Global Ultrasonic Plastic Welder Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global ultrasonic plastic welder market is characterized by decades of trial and error, refinement, and rising demands for cleaner and more precise joining methods. It started in the late sixties when engineers tried to fuse thermoplastic parts with high-frequency vibration without using flame or chemical agents. The early experimental devices were big and weak but came up with a way that would later become the standard for assembly speed and precision. By the late 1980s, the ultrasonic welding got itself a solid foundation for its ability to move quickly from small laboratory tests to full-scale production on the main floors of the factories due to the advanced transducer designs, lighter generator units, and active polymer research.

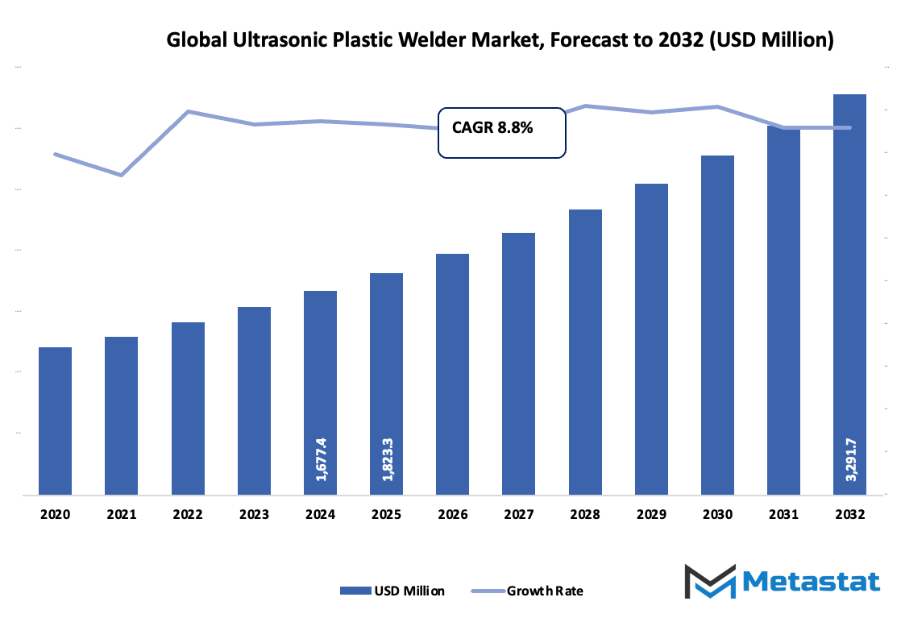

- The global ultrasonic plastic welder market has an approximate value of USD 1823.3 million in 2025, with a projected CAGR of around 8.8% through 2032, thereby having the potential to surpass USD 3291.7 million.

- Handheld Ultrasonic Welders take up about 10.3% of the market share and are at the forefront of innovation while their applications are extended through sharp research.

- The main factors causing demand to grow include the need for more plastic parts that are both light and strong in the automotive and electronics sectors and the ramping up of the use of automation and precision assembly technologies in manufacturing.

- Integration of ultrasonic welding in the production of medical devices and micro-assembly applications can be considered opportunities.

- The insight tells that the market is going to be of much larger value in the coming decade, thus, making it a very attractive area for investment.

In the 1990s, the ultrasonic systems were introduced globally in tighter tolerances and quicker to cycle areas and thus gained acceptance in sectors like automotive interiors, consumer electronics, and medical disposables. The FDA and EMA, along with other regulatory bodies, forced medical device manufacturers to use cleaner methods of joining, thus propelling the abandonment of adhesives. Ultrasonic welding then gained acceptance as a reliable and repeatable technique. Parallelly, the Society of Plastics Engineers and other groups discussed the enhancement of the polymer properties through ultrasonic energy, thus helping companies to standardize their procedures and cut down on defects.

Besides, the demand for light-weight assemblies has increased tremendously during the recent years due to the agencies like the U.S. Department of Energy advocating transportation efficiency and sustainability policies. Among the manufacturers, the most advanced digital controls, automated systems for calibration, and real-time logging of data have been integrated into the welding units. The International Federation of Robotics reports that in 2023, global robot installations reached a total of 550,000 units, which is a encouraging figure for the market's progress as automated ultrasonic welding cells have been installed that the operators can use to get high throughput with very little manual handling involved.

