Global Money Insurance Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global money insurance market reshape conventional financial security models as virtual transactions retain to surge international, or will it war to keep tempo with evolving risks? In an era of growing cyber threats and transferring regulatory landscapes, how organized is the industry to stability innovation with believe and compliance? As new players and technologies emerge, will the market release untapped opportunities or face disruptions that redefine its future trajectory?

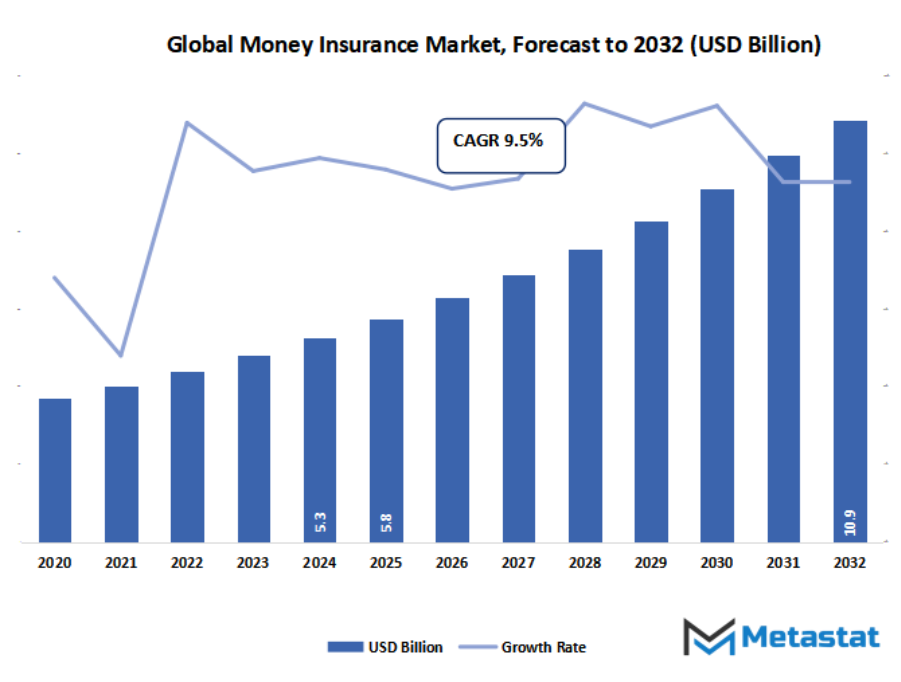

- Global money insurance market valued at approximately USD 5.8 Billion in 2025, growing at a CAGR of around 9.5% through 2032, with potential to exceed USD 10.9 Billion.

- Term Money Insurance account for nearly 70.2% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: High-value cash transactions in retail, hospitality, and banking sectors., Regulatory requirements for businesses handling significant cash volumes.

- Opportunities include Bundling with broader business insurance policies for comprehensive coverage.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

The global money insurance market will keep evolving beyond the traditional confines of financial protection, building a platform that secures institutions as well as individuals in the future. As money transactions become increasingly complex, the direction of this market will go beyond what is considered normal risk, opening doors that blend technology, regulation, and trust into one dynamic. The market itself will cease to be viewed as a haven for physical holdings only but as a protection against threats that emerge due to digital platforms, cyber attacks, and border transactions. This change will reshape the concept of security for funds within organizations ranging from banks to small businesses.

In the coming times, the global money insurance market will not just replicate the dynamics of the past but will widen its horizon by unfolding more resilient solutions. With digital money paving its way and the flow of money assuming new shapes, the sector will need to consolidate its strategies to be of relevance. Insurance companies will drive beyond traditional policies and instead design products that cover threats associated with blockchain transactions, payment gateways, and other technology interfaces. This will lead to a broader safety net that keeps up with the financial habits of contemporary societies.

Market Segmentation Analysis

The global money insurance market is mainly classified based on Product Type, Distribution Channel.

