MARKET OVERVIEW

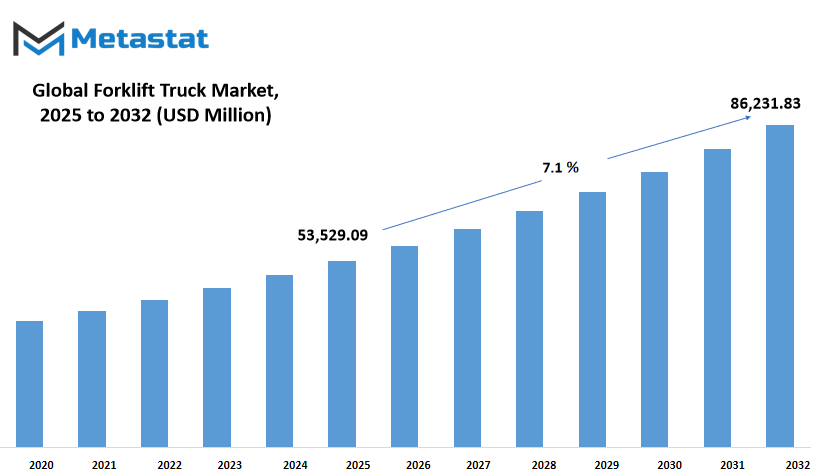

Global forklift truck market is estimated to reach $86,231.83 Million by 2032; growing at a CAGR of 7.1% from 2025 to 2032.

The global forklift truck market is more industrial as the demand in logistics, manufacturing and infrastructure has increased. Rapid and efficient materials have become a source of life for daily activity in warehouses, factories, ports and distribution centers, with a rapid global world based on transportation. Their importance to flourishing the e-commerce industry is moving even further, forcing companies to mechanize their warehousing system with high amounts and increased accuracy.

This development is being aided further by the increased demand for efficient logistics and the emergence of big-ticket construction schemes. Forklift trucks are both versatile and functional in nature and hence adaptable to industrial usage across a broad spectrum. Yet, while they gain popularity, businesses are typically hampered in their adoption. Heavy initial investments, maintenance costs, and compliance with regulations principally emissions and safety are still key issues. These same factors will reduce access, particularly for smaller and medium-sized businesses with less stringent budgets.

Despite this, the global forklift truck market is not without great opportunities. Perhaps the most complicated tendency is to move towards electric and automatic forklift. The new models are not only cleaners and cool, but are maximum automated for low -hand maintenance, reduce long -term costs by increasing the safety of the workplace. With focus on tightening environmental rules and achieving stability goals, electric forklifts are ready to become rapidly prominent. In addition, the quick speed of industrialization in emerging economies provides an opportunity for admission to the immense market, especially in the new era infrastructure and manufacturing heavy invested in manufacturing units.

The global forklift truck market is at a significant twist where requirement, opportunity and innovation are convergence. Along with the need to increase efficiency, therefore there will also be a demand for smart, responsible forklift solutions. This tireless development promises a future in which material handling is more comfortable, durable and scalable in industries globally.

GROWTH FACTORS

The global forklift truck market is further reshaping the industrial scene as increased demand in logistics, manufacturing, and infrastructure drives the transformation. With an increasingly globalized world depending upon rapid and efficient material transport, forklifts have become a source of life for daily activity in warehouses, factories, seaports, and distribution centers. Their importance is increasing even further as the e-commerce industry flourishes, compelling companies to mechanize their warehousing systems to process higher volumes faster and with increased accuracy.

This development is being aided further by the increased demand for efficient logistics and the emergence of big-ticket construction schemes. Forklift trucks are both versatile and functional in nature and hence adaptable to industrial usage across a broad spectrum. Yet, while they gain popularity, businesses are typically hampered in their adoption. Heavy initial investments, maintenance costs, and compliance with regulations principally emissions and safety are still key issues. These same factors will reduce access, particularly for smaller and medium-sized businesses with less stringent budgets.

Despite that, the global forklift truck market is not without great opportunities. Perhaps the most intriguing trend is the move toward electric and automated forklifts. The newer models are not only cleaner and quieter but also maximally automated for low-hands maintenance, reducing long-term costs while enhancing workplace safety. With tightening environmental regulations and a focus on achieving sustainability targets, electric forklifts are set to become increasingly prominent. In addition, the quick pace of industrialization in emerging economies provides an opportunity for immense market penetration, particularly in areas heavily investing in new-age infrastructure and manufacturing units.

