Global Mining Metal Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global mining metal market and its corresponding industry have come a long way from the primitive stage of rough prospecting in ancient civilizations to an advanced technological system that provides the world with the necessary materials for manufacturing, construction, power generation, and new innovations. It has been over six thousand years since people first learned how to extract metals from the ground. During that time, copper and tin were the main minerals mined, and miners were making use of stone tools, digging small pits to get them. When human societies figured out that adding tin to copper made bronze, mining became more systematic, and the movement of metals among different continents started through traders. That point transformed mining from being a mere resource activity to the center of early trade.

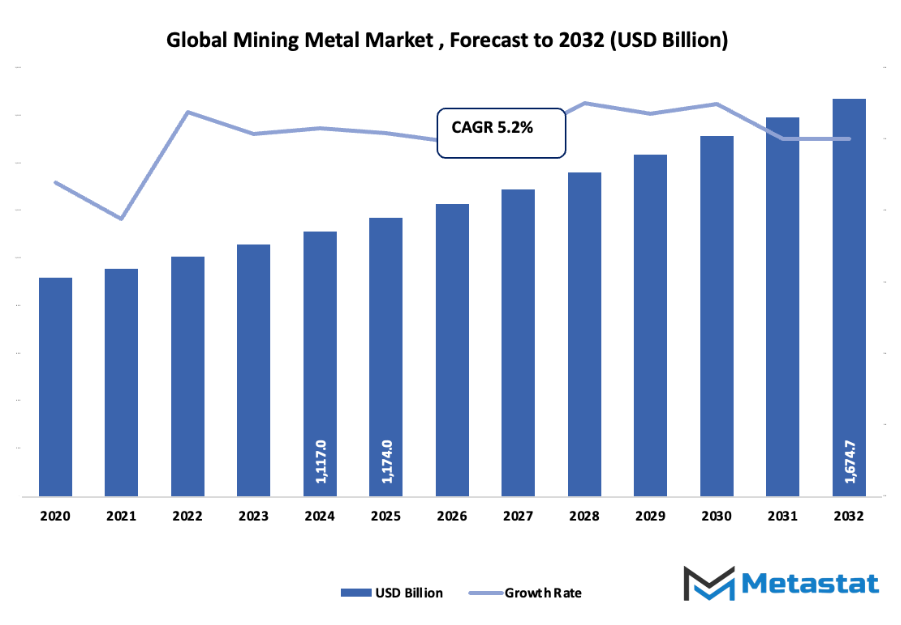

- The global mining metal market was valued at around USD 1174 billion in 2025 and is expected to grow at a CAGR of about 5.2% till 2032, with a possibility of going beyond USD 1674.7 billion.

- Iron is the largest metal in the market, representing almost a third of it (33.4%), and through extensive research, it is constantly driving the innovation and the application of that metal to different sectors.

- The major factors contributing to the market growth are: an increase in the consumption of metals in the infrastructure and industrial sectors, the use of renewable energy technologies that require critical minerals growing.

- The prospects for the industry are: betterments in eco-friendly mining technologies and Treating of metals.

- Major point: The value of the market is anticipated to increase rapidly over the next ten years, which will open up many new avenues for growth.

The milestone following the one with iron was the use of iron. The stronger tools made it possible for the people to go even deeper into the earth. The Geological Revolution, which lasted through the century beginning with the 19th, was the major event. The drills were steam engines, the underground safety was ventilation, and the large transferring of ore was by rail. The mining industry was taking its first steps into the modern world. Companies were operating in continents chasing for deposits that were superior in quality even in the most inaccessible places. The steelworks, power stations, and transport networks were all consuming metal and thus, high demand became the measuring criterion of industrial strength by the 1900s.

The late 20th century era brought satellites and digital mapping that allowed geologists to spot the deposits through the surface instead of blind digging. The global consumer market of electronic devices, communication, and cars set the demands of these industries in the direction where they would need to deal with metals like aluminum, copper, nickel, and others used for batteries, wiring, and aerospace parts in a more refined manner.

In recent years one of the factors behind the closure of some mines has been environmental regulations. Among the new mining practices are the installation of dust-control systems, water-recycling networks, and land-restoration programs. In the past, the industry was less concerned about communities and stakeholders but it has changed, and people want to know exactly where the metals come from and how the workers are treated. To streamline the entire mining process, the industry started considering the use of automation which included the invention of remote-operated trucks and the use of sensors that can determine ore quality in real time. The future of AI is that it will be deployed in predicting the failure of equipment and planning of safe drilling routes which in turn will enable companies to minimize waste and maximize yield.

The global mining metal market will keep on progressing towards the adoption of digital and ethical standards. From the earliest and simplest forms of digging, the future will be a completely connected network of intelligent mines. Society will need metals as it continues transitioning to renewable energy, electric vehicles, and data-heavy technologies.

Market Segments

The global mining metal market is mainly classified based on Type, End-use Industry.

