MARKET OVERVIEW

The Global Automotive Transmission market will constitute a significant share of the automobile industry, concentrating on the systems that transfer power from an automobile’s engine to its wheels. These systems play a crucial role in determining the performance, fuel efficiency, and overall driving experience of a vehicle. With further progress in automotive technology, the global automotive transmission market will have to adapt to emerging new materials and engineering methods combined with digital integration to fulfill requirements from regulations as well as demand from customers.

There will be diversification of automotive transmission systems into manual, automatic, semi-automatic, and continuously variable transmissions (CVTs). All these types will cater to different needs in the markets-from cost-effective manual ones that are highly popular in specific markets to high-end automatic ones that are used in luxury and high-performance vehicles. Hybrids and electric vehicle transmissions will start to gain a better share in this market as sustainable transportation picks up around the globe.

The Global Automotive Transmission market will not be limited to conventional combustion engines. With the trend in the automotive industry toward electrification, the technology of transmissions is going to undergo a massive shift. EVs usually need fewer gears than the conventional ones; however, improvements in multi-speed transmissions for EVs are expected to provide new opportunities within this market. Innovations are likely to target increased efficiency, improved driving range, and vehicle performance, particularly in high-performance electric models.

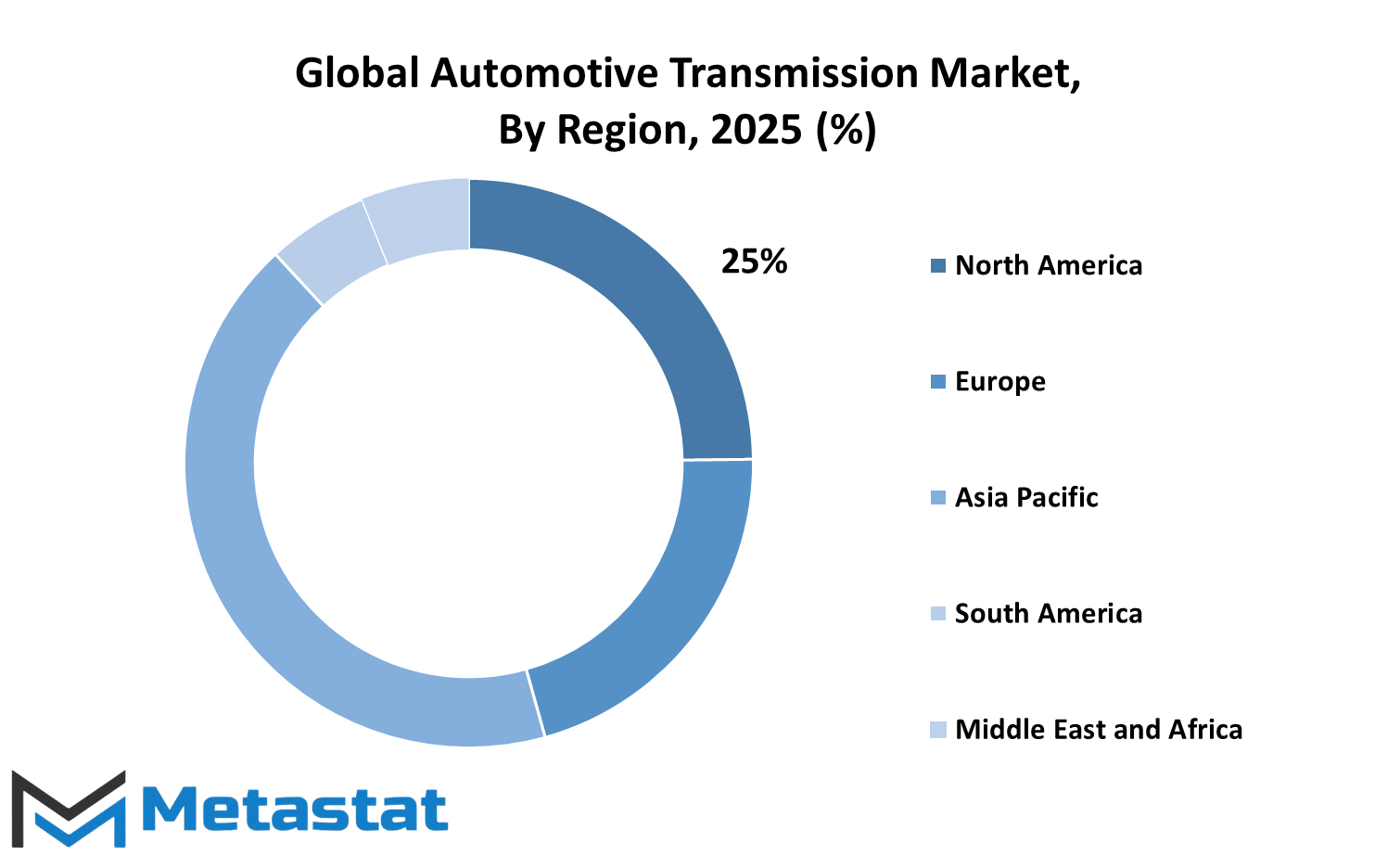

The Global Automotive Transmission market will expand geographically into key regions like North America, Europe, Asia-Pacific, and emerging markets in Latin America and Africa. Asia-Pacific will be a leading player because of its strong infrastructure in automotive manufacturing with countries like China, Japan, and South Korea. Europe will place more importance on emissions reductions as well as widespread adoption of electric mobility in the future. There will be higher innovation in types of transmissions to be used for both old and new technologies. North America will, however be stable in demand; big vehicles like trucks, SUVs will continue to require heavy-duty and efficient transmission systems.

