MARKET OVERVIEW

The global online ready-to-assemble (RTA) furniture market in the furniture and home decor industry will keep shaping the way consumers interact with efficient living spaces. This segment is all about self-assembled furniture goods purchased over the internet. With reference to typical furniture categories based on in-store purchase and white-glove delivery, this segment will increasingly reflect customers' demands for convenience, space savings, and affordability. It caters to a wide variety of end-users city apartment residents and campus students, family budgets, and hotelier professionals who like to have simpler arrangements with fewer logistical hassles.

The defining feature of this market is that it has the ability to merge flat-pack design originality with e-commerce dynamism. The global online ready-to-assemble (RTA) furniture market will be shaped by evolving supply chain structures, direct-to-consumer supply chains, product customization technologies. Its participants include digital-first furniture businesses, third-party retailers with extensive RTA catalogs, and manufacturers aligned with drop-shipping models. As the character of the retail industry evolves towards increased digitized customers, the market will expand across numerous product lines such as beds, desks, storage units, seating furniture, and kitchen furniture. These will be designed to reduce itty-bitty packaging size without sacrificing itty-bitty structure, and consumers will want easy, tool-aided assembly access.

This market will expand in use throughout residential and commercial interiors, it will particularly expand in sectors like co-living facilities, short-term office installations, and modular hospitality settings. Fresh interior style fashions and material purchasing patterns will influence product design and how inventories are sold online. The global online ready-to-assemble (RTA) furniture market will need to balance the twin requirements of simplicity and durability, particularly as consumers worldwide bring their own regional tastes in terms of size, functionality, and finish. Companies seeking to enter or expand this market will need to optimize digital stores, invest in augmented visualization software, and enhance return logistics in an effort to compete.

Geographically, the market will have a wide geographical presence. It will span North America, Europe, Asia Pacific, the Middle East, Latin America, and Africa and involve various operational opportunities and challenges in every geography. Urbanization and residential patterns will fuel product innovation, but regional taxation, delivery networks, and restrictions on cross-border trade will impact the way offerings are launched and sustained. The global online ready-to-assemble (RTA) furniture market will continue to innovate in response to these external pressures by building localized sourcing and hybrid warehouse models that reduce delivery time and costs.

In building the future of online furniture retailing, the market will also meet up with sustainability goals, packaging engineering, and customer engagement metrics. Online Ready-to-Assemble (RTA) Furniture globally will not only be peddling physical goods but also a brand promise of user-friendliness and flexible lifestyle compatibility. As user navigation and experience in the digital world improve, this sector will transform how furniture is conceptualized, bought, transported, and assembled in the digital-first era.

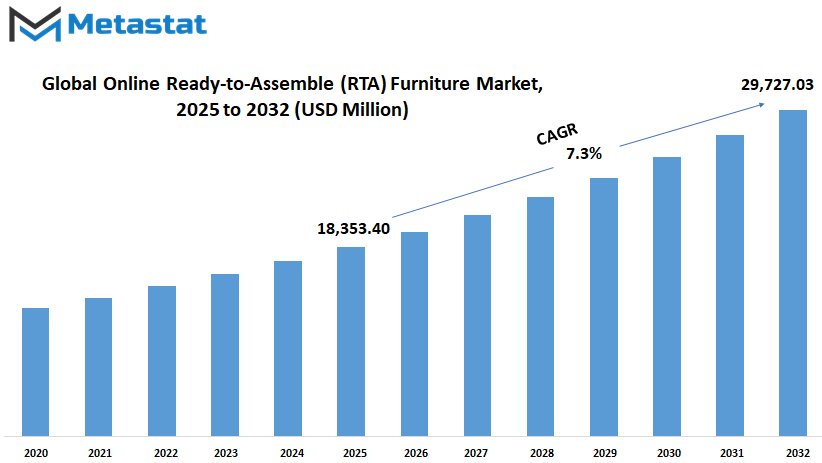

Global online ready-to-assemble (RTA) furniture market is estimated to reach $29,727.03 million by 2032; growing at a CAGR of 7.3% from 2025 to 2032.

