MARKET OVERVIEW

The global lithium ion battery cathode material market will be a special segment in the advanced materials and energy storage industry. It will be a crucial component in the lithium-ion battery, allowing for applications from consumer goods, through electric vehicles to large-scale energy systems. With growing needs for efficient and sustainable power sources, demand for cathode material with tailored chemical and performance characteristics will continue to be a key technical and industrial necessity. The global lithium ion battery cathode material market will focus on the delivery of specialized materials intended to serve as the positive electrode of lithium-ion cells.

These materials will dictate crucial performance attributes such as energy density, life, rate of charging, and thermal stability,. Standard chemistries like lithium nickel manganese cobalt oxide, lithium iron phosphate, and lithium cobalt oxide will predominate production scenes, but other formulations could emerge as activities to decrease reliance on critical minerals increase. The market will not only serve mass-scale manufacturing but also the upgrade of material quality, consistency, and safety levels to suit changing end-user requirements. Scope of the global lithium ion battery cathode material market will extend from upstream raw material sourcing and processing to downstream integration in cell manufacturing and system assembly. Players of this value chain will include chemical producers, mines, battery producers, and even auto and electronics firms which will be integrating vertically to ensure supply chains.

Regulatory frameworks, supply of raw material, and regional-level technological capability will determine involvement, with the topography diverse as well as strategically fractured. What will mark this market is its dependence on advanced material science as well as precise engineering. Every composition of the cathode will require careful formulation in order to mix cost, performance, and environmental impact. Whereas the inherent chemical structure will define electrochemical characteristics, particle size, surface treatments, and synthesis method will dictate the final product's performance in a battery cell.

This will necessitate constant technical assessment, materials development, and increased cooperation between research laboratories and commercial manufacturing facilities. The global lithium ion battery cathode material market will also be marked by groundbreaking collaboration between the public and private sectors, especially in nations with battery self-sufficiency and green environmentalism as priorities. Government initiative-driven efforts are expected to encourage domestic battery material production in terms of subsidies, policy integration, and infrastructure creation. Such activity will shape future patterns of production and trade, and some regions will create themselves as processing sites or centers of technology.

In addition, this market will also involve recycling and reprocessing of spent batteries' cathode materials, which will grow in significance as retired cell volumes increase. Manufacturers have to redesign their production models in order to include circular systems, closing material loops and maximizing resource use. This will impact design paradigms as much as supply chain sourcing strategies and environmental regulations. Overall, the global lithium ion battery cathode material market will become a central driver of next-generation energy systems, with technical depth, competitive scale, and strategic significance in every industrial sector. The establishment of this market will establish new paradigms for energy materials thinking, production, and recycling, worldwide.

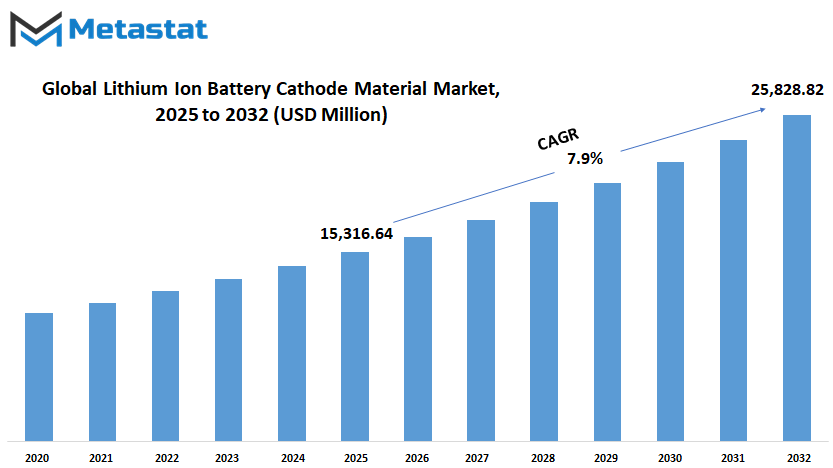

Global lithium ion battery cathode material market is estimated to reach $25,828.82 Million by 2032; growing at a CAGR of 7.9% from 2025 to 2032.

