MARKET OVERVIEW

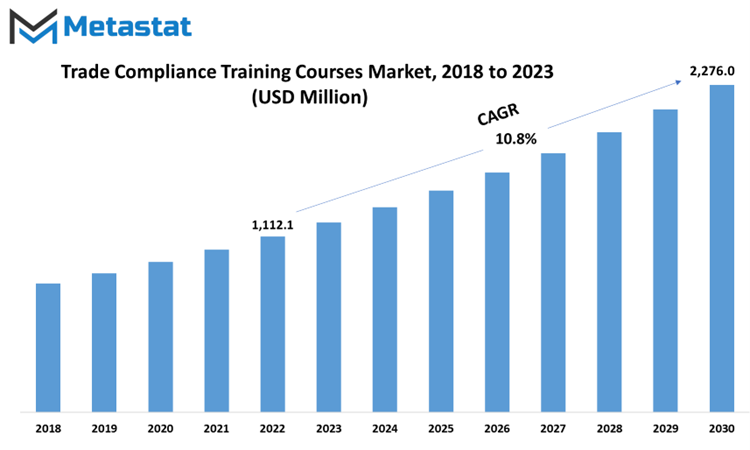

The Global trade compliance training courses market is estimated to reach USD 2,276.0 million by 2030, growing at a CAGR of 10.8% in forecast period.

The Global Trade Compliance Training Courses market is a dynamic and rapidly evolving sector within the broader landscape of international trade and commerce. In an increasingly interconnected global economy, businesses and individuals engaged in cross-border trade are confronted with a complex web of regulations, laws, and compliance requirements. In this context, the role of trade compliance courses becomes pivotal, as they serve as a crucial resource for imparting the knowledge and skills necessary to navigate the intricate world of global trade compliance.

Trade compliance courses are structured educational programs that are meticulously designed to address the multifaceted challenges and intricacies of international trade regulations. These courses are not mere academic exercises; rather, they are practical and hands-on training initiatives aimed at equipping participants with a deep understanding of the legal frameworks that govern global trade. The primary objective is to ensure that individuals and organizations can engage in international trade activities while adhering to the rules and regulations set forth by various governmental and international bodies.

One of the key aspects of trade compliance courses is their adaptability to the ever-changing global trade landscape. Trade policies, customs regulations, export controls, and sanctions are subject to frequent updates and modifications. Therefore, it is imperative that individuals and businesses stay abreast of these changes to avoid costly compliance violations and penalties. Trade compliance courses provide the means to achieve this by offering up-to-date information and insights into the evolving regulatory environment.

The Global Trade Compliance Training Courses market is a critical component of the contemporary global trade landscape. Its significance lies in its ability to equip individuals and organizations with the knowledge and skills needed to navigate the intricate web of international trade regulations and compliance requirements. As the global economy continues to evolve and becomes increasingly interconnected, the demand for specialized and up-to-date trade compliance training is expected to grow, making this market a vital pillar of the international business ecosystem. Global Trade Compliance Training Courses market is estimated to reach $2,276.0 Million by 2030; growing at a CAGR of 10.8% from 2023 to 2030.

MARKET DYNAMICS

The rapid expansion of international business activities increased cross-border trade, and the ever-evolving nature of global trade regulations have created a pressing need for specialized knowledge and training. This essay explores the Global Trade Compliance Training Courses market, examining the driving forces, challenges, and opportunities that shape this essential sector of education.

The globalization of businesses and supply chains has led to a surge in international trade activities. As companies seek new markets and opportunities across borders, the need for trade compliance education becomes critical. Understanding the intricacies of trade regulations, export controls, customs procedures, and sanctions regimes is essential to ensure smooth cross-border operations. Consequently, the demand for trade compliance courses has seen a steady increase.

Furthermore, governments and international bodies are continuously updating trade regulations to address emerging challenges such as security threats, intellectual property protection, and environmental concerns. This constant evolution of trade regulations necessitates ongoing education to keep businesses and individuals abreast of the latest developments and maintain compliance.

Despite the growing demand for trade compliance education, several challenges hinder the market's growth. One significant challenge is the investment required in terms of time, money, and resources. Participating in trade compliance courses often entails dedicating considerable time and financial resources. This can pose a barrier for individuals or organizations operating on tight budgets or facing constraints in terms of skilled personnel available for training programs.

Another challenge is the need for trade compliance courses to stay current with the rapidly changing regulatory environment. Frequent updates and revisions in trade regulations can make it difficult for educational institutions and training providers to ensure that their courses are up to date. The process of incorporating the latest information into course content and materials can be time-consuming and resource intensive.

Despite these challenges, the Global Trade Compliance Training Courses market is poised for growth due to the rise of digital platforms and online learning. The advent of technology has transformed the way education is delivered, making it more accessible and cost-effective. Online trade compliance courses offer flexibility in terms of scheduling, allowing individuals and organizations to access training materials at their convenience. This flexibility has the potential to attract a broader audience, including working professionals and businesses operating across different time zones.