GROWTH FACTORS

The global online ready-to-assemble (RTA) furniture market is set to experience extraordinary growth as a result of several important factors. One of the most important growth drivers is that individuals are seeking increasingly inexpensive furniture with the added requirement of space-saving needs. Such a demand is especially evident with city residents and younger generations that often find themselves with limited living space area in addition to limited budgets. These customers desire fashionable furniture that will suit homes with intricate shapes or apartments without spending much. Ready-to-assemble furniture fills these needs to the letter since it can simply be put together online and delivered flat-pack, saving both money and storage space dramatically.

The rapid spread of online shopping websites and home delivery networks is yet another key factor that will fuel the growth of this industry. Since more people feel comfortable buying products online, ready-to-assemble furniture is now easier to find. People can now browse through numerous designs from the comfort of their own homes and have the furniture shipped to their doorsteps. It is this convenience that makes more people prefer RTA furniture over traditional furniture that requires physical store visits. Also, the ability to compare prices and designs online allows consumers to make more informed decisions.

Despite these advantages, the business has some disadvantages that can slow its development. Among the usual problems with the consumers is the perception that assembly required furniture is not as durable as pre-assembled or custom ones. Others are concerned that the products will not be as durable or will work well in the long term. Another issue is the irritation caused from the assembly process itself. The customers might have a hard time following the instructions or discover they have missing parts, which can lead to a bad experience and not wanting to purchase again.

In the future, there are positive prospects for the global online ready-to-assemble (RTA) furniture market via the inclusion of new technologies like augmented reality (AR) and virtual reality (VR). These technologies have the capability of allowing customers to imagine virtual arrangements of furniture in their own home before actual purchase, thus helping them choose the right size and model. In addition, AR and VR can also provide assembly instructions in a step-by-step manner, which is easier and reduces the risk of misplaced pieces or mistakes. As they become mainstream, they are likely to improve the overall customer experience and lead even more individuals to embrace ready-to-assemble furniture in the future.

MARKET SEGMENTATION

By Type

The global online ready-to-assemble (RTA) furniture market is growing fast and revolutionizing the way people shop for and make use of furniture. More and more people are demanding furniture that is bought online and easily assembled in the home. The convenience and savings offered by ready-to-assemble furniture are the reasons for this. People no longer need to rely on specialty stores or on deliveries that need professional assembly. Instead, they can browse many options on their computers, choose what they want and desire, and receive merchandise to be assembled for them. This shift is bringing the world of furniture to more customers, like young professionals, families, and anyone who values flexibility.

The global online ready-to-assemble (RTA) furniture market is classified on the basis of type, and such classification reveals the differing needs that it serves. Office furniture will keep growing with more people working at home or seeking flexibility in office setup. Products in this category will be created such that they combine comfort with space utilization. Living room furniture will continue to be popular, with the units offering functionality as well as style to suit informal and formal spaces. The bedroom furniture segment will also increase, with items offering optimal space management without losing comfort.

Kitchen and dining furniture will be trendy with functional as well as aesthetically pleasing designs and suit various home designs. Furniture for storage will be in demand because it will allow people to organize their homes better. As homes become more functional, storage furniture that is simple to install and customize will be highly sought after.

In general, the future of the global online ready-to-assemble (RTA) furniture market will be shaped by technology, changing lifestyles, and environmental awareness. Online shopping made convenient and simple-to-assemble furniture will remain a key selling factor, simplifying and making home décor more convenient than ever.

By End User

The global online ready-to-assemble (RTA) furniture market is ready to change the way people and business organizations buy and use furniture in the years to come. Ready-to-assemble furniture has become increasingly popular because of its convenience, price, and flexibility, especially if purchased online. With more people and businesses looking for easy-to-transport and simple-assemble options, this market will continue to expand and develop in many different ways.

In the coming times, individual consumers will remain a key part of this market. Those who live in urban apartments or small houses will be interested in products that can be rushed to them and easily assembled without the need for a professional. Having parts that will fit into a specific space will also generate demand. With more individuals spending longer periods of time at home due to changing lifestyles and work habits, demand will be higher for fashionable and functional furniture that can fit into multiple rooms. There will be increased offerings from websites in the form of enhanced product pictures and assembly instructions so that customers feel better about what they are buying.

