Global Metalworking Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global metalworking market has been the mainstay of industrial development, the basis for manufacturing and engineering not only for centuries but the whole range of development in these fields. The industry went from the very first hand-made tools and blacksmithing to a massive laid out network of mechanized production during the Industrial Revolution. What started as a skillful handcraft gradually transformed into a complex ecosystem that made the industry of the whole world. First, steam and then electricity powered those processes, making them much more efficient than before, and thereby marking the first significant turning point in the global metalworking market.

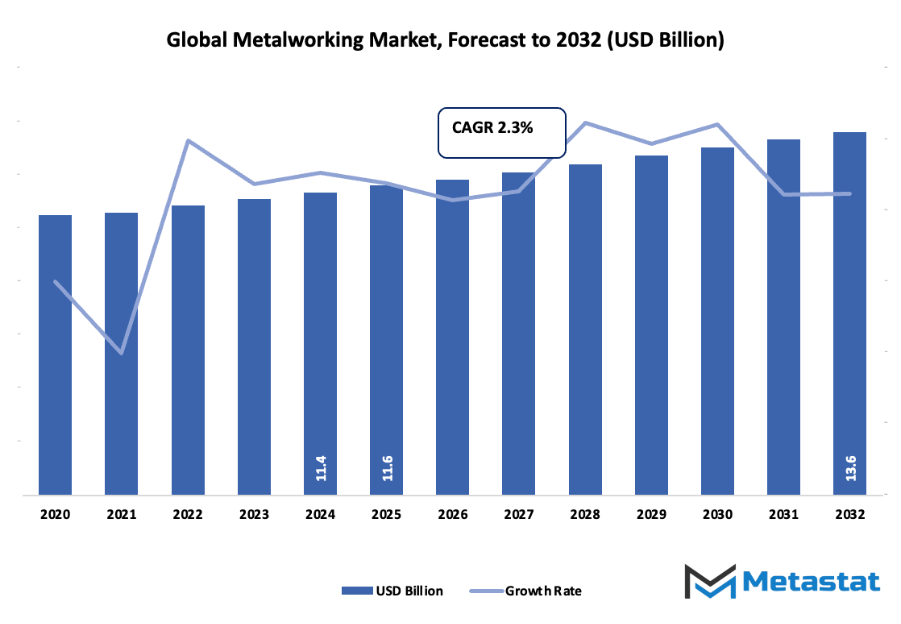

- The global metalworking market is going to be worth around USD 11.6 million in 2025, with a CAGR of approximately 2.3% taking it over USD 13.5 million till 2032.

- Casting emerges to be the single largest segment of the market sharing almost 19.4% and continues to be the driving force behind the advancements and proliferation of the different areas through vigorous research.

- Among the major trends that are contributing to the growth are the rising need for high-precision parts in the automotive and aerospace sectors, the increase of manufacturing and industrial automation sectors.

- Technological innovations such as CNC machining and additive manufacturing becoming widely used will be the main reason for the expansion of the markets.

- A very reliable source of information indicates that the market will transform to be of enormous value within ten years which has already been pointed out as the time of passing significant growth opportunities.

Century by century, the process of mass production had completely reshaped metal fabrication. The rise of precision types of processes like casting, machining, and welding were to a large extent due to the manufacturing of automobiles, railroads, and huge machines. It was really very much an era of radical changes; in fact, the factories would soon become the field of applied research where materials and machining techniques would be invented and soon be used in aerospace and defense besides. The post-war period marked the beginning of another decisive epoch, as the world opened up, and large-scale industrial centers sprang up in Asia and Europe with the help of the West. The global metalworking market already was showing the interconnectedness of that time to a greater extent, where raw materials, technology, and know-how were moving across borders to satisfy the rising industrial demand.

The last twenty years of the 20th century saw the birth and introduction of computer numerical control (CNC) systems, which caused a revolution in manufacturing with respect to both accuracy and speed. Automation transformed the flow of operations so that human error was minimized at the same time that productivity was increased. The digitalization path started to take over in the manufacturing sector and it became more smart and adaptive with the beginning of the new millennium. Among the defining characteristics of its future may be the smart factories, 3D metal printing and sensor-controlled machining. Environmental regulations will operate as well and influence the current situation in a sense that they will lead the manufacturers to choose sustainable sources of materials and adopt cleaner production methods.

