MARKET OVERVIEW

The global merchant banking services market is a powerful sector of the financial sector that will shape the investments and strategic alliances of tomorrow's economic landscape. It will remain a crossing platform between capital raisers and investors, providing sophisticated financial solutions to companies that want to grow, innovate, and diversify. Unlike conventional banking institutions, merchant banking will specialize in the development of tailor-made financial plans, which will make it a pivotal driving force in making mergers, acquisitions, and capital growth over the long term possible.

Over the next few years, this market is likely to change under the pressure of fast-paced globalization and incessant efforts for corporate growth. Organizations will not just look for funding but also advice that aids complex financial deals. Merchant bankers will lead the way in these trends, with expertise in deal structuring, risk management, and cross-border transactions. The role of such services will grow as companies make their way through uncertain economic environments and competitive markets, needing end-to-end solutions rather than independent products.

Technology will be a principal driving force for change in this industry. Advanced analytics and artificial intelligence will transform how merchant banking services function, adding accuracy to risk assessment and making decision-making processes more efficient. Blockchain can even lend an assisting hand by means of permitting transparency in mass economic transactions, making service provider banking more efficient and secure. This convergence of monetary acumen with the modern-day generation will permit the sector to deliver smarter, quicker, and more reliable services, eventually reworking customer expectancies and marketplace standards.

The enterprise panorama inside the future can also be characterized via greater recognition on sustainability. As environmental and social governance (ESG) ideas grow to be extra influential, merchant banks will customize techniques to be well suited with responsible funding practices. Companies in need of funding will realize that compatibility with such principles will become a requirement for gaining access to high-value funding. As a result, the merchant banking role will extend beyond mere advisory and simple financing; it will become a model that accommodates ethical and forward-looking business models.

In addition, the need for global growth will tempt businesses to pursue emerging markets, and merchant banking will be the strategic ally facilitating this expansion. By making cross-border mergers and acquisitions possible and offering expertise in varied regulatory regimes, merchant bankers will enable businesses to capture global opportunities with low risks. This strategy will make the industry a keystone of corporate globalization for the next decade.

Essentially, the global merchant banking services market will not just be an intermediary financier; it will evolve into a strategic catalyst of economic change. Its destiny will be characterized by technological embedding, environmentally conscious practices, and the capacity to provide customized solutions in a more interconnected world.

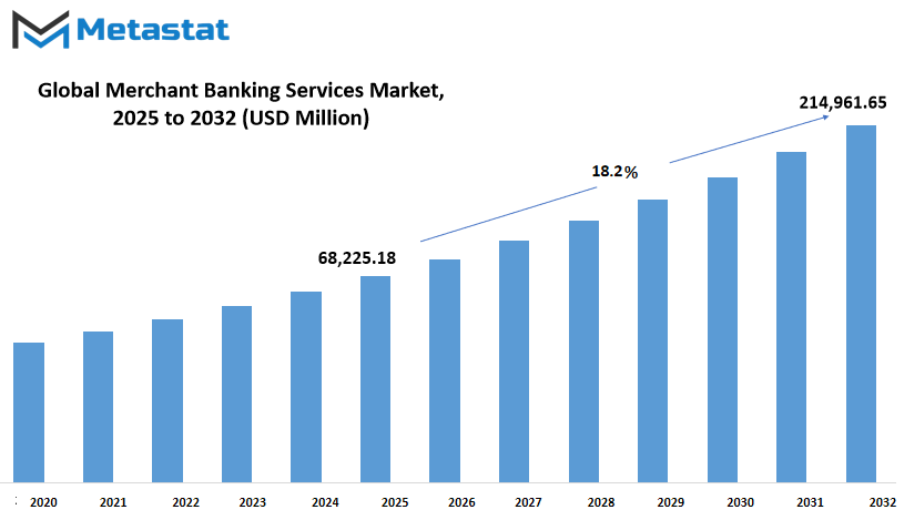

Global merchant banking services market is estimated to reach $214,961.65 Million by 2032; growing at a CAGR of 18.2% from 2025 to 2032.

GROWTH FACTORS

The global merchant banking services market is coming into focus as companies from all industries seek professional guidance in addressing intricate financial requirements. Enterprises these days want to increase, diversify, and beautify monetary fitness, and this has hugely boosted the want for advisory offerings and capital-elevating merchandise. Merchant banks are playing an essential role in assisting corporations with strategic investment planning, coping with massive-ticket transactions, and presenting access to funding for expansion. This call for expert financial specialists is no longer restrained to multinational agencies; even medium-sized organizations are looking for them to remain competitive in developing tougher surroundings.

