Global Polystyrene Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The polystyrene market and its related industries worldwide had their beginnings in the early 1900s when the first trials with styrene-based materials were done in laboratories and researchers were looking for lighter, moldable alternatives for metal and wood. The 1930s and 1940s were the decades when polystyrene went hand in hand with the move from an experimental material to a commercial product as the manufacturers found that it could be formed with heat and hold its shape once cooled. The post-war period was the time when the demand for the material rose dramatically as new factories launched large-scale production for packaging of food, insulation, appliances, and consumer goods. A laboratory experiment that was initially considered a drawback turned into a quality of life, symbolizing convenience perfectly while the world of mass production was expanding.

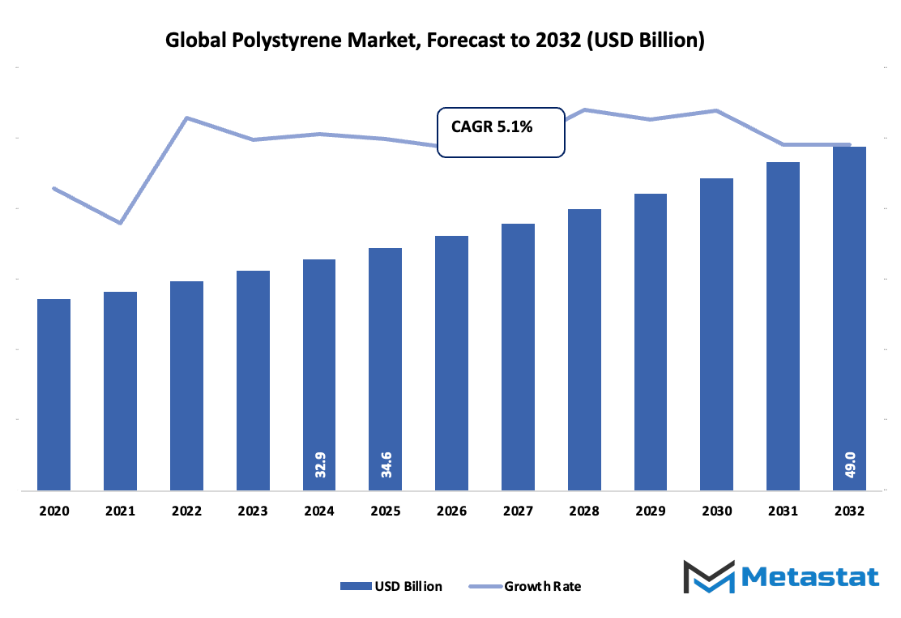

- The global polystyrene market is predicted to surpass a whopping USD 49 Billion by growing at a CAGR of around 5.1% through 2032 with a value of approximately USD 34.6 Billion in 2025.

- The general-purpose polystyrene (GPPS) is playing a leading role in the global polystyrene market with a share of almost 31.6%, and the continuous research in this area is driving innovations and more applications.

- Top factors responsible for growth include: The rampant demand from the packaging and construction sectors, Polystyrene products are cheap and versatile.

- Some other factors are: The introduction of recyclable and bio-based polystyrene substitutes for green applications.

- The market is sure to grow in value tremendously over the next ten years thus indicating the presence of considerable growth.

The momentum just kept increasing when the culture of disposability came into the picture during the mid-20th century. The fast-food industry turned to polystyrene extensively for cups and containers, and shipping companies made use of it to ensure fragile items were safe during transport. The protective foam packaging also got into consumer electronics, and portable household items around the world. The manufacturers eventually figured out, besides the use of additives and changes in processing conditions, the development of new textures and strengths that enabled the material to find its way into building insulation and falsework for automotive parts.

To the manufacturers' delight, consumer expectations were never constant and in the last twenty years, new consumer habits began to influence the market as the primary driver. Single-use materials started to be questioned, which led to the establishment of recycling and waste management regulations by governments. These developments did not mean the end of polystyrene; on the contrary, they provoked companies to try out new recycling systems, lighter formulas, and cleaner production methods. Digital modeling and sophisticated molding machines gave the manufacturers the ability to produce shapes with utmost precision thus reducing waste and energy consumption. Recent technological advancements are expected to lead to even more efficient methods for reuse such as chemical recycling processes that will reduce the material to its base substance for quality retention during remaking.

With the focus on sustainability, the companies of the global polystyrene market will have to rethink the whole process of material production, collection, and reuse. The revolution in synthetic materials has since then been entering a new phase that is characterized by accuracy and responsibility. The saga illustrates how an innovative thought considered in a laboratory turned into an industry that still adapt its practices according to people's demands and technological advancements.

Market Segments

The global polystyrene market is mainly classified based on Type, Form, End User.