Business clients will also be significant. Offices and common workplaces will need furniture that can be installed or reinstalled as their groups grow or change offices. Companies will look for affordable and utilitarian furniture that appears professional but is easy to ship or swap. Web-based RTA furniture will be appealing to companies because it reduces delivery time and shipping costs. With the world moving towards more flex-work situations, demand in this market will increase.

Schools and colleges form yet another critical segment of this market. Colleges and schools would seek furniture that is not only useful but also supportive of high utilization rates throughout the day. Convenience in buying pre-fabricated components online will reduce effort and time for educational institutions. They would need easily expandable or adjustable products to accommodate fluctuations in the student population or room layout. This will cause suppliers to offer more diversified products attuned to the needs of educational settings.

The hotel industry too will be positively impacted by the growth of the global online ready-to-assemble (RTA) furniture market. Hotels, restaurants, and other such businesses will need trendy, easy-to-maintain furniture that is easily replaceable or refitable with minimum disruption. The speed and cost-effectiveness of online purchasing along with the flexibility of RTA furniture will be a winner. As the hospitality sector comes back on its feet and expands, it will turn to these solutions to set up amicable environments without hefty costs or long lead times.

Overall, the future of the global online ready-to-assemble (RTA) furniture market is promising. All types of customers will find unique advantages in this type of furniture, making it convenient and logical to utilize for many purposes. With technological advancements and ever-evolving designs, this market will include even more products suitable for modern lifestyles and business demands.

By Sales Channel

The global online ready-to-assemble (RTA) furniture market will be one of the most exciting markets to follow in the coming years. With increasingly more consumers buying goods online, the furniture selling and delivery model is shifting. It will continue to expand as it is providing convenience, assortment, and value, all of which are exactly what consumers today are seeking. The uniqueness of this market is how sales channels are evolving, especially through online shops, e-commerce sites, and direct-to-consumer.

Online shops will remain prominent in how shoppers purchase RTA furniture. Online shops generally have special websites or applications where customers can navigate a broad collection of furniture, shop around, and post reviews. Since they are selling online directly to consumers, they will concentrate on building accessible experiences that enable easy shopping and convenience. That convenience of shopping on those websites and having the furniture delivered right to the house will attract more consumers to utilize this avenue as opposed to entering the typical brick-and-mortar establishment.

E-commerce sites, which act as marketplaces connecting multiple sellers, will also have a vital role to play. These websites have access to an even larger range of products from other companies, making it easier for the consumer to get what they want and can afford. The competitive nature of these websites will cause sellers to become more competitive in price and service, like faster shipping and simpler returns. These sites will introduce more intelligent technologies in the future to assist customers in finding the appropriate furniture pieces more quickly and precisely.

Channels to consumers directly are another increasing part of the global online ready-to-assemble (RTA) furniture market. Companies that sell products directly to consumers via an intermediary can provide consumers with more competitive prices and ties. The direct relationship enables companies to give immediate feedback on consumers' opinions, refine designs, and establish one-to-one relationships with consumers. Direct-to-consumer brands will invest extensively in virtual showrooms and interactive tools in future years so that consumers can see furniture in the home before they purchase it.

Technology will be at the heart of furniture sales online in future years. The AI and augmented reality advancements will be assisting the consumers in making informed decisions and enjoying a better shopping experience. The delivery will be made finer so that even big-size furniture products reach the customers safely and on time. Convenience, customization, and price affordability by e-commerce portals, online retailers, and direct-to-consumer firms will define the destiny of the global online ready-to-assemble (RTA) furniture market and make it a growth and development industry.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$18,353.40 million |