One of the important drivers of the global merchant banking services market is the increasing call for company advisory services and capital-elevating help. Organizations regularly are looking for recommendation on strategic partnerships, mergers, and acquisitions, which name for a high level of knowledge approximately market traits, valuation, and threat management. Moreover, the growing extent of mergers and acquisitions globally has spurred the desire for excessive-stage monetary understanding that service provider banks are uniquely located to deliver. Such banks no longer only assist shape offers but offer recommendations to reduce chance and maximize price to companies engaged in such deals.

Even with the boom ability, the global merchant banking services market is challenged by using elements which can avert its progress. International regulatory requirements frequently pose barriers to seamless operations, and compliance remains a consistent difficulty of subject for service provider banks. These rules help keep the money system stable and guard against malpractice but raise operating costs and complexity. Another challenge is that intense competition from incumbent investment banks puts a cap on the market share for merchant banking services. Global networks of big investment banks tend to attract large clients, leaving small merchant banks struggling to differentiate their products.

Meanwhile, digitalization is opening up stimulating opportunities for the sector. The implementation of cutting-edge technology in banking services is revolutionizing the manner in which merchant banks provide their solutions. From online portals that simplify transactions to advisory tools based on data, technology is assisting banks in becoming more efficient and client-centric. The move towards digital solutions will enable merchant banks to service their clients quicker and more efficiently, thereby competing more effectively with traditional banks. As companies continue to adopt technology, merchant banks that respond in a rapid manner will gain from these developments and establish a more prominent role in the future years.

MARKET SEGMENTATION

By Service Provider

The global merchant banking services market is witnessing sustained growth as companies look for financial solutions that increase beyond conventional lending. Merchant banking offerings offer them an aggregate of advisory and investment assistance, enabling them to manipulate capital, get right of entry to budget, and execute mergers or acquisitions. Merchant banks are increasingly more becoming a reliable option for firms that require tailored financial solutions to stay competitive in a tough financial panorama. This marketplace has gained hobby as it caters to the requirements of businesses with needs for greater than mere credit score traces, supplying specialized offerings that solidify their monetary foundations and drive growth.

One of the most significant parts of the global merchant banking services market is the service provider segment, classified under banks and non-banking institutions. Banks continue to lead with a sizeable share, with services worth $39,843.53 million. These organizations have deep expertise and global networks, which make them good partners to do business with in order to gain access to mass-scale financing or strategic guidance. Their capacity for offering combined solutions, ranging from funding to advisory, makes them favorites among large businesses and companies that appreciate credibility and long-term relationships. Banks similarly enjoy robust regulatory environments, which provide confidence among clients seeking stability.

Non-bank institutions are also becoming significant in merchant banking services. They serve organizations looking for bendy and innovative solutions that might not be supplied by traditional banks as simply. These gamers tend to concentrate on areas of interest products, like non-public equity, challenge capital, and dependent financing, for rising agencies and startups. Their capability to move faster and embody new financial models locations them in a higher function in markets in which velocity and versatility are most crucial. As they do no longer but rival banks' market percentage, their function as a facilitator of various commercial enterprise requirements will most effective make bigger.

Overall, the global merchant banking services market will continue to grow as corporations search for economic companions who can supply knowledge and strategic advice over mere lending. Banks and non-banking institutions could have critical roles to play, with banks keeping their management position and non-banking establishments expanding their portion through that specialize in upstart companies and providing area of interest offerings. With this stability, the marketplace will continue to be dynamic and capable of respond to converting business needs in various sectors.

By Services

The global merchant banking services market will preserve to play a essential function in assisting companies with financial solutions that meet their evolving needs. These offerings cater to organizations searching for professional help in coping with capital, enhancing enterprise systems, and having access to funding opportunities. Merchant banking acts as a bridge among groups and monetary markets, imparting strategic advice and solutions that permit agencies to develop and remain competitive. With corporations continuously searching out methods to bolster their monetary positions, the demand for those services is anticipated to rise gradually in the coming years.

One of the vital areas within this marketplace is portfolio management. This carrier makes a speciality of coping with investments effectively to reap the first-class viable returns while decreasing risks. Businesses and excessive-net-really worth people regularly depend upon portfolio control to align their financial desires with marketplace opportunities. Merchant banks provide understanding in asset allocation, investment making plans, and chance evaluation, ensuring that clients’ sources are optimized. As international markets come to be greater dynamic and companies look for stable yet worthwhile investment avenues, portfolio management will remain a preferred choice for plenty.