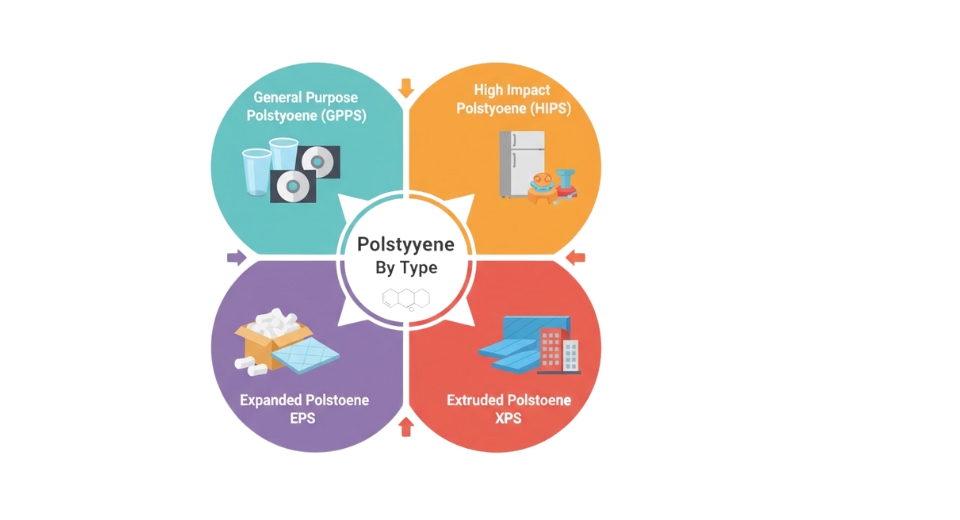

By Type is further segmented into:

- GPPS (General Purpose Polystyrene): GPPS is a type of polystyrene which is called general purpose and has the best transparency and smoothness among the plastics. The material can be used in the areas of display items, transparent packaging, and decorative products. Thus, the manufacturers can use flexible shaping and easy coloring to create intricate designs without having to undergo heavy processing. A stable structure ensures consistent results so that companies do not have to face excess manufacturing challenges to meet visual and functional needs.

- HIPS (High Impact Polystyrene): HIPS is a type of polystyrene known for its high impact resistance, toughness, and it being better than other types of hence, HIPS has great applications in protective packaging, appliance housings, and display making. The material retains its properties during the shaping process and does not lose its stability. By this reason, the manufacturers like this choice because it offers durable consumer goods that need impact resistance but without adding other difficulties in weight or production.

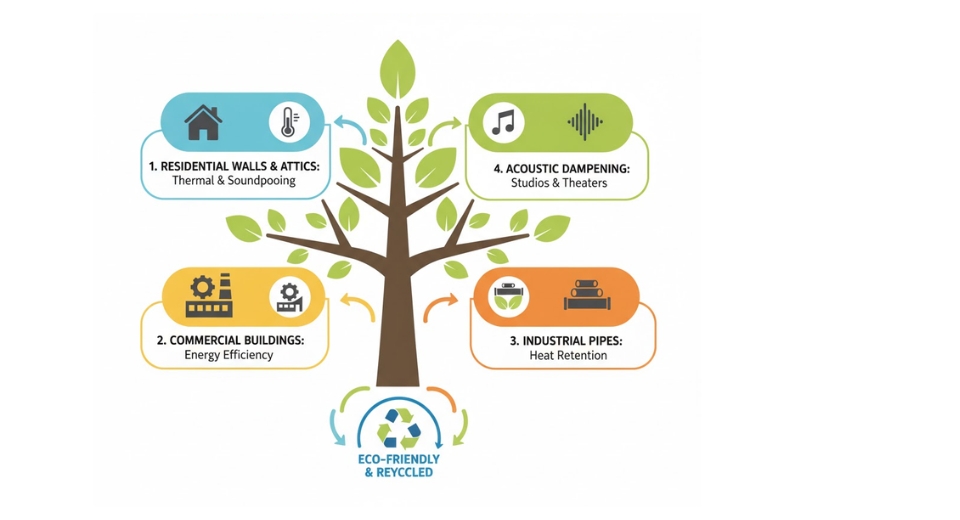

- EPS & XPS (Expanded Polystyrene & Extruded Polystyrene): The expanded and extruded forms of polystyrene hold back heat very efficiently and practically moisture absorption is non-existent. The construction activities and protective packaging are the two main areas of application of this lightweight material. The energy efficiency is so good that it supports the builders to practice cost-saving building. The material's capability of being easily shaped and cut provides fast installation in the case of construction projects, ensuring that the performance is the same across insulation boards and protective packaging blocks.

- Others: Other types include specialized blends for unique manufacturing purposes. These materials usually focus on special performance features such as greater heat tolerance, enhanced structural balance, or improved chemical resistance. This range offers freedom for experimentation, supporting design needs beyond the standard performance of commonly used polystyrene categories.