By Product Type is further segmented into:

- Term Money Insurance - There will be robust focus towards term policies globally as enterprises and individuals look for affordable alternatives. Term Money Insurance will remain in demand due to its affordability and concentrated protection. Flexible term products will become the key to addressing temporary financial security needs amid economic uncertainty influencing spending behaviors.

- Whole Money Insurance - The global money insurance market will see steady growth in whole policy uptake. Whole Money Insurance will attract those seeking stability and lifetime cover. Buyers in the future will resort to these products as a means of maintaining continued financial security, coupling protection with savings to manage long-term uncertainties.

By Distribution Channel the market is divided into:

- Direct Sales - The global money insurance market will still evolve as direct selling becomes increasingly important. Direct communication between buyers and providers will produce quicker decision-making and confidence. Future direct contact will still be important for individuals who need transparency in the details of coverage without reliance on middlemen.

- Insurance Brokers - The global money insurance market will depend on brokers as strategic advisers in advising on policy decisions. Insurance brokers will act as consultants who make things easier for individuals and companies. As future markets are becoming more diversified, brokers will remain valuable by linking clients to solutions that are designed to meet their specifications.

- Online Platforms - The wglobal money insurance market will grow sizably via online channels. Online environments will be the key to providing transparency and accessibility, facilitating easy comparison of plans by the buyers. As people become more digitally literate, the forthcoming customers will increasingly rely on the online systems for real-time transactions and easy application processes.

- Banking Institutions - The global money insurance market will witness banking organizations consolidate their position as channels of distribution. Banks will fold money insurance into broader packages of money and other services, prompting customers to insure their assets along with other services. Banking channels will have a decisive influence on trust building and uninterrupted availability in the years to come.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5.8 Billion |

|

Market Size by 2032 |

$10.9 Billion |

|

Growth Rate from 2025 to 2032 |

9.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Geographic Dynamics

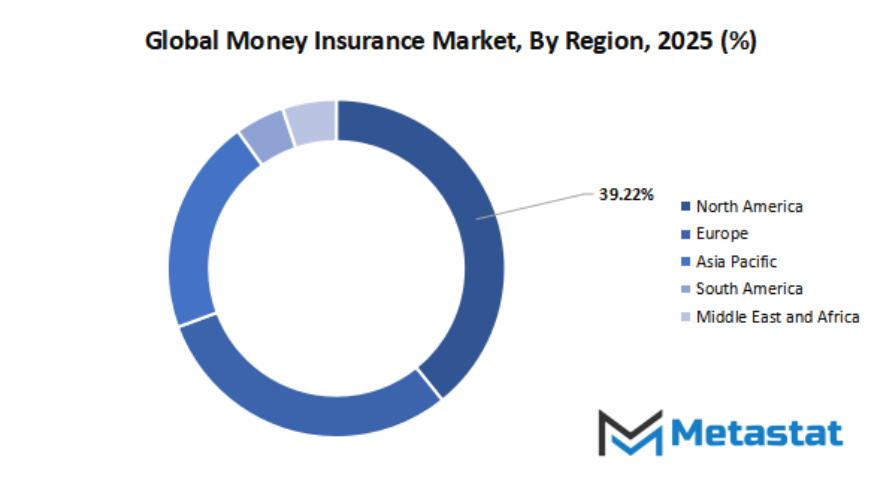

Based on geography, the global market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global money insurance market has been drawing attention as companies and individuals persist in searching for financial protection against uncertainty and risks. This market is centered around protecting money in transit, safe money in safes, and money in financial institutions so that companies as well as individuals can be protected against loss of money due to theft, fraud, or any other unforeseen circumstances. As financial operations increase across geographies and electronic transactions increase, the requirement of comprehensive insurance coverage for money risks will continue to be a key part of corporate and individual financial planning.

