MARKET OVERVIEW

The global credit insurance market is a key part of the financial services sector because it safeguards firms against the chance that their clients cannot pay. Businesses can safeguard accounts receivable against potential defaults with this insurance type. It assists with keeping their finances healthy and operations stable. Due to global trade and economic activities that expand, credit insurance plays a role that eases transactions that are secure and reliable between companies more and more.

Credit insurance policies, across a broad spectrum of industries, are designed also for manufacturing, retail, services, as for exports. Businesses are more inclined for transacting when credit sales risks are reduced, sales they'd deem too risky otherwise. More dynamic as well as fluid commercial exchanges enable economic growth along with foster greater confidence in extending credit lines in turn.

It is that the global credit insurance market is able to give to businesses a safety net for protection against unforeseen economic downturns as well as market volatility highlighting its importance. Companies are able to operate with a greater level of confidence. Their receivables are protected even if customers face insolvency or protracted default risks. This protection secures a company's cash flow furthermore it improves its overall creditworthiness, and this lets it secure greater financing terms from lenders and investors.

In the coming years, the global credit insurance market will change in accordance with developing economic patterns and technological innovations. The role of advanced data analytics and artificial intelligence in the assessment and management of credit risks will be revolutionary. Such technologies will be utilized by insurers to deliver more precise and customized protection, thereby improving risk reduction schemes for businesses across various industries. Blockchain technology also has the capability to revolutionize the credit insurance market with added transparency, reduced fraud, and improved claims processing.

Moreover, as businesses get more globalized in their operations, the demand for complete credit insurance solutions will keep on increasing. International businesses are at higher risk due to varying economic conditions, regulatory regimes, and political stability across various regions. The global credit insurance market will continue to expand in size, offering personalized solutions that address the unique requirements of cross-border transactions and help companies manage the complexities of international trade.

Regulatory realignments and economic policy changes will also determine future dynamics of the global credit insurance market. Regulators and governments will need to implement new models to stabilize the market and secure interests of stakeholders. More will rely on credit insurance to promote their economic steadiness, propelling more vigorous and sustainable progress in a interconnected world economy. The destiny of the global credit insurance market contains tremendous potential to be dynamic as well as of pivotal importance towards sustained stability as well as future growth of business worldwide.

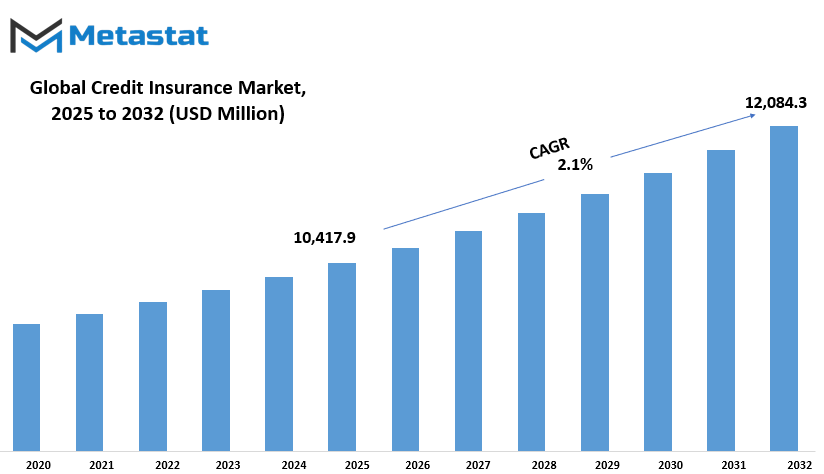

Global credit insurance market is estimated to reach $12,084.3 Million by 2032; growing at a CAGR of 2.1% from 2025 to 2032.

GROWTH FACTORS

The global credit insurance market is on the verge of spectacular growth in the coming few years, driven by a plethora of catalysts. Among them, heightened globalization and trade liberalization is one of the strongest driving forces. With businesses spreading their wings across country boundaries, the risk of payment defaults and insolvency is greater, thus propelling credit insurance as the most critical means of protecting business deals. Firms are becoming more conscious of managing credit risk and protecting their accounts receivable, which calls for the purchase of credit insurance cover. There are some challenges, though, that could retard the expansion of the market.

It could be relatively expensive for credit insurance premiums, especially for firms that have riskier clients or whose products are in fluctuating industries. This cost can be a large disincentive, particularly to small firms that may already be operating on thin margins. The complexity of credit insurance policies and underwriting standards can similarly deny access by small and medium-sized businesses (SMEs) and emerging market companies. It takes some level of knowledge and resources to be able to navigate through these complexities, resources that are lacking for a majority of small firms, so its extensive use is hindered. Even with these challenges, there are huge opportunities in the future for the global credit insurance market. One of them is developing credit insurance products for emerging industries and markets.