By Type is further segmented into:

- Iron: Iron the production helps building construction and heavy equipment manufacturing. Transportation networks and large-scale infrastructure have strong demand that also creates market activity. Globally, the Mining and Metal market is showing a steady interest in iron because of its strength, durability, and the availability of large reserves. While steelmaking uses iron as its main input, iron also supports bridges, rail lines, and industrial facilities.

- Aluminum: Aluminum production results in the use of thinner structural designs and red hot material. Metals, especially aluminum, support packaging, transport parts, and power transmission hardware. Their low weight allows for less energy use in the movement of finished products. The recycling of aluminum uses much less energy compared to fresh production, which helps in cost reduction and at the same time supporting sustainable industrial planning.

- Manganese: Manganese contributes to the steel industry by the production of primary reinforcement elements. It raises the yield strength production of alloys, gives them higher hardness, and improves their resistance to wear. The trend of increasing construction spending and the focus on better road networks stimulate the demand for the metal. The presence of manganese ores in several locations worldwide enables the mining companies to use multiple sources and consequently minimize the risk of disruption in the supply chain. Manganese-based additives still hold their place in the steel industry as they do so by giving a performance boost to the steel.

- Chromium: Chromium supports stainless steel manufacturing. Resistance to corrosion encourages usage in food processing equipment, medical instruments, and household hardware. Chrome plating enhances surface protection for industrial machinery. High melting capability allows performance under heat exposure. Demand growth links with household modernization and factory installations requiring long-lasting protective coatings.

- Copper: Copper delivers strong thermal and electrical conduction. Wiring systems, power grids, and heavy machinery depend on copper for dependable current flow. Renewable energy projects require copper for wind turbines and solar equipment. The metal also supports plumbing, providing resistance against corrosion and long service duration. Recycling supports cost savings for manufacturers.

- Others: Other metallic materials include nickel, zinc, and lead. Specialty alloys require these materials for coating, plating, and battery applications. Usage expands within manufacturing, aerospace, and durable consumer products. Widespread application makes diverse metals valuable for both functional and aesthetic purposes. Market stability benefits from broad consumption across numerous industries.

By End-use Industry the market is divided into:

- Construction: Construction activities rely on metallic materials for structural strength in buildings, bridges, and transport networks. Steel beams, reinforced framing, roofing panels, and plumbing depend on metal supply. Growing urban expansion and modernization projects increase consumption. Higher investment in housing and commercial buildings sustains consistent material requirements across many regions.

- Automotive: Automotive production uses metals for engine blocks, frames, body panels, and safety systems. Lighter options such as aluminum help reduce fuel usage. Steel supports durability and crash protection. Electric vehicle development expands demand for copper and other conductive metals. Continuous design improvements encourage ongoing metal sourcing for manufacturing.

- Electrical and Electronics: Electrical networks and electronic device assembly require conductive metals for wiring, connectors, and circuit pathways. Copper and aluminum improve power flow and heat control. Electronics manufacturing uses small precision metal components in appliances, communication devices, and power systems. Long equipment lifespans support steady sourcing from metal producers.

- Consumer Goods: Daily-use products such as furniture hardware, kitchen tools, and devices with mechanical parts frequently include metal components. Metal strength supports durability and long service life. Stainless materials also support scratch resistance and hygienic surfaces. Consumer demand for long-lasting products encourages continued sourcing from suppliers of metallic materials.

- Others: Additional usage appears in packaging, machinery parts, and energy equipment. Industrial activities require metal for equipment frames, storage tanks, and mechanical supports. Diversified applications protect market stability, reducing dependence on a single industry. Wide applicability ensures ongoing demand growth across multiple production processes.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1174 Billlion |

|

Market Size by 2032 |

$1674.7 Billlion |

|

Growth Rate from 2025 to 2032 |

5.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

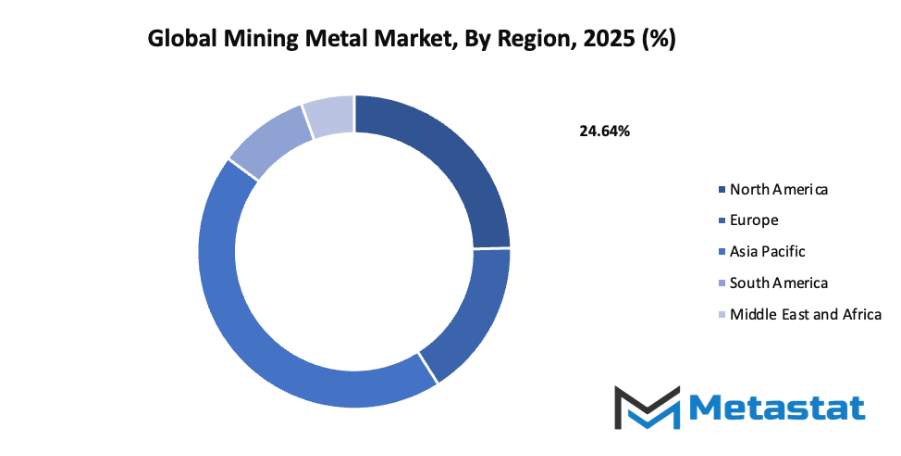

By Region:

- Based on geography, the global mining metal market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Growing demand for metals in infrastructure and industrial development:

Rising construction of bridges, transport systems, and commercial structures encourages higher consumption of steel, copper, and aluminum. Expanding manufacturing activity also requires steady metal supplies for machinery and equipment. Strong investment in housing and public facilities supports long-term demand, allowing the global mining metal market to maintain momentum and support economic progress.