Furthermore, online platforms can efficiently incorporate updates and revisions to course content as trade regulations evolve. This adaptability ensures that learners have access to the most current information, enhancing the value of trade compliance education.

The Global Trade Compliance Training Courses market plays a vital role in equipping individuals and organizations with the knowledge and skills needed to navigate the complexities of international trade compliance. The market is driven by the globalization of business, the constant evolution of trade regulations, and the need to mitigate risks associated with non-compliance. While challenges such as resource constraints and regulatory changes exist, the adoption of digital platforms and online learning presents promising opportunities for the market's growth. In the ever-changing global trade landscape, trade compliance education remains an essential tool for success.

MARKET SEGMENTATION/REPORT SCOPE

By Organization Type

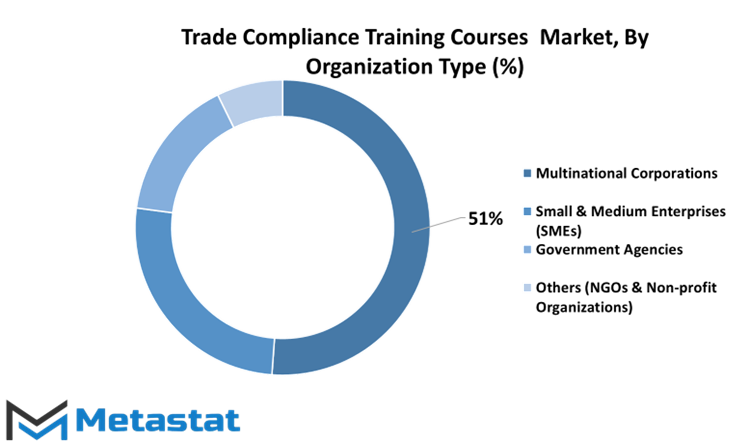

Multinational Corporations (MNCs) play an important role in the Global Trade Compliance Training Courses market. These corporate giants, with their extensive international operations, have a high demand for comprehensive trade compliance education. In 2022, the Multinational Corporations segment accounted for a substantial share, valued at 512 USD million.

MNCs operate across diverse geographical regions, each with its own set of trade regulations and compliance requirements. Consequently, they require tailored training programs that address the specific challenges they face. This segment invests significantly in trade compliance training to mitigate risks associated with non-compliance, ensure smooth cross-border operations, and protect their global reputation. The MNCs' commitment to compliance is expected to drive continued growth in this segment.

Small & Medium Enterprises (SMEs) is a vital segment within the Global Trade Compliance Training Courses market. While traditionally SMEs may have lagged in compliance efforts due to resource constraints, this segment is experiencing a surge in demand for training. In 2022, the SMEs segment was valued at 589.1 USD million and is anticipated to continue its growth trajectory. This segment is characterized by its adaptability, seeking out training programs that cater to their specific needs and budgets. The projected growth in the SMEs segment reflects their increasing commitment to compliance and global expansion. Government Agencies form another significant segment within the Global Trade Compliance Training Courses market. In 2022, this segment was valued at 158.2 USD million. Government agencies are responsible for formulating and enforcing trade regulations. They require specialized training to ensure that their staff is well-versed in trade compliance matters.

These agencies often operate in complex regulatory environments and must stay updated with the latest trade policies, export controls, and import regulations. Investing in training programs enables government agencies to maintain the integrity of trade operations, enforce compliance, and contribute to national economic growth. Their continued investment in training is indicative of their commitment to efficient trade governance.

The Other segment comprise NGOs & Non-profit Organizations, accounted for 7.36% of the Trade Compliance Training Courses Market in 2022. While this segment may be smaller in comparison to others, it plays a crucial role in promoting ethical trade practices and advocating for compliance within the global trade community.

NGOs and non-profit organizations engage in capacity-building initiatives, working with various stakeholders to foster a culture of responsible trade. They offer training programs aimed at promoting sustainability, ethical sourcing, and fair-trade practices. This segment's influence extends beyond traditional business interests, emphasizing the importance of trade compliance in achieving broader societal and environmental goals.

By Industry Verticals

The Manufacturing segment stands as a formidable pillar within the Trade Compliance Training Courses market. Valued at 353 USD million in 2022, it accounted for a significant 35.1% share of the market. The manufacturing industry is highly reliant on international trade, with complex supply chains stretching across borders. As a result, manufacturers recognize the importance of equipping their workforce with the knowledge and skills required to navigate the intricacies of global trade compliance. This segment is expected to continue its robust growth trajectory, driven by the expansion of manufacturing activities and the ongoing need for compliance expertise.

The Retail & Fashion segment, valued at 124.6 USD million in 2022, plays a pivotal role in the Trade Compliance Training Courses market. With an anticipated growth to 165.4 USD million by 2030, it showcases the industry's commitment to staying compliant in the face of rapidly changing global consumer trends. The retail and fashion sectors have witnessed a surge in cross-border trade, driven by e-commerce and global consumer demands. Staying compliant with trade regulations, customs procedures, and import/export controls is crucial to ensuring the seamless flow of goods. As these industries expand further into international markets, the demand for trade compliance education is set to rise.

