MARKET OVERVIEW

The global electric construction equipment market will lead the conventional machinery business onto a quieter, greener, and sustainable course. Although the majority of discourse regarding this market automatically tends to focus on trends, legislation, or environmental advantages, what is beyond its existing perimeter is a more profound reshaping of how construction as an industry will be practiced and implemented in the foreseeable future. As the sector slowly moves away from diesel-driven systems, electric equipment not only will reshape project logistics but transform labor functions, city planning, and site design.

In the foreseeable future, the global electric construction equipment market will help develop construction projects that consider levels of noise pollution and spatial constraints. The lower noise levels and emission-free operations will enable contractors to undertake intricate jobs in populous cities or in the vicinity of sensitive sites such as hospitals, schools, or wildlife habitats venues where conventional heavy equipment has been deemed impractical for years. This shift will extend beyond equipment improvement; it will awaken totally new construction planning, permitting, and scheduling strategies.

In addition, the growth of this marketplace is anticipated to influence workforce dynamics. When conventional fuel-powered engines supply manner to state-of-the-art battery-powered structures, operators will ought to research new technical skills. Remote diagnostics, software updates, and virtual monitoring of performance will become norms. Eventually, this fashion will reduce reliance on guide inspections and reactive renovation, encouraging a information-pushed surroundings wherein uptime and consistency of performance take middle degree with the use of predictive tools. As greater builders include such technology, the equipment may be related to a larger virtual framework, growing the destiny task web page as extra connected and responsive.

Another course that the global electric construction equipment market will wonder expectations is in shaping power storage innovation. As the call for grows for high-capacity batteries capable of helping lengthy-length operation in severe conditions, it'll assignment battery chemistry, thermal management, and fast-charging technology. These advancements will no longer stay constrained to production; they will discover their manner into different industries like transportation, mining, and off-grid power answers. Thus, creation device will act as a spur to force cross-enterprise electrification.

At a larger level, the presence of electric equipment on building sites will also produce unexpected synergies with renewable energy projects. Solar and wind-powered portable charging stations can potentially replace fuel tankers, enabling remote job sites to be completely off the grid. This type of flexibility will prove especially useful in developing countries where access to energy is sketchy but construction demand remains high. The impact of this market, thus, will reach far beyond business projects into humanitarian, disaster-relief, and infrastructure development initiatives.

In short, the global electric construction equipment market will look beyond its present direction to machine design and compliance with regulations. It will take an active role in the creation of more intelligent cities, the evolution of skilled labor, energy revolution, and sustainable models of development. The future does not hold just an increase in equipment but a fundamental revolution in the way the built environment engages with technology and the earth.

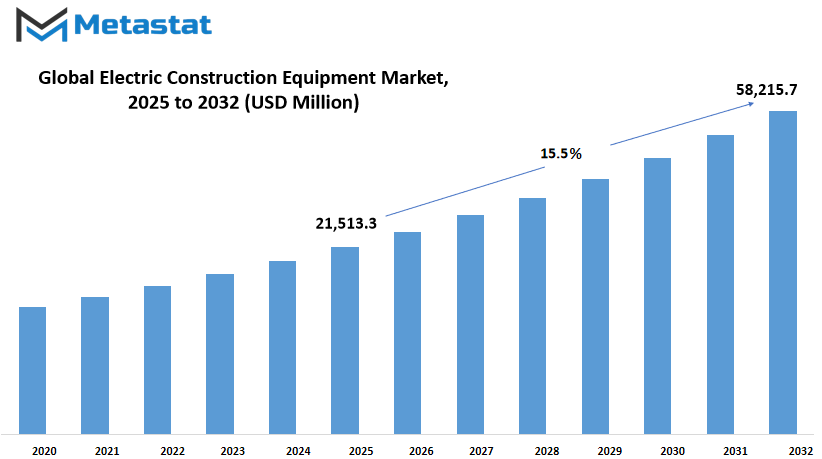

Gobal electric construction equipment market is estimated to reach $58,215.7 Million by 2032; growing at a CAGR of 15.5% from 2025 to 2032.

GROWTH FACTORS

The global electric construction equipment market is increasingly in the spotlight as global industries start to focus on green solutions. The most compelling force driving the change is increased demand for green and emission-free construction equipment. As climate change continues to be a priority, along with awareness among consumers increasing, electric options are being accepted not only for being less polluting, but also for lower noise levels and lower maintenance requirements. In addition to this movement, policies of the government are coming into play. Most nations are providing incentives to promote electrification of heavy machines, making it easy for manufacturers and purchasers alike to switch over.