The e-commerce and digital sectors, in reality, offer rich soil for development. As these sectors keep growing and developing, the need for credit insurance to cover against the peculiar risks of online transactions is bound to rise. This growth not only contributes to the count of insurer customers but also provides room for the creation of new products based on the particular needs of such industries. The future of the global credit insurance market will be shaped by technological changes and greater interaction with online platforms. Insurers that leverage data analysis and AI to automate underwriting processes and provide more personalized products will be in the best position to reach a greater number of customers. Technological integration also helps simplify credit insurance policies, making them even more relevant to emerging markets as well as small and medium-sized enterprises. Although there are certain challenges confronting the global credit insurance market, the overall outlook is positive. Growing foreign trade and globalization, combined with growing awareness of credit risk management, are fueling demand.

Challenges in availing policies and premiums being prohibitively expensive need to be addressed, more so in order to support small businesses. Nevertheless, opportunities offered by emerging markets, particularly in the e-markets and digital markets, and chances of technological upgrade, hold good promises for the business. With the world struggling with the intricacies of an emerging global economy, the significance of credit insurance would only grow.

MARKET SEGMENTATION

By Type

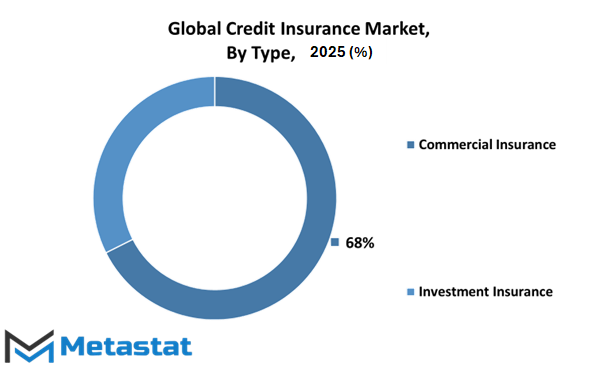

The global credit insurance market is expected to experience mammoth growth spearheaded by several factors as much as by changing economic currents. Credit insurance, largely insulating businesses against customer non-payment risks, continues gaining relevance in epochs when financial doubt becomes the manner of existence. By category, the market yet segments into commercial insurance and investment insurance, the two addressing niched requirements within finance.

Commercial insurance, being a significant branch, insures businesses against insolvency risk of customers. This form of insurance helps businesses continue to have cash flow and steer clear of big financial losses even if customers do not pay for goods or services acquired. With international business further on the rise and enterprises becoming more global, commercial credit insurance is expected to see increased demand. Firms will look to protect their interests, particularly in economies where economic instability could be a serious threat to their business. Investment insurance, however, aims to insure foreign economic investments.

Investment insurance is very important to investors investing in riskier economies because it insures against political risks, expropriation, or currency inconvertibility. Since there is steady growth in the emerging markets and they are so appealing to foreign investments, there shall be growing demand for sound investment insurance products as well. Investors shall desire their investments to be protected against sudden political or economic turmoil. Further, blockchain technology might completely transform the global credit insurance market since it would make it possible to have secure and unalterable records of transactions. This would simplify claims procedures, lower fraud rates, and enhance policyholders' and insurers' trust. These technologies will be a positive contributor to credit insurance market growth and stability as they gain increasing acceptance.

By Application

The global credit insurance market is poised to experience unprecedented growth, driven by its use in domestic and export credit insurance. Domestic and export credit insurance gives companies an umbrella that safeguards them from the risk of non-payment by their customers. As foreign trade increases and the intricacies of international business become more complex, credit insurance demand will increase.

In credit insurance domestically, companies utilize these policies as a guarantee against losses in the domestic market. Companies, particularly small and medium-sized companies (SMEs), are vulnerable to threats when it comes to the quality of credit on their customers. Credit insurance is utilized to mitigate these risks because it ensures companies receive payment for goods and services extended to customers on credit. Such protection not only boosts the financial stability of a company but also ensures growth and progress by enabling firms to extend credit terms without apprehension. Demand for domestic credit insurance will continue to rise in the future because economies are getting more interconnected. With increasing online platforms and web shopping, firms are tapping into larger markets, which enhances the risk of non-payment. With advancement in technology, the credit insurers will be better able to come up with sophisticated instruments to analyze and control such risks, which will further make credit insurance more within reach and credible to small and large companies.