The global ultrasonic plastic welder market has come to a stage where it is crucial for precision manufacturing, environmental requirements, and automation to dictate its course. As the industries are gradually moving towards intelligent factories, the ultrasonic welding technology would also acquire its fair share of the upgrades in terms of getting more sensors, adaptive tuning options, and energy-efficient power, thereby, reinforcing its position in the production of durable, high-performance, and plastic components for the next-generation products.

Market Segments

The global ultrasonic plastic welder market is mainly classified based on Product Type, Frequency Range, Automation Level, End-Use Industry.

By Product Type is further segmented into:

- Handheld Ultrasonic Welders: Handheld Ultrasonic Welders support flexible use during production tasks across the global ultrasonic plastic welder market. Portable operation helps meet varied welding needs in workshops and small facilities. Consistent performance supports steady joint quality, helping many manufacturers manage tight schedules, varied materials, and frequent adjustments during daily operations without slowing overall workflow.

- Benchtop Ultrasonic Welders: Benchtop Ultrasonic Welders offer stable placement for controlled welding conditions. Fixed positioning supports steady pressure, balanced energy delivery, and reduced variation during repeated tasks. Compact construction supports organized work areas, while reliable output helps manufacturing teams maintain dependable weld strength for frequent production cycles in small, medium, or large industrial settings.

- Integrated Ultrasonic Welding Systems: Integrated Ultrasonic Welding Systems support coordinated operation within larger production lines. Unified controls assist with synchronized timing, consistent joint formation, and reduced manual supervision. Built-in monitoring enhances production accuracy, helping manufacturing operations maintain steady output, reduced scrap, and reliable bond quality during high-volume welding tasks requiring dependable performance.

By Frequency Range the market is divided into:

- Low Frequency (≈15–20 kHz): Low Frequency (≈15–20 kHz) equipment delivers strong welding power suited for larger components and tougher plastics. Lower pitch supports deeper energy transfer, helping industrial operations handle thick materials with steady bond strength. Robust vibration output supports dependable joining results during demanding manufacturing tasks requiring stable and uniform weld formation.

- Mid Frequency (≈20–40 kHz): Mid Frequency (≈20–40 kHz) equipment supports balanced performance for general welding duties. Moderate pitch helps achieve dependable joint strength across a wide range of plastics. Consistent vibration levels support stable production schedules, reduced rework, and reliable weld appearance for many industrial applications requiring flexible and efficient welding solutions.

- High Frequency (≈40–70 kHz): High Frequency (≈40–70 kHz) equipment supports delicate welding needs involving small parts and thin materials. Higher pitch aids controlled energy transfer, helping sensitive components maintain proper form during bonding. Precise vibration levels support accurate weld placement for industries requiring fine detail and careful handling during assembly.

By Automation Level the market is further divided into:

- Manual: Manual systems support hands-on operation for customized welding needs. Direct technician control helps adjust pressure, positioning, and timing based on part variation. Flexible handling supports low-volume tasks, specialized components, and development projects requiring careful alignment and controlled energy application during bonding activities.

- Semi-Automatic: Semi-Automatic systems combine guided functions with limited operator involvement. Assisted controls help maintain consistent timing, balanced force, and stable weld output. Partial automation supports faster cycles, reduced handling errors, and improved production reliability for manufacturing lines aiming for steady quality without full robotic integration.

- Fully Automatic / Robotic Integration: Fully Automatic / Robotic Integration supports continuous production with minimal manual adjustment. Coordinated systems deliver precise positioning, repeatable energy output, and rapid cycle times. Automated pathways help reduce scrap, improve uniformity, and support large-scale manufacturing where stable weld strength and predictable daily throughput remain essential.

By End-Use Industry the global ultrasonic plastic welder market is divided as:

- Automotive: Automotive manufacturing uses ultrasonic welding to support bonding tasks involving interior parts, electrical components, and lightweight assemblies. Consistent weld formation supports long-term durability, reduced vibration issues, and dependable part alignment for vehicles requiring strong and repeatable joint performance during daily operation and extended service lifespans.