Business restructuring is any other main issue of merchant banking services. Companies regularly face challenges consisting of declining income, debt problems, or operational inefficiencies. In such cases, restructuring facilitates in reshaping the company’s monetary and operational framework to restore stability and profitability. Merchant banks assist organizations by way of advising on mergers, acquisitions, debt reorganization, and other strategies that may fortify their role. This service is mainly valuable throughout uncertain economic situations whilst organizations need expert guidance to navigate via financial problems.

Credit syndication is also a significant a part of the service provider banking region. It entails arranging huge loans for groups via pooling resources from multiple lenders. This is especially useful for businesses assigning massive projects that require significant funding. Merchant banks act as intermediaries, negotiating phrases, assessing credit score risks, and ensuring clean coordination amongst lenders. The technique no longer only helps businesses steady the necessary capital however also distributes the risk among diverse monetary institutions, making it a realistic solution for large-price ticket investment requirements.

Apart from those, other offerings supplied in this marketplace include advisory for mission financing, issue management, and personal equity placements. These offerings aim to assist agencies in exceptional levels of growth via providing custom designed solutions. As businesses increase and new ventures emerge across sectors, the call for specialized economic services will most effective growth. Merchant banking, through its diverse services, will continue to be a key enabler for groups aiming for sustainable growth in a aggressive environment.

By End-User

The global merchant banking services market is transforming the manner of managing financial transactions and investments in contemporary economies. Such services provide tailored solutions which might be geared in the direction of meeting the requirements of groups and people, facilitating seamless access to capital, advisory services, and strategic advice. With global alternate and monetary activities growing, service provider banking has grow to be greater large for entities looking for professional steerage on managing investments and monetary making plans. The industry has seen a developing want for specialists who are capable of provide custom designed guidance and help customers in negotiating tricky financial situations without problems.

For companies, merchant banking centers serve as an critical aid gadget. Businesses tend to are seeking finance for boom, mergers and acquisitions, and managing mega-projects. Merchant banks provide information in fund-raising, project finance, and investment recommendation that without delay influences business increase. These offerings permit businesses to gain the funds they require and minimize risks the use of professional evaluation and based financial plans. As competition grows, businesses prefer to deal with institutions that appreciate their specific needs and have the ability to provide solutions that bring long-term stability.

At the same time, individuals also contribute significantly to the demand for merchant banking services. High-net-worth investors, entrepreneurs, and businesspeople tend to seek the advice of experts when it comes to managing their wealth. Whether it is portfolio management, tax planning, or investment planning, these services assist them in protecting and increasing their assets. The customized solution provided by merchant banks ensures that clients get strategies that fit their financial objectives. This section keeps expanding with more people seeking professional advice to make educated choices in an uncertain market scenario.

The future of the global merchant banking services market will include developments in technology and greater digital adoption to suit the needs of businesses as well as individuals. Online platforms and automated technology are likely to make these services more efficient and accessible while still preserving the personal aspect that clients appreciate. As globalization and new investment opportunities set in, the market will continue to be a key part of the financial sector as a link between growth and capital for any kind of client.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$68,225.18 million |

|

Market Size by 2032 |

$214,961.65 Million |

|

Growth Rate from 2025 to 2032 |

18.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

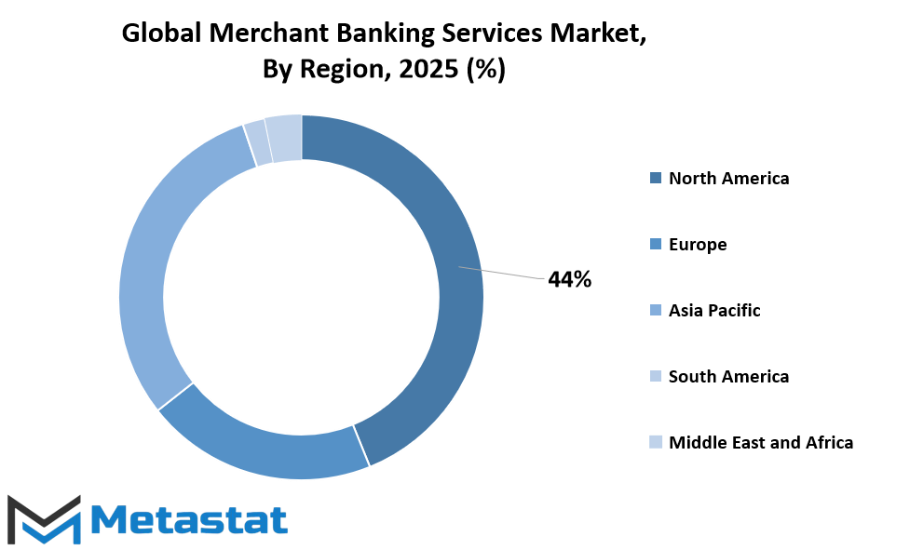

The global merchant banking services market is experiencing immense interest from various regions, each contributing in its own way to its expansion. North America has been one of the key markets, backed by a robust financial setup and sophisticated investment culture. The presence of key financial centers such as the U.S. and Canada is crucial in fuelling this expansion. Mexico is also increasingly embracing merchant banking solutions as companies look for more effective financial advisory and structured financing alternatives for expansion.