Currently, the global market for metalworking is a mix of old-time practices and new technologies. The pouring of metal into different shapes is the same old thing but the ways to do so will be changed constantly through the use of data processing, robotics, and breakthroughs in materials science. The path it has taken—from hand tools to intelligent machines—tells the saga of being tough and changing. The metalworking sector will not only be a quick respondent to the demand of the industries but also a predictor that will create the very materials and structures supporting the new inventions.

Market Segments

The global metalworking market is mainly classified based on Process, Application.

By Process is further segmented into:

- Casting: Casting in the global metalworking market involves pouring molten metal into molds to achieve desired shapes once cooled. This method is preferred for producing complex parts in large volumes. The process helps manufacturers create components with excellent dimensional accuracy and durability. Industries such as automotive and aerospace rely heavily on casting to manufacture engine blocks, turbine parts, and machinery components. The rising use of lightweight alloys and new casting techniques continues to improve product strength and reduce material waste, helping the market grow steadily.

- Machining: Machining in the global metalworking market focuses on shaping metal parts through controlled removal of material using tools like lathes, mills, and drills. It ensures high precision and smooth finishes, making it essential for manufacturing complex parts. The use of computer numerical control (CNC) technology has transformed machining, offering greater efficiency and accuracy. This process supports multiple industries that require strict tolerances and refined finishes. Continuous improvements in tooling materials and automated systems have enhanced productivity and reduced operational costs.

- Welding: Welding is a key process in the global metalworking market, joining metal parts through the application of heat and pressure. It provides strong and permanent connections required in sectors such as construction, automotive, and aerospace. The process is essential for creating durable structures that can withstand extreme conditions. Advancements in laser and robotic welding have improved quality control and reduced errors during production. As safety standards and performance demands increase, welding continues to be a crucial step in metal fabrication and industrial manufacturing.

- Forming: Forming in the global metalworking market shapes metal through mechanical force without removing material. Processes such as bending, rolling, and stamping allow efficient use of raw materials while maintaining structural strength. This method supports the production of automotive panels, appliance shells, and building materials. The technique helps reduce waste, energy use, and production time. With innovations in high-strength steel and automated forming machines, manufacturers achieve greater precision and consistency in shaping parts.

- Cutting: Cutting in the global metalworking market involves separating metal pieces into desired sizes and shapes. Methods such as laser cutting, plasma cutting, and waterjet cutting offer precise and clean edges. This process is vital for creating components used in automotive, aerospace, and construction industries. Modern cutting systems equipped with digital control have improved speed and reduced errors. The growing demand for customized designs and high accuracy continues to push technological upgrades in this area.

- Other Processes: Other processes in the global metalworking market include grinding, stamping, and surface treatment, which enhance the final product’s quality and performance. These methods refine the appearance and functionality of metal parts by improving texture and durability. They also support the production of specialized items where standard methods are insufficient. The adoption of automated inspection and finishing systems has ensured uniformity and reduced defects. Together, these processes contribute to higher product reliability and long-term market growth.

By Application the market is divided into:

- Automobile Manufacturing: Automobile manufacturing is one of the largest contributors to the global metalworking market. The process involves creating frames, engines, and various metal components used in vehicles. Precision machining and forming play a vital role in ensuring safety and performance standards. With growing demand for electric vehicles, manufacturers are focusing on lightweight materials and efficient fabrication methods. Continuous innovation in metalworking technology supports higher production rates and better energy efficiency in automotive plants.

- Energy & Power: The energy and power industry heavily depends on the global metalworking market for producing equipment such as turbines, pipelines, and generators. Strong and durable metal components are essential to handle high pressure and temperature. Fabrication techniques like welding and machining help ensure performance and reliability in harsh environments. As renewable energy projects expand, the need for specialized metal parts is increasing, supporting consistent growth in this segment.

- Aerospace & Defense: Aerospace and defense applications in the global metalworking market demand extreme precision and high-strength materials. The production of aircraft frames, engines, and defense equipment relies on advanced machining, welding, and forming methods. Lightweight metals such as titanium and aluminum are frequently used to improve fuel efficiency and performance. Strict regulations and safety standards drive manufacturers to maintain accuracy and consistency in every component. This sector continues to adopt innovative metalworking technologies to meet rising global defense and aerospace requirements.