In healthcare, the Trade Compliance Training Courses market serves a critical purpose. The healthcare industry's global footprint extends from pharmaceuticals to medical equipment, making it imperative to maintain stringent compliance with international trade regulations. This segment contributes significantly to the market's growth, with a precise valuation in 2022. As healthcare organizations expand globally and deal with intricate regulatory frameworks, the need for comprehensive compliance training becomes evident. Staying abreast of regulations governing the import and export of pharmaceuticals and medical devices is paramount to ensure global health and compliance.

The pharmaceutical industry, characterized by its precision and attention to detail, is a key player in the Trade Compliance Training Courses market. The sector's contribution to global health and well-being requires adherence to stringent regulatory standards in every facet of its operations. As the pharmaceutical industry continues to innovate and expand globally, the demand for specialized trade compliance training courses is on the rise. This segment represents a vital aspect of the market, underscoring the industry's commitment to compliance and patient safety.

The automotive industry is synonymous with innovation, and its global reach necessitates a deep understanding of trade compliance. Whether it's importing auto parts or exporting finished vehicles, automotive companies are subject to a multitude of trade regulations. This segment, though not quantitatively evaluated here, is a critical participant in the Trade Compliance Training Courses market. The need for comprehensive training in navigating complex international trade regulations and ensuring smooth cross-border operations is a primary driver of growth in this industry.

The Others category, encompassing Technology and Financial Services, represents industry verticals undergoing rapid digital transformation. While not quantified in this discussion, these sectors recognize the increasing importance of global trade compliance. As technology companies expand their global presence and financial services organizations engage in cross-border transactions, they encounter a host of trade-related challenges. The demand for specialized trade compliance training courses is expected to rise within these sectors, reflecting the broader trend of digitalization and globalization.

REGIONAL ANALYSIS

The European Trade Compliance Training Courses market presents a diverse landscape, encompassing the United Kingdom, Germany, France, Italy, and the rest of Europe. Europe's diverse regulatory environment, shaped by the European Union and individual country regulations, has given rise to a specialized approach to trade compliance education. As businesses within the European Union deal with a unique set of trade regulations, localized training programs tailored to specific countries' needs have gained prominence. The European market, valued at 244.5 USD Million in 2018, is characterized by a mix of comprehensive courses for pan-European compliance and region-specific offerings.

The global Trade Compliance Training Courses market is not a uniform entity but rather a mosaic of regions, each with its unique characteristics and challenges. North America, Europe, Asia-Pacific, South America, and the Middle East & Africa contribute to the overall vibrancy of the market. Understanding the geographical nuances is crucial for educators, businesses, and learners alike, as it allows for tailored approaches to trade compliance education that meet the specific needs of each region. As international trade continues to evolve, so will the Trade Compliance Training Courses market in response to the demands of the global business landscape.

COMPETITIVE PLAYERS

The Global Trade Compliance Training Courses market is a dynamic and vital sector, driven by the increasing need for individuals and organizations to stay compliant with ever-evolving international trade regulations. In this essay, we delve into the key players operating in this industry, each contributing uniquely to the landscape.

One of the prominent players in the Trade Compliance Training Courses industry is SGS SA. SGS is a globally recognized leader known for its comprehensive range of services. Beyond trade compliance training, SGS offers product testing and certification, quality assurance, supply chain management, and sustainability solutions. What sets SGS apart is its commitment to helping clients improve operational efficiency and reduce risk through technical inspection and auditing services. In an era where supply chains are under constant scrutiny, SGS's multifaceted approach is invaluable.

e2open is another heavyweight in this market, specializing in supply chain management solutions. e2open has garnered industry accolades and recognition for its innovative technology, industry expertise, and customer satisfaction. Its strategic partnerships and acquisitions have allowed it to continuously enhance its product portfolio, providing businesses worldwide with the means to transform their supply chain operations and gain a competitive edge.

Apart from these there are many other key players in the Global Trade Compliance Training Courses market, each contributing significantly to the education and support required to navigate the complexities of international trade compliance. From comprehensive service providers to specialized niche players, these organizations play an indispensable role in ensuring that businesses and individuals remain compliant in an ever-changing global trade landscape.

Trade Compliance Training Courses Market Key Segments:

By Organization Type

- Multinational Corporations

- Small & Medium Enterprises (SMEs)

- Government Agencies

- Others (NGOs & Non-profit Organizations)

By Industry Verticals

- Manufacturing

- Retail & Fashion

- Healthcare

- Pharmaceuticals

- Automotive

- Others (Technology & Financial Services)

Key Global Trade Compliance Training Courses Industry Players

- SGS SA

- e2open, LLC

- WiseTech Global Limited

- DB Schenker Trade Solutions

- 4PL Academy

- ECTI, Inc.

- The Knowledge Academy

- International Trade Institute

- Content Enablers

- Global Training Center

- com

- Sandler, Travis & Rosenberg, P.A.

- Skillsoft

- Irish Medtech Skillnet

- NAVEX Global, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383