MARKET OVERVIEW

The India forex cards market, as a sub-segment of the total financial services and travel payments industry, will continue to evolve as global tourism, cross-border education, and global business revolutionize the way foreign money is dealt with by consumers. The sector is founded on prepaid cards specially designed to store several foreign currencies, offering a solution option other than traditional methods of currency exchange. As more people become aware of safe and hassle-free global expenditure devices, forex cards will gain more popularity among Indian tourists and students traveling overseas. Compared to credit or debit cards provided by local banks, forex cards provide customers with fixed exchange rates and lower charges on cross-border purchases and withdrawals from ATMs.

India forex cards market shall serve a specific set of customers who need currency fluctuation control while overseas. Such customers are bound to span across a broad age group that includes students traveling for study abroad, corporate executives traveling overseas on duty, and recreation travelers traveling to more than one destination. With growing needs for low-cost and secure spending options, the structure of this market will change to meet changing consumer requirements. Product customization and innovation will be the forces driving the India forex cards market during the next several years. Banks and fintech players will pilot value-added card programs that cater to a range of traveler behaviors, such as currency pairings for the most popular destinations.

A few of these innovative features like app synchronization, real-time tracking of expenses, instant reload options, and roadside support will most likely be embedded in these cards. Suppliers will try to offer a seamless experience to the consumers with improved online platforms, catering to the industry-wide trend towards mobile-first offerings. Compliance and security will also influence the India forex cards market's growth. RBI (Reserve Bank of India) regulations and foreign exchange regulations under FEMA (Foreign Exchange Management Act) will be the driving force behind product design and delivery. Issuers will have to adhere to KYC (Know Your Customer) requirements, limit transactions, and usage reporting.

These factors will shape how banks and authorized dealers offer forex cards to their clients, creating a market where transparency and reliability become central pillars. With the growth of the market towards maturity, bank-card-network collaborations will come into more relevance. Globally usable co-branded cards available on Visa, MasterCard, or other such global networks will enhance the cardholder usage through convenience. Through these collaborations, extended reach will be provided coupled with improved usability of the cards, helping users conduct their transactions easily from one geography to another.

The India forex cards market would thus rely on a strong ecosystem of network providers, payment processors, banks, and regulatory agencies. Educational campaigns and web-based learning will also have an influence on adoption patterns in the India forex cards market. Providers will try to highlight benefits in lieu of cash or traditional banking products, particularly among first-time international travelers. Facilities such as currency conversion calculators, budgeting facilities, and fraud prevention features will be emphasized to facilitate responsible card use. In the future, India Forex Cards business will come even nearer to tracing digital payment technology, so it remains a first-preference alternative for outward-traveling Indian consumers. Its path will be determined by regulatory management, technological developments, and changing travel patterns, thus it is a natural component of the cross-border financial services climate.

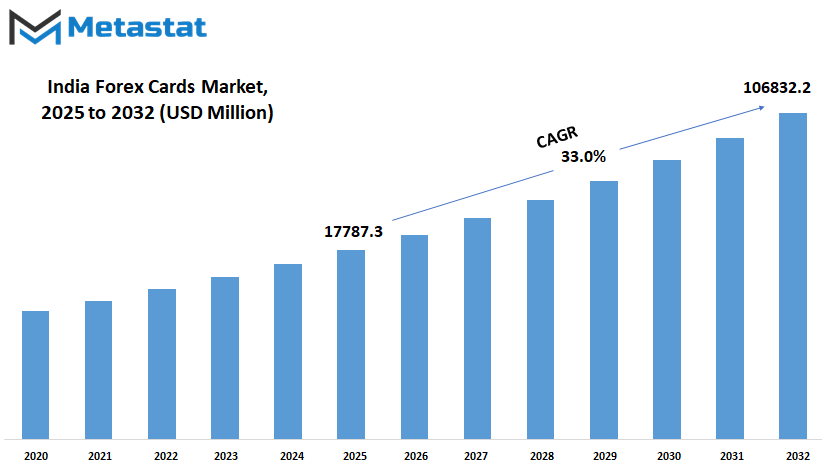

India forex cards market is estimated to reach $106832.2 Million by 2032; growing at a CAGR of 33.0% from 2025 to 2032.

GROWTH FACTORS

The India forex cards market is slowly becoming an integral part of the way money is managed while abroad by travellers, students, and business executives alike. The cards are used by tourists, students, and even business leaders as a safer and more convenient way to carry foreign money. With increasing numbers of Indians exploring international travel, either for studies, work, or recreation, the need for a secure and easy-to-use money tool continues to grow. Customers prefer to use forex cards because these cards have a better exchange rate compared to the use of a credit card or cash, and they allow clients to lock-in the rate before they even leave the country. This can serve to avoid shocking changes in the value of a currency, as users have full control over expenditure. One of the strongest drivers for this market's growth is the rising number of Indian students and professionals traveling overseas.