By Form the market is divided into:

- Foams: Foam has a support role in insulation, cushioning, and protection. The project of the building entirely relies on foam for temperature-controlled areas. The shock resistance property of foam during shipping is highly appreciated in the packaging industry. The ease of shaping and light weight assist in the production processes while minimizing material use, yet providing the same level of support and structural stability throughout the production cycles.

- Films and Sheets: Films and sheets provide transparency and adaptability. The thinness of the material means that it provides a smooth surface that is ideal for labeling, covering, and packaging. The very high quality of printing meets the needs of branding. The dependable forming ability encourages the manufacturers to make containers, trays, and sealed coverings without additional processing materials, which in turn promotes the efficient production within the different environments of the industry.

- Others: The other forms are custom shapes like molded parts and technical components. These have the characteristics of putting the detailed functional needs in niche sectors. The special designs help with stability, fitting for assembly, and durability. The manufacturing teams opt for these selections when the specific geometry or design accuracy becomes essential for performance and function.

By End User the market is further divided into:

- Automotive: The automotive industry has a high regard for strong but light components. Polystyrene aids in the material used for interiors, instrument clusters, and other parts. The lessened total weight leads to better fuel consumption. A uniform shaping enables engineers to keep the size accuracy without making many adjustments, which in turn helps to keep the production schedules and reduce the manufacturing cost in the long run.

- Packaging: The packaging industry finds the qualities of protection and lightness to be very important. The material is used for food containers, trays, and custom protective inserts for shipping. The cushioning that is very effective helps to avoid the damage of the product during the move. The clear grading allows easy viewing of the packaged goods, thus increasing the product presentation and reducing the waste created from damaged shipments.

- Building and Construction: Polystyrene is a major material for insulation boards and structural filler supporting in construction projects. The combination of low moisture absorption and strong thermal resistance helps cut down energy loss in buildings. The cutting and forming are very reliable, thus allowing flexible use during installation. The long-lasting performance is an assurance for both commercial and residential structural needs.

- Electrical and Electronics: Electronic manufacturers make use of polystyrene in the production of housings, internal support parts, and protective packaging. Maintaining dimensional consistency makes it possible to perfectly secure delicate components. The use of reliable insulating performance cuts down electrical transfer, which in turn supports safer device design. The material helps manufacturers to find the right spot between durability, shaping convenience, and cost-effective production.

- Consumer Goods: Consumer goods use polystyrene for storage containers, toys, and decorative household items. The material accepts colours and patterns easily. Smooth surfaces create visually pleasing designs. Resilient structure helps maintain product shape during regular use. This combination of aesthetic flexibility and dependable performance keeps polystyrene appealing in retail product categories.

- Healthcare: Healthcare facilities rely on polystyrene for sterile packaging and lightweight medical lab items. The material allows precise molding and stable structure under controlled environments. Clear visibility helps users observe contents easily. Single-use applications support high hygiene standards, aiding safe handling and disposal.

- Others: Other users include educational supplies, craft sectors, and custom industrial applications. This group benefits from the wide shaping range and cost efficiency. Creative designers and industrial engineers choose polystyrene where light weight, dependable strength, and easy forming produce favourable results across unique projects.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$34.6 Billion |

|

Market Size by 2032 |

$49 Billion |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

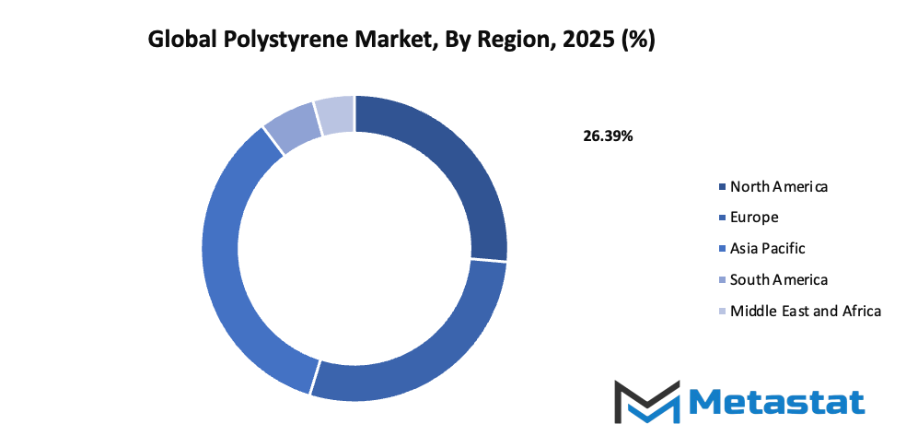

- Based on geography, the global polystyrene market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- High demand in packaging and construction industries:

Strong demand for polystyrene in packaging and construction drives steady expansion of the global polystyrene market. Polystyrene supports secure product protection during transport and helps builders create sturdy insulation for walls and roofs. Growing online shopping and rapid urban growth push factories to produce larger volumes of polystyrene products worldwide. - Cost-effectiveness and versatility of polystyrene products:

Polystyrene offers low production expense and flexible use across numerous sectors. Manufacturers gain reliable results with simple molding processes and quick turnaround. The material accepts various shapes and finishes, allowing broad adaptation for trays, insulation boards, and disposable containers, while maintaining consistent performance during storage, delivery, and final use daily.