But even with mounting interest, there are a few hurdles hampering the mass penetration of electric construction machinery. One of the primary concerns is the exorbitant initial cost, which can prove a heavy financial burden for contractors, particularly those in smaller companies. To boot, the infrastructure required to accommodate such machines especially the charging stations on the job site is still in its nascent stages in most areas. Another area of concern lies with performance. Although electric machinery is promising, they are still not capable of carrying out strenuous, large-scale construction operations for an extended duration.

On the positive side, battery and charging advancements continue to create new avenues for the market. Firms are spending a fortune on enhancing energy storage systems and shortening recharging time, which could become a reality soon to make electric equipment more feasible and desirable for general use. There is also increasing global momentum towards constructing smart cities and going green with construction techniques. These long-term initiatives not only open the way for cleaner equipment but also create a sure market for electric construction equipment to flourish. As the trend towards sustainable infrastructure gains force, the market will probably witness fresh growth opportunity and increased acceptance globally.

MARKET SEGMENTATION

By Product

The global electric construction equipment market is gradually shaping a brand new direction inside the creation enterprise. As industries retain to prioritize sustainable operations and stricter emission rules come into pressure, the shift in the direction of electric powered-powered equipment is now not just a trend it’s becoming a practical necessity. Traditional diesel-powered device has long ruled the scene, but the demand for cleanser, quieter, and more cost-efficient alternatives is now influencing purchase selections throughout the board.

One of the maximum sizable trends in this transition is the product segmentation. Among electric creation equipment, excavator keep a primary proportion, valued at $1,173.5 million, showing clean symptoms of management on this movement. Other products in this category encompass loaders, forklifts, aerial paintings structures (AWP), and plenty of others which might be gradually constructing momentum as infrastructure wishes grow and urban tasks multiply. These machines not simplest reduce noise and air pollutants on activity websites but additionally reduce down on operational prices through the years, making them attractive from each an environmental and monetary angle.

As production activities preserve to rise in each advanced and developing areas, mainly in urban settings in which guidelines on noise and emissions are tighter, the need for electric options will best grow. The advancements in battery generation, faster charging answers, and growing recognition of sustainable practices are setting the pace for a market with a purpose to maintain expanding. While demanding situations which include excessive prematurely fees and restrained charging infrastructure remain, the lengthy-time period blessings are pushing manufacturers and contractors to put money into electric alternatives.

Overall, the global electric construction equipment market is not just experiencing a transient push it’s shifting towards a destiny that needs purifier generation without compromising overall performance. With governments, industries, and builders aligning in the direction of shared goals of efficiency and sustainability, this quarter is expected to develop at a healthful rate, reshaping how production sites perform around the arena.

By Propulsion

The global electric construction equipment market is slowly changing the way industries are looking at heavy-duty projects. Increasing demands for cleaner energy sources and stringent environmental laws have put electric substitutes squarely in the center instead of being the secondary option they're the norm. Governments, developers, and contractors are increasingly leaning towards equipment that has lower emissions and makes less noise, particularly in cities. These machines are not only sustainable but reduce operational noise and long-term fuel expenses, two factors which have historically caused difficulty on worksites.

One of the hallmark traits of the global electric construction equipment market is its segmentation through propulsion type Hybrid-Electric and Battery-Electric. Hybrid-Electric machinery derives power from both gas and electricity, presenting customers a compromise among overall performance and sustainability. This alternative is often favored for use in big production tasks where lengthy-time period use is paramount and charging infrastructure is still evolving. In contrast, Battery-Electric fashions are more and more popular for smaller initiatives and urban traits, where emissions, noise, and maintenance turn out to be more closely managed. These machines run most effective on rechargeable batteries, which cause them to a applicable choice for progressive builders in search of to be in compliance with inexperienced building rules.

While both segments are being followed, Battery-Electric machines are likely to increase extra swiftly, in particular in the markets that are closely making an investment in clever infrastructure and green strength. As batteries enhance their potential will increase, charging turns into quicker, and their charges lower the hurdles to adoption lower. The market is likewise experiencing a boom of collaborations among production organizations and technology builders aimed at making these machines smarter, more secure, and extra efficient. This partnership is paving the manner for a change of how construction work in the destiny will be carried out.

