What we currently have will evolve into smart, more thoughtful designs that meet the needs of both employees and the world they work in.

By End-Use

The global office equipment market will continue to define how individuals work in different industries. As technology evolves and working conditions shift, the demand for effective, trustworthy tools becomes increasingly crucial. Companies, schools, government agencies, and other organizations rely on an array of equipment to facilitate everyday activities. From printers, scanners, and copiers to desk supplies, these products will remain vital to sustaining productivity and organization in both digital and physical environments.

In the future, the market will expand not only due to increased demand, but also as a result of how work environments continue to change. Commercial areas will probably experience an increased trend toward intelligent, energy-efficient machines that can be easily integrated with cloud systems or remote work environments. Offices will desire machines that can accomplish more, save time, and reduce maintenance. As more individuals work from various locations, having tools that enable flexible arrangements will be increasingly valuable.

Schools will still require reliable equipment as well. Despite more online learning, schools need fundamental tools such as projectors, copiers, and classroom printers. The future versions of these tools could be more interactive or more specifically designed for hybrid classrooms, where students are both online and in the classroom. Schools will seek out equipment that is both durable and easy to use for faculty and students.

Government agencies, which tend to deal with a great deal of paperwork and sensitive information, will be required to implement up-to-date equipment that is safer and performs better. These agencies will most likely prefer systems that can scan and save documents electronically as well as provide improved data security. Low-maintenance machines that adhere to strict regulations will most likely gain more attention from this sector.

Other participants, including healthcare facilities or law offices, will also have some influence on the direction that this market will head. Each environment has its own requirements, and the equipment will be needed to meet those demands. Whether it's speedier machines, improved printing quality, or more effective storage, future demand will be influenced by how these tools are able to integrate into everyday work life.

Generally, the global office equipment market will continue to grow with advances in how individuals work, learn, and conduct tasks. Even as more people use digital tools, physical office equipment will continue to play a significant role in much of the professional landscape.

By Sales Channel

The global office equipment market will continue to grow significantly in the coming years with growing demands for productivity as well as convenience. With evolving work trends and technological advancements, the way in which office equipment is procured as well as used will also change. The channel through which individuals like to make purchases is one of the primary drivers that will shape this market. The sales channel, whether offline or online, plays an important role in the way companies and consumers make purchasing decisions.

The online channels will keep gaining prominence. More businesses are embracing digital systems for managing purchases, and the convenience of shopping online is still one to be contended with. Consumers can surf, read reviews, and shop from their desktops. This ease of access will continue to propel more consumers to online shopping. Also, as companies are looking for faster options and efficient delivery channels, online suppliers will be compelled to improve their services so that they can stay competitive

The offline channel will nevertheless not die out. There will always be situations where face-to-face communication is preferred, especially for companies that want to make bulk or custom orders. Most companies still want to see it before they purchase, especially furniture or high-end equipment. Some clients feel safer when they are able to ask questions face-to-face and get immediate answers. Off-line stores are also able to offer personalized services and help that are hard to get online.

With time, the ratio of sales online versus offline will be decided by the behavior of customers, organizational policy, and how both platforms cater to changing office needs. Both online shopping and offline service hybrids might become the norm. Businesses may start offering ways for customers to order online but collect and inspect in store, a middle ground between both.

The Global Office Equipment industry will not just be selling products. It will be the delivery of smoother experiences through smarter selling strategies. As businesses increasingly work towards creating more agile and technology-sensitive workplaces, they will demand faster, more reliable, and easy-to-use buying processes. How office equipment will continue to be bought by consumers, screen or shop, will remain an expression of their work needs and lifestyle.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$173,546.02 million |

