Global OTSG for Thermal Enhanced Oil Recovery Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

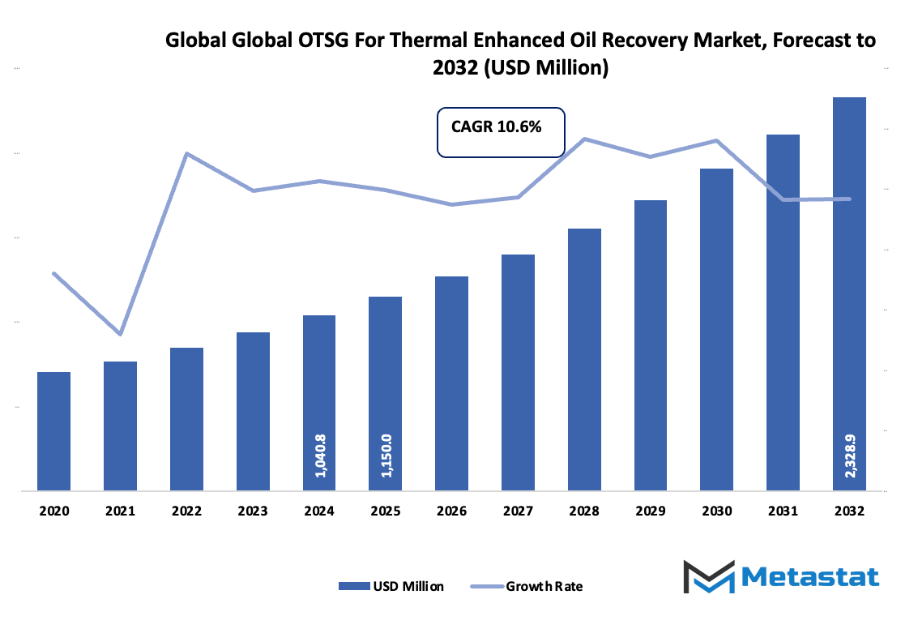

- The global OTSG for thermal enhanced oil recovery market valued at approximately USD 1150 million in 2025, growing at a CAGR of around 10.6% through 2032, with potential to exceed USD 2328.9 million.

- Horizontal account for a market share of 59.5% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising global production of heavy oil and oil sands requiring steam-based recovery methods., Increasing capital investment in thermal EOR projects in Canada, Middle East and Asia.

- Opportunities include: Growing adoption of cogeneration, waste-heat recovery and advanced OTSG technologies for lower-carbon steam provision.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