Meanwhile, drawbacks including excessive preliminary prices and an as-but-undeveloped charging network stay. Businesses are balancing the long-time period gasoline savings and maintenance against the prematurely cost. Governments' incentives, however, combined with growing gasoline expenses, are assisting to push the stability inside the direction of electrical options.

By Battery Capacity

The global electric construction equipment market is experiencing a steady evolution, fuelled by the transition towards cleaner technologies as well as regulations on emissions all over the construction sector. With organizations looking to minimize their carbon footprint as well as optimize operations, electric counterparts are gaining popularity. The change isn't based only on sustainability; it also stems from practical advantages such as less noise, lower operating expenses, and the need for less maintenance. The demand for electric construction equipment is rising across both developed and developing regions, with growing infrastructure projects and increasing awareness about environmental concerns.

When examining the global electric construction equipment market by battery capacity, it's clear that different capacities serve different construction needs. Equipment with battery capacity below 50 kWh would generally be ideal for smaller projects or small machinery utilized in urban areas with less space for equipment operation and more stringent emission regulations. These would best suit landscaping, residential construction, or municipal upkeep. They are easy to drive, fast to charge, and frequently affordable, so they are an ideal option for short-run operations or frequent start-up during the day.

On the other hand, the 50–200 kWh battery capacity segment supports a much wider variety of applications. Equipment within this range have a power–flexibility balance and are hence in demand for medium-duty applications. They find their applications in bigger construction sites where performance and runtime must be assured, but need not be continuous during the entire day. The capacity to run for several hours from a single charge without requiring undue infrastructure backing makes this segment extremely valuable to contractors who handle a variety of sites or equipment fleets.

In the upper segment, production gear with batteries over two hundred kWh is used for heavy-duty packages. These are appropriate for foremost initiatives consisting of dual carriageway constructing, mining operations, and huge commercial developments in which overall performance and sturdiness are paramount. More steeply-priced however with great runtime and electricity, this kind of system reduces downtime and enhances operations requiring high power. As charging generation advances and batteries enhance, this category is likely to benefit reputation, especially amongst agencies with targets to completely electrify their fleet.

In total, the expansion of the global electric construction equipment market by battery capacity is a reflection of the practical demands of the industry. It's not a case of one size fits all; instead, each range of batteries serves a different set of work environments. As innovation presses on and infrastructure plays catch-up, the market will increasingly move faster toward electrification, assisting the construction industry to build cleaner and smarter.

By Battery Type

The global electric construction equipment market is slowly redefining the manner in which the construction sector thinks about power, efficiency, and sustainability. With rising concerns regarding environmental footprint and tighter emission norms across the globe, electric equipment is starting to take over from conventional fuel-driven machinery. The need for electric options is no longer confined to large companies with green objectives; even mid-sized and small-sized construction firms are looking to adapt. Of the most important factors propelling such a transition is the battery technology used to drive these machines. Not only does the type of battery influence the performance but also the life, maintenance requirements, and cost of ownership.

Based on form of battery, the global electric construction equipment market is segmented into Lithium-ion, Lead-acid, and Others. Of these, Lithium-ion batteries are choosing up sturdy popularity due to their excessive power density, short charging function, and longer lifespan. Construction cars powered via Lithium-ion batteries can function for longer hours and want fewer protection sessions, which makes them a fee-effective choice for excessive-usages. While their preliminary fee is higher, the fuel financial savings and reduction in servicing desires over a period of time cause them to a great monetary investment for maximum customers. These batteries also accommodate more modern technologies like remote monitoring and shrewd diagnostics, which can be gaining huge recognition in cutting-edge production environments.

Lead-acid batteries, meanwhile, still maintain their position by virtue of affordability and availability. For companies working on tighter budgets or in areas where advanced battery infrastructure is still developing, these batteries provide a less expensive path into electric equipment. But they are subject to regular maintenance and don't have as much life as Lithium-ion, which can contribute to delays in operation over the longer term. Their heavy weight and less-efficient energy use also make them less well-suited for heavy-load applications, though they continue to be used in their application in smaller or lighter applications.

The "Others" institution contains batteries like nickel-steel hydride and newer experimental ones that are yet to be adopted on a large scale. These may have specific benefits in positive use cases, but they are no longer but on the scale or agree with degree of Lithium-ion or maybe Lead-acid batteries. With further research, some of these alternatives will be extra competitive, particularly as manufacturers are seeking to decrease using rare earth materials or enhance recycling alternatives for batteries.