The scope of the Global Automotive Transmission market will go beyond the production and sale of new transmission systems. Aftermarket services, including maintenance, repair, and replacement parts, will continue to play a critical role in this market’s overall structure. As vehicles remain in use for longer periods due to advancements in durability and technology, the demand for transmission servicing and component replacement will stay robust.

Technological advancement will further redefine the Global Automotive Transmission market. Integration of electronic control units (ECUs) in transmission systems will allow for smarter, more adaptive gear shifting and improve fuel efficiency and driving dynamics. The inclusion of software and data analytics will also provide predictive maintenance capabilities to manufacturers and service providers, who can monitor the health of transmission systems remotely and in real time.

The regulatory environment is also a crucial factor to influence the Global Automotive Transmission market of the future. Worldwide governments would still enforce new stringent fuel efficiency and emissions regulations. This could shape the structure of transmission designs as well as its functionality, further compelling producers to innovate while staying within defined limits of automotive performance.

The Global Automotive Transmission market will remain dynamic and integral to the automotive industry. As it continues to grow through changes in electrification, digital integration, and regional demands, it will continue to broaden both its traditional and emerging technologies scopes. In this sense, this continuous change will ensure that the Global Automotive Transmission market remains integral to the evolving landscape of global mobility.

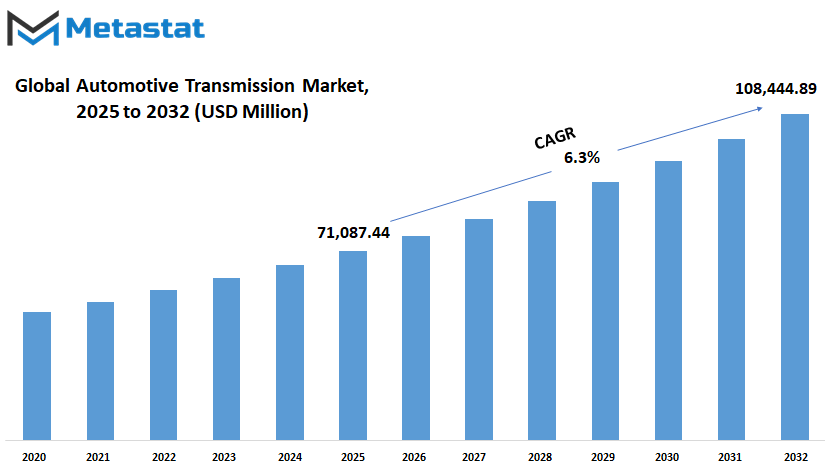

Global Automotive Transmission market is estimated to reach $108,444.89 Million by 2032; growing at a CAGR of 6.3% from 2025 to 2032.