Export credit insurance does play the vital function of making international trade possible. Insurance of this nature shields foreign buyers from the risk of non-payment, especially with the uncertainties that come with cross-border transactions. Political upheavals, exchange rates fluctuations, and differences in legal frameworks can all prove to be enormous risks to exporters. Export credit insurance offers insurance, enabling companies to venture into foreign markets and increase their global footprint without the fear of losing money.

By Distribution Channel

The global credit insurance industry will go on to evolve immensely in the years to come through a myriad of distribution channels that have considerably influenced its growth. With companies shifting to insuring their financial interests against payment default volatility, the demand for global credit insurance rises. It has a variety of alternative distribution channels and segmentation through which it can play a role or drive the growth of the industry in a number of different ways.

Intermediaries in insurance will remain at the forefront of the global credit insurance market. These professionals are middlemen between customers and insurers, delivering bespoke solutions specially honed to fit unique needs. Their efficacy in assessing risks and recommending appropriate coverages will drive their on-going usage and worth in the marketplace. The more that firms understand the risks of non-payment, the more valuable the intermediary's role as a consultant and advisor to clients.

Insurance companies themselves are the direct issuers of credit insurance policies. Insurance companies possess the infrastructure and funds to offer full cover to businesses of all sizes. Insurance companies, in the future times, are likely to innovate and diversify their product sets to meet the emerging requirements of the market. These operators will be capable of assessing risk more accurately and providing customized solutions that are attuned to the specific needs of their clients with the help of advanced technologies such as data analysis and artificial intelligence. Banks also play a critical role as conduits of distribution for credit insurance.

With the help of their extensive networks and current connections with businesses, banks are well-equipped to distribute products of credit insurance as part of their financial solution package. The addition of credit insurance as one of the traditional banking offerings will provide customers with an effortless experience and bring in another layer of financial security. Banks will become increasingly dominant players in the credit insurance distribution space as the financial environment continues to evolve. Insurance brokers are intermediaries that represent clients in their dealings with insurance companies.

Their negotiating prowess and knowledge of the market to negotiate favorable terms for their customers will ensure they remain relevant in the global credit insurance market. Brokers will ensure that they lead companies through the complexities of insurance policies and selecting the most suitable coverages. Insurance aggregators, based on websites to compare many credit insurance policies, will be the order of the day. These sites provide the ease of multiple assessments and wise choices to companies. With advancements in technology, aggregators will keep evolving more sophisticated comparison features and choosing abilities.

By End User

The global credit insurance market will witness strong growth in the coming days as a result of several industries such as manufacturing, services, construction, wholesale, retail, and others. This type of insurance covers the buyer's risk of non-payment, which is vital for companies carrying on their business on a credit sale basis. As companies are increasing their business operations and involving themselves in global trade, the demand for strong credit insurance solutions will keep rising its importance.

In production, credit insurance assists businesses to cushion themselves against risk in bulk production and sale. Manufacturers tend to handle enormous orders and long payment terms, which can be expensive if the buyers fail to make payments. Using credit insurance, manufacturers are able to cover their cash flow and stay in business, even amidst volatile economies.

The services industry, including a large variety of businesses like consulting, information technology, and financial services, also benefits substantially from credit insurance. Service providers usually enter into various agreements and contracts with clients on credit. Credit insurance allows these companies to protect their receivables, lessening the potential effect of client insolvency on the company. With the increasing movement of the global economy towards services, the need for credit insurance here will increase as well. Construction firms are particularly threatened by the fact that their work takes a lot of time and huge investments. Construction credit insurance protects against delay in payment or non-payment by project owners or subcontractors. This safeguard is crucial in keeping projects smoothly operational without being bogged down by finance.

Wholesale and retail companies, with thin profit margins but large volumes, also depend on credit insurance. These companies extend credit to customers to sell and capture market share. Credit insurance gives wholesalers and retailers assurance that they can recover some of the lost money in the event of default by the customers. This cover motivates these companies to provide competitive credit terms, promoting growth and customer loyalty.

Other industries such as energy, agriculture, and transport will also gain from the growth of the gloabl credit insurance market. As more international trade and economic activity increases, business firms in all industries will pursue complete credit insurance cover to protect themselves against their credit risk. The global credit insurance market future appears promising with improvements in technology and data analytics increasing the capability to analyze and manage credit risk. This new frontier will provide firms with the skills they need to control financial risks and thrive in an open, competitive international economy.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,417.9 million |

|

Market Size by 2032 |

$12,084.3 Million |

|

Growth Rate from 2025 to 2032 |

2.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global credit insurance market is a vital part of the economy, providing cover against the risk of non-payment by buyers. The market is divided geographically into a number of regions: North America, Europe, Asia-Pacific, South America, and Middle East & Africa. Each of these regions is marked by special features and potential for the development of the global credit insurance market.