As more people choose to study or work overseas, the demand for products that help handle foreign currency obviously goes up. In addition to this, the convenience of online banking and higher awareness among users also encourages more people to choose forex cards over cash or traveller's cheques. Ease of usage, along with enhanced security measures, is contributing to these cards being the card of choice. Furthermore, increased affiliations among banks and travel service companies have made acquiring such cards relatively simpler, often with other related services for travel.

Nevertheless, there are some apprehensions that can curtail the growth. One of them is the lack of awareness in towns and villages. While people in major cities are accustomed to forex cards, some still might opt to use cash or other methods due to ignorance or distrust. Additionally, high additional charges and complex fee plans might discourage users if they do not know what they are being charged for. Such issues might serve as a deterrent, especially to first-time users.

Alternatively, the future is full of promise for the India forex cards market to grow. As long as companies invest in promotional efforts and simplifying the process of purchasing and using the cards, more people will utilize them. New technology in the form of mobile apps that make the management of card balances and tracking of spending easier will add value to the equation as well. Over the coming years, as international tourism keeps on expanding and digital finance technologies continue to grow in popularity, this market will most likely develop steadily and hopefully.

MARKET SEGMENTATION

By Card Type

The India forex cards market shall grow steadily since more individuals will start traveling overseas, either for education, work, or for leisure. Such cards are fast becoming a preferred option since they provide a convenient and safer medium to carry foreign exchange. No one wants the inconvenience of handling cash, stressing over exchange rates, or sneaking charges while traveling. Travelers have found an easy substitute in Forex cards. They can be swiped as normal debit cards, and they also have additional features that make them all the more desirable. With technology advancing further, the cards are also becoming intelligent, providing enhanced security and management through mobile apps and other means of digitality. In the coming times, the India forex cards market will tend towards a change in the kind of cards individuals are going to want.

These cards are currently bifurcated into two major categories: Single-Currency Forex Prepaid Cards and Multi-Currency Forex Prepaid Cards. Multi-Currency cards enable a user to place multiple currencies onto one card. This is particularly beneficial for an individual who will be visiting numerous countries. Time and effort are saved, as users do not have to bring different cards according to the nations they are planning to visit. Conversely, Single-Currency cards are for individuals traveling to a single nation. These tend to be simpler to deal with and are best for short-stay travelers. As the travel requirements of individuals change, the adoption of multi-Currency cards could rise. They provide convenience, which is increasingly essential for global travelers. With the increasing number of digital options entering the scene, these cards will become all the more convenient to use. Facilities like instant loading of currency, tracking of transactions, and customer service via mobile apps will draw more customers.

Safety too is an area where enhancements are likely to be made. Sophisticated facilities like chip-based protection, biometric entry, and real-time alerts on transactions will secure the cards and make them more trustworthy. Banks and financial entities will also unveil more tailored offers and reward schemes to draw customers. As India evolves as a serious global player in the travel and finance arena, the India forex cards market will be significant. Individuals are seeking more intelligent, secure, and convenient money tools when they travel, and these cards fill those roles nicely. The trend towards more sophisticated and versatile card products is likely to continue and define the future of this market in a significant manner.