- Medical & Healthcare: Medical & Healthcare production uses ultrasonic welding for clean, secure bonding of diagnostic housings, fluid connectors, and sterile device components. Heat-free joining supports material protection, stable sealing, and reduced contamination risk, supporting safe equipment use and dependable performance in sensitive healthcare environments requiring reliable component integrity.

- Consumer Electronics: Consumer Electronics assembly uses ultrasonic welding for compact housings, delicate components, and small connectors. Controlled vibration supports neat joint lines, reduced surface damage, and dependable alignment, helping manufacturers achieve reliable function and durable construction for frequently handled electronic devices used in daily routines.

- Packaging: Packaging operations use ultrasonic welding to form secure seals on containers, closures, and protective materials. Rapid cycle speed supports high-volume output, while clean bond formation helps maintain freshness, safety, and product stability during storage, transport, and distribution across various commercial settings.

- Appliances & Consumer Goods: Appliances & Consumer Goods production uses ultrasonic welding for housings, handles, and interior components requiring strong connections. Bonding support helps maintain structural stability, product durability, and safe handling for everyday items exposed to repeated use and varying environmental conditions.

- Textiles & Nonwovens: Textiles & Nonwovens manufacturing uses ultrasonic welding for seams, filters, and layered materials. Vibration-based bonding supports quick processing, uniform seals, and reduced fraying, helping producers maintain smooth finishes and dependable material performance during frequent handling and extended application cycles.

- Others: Other sectors adopt ultrasonic welding for diverse applications involving specialty plastics and custom components. Stable joining support helps maintain reliable structure, reduced waste, and consistent performance across varied production demands, enabling flexible adoption in operations seeking solid welding results for unique manufacturing needs.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1823.3 Million |

|

Market Size by 2032 |

$3291.7 Million |

|

Growth Rate from 2025 to 2032 |

8.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

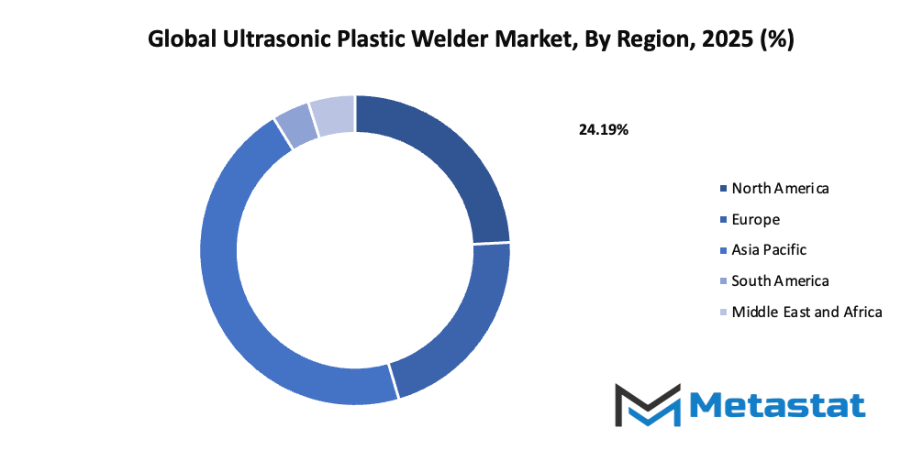

- Based on geography, the global ultrasonic plastic welder market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Rising demand for lightweight and durable plastic components in automotive and electronics manufacturing: Rising need for components that reduce weight while maintaining strength encourages wider use of advanced joining systems. Automotive and electronics production lines benefit from steady weld consistency, shorter processing times, and reduced material damage. Such advantages support smoother production flow and help maintain dependable assembly standards across multiple plastic-based applications.

Increasing adoption of automation and precision assembly technologies in industrial production: Higher interest in automated systems encourages manufacturers to choose welding solutions that support consistent alignment, stable energy control, and minimal manual intervention. Automation improves cycle predictability, reduces processing errors, and strengthens long-term output efficiency. As production lines expand, controlled ultrasonic welding supports dependable operation under tight assembly requirements.

Challenges and Opportunities

High initial equipment cost and limited suitability for very large or thick plastic parts: Purchase of specialized machinery can place pressure on budgets, especially for small operations. Welding performance also reduces when material sections exceed practical thickness limits. These conditions require thoughtful evaluation of part design, production volume, and long-term benefits before investing in equipment that demands careful financial and technical planning.