|

Market Size by 2032 |

$207,690.73 Million |

|

Growth Rate from 2025 to 2032 |

2.6% |

|

Base Year |

2024 |

|

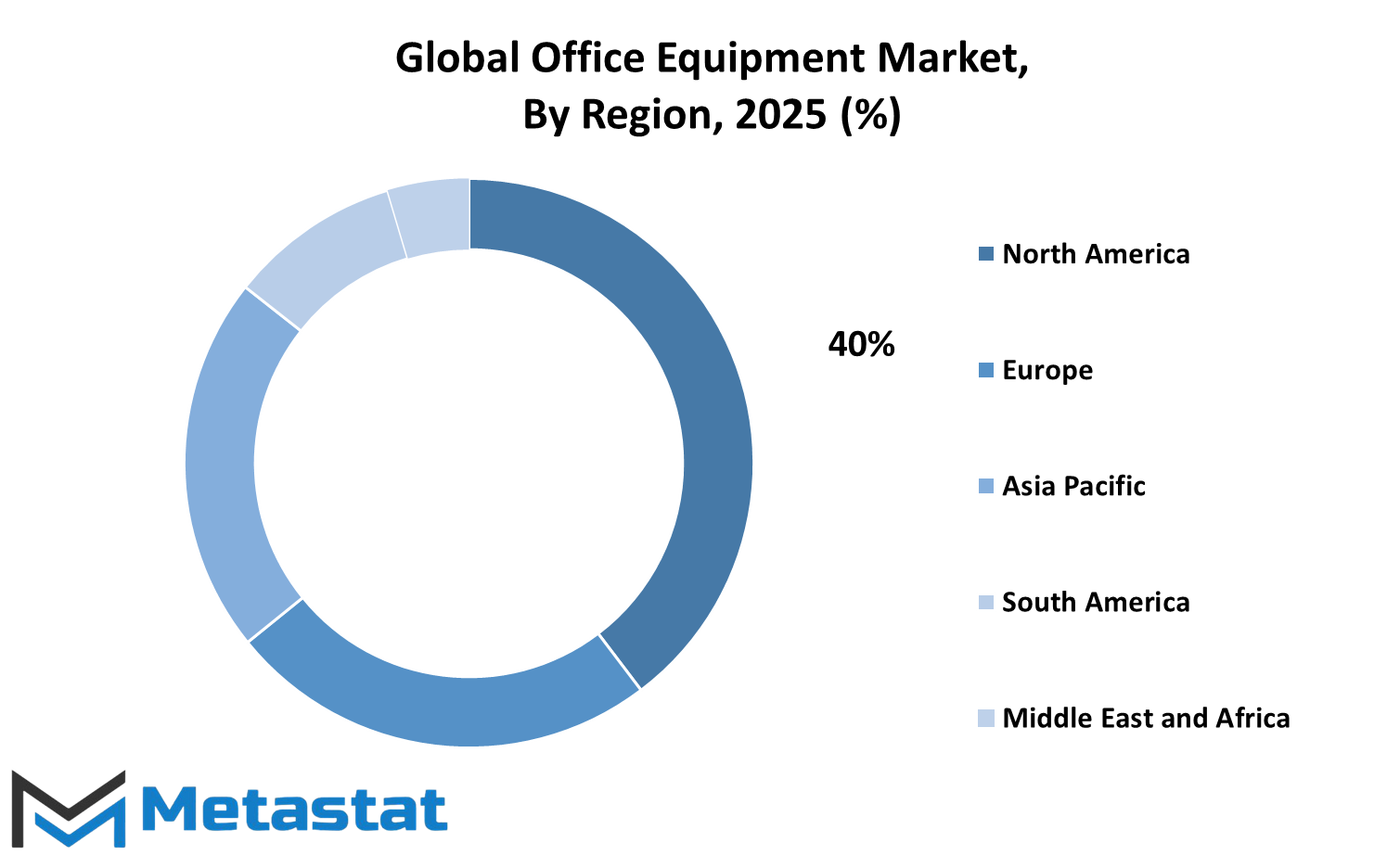

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global office equipment market will continue to reflect diverse growth patterns and demand depending on the region. It does make sense to analyze these trends across regions in order to realize how businesses in various regions of the world could invest and convert into office equipment and technology. Each region has its own set of challenges and opportunities based on local economies, government policies, and work culture. In North America, specifically in the U.S., stable demand should be expected due to a serious focus on productivity machinery and new technology. North American businesses often seek products that support hybrid working and enable flexibility. Even though Canada and Mexico are somewhat different when it comes to market maturity, they will almost definitely replicate their North American counterparts with greater interest in office solutions of the day, but particularly those moving communications and work-from-home equipment forward.