The global forklift truck market is at a critical juncture where necessity, opportunity, and innovation converge. With the need for efficiency mounting, so too will the demand for smart, responsive forklift solutions. This relentless evolution promises a future in which material handling is more intuitive, sustainable, and scalable across industries globally.

MARKET SEGMENTATION

By Class

The global forklift truck market has experienced a consistent overhaul spearheaded by shifts in manufacturing, warehousing, and logistics operations. As businesses increase operations and e-commerce keeps on gaining momentum, the need for effective material handling devices has increased more intensely. Forklift trucks, used for transporting heavy hundreds within tight spaces, are now an inseparable thing of warehouses, construction websites, and commercial setups throughout the globe. Their capacity for load lifting, wearing, and transporting with velocity has installed them as a workhorse of operational strategies in industries. As the eye to productivity, protection, and automation will increase, there is a growing hobby in contemporary forklift models with improved control systems, multiplied fuel efficiency, or even electric forklift editions.

The enterprise is widely segmented in line with product elegance, and each product elegance fulfills a specific cause. Among them, Class 1 forklift vans, which include electric motor rider trucks, occupy a remarkable percentage and are projected to develop to $7,994.98 million, indicative of the fashion in the direction of purifier and quieter machines. These forklifts are normally utilized indoors wherein 0 emissions and minimal area are necessary. Class 2 forklifts, characterized with the aid of their slender aisle fashion, are increasingly adopted in warehouses that want improved space efficiency. Class three, made up of electric pallet jacks and stackers, stays used for quick-distance load motion, specially in retail and small garage complexes. Class 4 and Class 5, on the other hand, cope with heavy-obligation programs in harsh outside environments, which might be usually driven by means of inner combustion engines. These are utilized in production areas and massive production facilities due to their brute power and flexibility. The "Others" section consists of lots of specialized trucks that play niche roles, starting from side loaders to box handlers.

The multiplied use of electrical forklift vans is the cutting-edge fashion to redefine the market. As more difficult environmental policies and growing gasoline fees have caused greater agencies adopting battery-powered system to reduce emissions and lengthy-term operating expenses. Also, inclusion of shrewd technology together with telematics and automatic steering structures is increasing the efficiency of forklift operations. These technologies permit improved fleet tracking, predictive upkeep notifications, and actual-time overall performance monitoring, allowing organizations to decrease downtime and maximize system longevity.

Another driving force behind market expansion is the exploding e-commerce sector. Internet-based retailers need enormous distribution facilities with high-volume movement of merchandise, requiring a material handling fleet well-equipped to handle it. Forklifts come into play here as well, keeping the supply chain in motion. With these warehouses increasing in height and shrinking in width, the demand for forklifts capable of operating in narrower aisles and lifting products to higher levels will only intensify.

Though there are various forces driving the market, issues such as high capital investment requirements, maintenance at regular intervals, and safety issues of operators remain to be resolved. Nevertheless, ongoing innovation in design and the provision of condominium and leasing options are making those merchandise more low cost to small and medium-sized corporations.

In the years to come, the global forklift truck market will hold on evolving to match changing business requirements and environmental norms. With electric powered versions gaining traction, smart technology turning into customary, and infrastructure tendencies spreading across the world, call for for flexible and reliable forklift answers will remain robust. For coping with huge inventory volumes or working in harsh conditions, forklift trucks will retain to play the pivotal position in defining material handling's destiny.

By Load Capacity

The global forklift truck market is witnessing a steady transition as groups preserve updating their operations and are targeting performance. Forklifts are now on the center of cloth handling for industries together with warehousing, production, logistics, and production. Forklifts allow corporations to transport heavy masses fast and correctly, making them vital for supply chain streamlining. With groups growing their storage and distribution necessities, demand for strong and green forklift vehicles keeps rising.

One of the approaches to view the forklift market is in terms of load ability. This categorization encompasses forklifts with capacities much less than 5 lots, five to 15 heaps, and greater than sixteen heaps. Forklifts beneath 5 lots are the most ubiquitous, specially in warehouses, shops, and small-scale commercial environments. These are light machines which are easy to move through confined areas and are quality suited for lighter lifting requirements. Their recognition can be attributed to their versatility, which makes them apt for each indoor use and repetitive loading and unloading operations.