In Europe, the UK, Germany, France, and Italy are among the countries that are at the forefront of enhancing the merchant banking sector. The UK, being a center of world finance, also exerts a significant impact on the growth of banking services, with Germany and France also displaying perennial demand emanating from industrial and corporate financing requirements. Cross-border investments in the region further drive the market, with the Rest of Europe also displaying slow but sure take-up of merchant banking services to finance economic undertakings and business expansion.

Asia-Pacific is another significant region experiencing growth in merchant banking services. India, China, Japan, and South Korea are experiencing growing demand with the growth of businesses, foreign investments, and developing start-up ecosystems. India and China, with their huge economies and business-oriented policies, are welcoming global merchant banks to offer advice and fund-raising services. The Rest of Asia-Pacific is also catching up as countries are investing in industry and infrastructure, and this gives a huge demand for structured financial products.

South America and Middle East & Africa are growth regions with huge potential in the merchant banking services industry. Brazil and Argentina dominate the South American marketplace as agencies hunt for based financing products to finance change and increase. In the Middle East & Africa, the GCC nations, Egypt, and South Africa are the maximum distinguished regions in which service provider banking is gaining momentum, supported by financial diversification techniques and the emergence of new industries. The Rest of these regions is similarly shifting closer to imposing sophisticated financial services to address increasing business necessities, placing the stage for long-time period prospects in the global merchant banking services market.

COMPETITIVE PLAYERS

The global merchant banking services market is positioning itself as a critical segment of the financial sector, facilitating businesses by way of advisory services, raising capital, and strategic investment solutions. This industry is crucial in enabling companies to grow, restructure, and obtain funds for expansions or acquisitions. The need for merchant banking services has increased due to businesses encountering the necessity of professional financial counsel in order to stay competitive and profitable in ever-changing economic situations. The services tend to concentrate on extended business relations with clients, guaranteeing personalized solutions that address unique business objectives while dealing with intricate financial structures.

Many different companies work in this field, and all bring their experience and international presence. Major banks like Bank of America Corporation, Barclays PLC, Citigroup Inc., and UBS Group AG have established solid reputations to provide solid merchant banking solutions in various regions. Likewise, Deutsche Bank AG, HSBC Holdings plc, and JPMorgan Chase & Co. have been in a commanding position in this market with their huge resources and extensive financial acumen to help businesses of every scale. Other well-established players such as Goldman Sachs Group, Inc., Morgan Stanley, and LAZARD are well known for their advisory mandates in mergers and acquisitions, and corporate restructuring.

Besides these industry leaders, boutique firms such as Bryant Park Capital and U.S. Capital Advisors LLC offer specialized expertise in niche segments, providing customized services tailored to mid-market companies. Firms like BERENBERG and NIBL Ace Capital Limited further diversify the market, such that enterprises are able to find both global and local solutions. The Royal Bank of Canada Website and DBS Bank Ltd. further enhance the competitiveness, demonstrating how merchant bank services are now a global requirement and not based on regions only.

As companies keep looking for new ways to handle risks and maximize growth, merchant banking firms will continue to be part of corporate strategies. Their capacity to integrate financial advisory, capital management, and investment solutions within a one-stop-shop setup is a powerful value proposition to clients. With the increasing complexity of global trade and finance, these entities are likely to play an increasingly significant role in helping companies navigate through volatile economic times. This increasing dependence on merchant banking services indicates consistent growth in the market, fueled by trust, knowledge, and the necessity for financial toughness in a more competitive business climate.

Merchant Banking Services Market Key Segments:

By Service Provider

- Banks

- Non-Banking Institutions

By Services

- Portfolio Management

- Business Restructuring

- Credit Syndication

- Others

By End-User

- Businesses

- Individuals

Key Global Merchant Banking Services Industry Players

- Bank of America Corporation

- Barclays PLC

- BERENBERG

- Bryant Park Capital

- Citigroup Inc.

- UBS Group AG

- DBS Bank Ltd.

- Deutsche Bank AG

- Goldman Sachs Group, Inc.

- HSBC Holdings plc

- JPMorgan Chase & Co.

- LAZARD

- Morgan Stanley

- NIBL Ace Capital Limited

- Royal Bank of Canada Website

- U.S. Capital Advisors LLC

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252