MARKET OVERVIEW

The global motor insurance market is poised to transcend its classical limits, forging an industry no longer limited to the coverage of risks. Through the years to come, this market will be a sophisticated network of services, technologies, and consumer-based solutions meant to revolutionize how motor vehicles and drivers are insured. In contrast to its initial phases, dominated by simple policies, the future phase will stretch the limits of what motor insurance can deliver in an interconnected world.

The business will not confine itself to underwriting policies; it will be a data-driven universe where insurers leverage instant analytics to offer customized solutions for solo drivers. As cars get more intelligent and more reliant on digital interfaces, insurers will bank on predictive models so that they can foresee risks before they happen. This will not just help lose fewer dollars but also result in a more responsible driving culture worldwide. As vehicles become semi-autonomous and autonomous, the Global Motor Insurance industry will evolve to deal with duties beyond human fault, raising new liability and ethical issues.

As connected cars grow in popularity, insurance will move into the mobility services space as well. It will no longer be linked solely to vehicle ownership but will expand into shared mobility, subscription services, and even ride-hailing services. In this case, insurers' role will shift from passive claim settlement to active participation in mobility planning and risk management. The expansion will necessitate a tight integration of technology with conventional underwriting and redefining the very roots of motor insurance practices.

Blockchain, synthetic intelligence, and telematics will spearhead the technological revolution within the enterprise. These technology will establish open, streamlined systems that lessen fraud even as dashing up declare settlements. In addition, the ability of connected vehicles to provide enormous amounts of data will empower insurers with the ability to create hyper-personalized products that reflect a driver's actual habits in real-time instead of drawing from general demographic assumptions. This change will shift customer expectations since people will expect adaptive policies that adapt to their usage profiles instead of fixed yearly plans.

Sustainability will also be a determining factor in influencing the global motor insurance market. As the motor industry moves towards electric and hybrid cars, insurance companies will develop products specially designed to meet the specific risks and infrastructure difficulties presented by these types of vehicles. Additionally, as urban local bodies embrace smart infrastructure and autonomous mobility networks, insurance companies will work with municipal governments and technology companies to provide exhaustive coverage of interlinked systems.

Finally, the market will pass beyond its traditional function and turn out to be a crucial facilitator of world mobility solutions. Through embracing technology, personalization, and sustainability, the future of the global motor insurance market will depict a colorful movement in the direction of innovation-led safety, wherein protection and versatility remain on the top of this dynamic body of reference.

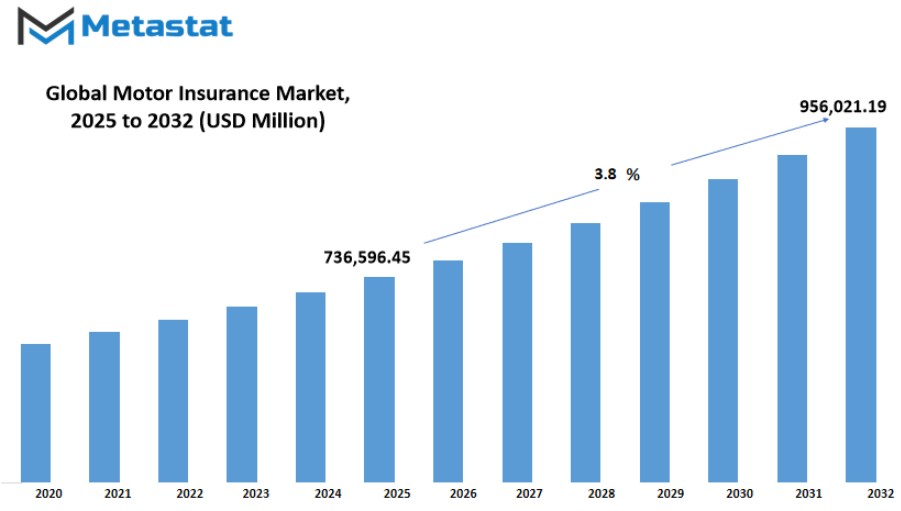

Global motor insurance market is estimated to reach $956,021.19 Million by 2032; growing at a CAGR of 3.8% from 2025 to 2032.