5–15-ton forklifts are stronger and normally found in larger warehouses or for managing moderately heavy products. This category serves business sectors which require both power and mobility. They find middle ground between power and size and are well-fitted for most environments, from construction yards to medium-sized logistics centers. As global infrastructure development and construction processes pick up, this type is likely to remain in high demand.

At the top stop, forklifts above 16 heaps are designed to deal with the maximum heavy-responsibility lifting jobs. They are applied in heavy industries inclusive of metallic, ports, and heavy production wherein heavy-obligation substances ought to be moved. Though they're no longer as numerous as their smaller opposite numbers, they play a important element in operations that call for each stamina and heavy lifting capability.

Every load capacity segment has a different application, but all of them represent how the forklift truck industry evolves to meet various industrial requirements. With automation, warehouse growth, and international commerce still evolving, every size forklift will have an integral part to play in helping these expanding operations.

By Power Source

The global forklift truck market is influenced by a range of developments, one of which is most prominent in the difference in type of power source. This aspect continues to have its impact on purchasing trends, production strategies, and regulatory policies. The market, when segmented on the basis of power source, is generally divided into electric forklifts and those which operate on internal combustion engines, with diesel, LPG and CNG being the variants.

Electric forklift trucks are becoming increasingly popular because of their cleaner operation and indoor usability. As the world's industries become more aware of indoor air quality and environmental sustainability, such battery-powered vehicles are becoming the choice of the industry. They emit minimal or no emissions, making them a rational choice for warehouses and logistics facilities where there may be limited air circulation. Maintenance needs are commonly much less, too, due to the fact electric forklifts have fewer moving components than combustion engine forklifts.

Internal combustion engine forklifts, however, continue to be in use in industries where heavy loads and out of doors packages are established. These diesel, LPG, or CNG-powered machines offer greater raw energy and more time between refueling and do now not require steady charging. In applications wherein productiveness is dependent on lengthy hours and difficult terrain, such forklifts are nonetheless a feasible alternative. Diesel versions are usually determined in constructing web sites and shipyards, with the slightly cleaner LPG and CNG providing a compromise of energy in opposition to less emissions.

When organizations are thinking about their selections, this division of power resources will remain sizable. Considerations such as charge, operating conditions, regulatory guidelines, and environmental goals all move into the choice to use electric powered versus combustion engine forklifts. In the long term, the scales ought to tip even extra in the direction of electric powered devices as battery technology maintains to enhance and emissions necessities become stricter. Yet, the necessity for strength and toughness in precise packages guarantees inner combustion engines will retain to stay on the global forklift truck market. This blend of old and new technologies, spurred by pragmatic requirements and changing standards, will shape how the global forklift truck market will progress.

By End User

The global forklift truck market also remains robust in its prospects, fueled by rising demand in a number of industries. Forklift trucks, used to lift and move heavy merchandise, can now be found in more environments than ever. From huge warehouses to intricate construction projects, their utility has expanded with the growing need for speed and safety in material handling. With time, most industries have come to appreciate the importance of mechanized handling solutions, particularly with the expansion in e-commerce, developing construction activities, and enhanced manufacturing activities in most countries. The move towards efficiency and minimized physical labor is compelling companies to embrace forklift trucks not only as a tool but also as a norm in operations.

By end user, the global forklift truck market is segmented into three broad categories: industrial, construction, and manufacturing. All of these contribute heavily to defining the market scenario. For commercial functions, forklift vans are appreciably applied to shift and set up products in warehouses, ports, and logistics parks. Due to the ability to maneuver via cramped areas and transport diverse sorts of hundreds, they may be excellent perfect for such environments. On creation sites, forklifts can convey building substances and heavy equipment across locations, assisting within the need for faster undertaking transport. On the manufacturing website online, in the meantime, forklift vans assist in distributing uncooked substances to manufacturing strains and finished items to storage, maintaining the complete waft clean and well-arranged.

As the call for automated and semi-automated structures increases, producers are also growing electric powered and hybrid models to meet environmental necessities and beautify value-effectiveness in the long time. This is also stimulated by way of governments and private businesses looking to cut down emissions and inspire easy power. Although traditional gasoline-powered forklifts continue to dominate, the trend closer to cleaner options is gaining more and more momentum.