As a whole, the battery type utilized within electric powered production system is a key thing in how some distance and a hit this era penetrates. As the global electric construction equipment market maintains to evolve, performance, fee, and sustainability will be the impetus at the back of shopping selections. Companies that provide flexible battery answers and spend time growing a legitimate guide shape will most likely take middle stage in defining the next era of the development device market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$21,513.3 million |

|

Market Size by 2032 |

$58,215.7 million |

|

Growth Rate from 2025 to 2032 |

15.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

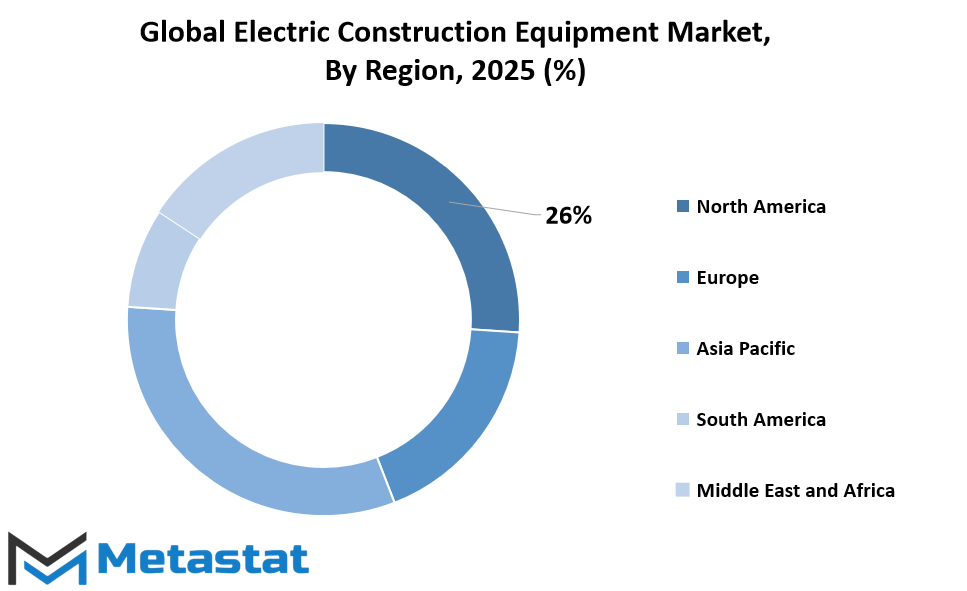

REGIONAL ANALYSIS

The global electric construction equipment market is picking up steam in different regions, with each region having its own rate of adoption. This drift towards electric machinery is driven by increased environmental awareness, stricter emission laws, and increasing fossil fuel prices. In North America, nations such as the U.S., Canada, and Mexico are driving cleaner technologies, backed by robust infrastructure budgets and government push. The United States, especially, is leading the way with cleaner options in the building sector, as numerous projects have electric equipment as part of their sustainability initiative. The emphasis on lowering carbon emissions in Canada and Mexico's growth as an industrial country also play a role in the region's interest in electric building solutions.

Europe has been a strong proponent of green construction technology for years. Nations such as the UK, Germany, France, and Italy are taking the lead with inducements for firms embracing green machinery. Governments are actively encouraging cleaner transport and building through grants, tax relief, and tighter emissions regulations. This is influencing public and private building projects to turn away from diesel fuel. Germany, which is famous for its engineering prowess, is emerging as the place for innovation when it comes to electric building equipment. Meanwhile, the Rest of Europe is following suit as awareness spreads and regulatory frameworks tighten.

In the Asia-Pacific region, demand for electric construction equipment is rising quickly, especially in India, China, Japan, and South Korea. These countries are experiencing rapid urban development, which is pushing the construction industry to explore more sustainable options. China and India, having big populations and infrastructure aspirations, are opening up enormous opportunities for electric equipment producers. Japan and South Korea, being technologically advanced, are pushing local manufacturers to become innovative and meet both domestic and overseas demand. The Rest of Asia-Pacific may still be playing catch-up, but the regional momentum in general is unmistakable.

South America is also improving, albeit slowly relative to other areas. Brazil and Argentina are slowly starting to introduce electric construction equipment, primarily in major cities where environmental issues are more critical. These nations are starting to see the long-term cost savings and environmental benefits of electric equipment, particularly in urban development. In the meantime, the Rest of South America is starting to embrace the idea, but affordability and infrastructure issues persist.