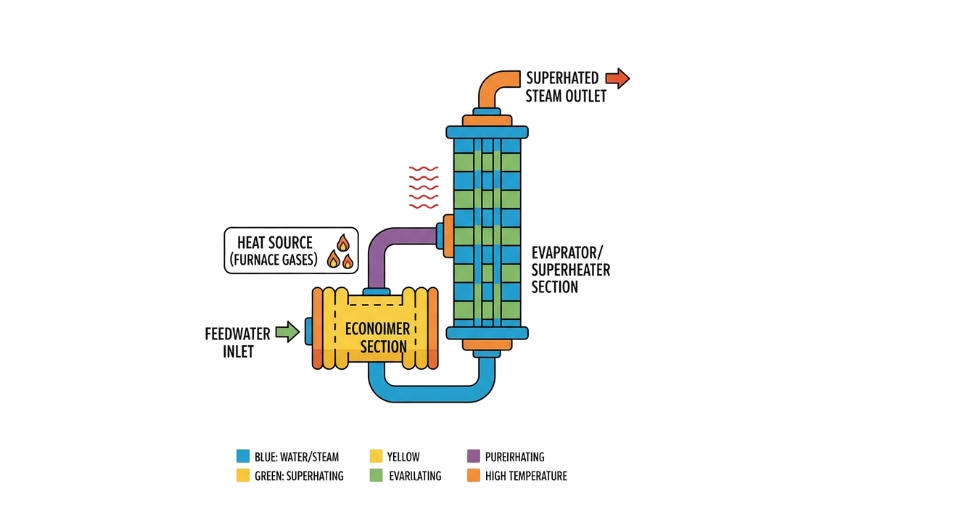

The global OTSG for thermal enhanced oil recovery market was formed from a continuous industrial effort that aimed to expand heavy-oil extraction beyond the boundaries of the traditional equipment available at that time. This created an industry that was a mixture of engineering progress, regulatory pressure, and field-tested innovation. The beginnings of the story go back several decades when the use of steam-assisted recovery in Canada and the U.S. showed that conventional boilers could not keep up with the high-temperature, continuous, and high-volume output required in remote oilfields. Engineers started using once-through steam generators maybe as early as the late 1960s but the first systems were large, burning up a lot of fuel, and often getting scaling in them. Their disadvantages facilitated a gradual re-routing of the technology that would lead to eventually changing the whole thermal recovery operations.

In the late 1980s momentum built up when the U.S. Department of Energy and other government agencies disclosed field performance data indicating that steam flooding could boost heavy-oil output in California fields by more than 300,000 barrels per day. Developers were also making the OTSG units more efficient, less compatible with water treatment, and with lower nitrogen oxide emissions. By the mids of 2000s, environmental regulations in North America were demanding stricter emission controls which resulted in manufacturers having to redesign burners and heat-exchange surfaces. These changes not only marked the technology's transition from a basic steam-making solution to the creation of a specialized tool built for continuous thermal reliability.

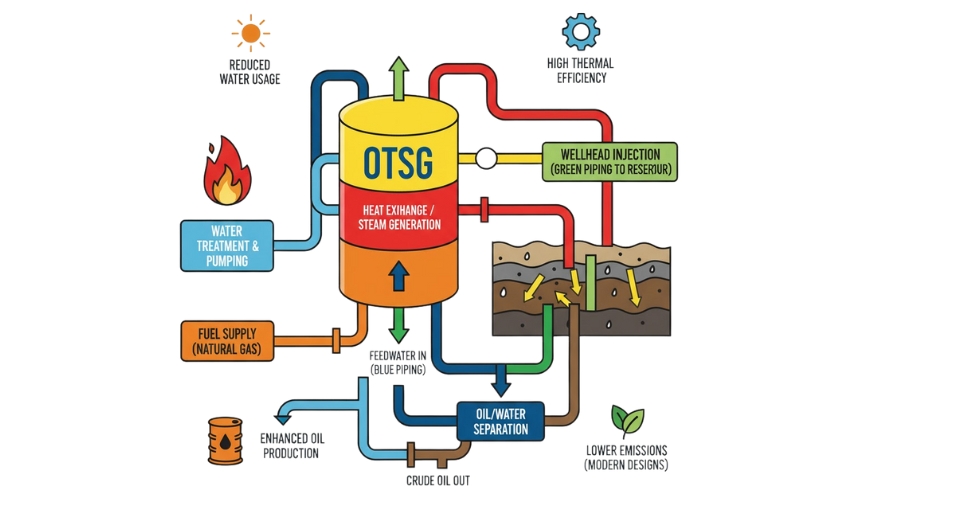

Operators will face a demand for changing the market, and they will do so by balancing the use of water, emissions, and the flexibility of the fuel they use. According to Natural Resources Canada, SAGD projects in Alberta had an average steam-oil ratio of approximately 3.2, which in turn made producers to adopt the technology that would ensure a more even output with less power consumption. This situation in operations was the main factor that pushed the gas/oil steam ratio towards the installation of more advanced OTSGs that could manage recycled produced water and cope with high total dissolved solids, thereby decreasing the amount of fresh water that is strictly monitored by the regulators.

The market is now relying on a base that was created by changes over the years. Consumers, the main ones being upstream operators, will demand systems that allow for digital monitoring, moving quickly between well pads, and waste-heat recovery. The heavy-oil-producing areas in Asia, South America, and the Middle East will continue assessing their long-term production strategies, and the industry will then be able to utilize the equipment that offers a compromise between thermal performance and environmental responsibility thus keeping the gradual transformation that has been characteristic since the first field trials.

Market Segmentation Analysis

The global OTSG for thermal enhanced oil recovery market is mainly classified based on Type, Capacity.