|

Market Size by 2032 |

$29,727.03 Million |

|

Growth Rate from 2025 to 2032 |

7.3% |

|

Base Year |

2024 |

|

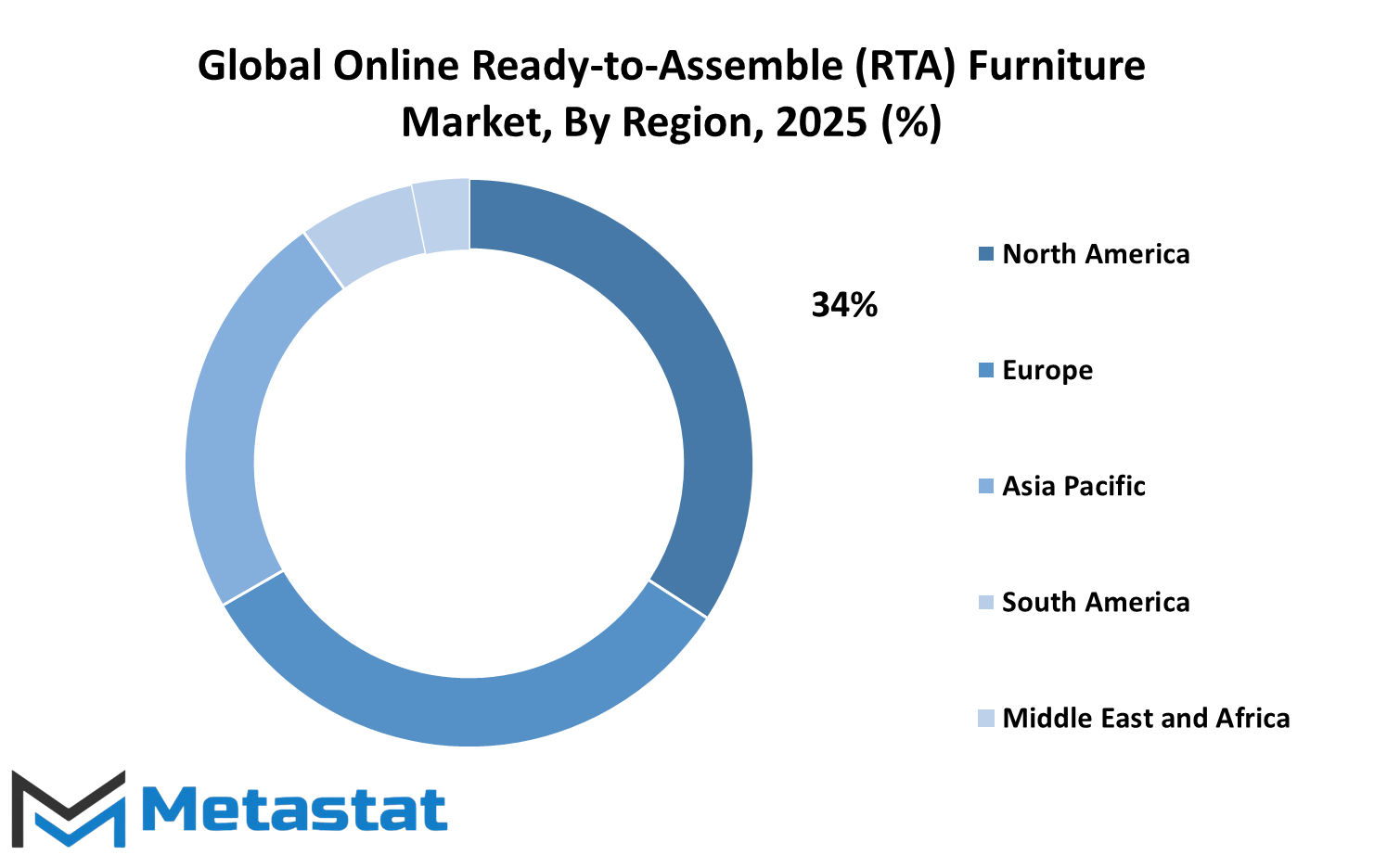

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global online ready-to-assemble (RTA) furniture market will be among the most adaptable and convenient markets in the furniture sector. Due to the ongoing proliferation of digital platforms and increased fondness for unproblematic shopping processes, the market has gained a consistent and increasing position within the buying behaviors of the consumers. Individuals are increasingly likely to buy conveniently mobile furniture that can be DIY assembled in their homes with little professional assistance. This is not just economically sound but also enables customers to create their own living rooms in a more intimate, touchy-feely, practical manner.