- Private Shipbuilding: Private shipbuilding depends on the global metalworking market for constructing ships, submarines, and marine structures. Metal forming, welding, and cutting are essential to create strong hulls and durable frameworks that can withstand marine conditions. Advanced welding and automated cutting systems improve efficiency and precision during ship construction. The rising need for luxury and specialized private vessels is creating more demand for high-quality metalwork and custom fabrication.

- Home Appliance: The home appliance sector benefits from the global metalworking market through the production of metal casings, frames, and components used in products like refrigerators, washing machines, and ovens. Processes such as forming and cutting ensure durability, corrosion resistance, and aesthetic appeal. Manufacturers emphasize cost-effective and lightweight materials to enhance product design and energy efficiency. Continuous improvement in fabrication technology has made appliances more reliable and visually appealing to consumers.

- Others: Other applications of the global metalworking market include construction, electronics, and industrial machinery. Each relies on metal parts that provide strength, stability, and longevity. Metalworking supports the creation of equipment and structures that meet performance and safety standards. The adoption of automation, advanced materials, and eco-friendly practices ensures sustainable production. These diverse applications highlight the importance of metalworking in shaping modern industrial development.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$11.6 Million |

|

Market Size by 2032 |

$13.6 Million |

|

Growth Rate from 2025 to 2032 |

2.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

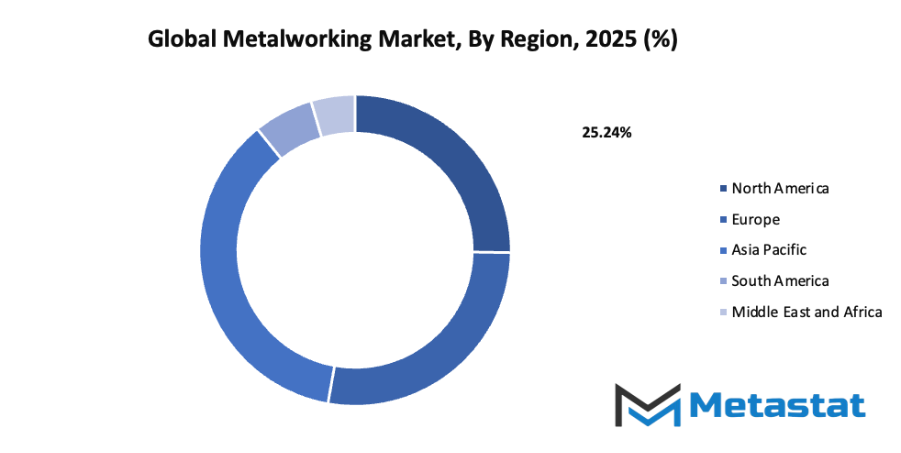

- Based on geography, the global metalworking market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Growing demand for precision components in automotive and aerospace industries: The global metalworking market is seeing significant demand due to the rising need for precision components in the automotive and aerospace sectors. These industries depend on highly accurate metal parts that ensure safety, durability, and performance. As manufacturers introduce lighter and stronger materials, metalworking technologies are evolving to meet the exact requirements for shaping and finishing. The focus on reducing production time and enhancing precision has encouraged the use of advanced cutting, welding, and forming processes. The increasing need for custom parts and specialized components is also adding to market growth.

Expansion of manufacturing and industrial automation sectors: The global metalworking market is expanding due to rapid industrialization and the rise of automated manufacturing systems. Automation helps improve accuracy and reduce human error, which makes it ideal for large-scale production. Modern manufacturing units are integrating robotics and smart machinery that allow continuous and efficient operation. This trend not only enhances productivity but also supports sustainability by minimizing waste and energy consumption. The growing global focus on efficiency and competitiveness is leading industries to upgrade their facilities with advanced metalworking technologies, ensuring faster turnaround and consistent product quality.