GROWTH FACTORS

The Global Automotive Transmission market will continue to show tremendous growth over the years and will be ruled by trends established by the future of the automobile industry. Some of the significant factors driving this market are the increasing need for fuel-efficient vehicles. As the concern for the environment increases and the governments of various countries increase their emission regulations, car manufacturers are focusing on making more advanced transmission systems for their vehicles to reduce carbon emissions and improve fuel efficiency.

The increasing popularity of automatic and continuously variable transmissions (CVTs) is because they optimize engine performance and help in achieving better fuel economy. This shift is encouraging manufacturers to invest in innovative transmission technologies.

The other important factor that contributes to the growth of the Global Automotive Transmission market is the growing popularity of electric vehicles and hybrid cars. While EVs generally have less complex transmission systems than traditional internal combustion engine vehicles, the demand for specialized components and efficient power management systems is on the rise. Hybrid vehicles, which combine electric and gasoline engines, require advanced transmission systems to switch between power sources smoothly. As the EV and hybrid market grows, so will the demand for transmissions that meet the specific needs of these vehicles.

Technological advancement, however also plays a major role in making the market grow. The evolution of DCTs, AMTs, and some other more advanced systems resulted in the improvement of driving experience by allowing for even smoother gear shifts and enhanced control over the vehicle. Innovations improve performance, but also reduce fuel consumption. With artificial intelligence and smart technologies integrated into transmission systems, predictive maintenance is possible and vehicles can adapt to driving conditions much better, which makes them more reliable and efficient.

The Global Automotive Transmission market is further augmented by the expansion of the automotive industry in emerging markets. Vehicle manufacturing and sales in countries like China and India in Asia are experiencing growth due to increasing incomes and urbanization. The more the people in those regions buy cars, the greater the demand for advanced transmission systems. Global supply chains and alliances between car makers and technology companies are also spurring innovation and making cutting-edge transmission technologies available.

The Global Automotive Transmission market will see tremendous growth based on various factors such as demand for fuel-efficient vehicles, growth of electric and hybrid cars, technological innovation, and an ever-expanding automotive industry in emerging markets. All these will form the direction for the future of the market and will lead to continuous development in order to satisfy the ever-changing needs of both consumers and manufacturers.

MARKET SEGMENTATION

By Transmission Type

The Global Automotive Transmission market is expected to face drastic changes over the coming years due to growing technological advancement and changing consumer needs. Transmission systems are critical elements in the way vehicles operate. They have direct impacts on aspects such as fuel efficiency and driving comfort. The market is split based on transmission types: manual transmission, automatic transmission, Continuously Variable Transmission (CVT), Dual Clutch Transmission (DCT), and Semi Automatic Transmission, with each of which having different merits and demerits.

Manual transmissions are history, and most drivers no longer seek them, especially in countries where convenience is the primary concern. Still, they are still in demand for the enthusiasts who crave more control over their vehicle, or those that appreciate the simplicity of the mechanism and lower costs of maintenance. Demand may be stable in specific markets where the global market will not experience a resurgence.

Automatic Transmissions have been the most preferred choice in the market for most drivers because of their simplicity in use and the latest advancements in performance efficiency. Future automatic systems would likely be more intelligent with advanced software and adaptive control, resulting in improved driving efficiency and energy usage. The hybrid and electric cars are gradually influencing how automatic transmissions would eventually be designed since OEMs try to experiment and explore ways of adapting to an electric powertrain.