By Type is further segmented into:

- Horizontal: The OTSG For Thermal Enhanced Oil Recovery market's global horizontal units guarantee constant steam generation for heavy-oil fields by facilitating the distribution of heat over the entire large project area. The layout not only helps to stabilize the production, but it also reduces the downtime to a minimum and, thus, enables the thermal output of the entire production zone to be utilized efficiently and economically.

- Vertical: The vertical units are designed for a compact structure with a limitation on the land availability which is usually the case in the places where they get installed. This design controls the steam output and temperature management, allowing different operators to maintain their heating requirements during the extraction process and at the same time eliminating the problems related to space and facilitating the placement of the units in tightly controlled project locations.

By Capacity the market is divided into:

- Up to 60 MW: The levels of capacity that reach up to 60 MW can support small to medium extraction areas that demand trustworthy steam generation and at the same time have a low fuel consumption. This range helps project planners to keep their installation costs reasonable, and the thermal supply steady and also to have various options on the location of the fields which are focusing on gradual production increases and resource-efficient long-term use.

- 60-100: The range of 60-100 MW is suitable for medium-scale operations needing very strong thermal stability for the extraction stages that are the most demanding. This capacity allows the creation of a deeper heating area, the consumption of fuel in a balanced way, and the maintenance of output at high levels, so project sites can control their production targets with even more consistency, and at the same time, they can keep their operational planning structured and adaptable to different field conditions.

- Above 100 MW: The capacity that exceeds 100 MW is great for the big projects of extraction that require high output, super reliable performance for a long time, and distributed heat transfer over a wider area. This range allows for intensive production goals, steaming at higher volumes, and stronger operational durability, which in turn helps the giant fields to continue their extraction efforts even in tough conditions with very few interruptions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1150 Million |

|

Market Size by 2032 |

$2328.9 Million |

|

Growth Rate from 2025 to 2032 |

10.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

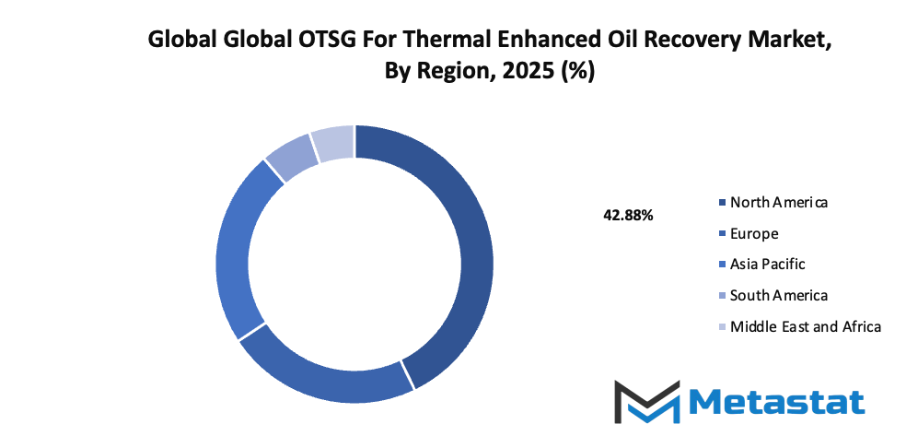

By Region:

- Based on geography, the global OTSG for thermal enhanced oil recovery market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Rising global production of heavy oil and oil sands requiring steam-based recovery methods:

Rising development of heavy oil fields and oil sands has created stronger dependence on steam-based recovery, expanding focus on the global OTSG for thermal enhanced oil recovery market. Growing need for stable steam output, reliable heat transfer and higher operational continuity supports wider adoption across major producing regions without disrupting overall project planning.

Increasing capital investment in thermal EOR projects in Canada, Middle East and Asia:

Greater financial commitment toward thermal EOR activity in Canada, Middle East and Asia has strengthened demand for modern steam systems, supporting growth in the global OTSG for thermal enhanced oil recovery market. Steady expansion of large-scale projects encourages upgrades, long-term contracting and broader deployment of high-performance generators across major oil-producing zones.