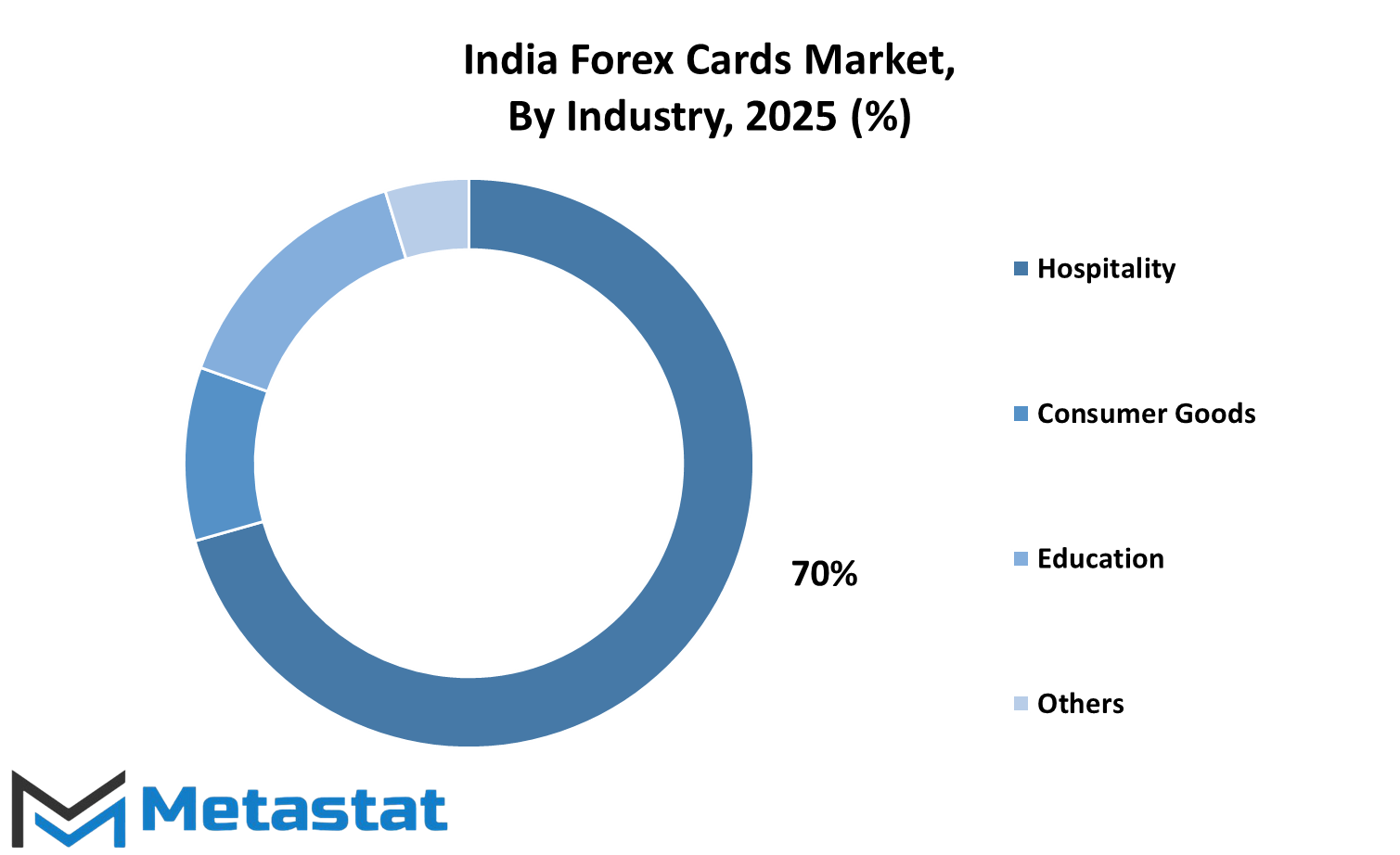

By Industry

The India forex cards market is likely to experience a consistent increase in the years to come, as more individuals start traveling abroad for various purposes like education, employment, and tourism. As the world becomes more interconnected, Indians are discovering more opportunities abroad. This increase in international travel translates to an increased demand for convenient, secure, and affordable means of carrying foreign currency. Forex cards have proven to be a viable solution, enabling users to keep away from carrying huge amounts of cash while also enjoying improved exchange rates and secure transactions.

Travel behavior of Indian consumers is one of the major factors that will continue to influence the development of this market. As more affordable world tourism becomes a reality and the middle class rises, individuals will seek out practical and low-cost financial products. Forex cards offer an option for controlling spending abroad without the surprise charges accompanying credit or debit cards. Forex cards also enable individuals to budget because the value loaded on the card can be planned in advance. This type of control will become ever more valuable to tourists who wish to stay on budget.

Various industries will have different roles to play in the future of the India forex cards market. For instance, the hotel industry will be likely to promote increased usage of such cards by incorporating them into their payment systems, making it convenient for visitors to pay during their visit. The consumer goods sector is also a big player in the use of forex cards as brands could begin introducing special offers or discounts for purchases made using forex cards. This would further attract international customers. The education sector is another significant contributor to the use of forex cards as more and more Indian students opt to study abroad. Such students require a secure method of funding and therefore forex cards are the appropriate option. The other sectors, such as the small business and professional services sector, will also benefit because they operate beyond borders and require easy tools for payment management.

As online transactions become increasingly prevalent, and as financial security awareness increases, forex cards will be an increasingly popular choice for overseas expenditure. Firms can invest in enhancing the user experience, providing improved apps and assistance. The India forex cards market, influenced by the requirements of contemporary travelers and students, will continue to expand and adapt to fit the evolving lifestyles of individuals in the nation.