In Middle East & Africa, there is growing interest in electric construction equipment. The GCC nations, particularly the UAE and Saudi Arabia, are developing smart cities and new-age infrastructure, which in turn is raising the demand for cleaner and less noisy construction solutions. Egypt and South Africa too are gaining traction, with urbanization and green consciousness fuelling the demand. Nonetheless, the Rest of the region experiences economic and logistical problems, which might impede the rate of adoption. Nevertheless, with foreign assistance and increasing awareness, the situation in all of these nations is improving incrementally.

COMPETITIVE PLAYERS

The global electric construction equipment market is shaping as much as be one of the most tremendous shifts inside the production industry’s future. As nations retain to push for greener infrastructure and purifier city environments, electric options to standard diesel-powered equipment are gaining critical traction. The push towards sustainability is no longer optional governments and companies alike are prioritizing reduced emissions, specifically on task sites positioned in densely populated cities. This trade, sponsored by using stricter environmental standards and noise policies, is growing room for electric powered creation device to move from the fringes to the vanguard of the marketplace.

Several foremost producers are already making strong moves in this path. Companies such as Caterpillar Inc., Komatsu Ltd, and Volvo AB are actively introducing electric variations of famous machinery, like mini excavators, wheel loaders, and compact song loaders. These machines no longer only lessen carbon emissions but additionally function extra quietly, making them best for residential and middle of the night tasks. The transition isn’t just about environmental blessings it’s also about slicing lengthy-time period operational prices. Electric creation gadget has a tendency to have fewer transferring parts, this means that less upkeep and fewer breakdowns, a key concern for contractors working underneath tight time limits.

Still, the street to large adoption has its challenges. One of the most important constraints is battery generation. While advances continue, the constraints in battery capacity and charging infrastructure are slowing down broader recognition, in particular for heavy-duty duties requiring sustained strength. The upfront value of electric equipment additionally stays higher than conventional alternatives, that could make smaller production companies hesitant to invest. However, with increasing government incentives and growing strain to meet ESG goals, extra groups are expected to make the switch inside the coming years.

The aggressive landscape is dynamic, with many main gamers working hard to secure a percentage of this emerging marketplace. In addition to Caterpillar Inc. And Volvo AB, others together with CNH Industrial NV, Doosan Corporation, Hitachi Construction Machinery Co., Ltd., and Deere & Company are closely investing in studies, innovation, and partnerships. Asian manufacturers like XCMG Group, Hyundai Construction Equipment Co., Ltd., and SANY Group also are expanding their global footprint with electric powered services tailor-made to numerous marketplace wishes. Meanwhile, European names like Liebherr-International AG and Manitou Group are specializing in compact electric machinery for urban applications. Smaller firms and startups aren't a long way at the back of, often using innovation with area of interest designs and bendy answers.

In the approaching years, the global electric construction equipment market will witness persisted boom as technology improves and charges decline. With influential gamers inclusive of Terex Corporation, Kobelco Construction Machinery Co., Ltd., HİDROMEK, Sumitomo Heavy Industries, Ltd., J C Bamford Excavators Ltd, and Zoomlion Heavy Industry Science and Technology Co., Ltd. Actively participating, the competition will possibly bring about quicker innovation and wider product availability. As the global production enterprise shifts towards cleanser, smarter answers, electric powered machinery is now not a futuristic idea it’s rapid turning into a realistic and strategic funding.

Electric Construction Equipment Market Key Segments:

By Product

- Excavator

- Loader

- Forklifts

- Aerial Work Platforms (AWP)

- Others

By Propulsion

- Hybrid-Electric

- Battery-Electric

By Battery Capacity

- 50-200 KwH

- 200+ kWh

By Battery Type

- Lithium-ion

- Lead-acid

- Others

Key Global Electric Construction Equipment Industry Players

- Caterpillar Inc.

- CNH Industrial NV

- Doosan Corporation

- XCMG Group

- Hitachi Construction Machinery Co, Ltd

- Hyundai Construction Equipment Co, Ltd

- J C Bamford Excavators Ltd

- Deere & Company

- Kobelco Construction Machinery Co, Ltd

- Komatsu Ltd

- Liebherr-International AG

- Manitou Group

- HİDROMEK

- SANY Group

- Sumitomo Heavy Industries, Ltd

- Terex Corporation

- Volvo AB

- Zoomlion Heavy Industry Science and Technology Co, Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383