Rising adoption of renewable energy technologies requiring critical minerals:

Solar panels, wind turbines, and energy storage solutions depend on copper, nickel, and other essential minerals. Faster installation of clean energy facilities increases mineral extraction activity, since each project calls for extensive metal use. Higher renewable energy targets from multiple countries create steady industrial demand, supporting continuous expansion for mining activities worldwide.

Challenges and Opportunities

Environmental concerns and stringent mining regulations:

Mining activity often faces stronger government rules to protect forests, rivers, and local communities. Higher environmental expectations raise operational costs and extend project approval timelines. Companies must meet strict standards regarding waste handling and land restoration, increasing pressure on mining operators while pushing the sector toward cleaner practices to maintain access to resource-rich regions.

Fluctuating metal prices impacting profitability and investment:

Unexpected price changes affect revenue and financial planning for mining companies. Unstable demand from construction and manufacturing sectors can limit budgeting confidence for exploration projects. Higher uncertainty may slow funding for new sites or equipment upgrades, leading to cautious decision-making and reduced willingness to commit resources during unpredictable market phases.

Opportunities

Advancements in sustainable mining technologies and recycling of metals:

Energy-efficient machinery, digital monitoring systems, and improved waste recovery methods support cleaner extraction activities. Enhanced recycling processes reduce pressure on natural reserves and lower production costs by reusing valuable materials. Greater adoption of eco-friendly techniques offers long-term growth potential, allowing mining companies to operate responsibly while meeting rising demand for industrial metals.

Competitive Landscape & Strategic Insights

The global mining metal market continues to demonstrate strong activity as demand for minerals and metals remains essential for industrial growth and infrastructure development. The industry is a mix of both international industry leaders and emerging regional competitors, creating a highly competitive environment. Leading corporations such as Barrick Gold Corporation, Freeport-McMoRan, Teck Resources Limited, Hudbay Minerals Inc., Anglo American, Alcoa Corporation, Antofagasta plc, BHP, Capstone Copper, Rio Tinto, Glencore, Codelco, Zijin Mining Group Co., Ltd., Norilsk Nickel, Vale, and Aurubis hold a significant share of global operations. Each company contributes unique strengths through innovation, resource management, and large-scale production capabilities.

The market continues to expand as new technologies improve exploration and extraction efficiency. Automation, data-driven operations, and sustainability initiatives play an important role in modern mining activities. Companies invest heavily in cleaner production processes and renewable energy integration to reduce environmental impact and align with international environmental standards. This approach not only enhances reputation but also improves long-term profitability by lowering operational costs and energy use.

Regional competitors continue to strengthen positions by focusing on cost efficiency, strategic partnerships, and access to local resources. Many developing regions with rich mineral reserves are attracting investments from both established global firms and smaller enterprises seeking growth opportunities. The rising demand for copper, nickel, aluminum, and other essential metals used in renewable energy technologies, construction, and electronics continues to drive market stability.

Market size is forecast to rise from USD 1174 billlion in 2025 to over USD 1674.7 billlion by 2032. Mining Metal will maintain dominance but face growing competition from emerging formats.

Fluctuating commodity prices, geopolitical tensions, and environmental regulations remain key challenges that shape industry direction. However, consistent innovation and responsible resource management help maintain global competitiveness. As industrialization increases across developing economies, mining metals will continue to play a central role in supporting growth and technological progress, ensuring the industry remains vital for global economic development.

Report Coverage

This research report categorizes the global mining metal market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global mining metal market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global mining metal market.

Mining Metal Market Key Segments:

By Type

- Iron

- Aluminum

- Manganese

- Chromium

- Copper

- Others

By End-use Industry

- Construction

- Automotive

- Electrical and Electronics

- Consumer Goods

- Others

Key Global Mining Metal Industry Players

- Barrick Gold Corporation

- Freeport-McMoRan

- Teck Resources Limited

- Hudbay Minerals Inc.

- Anglo American

- Alcoa Corporation

- Antofagasta plc

- BHP

- Capstone Copper

- Rio Tinto

- Glencore

- Codelco

- Zijin Mining Group Co., Ltd.

- Norilsk Nickel

- Vale

- Aurubis

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252