By End Use Industry

The India forex cards market will continue to grow steadily over the next few years as more companies and individuals switch to safer and easier ways of managing money when they travel overseas. Forex cards are a safe option to avoid the hassles of carrying large sums of money or dealing with fluctuating exchange rates. Their demand will likely increase as international travel becomes more common among business and leisure travel. Demand for financial products that offer security, convenience, and favorable exchange rates will support the development of this market. Businesses will likely be the ones to push this market forward.

When Indian companies send staff abroad for meetings, training, or long-term stays, they will look for products that can fulfill their needs. Forex cards will provide an easy substitute for such companies, allowing them to control travel expenses in a controlled and secure manner. With increasing awareness of cost control, all companies will remain to prefer prepaid over corporate credit cards for shorter trips. Companies that undertake recurrent international travel will find these cards useful not just for expenses but also for keeping tabs on employee expenses more easily. Individuals, though, will be a strong part of this market as well. More people are going abroad for education, holidays, and personal visits than ever before.

These travellers are looking for alternatives that offer security, ease, and beneficial exchange rates. As people become more aware of the hidden charges involved in using conventional debit or credit cards when traveling abroad, they will turn to Forex cards for a better experience. Foreign students will also be included in this demand, as such cards provide parents and guardians with a sense of security and control when they send money for purposes. Technology will also continue to advance the way such cards are issued and used. Online assistance and mobile applications will make loading and managing multiple currencies easier for users.

As banks focus on internet-based services, they will also offer instant blocking of cards, re-loading via the internet, and better management of multi-currency transactions. All these trends will benefit the India forex cards market, along with increasing foreign travel, greater awareness of safer means of payment, and changing needs of businesses as well as individuals. This consistent growth will be a function of a combination of trust, convenience, and the ability to adapt to shifting user expectations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$17787.3 million |

|

Market Size by 2032 |

$106832.2 Million |

|

Growth Rate from 2025 to 2032 |

33.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

COMPETITIVE PLAYERS

The India forex cards market is gradually taking form to become one of the significant financial services for international travel, education, and business needs. As people are looking more and more for safer and more convenient ways of carrying foreign money, the demand for Forex cards will continue to rise. These cards contain foreign currency pre-loaded and offer security, convenience, and better exchange rates than more conventional options like cash or traveller's cheques. In the years to come, this segment will attract more focus from consumers and financial institutions alike as cross-border travel increases and consumer spending habits change. The drive for electronic finance and the growing knowledge regarding secure transactions will further encourage the use of Forex cards.

The customers today ask for not just a good rate but also enhanced features like the use of international ATMs, mobile app compatibility, and low conversion fees. This shift in user inclination will force banks and fintech companies to get innovative with better solutions that are capable of servicing more travelers. Businessmen, tourists, and students will be among the participants in the greater popularity of such cards. A few of the most dynamic stakeholders in the India Forex Cards industry are leading banks and financial institutions. Names like HDFC Bank Ltd., ICICI Bank Ltd, Axis Bank, and State Bank of India already have strong networks and customer confidence that will continue to keep them ahead.

While that's happening, newer players like the technology-centric Niyo Solutions Inc. and EbixCash are gaining speed as well by offering fresh digital-first experiences. The companies are launching new features that appeal to younger customers who prefer managing their money with mobile interfaces. What will more and more differentiate the future tech leaders is how they innovate but don't complicate the product too much. Consumers are looking for simple, secure, and fast services. This means that banks and fintechs must focus on simple interfaces, strong customer service, and partnerships with international networks that get the card accepted in more places.

While traditional banks will benefit from their huge client base and existing infrastructure, tech companies can steal the show with their flexibility and adaptability. As more and more people become aware of Forex cards and how they can help, competition is going to get fiercer by the day. The future of the India forex cards market will be largely shaped by the rate and manner in which these players respond to changing user needs, technology, and global travel and finance trends.

India forex cards market Key Segments:

By Card Type

- Multi-Currency Forex Prepaid Cards

- Single-Currency Forex Prepaid Cards

By Industry

- Hospitality

- Consumer Goods

- Education

- Others

By End Use Industry

- Businesses

- Individuals

Key India Forex Cards Industry Players

- HDFC Bank Ltd.

- ICICI Bank Ltd

- Standard Chartered Bank

- Axis Bank

- State Bank of India

- Thomas Cook India Ltd.

- Niyo Solutions Inc.

- IndusInd Bank Limited

- YES BANK Limited

- Kotak Mahindra Bank Limited.

- Bank of Baroda

- IDFC FIRST Bank Ltd.

- EbixCash

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252