The global money insurance market is made up of a mix of world leaders and regional players who all play their roles in crafting its growth and direction. Well-set up gamers like AXA SA, Allianz, Tokio Marine, and Berkshire Hathaway have an extended records and are diagnosed for their enormous financial offerings and coverage products. Together with them, players like HDFC ERGO, Hollard, Bharti AXA General Insurance, and Geminia Insurance Company Limited are working in the direction of developing sturdy networks in local markets. This blend of world information and nearby presence permits the world to fulfill numerous purchaser needs, whether in big financial hubs or emerging economies.

Some firms in this sector are diversifying their offerings by launching customized products addressing both traditional risks and new issues caused by technological change. For instance, with the rise in digital banking and online payments, there has been an exposure to cyber attacks, leading to insurers creating solutions that extend beyond the protection of cash. Companies like Ping An Insurance (Group) Co of China Ltd., Virgin Group, and Sompo Insurance Singapore Pte. Ltd. are shifting their strategies to make sure customers stay secure as the financial world continues to evolve. This adaptability indicates the capability of the industry to modify its products according to customer demands and market changes.

Competition in the Money Insurance industry is not merely size but also innovation and trust. Players like ICBC, LG Chem Ltd., and Allianz SE offer credibility and financial muscle, while newer players and regionally oriented insurers like SALAMA Islamic Arab Insurance Company and BizCover establish their advantage through specialist services and solution-driven customer focus. This interplay between old and new players provides the sector with depth and ensures customers have access to both mass resources and specialist expertise.

In the future, the global money insurance market will continue to be a stabilizing force for financial systems globally. Having such major players as A123 Systems LLC, AVL List GmbH, and Tesla Inc., as well as solid insurance providers, the sector is one that portrays a future where security is less a precaution and more a necessity. With increasing challenges for individuals and businesses in the protection of their assets, the need for this market can only grow and become more of a foundation for global financial protection.

Market Risks & Opportunities

Restraints & Challenges:

- Limited demand due to the shift toward digital payments. - The global money insurance market will experience constrained growth as organizations and individuals increasingly embrace digital payment systems, lessening the need for physical cash. As fewer transactions are made in cash, the explicit demand for such insurance falls, compelling the market to explore means of coping with this financial change.

- High risk of fraudulent claims and stringent verification processes. - One other challenge facing the global money insurance market will be rising sophistication in fraudulent claims. The insurers will have to use sophisticated verification systems, ensuring the process becomes tighter and often taking more time. This deters potential buyers and hinders quicker claim settlements, adding further pressure on market expansion in upcoming years.

Opportunities:

- Bundling with broader business insurance policies for comprehensive coverage. - The international Money Insurance market will benefit through integration with larger business insurance packages. Through the provision of bundled policies covering physical cash and broader business assets, insurers will add greater value to companies. This approach will promote wider usage and create openings for long-term growth in the future.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 5.8 Billion in 2025 to over USD 10.9 Billion by 2032. Money Insurance will maintain dominance but face growing competition from emerging formats.

What will differentiate the global money insurance market in the future is how it combines financial protection and innovation, making the policies continuously responsive to the quick changes in global trade. The remit of protection will expand, covering not just physical money and transit but also money operated in digital networks. By moving beyond previous boundaries, this sector will secure itself as a pillar of financial strength, creating trust for the next few decades.

Report Coverage

This research report categorizes the global money insurance market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global money insurance market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global money insurance market.

Money Insurance Market Key Segments:

By Product Type

- Term Money Insurance

- Whole Money Insurance

By Distribution Channel

- Direct Sales

- Insurance Brokers

- Online Platforms

- Banking Institutions

Key Global Money Insurance Industry Players

- AXA SA

- Hollard

- Allianz

- Jubilee Holdings Limited (JHL)

- Bharti AXA General Insurance

- BizCover

- SALAMA Islamic Arab Insurance Company

- Sompo Insurance Singapore Pte. Ltd

- Virgin Group

- Tokio Marine

- HDFC ERGO

- Geminia Insurance Company Limited

- ICBC

- Berkshire Hathaway

- Ping An Insurance (Group) Co of China Ltd.

- Allianz SE

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252