GROWTH FACTORS

The global lithium ion battery cathode material market is moving through a significant period of change as new technologies and growing industries continue to shape its path. A major driver of this shift is the rising need for electric vehicles and advanced energy storage systems. As more countries and companies focus on cleaner energy solutions, the demand for lithium ion batteries is expected to rise steadily. These batteries are known for their reliability and efficiency, making them essential in both personal and industrial use. Electric vehicles, in particular, have become more than just a trend. They are now seen as a necessary step toward reducing carbon emissions, which in turn pushes the need for better battery components like cathode materials.

Another important factor that will influence this market is the progress being made in battery technologies. Engineers and researchers are working hard to create batteries that can charge faster and hold more power for longer periods. This is especially important for consumers who expect their electric vehicles and electronic devices to function well without frequent charging. Such improvements will not only meet consumer expectations but also increase the attractiveness of switching from fuel-based engines to battery-powered options. With better performance and charging speed, lithium ion batteries will likely see even broader adoption.

However, there are still challenges that could slow down this growth. One of the most pressing issues is the unstable pricing and limited supply of key raw materials such as cobalt and lithium. These materials are essential for making cathodes, yet they are not always easy to obtain. In some areas, political and trade conditions make access unpredictable. On top of that, the way these materials are mined often raises both environmental and ethical concerns. Mining practices have been criticized for damaging ecosystems and for involving poor labor conditions, which puts pressure on companies to find cleaner and more responsible sources.

Despite these hurdles, the future holds promise. A great deal of effort is being put into finding alternative materials that are both effective and environmentally friendly. One of the most exciting developments is the potential to create cobalt-free cathode materials. These innovations could lessen the strain on existing resources and offer a more sustainable path forward. If these new materials prove successful, they could open up fresh opportunities for growth in the global lithium ion battery cathode material market.

MARKET SEGMENTATION

By Material Type

The global lithium ion battery cathode material market is expected to play a huge role in shaping the future of technology and energy solutions. As industries move toward cleaner alternatives and sustainable power sources, the demand for better battery materials will grow steadily. One of the main components of these batteries is the cathode, and its development will determine how efficient, safe, and long-lasting future batteries will be. With more electric vehicles being used and renewable energy being stored, the quality of the materials used in the cathode becomes even more important.

The global lithium ion battery cathode material market, by material type, includes various substances that will continue to drive innovation. Cobalt is known for improving battery life and energy density, but due to supply limitations and cost, other options are gaining attention. Lithium iron phosphate offers stability and safety, which makes it a strong choice for large-scale use, especially where long-term reliability is key. Manganese is seen as a more affordable alternative that still supports good performance, while nickel cobalt manganese blends are designed to balance cost, lifespan, and capacity. Phosphate materials provide strong thermal stability, which is important for safety in high-heat environments. Other materials are also being tested, as researchers search for the right combination that meets the increasing demands of modern power systems.

Looking ahead, the growth of this market will likely be shaped by the need for cleaner transportation and better energy storage. As more devices rely on batteries, including homes and industries powered by solar and wind energy, the focus will shift to finding materials that offer more power, charge faster, and last longer without raising costs too much. Companies will look for new blends of materials that not only perform well but are also easier to source and recycle. This shift will help reduce pressure on limited resources like cobalt and help make battery production more sustainable.

Governments, researchers, and manufacturers are already working together to support better production methods and encourage the use of alternative materials. These efforts will influence how the global lithium ion battery cathode material market moves forward. With constant testing and improvement, future batteries may rely on combinations that are not yet widely used today. The market will continue to grow as part of the larger global move toward cleaner energy and smarter technology.

By Application

The global lithium ion battery cathode material market will continue to grow steadily as demand for energy storage solutions becomes more widespread across several industries. One of the main driving forces behind this progress is how useful and flexible lithium-ion batteries are, especially when it comes to powering a range of tools and devices. As industries look for better and more reliable power sources, this market is set to expand into areas that will influence how people live, work, and connect in the future.