GROWTH FACTORS

The global motor insurance market is experiencing consistent growth as individuals all over the world acquire cars. With increased income levels and urbanization, the number of vehicles on the roads keeps rising, leading to a high demand for insurance. Motor insurance has also become necessary not only to cover cars but to fulfill obligatory requirements in most countries. This increasing ownership phenomenon will continue to be one of the key drivers of the market. Individuals are becoming more conscious about the money losses that may result from accidents, and this makes them choose comprehensive insurance policies.

Yet another significant driver propelling the global motor insurance market forward is the stringent regulatory environment in most nations. Governments require motor insurance as a minimum, and thus it is inevitable for car owners. These laws provide steady demand since compliance is needed to drive legally. This enforcement supports the industry in sustaining a stable pool of policyholders irrespective of economic changes. While more regulations continue to be imposed, more individuals will shift towards formal insurance avenues, supporting further growth in the market.

Nonetheless, the global motor insurance market is faced with significant challenges that will hinder profitability. One of the main problems is cutthroat competition among the insurers that tend to result in price wars. To increase customers, firms reduce premium rates, thus decreasing total margins. This is a challenge that makes it hard for insurers to realize good profits, particularly where operational expenditures are high. Also compounding the situation is increasing insurance fraud. False claims and fraudulent submissions put financial pressures on providers, and they must spend a lot of money on detection and prevention systems.

Progress has been made despite the challenges, and the global motor insurance market presents bright opportunities for expansion. Telematics insurance, based totally on facts furnished by way of smart devices and car sensors, is becoming increasingly popular. Such plans are supplying customized charges consistent with riding conduct, drawing technology-driven customers who insist on equitable pricing structures. In addition, the increasing trend of electric cars is opening up a new niche for insurers. With electric vehicles becoming mainstream, firms will create custom policies to ensure particular risks involved in driving them. All this indicates that innovation and adjustment will form the key to forging the motor insurance future globally.

MARKET SEGMENTATION

By Coverage

The global motor insurance market has the crucial task of insuring people and companies against the financial implications of car ownership and accidents. As extra motors hit the arena's roads, demand for motor insurance will continue to grow. This is fueled by way of developing urbanization, rising earning, and stringent criminal mandates in most countries that compel humans to insure their cars. Motor insurance now not only offers protection but also helps easier healing from unexpected losses, supplying policyholders with confidence and reassurance.

The major feature of the global motor insurance market is the breadth of coverage available to suit various customer requirements. Coverage is also segmented under Liability Coverage, Collision Coverage, Comprehensive Insurance, and Others. Of those, Liability Coverage instructions the best amount, well worth $286,953.83 million, in reputation of its function in protecting drivers against claims for accidents or belongings damage inflicted on others. Collision Coverage is worried with the restore or replacement of the blanketed vehicle in the event of an accident, while Comprehensive Insurance affords a much wider safety against non-twist of fate-associated events like robbery, herbal failures, or vandalism. The "Others" category consists of upload-on offerings and specialized plans, addressing unique wishes for additional flexibility. Consumer flavor on this market is shifting in the direction of policies that offer not simply affordability but comfort and customizability as properly. Mobile apps and online websites will facilitate clients in comparing regulations, renewing plans, and making brief claims. These trends beautify velocity and transparency, supporting insurers gain the agree with of their clients. Also, with the inclusion of telematics and usage-based fashions, safer driving will be promoted, which will impact the calculation of charges in the future.

While cars grow to be smarter and extra linked, the motor coverage zone will evolve to deal with emerging demanding situations like electric powered vehicles, independent using, and cyber hazard related to related vehicles. The shift will necessitate insurers to create modern merchandise and pricing strategies attuned to the brand new car landscape. With multiplied recognition on purchaser experience and risk management, the global motor insurance market will continue to be an important part of the economic enterprise, facilitating non-public and commercial mobility at the worldwide level.

By Vehicle Type

The global motor insurance market is crucial in offering financial protection to vehicle owners and drivers worldwide. With an increase in the number of vehicles, motor insurance demand will continue to expand. Individuals buy motor insurance not only due to mandatory requirements in most countries but also as a measure to safeguard themselves against loss of money in the event of an accident, theft, or damage. This increased consciousness regarding safety and risk management is dictating the direction of this market in the future. Personalized policies and online solutions are also being launched by insurance companies to simplify the process and ensure greater transparency for the customer.