Need for skilled operators and precise material compatibility for consistent weld quality: Stable weld formation depends on correct settings, controlled pressure, and proper understanding of material behaviour. Operator training supports better handling of equipment and safer operation. Material choice also influences weld strength, making thorough testing essential for maintaining stable results throughout repeated production cycles in demanding environments.

Opportunities

Growing integration of ultrasonic welding in medical device manufacturing and micro-assembly applications:

Medical components and miniature assemblies rely on precise joining without contamination or excess heat. Ultrasonic methods support clean bonding for housings, micro-fluidic parts, and sensitive enclosures. Adoption in these areas strengthens long-term demand for precise weld systems that maintain accuracy, protect component integrity, and support strict regulatory expectations.

Competitive Landscape & Strategic Insights

The global ultrasonic plastic welder market is shaped by both long-established international manufacturers and growing regional competitors. The presence of several influential companies drives innovation and competition within this sector. Leading participants such as Emerson Electric Co., Herrmann Ultrasonics, Dukane Corporation, Telsonic, Ever Ultrasonic Co., Ltd., Sonics & Materials (Sonics), Rinco Ultrasonics, Hangzhou Altrasonic Technology Co., Ltd., Axess Ultrasonics Pvt. Ltd., Mecasonic, Nippon Avionics Co., Ltd., SBT Ultrasonic (Sbt Ultrasonic Technology), K-Sonic, Crest Group, Ultrasonic Engineering Co., Ltd., and Hornwell (Hornwell Ultrasonics) contribute significantly to the growth and advancement of ultrasonic welding solutions worldwide.

This industry is influenced by the growing need for efficient, clean, and reliable plastic joining methods used across multiple manufacturing applications. As production lines seek faster and more consistent welding results, demand continues to rise for ultrasonic welding systems that offer higher precision and energy efficiency. Each company strives to strengthen market position through new product development, improved automation, and enhanced material compatibility. These efforts help meet the growing needs of industries such as automotive, electronics, packaging, and medical equipment manufacturing, where durable plastic joints are essential.

Market size is forecast to rise from USD 1823.3 million in 2025 to over USD 3291.7 million by 2032. Ultrasonic Plastic Welder will maintain dominance but face growing competition from emerging formats.

Competition encourages steady improvements in performance, affordability, and user convenience. While large corporations dominate global distribution and technology standards, regional firms focus on customization and affordability to capture local demand. This balance between global expertise and regional adaptability keeps the market dynamic and diverse. The continuous introduction of advanced machines, better frequency control, and user-friendly interfaces shows that this field remains responsive to industrial progress. As manufacturing processes continue to advance, the global ultrasonic plastic welder market will maintain its importance by offering sustainable and dependable solutions for joining plastic materials with accuracy and speed.

Report Coverage

This research report categorizes the global ultrasonic plastic welder market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global ultrasonic plastic welder market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global ultrasonic plastic welder market.

Ultrasonic Plastic Welder Market Key Segments:

By Product Type

- Handheld Ultrasonic Welders

- Benchtop Ultrasonic Welders

- Integrated Ultrasonic Welding Systems

By Frequency Range

- Low Frequency (≈15–20 kHz)

- Mid Frequency (≈20–40 kHz)

- High Frequency (≈40–70 kHz)

By Automation Level

- Manual

- Semi-Automatic

- Fully Automatic / Robotic Integration

By End-Use Industry

- Automotive

- Medical & Healthcare

- Consumer Electronics

- Packaging

- Appliances & Consumer Goods

- Textiles & Nonwovens

- Others

Key Global Ultrasonic Plastic Welder Industry Players

- Emerson Electric Co.

- Herrmann Ultrasonics

- Dukane Corporation

- Telsonic

- Ever Ultrasonic Co., Ltd.

- Sonics & Materials (Sonics)

- Rinco Ultrasonics

- Hangzhou Altrasonic Technology Co.,Ltd

- Axess Ultrasonics Pvt. Ltd.

- Mecasonic

- Nippon Avionics Co., Ltd.

- SBT Ultrasonic (Sbt Ultrasonic Technology)

- K-Sonic

- Crest Group

- Ultrasonic Engineering Co., Ltd.

- Hornwell (Hornwell Ultrasonics)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252