Looking closely at its uses, power tools will remain a strong area where lithium-ion battery materials are in demand. The ability to offer longer battery life and faster charging makes these batteries the top choice for professionals and everyday users alike. As power tools become more advanced, their dependence on strong, long-lasting batteries will only increase. This change not only improves work efficiency but also makes battery-powered tools more appealing than traditional ones that rely on cords or gas.

Consumer electronics, another key area, will also push the global lithium ion battery cathode material market forward. Phones, tablets, laptops, and wearable devices are all built around battery life. With more people depending on these tools daily, the pressure to improve battery performance will grow. In the future, the aim won’t just be about longer battery life, but also about making batteries that are lighter, faster to charge, and safer. All of this adds to the market's continued rise and growing importance.

Medical equipment is another area where growth will continue. Devices that monitor health, deliver treatment, or support patients during emergencies will need batteries that are both reliable and strong. As healthcare becomes more mobile and personalized, lithium-ion batteries will help power solutions that save lives and make treatment easier. This growing need will play a major role in shaping the market's future.

Other uses, which can range from small devices to larger energy systems, will also play a part. These areas may not stand out now, but they will gain more attention as battery technology spreads across more sectors. As new tools and machines appear that rely on stored energy, the global lithium ion battery cathode material market will have more chances to grow and support progress across all kinds of industries.

By End-Use

The global lithium ion battery cathode material market is expected to experience growth across several areas, shaped by changing demands and continuous improvements in technology. Looking ahead, it is clear that this market will keep developing as industries look for better and more efficient power sources. Among the major users of lithium-ion battery cathode materials are sectors such as electrical and electronics, energy, automotive, medical, and others. Each of these areas will likely continue to influence how the market expands, as they push for longer-lasting and more reliable batteries to support their products and services.

In the electrical and electronics space, there is a growing need for compact devices that can function for longer hours without frequent charging. People expect phones, laptops, and other portable devices to be lighter, faster, and more durable. This pushes the need for advanced battery materials, including improved cathode components that offer better performance without increasing weight or size. As electronics get smarter and more integrated into everyday life, the demand for improved battery material will continue to rise.

The energy sector is also seeing changes that will have a strong impact. More companies are looking for safer, cleaner ways to store energy, especially those tied to solar and wind power. These systems depend on batteries that can hold energy for longer periods and recharge many times without losing efficiency. This means new types of cathode materials will be needed that offer stability and high storage capacity. The need for cleaner energy will keep encouraging research and investment in better battery components.

The automotive sector stands out as one of the key users. As more people switch to electric vehicles, car makers will depend heavily on lithium-ion batteries. These batteries need to support longer travel distances and faster charging times. This puts pressure on manufacturers to come up with new solutions in cathode material that can meet those expectations. Future developments will likely focus on combining energy density with safety and cost-effectiveness.

In medical settings, reliable battery power is crucial for equipment that supports health monitoring and life-saving tools. These devices often need consistent performance in small sizes, which makes improved battery material very important. Other industries, including those involved in tools, backup systems, and mobile machinery, will also benefit from better cathode materials.

The global lithium ion battery cathode material market will continue to adapt as user needs change and new ideas emerge, helping shape a future built on stronger and more efficient energy solutions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$15,316.64 million |