Based on the type of vehicle, the global motor insurance market has been segmented into new vehicles and used vehicles. New. car insurance tends to be costlier because the cost of the car is more., and repairing or replacing it. in the event of damage is higher. New. cars are. most often. taken on loans., and. borrowers. want comprehensive insurance cover, which further. contributes. to. this. segment. Brand-new car buyers prefer. full. coverage. policies to. have. every. bit. of. cover, including add-ons such. as. zero. depreciation. and. roadside. assistance.

Conversely, the global motor insurance market for used vehicles also commands a substantial portion of the motor insurance business. With increased demand for second-hand vehicles across the world, more individuals are insuring their investments. Although insurance for used vehicles is normally lower-priced because they have less market value, owners also require cover from accidents, natural calamities, and third-party claims. Most insurance companies provide cheap options especially designed for used vehicles, and this ensures that clients are able to keep the coverage without incurring a lot of costs.

Technology is going to dominate the Global Motor Insurance space by enhancing the customer experience and facilitating the management of policies. Services such as online settlement of claims, immediate issuance of policies, and telematics-based premiums will gain the maximum number of customers in the future years. Insurance for new and old vehicles will still be crucial as more cars take to the roads, and the emphasis on safety and financial stability becomes more intense globally.

By Application

The global motor insurance market has grow to be a necessary aspect of the motor enterprise, providing monetary safety to individuals and organizations against unfortunate incidents. Insurance is a safety blanket that pays for losses arising from injuries, theft, or harm to motor automobiles. As motor car possession will increase around the world, so does the want for motor coverage. This is inspired by using stringent government rules requiring coverage for every automobile in addition to extended patron focus approximately the benefits of being insured. Motor insurance now not only gives vehicle owners peace of thoughts but also guarantees monetary safety at some point of emergency situations.

By application, the global motor insurance market is similarly segmented into business automobiles and personal cars, each catering to exclusive purchaser necessities. Commercial vehicle coverage is vital for agencies that own fleets, vans, or delivery groups. Such cars are on the road greater frequently, so the possibilities of accidents are higher, making complete coverage a need to-have. Insurance on this section assists companies in dealing with wonder repair costs, criminal prices, and cargo-related threats, enabling them to keep operations without economic losses.

Conversely, non-public car insurance targets person vehicle proprietors who wish to shield their property. Increased middle-class populations and escalating vehicle possession round the arena have contributed in the direction of making non-public car insurance the most important segment in the marketplace. Personal car guidelines generally cover damages as a result of injuries, herbal calamities, or robbery, in addition to 1/3-birthday celebration liabilities. The presence of bendy plans and inexpensive pricing through insurers has facilitated get right of entry to non-public car insurance for the larger population.

Both segments are seeing enhancements in digital systems and technologies that simplify buying and handling regulations. Online claims strategies, cell app policy management, and telematics-based totally premiums are remodeling consumer engagement with insurers. Consequently, the global motor insurance market will similarly develop, addressing the specific needs of industrial operators and private owners and conforming to new convenience and transparency expectations.

By Distribution Channel

The global motor insurance market serves a critical purpose in guarding vehicle proprietors against financial vulnerabilities arising from accidents, robbery, and loss. With more vehicles plying the roads globally, demand for safe motor insurance has also mushroomed. Individuals now appreciate insurance that not simplest complies with the law however additionally brings peace of thought. Insurance carriers are constantly striving to make guidelines greater low cost, handy, and custom designed to suit diverse consumer requirements.

Taking a view of the market by way of distribution channel, one of the most usually used modes is through coverage brokers and marketers. This channel has remained popular all along since it allows for a personal touch. Customers prefer to speak with an agent who can break down policies into plain language and assist them in selecting the most appropriate plan. Agents and brokers establish trust by interacting directly with clients, which increases the likelihood of people comprehending details of the coverage. This distribution channel is particularly robust among individuals who are not as comfortable buying financial products on the Internet.

Another emerging distribution channel is direct response. This method permits clients to purchase motor coverage without delay from the insurer through websites, apps, or call facilities. It has become notably famous in current years because it saves time and often comes with decreased costs. The comfort of evaluating policies online, getting immediately quotes, and making quick payments appeals to tech-savvy clients. This manner also enables insurers to cut on middlemen dependency, which ends up in advanced pricing and faster carrier for policyholders.