In Europe, the UK, Germany, France, and Italy will likely lead growth in the Office Equipment market with continued investment in digital technologies and green initiatives. These countries have a history of early adoption of innovations that streamline day-to-day office tasks and make them more efficient. As environmental regulations get tougher, offices across Europe may shift to green machines that not only save energy but are also in line with new workplace standards. This trend may convince companies to swap current setups rather than revert to older machines.

Asia-Pacific is becoming a highly dynamic area to grow in the coming years. India, China, Japan, and South Korea will most likely lead with strong investment in smart devices as well as cloud-connected solutions. Development of cities at a rapid rate and increasing numbers of new organizations may drive increased demand for cost-effective and scalable office equipment. Additional companies will likely seek multifunctional equipment and software that will support busy work environments. Regionally, the move towards automation and digitalization will be a key driver in the market.

Growth in South America will likely be slower but steady. Brazil and Argentina are showing signs of improvement, especially with additional businesses attempting to modernize their infrastructure. Demand for smaller, cheaper office equipment will likely grow. The Middle East & Africa is gradually turning around. Countries like the UAE, Egypt, and South Africa are likely to witness growing demand for digital office solutions. With governments fueling business expansion, firms will invest in newer technology that allows for smoother functioning and efficiency over time. This global trend signals a promising future based on local needs and broader shifts in workplace culture.

COMPETITIVE PLAYERS

The global office equipment market will continue to expand steadily with evolving workplace demands and the need for more efficient and flexible equipment. As companies move towards hybrid workplace setups, devices and solutions that support both in-office and off-site setups will be in more demand. The change in working practices will influence how companies select equipment, favoring those with features that support ease of use, reliability, and interlocation connectivity.

One of the key driving factors of the movement of the market is the cluster of competitive businesses that determine its trends and technologies. These companies, including Canon Inc., Xerox Corporation, Ricoh Company, Ltd., HP Inc., Epson America, Inc., and others, will continue to be the key drivers of how the market shifts. By anticipating, these companies will try to bring wiser and greener products to customers. For instance, energy-efficient printers and cloud document technology will become the standard rather than the exception. As these pioneers continue to consolidate their products, other small businesses and startups will be inspired to follow suit, creating a wave of innovation that benefits the industry as a whole.

The future will likely see tight collaboration between office equipment manufacturers and software firms. Rather than simply offering hardware, industry leaders like Konica Minolta, Panasonic Corporation, and Kyocera Document Solutions can transition towards comprehensive solutions that integrate devices with software. This will cater to the growing need for combined systems that allow users to address tasks from one platform. For example, collaborating on documents, live editing and security monitoring would all be brought together in a single product setting, making routine work simpler and more secure.

Simultaneously, the need for customer service and prompt customer care will rise. Organizations such as Bechtle AG, RAJA Group, Office Equipment Company, and Touch Office Technology will also adapt their services to match this requirement. Getting closer to customers will guarantee loyalty and stand out against a market that will progressively become competitive in the long run. With increasingly offered choices, user experience will match the level of product function.

Overall, the global office equipment market will move towards more intelligent equipment, more integration, and better service. Companies that embrace new ways of working and emerging technology will lead the charge, delivering a more productive and connected office experience for the future.

Office Equipment Market Key Segments:

By Type

- Printers

- Copiers

- Fax Machines

- Computers

- Telephones

- Shredders

- Scanners

- Other

By Material

- Wood

- Metals

- Plastic

- Others

By End-Use

- Commercial

- Educational Institutions

- Government

- Others

By Sales Channel

- Online

- Offline

Key Global Office Equipment Industry Players

- Canon Inc.

- Xerox Corporation

- Ricoh Company, Ltd.

- HP Inc.

- Epson America, Inc.

- Pitney Bowes Inc.

- Kyocera Document Solutions

- Panasonic Corporation

- Konica Minolta, Inc.

- Office Equipment Company

- Touch Office Technology

- DURABLE Hunke & Jochheim GmbH & Co. KG

- RAJA Group

- Bechtle AG

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252