The global forklift truck market, according to Metastat Insight, will most probably continue to grow because of the combination of infrastructure expansion, growing warehouse automation, and international trade activities. Firms investing in this area are not only considering increasing productivity but also providing increased safety measures for their employees. As various sectors continue to expand their boundaries in the areas of logistics and delivery expectation, the role of a sound, dependable forklift system will become even more critical in the years to come.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$53,529.09 Million |

|

Market Size by 2032 |

$86,231.83 Million |

|

Growth Rate from 2025 to 2032 |

7.1% |

|

Base Year |

2024 |

|

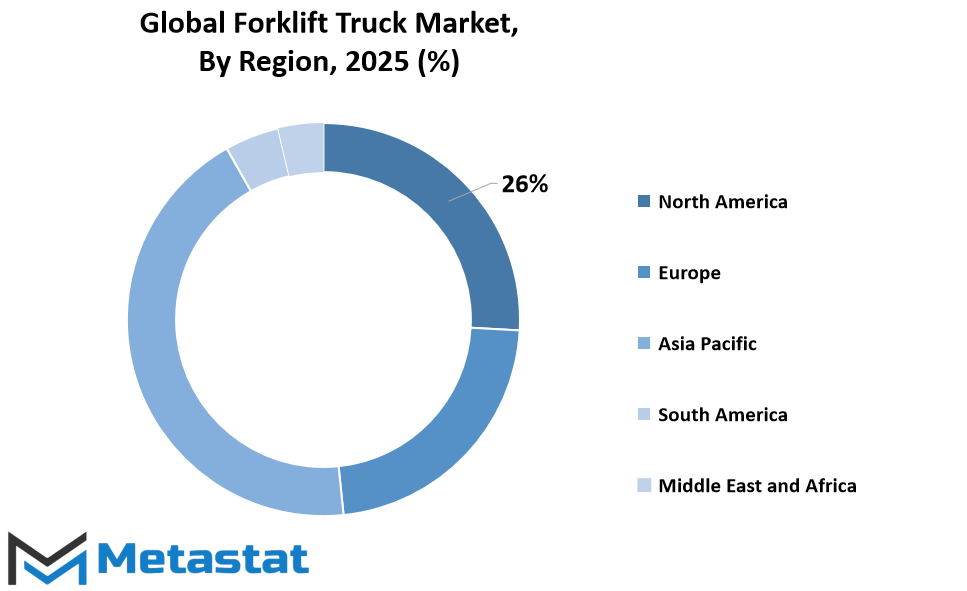

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global forklift truck market shows a dynamic geographic spread, reflecting the various industrial wishes and infrastructure improvement throughout regions. In North America, the marketplace stretches across America, Canada, and Mexico, with the U.S. Playing a primary position due to its sizable use of forklifts in warehouses, construction, and retail sectors. Canada and Mexico additionally display consistent call for, supported via cross-border exchange and growing logistics operations.

In Europe, countries like the UK, Germany, France, and Italy stand out. Germany’s advanced production zone, the United Kingdom's logistics networks, and France's growing production sports make contributions to market increase. The relaxation of Europe adds to this with moderate however regular demand driven by way of regional alternate and modernization of supply chains.

Asia-Pacific holds good sized weight inside the international picture. With nations like India, China, Japan, and South Korea, this place benefits from rapid industrialization, booming e-commerce, and developing investments in automation. China and India, mainly, preserve to build up their production and warehousing sectors, which fuels forklift usage. Meanwhile, Japan and South Korea lead with technological advancements and efficient warehouse operations, improving the need for high-performance vans. The Rest of Asia-Pacific, at the same time as extra jumbled together improvement, nevertheless performs a role as industries extend.

South America contributes through nations like Brazil and Argentina. In Brazil, demand is ordinarily pushed via agriculture, production, and business manufacturing, while Argentina follows similar traits, albeit at a smaller scale. The rest of South America provides to the market via sluggish financial improvement and enhancements in distribution systems.

The Middle East & Africa region includes diverse markets which include the GCC Countries, Egypt, and South Africa. The GCC countries way to their construction and logistics initiatives continue to apply forklift trucks across diverse sectors. Egypt and South Africa also display capacity with increasing business interest and infrastructure enhancements. The relaxation of the area is slowly catching up as efforts to enhance transportation and warehouse infrastructure circulate forward.

Each vicinity, with its distinct industrial strengths and financial sports, brings precise contributions to the global forklift truck market, shaping its course in a manner that reflects each progress and call for on the ground.