Banks also play a significant role in distributing motor insurance policies. Banks team up with insurance companies to provide motor insurance as an additional service to their existing customers. This is advantageous to customers who would rather have their financial products under one roof. Banks offer a feeling of security and trust and hence are a trusted medium for individuals wishing to buy insurance effortlessly. Besides these, other media like corporate alliances and third-party websites also help in expanding the scope to reach more customers.

By and large, every distribution channel has its own merits in the global motor insurance market. While some consumers appreciate personalized advice from agents, others like the speed and convenience of the cyber world. The coexistence of those channels ensures that coverage offerings continue to be available to people with varied options and desires. As technology maintains to shape buying conduct, some of these channels will collaborate to ensure the marketplace remains strong and aware of evolving customer expectancies.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$736,596.45 million |

|

Market Size by 2032 |

$956,021.19 Million |

|

Growth Rate from 2025 to 2032 |

3.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

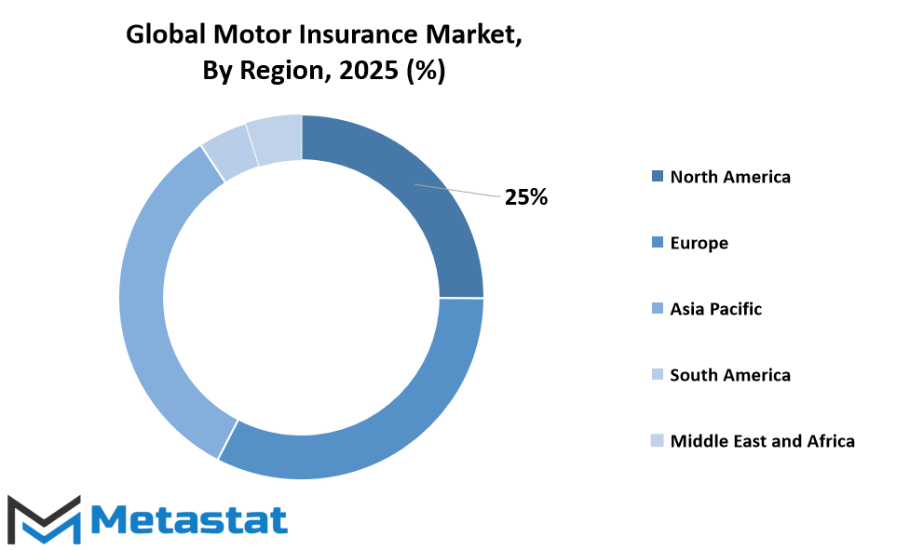

The global motor insurance market is distributed over a number of dominant regions, which each make a significant contribution to the entire industry. The market is split broadly into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. All these regions have their own economic climate, regulatory landscape, and consumer tastes, which affect the adoption and growth of motor insurance. Market structure also mirrors diversity in demand since the pattern of ownership and usage of vehicles is quite diverse across these countries.

One of the most advanced motor insurance market is North America, dominated by the U.S., Canada, and Mexico. The majority of this market belongs to the United States, with a robust regulatory framework and high vehicle ownership levels. Canada is close behind, with an orderly system of insurance that protects consumers and keeps premiums competitive. Mexico, while smaller than the U.S. and Canada, also continues to expand as a result of increasing vehicle sales and enhanced awareness of financial security by drivers. Combined, they provide a solid foundation for the auto insurance industry in North America.

Europe is another major segment, with major players including the UK, Germany, France, and Italy. These countries have strict motor insurance regulations that compel all automobile owners to take out cover. The market is buttressed by a developed automobile market and sophisticated risk management techniques. Though the UK and Germany dominate on a market size and penetration basis, the rest of the region contributes through incremental take-up and changing customer needs. Strong economic stability and high quality insurance services characterize the European market as a whole.

Asia-Pacific, on the other hand, is viewed as the most dynamic region to develop in the future. India, China, Japan, and South Korea are leading this growth with the support of swift urbanization, growing disposable incomes, and rising automobile ownership. China and India specifically demonstrate impressive growth in both vehicle numbers as well as insurance penetration. Japan and South Korea, however, have well-established insurance regimes with innovative products and digital penetration. The Rest of Asia-Pacific, encompassing emerging markets, will also contribute to this growth, providing immense opportunities for insurers.