In North America, the market is segmented into the U.S., Canada, and Mexico. The United States is the largest North American market because of its strong economy and the presence of many large companies that need credit insurance to facilitate their transactions. Canada and Mexico have great potential on the basis of increasing trade activity and increasing awareness among enterprises about credit risk management.

Europe's credit insurance market comprises the UK, Germany, France, Italy, and the Rest of Europe. The region has a well-established credit insurance system, with Germany and the UK among the notable market sizes. Strong regulatory support and the presence of large credit insurance companies in the region underpin the size of the European market. Demand for credit insurance will keep growing as Europe recovers from economic uncertainties and will function as a shock-absorbing attribute to financial turmoil.

Asia-Pacific market, segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific, exhibits high growth rate in the case of credit insurance. Export-orientated big economies are driving the demand for credit insurance in India and China. Japan and South Korea are also considerable because of the strong industrial strength and foreign trade relations. General economic growth, as well as growing Asian-Pacific globalization, will drive the credit insurance market in the future. In South America, Brazil and Argentina are on top of the credit insurance market, while Rest of South America also has exciting potential. Political and economic shocks in these nations indicate the need for credit insurance to minimize the risk of non-payment. As these economies stabilize and develop, credit insurance demand will be increasing.

Middle East & Africa is divided into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa. The fast-evolving economies and large trade networks of the GCC countries make them a primary market for credit insurance. Egypt and South Africa are also emerging markets with rising trade transactions and growing awareness of credit risk management. While the Middle East & Africa continue their path of economic development, the credit insurance market is set to grow significantly. All in all, the world credit insurance market has great prospects everywhere. Every regional market has its own opportunities and challenges on the basis of economic situations, trade transactions, and regulatory environments. Since there will be even greater interdependence of states in the future, utilization of credit insurance in facilitating overseas business and eliminating financial risk will grow exponentially.

COMPETITIVE PLAYERS

The global credit insurance market is a competitive and dynamic industry with many major players who shape its innovation and growth. Some of the major players include Sinosure, Allianz, Atradius, Coface, Zurich, Credendo Group, and QBE Insurance, each contributing its own strengths and approach to the market.

Sinosure, the China Export & Credit Insurance Corporation, has become a pillar in offering export credit insurance, enabling Chinese companies to expand abroad by reducing risks involved in foreign trade. Allianz, one of Germany's biggest insurance firms, uses its vast experience and far-reaching presence to provide end-to-end credit insurance services, guaranteeing companies to be safe from credit risks.

Atradius, with its headquarters in the Netherlands, is known for its extensive global network and in-depth market knowledge, which allows it to provide customized credit insurance products that suit the unique requirements of its customers. Coface, another major player, offers credit insurance services with a specific emphasis on assisting companies in making well-informed credit decisions, thereby creating safer trade conditions.

Swiss-based multinational Zurich Insurance Group extends its solid risk management experience to the credit insurance space with products and services designed to guide enterprises through the volatility of credit transactions. Belgian-headquartered Credendo Group diversifies the market through its offering of various credit insurance products for major companies and small and medium enterprises alike, in support of cross-border trade in many different industries.

QBE Insurance, an Australian business, has a comprehensive base in the credit insurance industry with innovative products that cater to the changing needs of enterprises across various regions. Cesce, a Spanish business, offers credit insurance and risk management services to businesses to help them secure their accounts receivable and effectively manage credit risk.

Other significant players are HKECIC and CCW Global, which both provide specialized credit insurance coverage aligned with the requirements of companies operating in Hong Kong and internationally. AXA, AIG, Marsh, Chubb, Liberty Mutual, Sompo Holdings, Swiss Re, Hiscox, Aon, Tokio Marine, and other companies are also major players in the market, with each of them contributing to the competitiveness and diversity of the industry.

Credit Insurance Market Key Segments:

By Type

- Commercial Insurance

- Investment Insurance

By Application

- Domestic Credit Insurance

- Export Credit Insurance

By Distribution Channel Overview

- Insurance Intermediaries

- Insurance Companies

- Banks

- Insurance Brokers

- Insurance Aggregators

By End User

- Manufacturing

- Services

- Construction

- Wholesale

- Retail

- Others

Key Global Credit Insurance Industry Players

- Sinosure

- Allianz

- Atradius

- Coface

- Zurich

- Credendo Group

- QBE Insurance

- Cesce

- HKECIC

- CCW Global

- AXA

- AIG

- Marsh

- Chubb

- Liberty Mutual

- Sompo Holdings

- Swiss Re

- Hiscox

- Aon

- Sinosure

- Tokio Marine

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383