|

Market Size by 2032 |

$25,828.82 Million |

|

Growth Rate from 2025 to 2032 |

7.9% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

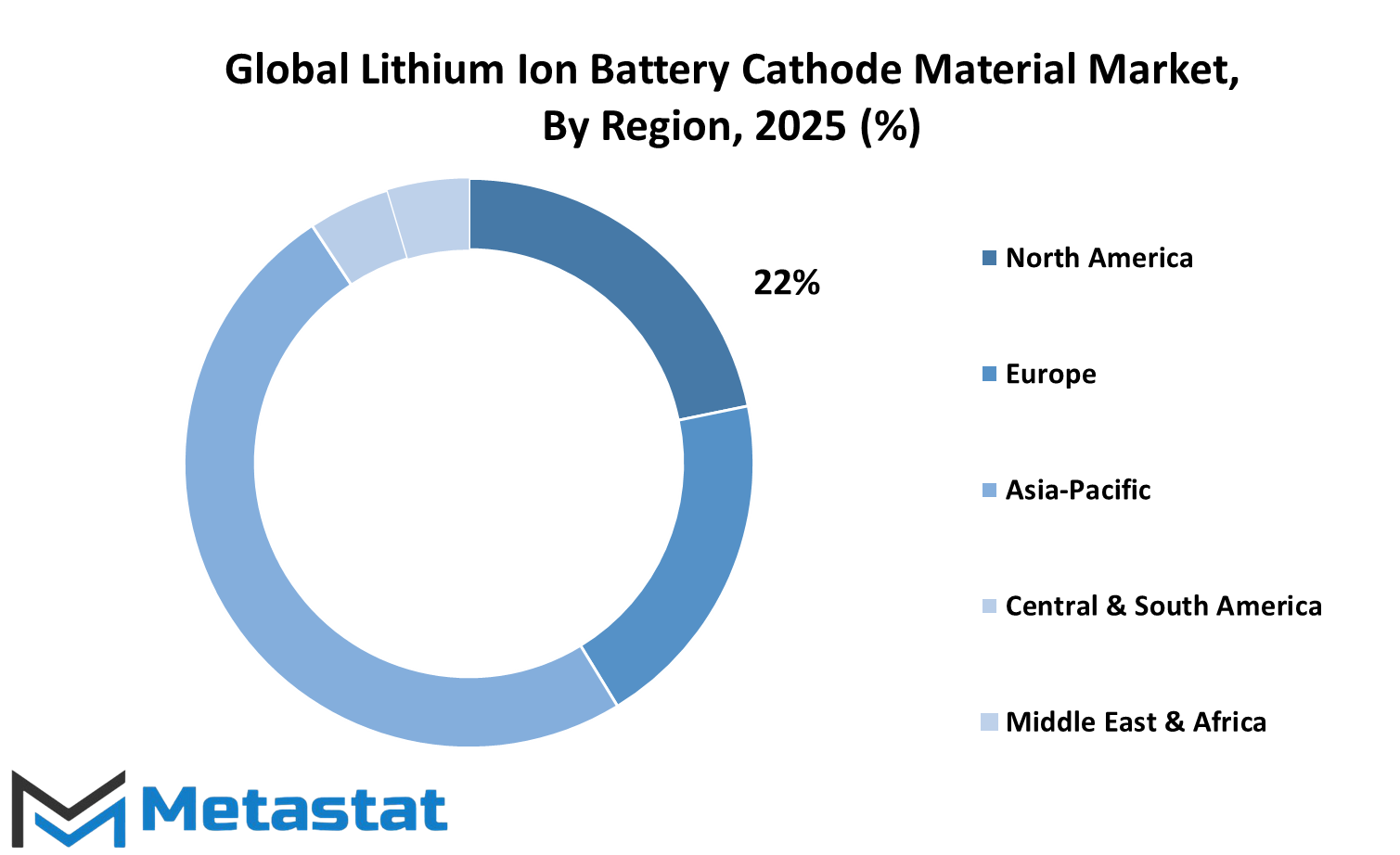

The global lithium ion battery cathode material market is shaped by regional differences that reflect varying levels of industrial growth, government support, and consumer demand for advanced energy storage solutions. Each part of the world brings its own set of strengths and challenges, contributing to a dynamic and competitive landscape. North America, which includes the U.S., Canada, and Mexico, has seen growing support for clean energy technologies. With electric vehicles gaining more traction and companies investing in battery manufacturing, this region is expected to play an important role in supporting innovation and scaling production. Strong infrastructure and research capabilities will likely help North America remain a key player as the global lithium ion battery cathode material market moves forward.