Challenges and Opportunities

- Environmental concerns due to non-biodegradability:

Non-biodegradable polystyrene remains in landfills and waterways for long periods, creating waste management pressure. Disposal challenges encourage recycling campaigns and cleaner design. Public awareness regarding pollution encourages firms to research safer materials and reduce uncontrolled dumping of discarded packaging and foam materials in natural surroundings, causing broad environmental concern worldwide. - Regulatory restrictions on single-use plastic products:

Many governments introduce strict rules limiting single-use plastic items, including polystyrene containers, cups, and cutlery. Such rules motivate producers to change manufacturing plans, adopt cleaner systems, and explore safer inputs. Enforcement increases operational costs and forces businesses to review product lines to align with sustainability goals and public expectations worldwide.

Opportunities

- Development of recyclable and bio-based polystyrene alternatives for sustainable applications:

Research teams and manufacturers work toward greener polystyrene solutions using recycled content or bio-based feedstock. Cleaner versions promise lower waste generation and reduced landfill burden. Investment in advanced material science supports improved durability and safer end-of-life handling, encouraging responsible growth across packaging, construction, and consumer goods sectors worldwide sustainable progress.

Competitive Landscape & Strategic Insights

The global polystyrene market shows a wide spread of company scale and strategy. Major corporations with long histories stand alongside newer regional participants. Each organization brings a different approach to production, innovation, and market expansion. INEOS Styrolution Group GmbH, TotalEnergies, BASF SE, Formosa Chemicals & Fibre Corporation, Kumho Petrochemicals Ltd., SABIC, Trinseo, Videolar-Innova S/A, Alpek S.A.B. de C.V., CHIMEI, LG Chem, SIBUR, HIRSCH Servo AG, ACH Foam Technologies, Inc., Chi Mei Corporation, Flint Hills Resources, Dow, Kaneka Corp., NOVA Chemicals, and Ravago Americas LLC represent some of the most influential names across the world. These companies guide pricing, product design, and quality standards. A strong focus on research encourages better performance and improved sustainability.

Growth across this sector reflects steady demand from packaging, construction, consumer goods, and insulation. Production centers adjust according to regional needs, helping reduce transportation costs and lead times. Strong supply networks support consistent delivery, allowing manufacturers to respond to unexpected shifts in customer demand. Market influence comes from scale, technical skill, and raw material access. Larger producers invest in new methods to reduce waste and support recycling. This approach raises brand value and strengthens long-term relationships with customers and partners.

Competition encourages continuous improvement. Some organizations emphasize advanced materials for high-performance packaging. Others work on expanding cost-efficient manufacturing to reach more regions. This difference in strategy creates a dynamic environment that encourages new technology, lower costs, and better products. The presence of both established producers and ambitious emerging players supports healthy balance and prevents overwhelming control by one major group.

Market size is forecast to rise from USD 34.6 Billion in 2025 to over USD 49 Billion by 2032. Polystyrene will maintain dominance but face growing competition from emerging formats.

The future direction of this sector depends on customer preference for sustainable and recyclable materials. Regulations that support responsible production also guide decision-making and investment. A strong market with many active participants encourages progress. Continuous efforts in technology, recycling programs, and energy management support a promising outlook for global production and use of polystyrene.

Report Coverage

This research report categorizes the global polystyrene market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global polystyrene market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global polystyrene market.

Polystyrene Market Key Segments:

By Type

- General Purpose Polystyrene (GPPS)

- High Impact Polystyrene (HIPS)

- Expanded Polystyrene (EPS) & Extruded Polystyrene (XPS)

- Others

By Form

- Foams

- Films and Sheets

- Others

By End User

- Automotive

- Packaging

- Building and Construction

- Electrical and Electronics

- Consumer Goods

- Healthcare

- Others

Key Global Polystyrene Industry Players

- INEOS Styrolution Group GmbH

- TotalEnergies

- BASF SE

- Formosa Chemicals & Fibre Corporation

- Kumho Petrochemicals Ltd.

- SABIC

- Trinseo

- Videolar-Innova S/A

- Alpek S.A.B. de C.V.

- CHIMEI

- LG Chem

- SIBUR

- HIRSCH Servo AG

- ACH Foam Technologies, Inc.

- Chi Mei Corporation

- Flint Hills Resources

- Dow

- Kaneka Corp.

- NOVA Chemicals

- Ravago Americas LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252