CVTs do provide a good, smooth acceleration without traditional gear shifts and therefore are often preferred for small cars and hybrid variants. They have an optimal operating engine speed which ensures that better fuel economy can be achieved. In the near future, this technology would perhaps improve in durability and performance in order to beat the present restrictions and thus it could gain appeal for wider variety of vehicles.

Dual-Clutch Transmissions; DCT combines the efficiency of a manual transmission with the convenience of an automatic. Fast and seamless gear changes make DCT systems popular among performance and luxury vehicles. In the near future, manufacturers are likely to refine the reliability and cost-effectiveness of such systems, thus spreading their acceptance beyond cars at the high end of the price scale.

Semi-automatic transmissions, which combine the best of manual control with automated functions, are also likely to be developed further, especially as driver-assist technologies advance. These systems can offer a middle ground for those who want control and convenience.

The Global Automotive Transmission market, therefore, will evolve with advancing automotive technology, environmental regulations, and shifting consumer preferences. It is such alterations that the transmission systems would continue to change and play an important role in the future of transportation.

By Vehicle Type

Global Automotive Transmission market is poised for significant upheavals, as rapid technological development and changing consumer demands propel it forward. As the trend continues, there will be a growing need for more efficient, reliable, and environment-friendly transmission systems to meet the needs of more constructive consumers. The market is also dominated by the need for decreasing carbon emissions and fuel efficiency while implementing technological changes that could reduce their 'modern time driving requirements'.

By type of vehicle, the Global Automotive Transmission market is classified into Passenger Cars, Light Commercial Vehicles (LCVs), Heavy Commercial Vehicles (HCVs), Electric Vehicles (EVs), and Hybrid Vehicles. These segments all represent a unique feature in the molding of the transmission industry's future. Passenger cars, for example, remain a dominant force, as they are used in high numbers worldwide. Smooting ride and the efficiency of fuels are becoming paramount in the considerations of consumers about their vehicles and this is leading to a considerable shift in how the transmission system is being researched. The adoption of automatic, and more predominantly continuously variable, transmissions is one such shift into better performance comfort.

LCVs and HCVs, on the other hand, require different specifications in terms of strength and durability as well as carrying heavy loads for long distances. The increasing need for goods transport, driven by the growth of e-commerce and logistics, requires manufacturers to pay attention to fuel efficiency while guaranteeing reliability under tough conditions. The increased usage of automated manual transmissions is a trend observed in these segments as they have an ideal mix of fuel efficiency and ease of usage.

The major shift in the Global Automotive Transmission market is observed in the Electric Vehicle and Hybrid Vehicle segments. Since the world is moving towards more eco-friendly transport options, Electric Vehicles and Hybrid Vehicles are finding their space more often than others. The kind of transmission used in such vehicles is also different from traditional internal combustion engines. Electric vehicles, in most cases, are single-speed transmissions, but there is a move towards multi-speed options to enhance performance and range. Hybrid vehicles, which integrate electric motors with conventional engines, require advanced transmission systems that can switch between power sources seamlessly to optimize fuel efficiency and reduce emissions.

Moving forward, the global automotive transmission market is going to go on a journey, with a significant thrust in sustainability, technological innovation, and the requirement of diverse consumer needs. Manufacturers are heavily investing in R&D to create superior transmission systems to cater to the future of mobility while ensuring performance efficiency and environmental responsibility at the same time.

By Fuel Type

The Global Automotive Transmission market is likely to witness considerable growth in the near future due to technological advancement and shifting consumer preferences. The automotive industry is slowly shifting towards more sustainable and efficient solutions, and the sophisticated transmission systems are being developed to ensure that vehicles run smoothly. By fuel type, the market is segmented into gasoline, diesel, electric, and hybrid, each of which has a role to play in the future of transportation.