Europe, with countries such as the UK, Germany, France, and Italy, has shown a clear commitment to reducing carbon emissions and encouraging sustainable practices. Government policies and funding programs have helped create a strong base for battery development. As demand for electric vehicles and renewable energy storage increases, Europe will continue to improve its local supply chains to reduce dependence on imports. The region’s focus on environmental responsibility and high production standards will make it an influential market for new technologies and long-term investments.

In Asia-Pacific, countries like China, Japan, South Korea, and India are at the center of global battery production. This region benefits from well-established manufacturing networks and access to key raw materials. China, in particular, leads the way with large-scale production facilities and steady investments in research. As more nations in this area increase their energy needs, there will likely be more local projects focused on meeting domestic demand while also serving global markets. The future of the global lithium ion battery cathode material market will likely be shaped strongly by the rapid pace of industrial growth and technological progress seen here.

South America, including Brazil and Argentina, is gradually building its presence in the market. While growth is slower compared to other regions, the potential is clear. As awareness of clean energy expands, local governments and businesses will likely focus on building capacity and exploring partnerships to support development.

In the Middle East and Africa, including countries such as Egypt, South Africa, and the GCC nations, interest in battery materials is increasing. These areas are starting to invest in modern infrastructure and exploring opportunities to join global supply chains. Over time, growing demand and the desire to diversify economies may push these regions to become more active in the future of the global lithium ion battery cathode material market.

COMPETITIVE PLAYERS

The global lithium ion battery cathode material market is expected to play an important role in shaping the future of clean energy and battery-powered technologies. As demand grows for electric vehicles, portable electronics, and renewable energy storage, the need for better battery materials will only increase. The companies leading this shift are making bold moves to secure their place in the market, each bringing its own strengths and strategies to the table. These players are not just reacting to current demand but are planning for what will come next as battery technology moves forward and global energy needs continue to grow.

The competition among these manufacturers is becoming more intense as innovation and long-term planning take center stage. Umicore is one such company that is focusing on creating more efficient and environmentally friendly materials. BASF SE is also investing heavily in research and development to keep up with industry changes, while LG Chem remains a strong force with its proven history of performance in the battery sector. Hitachi Chemical Co., Ltd. is putting effort into improving product safety and lifespan, which are major concerns for both consumers and manufacturers. All of these moves show how focused these companies are on staying ahead and being ready for what will come.

In the coming years, this market will likely see even more investment in sustainable production methods. Targray Technology International Inc. and Xiamen Tungsten Co., Ltd. are already exploring ways to reduce their environmental impact while improving the quality of their materials. Nichia Corporation and Posco Chemical are also positioning themselves to serve the growing demand for reliable and efficient energy solutions. As the world slowly shifts away from fossil fuels, battery performance and life span will be more important than ever.

The efforts of BTR New Energy Material Ltd., Beijing Easpring Material Technology Co., Ltd., and JFE Chemical Corporation are also worth noting. These companies are focusing on steady supply and material purity, both of which are critical in meeting global expectations. What makes this market especially dynamic is that no one company can dominate it alone. Collaboration, strategic partnerships, and consistent innovation will guide its future path.

The global lithium ion battery cathode material market will not just reflect changes in battery production it will help shape how the world stores and uses energy. As leading companies push forward, they will likely set the tone for global energy storage solutions in the years to come.

Lithium Ion Battery Cathode Material Market Key Segments:

By Material Type

- Cobalt

- Lithium Iron Phosphate

- Manganese

- Nickel Cobalt Manganese

- Phosphate

- Others

By Application

- Power Tools

- Consumer Electronics

- Medical Equipment

- Others

By End-Use

- Electrical & Electronics

- Energy

- Automotive

- Medical

- Others

Key Global Lithium Ion Battery Cathode Material Industry Players

- Umicore

- BASF SE

- LG Chem

- Hitachi Chemical Co., Ltd.

- Targray Technology International Inc.

- Xiamen Tungsten Co., Ltd.

- Nichia Corporation

- Posco Chemical

- BTR New Energy Material Ltd.

- Beijing Easpring Material Technology Co., Ltd.

- JFE Chemical Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383