Challenges and Opportunities

High initial investment in advanced machinery and tools: The global metalworking market faces challenges from the high cost of acquiring advanced machinery and tools. Setting up modern facilities requires large capital, which can limit smaller firms from adopting new technologies. Despite the benefits of automation and precision equipment, the initial financial burden often slows adoption rates. Maintenance and training costs also add to the total expense. However, long-term benefits such as reduced downtime, improved accuracy, and higher output make such investments worthwhile over time, encouraging gradual adoption among forward-looking manufacturers.

Shortage of skilled labour for specialized metalworking operations: The global metalworking market is affected by the shortage of skilled labor capable of handling specialized metalworking operations. Advanced machinery requires trained workers who understand complex systems, programming, and precision techniques. Many regions face a gap between available workers and industry needs, leading to delays and reduced productivity. Training programs and partnerships between industries and technical institutions are being developed to bridge this gap. As technology continues to evolve, continuous skill development will be essential to maintain the required quality and efficiency in metalworking processes.

Opportunities

Adoption of advanced technologies such as CNC machining and additive manufacturing: The global metalworking market has promising opportunities through the adoption of advanced technologies like CNC machining and additive manufacturing. These methods allow higher accuracy, reduced waste, and faster production cycles. CNC machines provide consistency and flexibility for complex designs, while additive manufacturing enables the creation of lightweight and customized components. The combination of both techniques improves production efficiency and product quality. Growing awareness of these technologies across various industries is driving modernization, allowing manufacturers to remain competitive while meeting changing customer and market demands effectively.

Competitive Landscape & Strategic Insights

The industry is a mix of both international leaders and regional competitors, each contributing to the steady growth and development of the global metalworking market. This market continues to expand as demand increases across sectors such as construction, automotive, aerospace, and industrial manufacturing. Constant advancements in production methods, automation, and precision engineering have encouraged companies to enhance quality, efficiency, and output while maintaining cost control and sustainability.

Prominent competitors include Robert Bosch GmbH, Atlas Copco Group, BTD Manufacturing Inc., DMG Mori Co. Ltd, Standard Iron & Wire Works Inc., Clark’s Welding LLC, Sandvik AB, Matcor Matsu Group Inc., AMADA Group, IMC Companies, R.S. Hughes Co., Inc., O’Neal Manufacturing Services, Ironform Corporation, Alcoa Corporation, PMF Industries Inc., Monti Inc., and Robinson Metal Inc. Each organization holds a unique position in the market, supported by long-standing experience, strong technological foundations, and a focus on innovation. International corporations often invest heavily in automation and digital systems to meet global standards, while regional players tend to emphasize flexibility and customer-specific solutions.

Increasing global competition has also encouraged partnerships and acquisitions, helping companies strengthen supply chains and broaden their customer base. Technological integration, including the use of computer-aided manufacturing and precision machining, continues to redefine production standards and improve accuracy in metal fabrication. Moreover, sustainability has become a crucial factor, pushing companies to adopt eco-friendly materials and energy-efficient processes.

Market size is forecast to rise from USD 11.6 million in 2025 to over USD 13.6 million by 2032. Metalworking will maintain dominance but face growing competition from emerging formats.

The overall direction of the market points toward continued modernization and diversification. As infrastructure projects expand and manufacturing demand rises, the metalworking industry will maintain a central role in supporting global development. Through innovation, collaboration, and consistent improvement, both established leaders and emerging manufacturers will continue to shape the industry’s progress.

Report Coverage

This research report categorizes the global metalworking market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global metalworking market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global metalworking market.

Metalworking Market Key Segments:

By Process

- Casting

- Machining

- Welding

- Forming

- Cutting

- Other Processes

By Application

- Automobile Manufacturing

- Energy & Power

- Aerospace & Defense

- Private Shipbuilding

- Home Appliance

- Others

Key Global Metalworking Industry Players

- Robert Bosch GmbH

- Atlas Copco Group,

- BTD Manufacturing Inc.

- DMG Mori Co Ltd

- Standard Iron & Wire Works Inc.

- Clark’s Welding, LLC

- Sandvik AB

- Matcor Matsu Group Inc.

- AMADA Group

- IMC Companies

- R.S. Hughes Co., Inc.

- O’Neal Manufacturing Services

- Ironform Corporation

- Alcoa Corporation

- PMF Industries Inc.

- Monti Inc.

- Robinson Metal Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252