Restraints & Challenges:

High operating costs, water usage and emissions associated with steam generation:

High costs linked with fuel consumption, water treatment and steam handling slow wider adoption of thermal EOR systems within the global OTSG for thermal enhanced oil recovery market. Rising pressure to lower emissions and reduce waste streams increases operational strain, encouraging developers to reassess system design, maintenance planning and long-term efficiency expectations.

Stringent environmental regulations and carbon footprint concerns in steam-EOR operations.:

Tighter regulatory measures focused on emissions, water discharge and land impact have created hurdles for growth in the global OTSG for thermal enhanced oil recovery market. Stronger scrutiny on energy use and steam production has increased compliance demands, prompting operators to adjust technology choices while supporting balanced expansion in related industries such as the Global Drug-Eluting Stents Market.

Opportunities:

Growing adoption of cogeneration, waste-heat recovery and advanced OTSG technologies for lower-carbon steam provision:

Rising acceptance of cogeneration systems, waste-heat recovery and next-generation OTSG designs offers a path toward cleaner steam supply, improving growth prospects for the global OTSG for thermal enhanced oil recovery market. Enhanced efficiency, reduced fuel burn and stronger carbon-management benefits encourage broader integration across developing fields while supporting long-term operational stability.

Competitive Landscape & Strategic Insights

A diverse mix of global leaders and rising regional groups continues to shape competition within the global OTSG for thermal enhanced oil recovery market. Each organization brings a distinct history, technical approach, and strategic focus, creating steady movement in product design, operational methods, and service quality. Established companies often set technical standards through proven equipment and long-standing project experience. At the same time, growing regional groups introduce adaptable solutions that answer local conditions and budget needs, adding steady pressure on larger firms to refine technology and expand support systems.

Propak Systems Ltd, TIW Western Inc, Nooter/Eriksen, Inc., Struthers Wells (Babcock Power Inc.), EN-FAB, Inc., Thermax Limited, Nakasawa Resources, TIW Steel Platework Inc, Amiran Petro Asia International Company, G.C. Broach Company, BIH (British Industrial Heaters Ltd), BadrEOR, and Premier Energy, Inc. represent key names mentioned across industry discussions. Each organization adds a separate layer of value, whether through engineering knowledge, manufacturing strength, or solutions designed for demanding thermal processes. Equipment reliability, heat transfer efficiency, and field support remain central factors guiding the position of each competitor. As projects in heavy oil regions expand, demand for dependable once-through steam generators continues to encourage both established and developing companies to strengthen research efforts and service networks.

Growing interest in long-term operational stability also encourages companies to apply new fabrication methods and material improvements. Stronger construction practices, better monitoring systems, and consistent safety planning support ongoing adoption of advanced steam generation equipment. Regional conditions further influence competitive behaviour, with project scale, environmental rules, and resource availability shaping the types of systems offered to operators. Continuous refinement from both global leaders and emerging groups supports a balanced and active environment, allowing a wide range of technical choices for heavy oil development efforts. This blend of experience, innovation, and regional insight keeps the global OTSG for thermal enhanced oil recovery market moving forward while maintaining steady focus on efficiency and project reliability.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1150 million in 2025 to over USD 2328.9 million by 2032. OTSG For Thermal Enhanced Oil Recovery will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global OTSG for thermal enhanced oil recovery market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global OTSG for thermal enhanced oil recovery market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global OTSG for thermal enhanced oil recovery market.

OTSG For Thermal Enhanced Oil Recovery Market Key Segments:

By Type

- Horizontal

- Vertical

By Capacity

- Up to 60 MW

- 60-100

- Above 100 MW

Key Global OTSG For Thermal Enhanced Oil Recovery Industry Players

- Propak Systems Ltd

- TIW Western Inc

- Nooter/Eriksen, Inc.

- Struthers Wells (Babcock Power Inc.)

- EN-FAB, Inc.

- Thermax Limited

- Nakasawa Resources

- TIW Steel Platework Inc

- Amiran Petro Asia International Company

- G.C. Broach Company

- BIH (British Industrial Heaters Ltd)

- BadrEOR

- Premier Energy, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252