Given the evolving lifestyles and lack of space in an expanding population in the future, this market will be most likely to welcome the change. Urban residents are increasing, and space at home is decreasing, so furniture that not only is small but also flexible is needed. Online purchase of furniture and assembly at personal convenience enables this change in urban dwelling. As more and more people are settling in the cities, particularly in nations with expanding middle-class populations, such furniture will gain popularity on a large scale.

Considering the international scenario, the global online ready-to-assemble (RTA) furniture market depicts distinct trends for various regions. North America, comprising the U.S., Canada, and Mexico, is consistently experiencing constant demand because of a robust e-commerce infrastructure coupled with the trend of Do-It-Yourself products. Europe is being led by the UK, Germany, France, and Italy with the growth wave with growing awareness for environmental-friendly as well as cost-effective furniture. These markets also possess extensive internet penetration and extensive internet shopping exposure.

Asia-Pacific, comprising India, China, Japan, South Korea, and others, shall most likely witness intense growth. This is primarily because of population size, rapidly expanding digital reach, and rising interest in contemporary home design. In Brazil and Argentina of South America, the market continues to grow but has significant potential as people increasingly shift towards online platforms. The Middle East and Africa, specifically the GCC Countries, Egypt, and South Africa, are slowly adopting these trends, particularly with youth beginning to influence how products are bought and consumed.

In general, the global online ready-to-assemble (RTA) furniture market will continue to grow as it offers room for new design and accommodates the practical uses of a broad cross-section of consumers globally.

COMPETITIVE PLAYERS

The global online ready-to-assemble (RTA) furniture market is going in a way where lifestyle transformation, growing digital activity, and higher convenience demands are revolutionizing the future. As more consumers seek convenient-to-move, convenient-to-install, and convenient-to-buy-online furniture, the market will continue to expand. Not only are customers no longer drawn by price or appearance but also by the ease of delivery and convenience of assembling products without professional help. This trend is making RTA furniture a number one choice for houses all over the world, especially for city residents where space is limited and people want things that function.

One major reason for this heightened want is the responsibility of key stakeholders who continue to improve and innovate their products. IKEA, Home24, and Wayfair lead the way in terms of user-friendly websites, fast delivery, and products that are in keeping with modern home decor. Amazon has also shown a strong presence in the market through offering a broad range of products and utilizing its existing delivery system to deliver goods quickly to customers. These other retailers like JYSK, Dunelm, Linens Limited, and H&M Home are carving out space for themselves by accessing customers who are looking for both style and value. Castorama and VidaXL are also making their websites hassle-free to navigate, with better search tools and detailed product guides, so customers can make better choices.

In the coming times, the global online ready-to-assemble (RTA) furniture market will only become more competitive. Brands will need to be fanatics about the entire customer experience from home browsing to eventual home assembly. Better instructions, online room planning software, and better packaging will be taken-for-granted norms. Those companies that meet these needs well will be market leaders in the next few years. Sustainable products and smart designs which are capable of responding to different kinds of living environments and lifestyles will be given more importance. This not only will appeal to new buyers but also will start repeat purchases.

As technology takes a bigger part in purchasing behavior, the companies in this industry will have to upgrade their online presence every now and then. Such an uncluttered, unadorned, and reliable online experience will be as much a part of the product's success as the product itself. As much effort will be devoted to what is on offer as to how it is offered and how seamlessly it will fit into the lives of those who buy it.

Online Ready-to-Assemble (RTA) Furniture Market Key Segments:

By Type

- Office Furniture

- Living Room Furniture

- Bedroom Furniture

- Kitchen & Dining Furniture

- Storage Furniture

By End User

- Individual Customers

- Business Customers

- Educational Institutions

- Hospitality Industry

By Sales Channel

- Online Retailers

- E-commerce Platforms

- Direct-to-Consumer Channels

Key Global Online Ready-to-Assemble (RTA) Furniture Industry Players

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383