Gasoline-powered vehicles have long dominated the automotive market due to their affordability and well-established infrastructure. However, as emission regulations tighten worldwide, manufacturers are under pressure to improve the efficiency of gasoline transmissions. This push has led to innovations in automatic and continuously variable transmissions (CVTs) that offer better fuel efficiency without compromising performance. Even though gasoline vehicles will continue to have a large share in the market, their percentage is likely to decline as years pass by as other fuel types become popular.

Diesel-based vehicles have long been preferred for commercial purposes and long-distance travels because of better fuel efficiency and torque. Still, the demand for diesel variants in the Global Automotive Transmission market is facing an uphill battle owing to stricter emissions and the acceptance of cleaner fuels. However, to be ahead of competition manufacturers are keenly looking towards better and high technological emission-transmissions while ensuring it is less likely to dilute diesel performance and advantages.

There could also come a point wherein long term scenario may favor electrics or other hybrids. A key factor leading the way through this scenario to success will most certainly be through electric vehicle sectors of Global Automotive Transmission. Unlike conventional IC engines, fewer complex transmission systems are needed for EVs, and indeed, mostly single-speed gearboxes can be utilised. Electric powertrains are, however, being pushed forward on multi-speed transmissions for EVs, which would offer increased efficiency and performance. As battery technology advances, coupled with increased charging infrastructure, sales of electric vehicle transmissions will increase, changing the market landscape overall.

Hybrid vehicles, which integrate an internal combustion engine with an electric motor, are a transitional phase toward full electrification. The Global Automotive Transmission market for hybrids is growing rapidly as consumers seek vehicles that offer better fuel economy and lower emissions without sacrificing the convenience of traditional engines. Hybrid transmissions are more complex because they need to manage power from both sources seamlessly. Hybrid variants form the hub of innovations in this aspect and yield tremendous optimization of performance and efficiency, thus appealing to a large number of drivers.

The future for the Global Automotive Transmission market would be based on the interplay of governmental pressure, technological advancements, and changing consumer needs. The general direction that the world is taking towards clean and efficient transport solutions will provide traction for expanding the demand for advanced transmission systems across all types of fuels.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$71,087.44 million |

|

Market Size by 2032 |

$108,444.89 Million |

|

Growth Rate from 2025 to 2032 |

6.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Global Automotive Transmission Market - Specific Regional Trends: The growth of the automotive transmission market varies regionally with respect to the growth in economy, technology advancement, consumer preference, and government regulations. The North American market, comprising the U.S., Canada, and Mexico, is expected to grow steadily mainly because of the high demand for automatic transmissions in passenger vehicles and increased investments in electric vehicle (EV) technology. The U.S. will continue the leadership in regional innovation, first and foremost being hybrid and completely electric vehicle transmission. The renewed focus of Canadian sustainable automotive practice and Mexico acting as a hub for manufacturing can be beneficial as well.

The UK, Germany, France, and Italy power the European region. Germany will most likely take the lead for advanced transmission systems, especially luxury and high-performance cars, considering it has an extremely strong automobile industry. Europe-wide, low emission and better fuel efficiency expectations for all automobiles will boost new transmissions, dual-clutch and CVTs in particular. In the UK and France, the respective governments are developing strategies for boosting electric mobility. The growing adoption of electric mobility will necessitate a rising need for electric drivetrain compatible transmissions. It will be difficult to deny participation as the southern European countries continue to be held under increasing pressures by regulatory environments.

The Asia-Pacific region has become a forerunner in the world market for automotive transmission. Growth factors include the country group China, India, Japan, and South Korea. China is rapidly industrializing and pushing for electric vehicles, making it a crucial player in determining future transmission technologies. Government incentives and more stringent environmental policies in the region would further boost demand for advanced transmission systems. Innovation in Japan and South Korea through leading automaker companies will primarily focus on efficient fuel consumption while incorporating smart features into transmissions. India has the potential to be a leading market, with increased middle-class demands and higher auto production.