COMPETITIVE PLAYERS

The global forklift truck market has evolved from being merely one component of industrial warehousing and movement to being an integral part of contemporary supply chains and warehouses. With growing consumer demand, the necessity for effective logistics has gone up exponentially, and companies have moved swiftly to take advantage of the opportunity. Forklift trucks are ubiquitous in almost all warehouses, building sites, factories, and distribution centers, facilitating the safe and speedy transportation of material. They are now the unseen force driving production timetables, warehouse storage, and timely deliveries. The global forklift truck market for these vehicles has experienced changes in patterns of demand in the past few years, with buyers requiring not only power and capacity, but also automation, energy efficiency, and compactness.

While industries are making a drive towards digitalization, forklift technology also has been seen making a smooth transition. What was earlier just an automated device to lift and transport heavy loads is now being equipped with sensors, AI-driven tracking systems, electric batteries, and even semi-autonomous functions. Electric forklifts, in fact, are in focus as more people become environmentally conscious and stricter emission controls are imposed. Firms nowadays seek more environmentally friendly, less costly, and less noisy substitutes for conventional diesel and gasoline-powered units. This has paved the way for greener innovations, further rooting the market into greener practices.

Still, there are challenges. The expensive nature of new equipment, particularly those with new technologies, may deter small firms from investing. With that comes the pressure of having to service these machines, deal with operator training, and maintaining safety protocols. But in spite of these challenges, the global forklift truck market keeps growing. The developing world is demonstrating a growing necessity for organized warehousing and better logistics, and that is anticipated to create massive demand over the next several years. Besides, the growth of e-commerce has transformed fulfillment centers into high-speed facilities where forklifts have an important role to play in order to satisfy rapid delivery demands.

Numerous companies are actively influencing the global forklift truck market, each contributing their own strength and specialization. At the helm is Toyota Material Handling, renowned for its extensive portfolio of rugged and efficient models. KION Group AG and Jungheinrich AG have also been strong representatives, frequently praised for their European engineering and advanced technology. Hyster-Yale Materials Handling, Inc. still presents tough solutions for heavy-duty applications, whereas Mitsubishi Logisnext Co., Ltd. provides a balanced combination of reliability and new features. Crown Equipment Corporation and Komatsu Ltd. introduce their international know-how and robust service networks, keeping themselves closely competitive. Combilift Ltd. is unique in its multi-directional handling specialty to meet the special needs of material movement. UniCarriers Americas Corporation, Manitou Group, and Hangcha Group Co., Ltd. are also well-established due to their quality and continuous innovation.

They are joined by richer players such as Hyundai Heavy Industries, Lonking Holdings Limited, EP Equipment Co., Ltd., and Godrej & Boyce Manufacturing Company Ltd., which have launched cost-effective and region-sensitive solutions to cater to various customer segments. Noblelift Intelligent Equipment Co., Ltd. and TCM Corporation, similarly, continue to prove themselves with specialized manufacturing and tailored service offerings. Collectively, these firms are not only vying for market share but also establishing new standards in performance, safety, and sustainability.

The future of the global forklift truck market will be determined by how effectively the industry continues to evolve to meet the increasing demands of speed, safety, and sustainability. With automation increasing and data-driven decision-making becoming the order of the day, forklift trucks will be integrated part of smart systems that can enhance warehouse productivity and reduce operational delays. Technology is evolving at lightning speed, and the urgency for intelligent logistics keeps growing, the forklift truck is more than a machine now it's an essential asset to propel business efficiency.".

Forklift Truck Market Key Segments:

By Class

- Class 1

- Class 2

- Class 3

- Class 4

- Class 5

- Others

By Load Capacity

- Below 5 Ton

- 5-15 Ton

- Above 16 Ton

By Power Source

- Electric

- Internal Combustion Engine (Diesel, LPG, CNG)

By End User

- Industrial

- Construction

- Manufacturing

Key Global Forklift Truck Industry Players

- Toyota Material Handling

- KION Group AG

- Jungheinrich AG

- Hyster-Yale Materials Handling, Inc.

- Mitsubishi Logisnext Co., Ltd.

- Crown Equipment Corporation

- Komatsu Ltd.

- Combilift Ltd.

- UniCarriers Americas Corporation

- Manitou Group

- Hangcha Group Co., Ltd.

- Hyundai Heavy Industries

- Lonking Holdings Limited

- EP Equipment Co., Ltd.

- Godrej & Boyce Manufacturing Company Ltd.

- Noblelift Intelligent Equipment Co., Ltd.

- TCM Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383