South America and the Middle East & Africa show a mixed scenario. Brazil and Argentina hold the pole position in South America, with the backing of huge populations and emerging automobile industries. Economic ups and downs in the region can affect stability. The Middle East & Africa comprises GCC Countries, Egypt, South Africa, and others, where the market is slowly emerging. Expansion in these regions is driven by growing imports of vehicles, economic diversification strategies, and improving awareness of financial security. Although these regions are at present smaller in terms of percentage compared to North America or Asia-Pacific, they have enormous potential as awareness and regulatory actions grow with time.

COMPETITIVE PLAYERS

The global motor insurance market is vital to the financial security of businesses and car owners around the globe. With an increasing number of individuals depending on personal and commercial vehicles for daily use, the demand for efficient motor insurance has risen dramatically. This market offers safeguarding against accidents, damage, and unexpected risks that could result in financial loss. With increasing road networks and a growing number of vehicles annually, the need for all-encompassing insurance policies will increase. The market also adjusts to evolving consumer needs, launching innovative plans and digital offerings that facilitate buying and policy management faster and more easily.

Rising awareness of the need for protection of vehicles is one of the significant drivers for this market growth. Governments of various nations are making motor insurance compulsory, thereby covering personal and third-party liabilities. Besides regulatory demands, customers now seek value-added add-ons such as roadside assistance, zero depreciation cover, and cashless repairs. Technology has also made a significant change, with online portals and mobile apps enabling policy comparison, payment of premium, and claim processing to become easy. These advancements are not just improving customer experience but are also helping companies reduce operational costs.

The global motor insurance market is highly competitive, with several leading players shaping its progress. Major players in the motor insurance sector are Allianz SE, AXA SA, Zurich Insurance Group Ltd., Berkshire Hathaway Inc. (GEICO), Generali Insurance, State Farm Mutual Automobile Insurance Company, Progressive Corporation, Allstate Corporation, Tokio Marine Holdings, Inc., Liberty Mutual Insurance, RHB Insurance, Berjaya Sompo Insurance, Etiqa General Insurance, Chubb Limited, Nationwide Mutual Insurance Company, MSIG Insurance, Admiral Group plc, QBE Insurance Group Limited, The Travelers Companies, Inc., Direct Line Insurance Group plc, RSA Insurance Group Limited, ERGO Group AG, Hong Leong Bank, and RHB Insurance Berhad. These insurers are always adding new policy choices and taking advantage of digital platforms to win and retain customers across regions.

In the future, the industry will continue to experience swift transformations as insurers adopt sophisticated technology such as artificial intelligence and telematics to deliver customized plans and usage-based insurance. Electric vehicles and mobility sharing trends are also shaping new product designs, with insurance coverage keeping pace with the future of transportation needs. With heightened competition and evolving customer expectations, motor insurance companies will prioritize innovation, affordability, and accelerated claim settlements to build trust and remain competitive in the business. The convergence of regulatory actions, technological revolution, and increasing ownership of vehicles guarantees that this market will continue to be one of the most dynamic markets in the world's insurance industry.

Motor Insurance Market Key Segments:

By Coverage

- Liability Coverage

- Collision Coverage

- Comprehensive Insurance

- Others

By Vehicle Type

- New Vehicles

- Used Vehicles

By Application

- Commercial Vehicle

- Personal Vehicle

By Distribution Channel

- Insurance Agents/Brokers

- Direct Response

- Banks

- Others

Key Global Motor Insurance Industry Players

- Allianz SE

- AXA SA

- Zurich Insurance Group Ltd.

- Berkshire Hathaway Inc. (GEICO)

- Generali Insurance

- State Farm Mutual Automobile Insurance Company

- Progressive Corporation

- Allstate Corporation

- Tokio Marine Holdings, Inc.

- Liberty Mutual Insurance

- RHB Insurance

- Berjaya Sompo Insurance

- Etiqa General Insurance

- Chubb Limited

- Nationwide Mutual Insurance Company

- MSIG Insurance

- Admiral Group plc

- QBE Insurance Group Limited

- The Travelers Companies, Inc.

- Direct Line Insurance Group plc

- RSA Insurance Group Limited

- ERGO Group AG

- Hong Leong Bank

- RHB Insurance Berhad

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383