South America, led by Brazil and Argentina, is showing moderate growth. Brazil's automotive sector is slowly recovering, and as disposable income increases, so will the demand for vehicles equipped with modern transmission systems. However, economic fluctuations in the region may pose challenges to consistent growth.

The overall Middle East and Africa region, encompassing GCC nations, Egypt, and South Africa, is expected to grow slowly for automobile transmissions. While GCC countries will undoubtedly accelerate the demand for luxury cars as drivers for higher-end transmission technology, other regions of this area might be more frugal in their approach because of budgetary restrictions. However, with increased infrastructure and more urban areas, the demand for better transmitted vehicles would arise in those regions.

COMPETITIVE PLAYERS

The Global Automotive Transmission market is in for a major shift in the next few years, primarily because of technological advancement and shifting consumer demands. With the world heading toward more sustainable and efficient transportation solutions, the major players in this industry are getting ready to face the challenge. The leaders of innovation are Aisin Seiki Co., Ltd., ZF Friedrichshafen AG, BorgWarner Inc., and Magna International Inc., constantly updating their products for performance improvement, better fuel efficiency, and more environmentally friendly usage.

A critical influence on the future of the Global Automotive Transmission market will be electric vehicles and hybrid technologies. The unique needs of these vehicles are forcing adaptations in the traditional, long-established transmission systems. A new generation of transmission technologies is also being designed, conceived directly with electric drivetrain performance enhancement in mind. Companies such as JATCO Ltd., Allison Transmission Holdings Inc., and Hyundai Transys Inc. are clearly making an investment in research and development to create products that meet the growing demand of EVs. This shift towards electrification is not only reflective of global environmental goals but also represents a new competitive landscape where innovation and adaptability are critical.

In the Global Automotive Transmission market, there is intense competition with a big play from established companies and emerging players alike with the technological edge. The other companies such as Eaton Corporation PLC, Schaeffler AG, and Valeo SA try to develop smart technology and lightweight materials in their transmission systems. Such developments would enable them to efficiently reduce fuel consumption and lower emissions, which are huge points of selling to these modern consumers and regulatory bodies as well.

This market also holds much future in collaboration with automotive manufacturers and technology firms. Partnerships and joint ventures would be more probable as companies aim to share their knowledge and resources to accelerate the innovation process. For instance, AVL List GmbH and Ricardo PLC are known for their engineering solutions, which would complement the manufacturing strengths of NSK Ltd. and GKN Automotive. This type of cooperation is expected to accelerate the development of cutting-edge transmission technologies suitable for both conventional combustion engines and the next generation of electric vehicles.

The Global Automotive Transmission market will continue its evolution with further new regulations, consumer preferences, and technological breakthroughs. Organizations that can accurately predict these and respond with more flexible, forward-thinking solutions stand to lead in the market. The established leadership and innovative dynamism of this industry's giants, such as Punch Powertrain N.V., Voith GmbH & Co. KGaA, and so on, promises that this business will continue on a dynamic footing, responding dynamically to future opportunities and challenges.

Automotive Transmission Market Key Segments:

By Transmission Type

- Manual Transmission

- Automatic Transmission

- Continuously Variable Transmission (CVT)

- Dual-Clutch Transmission (DCT)

- Semi-Automatic Transmission

By Vehicle Type

- Passenger Cars

- Light Commercial Vehicles (LCVs)

- Heavy Commercial Vehicles (HCVs)

- Electric Vehicles (EVs)

- Hybrid Vehicles

By Fuel Type

- Gasoline

- Diesel

- Electric

- Hybrid

Key Global Automotive Transmission Industry Players

- Aisin Seiki Co., Ltd.

- ZF Friedrichshafen AG

- BorgWarner Inc.

- Magna International Inc.

- JATCO Ltd.

- Allison Transmission Holdings Inc.

- Eaton Corporation PLC

- Schaeffler AG

- Hyundai Transys Inc.

- Valeo SA

- NSK Ltd.

- GKN Automotive

- Punch Powertrain N.V.

- Ricardo PLC

- AVL List GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383